As we celebrate the Lufthansa Innovation Hub’s 10th anniversary this month, we’re taking a moment to reflect on a full decade of InTENtional Innovation.

This includes our TNMT research platform. Since our founding, we’ve been committed to pushing the boundaries of travel and mobility through cutting-edge research and insights.

In this spirit, we’re revisiting some of the major milestones from our TNMT journey since 2018.

So get cozy, because we’ve got a lot of ground to cover. Here are ten TNMT research milestones—one for each year since our LIH founding—that we are particularly proud of (even though they don’t necessarily represent our most-read pieces).

#10: The Rise of Asia in Travel and Mobility Tech

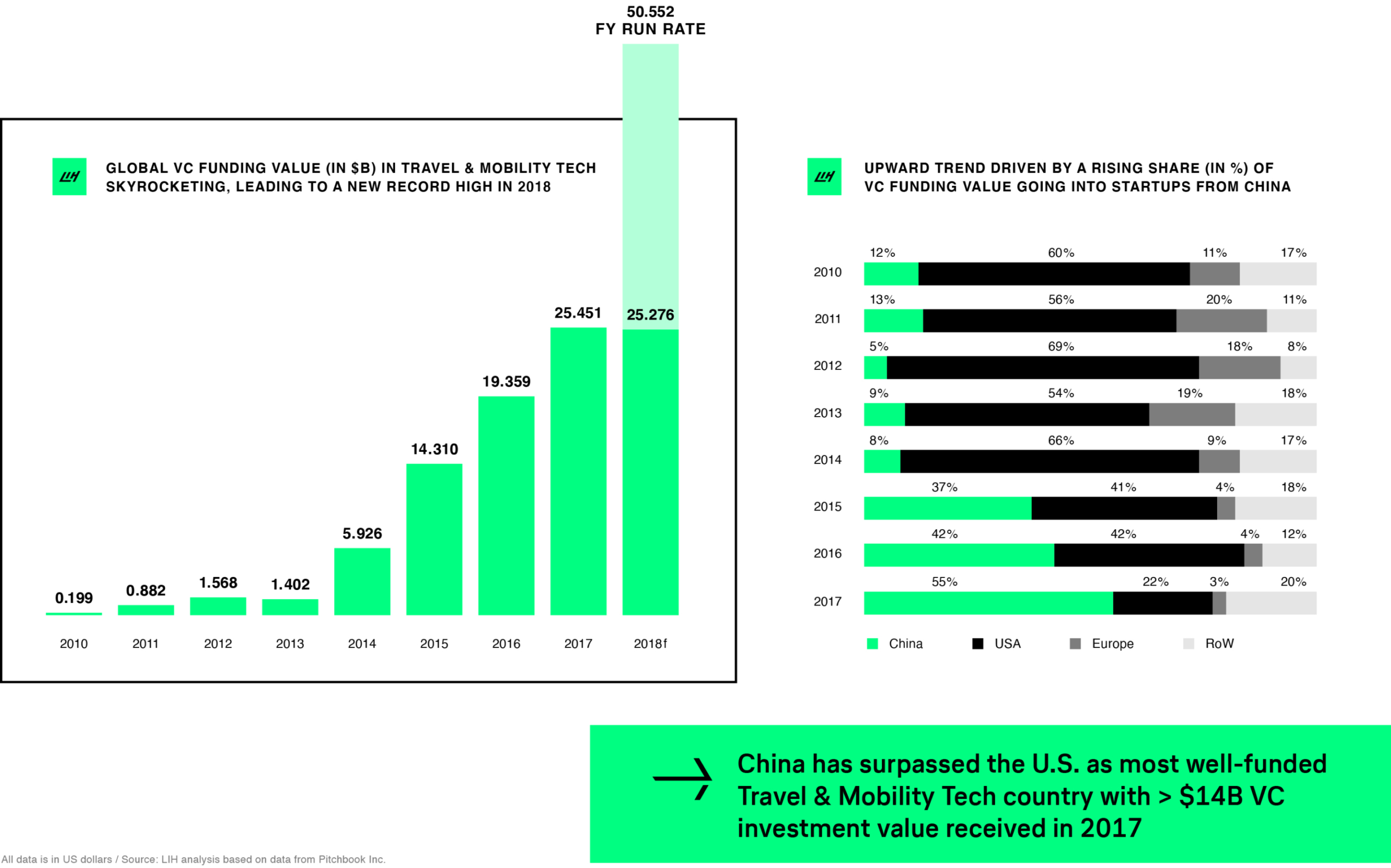

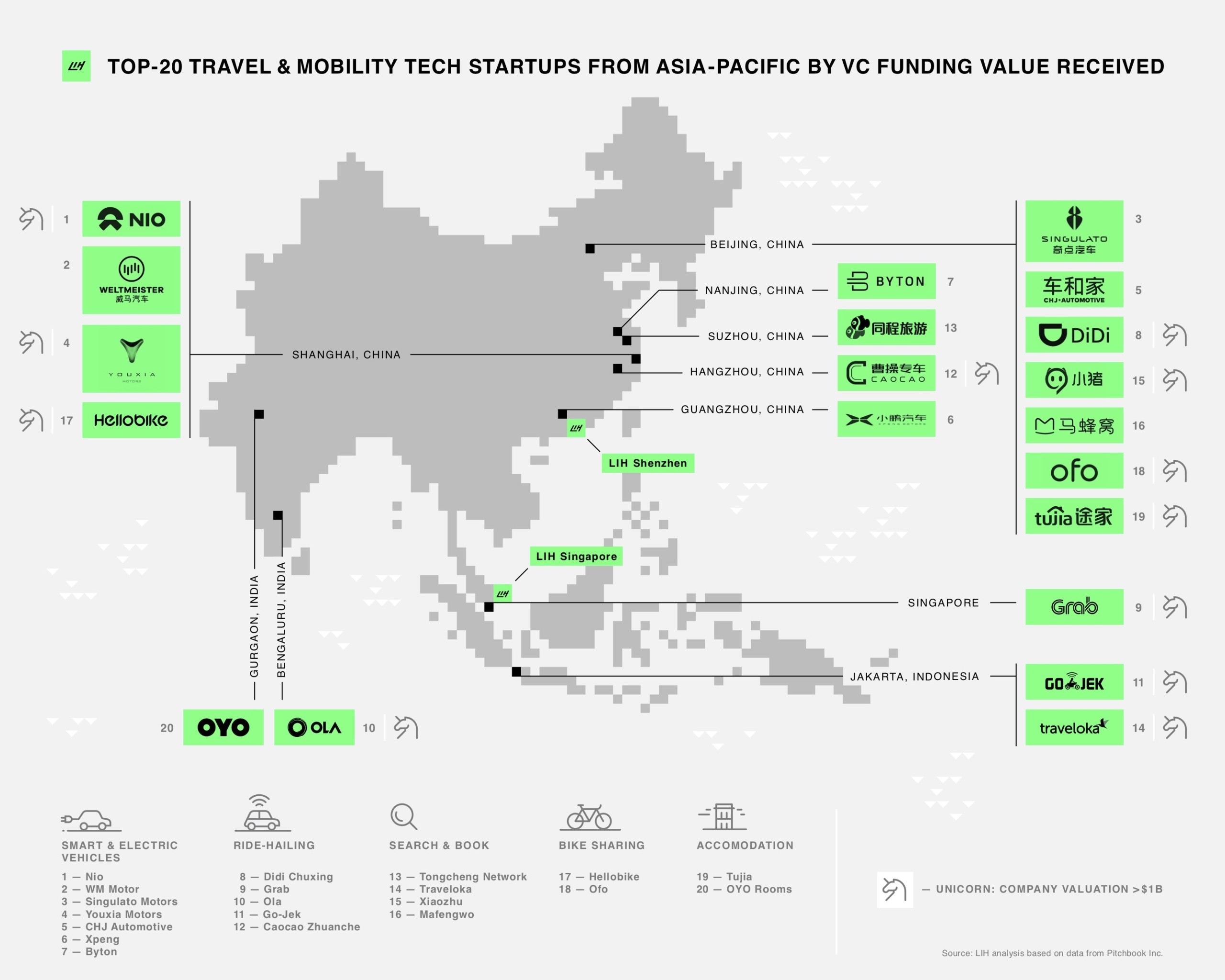

Our TNMT research journey in early 2018 began with an in-depth analysis of venture capital funding trends within the global travel and mobility startup ecosystem, utilizing our proprietary startup database.

Early on, we pinpointed a significant trend: Asia, particularly China, was becoming the powerhouse in driving travel innovation and funneling substantial funding into promising travel startups.

Two insights stood out:

- In 2017, China surpassed the United States to become the most-funded startup region in the Travel and Mobility Tech sector, indicating a pivotal innovation shift from West to East.

- This funding dominance was an early indicator of China’s growing influence in the Electric Vehicle (EV) sector, a trend that is profoundly shaping the global mobility landscape today.

Although the Chinese VC landscape has seen a major cooling off since then, by early 2018, China was home to over half of all Travel and Mobility Tech unicorns originating from Asia.

This marked a significant milestone in our understanding of global investment dynamics and underscored the shifting centers of technological progress (also one of the reasons why the LIH opened its dedicated Singapore base in 2018).

#9: Elevating the Discussion on Air-Taxis

2018 marked our inaugural exploration into the emerging air-taxi sector, specifically electric vertical take-off and landing (eVTOL) vehicles.

At that time, the hype around air taxis was reaching new heights, spurred by a flurry of startup announcements and growing press momentum that had been building since late 2017.

Yet, much of the public discourse was narrowly focused on these emerging startups and their bold promises, with limited attention given to crucial aspects like regulation and airspace management.

Recognizing the need for a more holistic approach, we committed to broadening the conversation within the Advanced Air Mobility (AAM) sector.

Our efforts have consistently emphasized the importance of examining all facets of AAM, beyond the initial excitement of aircraft technology. This commitment is exemplified in our more recent AAM research, including our State of Air-Taxi Report from 2021 and our ongoing eight-factor AAM assessment to transform the air-taxi vision into a commercially viable reality.

We are fully dedicated to maintaining this approach going forward, underscoring our role in shaping a more informed and realistic dialogue about the future of air mobility.

#8: Decoding Airline Priorities with AI

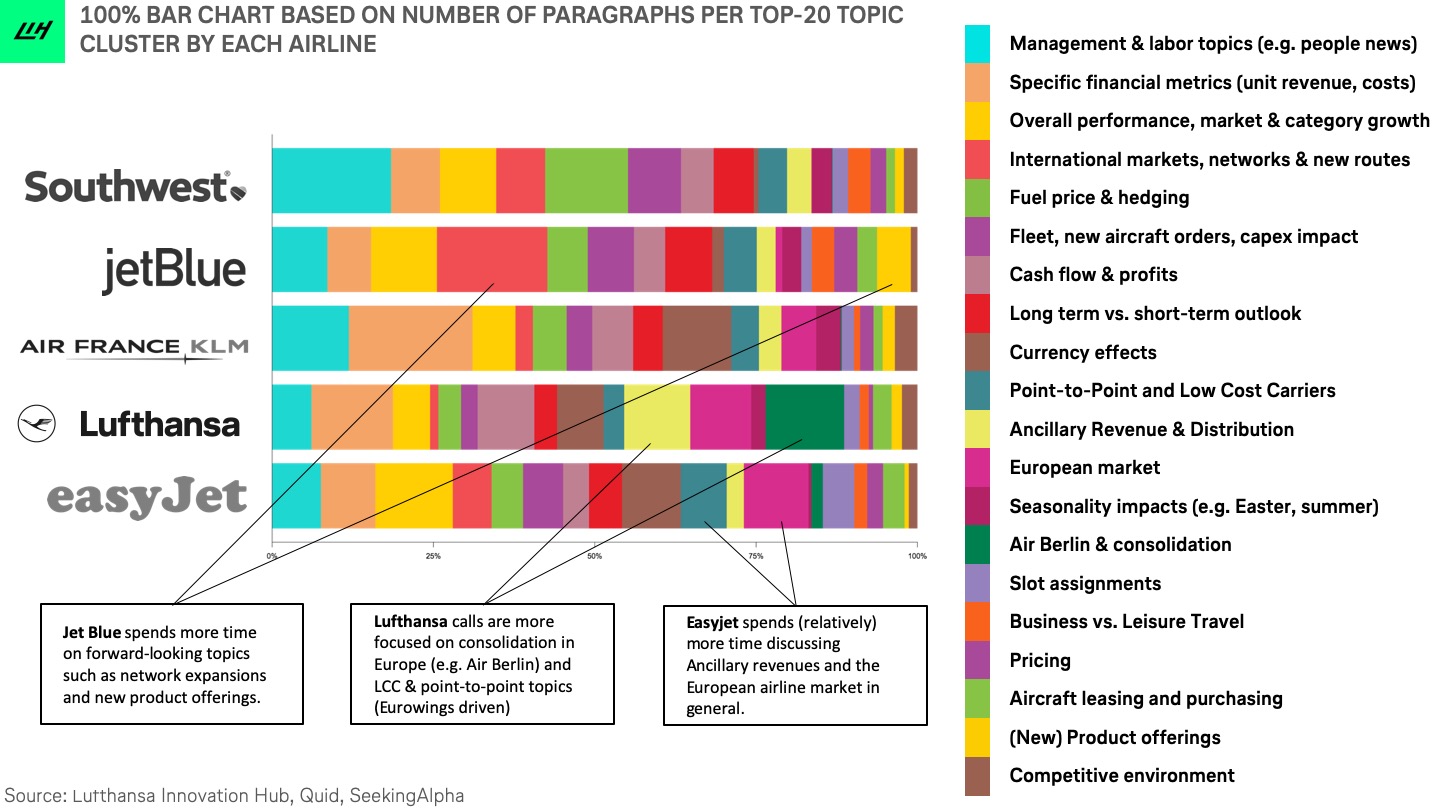

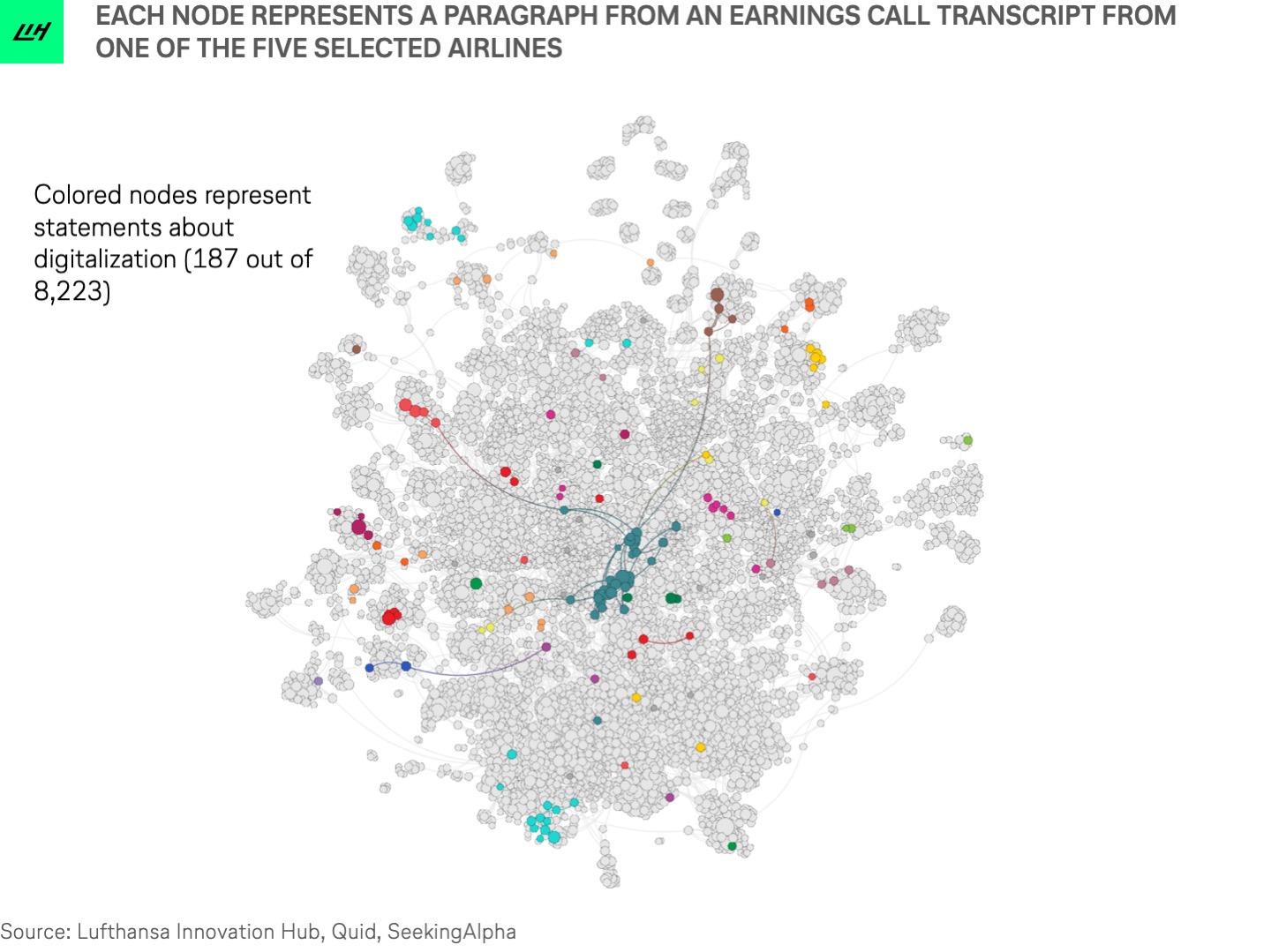

In 2019, we expanded our analyst spectrum by incorporating Artificial Intelligence and Natural Language Processing (NLP) techniques into our research arsenal.

This move allowed us to delve into vast amounts of unstructured data and text information.

One of our first experiments was a comprehensive analysis of over 60 earnings-call transcripts from major airlines.

Our goal?

To systematically understand the extent of “digital innovation” discussions at the board level.

What did we discover?

Airline earnings calls are predominantly focused on traditional financial metrics, with minimal attention to innovation efforts.

While each airline demonstrated unique priorities (see chart above), a common theme emerged from our analysis.

Shockingly, discussions around digital innovation were almost nonexistent.

Out of 8,223 paragraphs analyzed, only 187—merely 2%—addressed topics related to digital disruption or strategic moves towards innovation.

This scarcity of “digital talk” remains a persistent trend, highlighting a significant oversight in the airline industry.

Why does this matter?

This underemphasis on digital innovation is, in our view, a critical weakness within the airline sector, contributing significantly to the ongoing customer satisfaction crisis.

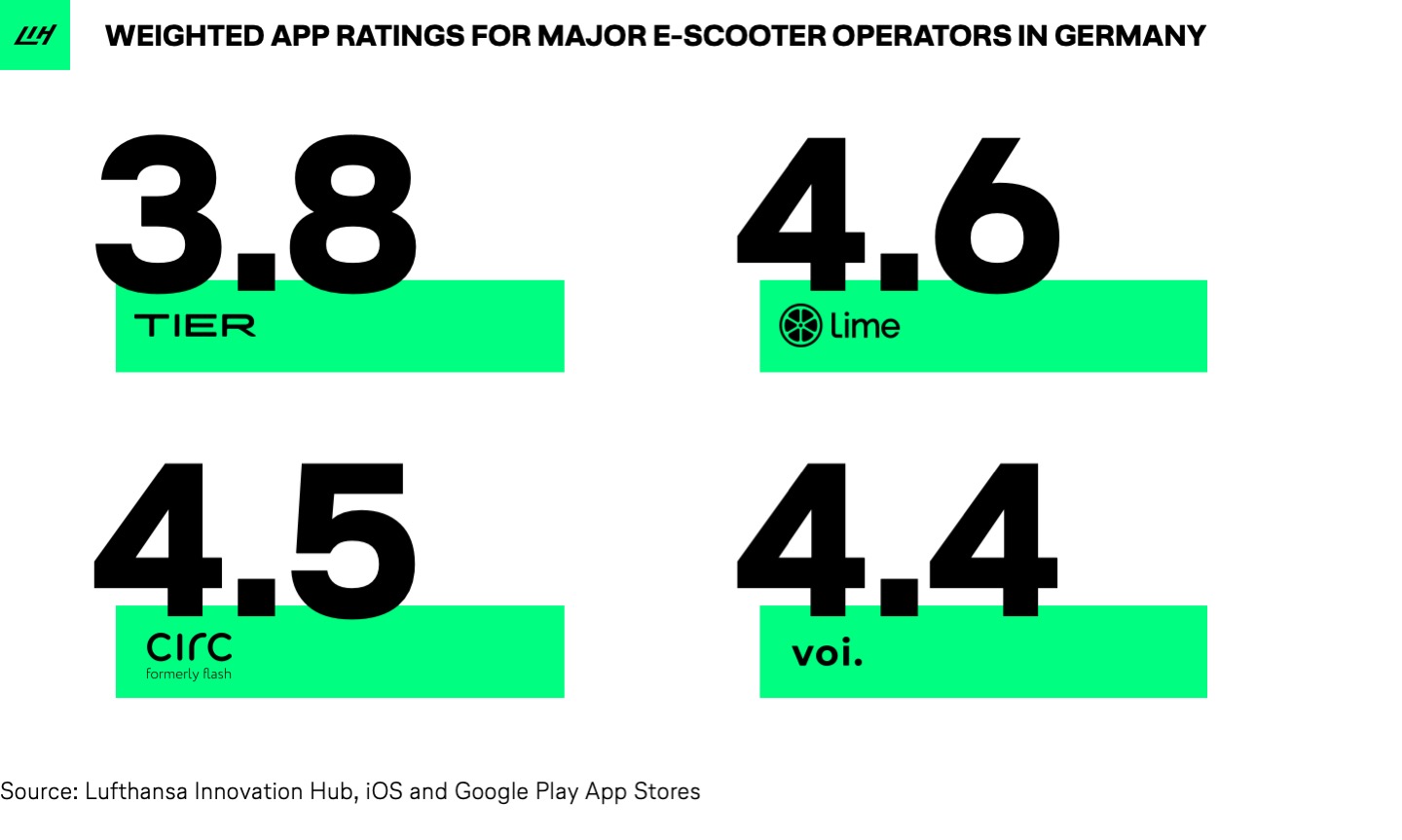

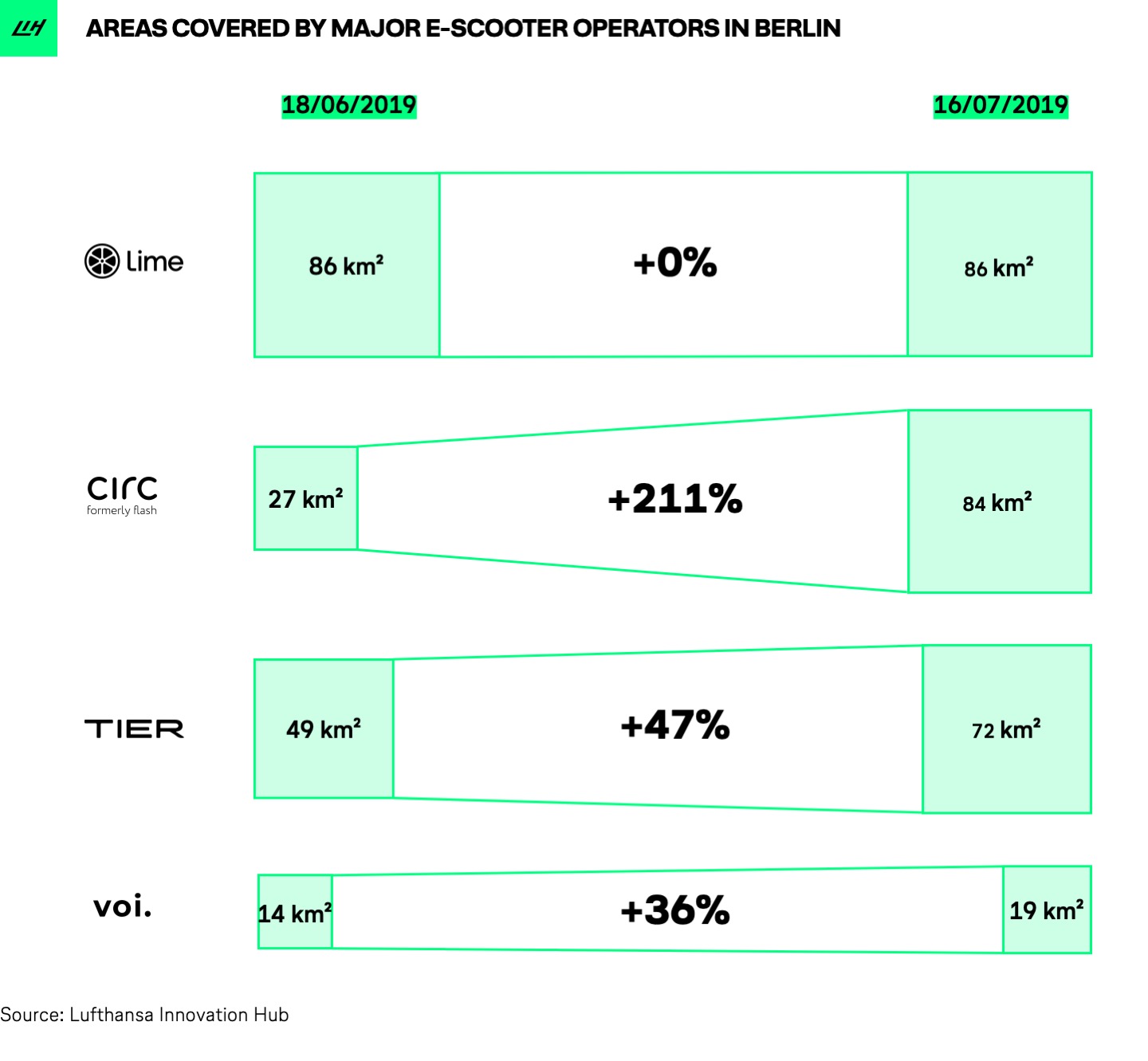

#7: Pioneering E-Scooter Market Analysis

2019 wasn’t just a year of exploring new data techniques; it was also when e-scooters took over urban landscapes—and our research focus.

As e-scooters flooded city sidewalks, we took the lead in decoding the competitive landscape in Germany.

Our approach?

A novel analysis combining app download data, Google search interest, and fleet sizes to unravel supply and demand dynamics within the e-scooter sector.

We didn’t stop at market shares.

Our team also monitored app ratings to assess customer satisfaction across the top four e-scooter providers.

Additionally, we analyzed each provider’s rollout speed and service area coverage to paint a comprehensive picture of their market presence.

This thorough analysis led us to predict that Tier and Lime would emerge as leaders in the German e-scooter market—a forecast that proved remarkably accurate.

#6: Bridging the Say-Do Gap in Sustainable Travel

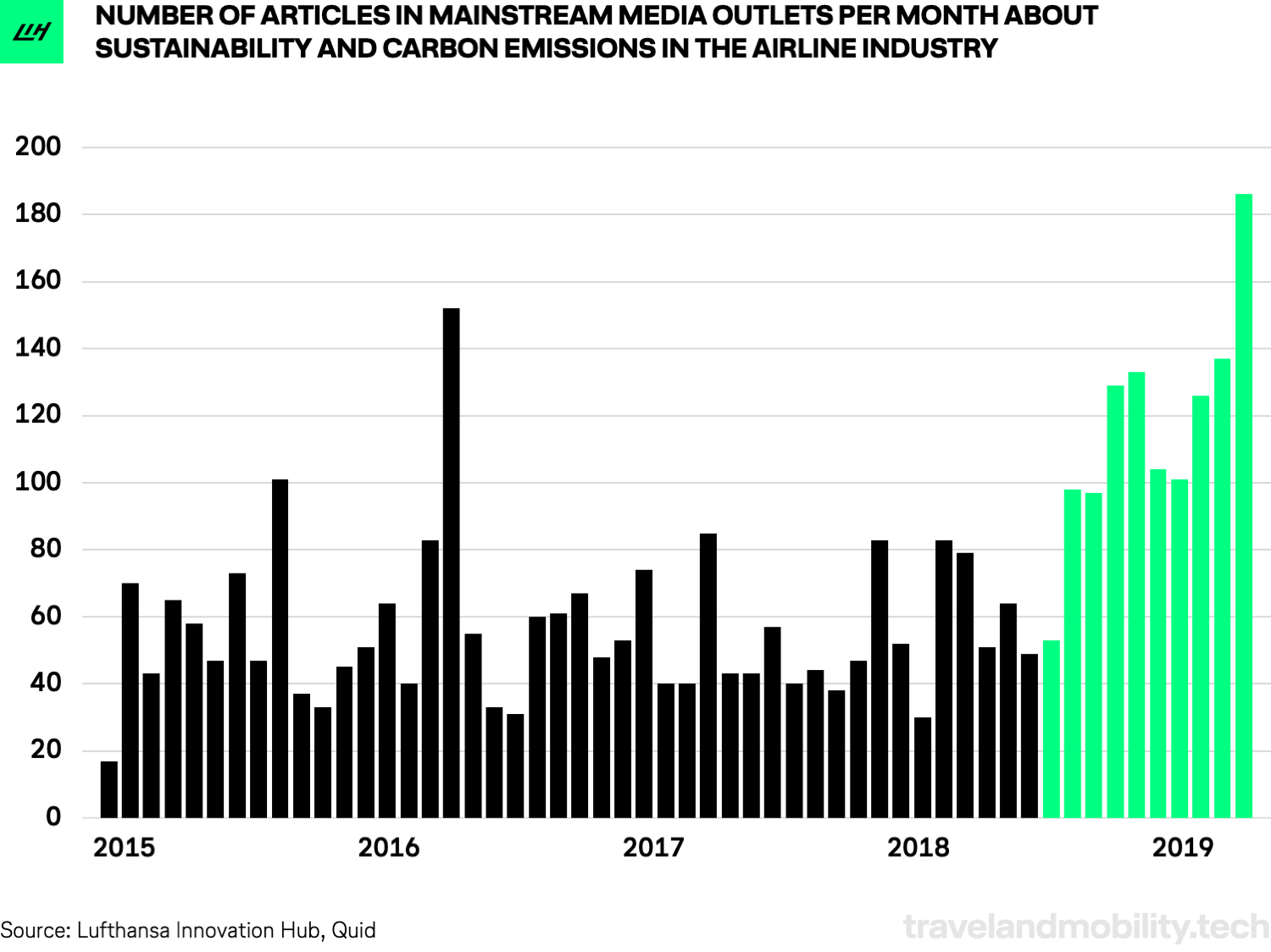

2019 marked a pivotal year for sustainability, becoming a central theme alongside the rise of e-scooters in the Travel and Mobility Tech sectors.

Prompted by the intensifying discussions around environmental impacts, we launched an extensive dive into sustainability, beginning with identifying the 50 most promising startups poised to drive sustainable change in the travel and mobility sectors.

This initiative provided foundational insights for future discussions and strategies.

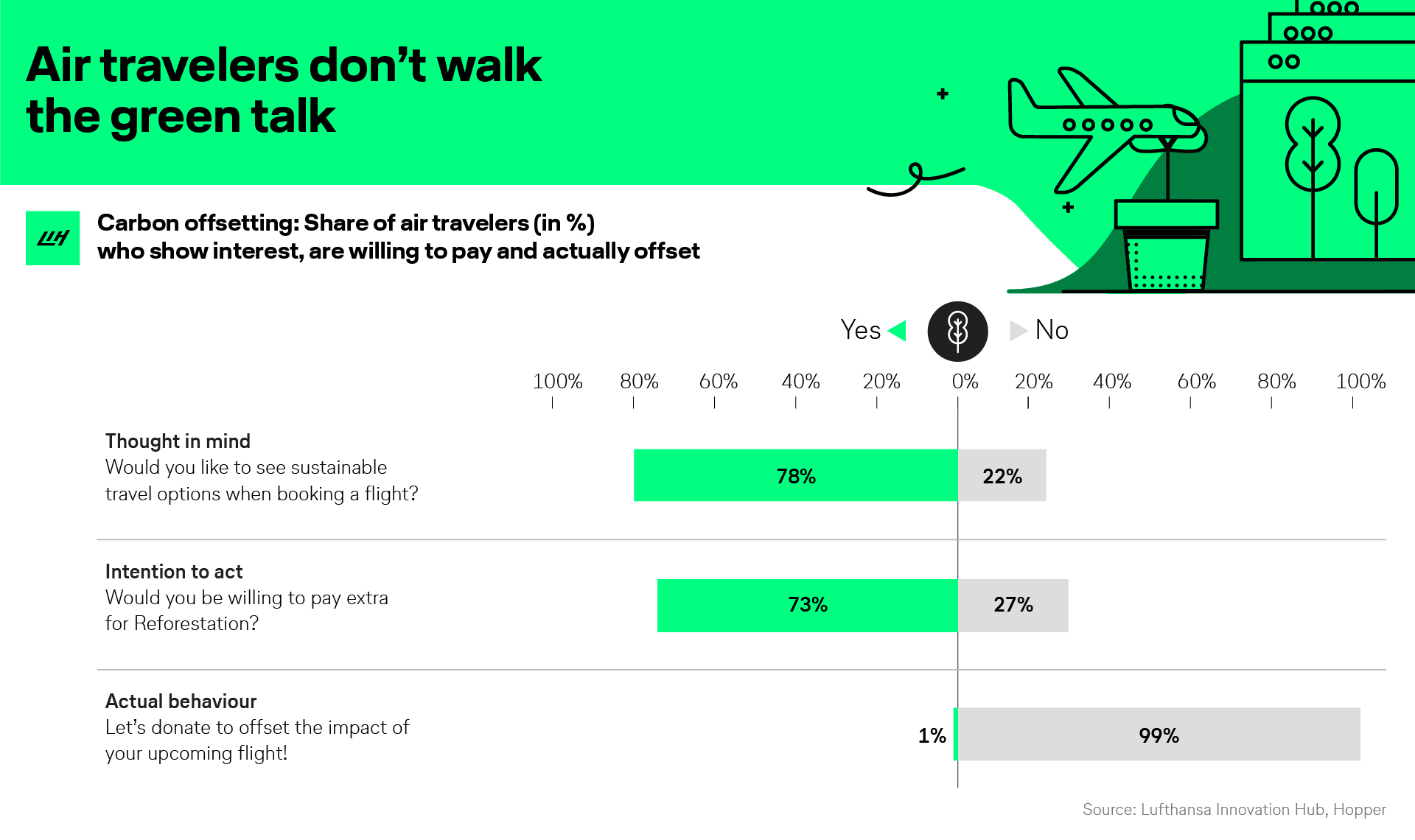

Another significant focus of our research was exploring the Say-Do Gap in sustainable travel behaviors, an insight that travel media have frequently cited since then.

In collaboration with flight booking platform Hopper, we conducted an experiment to measure actual traveler commitment to sustainable travel options, such as emissions-compensated flights.

The results were eye-opening:

While over 70% of travelers expressed a desire for more sustainable travel options, a mere 1% were willing to pay even a small premium to make those options a reality.

This discrepancy between intentions and actions highlighted a significant challenge within the sector. However, our research also indicated that it’s too simplistic to solely blame travelers for this gap.

Travel providers, especially airlines, have numerous strategies available to enhance the uptake of sustainable travel.

For an in-depth look at these tactics and to understand how companies can effectively encourage sustainable travel behaviors, check out our full analysis.

#5: The Pandemic Pivot: Scouting New Opportunities in Travel

From Q2 2020 onward, our research took an entirely new direction, triggered by the worst and most abrupt crisis the Travel and Mobility Tech industry had ever faced: the pandemic.

After initial attempts to gauge the crisis’s impact on the travel industry, we quickly shifted into opportunity mode, asking: What trends would shape the post-pandemic travel era?

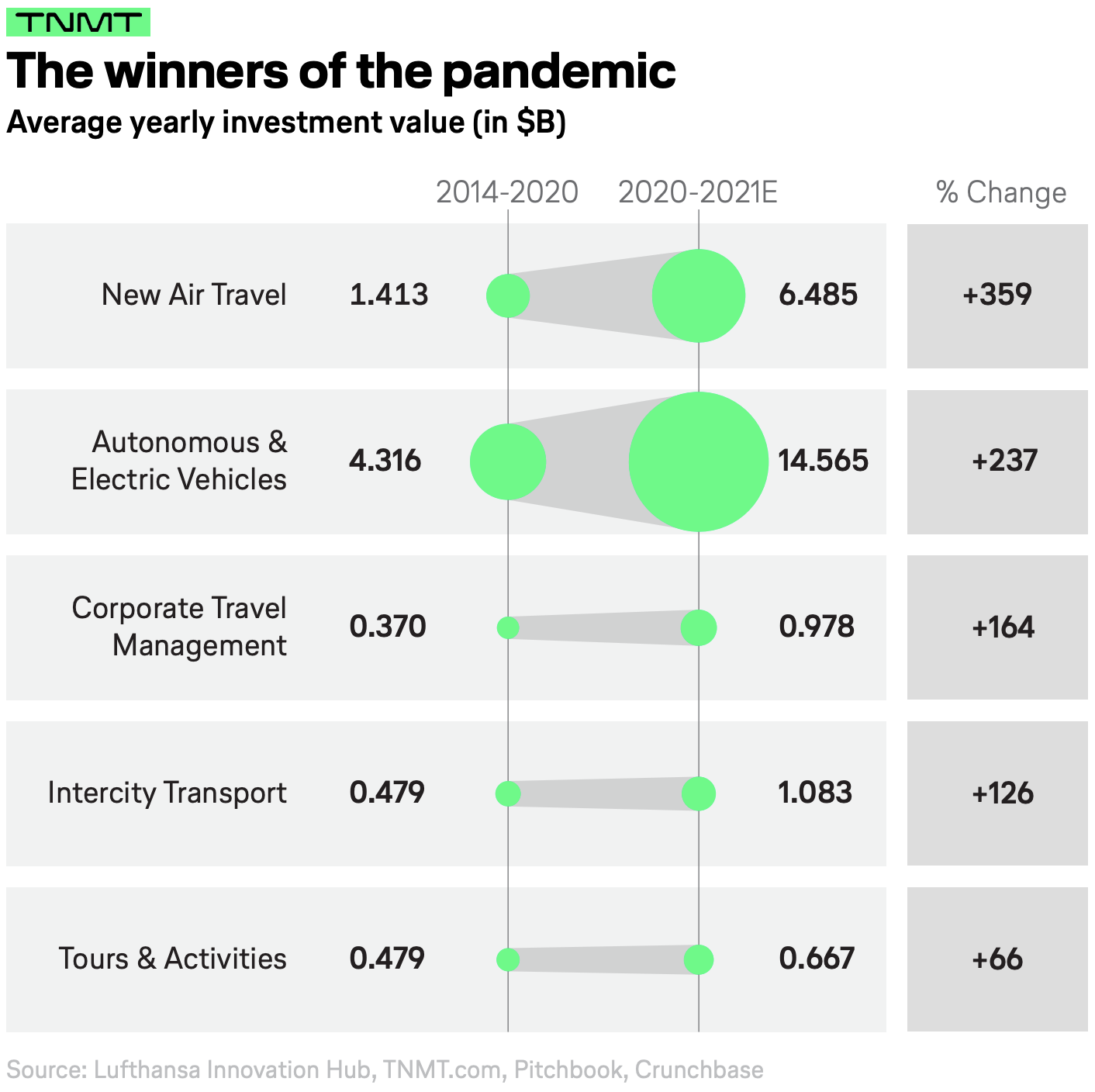

We crunched the numbers for a comprehensive update on investment trends in the Travel and Mobility Tech startup ecosystem, aiming to illustrate how the crisis impacted startup financing and what this could mean for the future of our industry.

It turned out that there were several winners, notably the so-called “New Air Travel” Players.

- This group included Uber-like on-demand aviation services, such as private jets offered by companies like Wheels Up, Surf Air, and Aero.

- The private jet trend was directly linked to soaring demand among the wealthy who avoided commercial flights but still wanted to travel to their exclusive getaways during the pandemic.

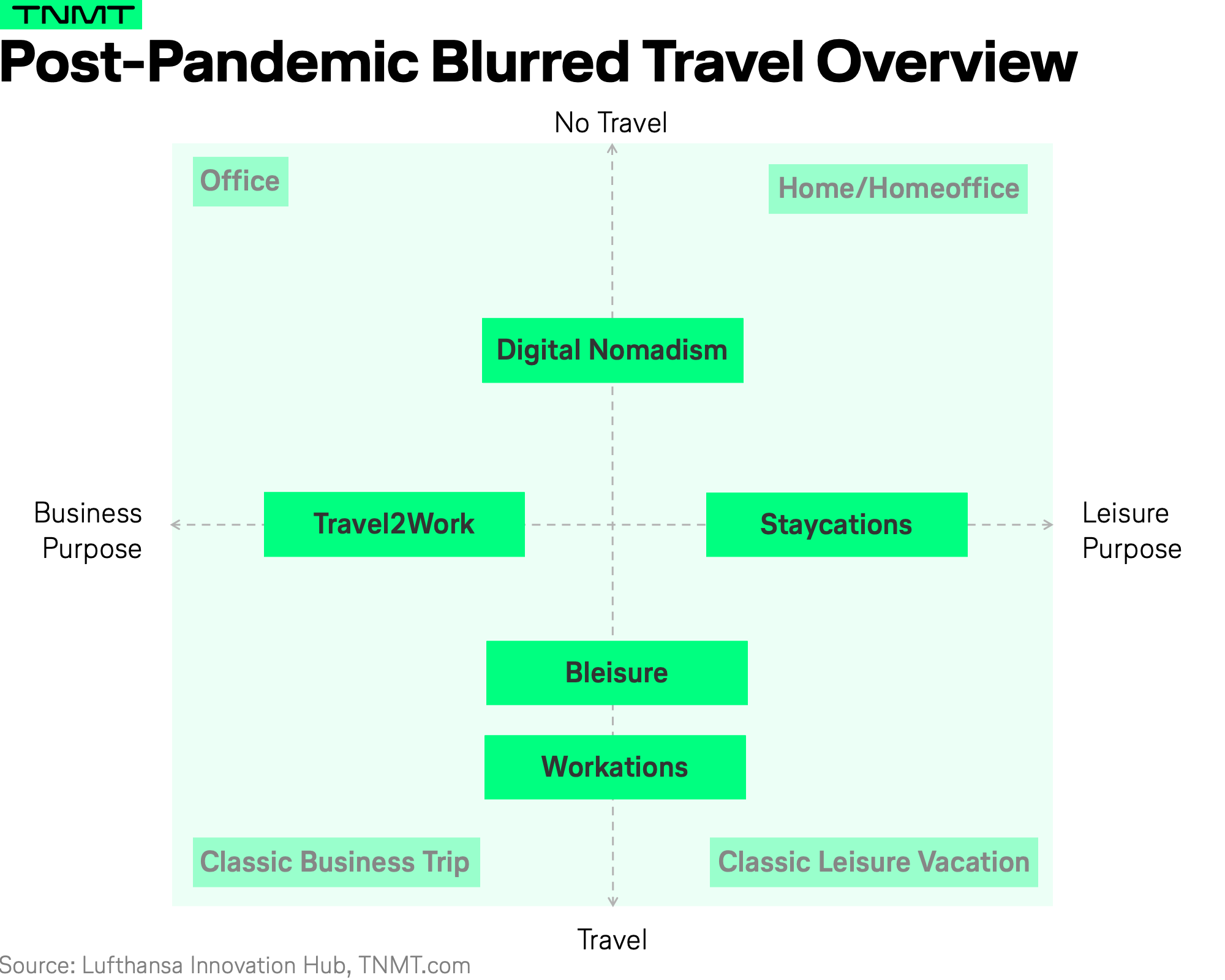

Another trend that gained momentum during the pandemic was Blurred Travel.

This concept describes the increasingly indistinct boundaries between leisure vacations and professional work trips.

In essence, Blurred Travel is “Bleisure on steroids.”

But it’s more than just what others might call “workation” or “digital nomadism.”

- We view Blurred Travel as a distinct travel categorization in its own right, existing alongside traditional categories like business and leisure.

- It should be recognized as an independent choice for travelers when prompted with the question, “For what purpose are you traveling?”

Blurred Travel introduces a new dimension for travel providers to consider when segmenting their market.

It caters to travelers who seek leisure opportunities—whether that’s exploring a new city, learning a language, or immersing in local culture—while simultaneously requiring facilities that support productive work, like dependable internet and conducive workspaces.

Within this emerging category, several specific use cases have developed, each addressing unique needs of the Blurred Traveler.

To understand these nuances and how they’re shaping the post-pandemic travel landscape, please dive into our comprehensive Blurred Travel Primer.

#4: NFTs & Metaverse: Redefining Travel since 2022

As 2021 drew to a close, the tech world found itself captivated by the hype around NFTs.

This fascination wasn’t just about digital art; it sparked a broader dialogue about blockchain applications and the virtualization of traditionally physical interactions.

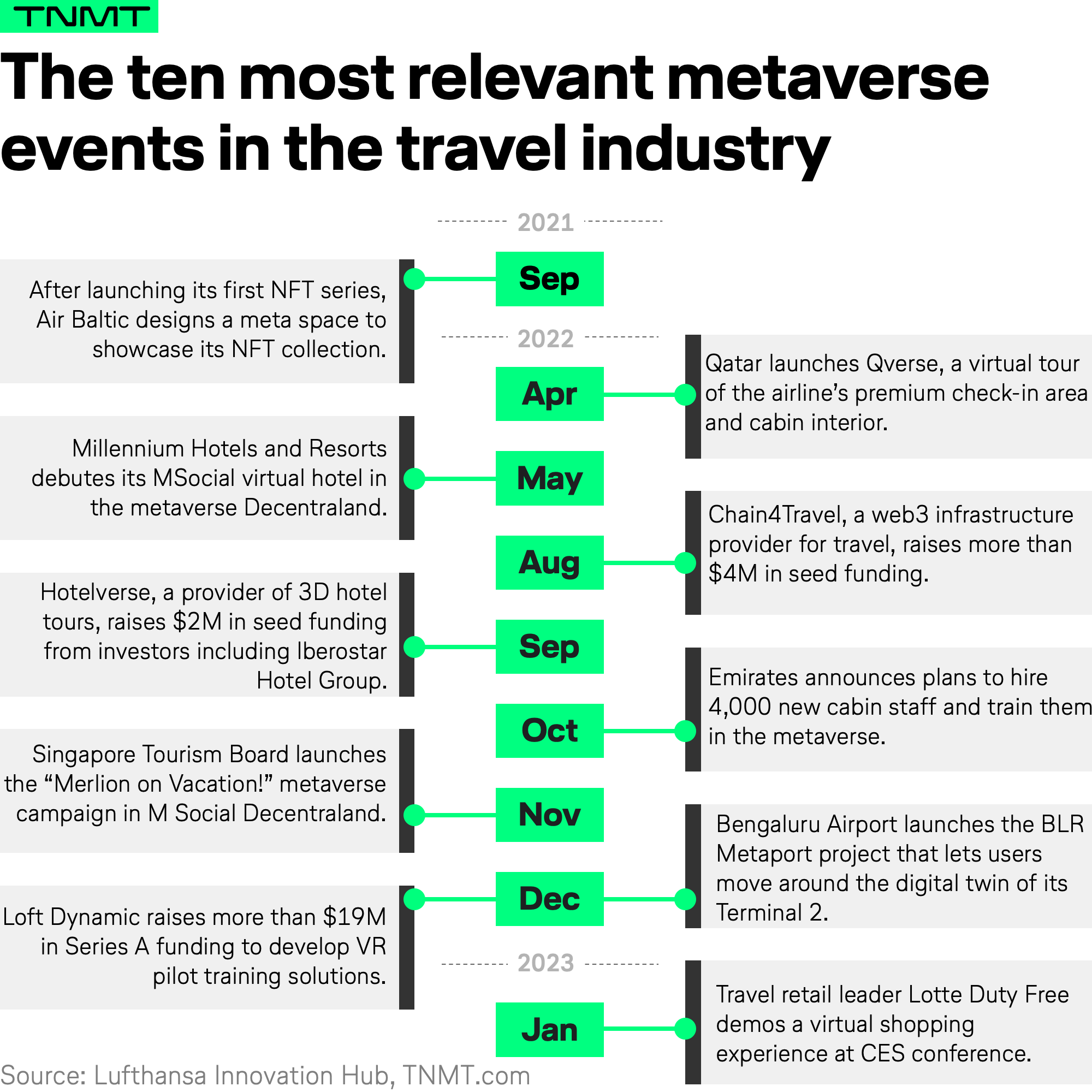

By 2022, these discussions funneled into what many called “the year of the metaverse.”

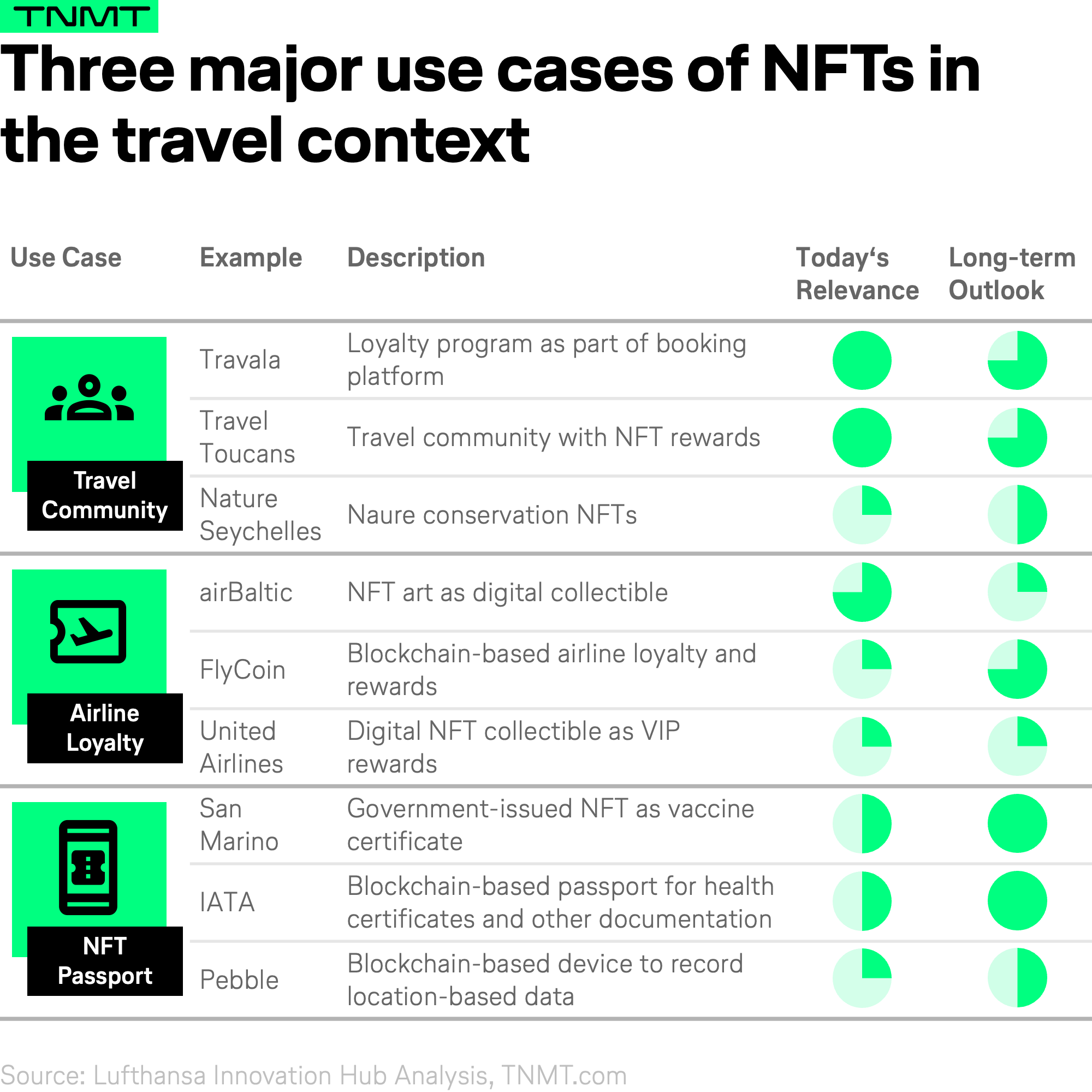

But what has been the real impact of NFTs on the travel industry?

To answer this, we initiated our “Trip3” series, starting with an exploration of NFTs’ major use cases within the travel sector.

Our research effort didn’t stop at mere categorization.

Over the following months, we delved deeper into the metaverse-centric initiatives launched by travel brands, including airlines, charting how these digital innovations are starting to reshape the landscape of travel and customer engagement.

While the NFT hype has significantly cooled over the past two years, metaverse applications continue to make waves in the travel industry, particularly in the airline sector.

Interested in discovering how exactly?

Dive into the latest chapter of our “Metaverse Meets Aviation” research series.

#3: Assessing Trends with Wikipedia Data

No new year without embracing a new unconventional research methodology at TNMT.

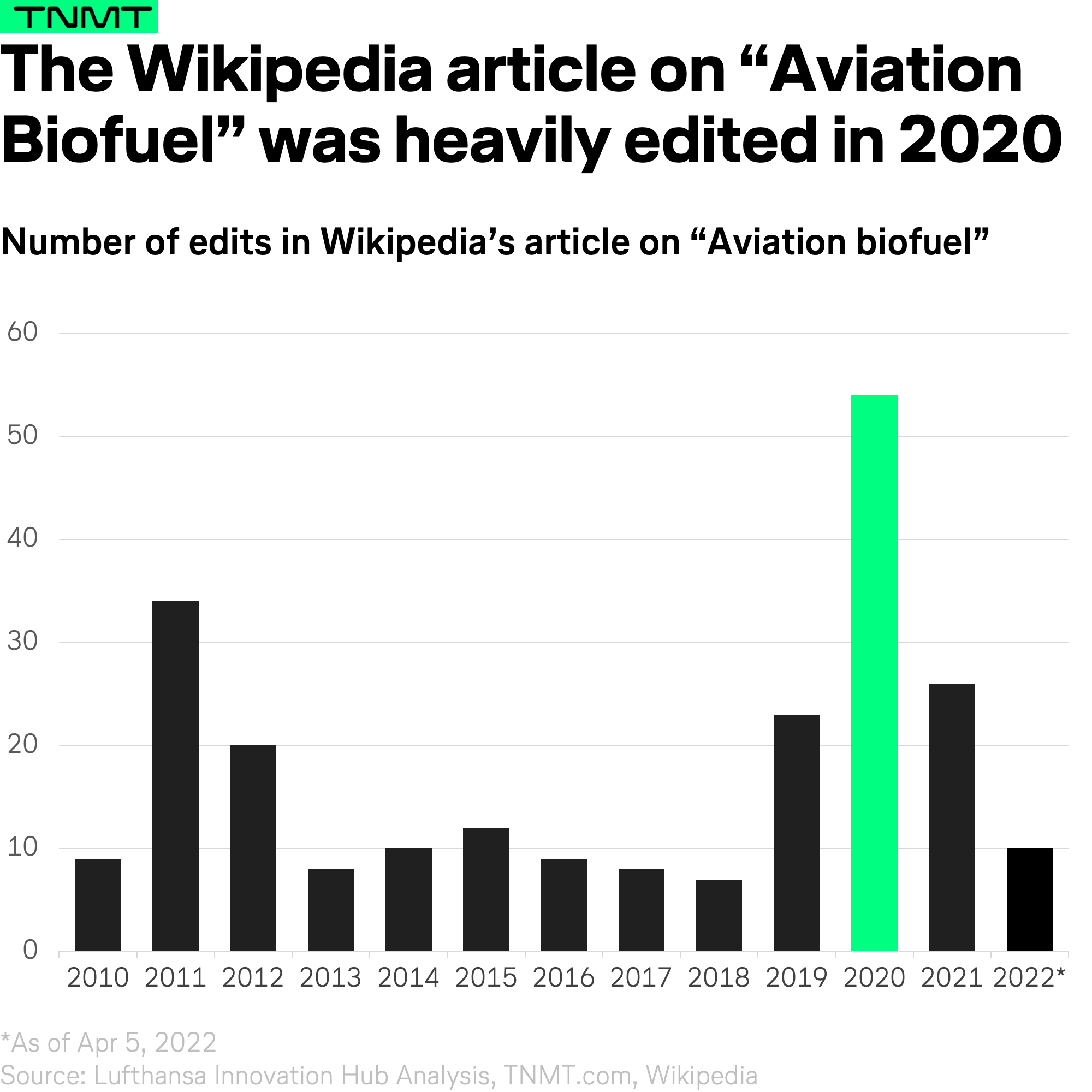

In 2022, we harnessed the power of Wikipedia to uncover and quantify trends within the Travel and Mobility Tech sector.

How did we do this?

By analyzing the frequency of edits made to Wikipedia pages on relevant travel themes.

Tracking these edits proved to be a fascinating trend indicator.

For instance, consider the Wikipedia page on “aviation biofuel,” also known as Sustainable Aviation Fuel (SAF).

The edit history reveals a compelling narrative:

- The initial excitement around biofuels in the early 2010s led to a surge in edits.

- This was followed by a period of decreased editing activity until a significant spike occurred in 2020, aligning with heightened sustainability concerns within the aviation industry.

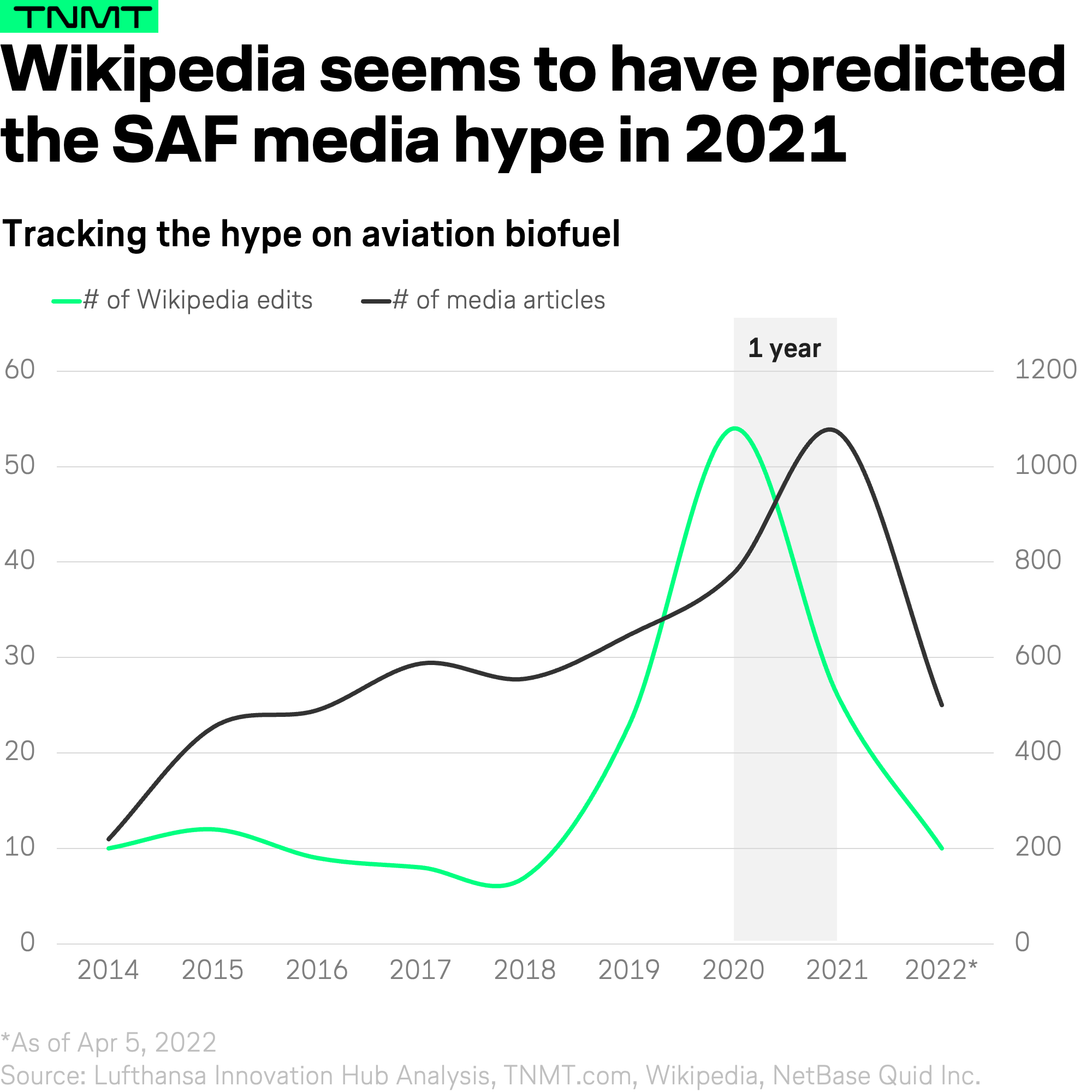

When we compare this trajectory with global media coverage concerning aviation biofuel, both datasets show a correlation.

Interestingly, the increase in Wikipedia edits seems to precede the media buzz by approximately one year.

Since uncovering this insight, tracking Wikipedia edits has become a standard tool in our research arsenal.

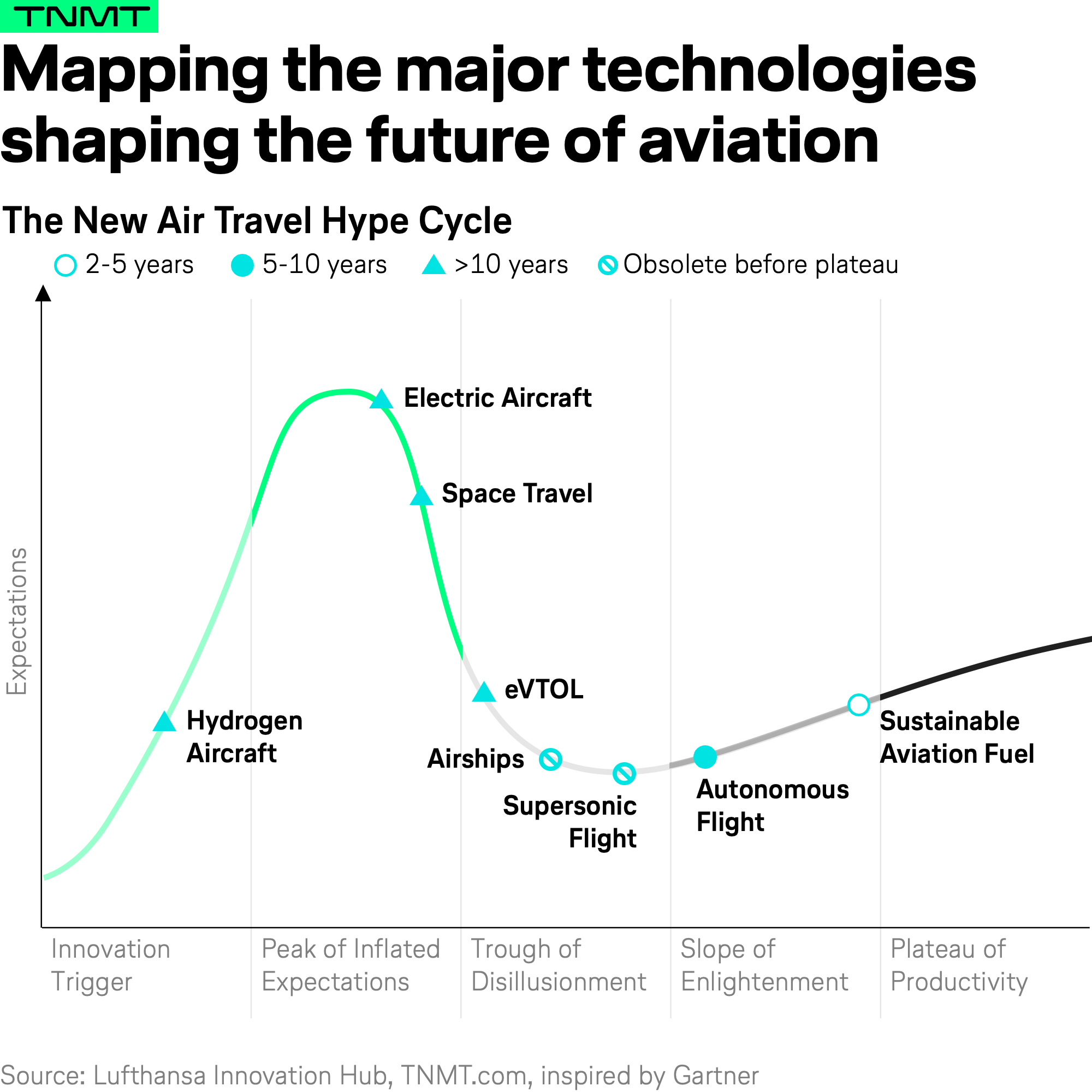

It even inspired us to assess major aviation technologies on the hype cycle curve, using Wikipedia edits as one of many indicators to evaluate the state of new air travel technologies.

This method has continually provided us with early signals on emerging trends, reinforcing the value of unconventional data sources in strategic research.

#2: How Airlines Are Betting on Green Aero Tech

Speaking of the sustainability movement in the airline industry, making aviation more sustainable is one of the macro trends that has consistently been on our radar.

It will likely shape the airline industry as one of the most pressing forces in the years and decades to come.

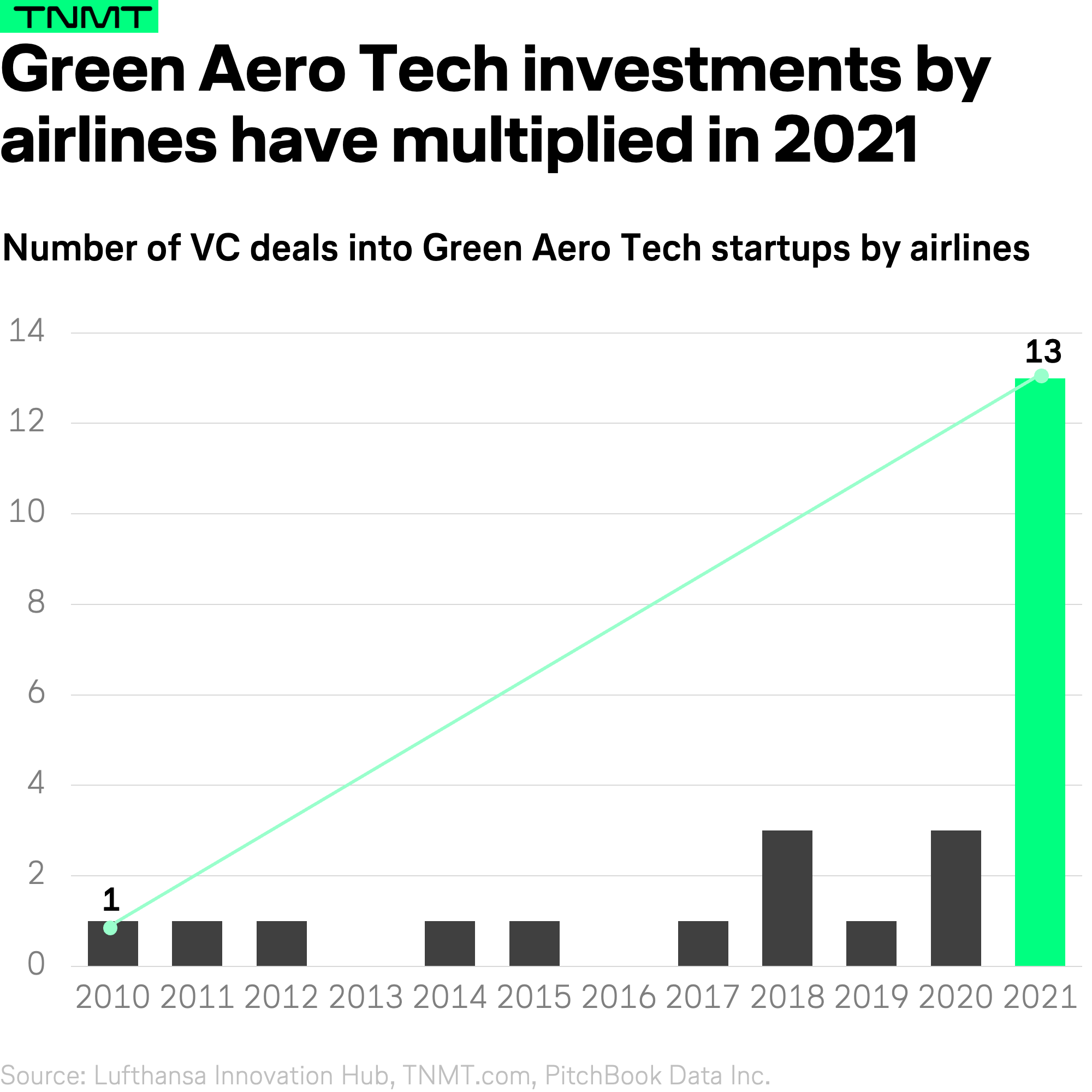

An interesting finding from our airline startup investment tracking is the increasing investment by airlines in disruptive startups that help the industry decarbonize.

- In 2010, KLM became one of the first carriers to explore the Green Aero Tech startup ecosystem through its investment in SAF provider, SkyNRG.

- Over the following eight years, a few more airlines committed to notable startup investments, especially in 2021.

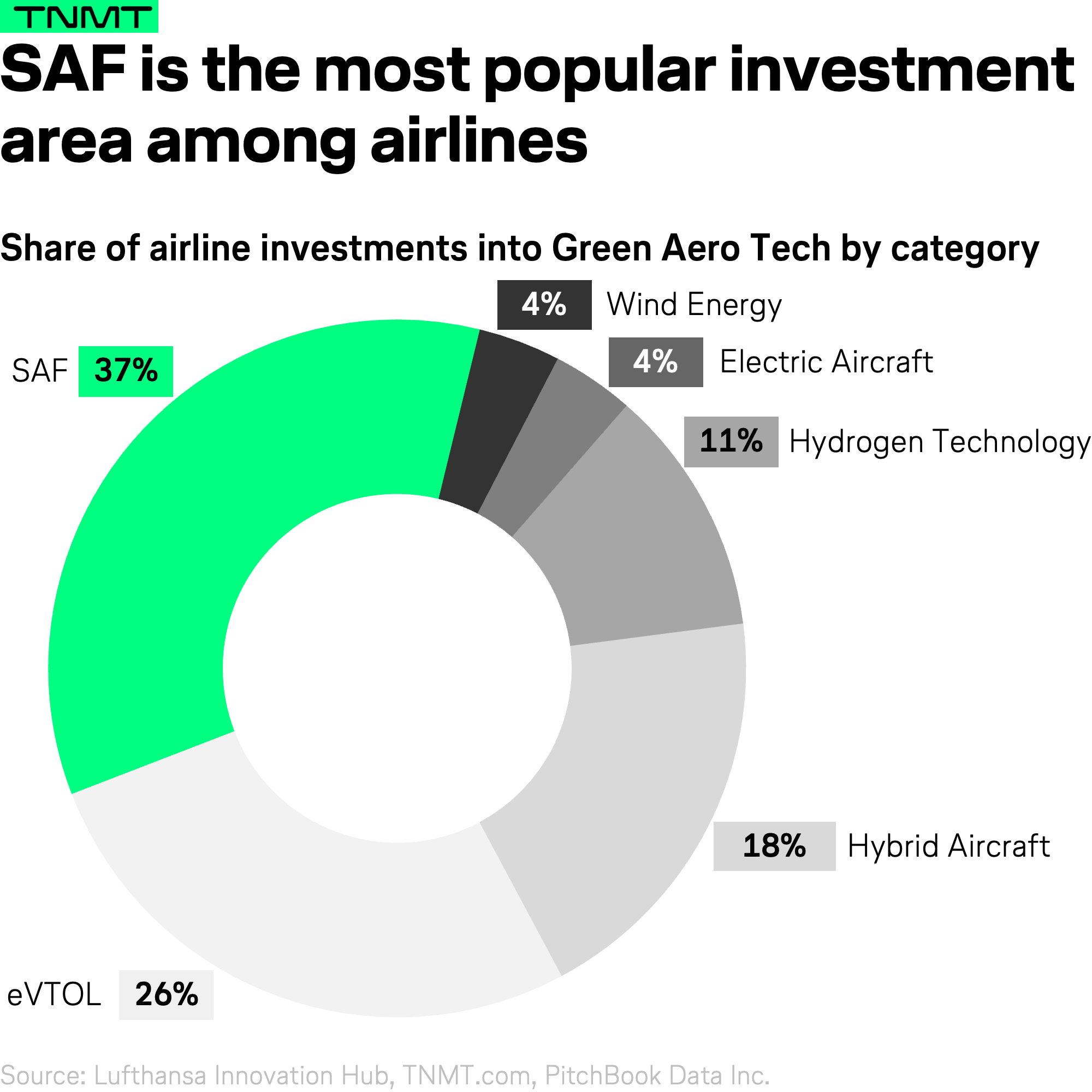

Which type of startups are airlines investing in the most?

We analyzed all Green Aero Tech startup investments since 2010 based on the technology field each startup specializes in.

It turns out SAF initiatives have seen the most funding activity; see our full analysis here.

Over one-third of all Green Aero Tech startups are involved in SAF development.

While Green Aero Tech startup investments by airlines have been on the rise, the overall willingness to bet on disruptive technologies in the sustainability context is still relatively low.

We continue to encourage airlines to intensify their startup investment activity.

#1: Transforming Airline Customer Service with GenAI

As we cap off this special edition of our newsletter, it’s time we focus on the defining trend of 2024: Generative AI.

Since ChatGPT burst onto the scene and became a household name in early 2023, the buzz around GenAI has been unstoppable.

Naturally, we dove deep into assessing this technology’s impact on the airline industry, focusing not just on its potential but on tangible, measurable outcomes.

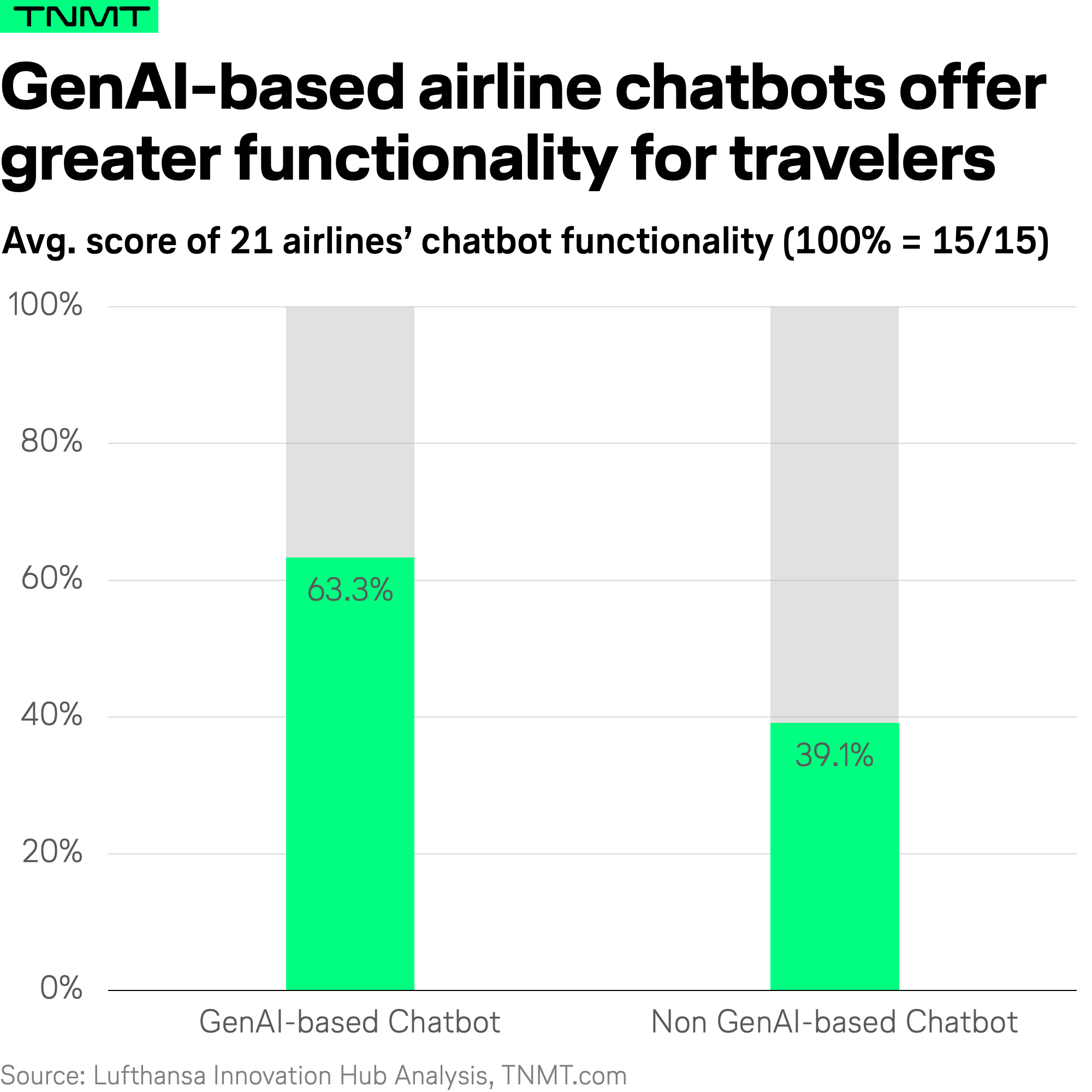

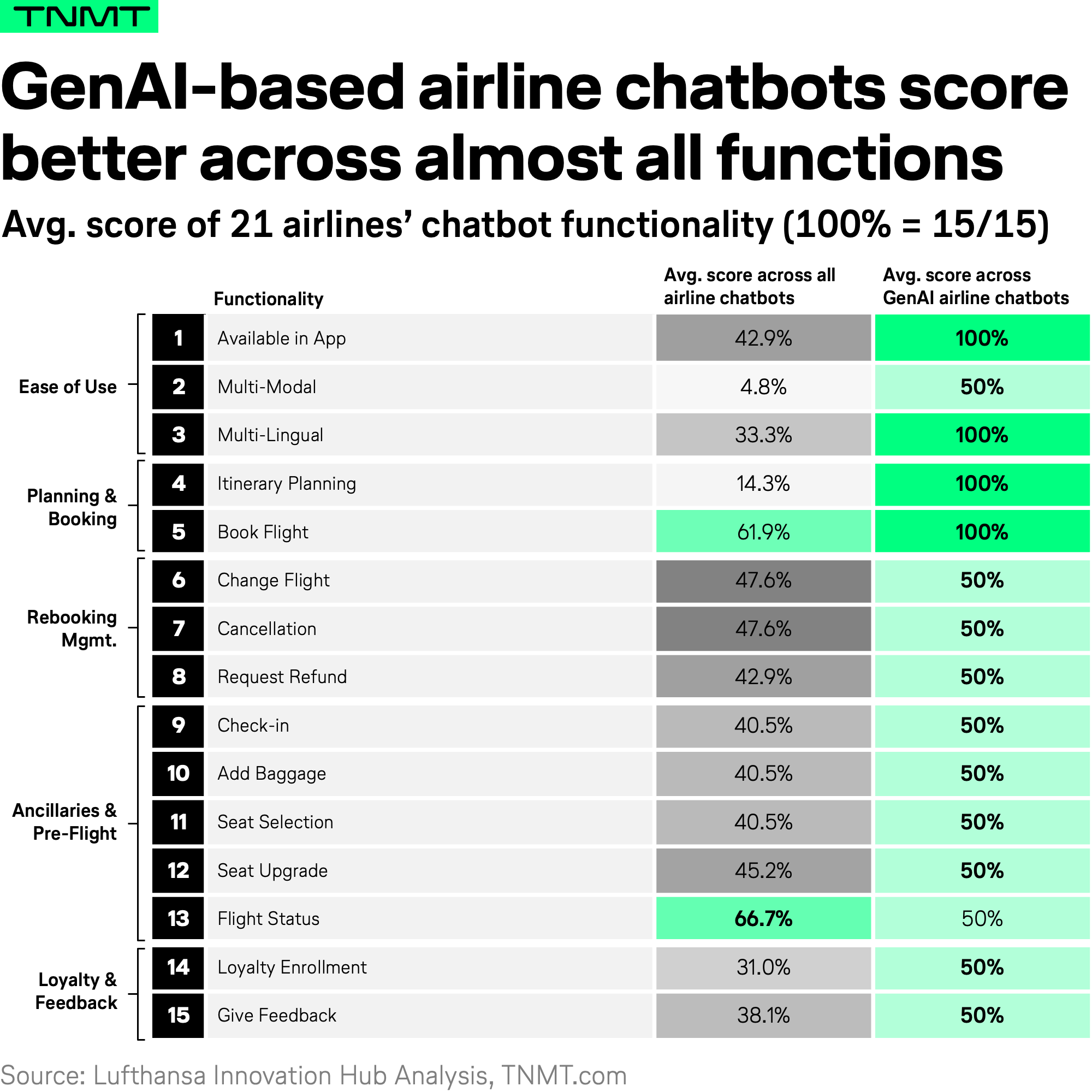

Our research this year took a pragmatic turn as we benchmarked major airline chatbots across 15 key functionalities to gauge their effectiveness in enhancing customer service.

The central question was: Can GenAI truly elevate airline customer service?

The answer, supported by our analysis, is a resounding yes.

We found that chatbots powered by GenAI significantly outperform their non-AI counterparts, providing a more robust airline service experience.

On average, GenAI-enhanced chatbots scored 24.2 percentage points higher than those without, achieving an impressive overall effectiveness score of 63%.

The superior performance of GenAI airline chatbots is noteworthy, but it’s in the details that we discover their real value.

GenAI-powered airline chatbots excel particularly in the early phases of a customer’s journey and in creating more inclusive user interactions.

These insights have led us to formulate best practice recommendations for airline executives on leveraging Generative AI to supercharge customer interactions effectively.

Our full analysis includes standout examples from industry leaders like Kayak and Trip.com, showcasing how they harness GenAI to transform customer service.

A Standing Ovation to Our TNMT Rockstars!

If you’ve read this far, you’re truly a TNMT rockstar, and we can’t thank you enough for your keen interest.

Delivering genuinely differentiated market intelligence is no easy task, and while not every piece we publish may hit the perfect ten, our commitment to striving for excellence is stronger than ever.

We’re here to arm you with both strategic and practical insights that foster informed decision-making.

As we look forward, our research will intensify its focus on the most promising startups and technologies transforming the Travel and Mobility Tech sectors—especially those that are elevating the customer experience within the airline industry.

Here’s to the next decade of standout research!