At the peak of the COVID-19 pandemic in the summer of 2020, we embarked on what would become one of our most comprehensive TNMT research projects to date. Our analysis processed over 15,000 airline reviews on TripAdvisor, aiming for an objective and quantifiable understanding of the major pain points in air travel.

During that time, consumer confidence in the airline industry was shattered. This was heavily impacted by travel bans, flight restrictions, and concerns about infection risks in airports and aircraft.

Fast forward to today, and the world has (largely) moved past the pandemic. And the airline industry has witnessed a robust recovery. The resurgence in travel activity is notable, with commercial flights in Europe almost surpassing pre-pandemic levels this past summer. According to OAG, flight demand is roughly 95% of what it was before the pandemic. It seems we’re almost back to the “old normal” as far as travel activity goes.

But there are critical questions that remain unanswered:

- Has there been any improvement in customer satisfaction within the airline industry?

- Did the industry utilize the pandemic-induced pause to recalibrate its focus on customer needs?

Unfortunately, today’s research indicates a negative answer to both questions.

- Despite the resurgence in demand for air travel, customer satisfaction has not only failed to improve but has deteriorated further.

- Shockingly, average traveler sentiment, as reflected in recent airline reviews on TripAdvisor, has further plummeted, falling even below the lows experienced during the pandemic.

This revelation leads us to ponder: What went wrong, and more importantly, what can the airline industry do to reverse this declining trend in customer satisfaction?

Welcome to our Air Travel Pain Point Analysis 2.0.

The Persistent Struggle for Customer Satisfaction

The struggle of the airline industry to meet traveler expectations is not a new phenomenon.

It’s a deep-rooted issue that has persisted for many years. A telling example of this can be seen in a 2017 survey by PwC titled “Future of Customer Experience.”

- The survey revealed a staggering negative 33% gap between customer expectations and actual experiences in the airline industry.

- This was the largest such discrepancy across all surveyed industries, underscoring the chronic inability of a significant portion of the airline sector to deliver a product that resonates positively with travelers.

Given these alarming statistics, one would logically expect airline executives to prioritize customer satisfaction as a key area for improvement. However, as our opening chart illustrates, it appears this gap has only widened in recent years.

Customer dissatisfaction has not only persisted but has deepened, raising serious questions about the industry’s commitment and strategies to enhance the passenger experience.

It’s important to acknowledge, however, that airlines are not the sole architects of the travel experience. The overall sentiment of travelers is also significantly influenced by various other players in the travel ecosystem. This includes booking platforms, airport management, ground handling services, and air traffic control – each contributing to the journey in its own way.

Despite this shared responsibility, the primary focus still heavily lies on airlines to spearhead initiatives aimed at narrowing this expectation-experience gap. As the primary touchpoint for travelers, airlines have the most direct influence (and opportunity) to reshape perceptions and experiences.

But what specific areas require the most urgent attention?

And what strategies could airlines adopt to reverse this trend of declining satisfaction?

The next section of our analysis will delve into these critical questions. But first, let’s take a quick look at our research methodology for this analysis.

Methodology: Tracking Airline Customer Sentiment

To accurately measure shifts in airline customer satisfaction, we adopted a methodology consistent with our 2020 approach.

- Just like in 2020, we scraped 15,000 new Tripadvisor reviews for the same set of airlines.

- However, this time, our dataset spans from 2020 to 2023, offering insights into the evolving nature of customer feedback post-pandemic.

- Recognizing the unique challenges of the pandemic period, our analysis heavily emphasizes recent reviews, with a focus on 2022 and 2023.

- Reviews from the past two years account for 90% of our total review data, ensuring our insights reflect the most current passenger experiences.

We leveraged the Natural Language Processing (NLP) capabilities of Quid Discover, an AI-powered analysis tool. This tool categorizes each review and assigns a sentiment score, thus quantifying customer feedback into different buckets of satisfaction.

This methodology enables us to compare post-pandemic sentiment shifts with previous years, offering a clear picture of how airline customer satisfaction has evolved in recent times.

The Leading Cause of Customer Dissatisfaction

- Flight irregularities emerged as the most discussed topic, accounting for 36% of all airline reviews posted on Tripadvisor. This means that nearly one in every three reviews highlighted issues related to delayed, canceled, or missed flights.

- The prominence of flight irregularities has notably grown compared to our previous analysis. In 2019, such issues constituted about 20% of reviews. The substantial increase to 36% in recent years underscores the escalating impact of operational challenges on passenger satisfaction.

This insight underscores the critical need for airlines to prioritize operational excellence. Travelers are annoyed that airlines seem unable to master the reliability and timeliness of their flight schedules. As we mentioned in our previous analysis, addressing these operational issues is a must-have strategy for airlines looking to improve customer satisfaction.

Unpacking Real Air-Travel Pain Points

While the most discussed topics in airline reviews can give us a general idea of customer concerns, they don’t always reflect the depth of traveler frustration.

To get to the heart of the matter, we examined the underlying sentiment of each review. This approach helps us identify the topics that genuinely constitute pain points for air travelers.

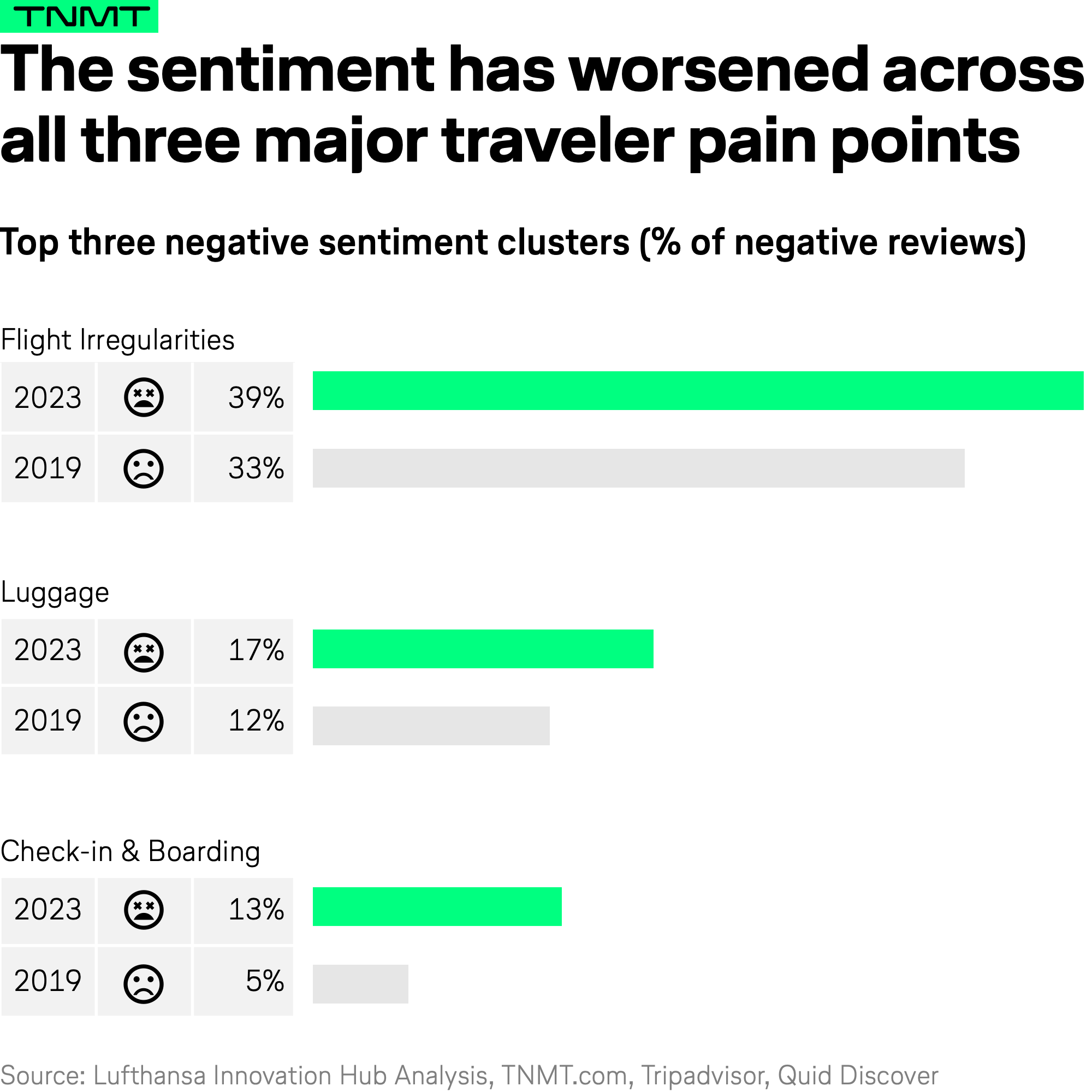

In the chart below, we’ve ranked the primary topic clusters based on the proportion of negative reviews they received, comparing these figures with those from 2019.

The results are quite revealing.

- The data confirms that flight irregularities remain the leading pain point for passengers. Even worse, this category’s dominance in negative sentiment has further increased since 2019.

- Following closely behind are problems associated with luggage. Lost, damaged, or delayed baggage is a significant source of traveler dissatisfaction.

- Thirdly, the process of check-in and boarding also ranks highly on the list of complaints. Long lines, inefficient boarding processes, and poor customer service at the gate add to passengers’ frustrations.

Cumulatively, these three areas – flight irregularities, luggage issues, and check-in and boarding challenges – represent nearly 70% of all negative feedback. The increase in the share of negative reviews for these categories compared to 2019 is a clear indicator that airlines need to focus their improvement efforts here.

While aspects like better food options or more entertaining in-flight systems seem important, they pale in comparison to these operational pain points. Addressing these critical areas should be the absolute top priority for airlines aiming to enhance customer satisfaction and loyalty.

How exactly?

The next part of our analysis will explore each of these pain points in more detail, offering insights into their specific challenges and potential solutions.

#1: The Pain Point of Flight Irregularities

The escalation in traveler frustrations related to irregularities aligns with the overall surge in flight delays during the past few years.

In 2022, the average departure delays in Europe hit the highest levels since 2003, with delays more than 50% above the historic average.

The impact of these delays is also reflected in the changing behavior of travelers. Many are turning to flight tracking platforms to stay informed, often due to the lack of updates or in-person assistance from airline staff. These platforms, such as Flightradar24, have seen their user bases expand significantly.

- Since the end of 2019, Flightradar’s active users, according to data.ai, have more than doubled, with a peak in August 2022 during the summer chaos.

- This increase, among other factors, is likely influenced by a rise in flight delays.

Furthermore, the willingness of consumers to pay for these services underscores the severity of the issue. Data from data.ai reveals that Flightradar24’s store revenue, including paid downloads and in-app purchases, saw an increase of over 200% from Q2 2021 to Q2 2023. This jump in revenue coincides with the lifting of travel restrictions and the growing demand for real-time flight information.

To address this pain point, several tech startups are emerging.

- UnDelay, established in 2018 and accelerated by ACT House in 2022, offers aviation communication data to pinpoint the root causes of flight delays, transforming radio conversations between airports and airlines into text.

- Layover Solutions is another example. The company enables airlines, when booking hotel rooms for disrupted passengers, to have a quick overview of the offers in the market.

Such solutions are vital in addressing the persistent issue of flight irregularities, providing both airlines and passengers with more transparent and efficient communication regarding delays.

#2: Rising Mishandled Baggage Rates

The issue of mishandled baggage has long been a concern for air travelers. However, the problem has further intensified in recent years, with rates reaching a decade-high in 2022.

- According to SITA’s 2023 Baggage IT Insights report, the mishandled baggage rate stood at 7.6 per 1,000 passengers, a sharp increase from 5.6 in 2019.

- This means that on average, one passenger on every short-haul flight (considering an A320 aircraft with a 150-seat configuration) faced luggage-related issues.

This trend was particularly pronounced on international flights, where the rate was a staggering 19.3 per 1,000 passengers, eight times higher than on domestic flights. While the lower rates in 2020 and 2021 were an anomaly due to reduced travel during the pandemic, the situation worsened significantly in 2022 when travel demand recovered.

Frustrated by the inefficiency of airlines in handling luggage, travelers have (again) begun taking proactive measures themselves. Many have started tracking the locations of their luggage using devices like Apple’s AirTags.

- One notable example, covered by CNN Travel, involved a passenger who, after not receiving his luggage for 34 days, used AirTag data to create a detailed presentation to assist the airline in locating it.

- A recent SellCell survey supports such anecdotal observations. According to its survey results, luggage tracking is the third most popular use of an AirTag, ranking even higher than using AirTags for tracking valuable personal items like wallets.

As a consequence, several startups are currently innovating in the luggage handling space, aiming to alleviate passenger woes. Here are three examples:

- AirPortr offers luggage transportation services that integrate directly with airline booking systems. It provides a service where luggage is collected from homes and checked in at the airport on behalf of passengers. AirPortr has partnered with major airlines like British Airways and Virgin Atlantic. As of March 2020, it had raised over $25 million USD.

- Launched in 2022, Alltheway allows passengers to check in their bags from home or city-center hotels, delivering them directly to their destination. It provides real-time baggage tracking through its app and plans to expand its services internationally by late 2024.

- Founded in 2018, BagsID Network‘s AI-based baggage handling solution uses deep learning and computer vision to identify individual bags by their unique physical characteristics. Its technology aims to eliminate the need for traditional baggage tags, offering a more efficient and reliable alternative for airlines, airports, and ground handlers.

The emergence of such startups showcases a concentrated effort to address the persistent issue of luggage mishandling, offering innovative solutions to enhance the travel experience for passengers globally.

#3: The Check-In and Boarding Bottleneck

The third major pain point in air travel, as highlighted by our analysis, is the check-in and boarding process. This category predominantly features complaints about extended waiting times and lengthy queues at check-in counters and boarding gates.

The issue of queuing at airports gained extra prominence during the travel rebound in early 2022.

- This period, characterized by labor shortages and a surge in travel demand, saw airports and airlines struggling to manage the influx efficiently.

- SITA’s research validates these concerns, indicating long wait times and congestion at airports as top reasons for traveler anxiety, with 17% of passengers citing it as a major concern.

So, how is the airline industry addressing this bottleneck?

Airlines have been actively exploring self-service options like self-check-in and self-bag drops, along with experimenting with different boarding strategies to reduce passenger processing times, for quite some time.

Additionally, consumers are increasingly willing to pay extra for comfort and convenience. This includes services like priority check-in and early boarding to avoid the hassle at counters and gates. In 2022, for example, Condor introduced a service allowing passengers to pre-book overhead bin space on select flights, reflecting some isolated attempts to enhance customer convenience.

Startups, too, are stepping up to offer innovative solutions to streamline the check-in and boarding process. Here are a few notable examples:

- Airboard Group is a web-based platform offering a digital boarding system that allows passengers to fast-track long lines at airports. Travelers can opt-in by scanning a QR code or pre-booking online, receiving live queue updates on their smartphones. Backed by Qantas Airways, Airboard was part of the AVRO Accelerator in 2018.

- Iboardings provides a suite of software and hardware solutions designed to make each stage of the passenger journey, from check-in to boarding, more efficient. Iboardings’ range of tools includes cabin baggage checkers, tagging points, easy drop and bag drop systems, check-in kiosks, and ID checks, all aimed at managing increased passenger flow.

- Specializing in conversational AI, NLX offers self-service automation solutions to improve the passenger experience. Its technology enables airline customers to handle tasks like seat changes, baggage inquiries, check-ins, and flight status checks without needing live agent assistance. To date, the startup has raised over $10 million USD, with funding rounds led by JetBlue.

The Staff Shortage Crisis As The Underlying Problem

A key question arises from our analysis: why have these pain points in air travel worsened so significantly in recent years?

The answer is that historic lows in customer satisfaction are closely tied to the issue of staff shortages within the industry. And airlines are clearly to blame for their mismanagement of the situation.

During the pandemic’s peak, the airline industry, misjudging the speed of the travel sector’s recovery, significantly reduced its workforce. A study by Oxford Economics estimates a global loss of approximately 2.3 million jobs in aviation during the pandemic.

Following this, the industry’s attempt to rapidly rehire as travel demand surged was hampered by several challenges:

- A significant portion of the workforce transitioned to other sectors, reducing the available talent pool for aviation.

- Being a regulated industry, aviation faces prolonged processes for acquiring security clearance for new hires, further delaying staff replenishment.

- The extensive training requirements for airline staff, taking up to three months for some roles, have prolonged the onboarding process, exacerbating the shortage.

The severity of this crisis is illustrated by several notable (and bizarre) examples:

- In 2022, Qantas resorted to asking its executives and management employees to temporarily assume ground-handling roles.

- At Edinburgh Airport, passengers were stranded onboard a parked Ryanair flight for hours due to the absence of a single driver to transport them to the terminal.

As of 2023, the aviation industry continues to grapple with staff shortages, particularly among ground staff. This shortfall has been a primary factor in the operational bottlenecks airlines have faced over the last two years, significantly impacting the overall travel experience and contributing to the decline in customer satisfaction.

Bridging the Expectation-to-Experience Gap

In our view, the aviation industry stands at a critical crossroads.

Ignoring customer needs and preferences is unsustainable in the long term and will inevitably affect the bottom line. The COVID-19 pandemic presented a unique opportunity for transformation, which, unfortunately, was largely focused on survival rather than improving the customer experience.

As we move forward, there are several key areas airlines need to urgently address:

1. Prioritize Operational Basics

Our 2020 analysis highlighted the importance of addressing fundamental operational issues. Flight irregularities, mishandled baggage, and long waiting times form the core of passenger dissatisfaction. Enhancing operational efficiency is crucial. The primary need of passengers is reliable and timely travel from point A to point B.

While improved seating, diverse food and beverage options, and luxury amenity kits are “nice-to-have,” they are secondary to operational reliability. This is also important from an immediate financial perspective. Focusing on operational efficiency not only enhances customer satisfaction but can also boost profitability. A study by AirHelp indicated that in 2022, flight disruptions alone would cost European airlines between $8 and $10 billion USD.

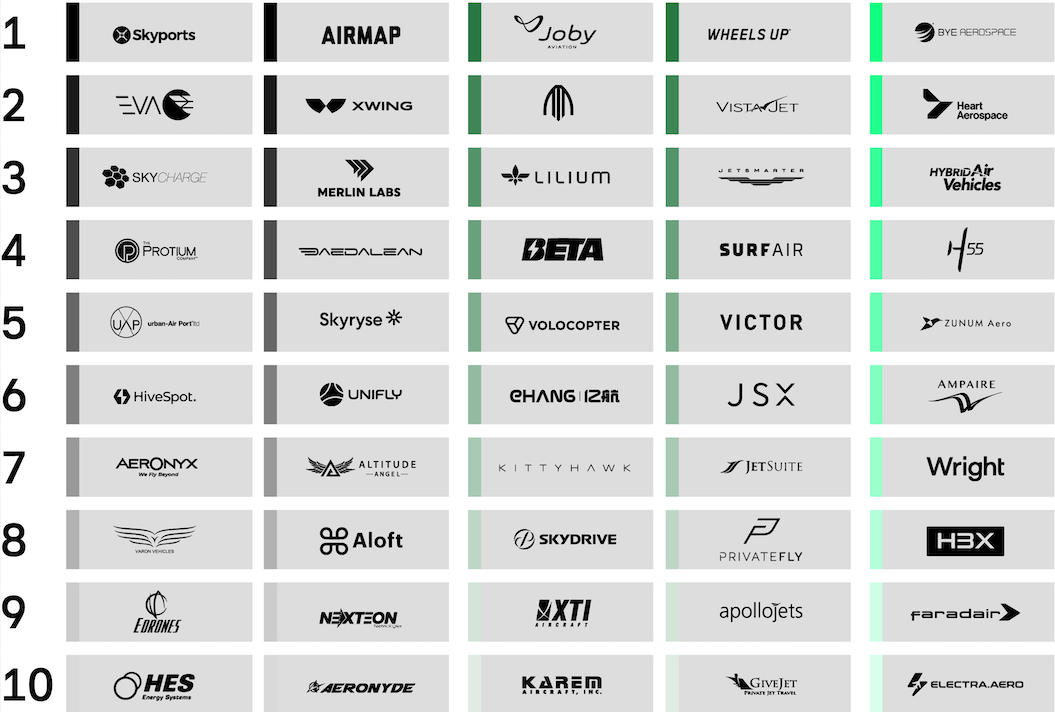

2. Leverage Startup Innovation

Startups and emerging technologies offer innovative solutions to improve existing systems, in many cases without the need for additional human resources.

This is especially vital given the ongoing staff shortages in the industry. By embracing these new technologies, as seen in several concrete examples we mentioned above, airlines can streamline their operations, enhance customer experiences, and stay competitive.

This can be achieved through data analytics and AI to understand customer preferences and tailor services accordingly.

In essence, for airlines to bridge the growing expectation-to-experience gap, a shift in focus is needed. This shift must prioritize operational efficiency and leverage innovative technology solutions. We are convinced that these strategies will not only enhance customer satisfaction but also pave the way for a more sustainable and profitable future for the aviation industry.