Basic economic theory suggests that the more competitive an industry is, the more innovative it becomes.

The rationale is straightforward:

- Increased competition compels businesses to differentiate themselves in order to stay ahead of their rivals.

- This usually leads to the development of new products, services, or processes, which make companies more attractive to customers and more efficient in their operations.

When there is a lack of competition, especially with few new market entrants around to shake things up, the opposite is usually true: stagnation and a lack of innovation cause existing industry incumbents to have little need or pressure to win over customers’ hearts.

Unfortunately, the latter phenomenon is exactly what seems to be taking place in the airline industry.

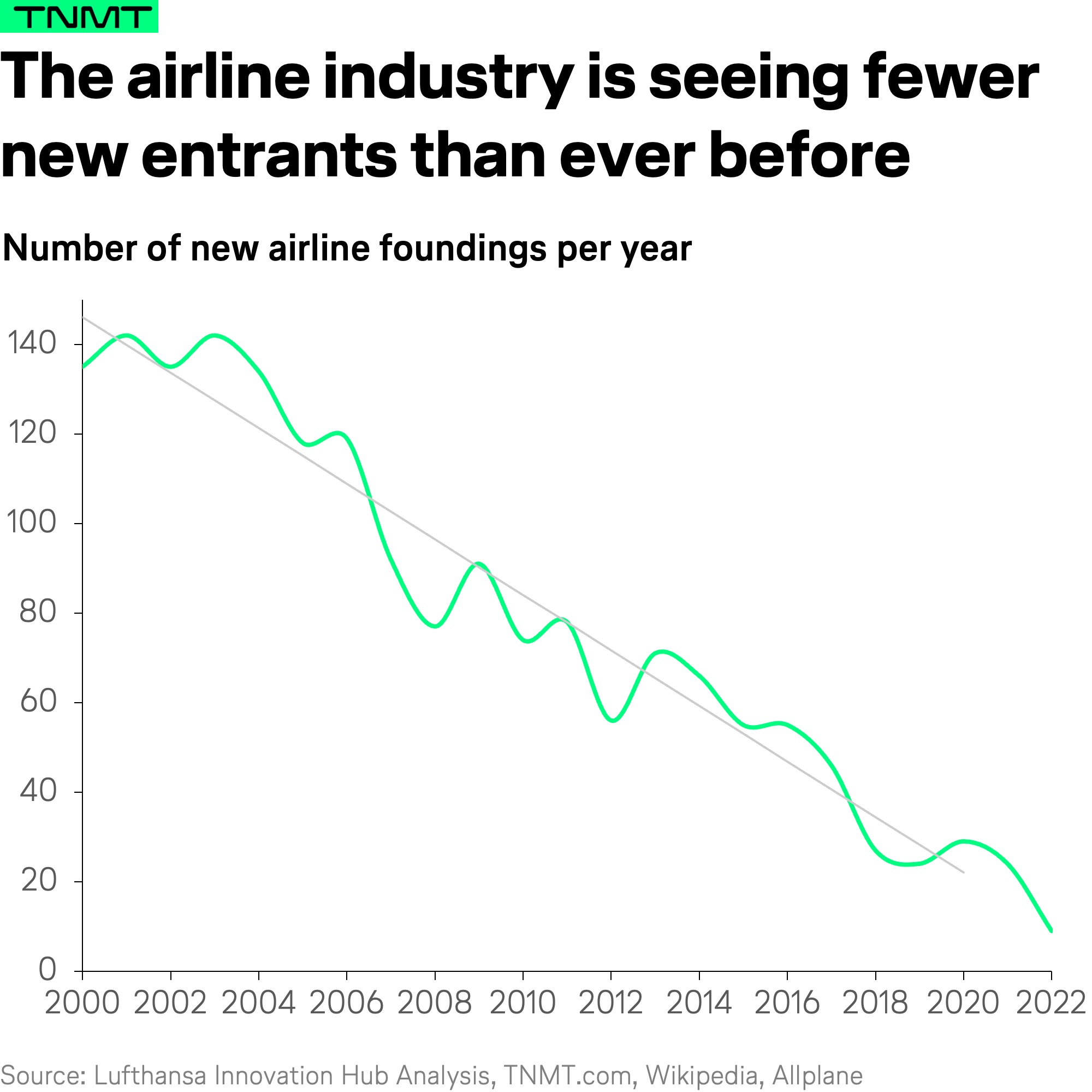

The airline industry is experiencing a never-before-seen decline in the new formation of airlines. The number of new airlines entering the market has dropped from almost 60 new airline foundings per year in 2016 to below 10 in 2022. Undoubtedly, competition is decreasing.

This decline is unprecedented and worth examining in more detail.

What are the factors behind this trend?

We took a closer look.

The industry dynamics in the airline industry

According to our analysis, there are eight major challenges that potential new airlines face when entering the market that can be structured into four main clusters, each having two main drivers.

All of these components either reduce the revenue potential or increase the overall cost base, making the airline industry increasingly unattractive.

Let’s go through each of these challenges individually to better understand their specific dynamics.

Challenge #1: Policy & Market

Regulatory requirements in the airline industry have become more and more demanding. This is hindering new “startup airlines” from being formed. Here’s why:

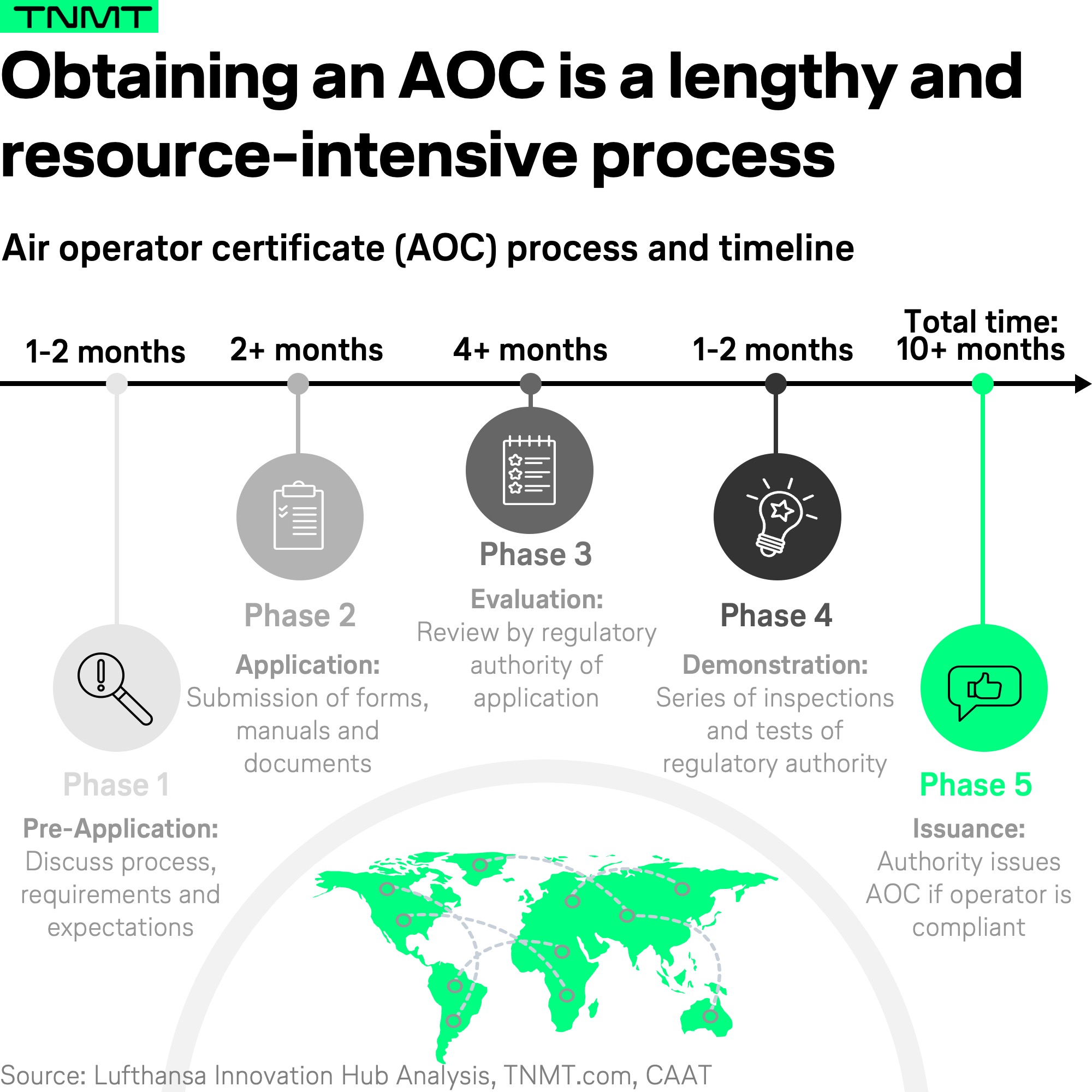

The pursuit towards obtaining an Air Operator Certificate (AOC) from regulators is both time and resource-consuming. Without an AOC, new airlines cannot transport passengers. Newly formed airlines, which are oftentimes resource-constrained, cannot afford to wait for 10 months on average, and sometimes even longer, for an AOC to be granted. This makes it difficult for said airline prospects to get commercial operations up off the ground in a timely manner.

The lengthy process requires significant manpower and resources, impacting the firm’s cost base. Regulatory standards in the aviation industry are high for a number of important reasons, namely safety. However, it’s anything but easy for new players to live up to these standards, given their lack of experience in meeting all of these requirements.

To provide more specifics, here’s what it takes to obtain an AOC.

As the chart above details, the steps that must be taken are structured along five phases.

Together, these easily span more than 10 months. However, realistically, it takes much longer than a year for most new entrants.

- Pre-application phase: In this phase, the applicant airline typically meets with the regulatory authority to discuss the application process, requirements, and expectations.

- Formal application phase: The applicant airline submits a formal application, which includes documentation outlining its operational and organizational structure, safety management systems, maintenance programs, and more.

- Document evaluation phase: The regulatory authority reviews the submitted documentation to ensure it meets the required standards and regulations.

- Demonstration and inspection phase: The applicant demonstrates its ability to conduct safe operations by undergoing a series of inspections and tests. These may include proving flights, maintenance checks, and audits of the operational and safety management systems.

- Certification phase: Once the regulatory authority is satisfied with the airline applicant’s compliance and capabilities, it will issue the AOC.

The duration of this process can vary significantly. It depends on factors such as the size and complexity of the applicant’s operations, the efficiency of the regulatory authority, and the applicant’s preparedness and ability to meet the required standards.

Regulations for obtaining an AOC have become more stringent in many countries over the past few years. This is mainly due to increased safety concerns, technological advancements, and a need to adhere to international standards. Regulatory authorities, such as the FAA and the EASA, have been enhancing safety and operational requirements to ensure that aircraft operators maintain high standards.

These stricter regulations often include more detailed safety management systems, comprehensive training programs, and enhanced maintenance procedures. Additionally, many countries have adopted the ICAO safety standards and recommended practices, further contributing to the global harmonization of aviation safety regulations.

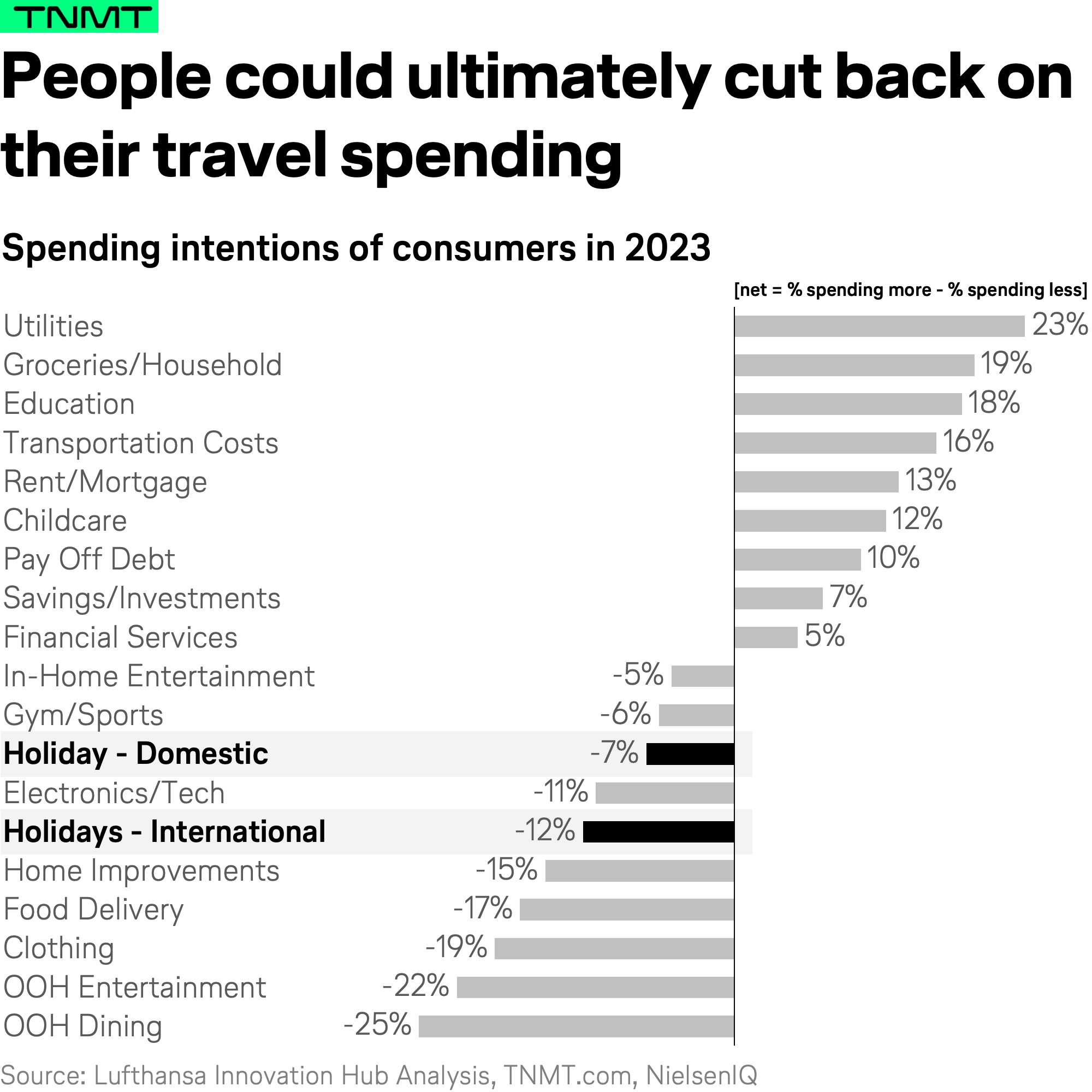

Another dimension within the Policy & Market category is the current economic environment, which is anything but rosy at the moment.

The current unstable global economic climate with high inflation rates and high-interest rates stresses more than just the real estate and banking sectors. Across industries, including the airline sector, the current poly-crisis time has led to pessimistic outlooks amongst investors. This has made it more difficult for heavy-asset industry entrants like new airlines to raise the funds necessary to launch.

Furthermore, an unstable economic environment comes hand-in-hand with people and businesses potentially reducing overall spending to include only the most important things. While this is not yet measurable in the travel industry, we cannot ignore the scenario that this could likely have a negative impact on revenue streams.

If the looming recession impacts people’s disposable incomes, they will also have less money to travel the world.

Challenge #2: Net-Zero Pressure

While the economic situation might change in the near future and make the airline industry more attractive to new entrants from a macro perspective again, the pressure to decarbonize the aviation industry won’t disappear any time soon.

This makes it increasingly challenging for new entrants to easily enter the industry.

Why?

Required decarbonization efforts are increasing costs for airlines, making it difficult for new airline entrepreneurs to raise funding and become profitable in a reasonable timeframe.

More demanding requirements will have a significant impact on the expense base of a given airline. Some examples that impact the cost structure are necessary price premiums for sustainable aviation fuels, carbon offsets, as well as enough capital to purchase carbon credits through the European Emissions Trading System.

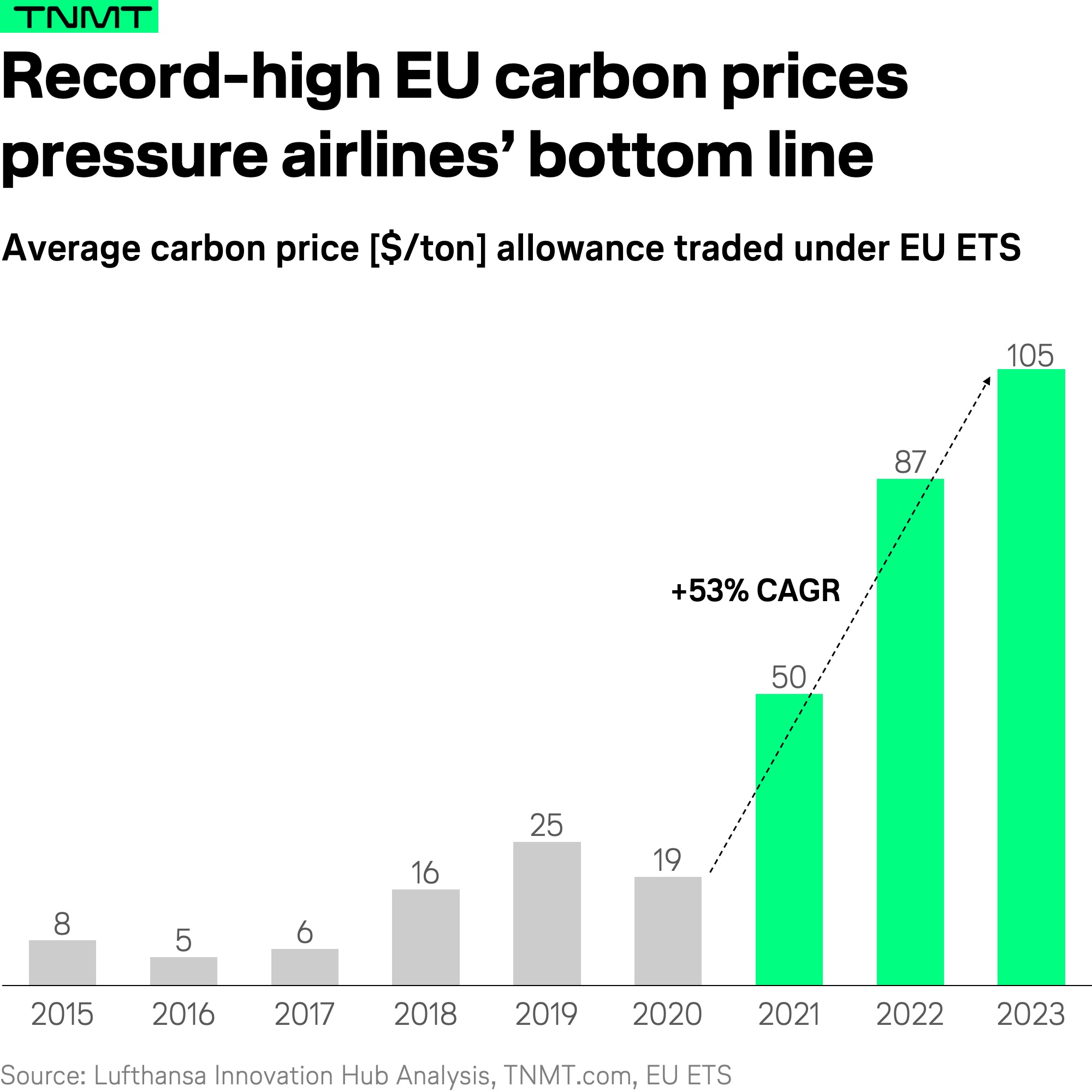

The price of carbon credits, in particular, has increased significantly in recent years, putting growing pressure on the profitability of airlines. In turn, this makes the airline industry a less attractive sector for new entrants.

The pressure to decarbonize comes from not only regulators and investors but also consumers.

In fact, consumer preferences are shifting towards more sustainable travel, which is impacting the airline industry heavily. Travelers are looking for ways to reduce their carbon footprints when they travel, especially on short- and medium-haul routes.

For example, many leisure and business travelers are increasingly considering high-speed rail or an alternative sustainable travel option where possible, leading to decreased demand on short-haul routes. The business travel segment, in particular, has the potential to drive this trend even further, as more and more companies implement and enforce sustainable travel policies.

This will have an impact on demand and hence, lower revenues for airlines.

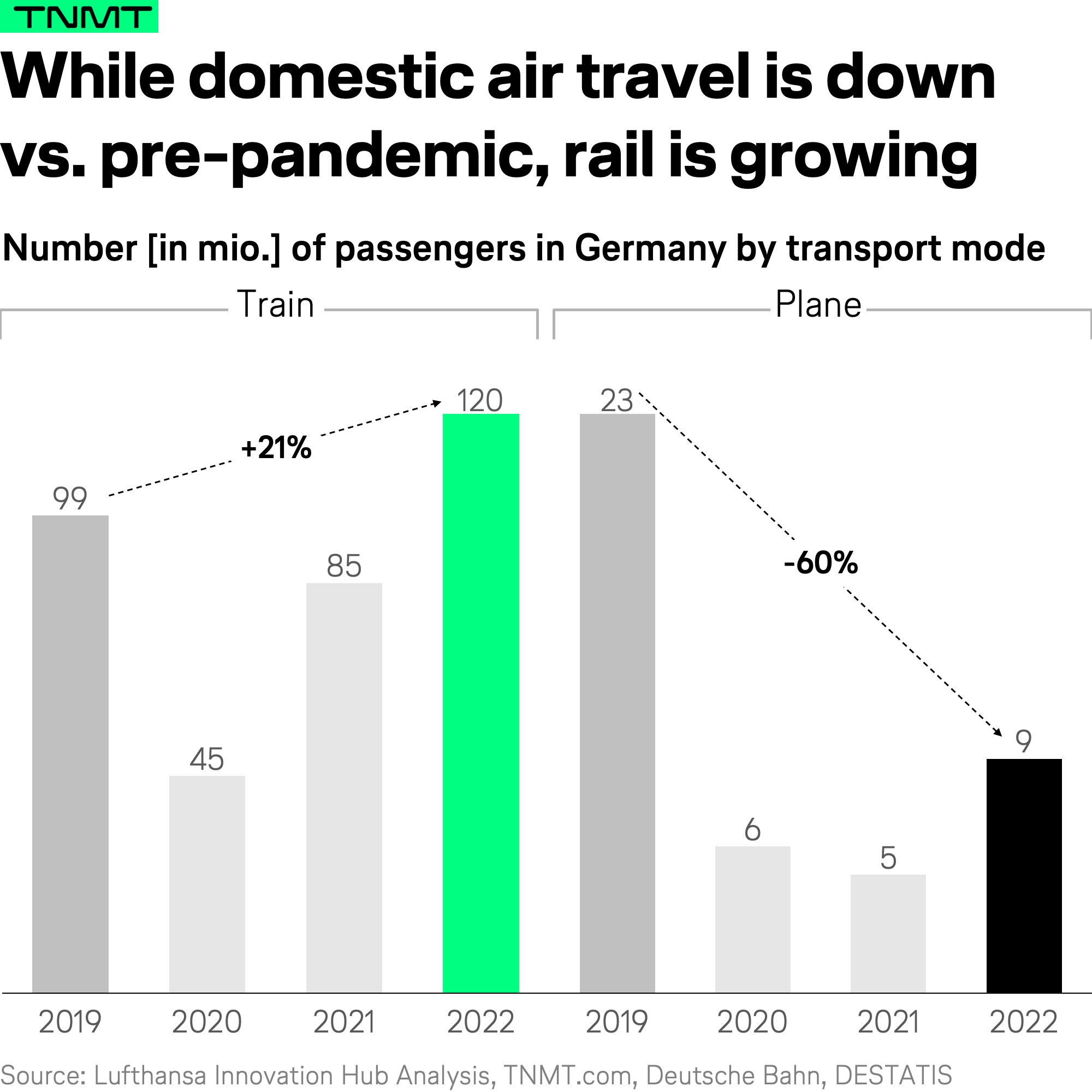

The German market is a great example of this. While the German train company (Deutsche Bahn) was able to increase overall passengers transported in its ICEs (high-speed trains) within Germany by 21% in 2022 vis-á-vis 2019, the number of passengers embarking on short-haul flights within Germany has not recovered to 2019 figures. In fact, this figure has actually declined by a staggering 60%.

Obviously, other reasons come into play here as well: pandemic side effects, supply constraints of airlines, the intentional reduction of domestic flights, and some share of passengers most likely transitioning to cars.

But overall, this trend paints a clear picture: short-haul air travel in its current form is no longer a growth market.

Challenge #3: Asset Scarcity

Growing economic uncertainty and rising sustainability concerns are challenging the attractiveness of the airline sector. Additionally, there are airline-specific industry trends on the asset side that are worth exploring.

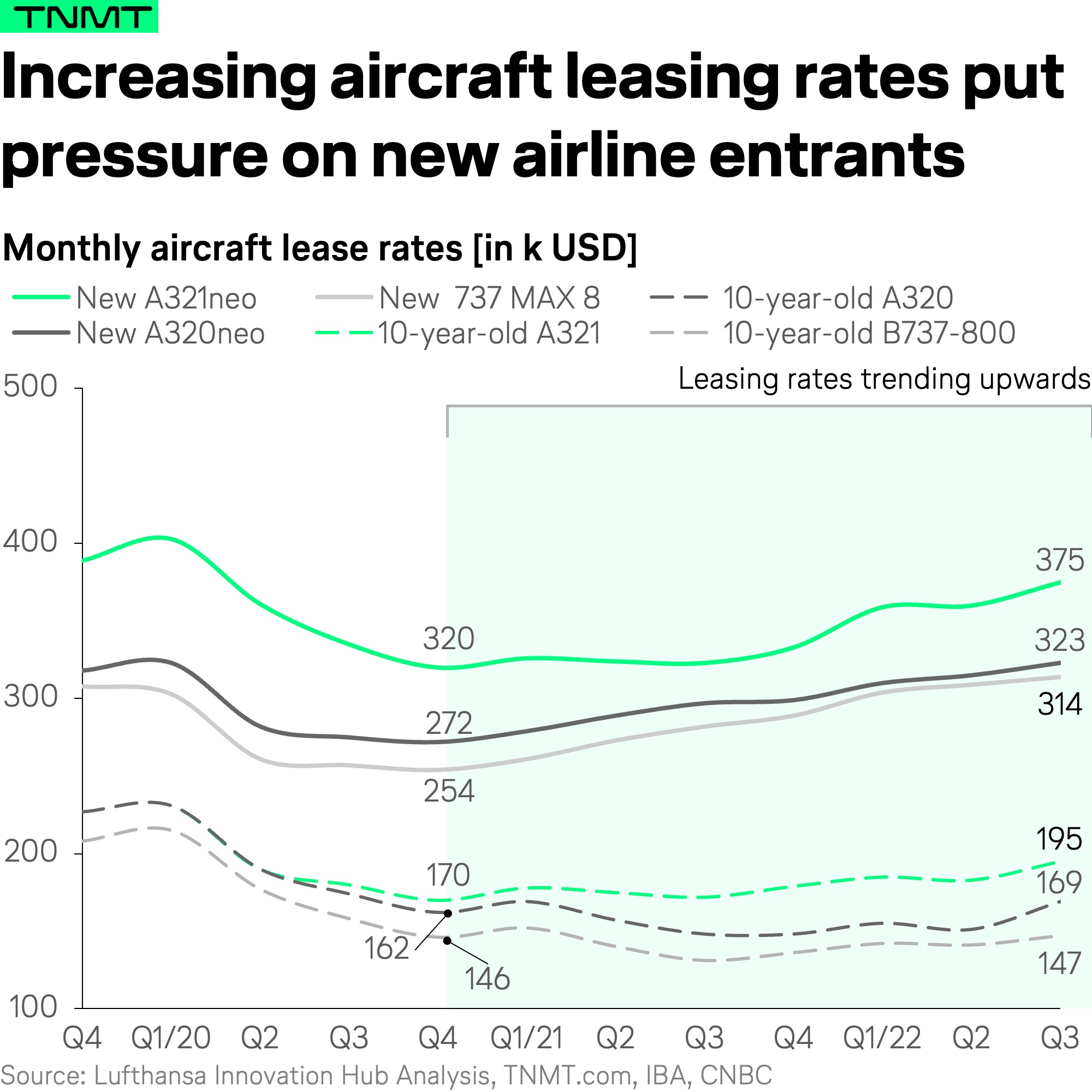

Aircraft leasing is one such area. There has been a high demand for aircraft since the world re-opened after the COVID-19 pandemic. This has led to a substantial increase in leasing rates (see chart below), especially since 2021 when the airline industry experienced high demand in a supply-constrained environment. Such a scenario has made it more difficult for new airline companies to lease aircraft, given the higher leasing rates.

This, again, leads to a significant impact on the expense base of airlines, making it difficult for new airlines to compete with industry incumbents with deeper pockets. For example, Flair Airlines was not able to pay a leasing aircraft company, leading to the grounding of multiple jets.

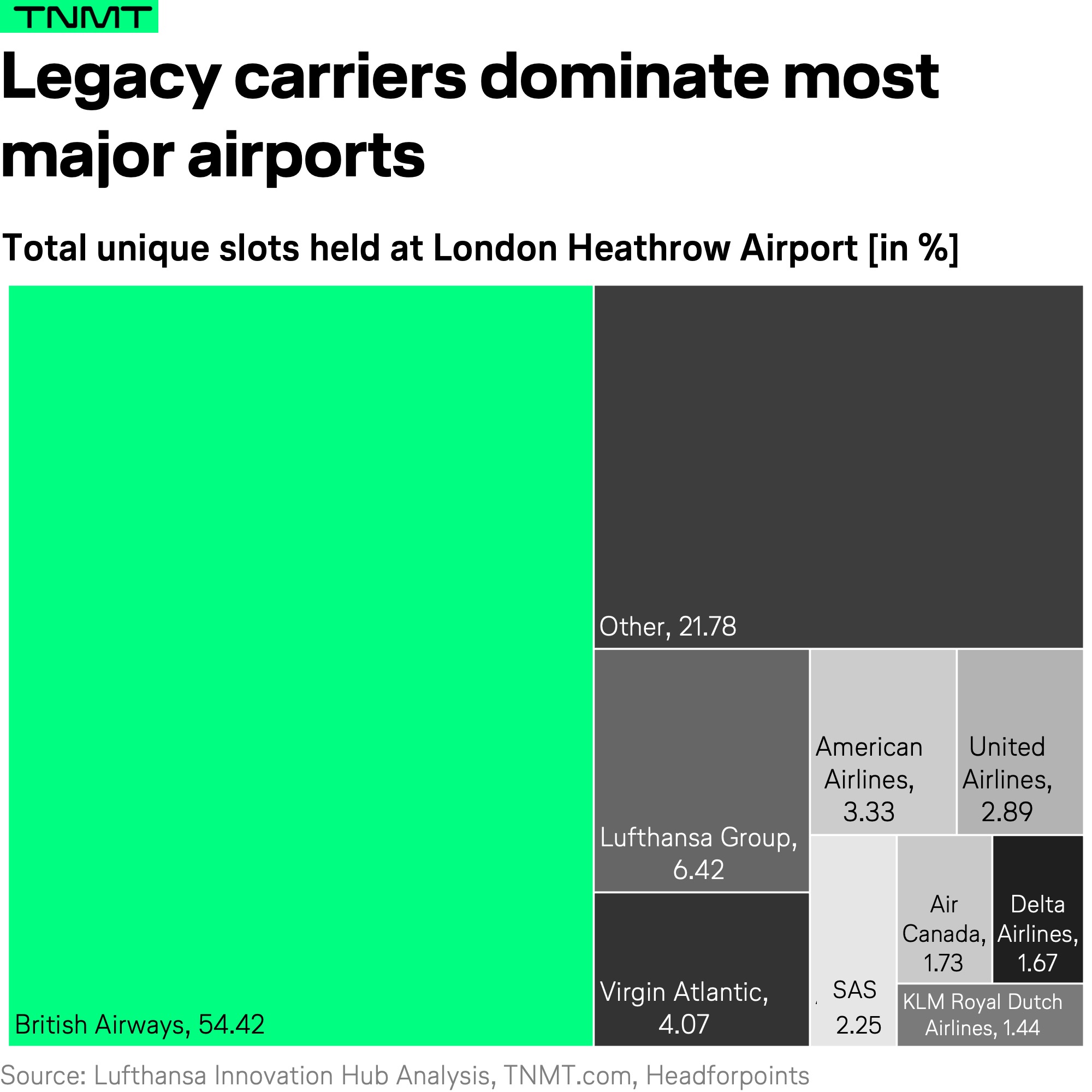

Limited airport slot availability is another aviation-specific phenomenon that makes it increasingly difficult to get a foot in the door.

Incumbents protect their hard-earned territory, particularly at congested and popular airports (see the below example for the London Heathrow slot allocation distribution). Incumbent airlines tend to protect their slots, making it harder for new airlines to gain a foothold in the market.

There are several reasons for this:

- Limited availability of slots: Airports have a finite number of slots available for takeoff and landing. At congested airports, particularly those serving major cities or popular tourist destinations, the demand for slots often exceeds the available supply. This limited availability can make it difficult for new entrants to secure slots at desirable times or locations.

- Grandfather rights and slot allocation: Many countries use a system of “grandfather rights” to allocate slots. Under this system, incumbent airlines that have used a particular slot in the past are given priority when it comes to allocating that slot in the future. This can put new entrants at a disadvantage, as they may be unable to obtain slots that are already being used by established carriers. However, regulations have led to a much more transparent and efficient allocation process in recent years.

- Slot trading and leasing: In some markets, airlines are allowed to trade or lease their slots to other carriers. This practice can further limit the availability of slots for new entrants, as incumbent airlines may be more likely to trade or lease their slots to other established carriers rather than new entrants.

Challenge #4: Economic Viability

Last but not least, some macro trends threaten the commercial viability of the airline industry going forward. These macro trends make it increasingly unattractive for new entrants to enter the industry.

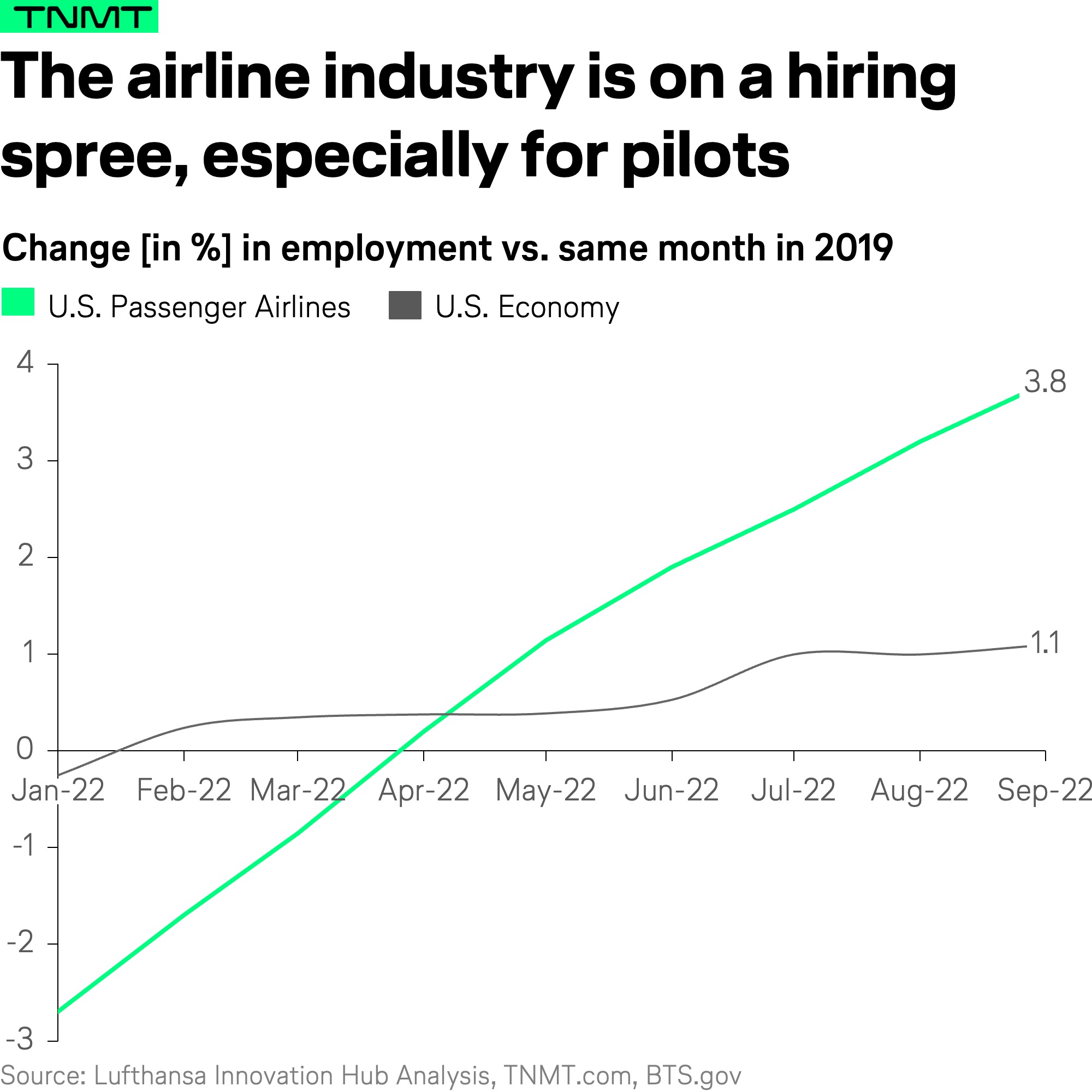

Labor shortages, for example, are putting mounting pressure on the industry to keep everything working.

As post-pandemic Revenge Travel accelerated air travel demand faster than most industry analysts expected, established airlines have started hiring pilots and crew members at an unprecedented rate, creating a supply constraint.

This has made it increasingly difficult for new airlines to find qualified personnel and has led to soaring personnel expenses, which will likely impact the overall expenses of new airline firms. For example, Delta Airlines increased pilot salaries by more than 30% over the past four years.

In the long term, the pilot shortage is not expected to slow down anytime soon.

- Oliver Wyman estimates that the airline industry already lacks 18,000 pilots in 2023, a delta that will expand to 65,000 by 2030.

- This shortfall can be attributed to myriad complexities, such as an aging population with an increasing number of baby boomers reaching the mandatory retirement age for commercial airline pilots as well as a shrinking pool of potential candidates.

- Furthermore, there has been a raft of pilots deciding to take early retirement during the COVID-19 pandemic, which accelerated the impact of the shortfall.

Margins are not only challenged by higher personnel costs but also low-cost airline expansion.

The airline industry’s established low-cost and ultra-low-cost carriers are moving into larger markets, putting pressure on established premium carriers, thereby, making it even more difficult for new airlines to break into profitable airline segments.

There are several prominent examples of this low-cost movement, like:

- Spirit moved into the Dallas International Airport, competing directly with American Airlines.

- Southwest Airlines expanded to Chicago O’Hare, competing directly with United Airlines.

- Norse Atlantic Airways, one of the few successful new startups of the last few years, has taken away some of the trunk routes from British Airways between London and New York City, having already secured a market share of 15% on this highly attractive route.

The low-cost competitive intensity will most likely increase even further now that the LCs and ULCCs are gaining momentum. This will have a negative effect on revenue, as prices usually decrease, leading to profitability coming under pressure.

The pandemic only caused a short-term relief

With all this being said, the airline outlook for new market entrants looks anything but attractive. While some industry analysts considered the pandemic to be a helpful relief to ease some of these industry barriers, it was a rather short-lived “hiccup effect.”

Airline leasing rates dropped significantly during the height of the pandemic in 2020. This made it more attractive for entrepreneurs to enter the market as low cost or ultra-low-cost airlines. Eurowings Discover, a subsidiary of the Lufthansa Group, is an example of a low-cost airline established during the COVID-19 pandemic with a focus on leisure travelers.

In the long-haul air travel segment, leasing rates for widebody planes like the Boeing 787-9 saw a decline of approximately 35% in 2020 compared to the year previous, with a modest recovery of 10% in 2021.

As well, the pool of talent had increased as legacy carriers laid off thousands of pilots and crews in 2020, which created an opportunity for new airlines to tap into this talent pool. In total, about 400,000 airline workers were fired, furloughed, or told they may lose their jobs due to COVID-19. This provided an opportunity for new airline entrants as the talent pool expanded massively, with many employees having or willing to switch employers.

Finally, the closure of 43 commercial airlines in 2020 and 19 in 2021, according to Cirium, created a window of opportunity for new players to access airport slots and routes that were previously inaccessible.

For example, in April 2020, Virgin Australia, the country’s second-largest airline, entered voluntary administration after failing to secure financial support from the Australian government or investors. The company was heavily impacted by the travel restrictions and sharp decline in passenger demand caused by the pandemic, which ultimately led to its insolvency. The slots of the airline became available for other airlines.

However, the uptick in new airline entrants seen during the COVID-19 pandemic in 2020 was short-lived, as the challenges that had been driving this decline since 2000 remained. In many cases, things got even harder, as outlined above.

What to expect in the future

In conclusion, the decline in new airline foundings over the past twenty years is a consequence of various factors that have negatively impacted the industry’s overall attractiveness to entrepreneurs and investors.

All of these challenges have contributed to reducing revenue potential and increasing the cost base of new airlines, ultimately hampering their ability to succeed. New airlines face significant challenges in gaining a viable foothold in the market due to the limited availability of airport slots; therefore, technology advancements that increase efficiencies and facilitate airport expansions are crucial in creating additional slots and fostering a more competitive landscape for emerging carriers.

The COVID-19 pandemic created a temporary surge in new airline startups due to factors like reduced aircraft leasing rates, an increased talent pool, and the closure of several commercial airlines. However, this surge was short-lived as the underlying challenges persisted.

The implications of this decline in new airline foundings are far-reaching.

It is expected to lead to decreased innovation within the industry and a lack of new players ready to disrupt the status quo. Furthermore, reduced competition may result in higher prices and fewer choices for travelers, negatively impacting the overall customer experience.

With this being said, are there any signs of hope for a trend reversal when looking at the decade ahead?

Indeed, there are.

We believe to see a resurgence in new airline formations over the next decade as next-generation aviation technologies, such as electric or hydrogen-powered aircraft, become more viable in playing a commercially relevant role in aviation.

These advancements could address some of the current challenges faced by the industry, including decarbonization efforts, shifting consumer trends towards sustainable travel, and the rising pressure to meet net-zero targets. As new, environmentally-friendly technologies are developed and proven in aviation, they could create opportunities for new airlines to enter the market and differentiate themselves from established players by offering innovative and sustainable solutions.

For instance, the emergence of Regional Air Mobility (RAM) has the potential to ease the strain of limited airport slots at major travel hubs by shifting some of the air traffic to regional airports. By utilizing smaller, more agile, electric aircraft focusing on short-to-medium distance routes, RAM can enhance regional connectivity by providing more frequent and convenient flight options between smaller cities or towns and larger urban centers. This increased accessibility can stimulate economic growth in regional areas, reducing the need for passengers to travel through congested major airports.

This potential shift in the industry landscape could attract a new wave of entrepreneurs and investors, leading to increased competition, innovation, and the emergence of more sustainable business models.

Ultimately, this could contribute to a revitalized airline industry better positioned to meet customers’ evolving needs and expectations while addressing global climate challenges.

The industry’s transition to electric and hydrogen-powered flight, in particular, signifies a transformative shift that could re-invent how we traverse the skies. While it may take at least two more decades for electric flying to become mainstream, the progress thus far offers a glimmer of hope and a promise of change.

Through the relentless pursuit of innovation and the unwavering determination of visionaries, we can look forward to a time when our skies are filled with environmentally-friendly aircraft, making the world more connected while preserving its natural beauty.

The journey may be long, but the destination is undeniably worth the effort – a cleaner, greener future for aviation and the world at large.