Welcome to the final TNMT Market Health Index briefing for 2023.

This December update holds a unique significance for us.

As many of you may have seen in recent news, our parent company has embarked on a promising journey with air-taxi pioneer Lilium, marking a supposedly pivotal moment in the aviation industry. The two parties have signed a so-called Memorandum of Understanding (MoU), a gesture symbolizing the potential for future collaboration.

Now, in all fairness, a MoU doesn’t mean much. It’s nowhere near a meaningful commercial collaboration yet. It is a preliminary agreement rather than a concrete contract. But the implications of this (potential) alliance cannot be understated. It represents a symbolic convergence of traditional aviation and next-gen New Air Travel.

So, given this notable development, we couldn’t resist diving into our TNMT Market Health Index to analyze the immediate impact of this announcement on public market perception around air taxis.

But before doing so, let’s take a quick look at how Lilium’s stock has performed over the year leading up to this significant moment.

Lilium’s Rocky Year (Thus Far)

When examining Lilium’s stock-market performance in our TNMT Market Health Index, it’s evident that 2023 hasn’t been smooth sailing for the air-taxi startup.

- When compared to its major peers in the sector, such as Joby Aviation and Archer, Lilium’s journey through the stock market in 2023 has been a rollercoaster of volatility.

- This instability can largely be attributed to growing concerns about the company’s cash burn rate and the challenges associated with pushing its innovative aircraft through the rigorous certification process.

For a significant portion of the year, Lilium’s stock price struggled, hovering dangerously close to falling below the USD 1 threshold. Such a downturn in stock value put the company at risk of compulsory delisting from NASDAQ, a scenario that would have severe implications for its public market standing.

However, there were glimmers of hope and signs of recovery despite these challenges. In July, a successful capital raise of $192 million USD briefly catapulted the stock to an annual peak of $1.78 USD. However, the stock price failed to maintain significant upward momentum in the following months.

Yet, recent strategic moves and developmental milestones have sparked a resurgence in investor confidence:

- Lilium entered a partnership with EMCJET, becoming the first eVTOL for private sale in the U.S.

- It marked its presence in the Middle East by appointing ArcosJet as an authorized dealer for Lilium Jets.

- A crucial alliance with InoBat was announced to gear up for large-scale production of battery cells for Lilium Jets.

- And in a major breakthrough, the company secured Design Organization Approval from Europe’s aviation regulator in late November, marking a critical step toward full certification.

These developments, collectively, have helped to pivot Lilium’s market sentiment from skepticism to cautious optimism. And then came the announcement of the MoU with Lufthansa, a moment that could potentially redefine Lilium’s market trajectory.

Market Reactions to the Lufthansa “Deal”

Following the announcement of the MoU between Lufthansa and Lilium, there was a significant positive reaction in the market.

As the chart shows:

- Lilium’s stock saw a remarkable turnaround. From its second-half low of $0.61 USD on October 27, the stock more than doubled to reach $1.38 USD by December 8.

- This jump in stock price is noteworthy (even though it has normalized again this week), especially considering the non-specific nature of the MoU and the absence of any concrete financial commitments.

It’s crucial to understand that such agreements in the air taxi industry rarely involve immediate monetary transactions. Most air taxi orders made in the past by other entities did not have any direct financial commitments attached to them either.

Consequently, the media’s response to this collaboration has been mixed. Gerhard Hegmann from Welt, for example, pointed out that while the partnership sets a direction, it falls short of being a firm order with financial implications. He noted that it does set the course, but it’s still a long way from being an order, so there’s no down payment that Lilium needs to fill its coffers.

This mixed reception in the media reflects the cautious optimism surrounding the potential of air taxi technology and its integration into mainstream aviation.

The Growing Air Taxi Ecosystem

Despite the mixed reactions, in our view, the partnership is a significant development in the air taxi industry, especially as it complements a series of critical industry milestones this year.

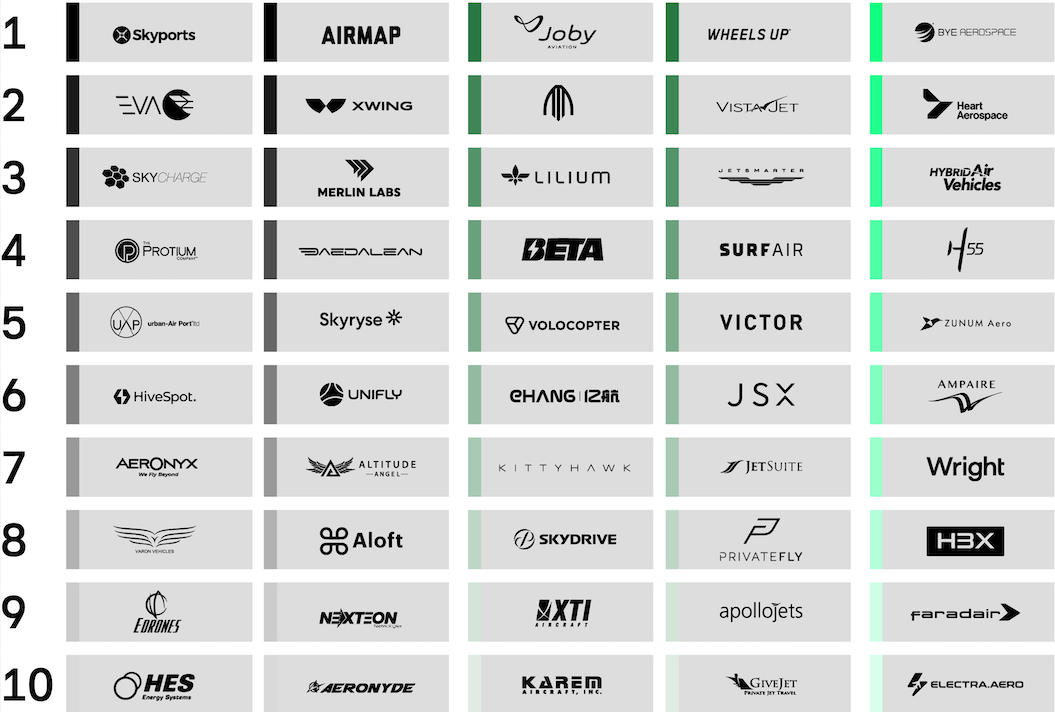

Lufthansa is not alone in exploring the air taxi domain. Several other aviation giants have already placed a handful of bets on this emerging sector:

- Wisk Aero, a US-based air taxi developer, is a joint venture that emerged from a collaboration between Kitty Hawk and Boeing in 2019. Boeing has invested a substantial $900 million USD in Wisk Aero, signaling strong confidence in its future.

- Going back to 2021, United Airlines formed a partnership with Archer Aviation, marking a significant commitment to eVTOL technology. This collaboration was highlighted by United Airlines’ order of 100 eVTOL aircraft from Archer, valued at approximately $1 billion USD. More recently, it has announced plans to introduce the first commercial air taxi route together.

- Delta Air Lines has thrown its support behind Joby Aviation, another key player in the air taxi space. The airline invested $60 million USD in Joby Aviation in October 2022 and has plans to increase its investment to $200 million USD upon achieving certain milestones.

These examples all illustrate that the air taxi ecosystem is rapidly evolving (see our Air Taxi Report from 2021), with major airline players actively participating and investing in its development.

This has led to the air-taxi subsector of our TNMT Market Index outperforming the broader mobility market in 2023.

Advancements in Air Taxi Technology

But it’s not just airline partnerships propelling the ecosystem.

The technological progression in the air taxi sector has been quite remarkable in 2023. Key players, particularly in the United States, such as Archer Aviation and Joby Aviation, have been at the forefront of these advancements.

- In early November, New Yorkers witnessed a significant moment in urban air mobility. Joby and Volocopter conducted demonstration flights in downtown Manhattan, offering the public a rare glimpse into the future of air taxis.

- Ehang, a leading Chinese air taxi developer, achieved a crucial regulatory milestone by obtaining Type Certification from China’s Aviation Authority. This approval is a significant step forward for Ehang in commercializing its air taxi services.

- Archer Aviation has been actively signing pre-purchase agreements for its recently unveiled Archer Midnight aircraft. Notably, Air Chateau, an advanced air mobility service provider based in the UAE, has shown interest in Archer’s innovative aircraft.

These developments collectively contribute to growing optimism in the air taxi industry.

Our commentary from late June delves into more details on these significant advancements.

The Varied Performance of Air Taxi Firms

As we wrap up our discussion on the air taxi industry, it’s crucial to acknowledge that not all players are cruising at the same altitude. Some are navigating the (imaginary) skies more successfully than others, and a few seem to be encountering turbulence.

A notable example is UK-based Vertical Aerospace, which has been struggling for several reasons:

- Reports indicate that Vertical Aerospace is grappling with cash flow issues.

- In August, the company’s prototype experienced a crash during a test flight, raising safety and reliability concerns.

- Vertical Aerospace has delayed its planned certification timeline, pushing back the launch of its service by another year. This marks the second delay since April 2022, when it shifted its commercial operations launch from 2024 to 2025.

However, Vertical Aerospace isn’t the only air taxi contender facing headwinds. Delays in commercial operations, test flight failures, and certification hurdles are common challenges across the landscape. And all companies share a common task: proving their commercial viability. This will only be possible once air taxis begin actual operations.

As soon as that is the case, a few critical factors will determine which providers have a real shot at revolutionizing air travel.

Cost of Flying: The high development and certification costs of these aircraft mean that the journey to profitability will be long. As per our Hype Cycle research, we expect air taxis to initially cater to high-net-worth individuals.

Route Attractiveness and Urban Infrastructure: The adaptability of eVTOLs to existing urban infrastructure is another significant challenge. Routes will likely focus on short-distance urban transit, necessitating new infrastructure like Vertiports with electric charging stations.

Autonomous Flight Hurdles: The transition to autonomous passenger flights remains uncertain. Many air taxi companies have pivoted their pitch decks from unmanned to piloted operations due to regulatory challenges. Ehang is one of the exceptions, having gained regulatory approval in China for its passenger-carrying unmanned aircraft.

So, while the air taxi industry is brimming with potential, it remains a sector marked by significant uncertainty. As we move forward, it will be fascinating to see which companies manage to navigate these hurdles and emerge as leaders in this revolutionary mode of transportation.