Welcome to this month’s analyst briefing of the TNMT Market Health Index.

Our spotlight for October is firmly on the Asian Travel and Mobility Market.

The reason?

After the exhilarating travel surge that many Asian countries experienced post-pandemic, it appears this sugar rush is slowly coming to an end.

How come?

The pulse of the Asian Travel and Mobility Market is closely linked to the region’s economic health.

As we delve deeper, it becomes evident that macroeconomic indicators are now steering in a quite bearish direction.

The Macro Economic Snapshot

Since late 2022, the US and Europe have grappled with inflation issues. Now, Asia is facing its own set of inflation concerns. The resulting stock market reactions offer insights into the impact of these inflationary pressures on investor sentiment:

- In Singapore, the consumer price index marked a higher-than-expected 4.1% YoY increase in September, up from an already above-expectation 4% increase seen in August.

- Despite facing economic challenges, China remains committed to its deflation practices. This approach isn’t resonating well with investors due to growing local government debt, record-high youth unemployment rates, and weak import-export figures.

- As a result, local stock markets are deflating as well. For example, the CSI 300 index recently plummeted to its lowest since February 2019.

As well, other key benchmarks across the region are registering declines, a concerning trend that underscores the broader economic challenges.

- Hong Kong’s Hang Seng Index is struggling, down by over 17% YTD.

- Korea’s Kospi Index, which tracks the Korean stock exchange, has given up more than 10% of its value since mid-September.

The Revenge Travel Fadeout

All these indicators signal a broader trend of economic uncertainty, likely influencing traveler sentiments and decision-making, impacting everything from discretionary spending to business travel frequency.

In fact, the ramifications are already evident in the world of travel.

- The enthusiasm for Revenge Travel, sparked by the easing of Covid-19 restrictions towards the end of 2020, has clearly faded. Elie Maalouf, CEO of the Intercontinental Hotels Group, offers a sobering observation. He recently pointed out that “We’re really past revenge travel—even in China.”

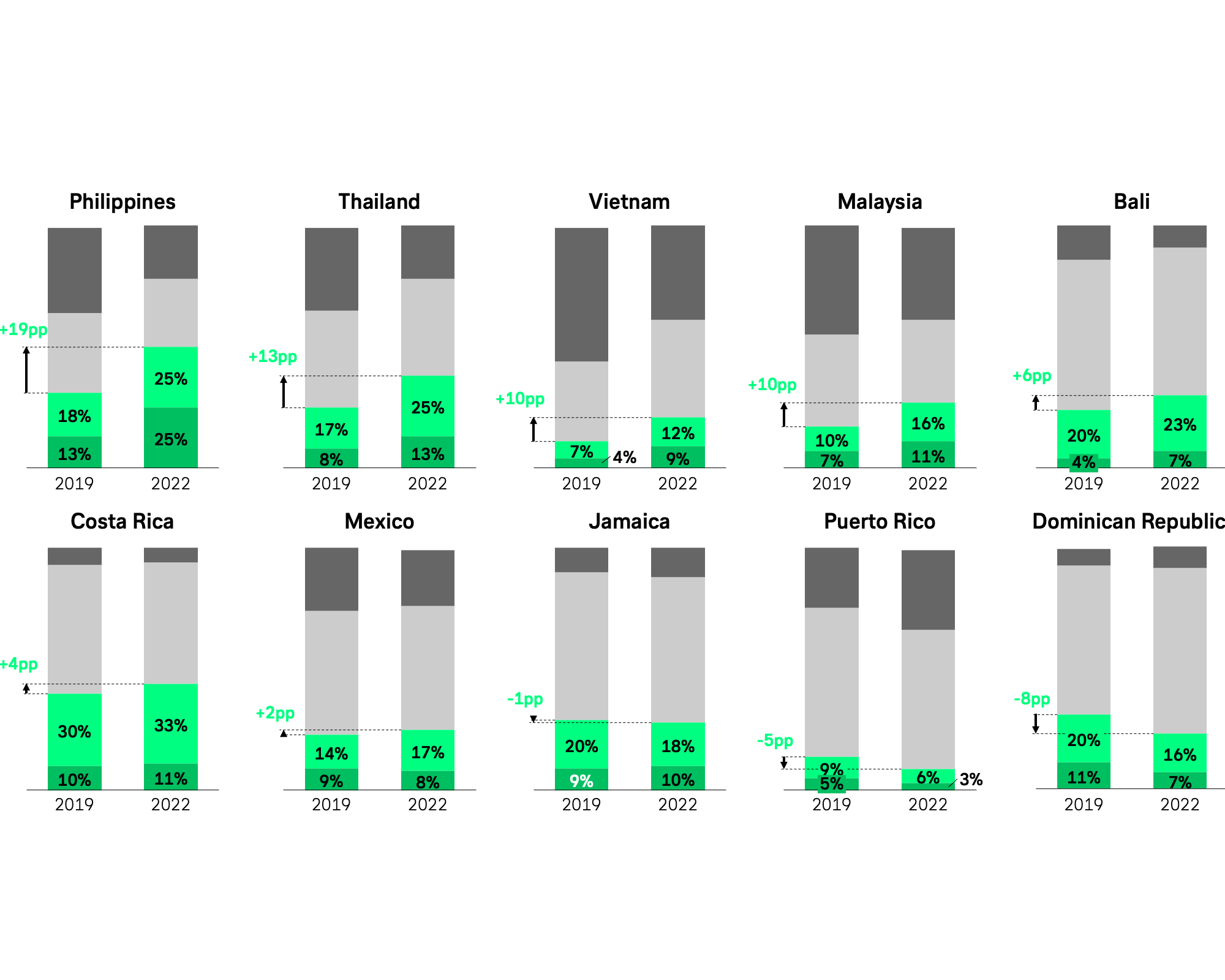

- While domestic travel shows resilience, with metrics surpassing pre-pandemic levels by almost 20% in September 2023 compared to 2019, international travel paints a contrasting narrative. Insights from Skift reveal it is still at only 84% of pre-pandemic figures.

- The return of travel has brought with it increasing costs, causing consumer caution. Hermione Joye, Sector Lead for Travel and Vertical Search APAC at Google, highlights this sentiment. More than half of APAC leisure travelers are concerned about growing travel expenses. Delving deeper, over a quarter believe accommodation prices stretch beyond their budgets, and 23% express concerns over fluctuating currency conversion rates. These sentiments align with our recent assessment of China’s post-pandemic travel landscape.

The TNMT Asia Index: Clear Warning Signs

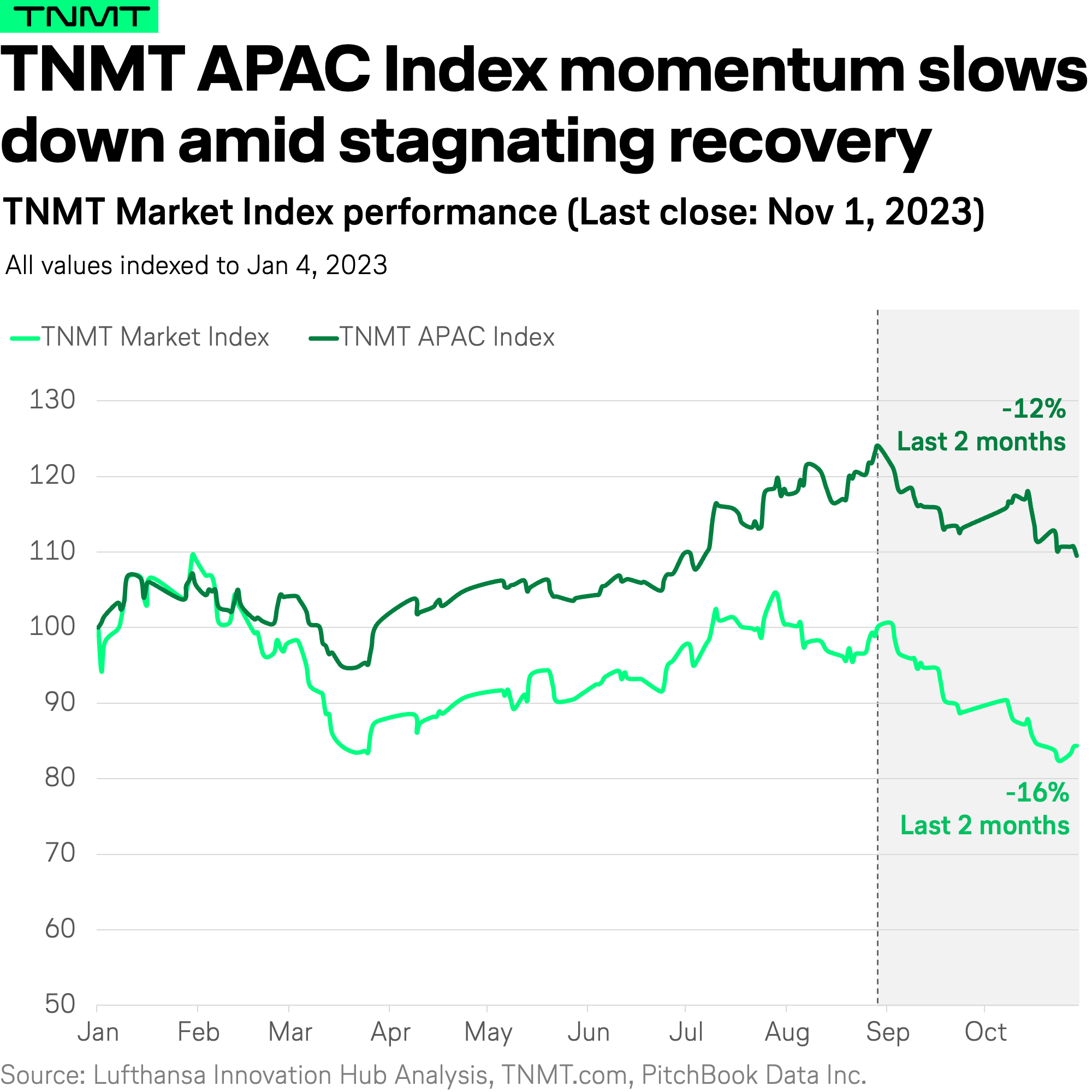

Pivoting to our proprietary TNMT Market Index, which keeps a close watch on the major tech innovators in the travel and mobility ecosystem, the ripple effects of the market headwinds in Asia become strikingly evident.

Although the resilience of Asian travel stocks has been commendable throughout the past year, their recent performance paints a different picture.

- Since peaking in early September, the TNMT APAC Index has registered a drop of close to 12%.

- This decline, though still in its early stages, signifies cautious sentiment and points to a looming turbulence in the market.

- Whether this is a temporary blip or a foreshadowing of more prolonged challenges is something that we will be tracking closely.

APAC Travel Giants Face Investor Hesitation

We can even better observe current market conditions when looking at the performance of individual stocks in our Asian version of the TNMT Market Index.

In fact, the majority of players are in the red.

Here’s a deeper dive into three of the most notable players from our YTD chart, revealing a gap between financial performance and investor sentiment:

Grab’s Volatile Journey: The euphoria surrounding Grab’s US debut in late 2021, marking the largest IPO by a SEA company, was short-lived. Despite narrowing its profitability timeline from Q4 2023 to Q3 2023, a potential boon for investors, the stock has struggled. Rumors of Singapore’s impending regulatory actions on the ride-hailing and shared mobility segments have further cast a shadow over its prospects.

Mismatched Trip.com Expectations: On paper, Trip.com had a commendable year, especially with its Q2 results surpassing Wall Street’s projections. The company was also ahead of the curve, integrating Generative AI and unveiling its AI assistant, TripGen. However, stock performance paints a different picture, likely swayed by wider concerns regarding local stock market health, especially considering the than-expected travel recovery visible during recent peak travel holidays such as the “Golden Week” in October. That week, typically known for its record-breaking levels of mass tourism, undershot government forecasts in both tourism revenues and number of trips this year.

Yatra’s Success Story With a Caveat: Yatra’s milestones this year, from its Indian stock exchange IPO to the rollout of its Yatra Prime Subscription, have been noteworthy. The company even reported a standout Q1 FY2024, boasting increased revenues and air travel figures that outpaced pre-pandemic numbers. However, a lukewarm response to its Indian IPO and prevailing headwinds in indices like the SENSEX have disappointed its NASDAQ showing thus far.

However, when there are losers, there are usually also some winners.

This is also true in the challenging Asian tech climate right now.

Despite Asian Turbulence: A Few Winners

Despite the formidable challenges in the Asian tech landscape, certain entities are forging ahead, unswayed.

- Leisure travel’s resurrection to pre-pandemic scope, fueled by pent-up revenge travel demand and phenomena like the Blurred Travel movement, has provided an opening for many.

- 2023 appears to have been the year for some of them to scale operations and prepare for tougher days like today. For example, many travel giants have chosen to redirect their rising incomes into tech innovations, resulting in a ripple effect of growth for travel tech stalwarts.

Let’s spotlight a few:

Rategain Technologies: A beacon of success in these times, this Indian Travel-Tech stock has been on an upward trajectory since 2023’s dawn, almost doubling its value. Its broad reach is evident—a lion’s share of top OTAs and hotel chains employ Rategain’s offerings. 2023 saw the company in expansion mode, from acquiring US-based Adara to partnering with global names like European airline SKY Express and Brazilian VOEPASS. Its Q1 FY 2024 financials further sealed its leading position, revealing y-o-y revenue growth close to 80%, improved operating margins, and nearly a tripling of its post-tax profits.

Siteminder: Rising from the ashes, this Australian hospitality tech frontrunner has reversed its fate impressively. An initially rough stock market journey after its ASX debut in late 2021 took a positive turn recently. The significant reduction in its losses, paired with a 30.5% revenue spike in August, sets it on a trajectory towards profitability.

Beyond these two, several other leaders stand out in their respective categories, justifying investor confidence with their dominant market positions.

- Ehang is maintaining its upward journey, drawing from the positive investor sentiments on air taxis, as we analyzed in our June commentary.

- Blue Bird, a key player in Indonesia, with its dedicated push towards fleet electrification, is gaining momentum in the local taxi domain, as also discussed previously in our July note.

- MakeMyTrip is capitalizing on the local travel recovery wave, reflected in its soaring gross booking value in the Q4 2023 results.

With all this being said, the prevailing challenges in Asia are evident, yet it remains intriguing to observe which entities manage to adapt, paving their way towards a more resilient future.

Follow the TNMT Market Health Index for updates on these companies going forward.