Back in May 2020, during the first pandemic wave, very few people could travel.

At the same time, the demand for videoconferencing, virtual work software, and other digital stay-at-home activities was through the roof, with people exchanging most of their “real-world” activities and interactions for virtual substitutes—think Peloton, Netflix, DoorDash, and Zoom.

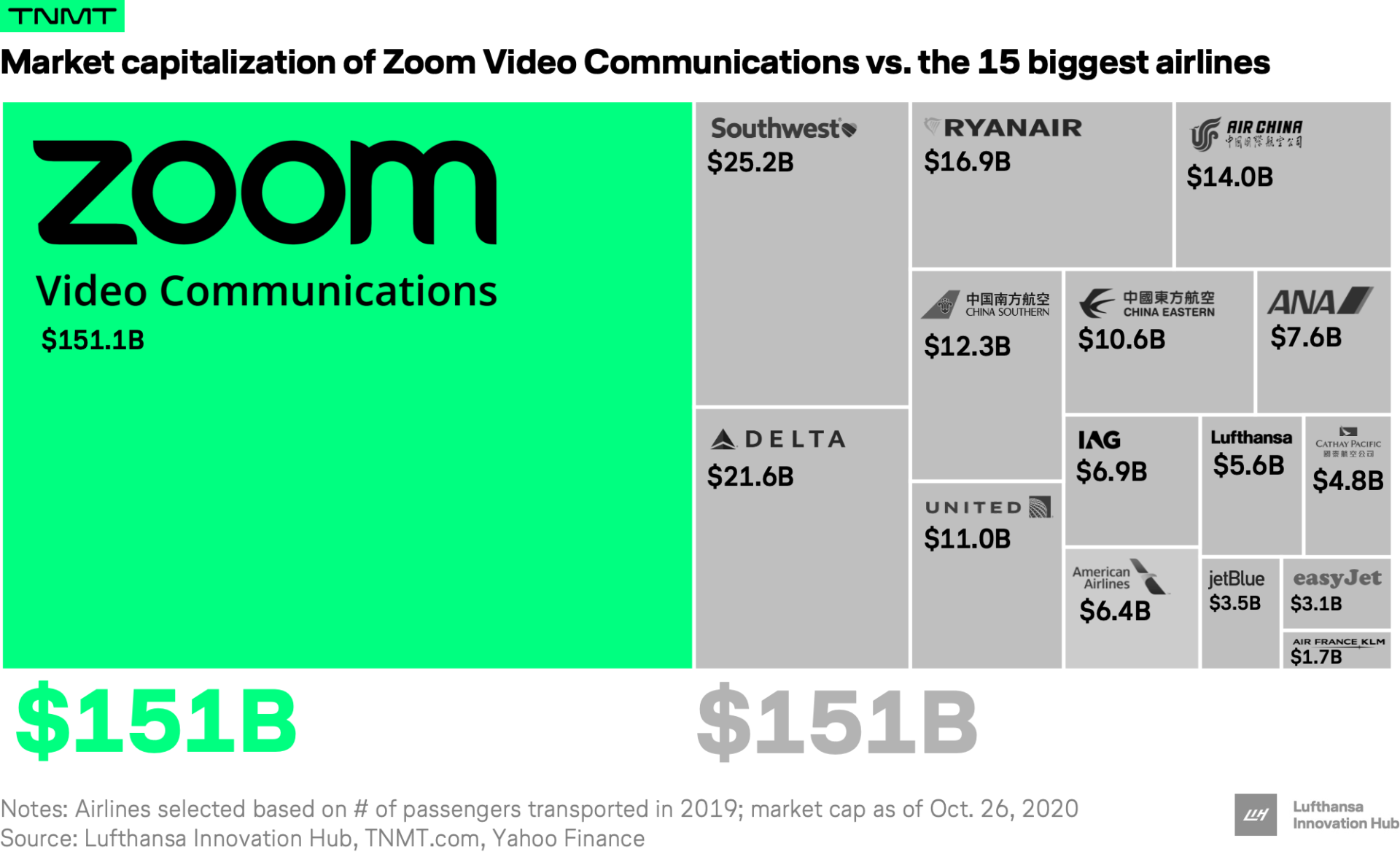

Zoom, the videoconferencing powerhouse, actually turned into one of the most impressive success stories of the pandemic, reaching a market cap north of 150 billion USD.

In October 2020, Zoom was actually worth more than the 15 largest airlines in the world.

At that point, even we argued that tech firms like Zoom had become direct competitors of travel companies like airlines, as the “virtual world” seemed to steadily replace face-to-face interactions.

How did that play out?

About two years into the pandemic—finally, with an end in sight—we see that this was kind of right, but not entirely.

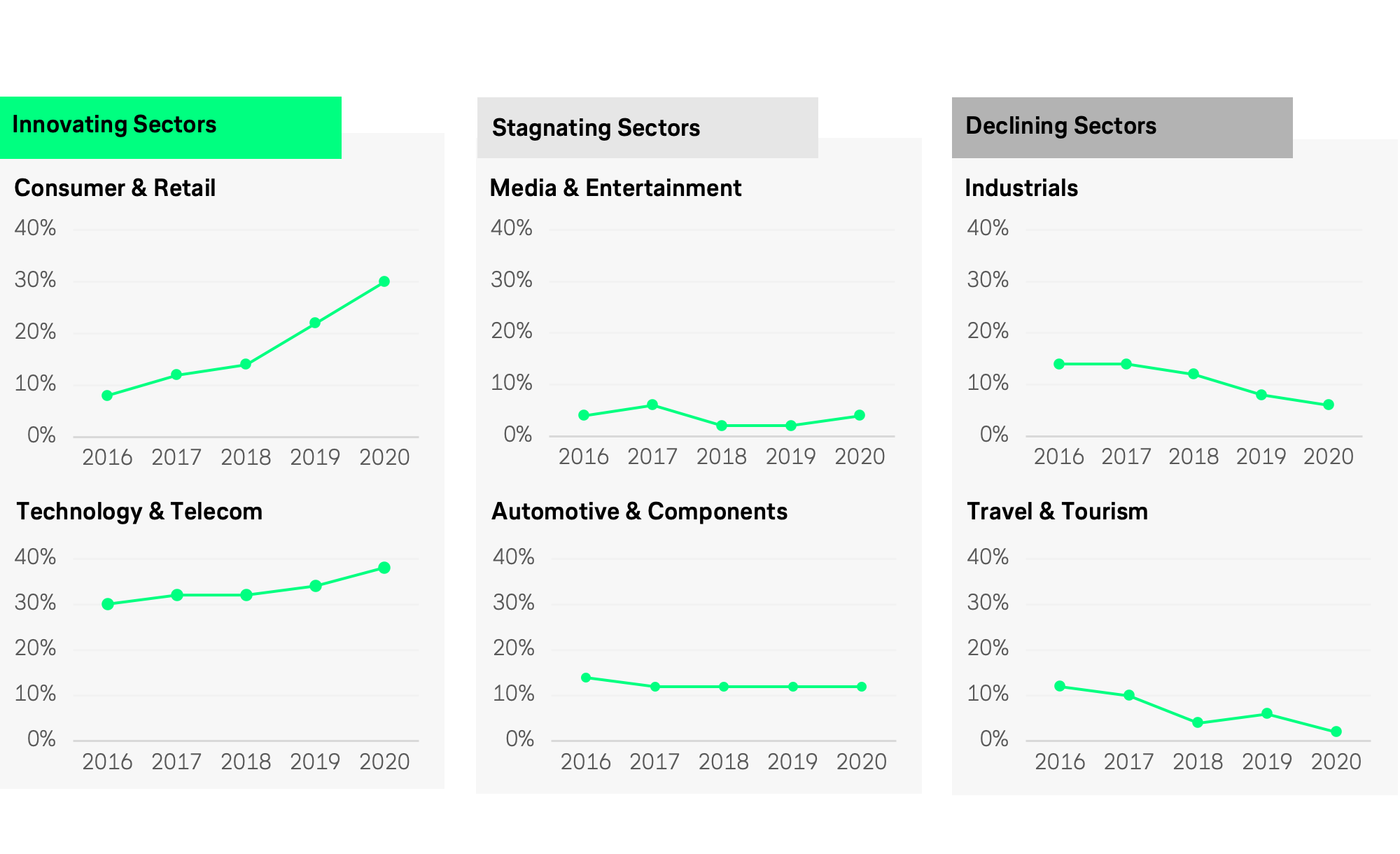

It’s undeniable that tech companies have done remarkably well during the pandemic, and that many have used the momentum of the crisis to grow exponentially. The growing virtual work startup ecosystem in particular leveraged the abrupt shift to working from home (or another remote location) with long-term implications we have yet to fully understand.

Corporate travel was one of the segments that experienced most of the impact from this virtual work substitution—a substitution that ate up a chunk of traditional corporate travel’s business, and that has yet to return to normal (and is unlikely to do so in the near future).

However, with the world slowly reopening, and companies and people returning to some of their old habits, from making travel plans to going to the office, the outlook across the virtual services board is changing. As financial analysts like to remind us, companies are worth the present value of their future cash flows, so when the latter part of that equation changes, the former does as well.

- Hopin, the virtual events platform often lauded for its rapid-scale growth during the pandemic, has cut 138 full-time employees, or 12% of its staff, as well as some contractors, according to multiple sources.

- Peloton, the home-exercise star of the lockdown era, has perhaps been the harshest signal of this easy-come, easy-go trend, cutting 2,800 jobs (including 40%+ of its marketing and sales staff), and removing its CEO John Foley from the helm of the company. The move comes after the fitness hardware company had to halt production of treadmill and bike products, due to slowing demand from consumers as gyms reopened worldwide.

2022 now looks like a judgment year, a year of determining whether these virtual-tech companies have gotten ahead of themselves, or whether they will find a sustainable product-market fit in an environment that is worlds away from the one we experienced during lockdowns and travel bans.

The travel vs. virtual competition

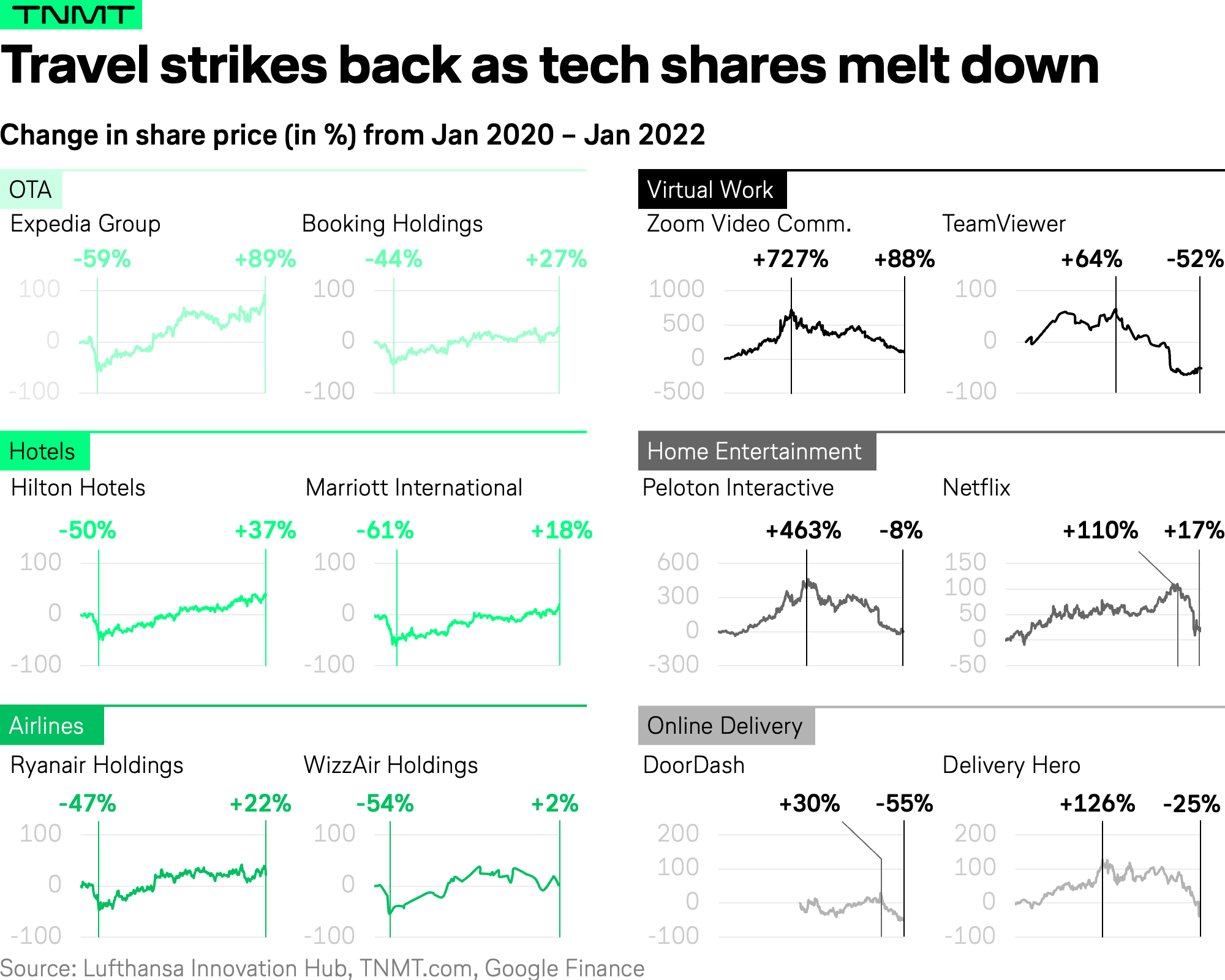

Let’s get back to our original question of how these virtual services compete with real-world travel activity. A look at current global stock markets shows that travel companies have been on the upswing for a while now. In contrast, most virtual services across the work, home entertainment, and food delivery sectors are experiencing plummeting share prices.

Over the last few weeks especially, many tech stocks have been experiencing a massive meltdown as investors adjust valuations to account for a period of rising interest rates. With inflation at a level that is starting to make policymakers uneasy, it seems the past decade’s expansionary monetary policy is quickly coming to an end. With Nasdaq down about >10% this year, and with many growth stocks having fallen 30-50% or more, value (travel) stocks look increasingly attractive.

The tech selloff has been so violent, in fact, that many COVID winners (Peloton, DocuSign, Zoom, PayPal, etc.) have lost all of their pandemic gains and now trade cheaper than they did at the beginning of 2020.

Check out this chart for a more thorough comparison.

Travel companies, on the other hand, are increasingly catching bids, with share prices on an upward trend across the board.

Leading booking platforms like Expedia, as well as accommodation providers like Hilton Hotels, have even surpassed their pre-pandemic share price levels by +65% and +30%, respectively.

The airline industry, on average, shows the slowest recovery among travel providers, especially for premium carriers who had a strong corporate travel focus pre-pandemic (which has since crumbled away). Low-cost carriers like Ryanair and Wizzair, conversely, recovered tremendously well, as they arguably benefit from their leisure focus—with travelers eagerly planning and booking their summer vacations once again.

Consumers are still eager to travel

Obviously, the return of travel stocks is good news for the travel industry. The share price recovery reflects the omnipresent consumer appetite to travel the world.

It confirms what we have stated many times before—that traveling and exploring are underlying human desires, and with the COVID-19 pandemic becoming endemic, this will persist.

Even at the height of the pandemic, we could tell that demand for travel was never held back by an indifference to see the world, but rather, by travel bans and quarantine restrictions that discouraged people from traveling.

As soon as countries lifted their restrictions, travelers rushed back to booking flights and accommodations.

- Lufthansa reported a 40% spike in flight bookings from Germany to the United States right after the latter lifted travel bans in October 2021.

- According to Travelport data, U.S.-bound flight bookings from the UK for Thanksgiving last year spiked 2,200% in the 24 hours following President Biden’s announcement.

Profitable travel companies are well-positioned

But it’s not only renewed travel demand that makes us confident that the travel industry will emerge from the crisis. Despite major disruptions, many travel companies used their downtime for restructurings and cost optimizations, which have made them leaner and more efficient.

While many tech companies are now eagerly trying to streamline their cost basis—Peloton just hired McKinsey to help them do exactly that—travel companies have already been through this painful period.

With the current state of the economy—with spiking inflation rates and soon-to-be-rising interest rates—investor appetite has quickly shifted from unprofitable tech to more value-style enterprises that generate free cash flows today, rather than the prospect of the same thing in the far future. While the rotation in some cases appears a bit overdone, we presume it may go on for a bit longer.

For all these reasons, we believe travel companies have a pretty decent chance of outperforming tech companies in the short to medium term, as consumers crave real-life, outside experiences and look forward to reconnecting with their loved ones.

Nonetheless, we wouldn’t sign off on the statement that travel companies will outperform tech companies in the long-term future just yet.

The virtualization of the travel industry

Although many of us can’t wait to make up for the past two years with revenge travel and other “real-world” activities that will boost travel and leisure stocks, our lives and interactions have inevitably become more digital due to increasing mobile proliferation, widespread broadband connectivity, and virtual worlds—aka metaverses—permeating our everyday life.

Additionally, keeping in mind that the planet is moving toward a climate disaster, virtual reality might potentially offer an escape from polluted beaches and melted ski slopes, and instead become a substantial threat to the physical travel industry.

Therefore, even in the mid-term future, travel companies need to become more tech-savvy and find ways to innovate toward a hybrid future that will increasingly blend our physical and virtual worlds.

This article and the information presented are intended for informational purposes only. The views expressed herein do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service.