Welcome to the grand finale of “The Great Inversion” research series.

Today, we unveil the fifth and final trend, a game-changer set to redefine how we move around the world.

Before we dive in, let’s quickly recap our journey so far:

- Trend #1 – Communities Define Demand: We explored how niche communities are reshaping travel demand.

- Trend #2 – Advanced Means: We delved into the changing meaning of travel, transitioning from mostly analog to immersive experiences.

- Trend #3 – Embedded Travel: We unpacked how technology is integrating travel inspiration and booking into our everyday digital experiences.

- Trend #4 – From Transactional to Relational: We examined the shift toward building long-term customer relationships in travel beyond classical loyalty schemes.

Standing at the threshold of a new era, the term “Diversified Asset Competition” encapsulates what makes up Trend #5 in The Great Inversion trend manifesto.

Here is the elevator pitch highlighting the trend’s relevance:

- Historically, our travel choices have been limited to a few distinct, siloed options with limited interconnectivity.

- However, the barriers are crumbling, and a wave of innovative mobility solutions is emerging.

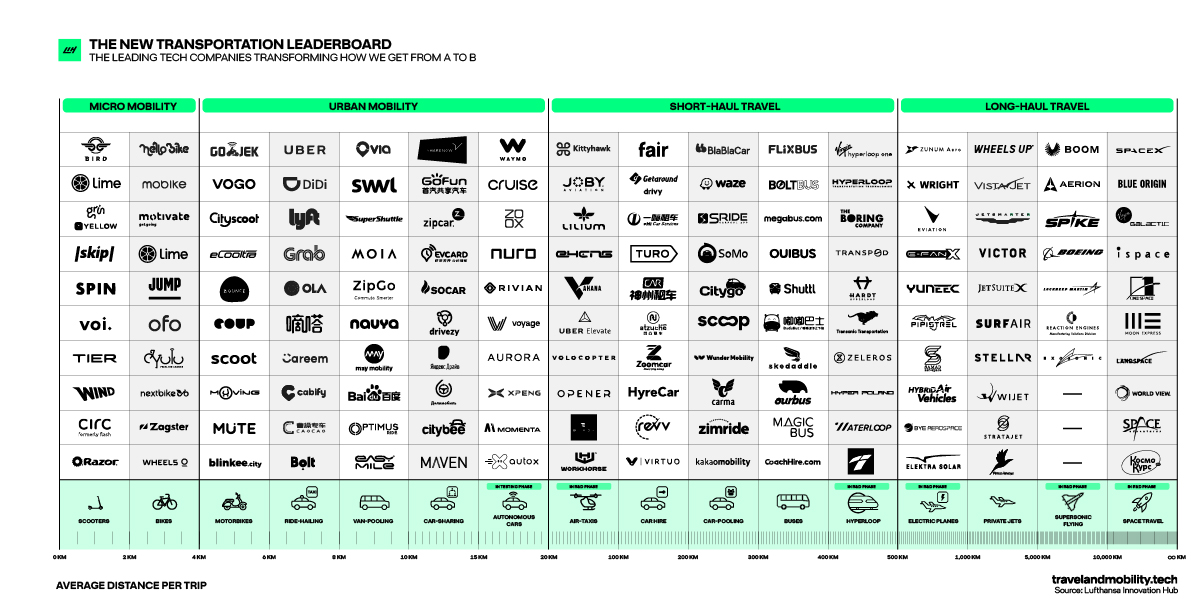

- Diversified Asset Competition describes the exponential expansion of transport options available to travelers.

Going beyond merely widening the availability of new mobility options, Diversified Asset Competition also illustrates how our future mobility landscape is connecting transport modes like cars, planes, and trains in unprecedented ways.

At the same time, the increasing commoditization of supply challenges the asset-driven logic of the travel industry. Competition has grown more diverse, with market incumbents, startup airlines, and alternative forms of transportation vying for their share of the market.

You might wonder:

- What does this all mean for existing travel and mobility providers?

- And how will these emerging modes reshape our approach to journeying from point A to point B?

That’s what we will cover as part of today’s analysis.

To get going, it’s mission-critical to understand the underlying drivers of change that initiated the movement towards Diversified Asset Competition.

Let’s briefly outline these major shifts that set the stage for this new era of mobility.

Afterwards, we will take a closer look at the new ecosystem of companies emerging from this transformation.

The Drivers of Diversified Asset Competition

The Diversified Asset Competition movement has been propelled by essentially four unresolved pain points in the travel and mobility landscape over the past few years.

1. Decarbonization Pressure

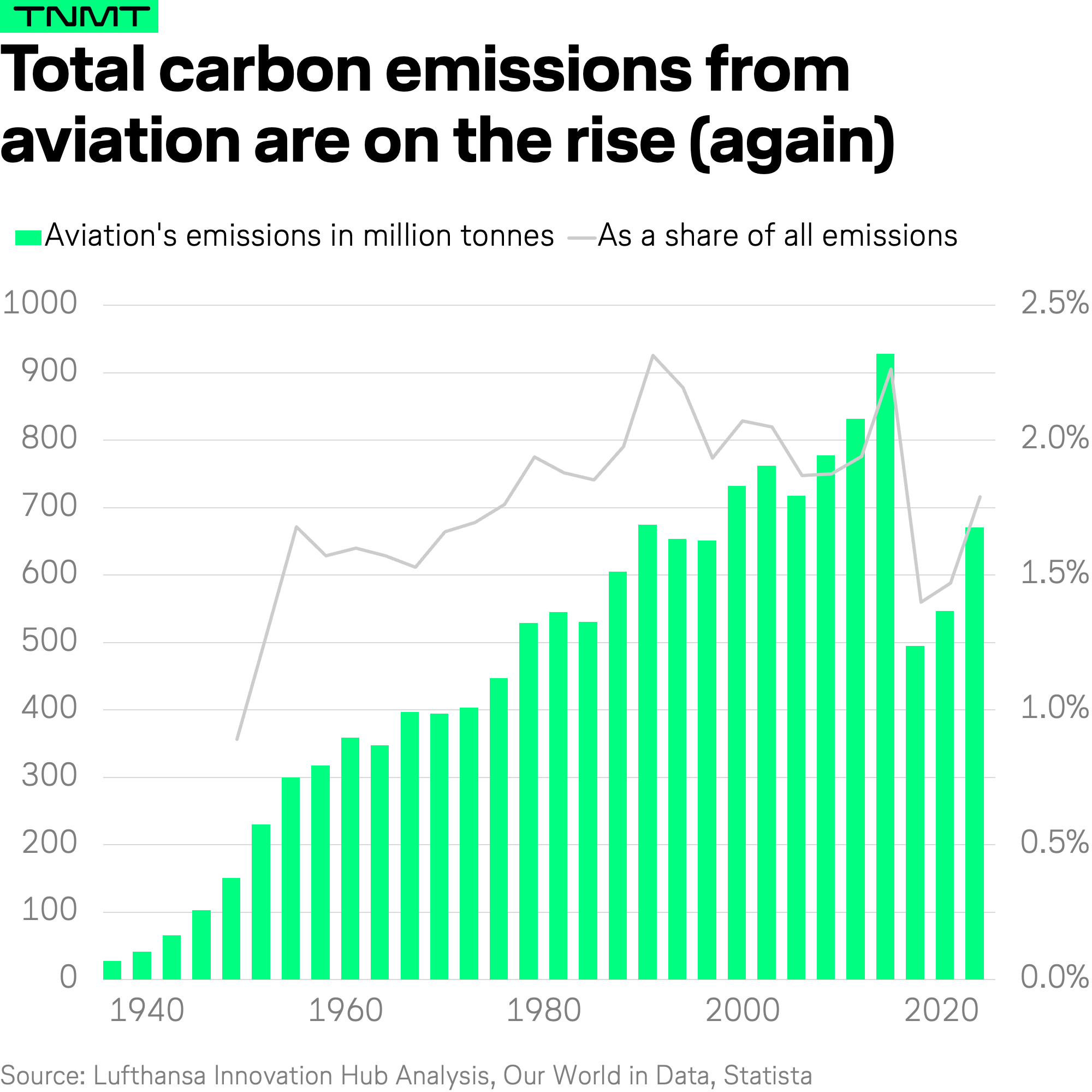

The push for environmental sustainability is more crucial than ever in the travel and mobility sector. Particularly in aviation, which accounted for close to 2.5% of global CO2 emissions pre-pandemic (or 3.5% of “effective radiative forcing” – a measure better reflecting aviation’s true impact on global warming), the industry’s environmental footprint is significant and growing.

The challenge of decarbonizing aviation is immense, especially considering the current limitations in technology.

This has given rise to a new wave of innovators. These technology startups are exploring cutting-edge solutions for more sustainable transportation, focusing mostly on electric and hydrogen propulsion technologies. Their work is pivotal in reshaping aviation’s future, steering it towards a greener, more sustainable path, as we will find out below.

2. Waiting Times

Another of the driving forces behind Diversified Asset Competition is the universal desire to reduce excessive waiting times. This trend is pushing the development of faster, more direct travel options.

Let’s quickly break down the significant areas where waiting times currently impact the travel experience:

- Waiting in Lines: The scale of time spent waiting in lines is staggering. In the United States alone, people spend an estimated 37 billion hours each year in queues. This immense consumption of time is a major pain point in everyday activities, including travel-related processes like check-ins and security screenings.

- Waiting in Airports: The airport experience, in particular, often represents a significant time investment. On average, travelers in U.S. airports spend about 133 minutes from airport arrival to boarding the plane.

- Traffic Jams: The phrase “Time is Money” gains a literal sense when considering the hours lost in traffic jams. In major cities like London, Chicago, Paris, and Boston, individuals can spend upwards of 134 hours annually stuck in traffic.

In response to these challenges, a group of innovative startups, dubbed by us as “The New High Flyers,” are exploring groundbreaking solutions for faster transportation. These include air taxi services, hypersonic flights, and even point-to-point space travel.

Their goal?

To transform travel into a more efficient, time-saving experience, allowing people to reclaim those lost hours and spend them in more meaningful ways.

3. Interconnected Mobility

Another key driver of the rising Diversified Asset Competition is the integration of various mobility solutions to create seamless, interconnected travel experiences. Modern travelers have long expected effortless transitions between different transportation modes, making connectivity a critical factor in enhancing the overall journey.

The need for connectivity becomes particularly evident when considering the current evolution of the mobility landscape.

- Rising Mobility Options: The emergence of new transportation means like e-scooters, e-bikes, and ride-hailing services has expanded the mobility landscape. These options have become integral parts of urban and intercity travel, yet we are still far away from accessing all those new mobility options on a single platform.

- Demand for Personalized, Multimodal Experiences: Travelers increasingly seek personalized journeys that blend different modes of transport. The ability to customize travel itineraries with various transportation options is becoming a significant value proposition.

- Reducing Private Car Dependence: A growing trend towards minimizing reliance on private cars is evident, propelled by environmental concerns and the desire for more flexible, cost-efficient travel options.

In response, existing travel and mobility companies are diversifying their offerings, integrating a broader spectrum of mobility solutions into their product portfolios.

A prime example of this trend is Sixt’s integration of e-scooters into its car-sharing booking app. This feature allows customers to rent e-scooters for short-term trips, particularly useful in major cities around the globe, and then frictionlessly jump into a rented car. Such integrations demonstrate how companies are adapting to offer a more holistic, customer-centric travel experience.

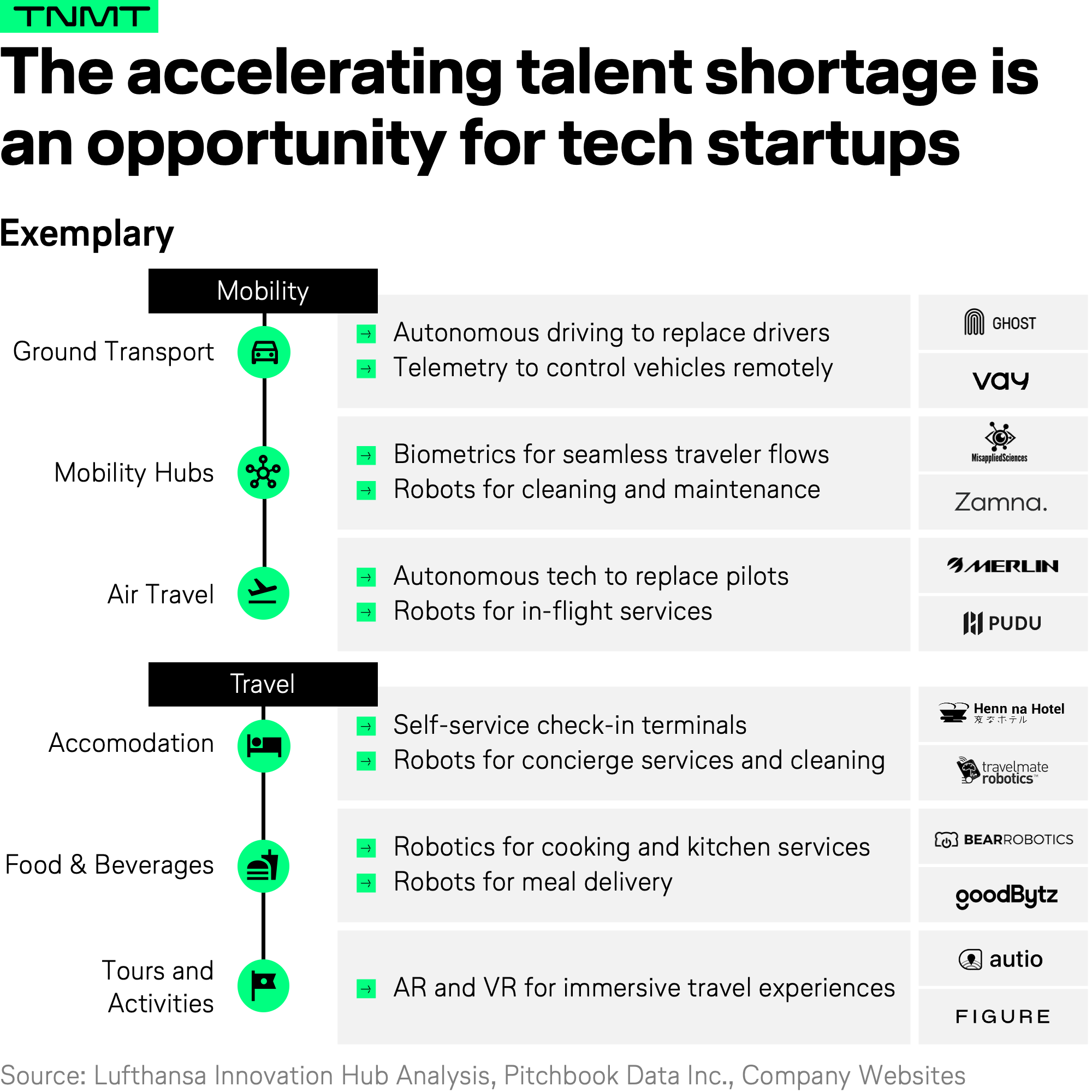

4. Labor Crunch

In the intricate movement towards Diversified Asset Competition, one pressing issue stands out the most: the scarcity of skilled labor in the travel industry, particularly in aviation.

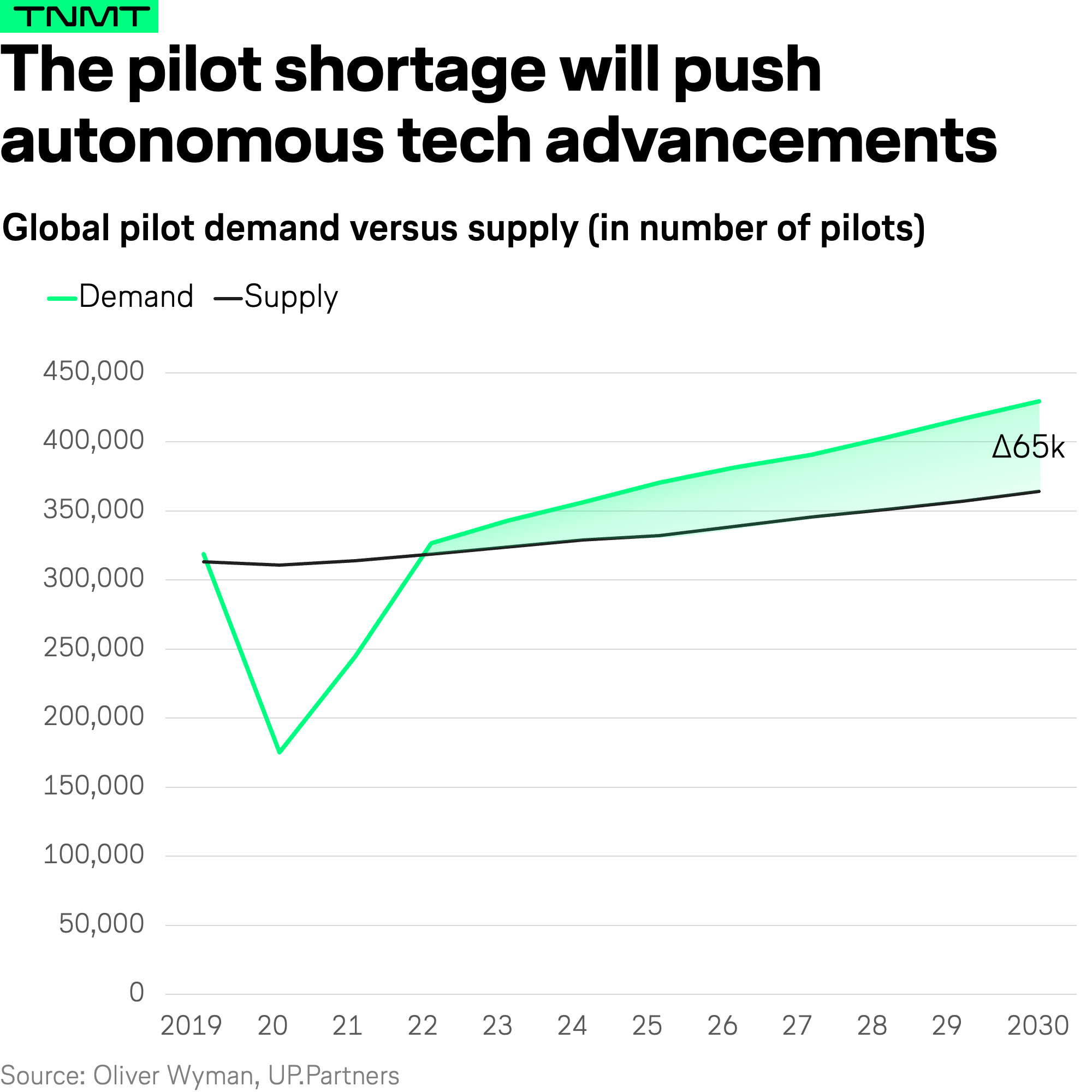

- The aviation sector is currently grappling with a significant shortage of pilots, a trend that is projected to intensify in the coming years.

- As per Oliver Wyman’s estimates, the airline industry already faced a shortfall of approximately 18,000 pilots in 2023. This gap is anticipated to widen to an alarming 65,000 by 2030.

- Even worse, the labor shortage is not just confined to pilots but extends across various roles in the aviation sector (and beyond).

- Boeing’s own models project that over the next two decades, the industry is expected to require two million new professionals, including maintenance technicians and cabin crew, to sustain its current growth trajectory.

This challenge has catalyzed a shift towards automated and technology-driven solutions, aiming to bridge the gap in human expertise while enhancing efficiency and safety.

- Robots, for example, are increasingly being seen as a viable solution to the skilled labor shortage. They are being considered for various roles within the travel sector, including check-in and boarding gate agents and luggage ground staff.

- The International Federation of Robotics reported that about 2.9 million robots were already operational globally in 2020. This figure is projected to skyrocket to 40 million by 2030 and will also be heavily leveraged by the travel and mobility sectors.

This trend towards automation and robotics is also driven forward by a growing ecosystem of startups, dubbed “Automation Pioneers”. These startups are developing solutions to address the skilled labor shortage. Their focus is not only on filling the existing gaps but also on streamlining operations for increased efficiency as we will outline below.

The Leaders of Diversified Asset Competition

In the dynamic landscape of Diversified Asset Competition, we are witnessing the rise of innovative company clusters, each uniquely addressing these industry pain points we explored above.

These clusters represent the vanguard of change, propelling the industry towards a more integrated, sustainable, and efficient future.

We can differentiate between three emerging company groupings:

- New High-Flyers aim to revolutionize air travel with cutting-edge technologies.

- Mobility Diversifiers try to redefine the interconnectedness of various travel modes.

- Automation Pioneers harness the power of automation and robotics to reshape industry operations.

These three clusters symbolize the diverse approaches companies are taking to navigate and lead in the evolving Travel and Mobility Tech ecosystem. Each group is targeting one or two of the specific drivers we explored above, collectively shaping a new horizon in how we experience and perceive travel.

Let’s uncover each company cluster in more detail.

New High-Flyers: Revolutionizing the Skies

The emergence of “New High-Flyers” is a significant feature of the Diversified Asset Competition landscape. These innovators, like air-taxi pioneer Joby Aviation and electric aircraft trailblazer Heart Aerospace, are leading a wave of Advanced Air Mobility transformation.

Their mission? To address environmental concerns and revolutionize travel efficiency.

These firms are reengineering air mobility from its very foundation. They envision aerial solutions that surpass current models in speed, efficiency, and cost-effectiveness.

The (potential) value proposition covers:

- Speed and Sustainability: These “time machines” target faster transit options without sacrificing environmental integrity. Electric and hydrogen aviation technologies are crucial here, (potentially) offering quieter, cleaner alternatives and aiming to significantly cut down emissions, particularly for long-haul flights.

- Travel Convenience: Beyond ecological benefits, these contenders promise a new level of travel convenience. For example, air-taxi operations could enable door-to-door aerial transport, though this remains a distant goal. Supersonic and hypersonic travel technologies are poised to drastically shorten long-distance travel times.

This cluster of companies brings together dynamic startups and established industry leaders like Airbus and Boeing. Startups are particularly notable for their innovative, boundary-pushing approaches. Meanwhile, the established players contribute their vast expertise and resources to amplify these innovations.

In essence, New High-Flyers are not just innovating within the industry; they are redefining the very standards of air travel for the years ahead. Their contribution to the Diversified Asset Competition trend signifies a bold leap toward an efficient, sustainable, and more accessible air travel future.

Mobility Diversifiers: Expanding the Mobility Footprint

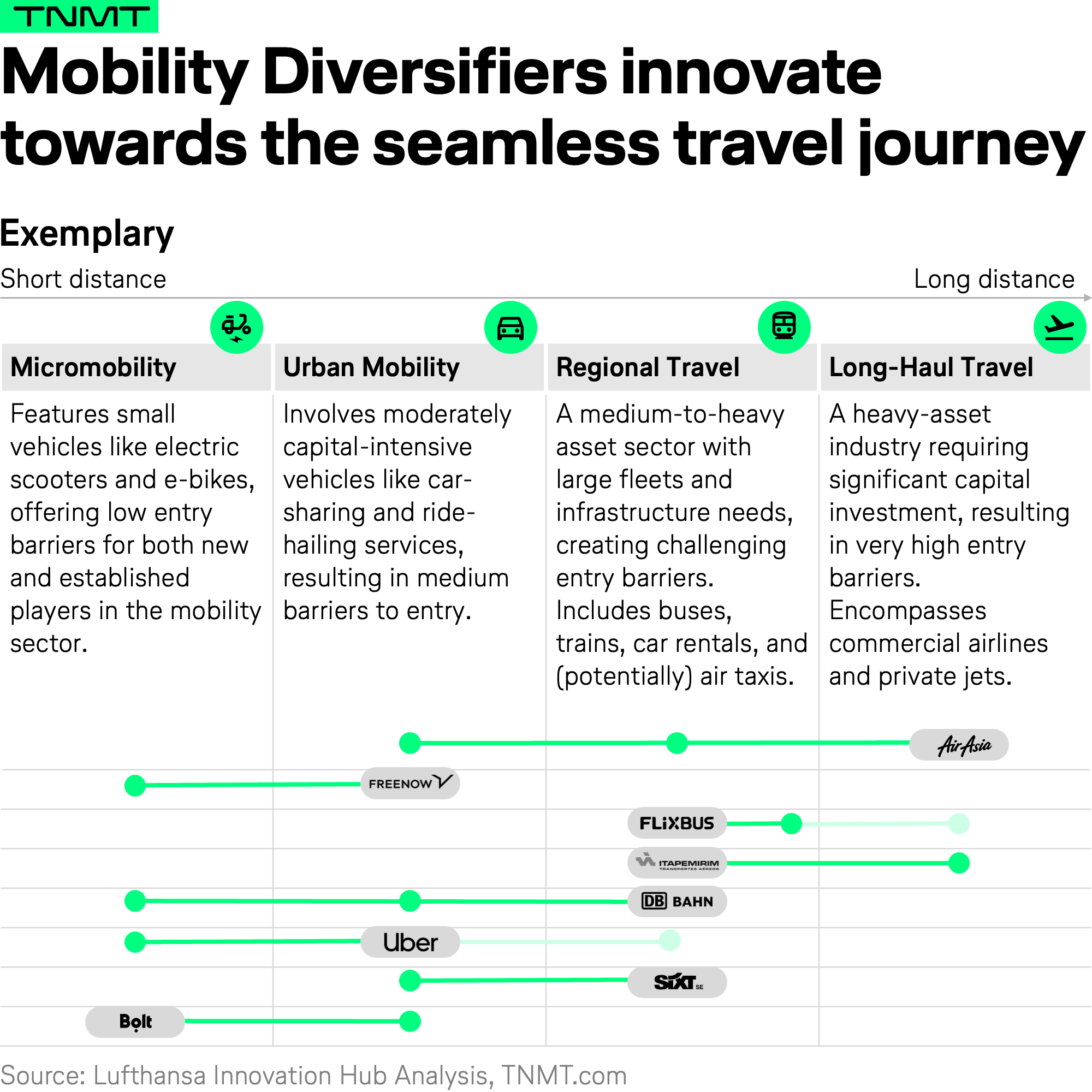

In the evolving landscape of Diversified Asset Competition, we witness a significant trend where companies are aggressively broadening their mobility offerings to ensure a more integrated customer journey. This trend is characterized by the emergence of “Mobility Diversifiers.”

Companies like Flixbus, Trainline, and Sixt are only a few well-known examples that exemplify this trend. These companies are strategically expanding their product portfolio to encompass a broader range of mobility solutions, ensuring a comprehensive and seamless experience for their customers on their respective platforms.

This approach involves venturing into market segments that traditionally lie outside their core business domain. For example, this could include a train operator branching out into airline services or a car rental firm integrating micromobility solutions.

This strategic expansion offers several advantages:

- Market Penetration: It enables these companies to potentially capture new customer segments and tap into emerging markets.

- Risk Mitigation: Diversification serves as a buffer against market fluctuations, evident during scenarios like the COVID-19 pandemic, where micromobility solutions like e-scooters and bike-sharing saw a faster recovery compared to car sharing.

- Synergistic Opportunities: By creating a holistic mobility ecosystem, these firms can leverage synergies between different types of assets, enhancing overall customer value.

Notably, these firms are more inclined towards downstream diversification, considering the high costs associated with upstream investments. For instance, a car rental company might find it more viable to branch into e-scooters rather than stepping into the extremely capital-intensive aviation sector.

As a result, airlines are uniquely positioned to become Mobility Diversifiers, although this entails signficant financial risks due to the hefty investment needed for expansion.

AirAsia serves as a prime example of a company willing to take the risk.

Over the past few years, AirAsia has transitioned into an all-encompassing mobility company, providing not just air travel but also integrated ground transportation services.

Here is a brief overview:

- Ride-Sharing and Hailing Services: AirAsia has launched its own ride-sharing and hailing services, allowing customers to book rides to and from airports directly through the AirAsia app. This initiative enhances brand visibility and strengthens customer association with AirAsia beyond air travel.

- Innovative eVTOL Investment: With an order of 500 Vertical Aerospace eVTOL VX4 aircraft, AirAsia is set to pioneer a ride-sharing platform in Southeast Asia. This groundbreaking move aims to seamlessly connect urban and regional travel, offering continuous engagement with customers throughout their journey.

- A Paradigm Shift in the Airline Industry: This strategy marks a significant evolution in the airline sector, as it presents a comprehensive approach that encompasses every aspect of the traveler’s journey, not just the flight.

In conclusion, Mobility Diversifiers like AirAsia are actively redrawing the lines in the travel sector. By extending their reach into multiple aspects of mobility, these innovators are not only adapting to the changing demands of the market but are also crafting a more holistic and seamless travel experience for their customers.

Automation Pioneers: Navigating Labor Shortages

In the face of escalating labor shortages within the travel and mobility sectors, “Automation Pioneers” are stepping up as key stakeholders. These innovators, comprising both startups and established companies, are turning the tide with digital and automated solutions designed to supplement or even substitute human labor.

- One prominent vertical within travel that leverages such innovation is the hospitality industry. Many hotels are introducing digital self-check-in systems, which not only streamline the guest experience but also significantly reduce staffing needs and associated costs.

- Restaurants are also increasingly adopting digital ordering systems. Take, for instance, Bear Robotics and its catering robots. These automated solutions enhance efficiency, accuracy, and speed in taking and processing orders, outperforming traditional human-operated systems.

- Perhaps one of the most groundbreaking arenas for Automation Pioneers is in aerospace and aviation. Companies like Xwing are leading the charge in developing autonomous flight technologies. This shift towards single-pilot and fully autonomous aircraft is a game-changer, promising to reshape the future of aviation.

Such automation and digital solutions offer dual benefits: cost reduction and improved efficiency. For example, hotel self-check-in systems lower staffing costs, while automated systems at restaurants and airports (like automated ID and ticket checks) enhance operational efficiency.

Despite the advantages of automation, it’s critical to balance these innovations with the human element. In the travel and mobility industry, known for its emphasis on service and experience, retaining a personal touch is vital for delivering an authentic and caring user experience.

Long story short: The trend towards embracing digital solutions as a response to labor shortages is set to continue. The benefits — cost reduction, operational efficiency, and the ability to address staffing challenges — are too compelling to ignore. Yet, the industry must navigate this transition thoughtfully, ensuring that the essence of travel and mobility — human interaction and personal touch — isn’t lost in the wave of transformation.

Concluding Thoughts on The Great Inversion

As we close the final chapter of our comprehensive “The Great Inversion” research series, it’s clear that the journey through the transformative world of travel and mobility has only just begun.

The “Diversified Asset Competition” trend, our last installment, unveils a dynamic and rapidly evolving competitor landscape, marked by innovation, disruption, and a redefinition of what mobility means.

The trends we’ve explored over the year — from Communities Defining Demand to the rise of Embedded Travel, Advanced Travel Means, and now the Diversified Asset Competition — reflect a sector that is not just responding to change but actively shaping it. These trends highlight how technological advancements, shifting consumer preferences, and new business models are collectively sculpting a new era in travel and mobility.

Yet, this is merely the tip of the iceberg. The pace of change in our industry is accelerating, and there are undoubtedly more exciting developments on the horizon.

To stay up-to-date on these ongoing transformations and to delve deeper into the insights and analyses that define the future of travel and mobility, our TNMT Newsletter is an invaluable resource.