Disclaimer: This article has been a living document for the past four months and and was last updated on Feb 23, 2023, which means that previous versions of this article may differ from this final version below.

A great deal has been written about the future of aviation.

In particular, people have pondered how passenger air travel will become more sustainable in the years to come.

As concerns over climate change continue to mount, the aviation industry is facing mounting pressure to reduce its environmental impact.

Undoubtedly, aviation has a significant impact on CO2 emissions.

As a result, technologies that might limit the carbon footprint of commercial airplanes, such as electric and hydrogen propulsion, are heavily discussed.

While this is the case, two aspects remain unclear:

- How advanced are R&D efforts for these technologies at present?

- When will these technologies be expected to play a meaningful role in the future of sustainable aviation?

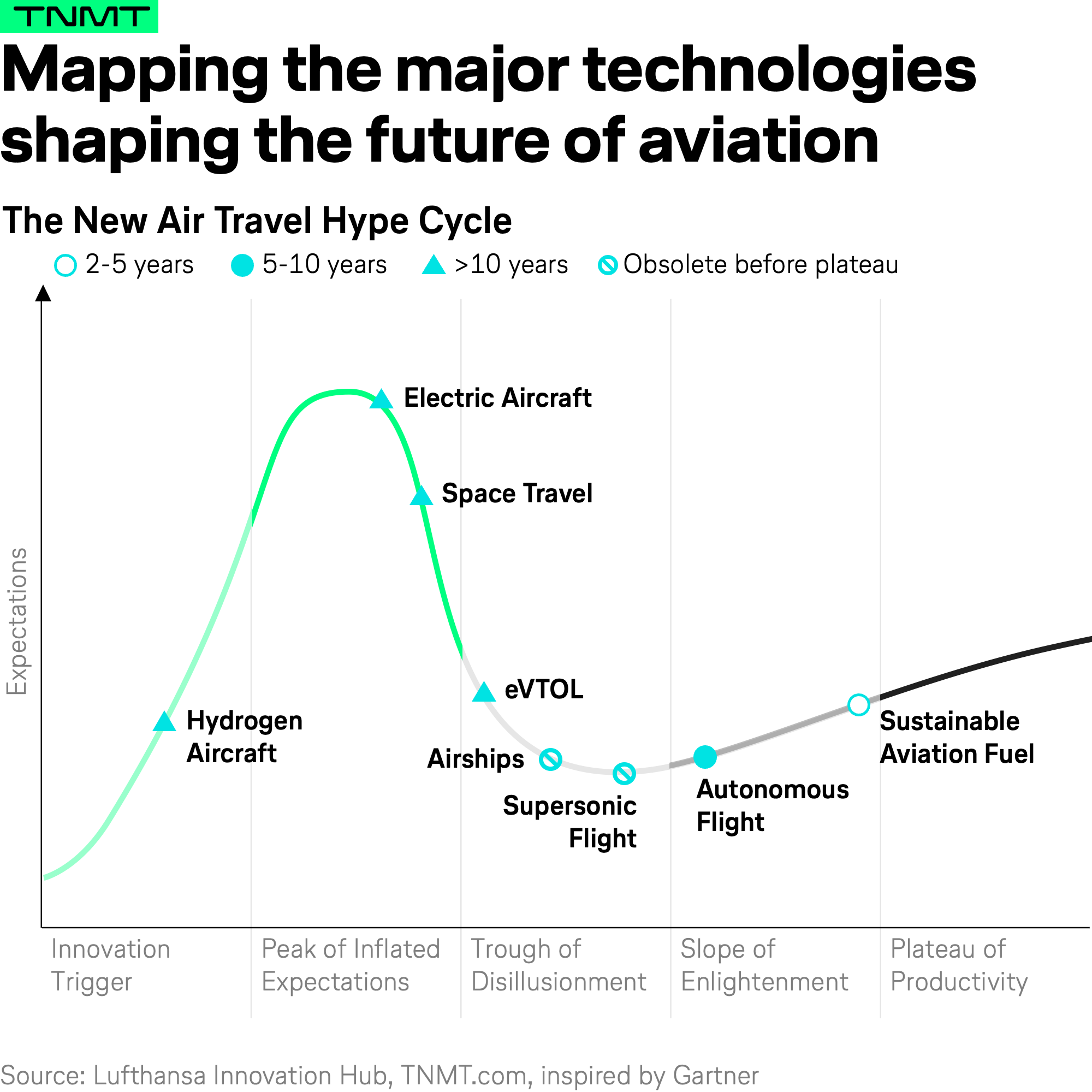

We want to increase transparency surrounding how far major technologies affecting the future of air travel have come. To achieve this, we applied the Gartner hype cycle framework and used it to evaluate all major New Air Travel technologies.

For this analysis, we identified eight key emerging technologies that have the potential to change the way we travel from A to B through the air.

- These technologies include hydrogen and electric flying, air taxis, a.k.a eVTOLs, futuristic airships, commercial supersonic jets, autonomously-flying aircraft, and space-travel jets.

- Given its potential to reduce aviation’s CO2 footprint, we also include Sustainable Aviation Fuel (SAF) as a technology to consider, even though it isn’t exactly a new technology on the same dimension as the previously mentioned.

The unofficial hype cycle for New Air Travel

Since November 2022, we have explored all of these eight technologies in detail and evaluated their market readiness by mapping them across the hype cycle framework.

You can directly jump to the analysis of each of these technologies right here:

- Sustainable Aviation Fuel

- Autonomous Flights

- Supersonic Flights

- Airships

- Air Taxis aka eVTOL

- Space Travel

- Electric Aircraft

- Hydrogen Aircraft

But first, take a look at how we map them.

As you can see, SAF is positioned all the way to the right side of the hype cycle.

This means that SAF is the most ready-to-use technology out of all the eight categories.

How so? Let us explain.

(1/8) Sustainable Aviation Fuel: the industry’s lifesaver

SAF is a jet fuel made from sustainable feedstocks that can have up to 80% lower life cycle carbon emissions than traditional fossil jet fuels.

- Our hype cycle assessment determined that SAF is currently located in the Slope of Enlightenment phase.

- Furthermore, we expect SAF to reach the Plateau of Productivity in the next two to three years.

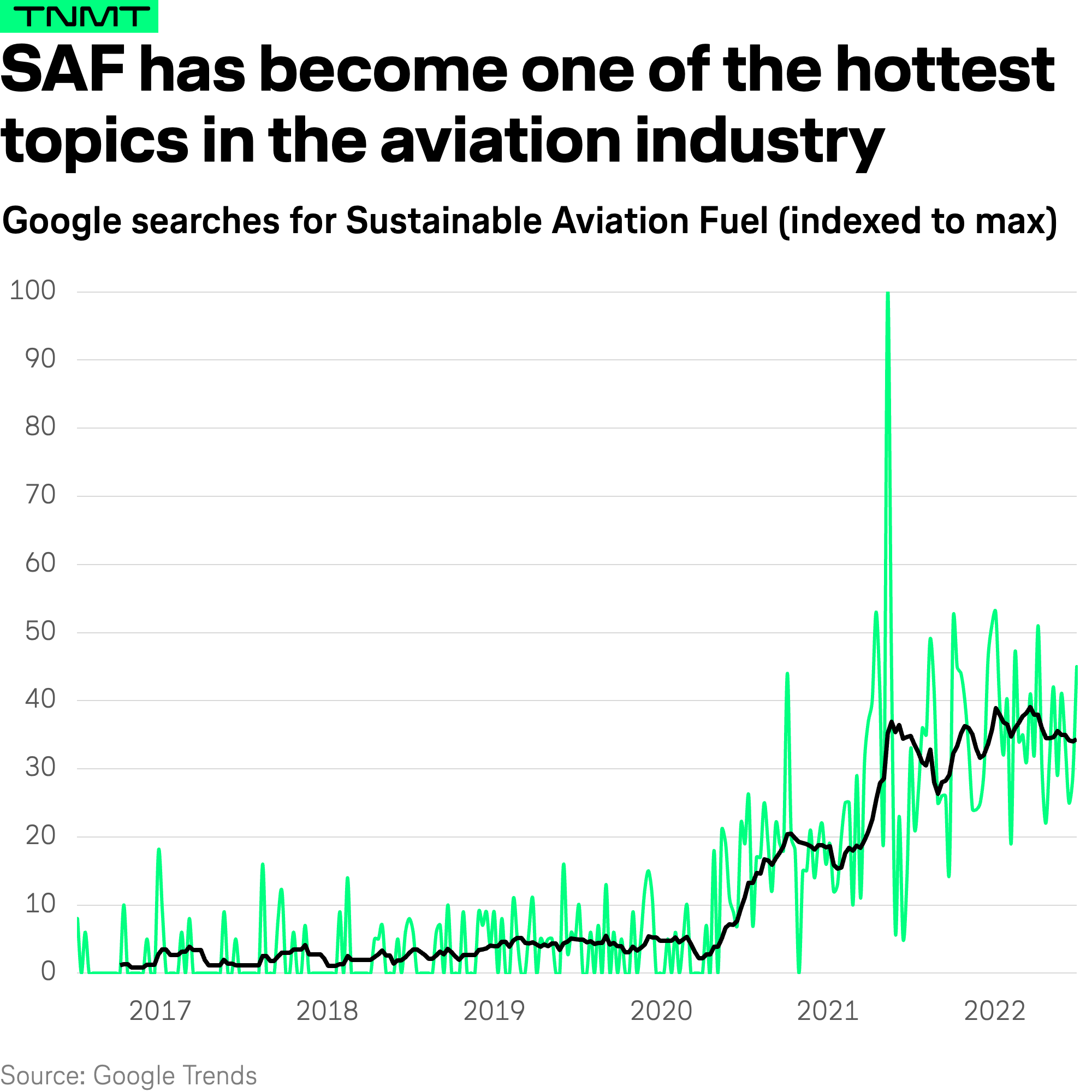

Here’s why: SAF has arguably become the hottest “green topic” in the aviation industry, and this has been the case since the onset of the sustainable air-travel debate in 2018.

The aviation industry has set ambitious goals to decarbonize by 2050. In order to achieve these goals, the sector must take immediate action and SAF seems to provide the most obvious solution. While there are still several challenges associated with SAF, such as limited availability and higher costs, the benefits outweigh the drawbacks.

As the Sustainable Aero Lab rightfully concluded in its SAF primer, the technology has been widely recognized as the only feasible option for the aviation industry to achieve its sustainability targets in the coming decades.

In other words, SAF is the industry’s primary means of providing a cleaner fuel source that will power the world’s aircraft fleets of the future.

It’s no wonder SAF has become so widely discussed, from internal industry talks to garnering mainstream media attention.

In fact, the number of Google searches for “Sustainable Aviation Fuel” skyrocketed in 2021.

The “SAF path” into a more sustainable aviation future also becomes evident when we take a closer look at how airlines have thus far addressed the pressure to reduce carbon emissions.

- Every major carrier in the world has recently launched its own SAF initiative.

- These include partially SAF-powered demonstration flights, SAF purchasing agreements with energy and fuel providers, and SAF-based compensation programs for customers, alongside other partnerships dedicated to enabling SAF use.

As SAF is a “drop-in fuel,” meaning it can be blended with fossil jet fuel, the technology is already produced and used by airlines worldwide. As a technology, SAF isn’t necessarily challenging to produce in and of itself. However, it must be produced in far greater sums to make a meaningful difference in climate change and keep up with global jet fuel demands. Currently, SAF is barely in use, which is troubling.

According to the same research by the Sustainable Aero Lab, SAF is still a fledgling industry, with roughly only 20 million gallons (~75 million liters) of production capacity in 2020, which accounts for less than 0.05% of the world’s aviation fuel use.

Despite this, a growing ecosystem of startups and energy companies is producing more SAF.

As a result, we believe the “technology” will enter its Plateau of Productivity in the next few years.

Next one up is autonomous flying.

(2/8) Autonomous Flights: Quietly getting to the market

When we speak of this technology, we are referring to a future scenario of commercial airline flights that are operated without a pilot controlling the aircraft. Instead, the aircraft management is overseen by an operator (who can take control of the plane if necessary) and the aircraft’s automated management system.

At present, autonomous flying is on the Slope of Enlightenment in the hype cycle. We believe that in five to ten years, this technology could reach the Plateau of Productivity.

To arrive at this conclusion, we based our reasoning on two dimensions, including the current state of technology and the number of companies working at the forefront of autonomous flying technology.

Let’s take a closer look at both.

The state of technology

From nearly the beginning of the aircraft era, which took place more than 100 years ago, engineers have contemplated flight technology that best supports pilots. It’s no wonder that the first airplane with somewhat of an autopilot system was built back in the 1910s by the Sperry Corporation.

Over the century to come, the progress of technology has, of course, grown exponentially. The “autopilots” of today are not comparable to the early origins of “autonomous flying”.

Modern autopilots use computer software to control the aircraft. As a result, these technologies are advanced to the extent that the majority of people who are not a part of the aviation or software industries are unable to wrap their heads around.

According to the Ranadovic scale of autonomy levels in the Advanced Air Mobility context, the current level of development is somewhere between Conditional Automation and High Automation.

- The former requires a human pilot to pay attention and be ready to suddenly take over flight operations.

- The latter can but does not need to have a pilot operate the plane.

From a technical perspective, the High Automation level is already a possibility today.

However, there are a couple barriers in the way of making this a reality, including regulations and social acceptance.

Firstly, authorities and regulators are constantly evaluating the acceptable next levels of autopilots. New features are evaluated, certified, and added on a regular basis.

- Thus far, some progress has been made to realize the High Automation level of autonomous flying. For instance, Reliable robotics company has started a certification process with the Federal Aviation Authority (FAA) on its “advanced navigation and autoflight system, which will eventually enable pilotless flights monitored by ground personnel.”

- However, final approval still seems to be a few years away. This is the case given that all potential technology loopholes must be closed in tandem with the aviation industry’s safety standards.

Secondly, the level of social acceptance of fully autonomous flights is still unclear. A 2019 survey conducted by Ansys revealed that 70% of consumers expect to “travel in an autonomous aircraft in their lifetime.”

However, this doesn’t mean that today’s travelers would feel comfortable boarding a fully autonomous aircraft, especially with the knowledge that there is no pilot on board.

Interestingly, the majority of travelers are unaware that today’s commercial flights are already heavily supported by autopilot technology. This demonstrates that there is little awareness of the technology and its application. The survey also shows that by actively informing people about current autopilot technology, perceptions can be changed positively. Therefore, proper communication can increase the social acceptance of autonomous flight technologies in the future, but it will be a long process.

As a result, we believe the social acceptance of autonomous flights will be challenging to overcome over the next decade. Hence, we don’t expect planes to become “pilotless” any time soon. We believe a pilot will stay onboard even if planes no longer require a pilot in the traditional sense. While social acceptance may take a while to come around, this doesn’t mean that planes won’t be flying mostly autonomously in the near future.

Pilots will remain in the cockpit to appease travelers who feel uncomfortable in the air without a human operator. However, pilots will be more aircraft system managers than actual manual flight operators.

The autonomous-flying startup ecosystem

The fact that autonomous flying technologies are moving towards market readiness also becomes evident when looking at the number of companies working on autonomous flying technologies. The number of these tech firms has rapidly increased over the past few years.

Furthermore, VC investments into these companies have been on the rise, reaching a record high in 2021. However, aggregated funding sums of about 350 million USD last year are still marginal, keeping in mind that more than 45 billion USD were invested in all of Travel and Mobility Tech last year.

There are a number of recently funded startups that are, particularly, promising for the future of autonomous flying technology.

- This includes Merlin Labs, which emerged from stealth with an autonomous flight system designed to be installed in existing aircraft. The company raised a massive $105 million USD in funding this summer.

- Meanwhile, Skyryse, another autonomous flight company, has also raised a significant amount of funding in its latest round. The company aims to “reduce the learning curve so that learning to fly is as easy as learning to drive.”

In conclusion, we believe that “High Automation” flight technology has a positive outlook in terms of technology readiness. The next step is certification. However, whether social acceptance will follow suit remains to be seen.

The startup ecosystem is gaining momentum. We wouldn’t be surprised to see more players entering the market in the years to come.

With all this in mind, we expect autonomous flying to reach the Plateau of Productivity in the next five to ten years.

(3/8) Supersonic flying: Slowly fading away

The third technology in our hype cycle is supersonic flying, which refers to passenger commercial aircraft with cruise speeds that exceed the speed of sound.

The most prominent example of said technology is BOOM’s Overture.

At present, supersonic flying is stuck in the Trough of Disillusionment, and we don’t think the technology will make it to market anytime soon. As a result, in our assessment, supersonic passenger flying won’t reach the Plateau of Productivity in the foreseeable future.

Why are we so pessimistic about the supersonic vision that has fascinated the aviation industry for so long?

Significant hurdles need to be overcome for supersonic flying to become a viable technology. Let’s dive deeper into the obstacles hindering the path forward.

Technology is still unable to overcome major shortcomings

The technology required to develop supersonic jets is well established. In fact, several decades ago, the idea was realized by the commercial supersonic passenger aircraft Concorde and Tu-144. Sadly, the jets were ultimately grounded following tragic accidents and economic challenges.

Since then, several new companies have repeatedly tried to advance the technology to make it economically valuable (e.g., optimize fuel burn) and socially acceptable (e.g. mitigate the supersonic boom effect). However, they haven’t been able to address both of these challenges.

Keep in mind, supersonic aircraft burn a substantial amount of fuel.

The Concorde, for example, was guzzling twice the fuel of a 747 jumbo to carry a quarter of the passengers. This is a jarring prospect to consider, especially in an eco-conscious era.

Nowadays, the climate impacts associated with aviation are under constant scrutiny from the public, with concerns having further accelerated during the pandemic.

The scientific community continues to doubt that modern aircraft designs can improve fuel efficiency and reduce environmental impacts, such as noise, to a level that can compete with modern commercial jets.

Startup dynamics are limited

Just a few tech companies are working on supersonic aircraft, which include the two leading players, Boom Supersonic and Exosonic. A third contender, Aerion Aerospace, recently shut down due to a lack of investments.

Startups like Boom and Exosonic have repeatedly claimed they can develop reliable, economically viable, and sustainable supersonic aircraft. However, to date, no relevant test flight has taken place. Given this, it might seem like an uphill battle for the technology to truly take off.

Nevertheless, since 2016, Boom Supersonic has raised nearly USD 320 million in investments. American Airlines and Boom Supersonic recently announced the airline’s agreement to purchase up to 20 Overture aircraft, including an option for an additional 40 jets. This news provides the industry with optimism that supersonic flying can make a comeback.

However, the recent withdrawal of Rolls Royce from the Overture program makes the entire program seem fragile. Currently, there appear to be no relevant engine manufacturers with a vested interest in driving forward respective engine development for supersonic aircraft at an advanced level.

With all this in mind, it remains highly questionable that supersonic flying will return in the next ten to twenty years.

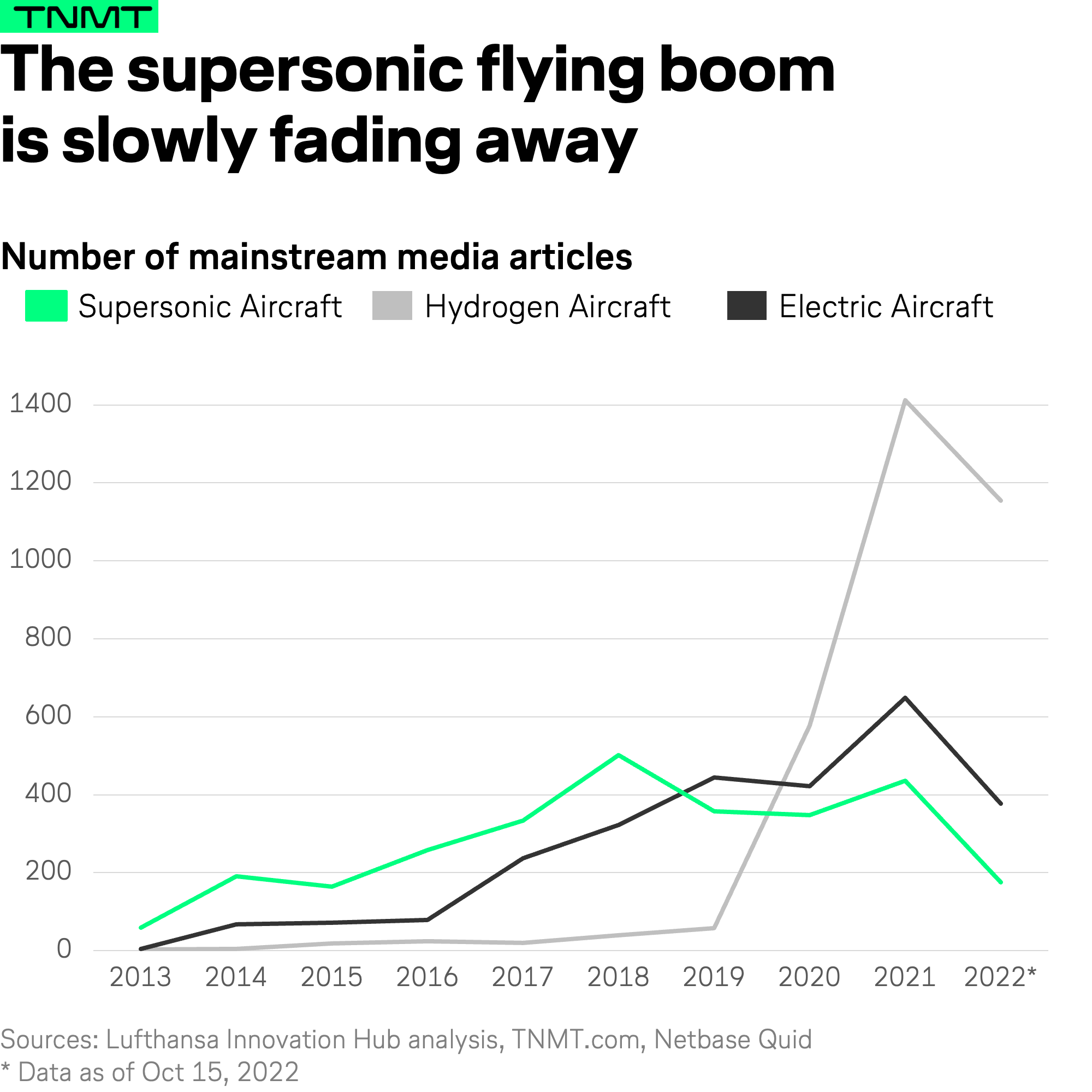

Media attention has slowed down

Another critical hurdle to consider when assessing the hype cycle of supersonic flying is media attention.

Over the past few years, press coverage of supersonic passenger flying has slowly but surely dwindled. While the number of mainstream newspaper articles about supersonic flights peaked in 2018, it has never reached this level again in the following four years, including 2022.

This is a symptom of the shift towards sustainable aviation alternatives.

Pricing will limit supersonic to the ultra-rich

Beyond the technological hurdles, there is another major question mark when evaluating the potential value proposition of supersonic passenger jets, pricing.

With one of the first-ever price sensitivity surveys among air travelers, we evaluated the feasibility of a supersonic air travel comeback a while ago. We concluded that speed alone wouldn’t justify the price premium.

Potential ticket prices for a supersonic transatlantic return trip in a Boom Overture, for instance, are expected to cost at least EUR 4,500 (if not significantly more).

While this might sound affordable to the “normal” business- and first-class customer of today, it’s essential to remember that the comfort level in a Boom Overture will mostly resemble that of a premium-economy class seat as flatbeds are unlikely to be offered given the smaller aircraft size.

We highly doubt that the identified target group would be willing to downgrade on comfort level (especially give up flatbeds) while paying a significantly higher price only to benefit from cutting flight time by 20-40%, especially on ultra-long routes like Frankfurt – Tokio or London – L.A.

Boom Supersonic seat design vs. Lufthansa business-class seat

To wrap it up

Given all this, the supersonic comeback is mostly fantasy for now.

Startup founders will continue to try and influence our thoughts on the matter, with visionary prospects of cutting flight time in half. But the substantial output in CO2 emissions—supersonic flights are expected to generate between five and seven times more carbon emissions per passenger than today’s long-haul jets—will be a dealbreaker.

Undoubtedly, the environmental downside to supersonic flying is a tough sell and seems impossible to mitigate. With the hurdles mentioned above, it is apparent that the development, operations, and sustainability concerns of supersonic flying are keeping this technology on the ground.

The current ecosystem has just two major players onboard. It will be challenging for the pair to bring this technology to market as a technologically viable and economically feasible solution.

As a result, at this stage, we do not believe this technology will reach the Plateau of Productivity anytime soon.

(4/8) Airships: No comeback for this relict of the past

Another aerial vehicle that existed in the past and is trying to find its way back into the world of aviation is the airship.

For context, an airship is a type of aircraft that can navigate through the air mostly under its own power by lifting gas that is less dense than the surrounding air. Historically, these aircraft have been used for both military and commercial purposes.

Airships were the first aircraft capable of controlled powered flight and were most commonly used before the 1940s. However, the use of this aircraft decreased as its capabilities were surpassed by those of airplanes. The decline of airships was further accelerated by a series of high-profile accidents, including:

- the 1930 crash and burning of the British R101 in France

- the 1933 and 1935 storm-related crashes of the twin airborne aircraft carrier U.S. Navy helium-filled rigids

- and the 1937 burning of the German hydrogen-filled Hindenburg.

The latter resulted in 36 deaths, effectively ending any further development on large-scale passenger ships.

In recent years, there has been renewed interest in the concept as researchers contemplate alternative forms of (cleaner) transportation.

With all this in mind, it begs the question of whether or not we actually expect airships to return to commercial operations.

For now, the answer is no, at least in the case of commercial passenger transportation.

Instead, the airship will likely stay stuck in the Trough of Disillusionment, where it has been for the past 80 years.

Our reasoning is pretty straightforward:

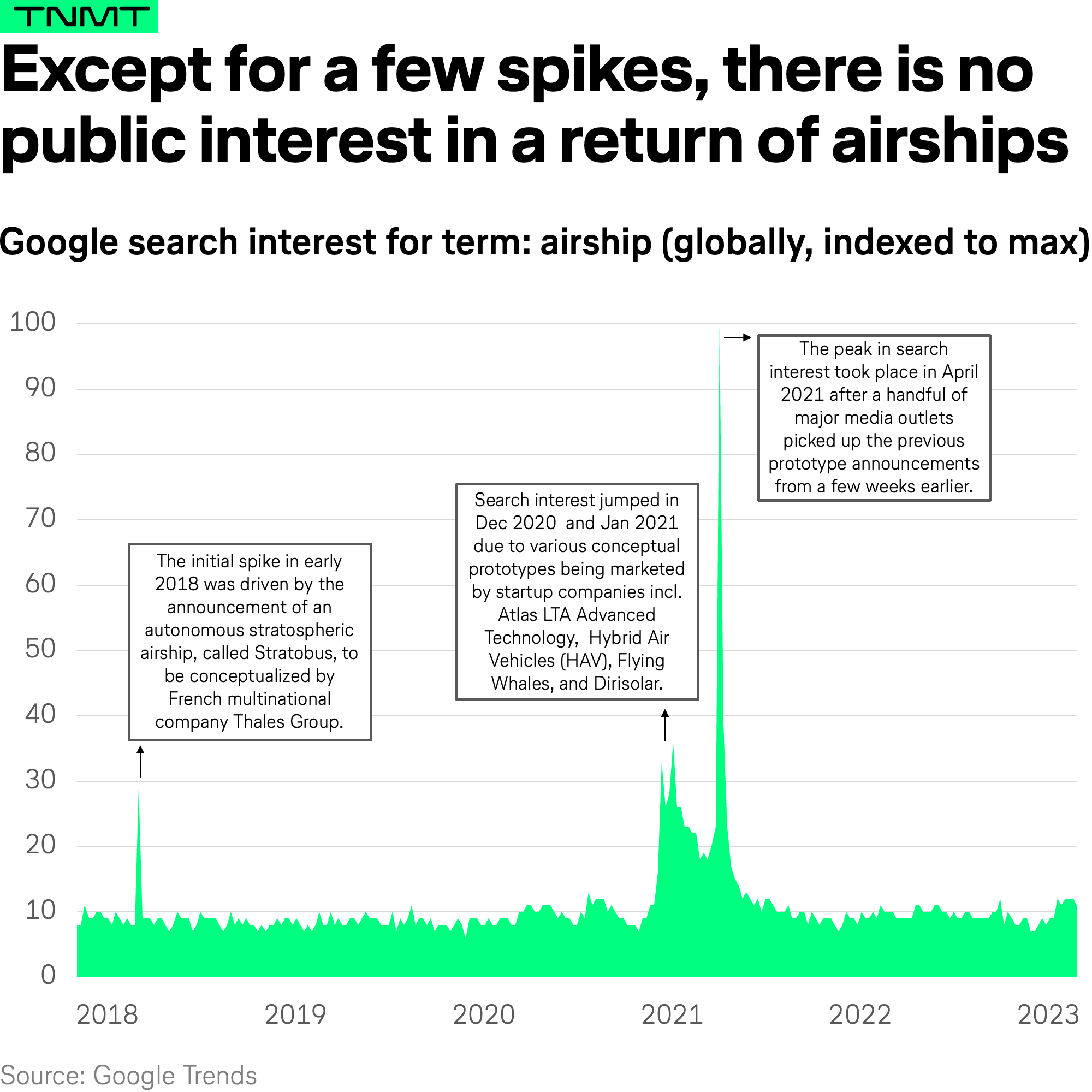

1. There is no real public interest

First of all, there is neither growing public interest, trust, nor desire for the return of the airship.

This is clearly reflected when measuring media attention about airships.

When looking at Google search interest for Airships, there is no upward trajectory visible, except for a few one-off spikes, see the chart below.

Simultaneously, when analyzing the global press coverage of airships across mainstream media outlets, any major media traction on the topic came from reportings about previous accidents, such as the Hindenburg catastrophe.

This says a lot about the public perception of airships.

This technology is more about a tragic past than an exciting future.

2. There is no relevant use case

More important than a lack of media attention is the state of technology. At present, the airship would not solve any pain point nor use case that cannot already be addressed by other alternative forms of transportation.

Obviously, the most common argument for airships to return to mass-market operation is their low-carbon nature. Airships, like the one in development by Hybrid Air Vehicles, could dramatically help reduce CO2 emissions from air transportation. The company’s hybrid lift powertrain is believed to generate 90% fewer emissions than conventional aircraft.

However, this benefit does not outweigh several of the airship’s core disadvantages that have not been solved thus far:

- Firstly, it costs hefty sums to build and run an airship. This aircraft is expensive to build and fly. Airships usually require a large amount of helium, which can cost up to $100,000 USD for one trip, according to industry sources like Quantum Technology.

- Secondly, the application areas of airships are expected to be limited and unreliable as weather conditions continue to make them vulnerable. In particular, airships are unable to fly over the weather as planes can. In other words, they are not safe unless conditions are perfect.

- Thirdly, airships move extremely slowly and will never operate at the speeds of their commercial aircraft peers. Time is money, as we all know.

- Additionally, it would take a lot of time and resources to train airship pilots. According to the Federal Aviation Administration, as reported in Reader’s Digest, only 128 people in the United States are qualified to fly airships today, which are mostly used for promotional activities like the Goodyear Blimp. In order for a pilot to go on their first solo trip in an airship, it takes 250 to 400 hours of training. For comparison, pilots of one-engine aircraft are usually expected to fly solo within their first 50 hours of pilot training.

As a result, alternative modes of transportation, especially those on the ground, such as trains, cars, and trucks, are far cheaper to transport people and goods. If these vehicles become fully electric at some point in the next decade or two, the sustainability advantage of airships will mostly be offset too.

And it wouldn’t just be ground transportation that competes with airships.

The advancement of other aviation technologies, such as electric aircraft and air taxis, would make “cleaner competition” even harder for airships. This is especially the case given that airships are likely to compete in the same market for passenger and cargo transportation, namely short trips no longer than 500 km, where a lack of speed wouldn’t be much of an issue.

Some startups try to prove us wrong

With these disadvantages listed, visionaries in the field are trying to prove us all wrong.

We observe a growing number of startup companies trying to build viable airships, which are mostly focused on cargo freight use cases. Examples of these include Cloudline, H2 Clipper, and Flying Whales. Together, these firms (and a couple more) raised more than half a billion USD in VC funding over the last five years.

The most prominent company that focuses on passenger airships is Hybrid Air Vehicles. The company has received about $45 million USD in total VC funding to date and promises to deliver the first Airlander 10 by 2026. Recently, Air Norstrum, a Spanish regional airline based in Valencia, signed a letter of intent to order 10 “Airlander 10” airships from Hybrid Air Vehicles, which are to be delivered by 2026.

In summary, even if some ventures eventually find a way to build safer and more economically viable airships, we don’t anticipate airship use cases to expand beyond niche application areas. These areas will mostly include non-time critical cargo transportation and specific passenger transportation, such as sightseeing tours in places with limited road infrastructure on the ground.

This being said, we don’t expect passenger airships to reach the Plateau of Productivity in the foreseeable future in any meaningful way that would impact mass transportation of people from A to B.

(5/8) Air Taxis: The hype is over, what’s next?

The first four categories were fun to analyze. In fact, most of them were relatively easy to score. Autonomous flight was arguably the most challenging technology to evaluate, given its wide range of interpretations and the differences between cargo and passenger use cases.

With this being said, it’s time to face the elephant in the room.

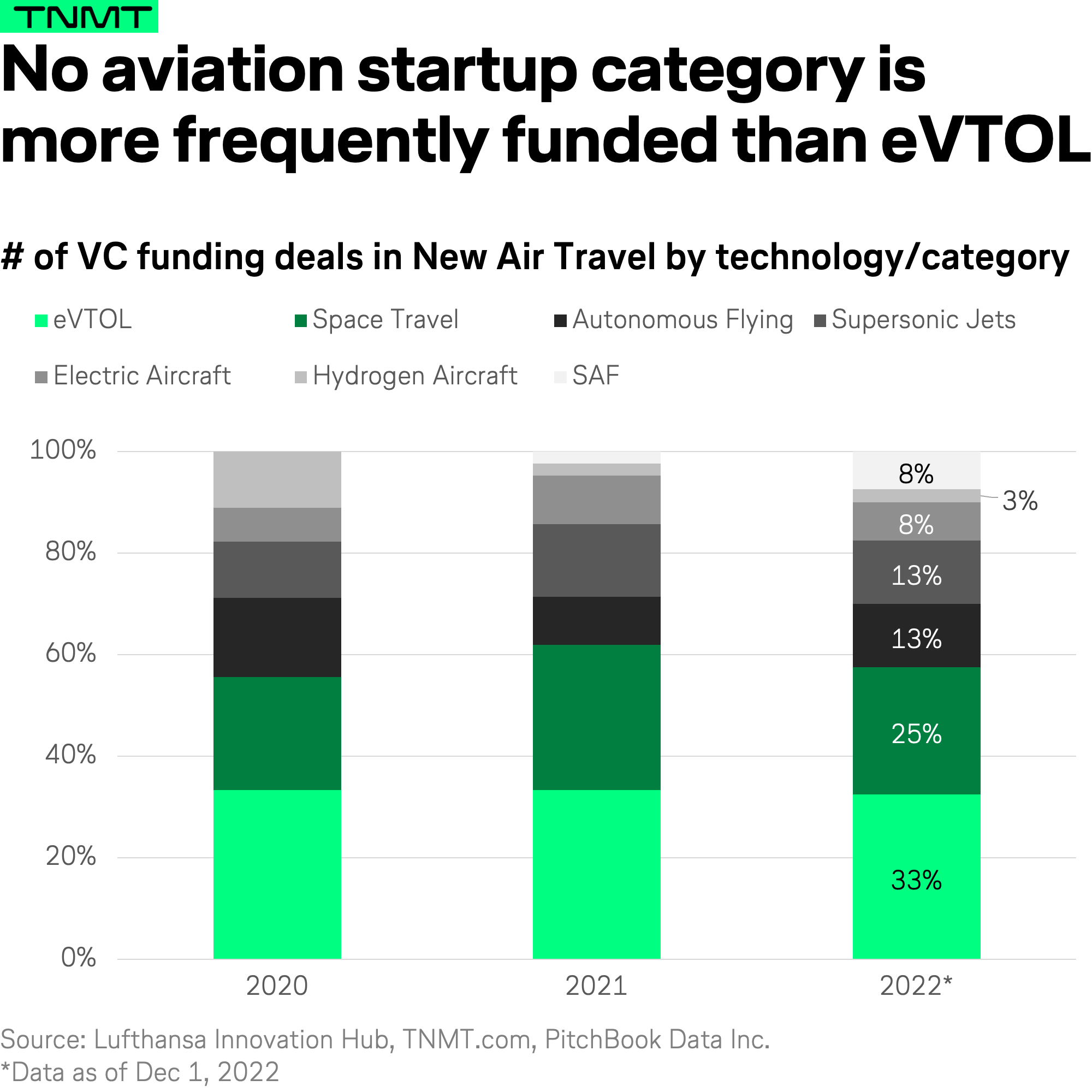

What is the current state of electric vertical take-off and landing vehicles (eVTOL) aka air taxis?

In recent years, no other technology in the aviation context has been more heavily discussed than air taxis. As well, this isn’t the first time we have taken a closer look at the evolution of flying cars and the companies working hard to get them off the ground. Here are some of our previous analyses:

- In early 2021, we put together a report full of data-driven views into the state of the air taxi ecosystem, including a patent analysis ranking eVTOL technology leaders.

- A few months later, we created another report in which we visualized the commercial relationships between the various players in the growing Advanced Air Mobility industry.

- Finally, we have repeatedly looked at Venture Capital funding trends into air taxis, the last of which took place in December 2022, to stay up-to-date with current investor sentiment.

Whenever we looked at air taxis in more detail, the main takeaway was essentially the same. The air-taxi startup hype looks extremely promising. Most industry analysts shared this enthusiasm. McKinsey predicted that, by 2030, Advanced Air Mobility—which is the market defined around eVTOLs—would generate revenue of about $3 billion USD globally.

But these bold forecasts are becoming more and more questionable.

As of early 2023, the air-taxi hype has failed to deliver any real-world proof that the technology will be able to transport people in a safe, sustainable, and commercially viable way before the end of the decade. In fact, we hear lots about big plans and market launches by air-taxi contenders like Joby Aviation, Lilium, Volocopter, and Archer, but rarely do we see any meaningful test flights that last longer than a few minutes in the air.

And none of these trips have transported any passengers yet.

Nearly every test flight has been unmanned thus far.

This current scenario is what leads us to our more cautious assessment of the air taxi space.

It’s been nearly a decade since the air-taxi industry first started gaining momentum. Predictions surrounding the potential of this technology reached dizzying heights. After years of hype, however, things have fallen into the Trough of Disillusionment.

More concretely, we don’t believe eVTOL companies will consistently transport people on commercial flights until the 2030s.

This doesn’t mean that we don’t believe the technology will come to life. Rather, it won’t be actualized as quickly as previously anticipated.

Here’s our latest reasoning:

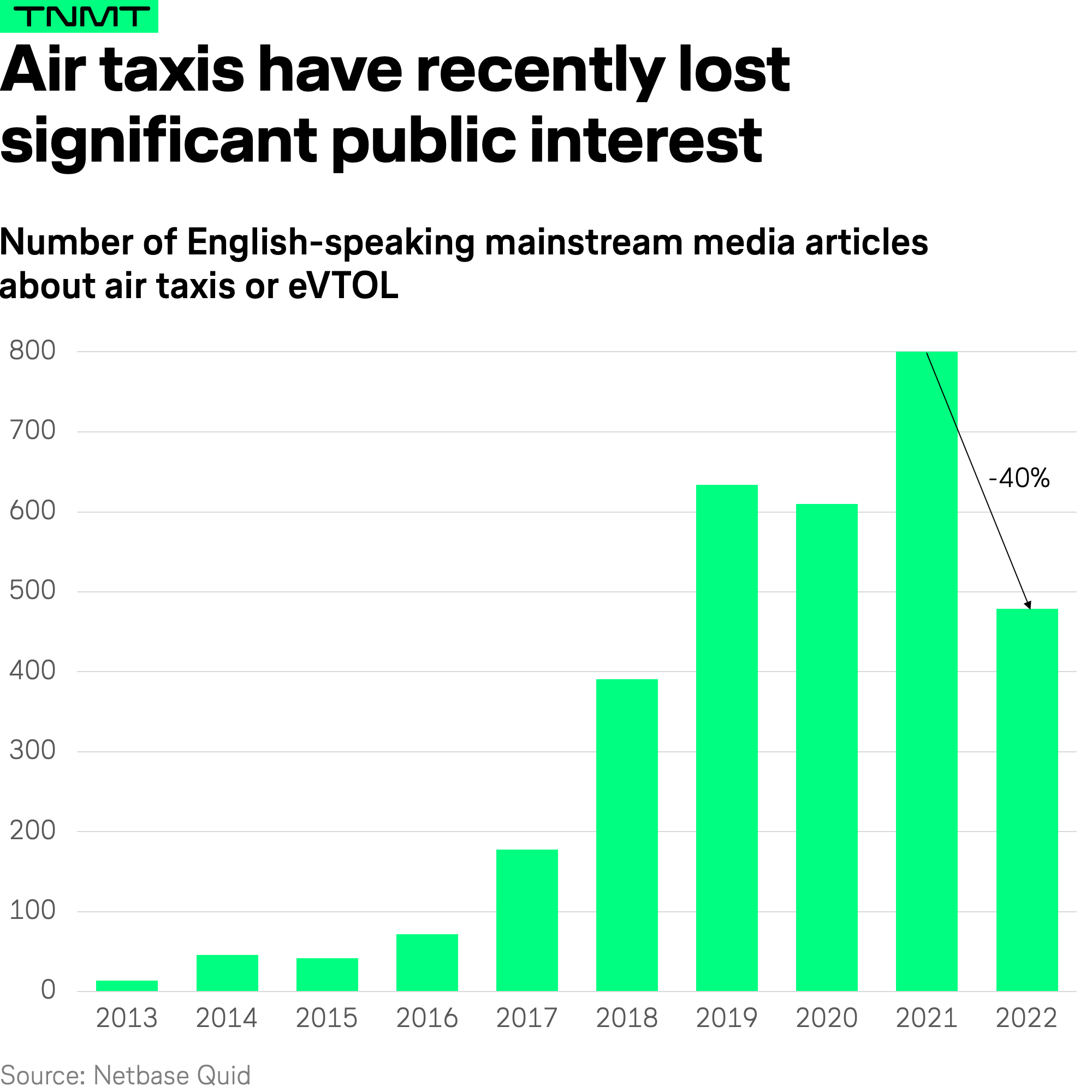

1. Media chatter has cooled off

As previously mentioned, media coverage around air taxis has exponentially grown over the past decade. However, the hype has cooled off. We can clearly see this slowdown when looking at the number of mainstream media articles that have reported on air taxis and eVTOLs over the past few years.

Obviously, media chatter itself is not an indicator of the state of technological progress. But it usually correlates with market updates and the number of technological breakthroughs, which, in the case of air taxis, seems to have slowed down significantly.

2. Technological progress seems to stagnate

Undoubtedly, it’s not easy to build a new form of aircraft, especially in the case of eVTOLs. Plus, air taxis will not only be electric but also take off and land vertically. As well, this technology will include autonomous flying at some point in the future. Air taxis basically combine several new technologies into a single aircraft.

There is a reason why it costs $350-400 million USD for Boeing and Airbus to build their respective 747-8’s and A380s. And the initial R&D and design costs are easily ten times higher for any given new aircraft.

Therefore, in hindsight, it appears that the timelines and expected engineering costs of air taxis have always been too ambitious. What we are seeing right now is a form of disillusionment that has brought most air-taxi companies back to reality and shows how long the road to market readiness really is.

Most air-taxi prototypes continue to be stuck in a never-ending cycle of test flight after test flight, which are undertaken in order to prepare them for certification. The latter has started for some of them, like Volocopter and Joby Aviation, but it’s still too early to tell how long these processes will take. Regulations around aircraft certification and pilot licensing remain unsolved issues.

On top of the development of the air taxi itself, there are still many challenges in the larger industry context that need to be solved, such as building the necessary infrastructure, as we already outlined five years ago.

All of these technological hurdles mean that commercial market launches are still many years away.

On top of that, we have serious doubts that air taxis will be able to offer a more sustainable form of transportation than their competitors, especially mobility modes on the ground (mainly cars that will also have gotten mostly electric by then). Although the vast majority of air-taxi vehicles will use electric engines, there are sustainability concerns to be addressed as these vehicles will demand significant energy to operate. This will put even more pressure on air-taxi manufacturers to develop truly revolutionary aerial vehicles in the future.

3. Limited funding and consolidation will water down the market

Given the cooling of the private VC market, it will be increasingly challenging for air-taxi companies to continue raising massive amounts of Venture Capital, as has been the case over the past five years. This will ultimately have consequences. We anticipate that some air-taxi companies will fail to further develop and deliver their products by promised deadlines. Kitty Hawk is one such example, which closed down after more than ten years in development.

As a result, investors will become pickier when it comes to betting on the air-taxi category. The same challenge will be faced by publicly traded air-taxi companies, many of which went public as part of the 2021 SPAC Mania. Unfortunately, this happened at pre-mature stages, as in the case of Lilium. As a result, the stock prices of all public eVTOL companies have significantly underperformed public markets as well as the TNMT sector itself throughout 2022, see our TNMT Market index.

In addition to limited funding, consolidation is expected to characterize the next few years of the air-taxi space, given that well-funded players might aim to acquire distressed assets. However, it remains to be seen if acquisitions can really deliver synergy effects that lead to leapfrogging development efforts. This might be challenging due to significant differences in technology approaches between companies.

In conclusion, taking into account all of the aforementioned points, we expect that air taxis will not reach noticeable commercial market relevance for another ten years at least. Until then, air taxis will slowly but steadily move through the entire phase of disillusionment. This is something that other long-overly bullish industry voices, like Roland Berger, are starting to admit as well.

But even though the state of the air-taxi industry may have been thrown into confusion, this does not mean that all hope is lost.

Far from it! Rather, the road has become longer and bumpier.

(6/8) Space Travel: A luxury vacation for billionaires

If you think air taxis are exciting, it’s time for arguably the most inspiring trend in the broader aviation context.

Who doesn’t like to talk about space travel?

Space has excited humanity for decades, if not hundreds or even thousands of years.

- What is out there?

- Are we alone?

- Can we soon explore entirely new worlds like the U.S.S. Enterprise crew in Star Trek?

For the first time in human history, it feels like we are closer to answering some of those questions, thanks to technological developments over the past few years, such as reusable rockets and unmanned missions to Mars.

Private space journeys, in particular, could soon become accessible for the average person. At least, that is, when we truly believe in all the hype created by companies like Blue Origin, World View, Space Perspective, and Virgin Galactic.

Where is all this enthusiasm coming from?

Since the dawn of space exploration, space travel has been a realm only accessible to a select few astronauts. However, as technology continues to progress and prices begin to drop, the possibility of space travel becoming accessible to more people is one that should not be overlooked.

With all this being said, let’s take a closer look at the current state of space travel and its potential to become accessible to normal people in the future.

It’s important to mention up front that when we evaluate the field of space travel, we refer to a future in which mainstream passenger transportation above the Kármán line (about 100 km) is accessible to the masses. Think of it as a sightseeing trip around planet Earth and beyond.

In our assessment, we currently see space travel at the Peak of Inflated Expectations. As a result, it’s going to take another twenty years, if not more, until space voyages for anyone other than billionaires is possible on a regular and commercially viable basis.

Why is this the case?

- Firstly, we are currently blindsided by the overall enthusiasm around the return of space exploration. Without a doubt, space exploration has come a long way from where it was just a few decades ago. Since 2020, in particular, there have been numerous advancements in space technology, including SpaceX’s successful launch of its first Crew Dragon capsule. This marked the first time in nearly nine years that humans had made it into orbit without relying on a foreign agency like Roscosmos or NASA’s own fleet of shuttles.

- Additionally, the cost of rocket launches has also seen massive declines over recent years. The cost per kilogram to orbit dropped by 90% since 2000. This decrease in cost is largely attributed to companies like SpaceX that have managed to reduce launch costs through reusable booster technologies.

However, despite these massive advancements, space exploration is still in its infancy. And the industry focus in the foreseeable future will be on business opportunities related to building infrastructure in space, such as satellite communication in the near-term future and asteroid mining in the long term.

Space tourism, in comparison, will only be a niche market as current ticket prices are around half a million USD or more. While these prices are likely to fall, they won’t reach levels affordable enough for the average household to consider. Instead, the DearMoon project, which is currently in preparation, is more likely to give us a clear indication of what the future of space travel might look like. The SpaceX-based mission aims to conduct a six-day moon flyby mission using the company’s future Starship spacecraft. Japanese billionaire Yusaku Maezawa finances the project.

Don’t get us wrong, the space industry itself is currently going through its biggest transformation ever. Private space companies, most importantly SpaceX, will soon be able to send humans back to the Moon and conduct research outside Earth’s atmosphere without having to rely on government funding or outside investment. This opens up a world (or universe) of possibility for humanity as a whole.

Till then, private space tourism will remain within reach only for those with deep pockets.

In summary, a growing number of companies are betting on high demand for space tourism.

However, space voyages as a tourist trap will remain a far-fetched dream in the next two decades.

(7/8) Electric Aircraft: Overhyped but promising

It’s time for the second-last technology: electric aircraft.

With electric flying, our analysis refers to conventional passenger aircraft that use electricity stored in batteries to power the engines. Actual real-world prototype examples include Alice Eviation or the e-plane by Harbour Air.

Our analysis of electric aircraft developments led us to the conclusion that this technology is currently facing the Peak of Inflated Expectations.

However, we are optimistic that it will reach market readiness within the next two decades.

Here’s why we think this is the case.

Firstly, public momentum (and pressure) is high

The current energy crisis, coupled with rising sustainability concerns within the aviation industry, have increased public attention and spurred the development of alternative aircraft technologies, such as electric engines, which have proven to be powerful for electrifying road transportation.

Given massive cost reductions of lithium-ion batteries—their costs have fallen by close to 98% over the past three decades—the aviation industry has started eyeing batteries to power aircraft more and more in recent years.

This has resulted in the emergence of a growing ecosystem of electric aircraft startup companies, like Heart Aerospace, Ampaire, Dovetail Electric Aviation, and Electra.Aero.

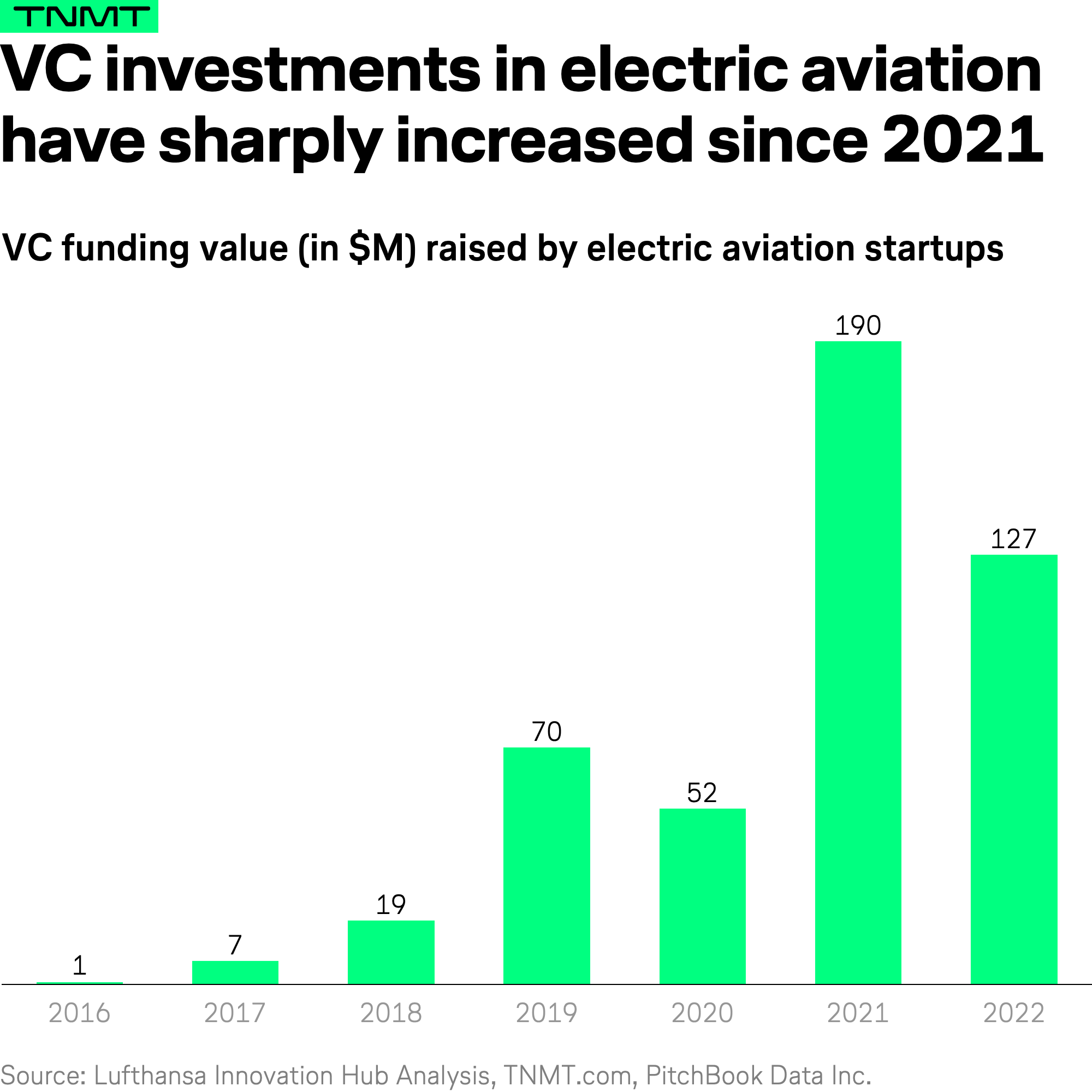

While investments into all of these electric plane manufacturers have been marginal compared to overall investments into Travel and Mobility Tech thus far (less than 0.1% in the five-year aggregate between 2017 and 2022), investor interest is, in fact, growing.

It turns out that electric plane startups raised nearly $320 million USD in 2021 and 2022 alone, which is twice the amount raised between 2017 and 2020.

While startup founding and funding momentum looks promising, real-world test flights have been pretty rare to date. Until now, Eviation, one of the leading contenders for electric passenger aircraft, has been the only player to successfully conduct meaningful test flights.

A lack of test flights usually indicates that the technology is still in its infancy.

Certification is still years away

On a similar note, many of the ambitious timelines set by electric aviation startups for certification of their electric aircraft in the past have been repeatedly corrected and moved into the future.

- For example, in 2019, Eviation announced that it would anticipate receiving type certification and starting its inaugural flights by 2022. However, the timeline for service entry has since been revised and pushed back all the way to 2027.

- Other electric contenders, like Dovetai, which aims to convert a combustion-powered Cessna Caravan into an electric battery-powered aircraft, do not anticipate having test flights before 2025.

- And Heart Aerospace, another highly promising player, which has already received pre-orders from airlines like United Airlines, does not plan to certify its ES-30 aircraft before 2028.

Why is this the case?

Certification standards in the aviation industry are (rightfully) strict and complex.

Many startup founders tend to underestimate the time and effort required to complete this process. Generally speaking, aircraft manufacturers need to obtain four levels of certification:

- Type Certificate

- Airworthiness Certificate

- Design Organization Approval

- Production Organization Approval

Type certification is usually the most important milestone.

In traditional aerospace, this certification alone can take between five and nine years, according to EASA and FAA. However, both regulators have already stated that this process might be speedier for electric aircraft as a result of the pressure for alternative propulsion systems.

In summary: expectations for an electric aviation future continue to rise, but the level of technology readiness, including certification, still requires significant work.

Better batteries are needed

What exactly is the most critical technological challenge?

Most importantly, there is the payload-range limitation.

Batteries are heavy. Any type of passenger aircraft would need a lot of them to generate the energy it takes to fly more than 20 tons (the weight of an average business jet), given today’s battery density levels.

As a result, most of today’s electric aircraft prototypes have a limited flight range, which would only make them feasible for regional flight routes. By regional, we actually mean ultra-regional.

- For example, the Heart Aerospace ES-30, with a planned capacity of 30 passengers, has a fully electric, zero-emission range of just 200 km.

- This wouldn’t even allow flights from New York City and Washington D.C. or London to Paris, as both routes are more than 300 km in length.

This means that electric aircraft need substantially better batteries before they can even manage classic short-haul travel routes of up to 500 km.

However, as soon as this is possible, we see a bright future for electric aircraft.

- Many airlines in the world aim to not only restore but expand their regional network with cost-effective aircraft.

- It seems that electric aircraft could be well-suited for this purpose, whether as a hub feeder or peer-to-peer network.

- As an example: United Airlines’ involvement with Heart Aerospace is based on the conviction that, as less than 1% of travelers making a 250-mile trip currently choose to fly, this market remains essentially unaddressed by aviation.

Two different design approaches

To equip aircraft for an electric future, there are two main approaches that are advancing in parallel: retrofitting existing aircraft, such as with Dovetail Electric Aircraft, or a clean sheet design, as with Eviation and Heart Aerospace.

While it is too early to determine which approach is the most efficient and economically viable, retrofitted aircraft seem better poised to enter the market faster than newly designed aircraft due to easier certification requirements. However, the newly designed electric aircraft are likely to be more energy-efficient and better suited for fully electric operations when considering charging, fast battery placement, and other operations jobs to be done.

Given all of these facts, electric aviation remains challenging. However, we believe this technology will ultimately come to life. Electric aircraft are a promising solution for regional aviation, one that could help restore connections to small towns, especially in the U.S., where American Airlines, Delta, and United have pulled out of a combined 68 cities since April 2020.

In other words, electric aircraft could make air transportation accessible to millions of more people in the future.

(8/8) Hydrogen flying: The much-needed long-term play

If you are reading this, you’ve made it all the way to the end of our analysis.

And your efforts are about to pay off. It’s time for the major highlight of our month-long analysis.

Why is this the case?

Well, hydrogen flying is considered by many in the aviation industry to be the holy grail of cleaner aviation.

How exactly?

Hydrogen has the potential to be a true-zero clean energy source for flying.

- When hydrogen is burned, only water vapor is produced as a byproduct. This means that the energy source has the potential to completely eliminate the aviation industry’s carbon footprint.

- In addition, hydrogen is an abundant resource that can be produced from renewable sources, such as solar and wind power, making it a sustainable option to power aircraft in the long term.

Although hydrogen only recently entered the public eye, the concept of hydrogen-powered flight is not new.

- In 1957, a NASA aircraft took flight and one of its engines was powered by hydrogen.

- As well, in 1988, Tu-155 became the first hydrogen-powered experimental aircraft to take off.

Now, there is a growing belief in the commercial viability of hydrogen as an energy source for aviation, which wasn’t the case previously.

Despite the long history of hydrogen in aviation, according to our analysis, the energy source is still in its nascent days. Given this, we have concluded that hydrogen is right at the beginning of the Innovation Trigger. As a result, it will take at least another quarter century until hydrogen becomes a market-ready technology for commercial aviation.

But this doesn’t mean that the excitement swirling around hydrogen flying will slow down anytime soon. Media attention has declared hydrogen to be one of the hottest topics in aviation right now. This hydrogen hype also shows up in our Wikipedia analysis from last year, which evidenced that “hydrogen-powered aircraft” has begun its second major peak phase.

All of this growing public interest is primarily driven by successful demonstrations from companies like ZeroAvia.

- In September 2020, ZeroAvia’s test plane Piper M-class turboprop completed its first hydrogen-powered flight.

- In January 2023, the company’s Dornier 228 aircraft took off for a 10-minute flight. However, it’s important to note that only one engine out of Dornier 288’s two used hydrogen.

The successful test flight demonstrates that the technology is functional and has the potential to become a powerful means of decarbonizing aviation.

Clarifying the different types of hydrogen

When following the public debate surrounding a hydrogen aviation future, it becomes clear that people still do not fully understand that there are different types of hydrogen and that the energy source can reduce or perhaps even eliminate aviation emissions. With this in mind, we will share some of the basics with you.

First of all, it’s important to differentiate between hydrogen production and hydrogen usage.

So, how exactly is hydrogen produced?

There are three main hydrogen types:

- Grey hydrogen, which means hydrogen, is produced by mixing fossil gas with steam. As a consequence, grey hydrogen releases large quantities of CO2.

- Blue hydrogen is produced using the same method as grey hydrogen, but with carbon emissions being supposedly captured and stored underground during this process. This has yet to be proven at any significant scale. Both grey and blue hydrogen are more accurately called “fossil hydrogen.”

- Last but not least, green hydrogen is produced by passing electricity generated from renewable sources through water, a process that results in low carbon emissions.

Secondly, there are two approaches to implementing hydrogen consumption technology for aviation: in the form of combustion and through the usage of fuel cells. Again, let’s take a closer look at each of these methods:

- Hydrogen combustion leads to zero-carbon output, meaning there are no CO2 emissions emitted. In this case, liquid or gaseous hydrogen is burned in an engine to generate thrust. However, this process does produce non-CO2 emissions, such as contrail cirrus and nitrous oxides, which are likely to contribute to the net warming effect. Several studies show that there are difficulties in controlling NOx emissions from hydrogen combustion in various industrial applications. Although no CO2 is emitted, this process is not optimal. Another set of research studies suggests that non-CO2 effects account for approximately two-thirds of the climate impacts of aviation. As a result, the technology needs more evaluation before its true climate impact can be fully assessed.

- Meanwhile, hydrogen fuel cells are truly zero-emission, meaning there are no direct emissions at all. Fuel cells generate electricity through an electrochemical reaction between hydrogen and air. This reaction occurs continuously, resulting in a steady supply of electricity. This is why there are no direct CO2 or non-CO2 emissions. However, fuel cells are costly given that they are complex and require expensive materials, such as platinum.

Given all of the aforementioned points, in order to reach the most environmentally-friendly hydrogen solution, the aviation industry must combine green hydrogen with hydrogen fuel cells. When compared to other options, this is undoubtedly the most costly combination. However, this solution is the only zero-carbon path leading to a future of sustainable aviation.

There is one major downside. Hydrogen fuel cells will demand entirely new aircraft configurations and electrical systems, which will take decades to develop and implement. Therefore, it’s unrealistic to think of hydrogen fuel cells as an immediate option to lower CO2 emissions associated with aviation.

Two groups of companies are pushing forward hydrogen progress

As with many of the technologies we have looked at before, we recognize that there is a growing number of companies eagerly developing hydrogen technology. This is a great sign and one that might further accelerate progress.

In fact, we see innovation dynamics being pushed forward by two different groups of companies:

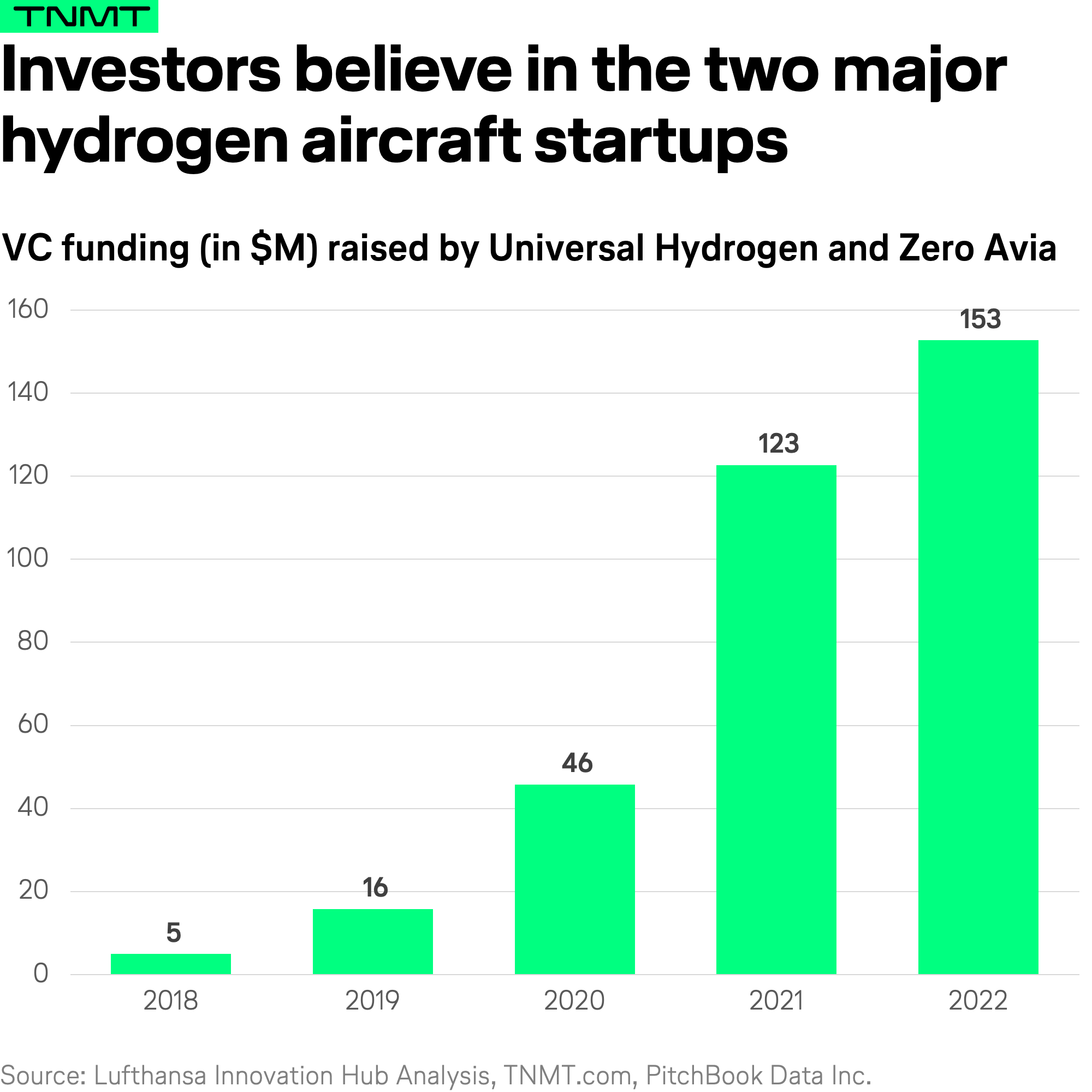

- First, there is a vibrant ecosystem of startups that have been founded over the last few years, including ZeroAvia (founded in 2017), Stralis (founded in 2021), and Universal Hydrogen (founded in 2020). The latter has just received approval from the FAA to begin flight tests. VC investments into these young technology ventures have quickly accelerated since 2020, with the two main players, ZeroAvia and Universal Hydrogen, raising around $350 million USD to date.

- Secondly, there is a growing group of strong corporate players involved in hydrogen development, such as Rolls Royce and Airbus. While these companies do not yet have commercial prototypes in place, we believe their significant resources and technical expertise give them a higher chance of success in realizing the ambitious, long-term project of green hydrogen flight.

Despite the promising progress, developing hydrogen technology to a practical commercial level and integrating it into the air transportation system will take many more years. To make the timescale more concrete, some studies suggest that airports will not be ready to serve hydrogen-fuel aircraft until 2050.

It is also important to consider the current status of the aviation industry. Overall, there is a world fleet of approximately 25,500 aircraft, a current production backlog (Airbus has 7,397 aircraft, and Boeing has 5,206 aircraft in progress), and the average aircraft retirement age is 25 years. This means that, in order for hydrogen aircraft to enter the global passenger fleet market, the opportunity won’t be available until decades from now.

When considering the aforementioned points, we predict that the opportunity for hydrogen technology to enter the Plateau of Productivity and make up a substantial share of the aviation market will become possible in 25 to 30 years.

Some final words

As you have seen, all major New Air Travel technologies are nowhere near the same level of market maturity.

Instead, these technologies are spread across the entire hype cycle. Hydrogen and electric flying are still in their infancy and slowly building momentum.

Meanwhile, Sustainable Aviation Fuel is at the other end of the hype cycle and about to enter the Plateau of Productivity.

In turn, SAF is set to have a major impact on the transformation of aviation as we have known it for the past 100 years. This advent will direct us away from an industry that has historically been built on fossil fuels.

In the long run, SAF alone will not be enough as it does not assist in the reduction of gross emissions. As a result, SAF is just one piece of the sustainable aviation puzzle. Electric and hydrogen flying are the necessary counterparts of SAF, which will be specifically used for short and mid-haul flying.