If you are one of our long-time TNMT readers, you are probably well aware that we explore unconventional data perspectives to unveil the hidden dynamics across the Travel and Mobility Tech ecosystem.

Here are a few past examples:

- We applied Natural Language Processing to analyze the crucial topics discussed by banking analysts and the leadership of major airlines during 60 earnings calls.

- We used web traffic data to illustrate how emerging bus companies, such as Flixbus, are competing with airlines, train and car-sharing providers.

- With Google Maps’ free mobility data, we proxied returning travel demand across more than 130 countries.

- We tracked mobility trends during the pandemic based on download figures of various mobile apps, resulting in the creation of the Go Out and Stay Home Index.

- With one of the first-ever price sensitivity surveys among air travelers, we evaluated the feasibility of a supersonic air-travel comeback.

- And we analyzed 15,000+ airline reviews on TripAdvisor for an objective analysis on how to (finally) fix the air-travel experience.

Our latest analysis delves deeper into social media, specifically Twitter.

This is another important piece of the puzzle allowing us to further explore the constantly growing Travel and Mobility Tech ecosystem.

What exactly did we do?

Social media is a valuable tool for companies to build their brands, generate leads and establish direct relationships with global audiences of fans and followers.

A strong Twitter presence coupled with engaging content creation shared on a regular basis can empower marketers to grow their company’s footprint and perception.

- Startups, in particular, rely on social media to garner attention, cut through the noise and make a splash online.

- For early-stage companies with little revenue proof, a strong social media presence is imperative. This is helpful to raise Venture Capital as “visibility” is considered one of the most important currencies to impress investors.

In today’s analysis, we want to find out the current state of the TNMT ecosystem in the ‘attention war’ on Twitter.

Our analysis provides a sense of the high-level marketing winners and losers. This includes helpful tips for startup founders and marketers on how to upgrade one’s company’s marketing strategies.

Here is the exact methodology

For our analysis, we checked out the Twitter accounts of the top 100 most-funded companies of all time based on our proprietary TNMT company database. This includes current startups alongside companies that used to be startups but are now publicly-listed corporations.

- For the 100 companies, we scouted the number of followers and the total number of tweets since their respective Twitter registration dates (as of May 2022).

- In some cases, we had to aggregate these numbers from various Twitter accounts associated with certain companies, given that they were running several simultaneously.

- We excluded Chinese companies as most of them do not have accounts due to local regulations.

We measured performance based on effectiveness

Our meta-analysis shows that Twitter is the place where 98 of the 100 most-funded companies have an account that is at least two years old. This demonstrates that the social media platform is a relevant channel for companies from the Travel and Mobility Tech sector to connect with their audiences.

However, widespread Twitter usage is not particularly eye-opening in and of itself.

There is a lot more to the story.

Our conviction is that the top performers are those that accumulate the most followers with the least number of tweets. This demonstrates the effectiveness of a company using Twitter to build an audience.

In a perfect world, we would measure and compare the engagement of followers with a company’s Twitter account, but since this data is not publicly available, we chose the alternative approach of tracking effectiveness.

With this in mind, we calculated an effectiveness score for each company, which divides the number of followers by the total number of tweets. This ratio evidences, on average, how many followers each company has attracted per tweet. The higher the ratio, the better.

Here are the leading Twitter performers

Our analysis shows that, according to the effectiveness ratio, 20% of the companies sampled have scores of less than 1. This means that for each tweet published, a company, on average, acquires less than one new follower, which evidences poor performance, and that the social media strategies of those in question are not working well.

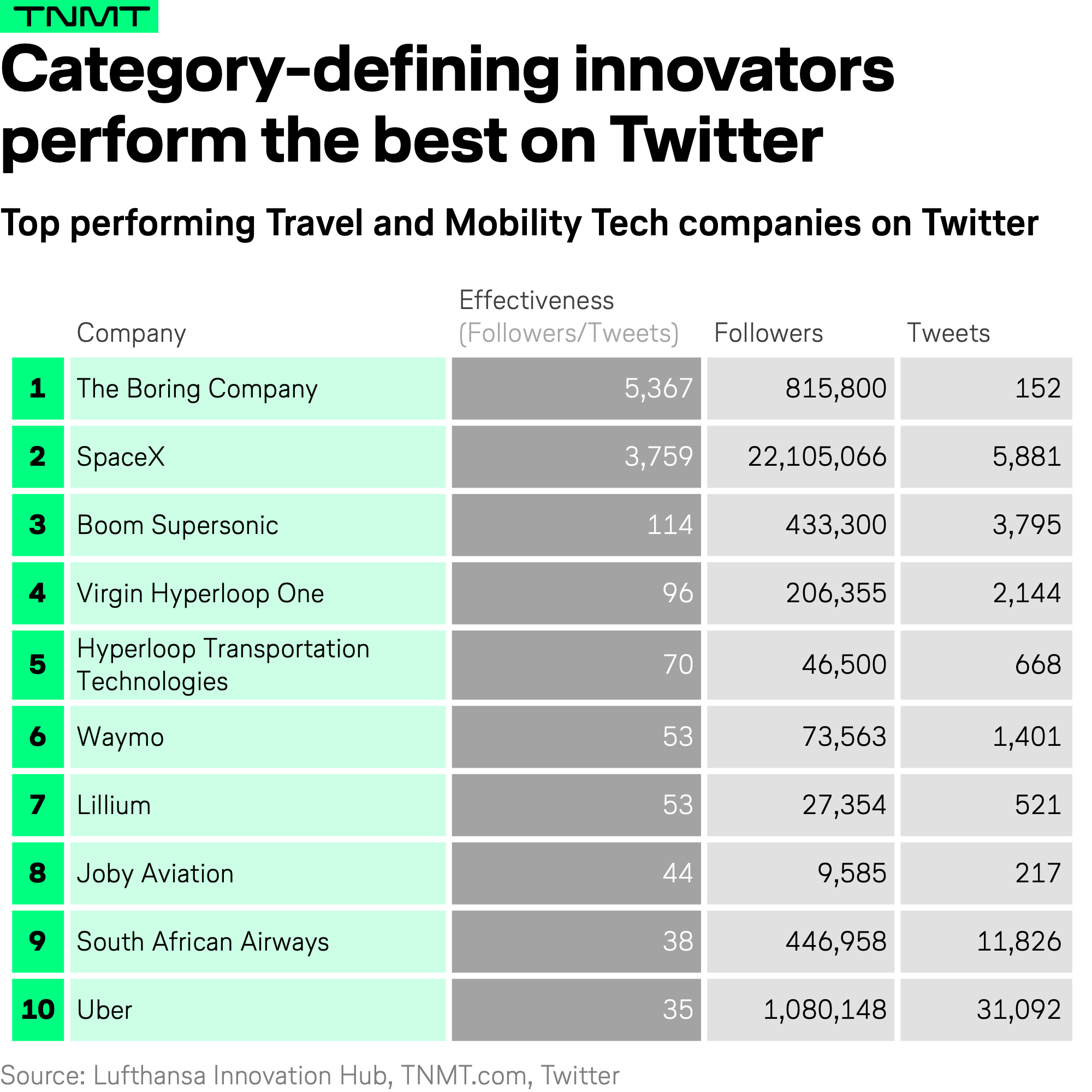

As demonstrated in the table below, the leading ten performers have scores higher than 30 with SpaceX ranking at 3,758 and The Boring Company has a remarkable 5,367.

Undoubtedly, an effective Twitter channel can produce exciting results. A single tweet has the potential to generate thousands of new followers for a brand, many of whom could be future customers.

What these winners have in common

As you can see above, the most successful TNMT companies on Twitter are early innovators of entirely new categories, including SpaceX (space travel), The Boring Company (tunnel-based mobility), Boom Supersonic (supersonic air travel), and Virgin Hyperloop and Hyperloop Transportation (obviously, both working on hyperloop solutions).

These companies have an unfair marketing advantage, given that they are building entirely new means of transportation, which generates a lot of media buzz and public interest online, even though many of these endeavors are highly questionable—does anybody really believe we will be driving fleets of Teslas in one-way tunnels below the ground one day?

Many of these companies have created powerful narratives and brands, which are often closely intertwined with their founder’s brand. For example, Elon Musk is the famous face leading The Boring Company and SpaceX. Such notoriety is easier to leverage on social media, including Twitter, than a no-name B2B travel-booking platform created by a recent university grad.

Especially in the case of The Boring Company, which leads our ranking in terms of effectiveness (despite having only shared 152 tweets so far in its entire Twitter history), the “Elon effect” is arguably the biggest driver for the company’s Twitter performance.

Interestingly, quite a few of the top-10 companies remain relatively passive on Twitter. Some of the winners in our effectiveness ranking do not seem to invest much in regular content creation and Twitter publishing: on average, the top-10 companies posted about 5,800 tweets versus 30,000 tweets for the companies ranked 11 to 98.

The few posts these companies share with the world are often general updates or visual content showcasing prototypes. This appears effective enough to attract a growing followership. Posts get numerous reactions, alongside criticisms from users questioning the feasibility of products, which trigger discussions and engage more people.

With this being said, we believe the above ranking needs to be taken with a grain of salt. Maybe effectiveness alone is not the best proxy to gauge Twitter success.

Therefore, we went one step further to identify the true Twitter champions.

Let’s look beyond the “Natural Winners”

Some of the companies with top-10 scores have a more engaged Twitter strategy. Boom Supersonic, Waymo, and Uber, for example, have dedicated a significant amount of time to produce more diverse content on a regular basis.

Usually, the content includes company updates, marketing announcements, promotion of public events, and general points of view on how the future of their respective markets may play out.

For example, Boom Supersonic regularly posts links on Twitter presenting interviews of their leadership team where they discuss the long-term outlook on the future of mobility.

As a result, these accounts provide deeper insights to their audiences that go beyond shallow product and company visions.

Compare this to The Boring Company, which in all of June, shared only two tweets about high-level updates on their tunnel project in Las Vegas (with two retweets from Elon Musk pushing the post). And in all of May 2022, the company didn’t post anything on Twitter.

What can upcoming travel startups learn?

This high-level analysis of the top-10 Twitter performers in our ranking yields a few takeaways on how startups can gain significant attention online.

- The product or service provided by a given company has to easily resonate with the public. A “Natural Winner” is a company that aims to radically transform the Travel and Mobility Tech sector and change the way we travel from A to B. If possible, upcoming startup founders should find such a niche for their respective company visions.

- However, this is not always possible. Many startup ideas don’t offer such a catchy and revolutionary B2C angle despite addressing relevant pain points and inefficiencies in a given industry. In this case, a diverse range of content beyond self-marketing posts can help boost Twitter effectiveness.

But there is more to learn.

To provide more nuance on how to play the Twitter game, it is worth studying the activity of more successful companies from the Travel and Mobility Tech sector beyond the top 10.

This includes those that have had to fight hard to build large followings given they did not have the unfair advantage of being a space or hyperloop contender, backed by one of the richest men on earth.

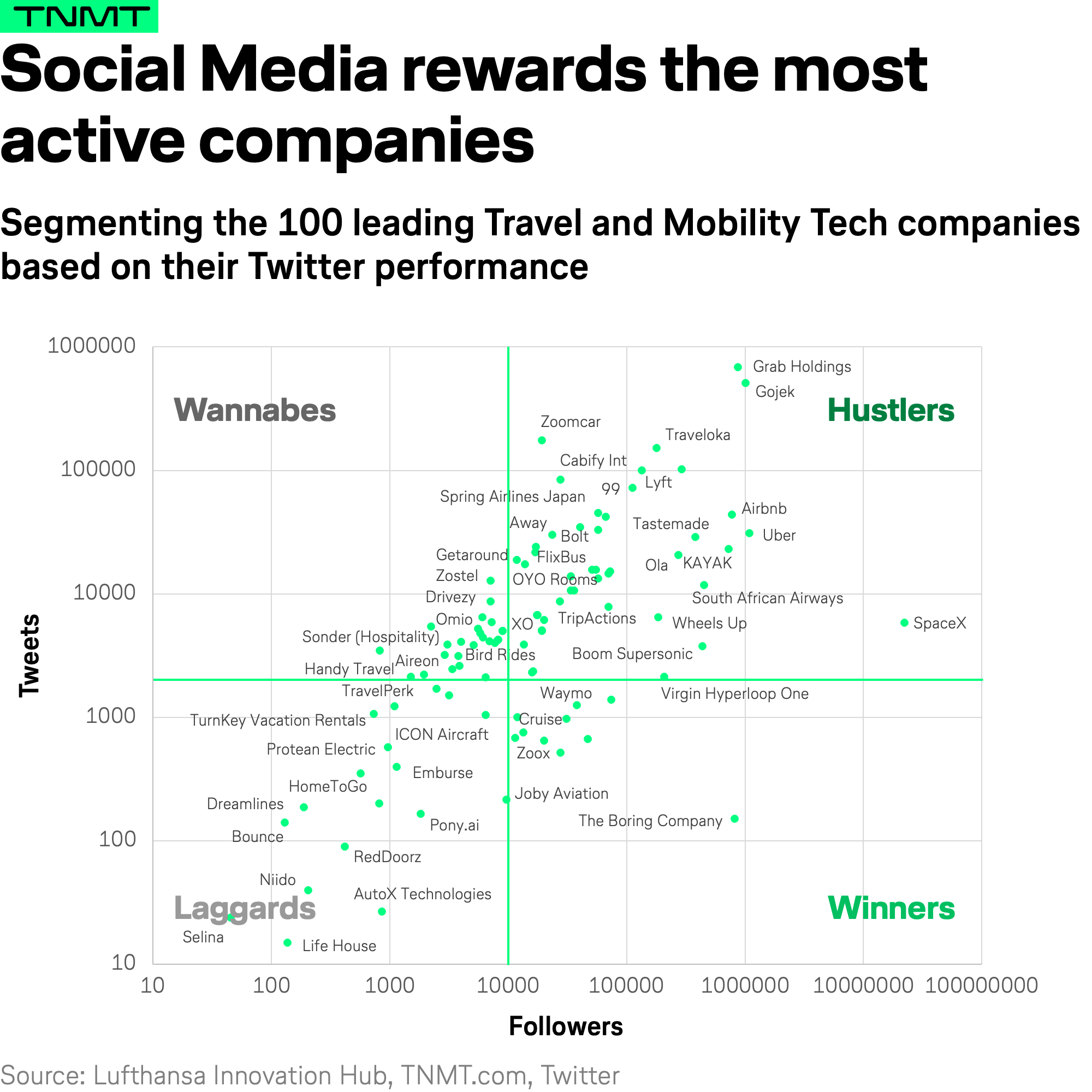

To do so, we plotted all 98 companies of our TNMT sample into a framework, which is visualized below and shows an interesting segmentation.

The real winners on Twitter

As you can see, the segmentation allows us to identify a category of Hustlers. These companies invested a significant amount of time and resources into sharing thousands of Twitter posts over the years to build an engaged followership.

We believe that these companies should be examples of the best practices for others to follow.

Therefore, we recommend startup founders and marketing managers of travel and mobility brands look into these companies in more detail.

As well, it is worth checking out companies that tweet a lot but are unable to convert their posts into followers.

These companies can be found in the Wannabes bucket and their Twitter activities are not effective (yet). As a result, their content strategies should be avoided.

Due to the scope of this article, we are unable to go into more detail surrounding these different categories.

Please research more about these firms and their respective Twitter activities. If you identify any other patterns that are shared by the most successful Twitter accounts, let us know.

A few final thoughts on the methodology

To determine the four segments, we set two indicative borderlines based on two hypotheses:

- We assume that there is no significant public interest if a company has less than 10,000 followers. Therefore, we differentiated between those companies with less and more than 10,000 followers.

- If a company has posted a total of less than 2,000 tweets, we don’t consider it to be interested in communicating with its audience via Twitter or the given business lacks the resources to produce enough content to feed its account. Given that the companies in our sample are of different ages, this dimension in our framework needs to be taken with a grain of salt