In our ongoing voyage through the dynamic realms of the travel sector, we warmly welcome you back to another chapter of “The Great Inversion.”

This is not merely a standard narrative featured on TNMT but, fundamentally, our pivotal industry thesis demystifying the future arc of the Travel and Mobility Tech ecosystem.

The Great Inversion manifesto, poised to navigate travel and mobility professionals through the next decade of our dynamic industry, is a finely-tuned synthesis of intuition, analysis, and foresight, all deeply rooted in research and comprehension.

In its essence, The Great Inversion articulates a key evolution within the travel and mobility arena.

Here is the executive summary as a quick reminder:

- Presently, the industry’s value chain pulsates predominantly to the rhythm of asset-centric logic, where the nucleus of value creation depends on the supply of tangible assets—be it airplane seats, cabin beds, or entire fleets.

- Observing through the lens of the value chain, we witness that value creation fundamentally flows from left (supply) to right (demand), birthing a market where assets are essentially pushed towards consumers.

However, winds of change are upon us.

The Great Inversion describes a metamorphosis towards a consumer-driven value chain logic, a shift potent enough to unlock new growth within the travel and mobility industry.

In previous articles, we’ve already explored the landscapes of the initial three trends encapsulating The Great Inversion:

- Communities Define Demand: The sculpting of demand is increasingly influenced by niche communities, steering decisions distinctively and necessitating innovative offerings and information.

- Advanced Means: The growing spectrum of travel use cases is recalibrating the industry’s conventional notion of demand, with several use cases veering towards virtualization or an absolute re-conceptualization (aka Trip3) in the coming decade.

- Embedded Travel: The omnipresence of technology has facilitated and merged travel inspiration and booking at any moment, sprouting fresh opportunities for all.

Today, we pivot our lens towards Trend #4, coined “From Transactional to Relational.”

Fundamentally, it revolves around the transformation of business models, altering the paradigms of interaction between travel providers and customers.

Allow us to delve deeper into this transformative shift in the sections to follow.

Rethinking Loyalty: The Shift From Transactional to Relational

At the heart of the transition “From Transactional to Relational” is a pivotal reevaluation of how loyalty is constructed and fostered within the travel sector.

Traditional models of nurturing loyalty, a prominent example of which is frequent flyer airline programs, have revealed their limitations and are seemingly losing their effectiveness.

Three compelling data points underscore this claim:

- A survey by Airport Dimensions in 2023 demonstrated a decline in participation in airline frequent flyer programs, with only 52% of travelers participating, a decrease from 66% in 2019.

- McKinsey provided another illuminating insight revealing that, in 2018, nearly 30 trillion frequent-flyer miles were languishing unspent in customer accounts.

- Furthermore, the percentage of flights redeemed from miles among US legacy carriers dipped from 9% to 7% over the past decade.

This latter point, in particular, brings a critical flaw to light—loyalty programs, fundamentally designed to incentivize customers to consistently opt for the same provider, aren’t yielding the desired outcomes.

In other words, many consumers are showing a growing indifference towards rewards programs.

This has critical implications.

An accumulating reservoir of unused miles not only poses a financial liability for companies but also pressures them to elevate the thresholds that customers must surmount to reap significant benefits from their loyalty programs.

Cases in point:

- In 2022, Delta Airlines upped both requirements and prices for customers using its Sky Club airport lounges.

- American Airlines also increased the loyalty points required to access its lowest elite tier from 30,000 to 40,000.

The intrinsic issue here is that traditional loyalty programs are inherently transactional.

Why is this the case?

Three fundamental problems are at the root of this.

Limited Touchpoints

The critical issue here is that traditional loyalty programs are inherently transactional.

Customers accumulate points primarily through the purchase of air tickets, representing merely a few touchpoints amidst a myriad across the entire traveler journey.

These interactions, invariably tied to transactions, inadvertently forge a relationship that feels predominantly transactional from an emotional standpoint.

The scarcity of touchpoints also cascades into further complications, guiding us to the second reason.

No Personalization

Given very few touchpoints, an airline can only infer limited insights about a traveler’s preferences and attitudes from the infrequent interactions during point redemption.

As a result, classic loyalty programs cannot offer genuine personalization.

Lack of Flexibility

Further complicating the loyalty landscape, conventional loyalty systems display a pronounced rigidity—both in the manner in which customers can deploy accumulated points and what these points can be exchanged for.

To underscore this point:

- PwC’s 2023 Customer Loyalty Executive Survey highlighted that both airline passengers and hotel guests predominantly value flexibility in rewards.

- Moreover, our own Buy Now, Pay Later (BNPL) analysis uncovered that travelers appreciate augmented flexibility in payment options as well.

In essence, the modern traveler seeks enhanced flexibility and desires personalized rewards that diverge from the standard offerings typically found in mileage programs.

For this to materialize, loyalty providers must delve deeper into understanding customer preferences and desires.

Addressing these multifaceted challenges, which pave the way towards next-gen loyalty programs and genuinely relational business relationships with travelers, necessitates travel brands to venture beyond conventional loyalty programs.

How can this best be done?

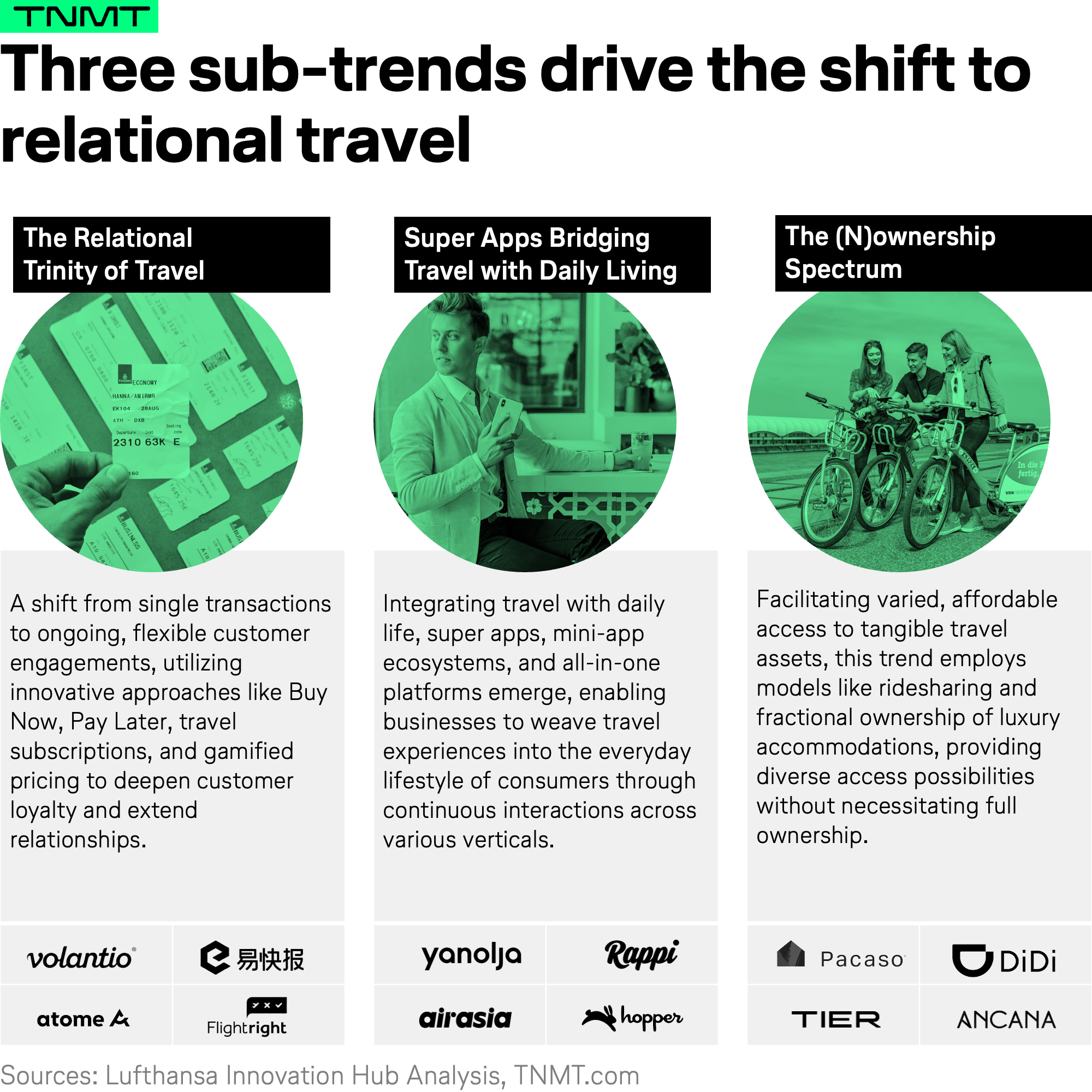

As we delve deeper into this trend, we’ll explore three crucial sub-trends, each symbolizing novel approaches towards cultivating a more enduring traveler relationship.

Unveiling the Relational Trinity of Travel

Navigating through the dense digital landscape of today’s travel sector is a task that demands keen precision and strategic foresight from mobility and travel providers.

The stakes are twofold:

Firstly, the competition is fiercer than ever, owing to travelers’ engagement with a plethora of digital services along the traveler journey, amplifying the challenge for brands to cut through the clutter and seize attention through repetitive touchpoints.

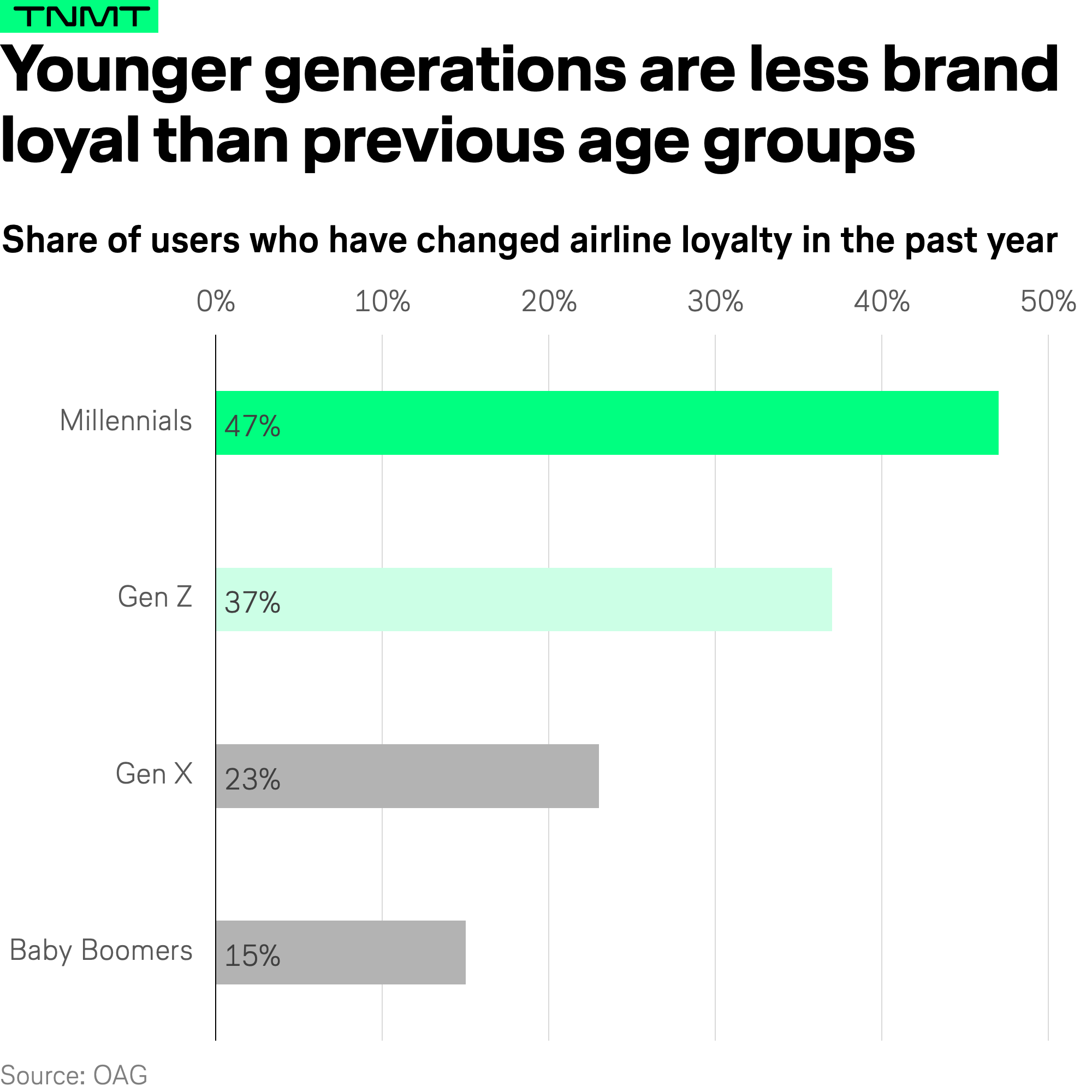

Secondly, younger generations, notably millennials, who are set to constitute the majority of future travelers, present a distinct challenge given their innate reluctance toward brand commitments. As clearly exemplified by an April 2023 OAG survey, a staggering 47% of millennials shifted their airline loyalty this year, starkly contrasting with the mere 23% of Gen X.

Breaking through the traditional one-off transactions is essential to building a loyal customer base, especially when aiming to captivate the less brand-loyal younger generations.

We see the solution in more relational offerings, and thankfully, there’s a growing wave of tech companies doing just that.

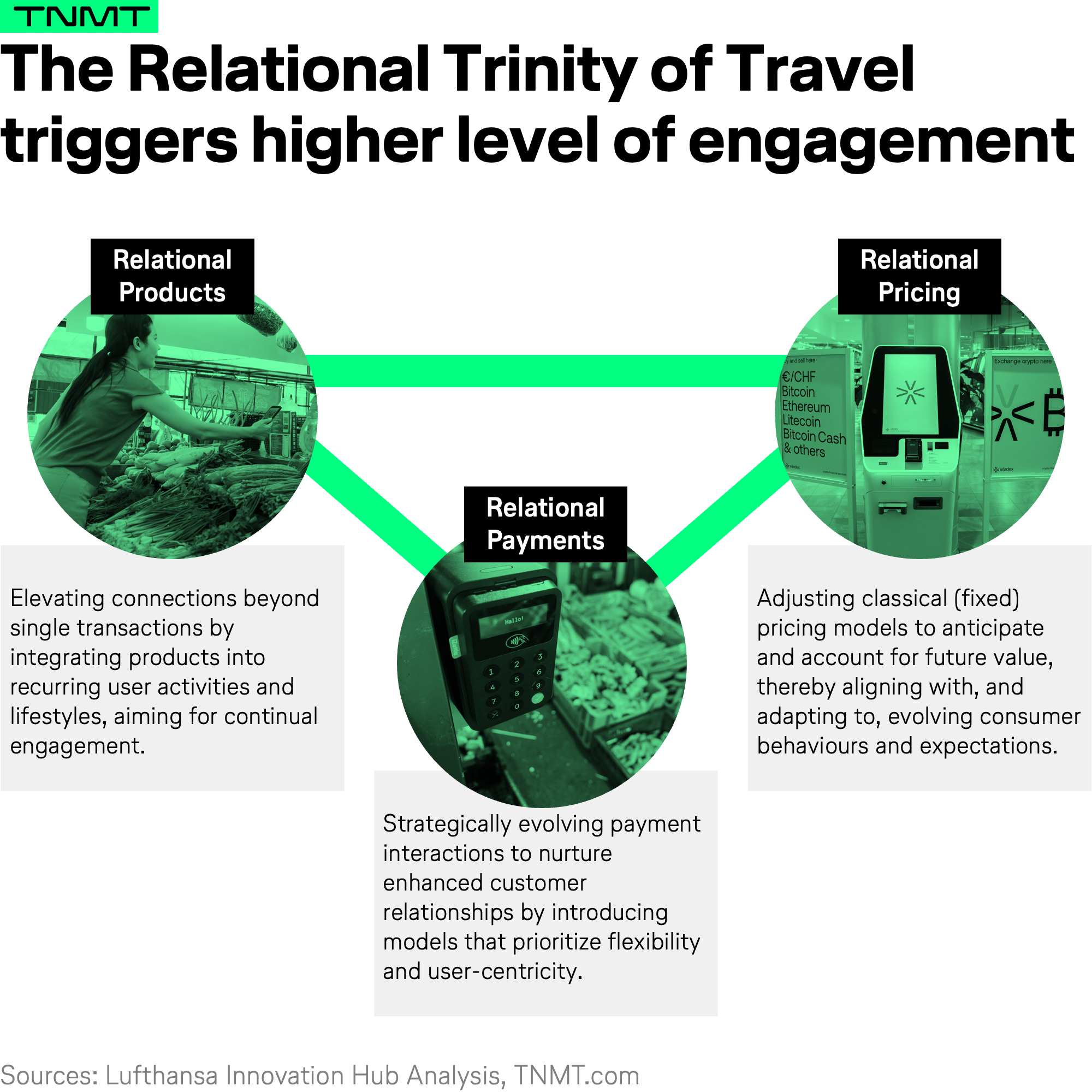

Our market analysis identifies a three-pronged approach, which we’re calling the “Relational Trinity of Travel.”

It hinges on three aspects: payment, pricing, and products, each one aimed at creating and maintaining long-term relationships with travelers by meeting their preferences and needs in a personalized and flexible way.

Let’s briefly break down each part to understand how they work together to build lasting loyalty in the travel sector.

Relational Products: More Than Just a Ticket

Relational products refer to travel offerings that extend beyond conventional single-ticket sales, aiming to foster a continual relationship with the traveler. These offerings often come in the form of flight passes or travel subscriptions that provide enhanced value and flexibility.

Let’s consider a few real-world examples:

- Alaska Airlines, among many airlines, recently embraced the subscription model by launching flight passes in 2022. For a monthly fee of $49 USD, subscribers can access certain flight benefits, with options to upgrade their subscription based on their travel frequency.

- Fontrip, a Taiwanese firm specializing in destination resource management, introduces integrated multi-day city passes. These passes cater to travelers exploring any of its 16 destinations, offering potential savings of up to 60% on their journey-related expenses.

- KabuK Style, originating from Japan, blends travel with fintech through its subscription platform. Users can accumulate HafH coins, which can be redeemed for hotels and experiences and, uniquely, can also be traded on cryptocurrency exchanges.

In each instance, the aim is to transcend the isolated transaction of a one-time purchase, nurturing an ongoing relationship between the provider and the traveler.

Relational Payments: Enhancing Touchpoints and Flexibility

Relational payments aim to extend consumer touchpoints and enhance customer relationships by providing alternative and flexible payment methods. Because of that, they should be on every travel provider’s agenda, as we have argued before.

These methods, which include Buy Now, Pay Later (BNPL) services, Save Now, Buy Later (SNBL) services, and various reimbursement options, not only foster greater flexibility for travelers but also act as a mechanism to build repeat engagement and loyalty.

BNPL services have proven particularly effective in encouraging repeat purchases and minimizing travel cart abandonment.

Here’s a closer look at two companies that have spearheaded this movement:

- Fly Now Pay Later, a UK-based BNPL firm, offers travelers the opportunity to spread the cost of their trips into manageable monthly installments, with variable interest rates. The company, having raised $178 million USD in Venture Capital to date, collaborates with notable airlines such as Malaysia Airlines, EasyJet, and Aer Lingus.

- Uplift, a US-based counterpart, provides no-fee and interest-free payment plans, enabling users to distribute their purchase costs over a period of three to 24 monthly installments. Uplift has forged partnerships with several airlines, including Emirates, Alaska Airlines, and Breeze Airways.

Relational Pricing: Tailoring Costs for Better Experiences

Relational pricing moves away from traditional static pricing, exploring innovative and dynamic pricing strategies that consider future potential lifetime value. As well, it integrates gamified pricing techniques like bidding and reverse pricing.

This approach not only triggers engagement but also aligns pricing models with the spontaneous preferences and behaviors of travelers.

Let’s delve into some exemplary models in the travel industry that have embraced relational pricing:

- Bidroom, based in the UK, pioneers a unique model by positioning itself as the “world’s first no-commission hotel booking platform.” The platform invites hotels to bid for guests’ stays, where guests specify their stay details and hotels have 24 hours to counter with an enticing offer. This model essentially creates a competitive marketplace where hotels vie for the attention and business of the traveler.

- Seatboost, a US company, introduces an element of excitement and last-minute surprise through its live, last-minute auctions. Travelers can engage in these auctions, available on their mobile phones, 24 hours before their flight, offering a blend of thrill and potential value. Moreover, with Seatboost’s app integration with flight departure control systems, victorious bidders are automatically issued new boarding passes, enhancing the user experience through seamless technological integration.

- Plusgrade, headquartered in Canada and renowned as a global market leader in ancillary revenue solutions, offers a suite of add-ons tailored to varying traveler needs. Importantly, these are priced according to passengers’ willingness to pay, ensuring alignment with customer value perceptions and enhancing satisfaction.

These models, underpinned by a relational philosophy, weave pricing into the broader tapestry of the customer experience, converting mere transactions into engaging, interactive experiences that also entertain travelers and entice repeated interactions.

Thus, relational pricing serves not merely as a transactional tool but as an experiential strategy, fostering a deeper, more continuous relationship between brands and their customers.

Caveats in the Relational Trinity

When embracing the Relational Trinity in the travel sector, it’s crucial to note that while the potential for deepening customer relationships is vast, there are some aspects and caveats that need to be navigated wisely:

History Echoes

While relational products and services, such as flight passes and subscriptions, present themselves as innovative solutions, it’s vital to remember that they aren’t entirely new.

- For instance, American Airlines introduced the AAirpass in 1981, which, for a hefty one-time fee, allowed unlimited travel.

- Cashback programs, gift cards, and promotional codes have also been staples since the 1970s and 1980s, respectively.

The contemporary shift lies in the digital-first approach, enabling businesses to more easily integrate various relational products and adapt them to evolving traveler needs, especially catering to millennials and Gen Z’s digital habits.

Navigating Challenges

While the Relational Trinity brings forward fresh avenues for customer engagement, it’s not without its hurdles. Particularly, BNPL providers may grapple with regulatory changes and rising interest rates.

Moreover, as sustainability claims a pivotal role in consumer choice and regulatory agendas, airline subscription services might face scrutiny for potentially boosting carbon emissions by promoting (unnecessary) extra travel.

In summary, the Relational Trinity introduces an expansive suite of products and services that stretch customer touchpoints beyond singular transactions, laying down a fertile ground for inventive travel offerings.

But they must be executed with a keen eye on historical contexts and short-term challenges.

Super-Apps: Bridging Travel With Daily Living

Moving from one-time transactions to ongoing relationships in the travel world has spotlighted “Super Apps” as a key new direction. These apps weave travel into everyday consumer life, offering more than just journey-related services.

Rather than only focusing on gaining traveler loyalty during trips, some forward-thinking brands are stepping up, staying relevant by embedding their offerings into daily routines and the needs of consumers.

The Engine Behind the Super-App Movement

Originating with the Chinese mini-app ecosystem—often heralded as the inaugural true super app—the lion’s share of today’s super apps are Asia-based, whereas platforms providing individual services to varied user groups, such as Uber and Lyft, find their stronghold in Europe and the US.

The emergence of super apps and platform-centric strategies in Asia can be linked back to three key developments:

Firstly, in Asia, particularly where super apps reign supreme, the challenge of meeting the demands of a mobile-first population contending with unreliable network infrastructure propelled companies to centralize multiple services into a single platform. Plus, considerable market fragmentation, especially in fintech and e-commerce within sub-regions like Southeast Asia, sets a relatively low entry barrier, inviting super apps to weave into these domains.

Secondly, companies delivering high-frequency services, like ride-hailing and food delivery, deployed these utilization rates to offer users ancillary services, which are easily supported by their existing infrastructure. Take Grab, the Singapore-based super app, for instance: it evolved from a taxi app to incorporate food and package delivery and financial services into its product spectrum.

Thirdly, the turbulence of the COVID-19 pandemic nudged travel entities like Indonesian OTA Traveloka and Malaysia-based Low-Cost Carrier AirAsia, as we explored before, to veer away from their pure aviation focus towards exploring new revenue channels, such as food delivery and on-demand courier services.

In essence, these three developments have jointly fueled the momentum of super apps in the Asian travel and mobility landscape.

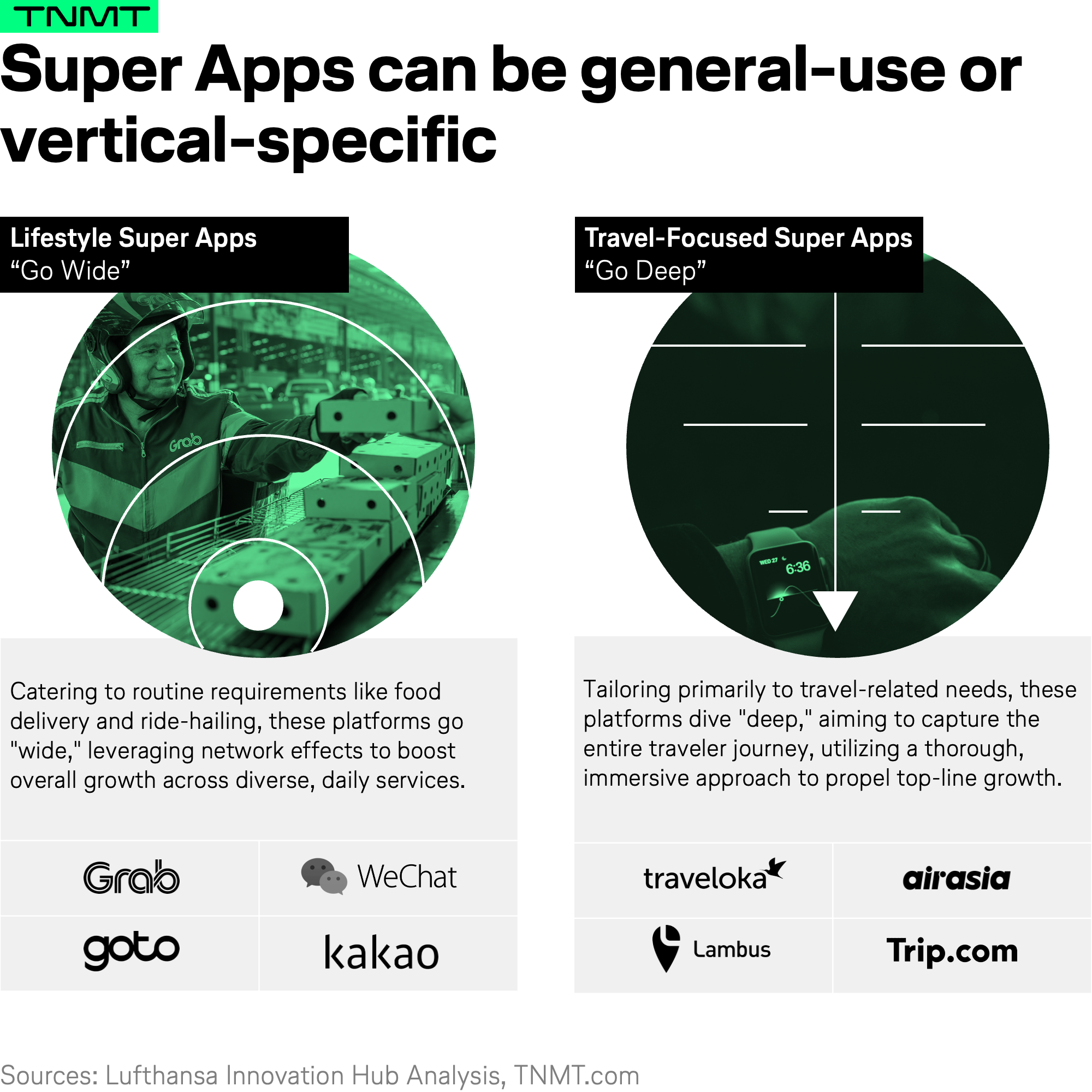

Diverse Super App Approaches

Further analyzing the technical realm of super apps unveils a spectrum of approaches, each tailored to the unique strategic intent of the platform.

- A quintessential example is China’s WeChat, operating as a “walled garden” that permits users to access an array of mini-programs, many of which aren’t developed in-house.

- In contrast, South Korean heavyweights like Yanolja and Kakao steer towards offering a holistic in-house suite of services, creating a tightly-knit ecosystem of functionalities.

Furthermore, we can navigate through these myriad approaches by categorizing super apps into two predominant types:

- Lifestyle-Leaning Super Apps: This model adopts a broad lifestyle orientation, where travel features are one of the add-on use cases, albeit not the core offering. Here, a generalist approach enables users to weave through various everyday services, with travel acting as an auxiliary feature, ensuring constant engagement across diverse facets of users’ daily lives.

- Travel-Centric Super Apps: In contrast, the other approach basks in a core travel-centric ethos, where lifestyle services are introduced as ancillary offerings. The primary aim revolves around anchoring the user’s travel experiences, with additional lifestyle services sprinkled in to augment the overall utility and appeal of the app.

Irrespective of the chosen strategic path, the crux lies in how super apps masterfully craft ecosystems that not only expand customer touchpoints but also captivate their attention across a multitude of services and experiences, binding them into a coherent, engaging, and perpetually relevant user journey.

Two examples in the Asian market spotlight intriguing and potentially inspiring pathways in blending travel and super-app functionalities: Yanolja and AirAsia, each wielding a unique approach to crafting an enriched user experience through their respective platforms.

- Yanolja: The acquisition of Interpark in 2021 bolstered Korean OTA Yanolja’s foray into outbound and foreign inbound tourism, broadening its operational panorama. The ripple effect of the acquisitions hasn’t just fortified its standing as a domestic travel powerhouse but propelled it into the global super-app arena, notably within the B2B hotel software industry. Yanolja has adeptly merged travel services with a cohesive, user-friendly platform, demonstrating how strategic expansions can weave a rich service portfolio that encompasses various facets of the travel journey.

- AirAsia: The evolution of AirAsia into Capital A heralded a cascade of multi-vertical offerings via its growing super app, adeptly merging travel with a spectrum of ancillary services. AirAsia Digital—comprising the brand’s super app, its cross-border logistics branch Teleport, and its digi-banking platform BigPay—played a pivotal role in diversifying the company’s revenue streams, contributing a robust 36% of AirAsia Group’s revenue in Q1 of 2021. This transformation underscores the potency of strategically curating a suite of services that extend beyond the primary offering, crafting a multifaceted platform that stays consistently relevant and engaging to its user base.

Unclear Commercial Viability of Super Apps

Despite the enthusiasm about super-app plays like those from Yanolja and Capital A, the jury is still out on the long-term viability of these super-app approaches, particularly those dabbling in the travel sector. These super apps navigate the complexities of profitability, customer retention, and market dynamics.

- Capital A’s journey through the super-app domain has seen its own set of challenges. The shuttering of AirAsia Food in January 2023, which operated across multiple Asian markets, illustrates the hurdles even well-established brands face when diversifying offerings. Despite optimistic forecasts placing its digital businesses on a path towards profitability by 2024, the lingering shadow of its Practice Note 17 Status, indicating financial distress, casts doubt on the smooth sailing towards this target.

- Another super app looking for commercial viability is Grab. While ambitious projections place Grab on a trajectory toward achieving positive adjusted EBITDA by the last quarter of 2023, the reality is that the company, despite its robust offerings and significant market presence, has yet to carve a path toward profitability on a net income basis. Thus, questions linger regarding the sustainability and long-term profitability of such expansive super-app platforms.

- Indonesian super app GoTo is another case in point, even with its diversified service offering spanning ride-hailing to e-commerce. The company has witnessed its stock valuation nosedive by 70% from April to December 2022, underscoring the inherent volatility and competitive challenges within the super-app space.

Furthermore, the replicability of super apps outside of the Asian context remains a contentious point.

Pioneering ventures, such as US-based DoorDash’s collaborative foray with Sephora, signal an inclination towards super-app-like diversifications in Western markets.

However, in regions where several dominant players preside, executing a super-app strategy with similar efficacy as seen in Asian markets may pose a formidable challenge.

The (N)ownership Spectrum: Bridging Travel Transactions

Amidst the shifting sands of consumer trends in the travel industry, the “(N)ownership Spectrum” emerges, underpinned by concepts of collaborative consumption, creating a transformative path from singular transactional interactions to robust, relational customer engagements.

This subtrend finds its roots in the melting of fluctuating asset utilization and a paradigm shift towards experience-driven consumerism, particularly evident among the millennial and Gen Z demographics.

Two key drivers propel this movement:

Underutilized Assets

Travel providers are struggling with occupancies. A quintessential example from the pre-pandemic era is seen in the US hotel industry. Here, occupancy rates averaged a mere 66% between 2018 and 2019. This underutilization of physical assets showcases a potential avenue where shared ownership models could optimize usage and enhance revenue streams.

The private aviation sector, too, has wrestled with inefficiencies; notably, 40% of private plane flights were empty return legs as of 2019, signaling a glaring opportunity for innovative, shared consumption models to better leverage these underutilized assets.

Shift Towards Experiential Consumption

The ongoing shift from product ownership to valuing experiences, especially among younger generations, is heralding a landscape where access trumps possession.

Post-pandemic, the urge to explore, experience, and engage without the burdens of ownership is fueling the popularity of platforms offering shared and fractional ownership across various travel-related assets.

In a world where experiences are progressively valued over possessions and where asset utilization is paramount to sustainable operations, the (N)ownership spectrum appears as a robust, innovative model that reconciles these dynamics.

The Spectrum of N(ownership)

The democratizing wave of the (N)ownership spectrum in travel has witnessed numerous innovators stepping into the limelight, illustrating distinct ownership models that are also permeating beyond transportation into various facets of the travel industry.

- Pacaso, for example, is pioneering fractional home ownership. It sells and manages properties on behalf of online co-owners, buoyed by a significant $1.5 billion USD in funding.

- Leavy.co is a French home-sharing enterprise that assures travelers of upfront cash when they list their apartments, independent of securing a booking.

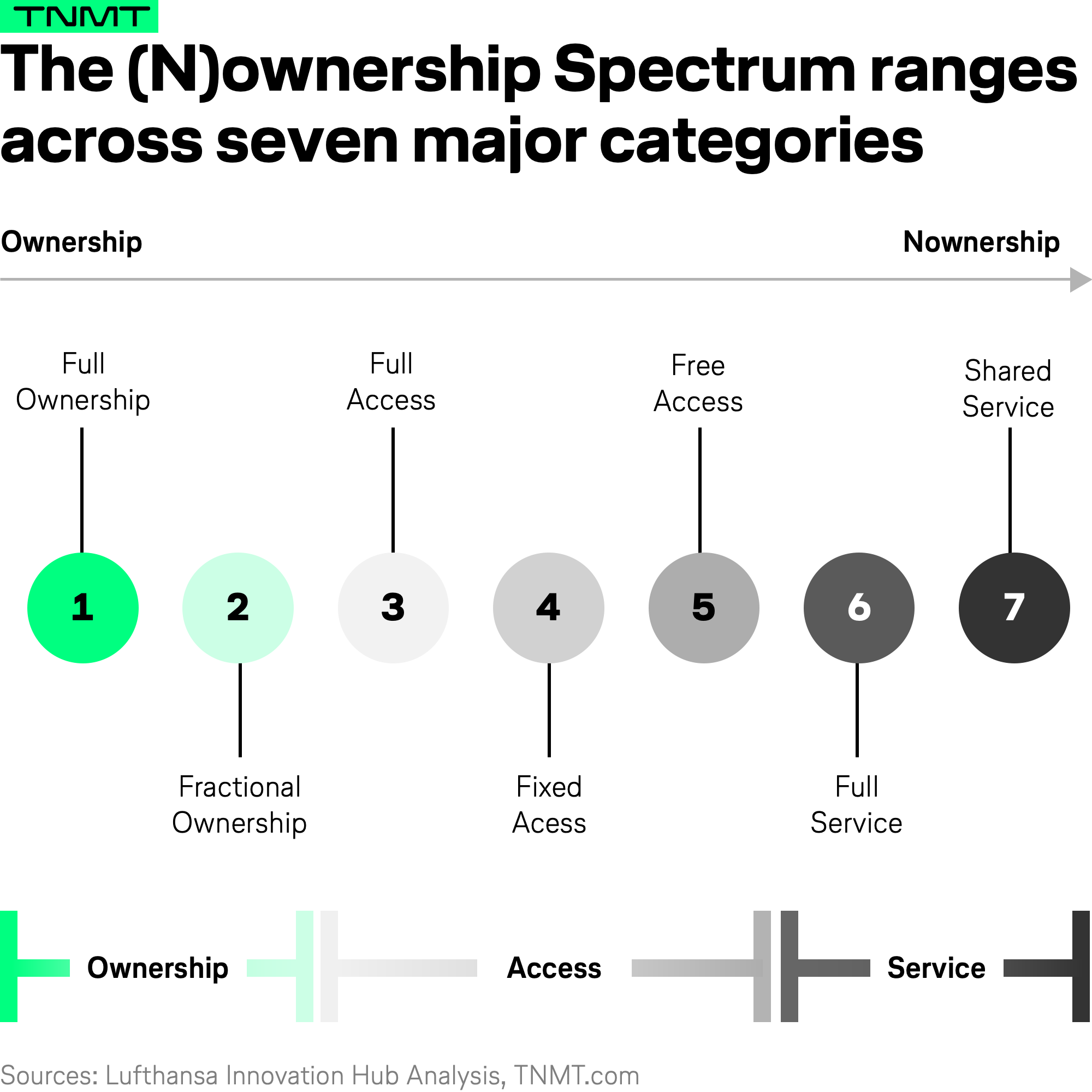

In general, we differentiate between seven levels of (N)ownership exposure.

In the realm of Full Ownership, customers immerse themselves in the complete acquisition of an asset, as seen with a classical car purchase, where they navigate through the ownership journey alone, shouldering all potential risks and rewards that come their way. This represents the traditional mode of possession, where the user has undivided control and responsibility over the asset.

With Fractional Ownership, exemplified by Flexjet, a fractional ownership aircraft leasing company, we observe a nuanced model where ownership and risk of high-value assets, such as private jets, are disseminated among several unrelated individuals. This dispersal curates a shared ownership experience, blending investment with communal access.

Full-access models, illustrated by the Norwegian auto subscription provider FINN, for example, offer users access to assets at a flat monthly rate, ensuring that customers enjoy a hassle-free usage experience. This modernized adaptation of ownership sees customers bask in the benefits of usage without being ensnared by the complexities of traditional ownership.

Fixed Access is a mode that strikes a balance, granting customers access to assets with certain usage limitations, often in exchange for a more favorable pricing model. Lime, which presents multiple transport modalities under a single app, exemplifies how fixed access can seamlessly integrate with everyday consumer life, often becoming an intrinsic part of their mobility routine.

The Free Access model, as utilized by platforms like Getaround and Turo, revolves around a user community that has free access to assets owned and managed by a single operator. Here, the asset utility is maximized by ensuring it is perpetually in use. This allows consumers to momentarily possess an asset without any strings attached.

Transitioning into Full Service models, consumers relish the utility of assets without the commitment of ownership. Platforms like Uber and Lyft have typified this model, allowing consumers to pay to revel in the service provided by the asset without entwining themselves in the obligations of possession.

Finally, Shared Service models, like any of the modern car-pooling platforms like Moia, facilitate a shared utility experience where multiple users leverage the asset simultaneously. This not only maximizes the asset’s utility but also fosters a collective consumption experience, harmonizing individual needs with a shared, eco-conscious ethos.

Each of these (N)ownership levels offers distinct yet interrelated strategies by which modern travel brands are evolving, seamlessly meshing the transactional and relational aspects to deliver a richer, more interconnected user experience across the traveler journey.

Despite varying levels of acceptance and recent backlash from regulators, as in the case of Pacaso, the innovative (N)ownership approaches within the travel industry demonstrate a resilient tendency to grow in relevance.

These novel models not only amplify customer access to premium assets, such as high-end accommodations, convenient vehicle rentals, and opulent private jets, but they also forge a pathway for businesses to optimize the utilization of these assets to their fullest potential.

Reimagining Travel Through Relational Models

In wrapping up the discussion on today’s trend #4 of The Great Inversion, it is pivotal to recognize that, as the axis of travel tilts from being predominantly transactional to inherently relational, the landscape of relational travel is still in its infancy.

This ongoing transformation will undoubtedly reimagine loyalty concepts, crafting products that captivate attention across various customer touchpoints and intertwine seamlessly with everyday activities, even those seemingly disparate from the conventional travel trajectory.

As a result, the concept of ownership is on the brink of evolution, expanding its reach to a broader user base and ensuring that brands, through a fine-tuned understanding and capitalization on the pivot from tangible products to unparalleled experiences, can distill maximal value from their assets.

As we transition into exploring the final trend of “The Great Inversion,” our ensuing discussions will delve even deeper, further exploring the rich tapestry of assets that travel brands, with a discerning eye towards the future, can harness and deploy in the present moment.