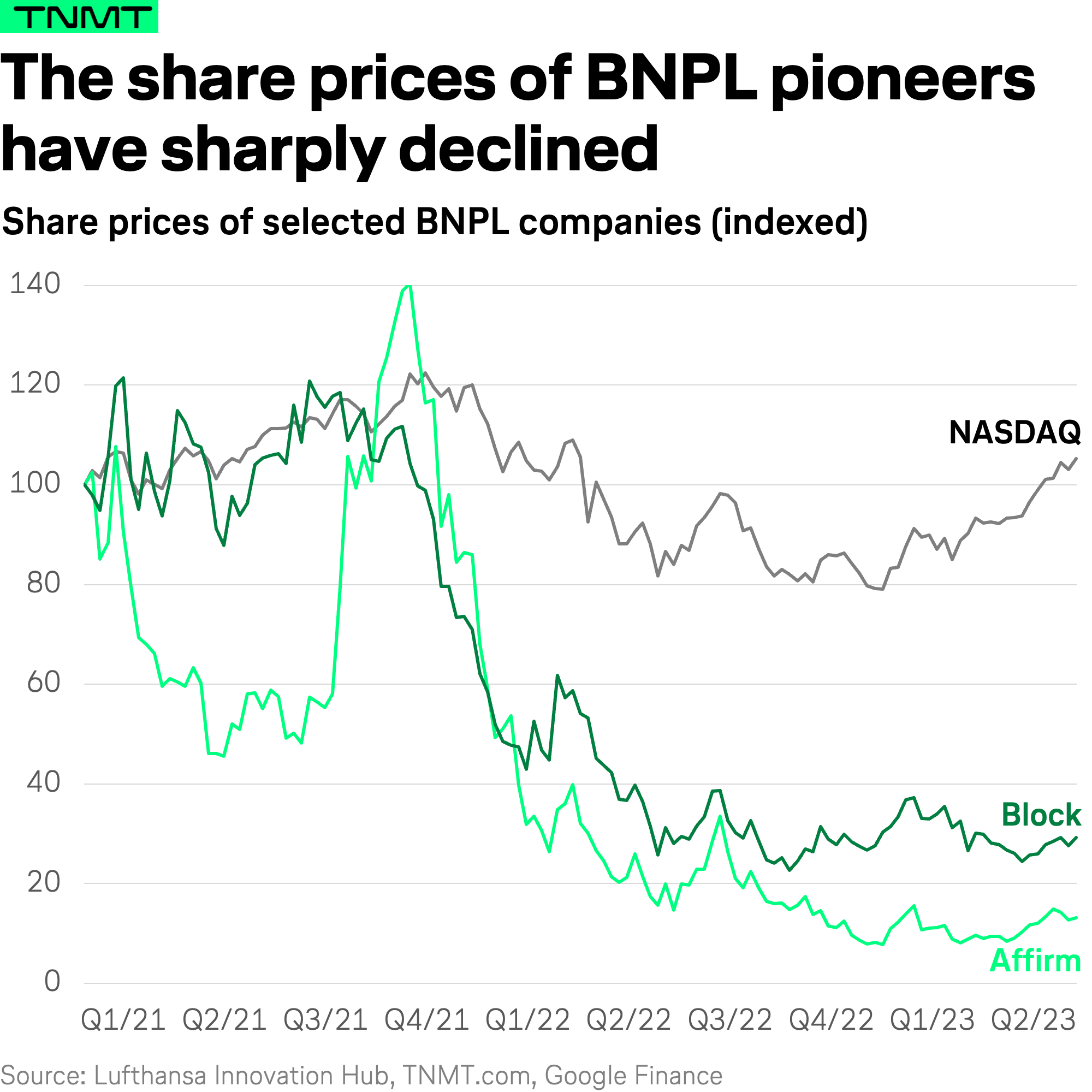

The last two years have proved to be tumultuous for “Buy Now, Pay Later” (BNPL) firms.

Plummeting company valuations, mounting losses, and an increasingly competitive landscape saw the industry’s pioneering firms feeling the squeeze.

Simultaneously, BNPL firms found themselves under the microscope as they grappled with backlash related to consumer debt. By promoting the use of loans for consumer products, these firms have played a significant role in fueling this backlash, leading to a period of intense scrutiny and criticism.

Given this backdrop of uncertainty and tumult, it may be tempting for those in the travel industry to dismiss the relevance and potential of BNPL.

However, a closer look reveals that despite these challenges, BNPL should not yet be written off.

The unique advantages and travel-specific consumer trends associated with this payment model could yet herald a new era of consumer engagement in the travel sector.

A potential niche: BNPL’s sustainable future in travel

According to our analysis, it appears that the travel industry presents a more stable and potentially fruitful landscape for the BNPL business model than other retail categories.

The robust performance of travel-focused BNPL providers, such as Uplift and Fly Now Pay Later, is a testament to this trend.

- Amid the financial upheaval of the past year, Uplift forged significant partnerships with industry heavyweights like Amadeus and Emirates.

- Meanwhile, Fly Now Pay Later secured a fresh infusion of $75 million USD in funding.

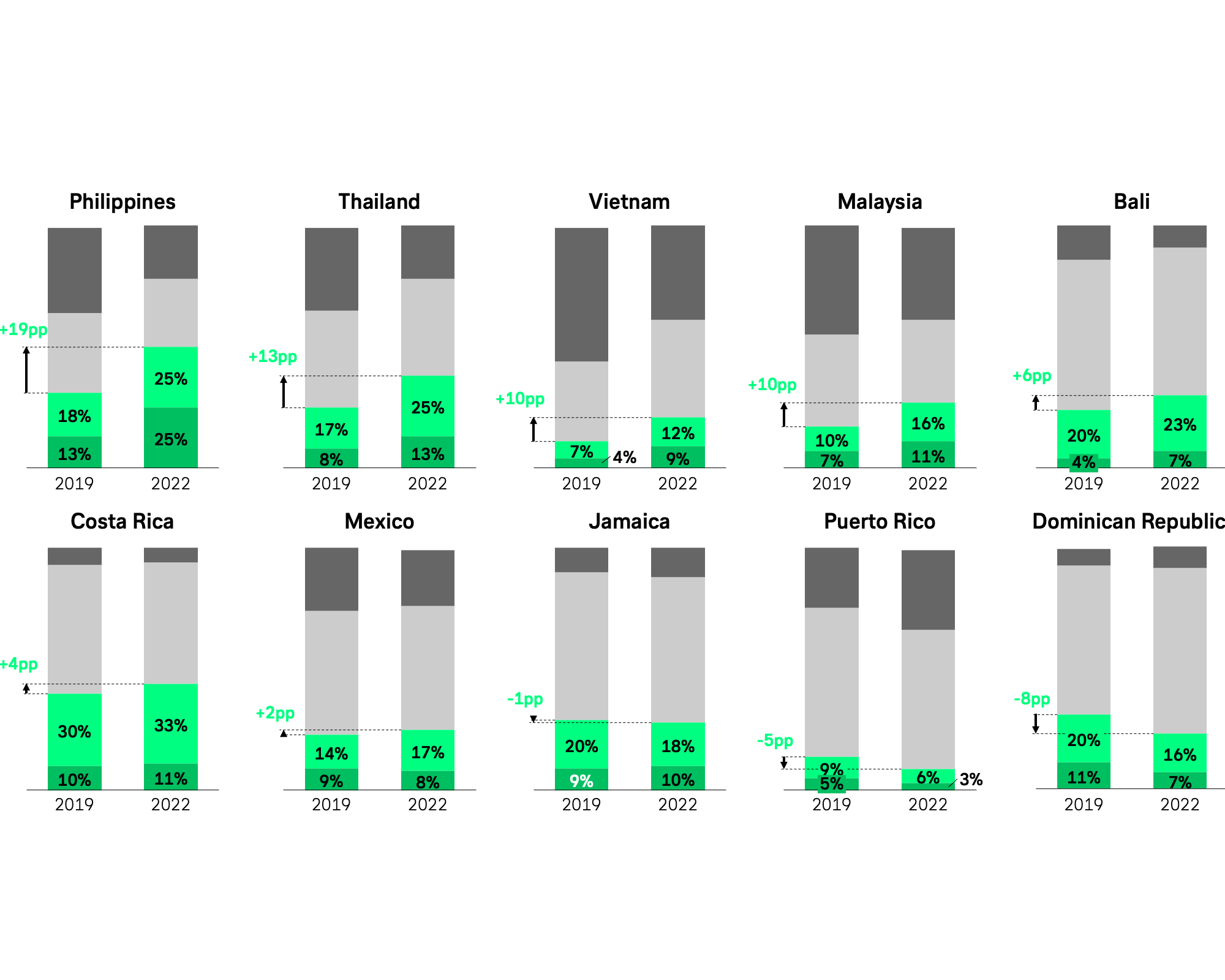

BNPL’s strong travel foothold isn’t confined to Western markets.

It continues to thrive in Southeast Asia (SEA), with regional powerhouses like Singapore’s Atome and Indonesia’s Kredivo not only offering point-of-sale loans but expanding their services to include long-term consumer loans and digital banking.

These companies’ strategies—which have included charging interest on loans and late fees since inception—could provide valuable insights for BNPL providers in other regions grappling with rising loan default rates.

- In fact, according to a key decision maker at Atome who shared insights with us during an interview, the company’s default rate in its home market of Singapore is less than 1%.

- Meanwhile, Kredivo has successfully managed to bring down its consumer default rates from 7.02% in June 2022 to an estimated 5% by the end of the year.

Exploring the global BNPL landscape and its intersection with the travel industry, five compelling arguments underscore the value of this model for travel providers, such as airlines, as well as for travelers themselves.

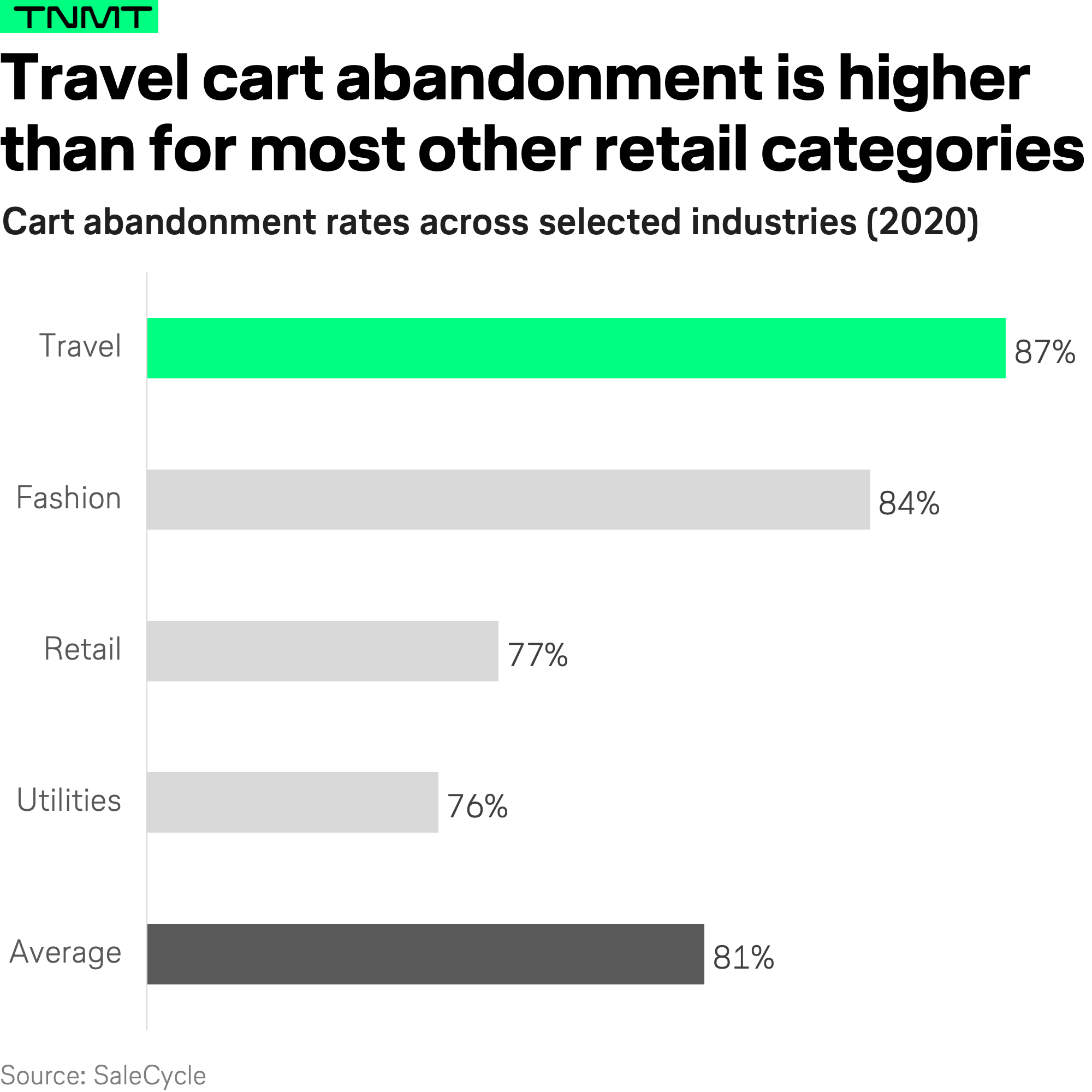

#1: Reducing cart abandonment and boosting high-value purchases

The issue of cart abandonment is a prominent one in the travel industry, with overall abandonment rates soaring above 80%. These figures are considerably higher than most other online retail categories.

One major reason behind this trend is the price disparity between initial and final costs. This is especially the case for travel products like accommodation. More than a quarter of customers abandon their carts due to unexpected additional charges, such as interchange and cleaning fees, which are only revealed at checkout.

While BNPL does not directly address this disparity, it significantly mitigates the impact of additional charges by making high-value purchases more appealing to customers.

By dividing large ticket prices into more manageable payments over time, the final cost becomes more digestible for the average customer. The presence of a BNPL option can also encourage travelers to consider ancillary purchases, given that the upfront cost is merely a fraction of the additional expense.

Items like seat upgrades, extra luggage space, and embedded travel insurance have a minor to negligible effect on monthly payments when spread across multiple installments.

Evidence from BNPL platform Atome underscores this trend.

- Insights gleaned from a conversation with one of Atome’s spokespeople revealed that the company boasts a higher average basket size for travel purchases.

- They further shared that customers who’ve made travel purchases using Atome are more likely to make repeat purchases at even higher ticket values.

Atome’s data paints a clear picture: the availability of a BNPL payment option can nudge customers to look beyond the lowest-priced tickets.

In fact, it can help them consider options that include additional services, suggesting significant potential for boosting revenue in the travel industry.

#2: A buffer against the impact of rising airfares

As the world recovers from the impact of the COVID-19 pandemic, the travel industry faces a stronger-than-expected demand. Coupled with manpower and aircraft shortages, flight prices have been on an upward trajectory in recent months.

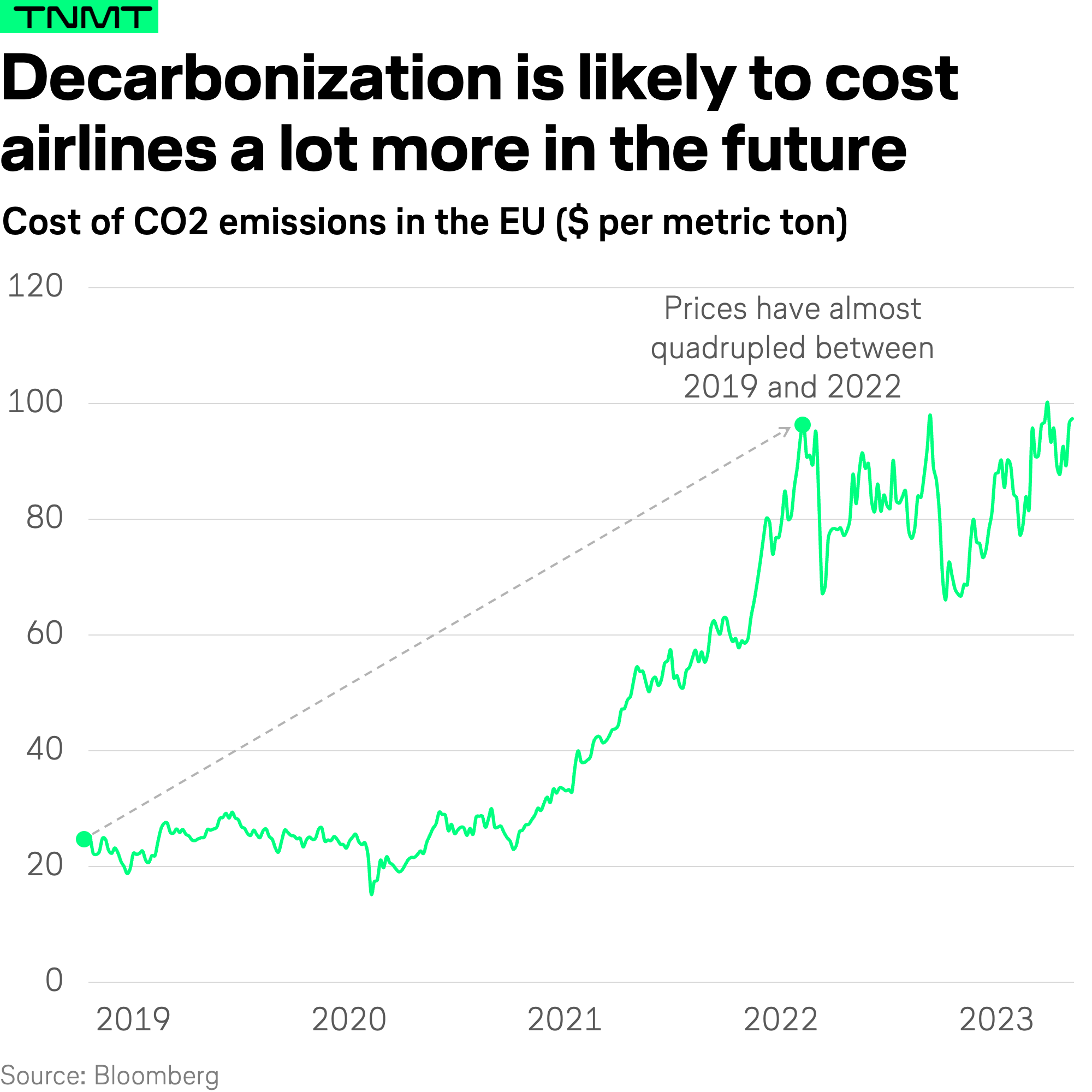

But this price surge isn’t just a fleeting concern; several factors suggest it’s here to stay.

Short-term pressures, such as staffing deficits and an inflationary environment, contribute to the situation. Yet, the combined backlog of industry giants Boeing and Airbus indicates that fulfilling all existing aircraft orders will take at least a decade. In this scenario, demand is poised to outperform supply, exerting further upward pressure on prices.

Long-term considerations add to these concerns. As the industry grapples with decarbonization costs, airfares are expected to continue to rise. The International Council on Clean Transportation warns that airfares could soar by nearly 22% by 2050, presenting another significant hurdle for travelers.

In the face of these ongoing and forthcoming increases in airfare, BNPL emerges as a means to maintain the accessibility of travel products and services for the average traveler.

While BNPL is merely a mechanism to spread costs over longer periods and does not reduce the total cost of air travel, it does make these higher costs more manageable, allowing the dream of travel to remain within reach for many.

#3: Addressing the spending power of future travel giants

The relevance of BNPL in the travel industry becomes particularly pronounced when we consider demographic trends.

- The average age of a Klarna user in 2022 was 33, a testament to the payment model’s popularity among younger consumers.

- Similar trends are observable across other BNPL providers—over 70% of Atome’s customers in 2022 were millennials.

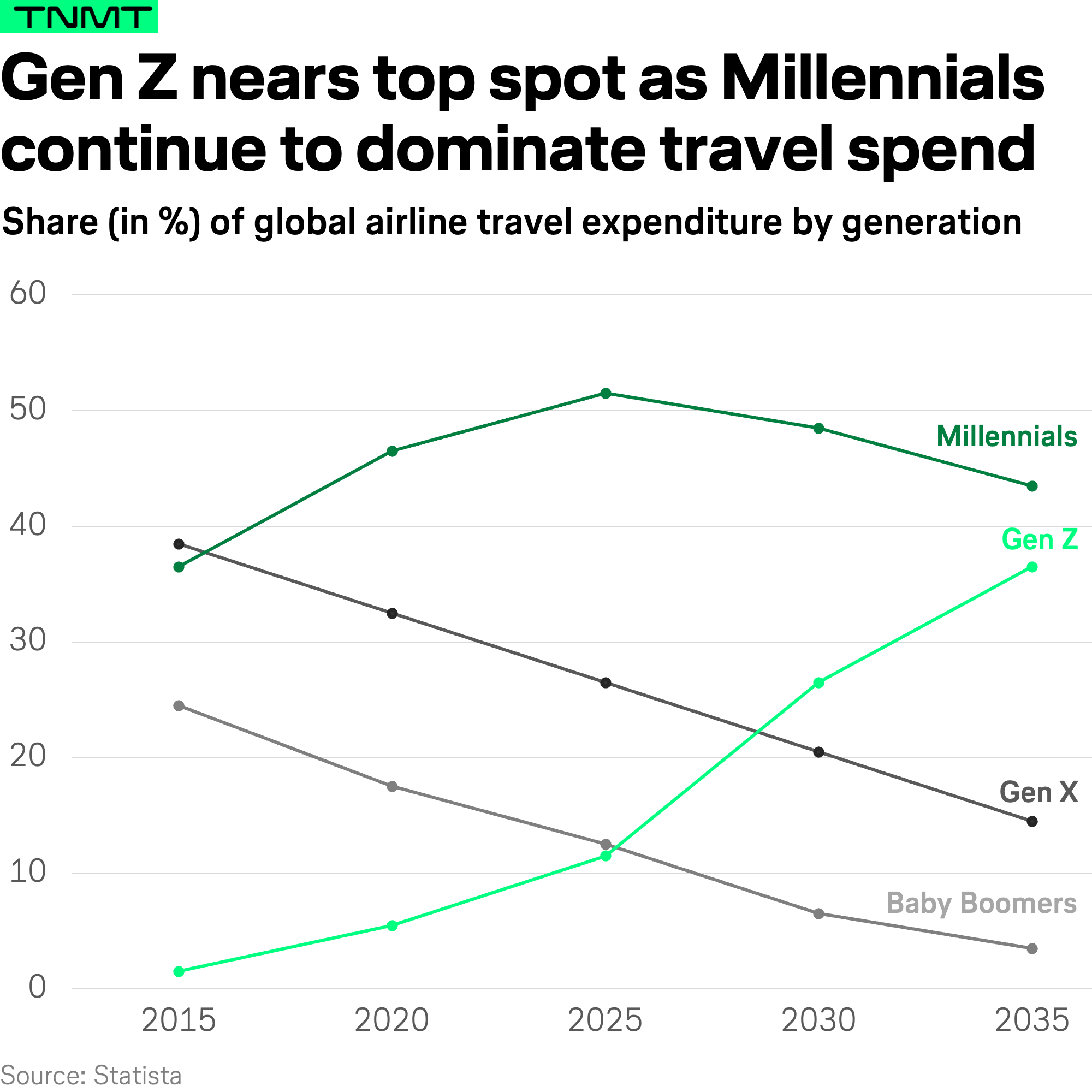

This demographic trend matters because Millennials and Gen Z are on track to become the biggest travel spenders.

In fact, they already are, as indicated by recent data (see chart below).

By 2025, millennials will comprise 75% of the global workforce.

As part of this cohort, they are expected to travel more frequently and for longer durations compared to other generations, driven in part by the “Blurred Travel” movement, which blurs the line between business and leisure travel.

BNPL resonates with these younger generations for two key reasons.

Firstly, the option to split large payments into smaller installments suits their financial circumstances. According to Deloitte’s 11th Global Gen Z and Millennial Survey, almost half of millennials and Gen Z worldwide live paycheck to paycheck and worry about their ability to cover expenses. Despite these financial constraints, separate studies show that both of these generations continue to prioritize and invest heavily in travel.

Secondly, by offering BNPL as a payment option, travel companies can widen their target market, reaching younger consumers on their terms and leveraging their growing purchasing power.

In essence, BNPL offers an avenue to tap into the spending habits and preferences of the future’s dominant consumer groups.

#4: Increasing customer engagement through frequent touchpoints

The introduction of BNPL payment options provides a unique opportunity for travel companies to consistently engage with customers. With BNPL, transactions aren’t simply one-off encounters; they unfold over multiple interactions across the installment periods.

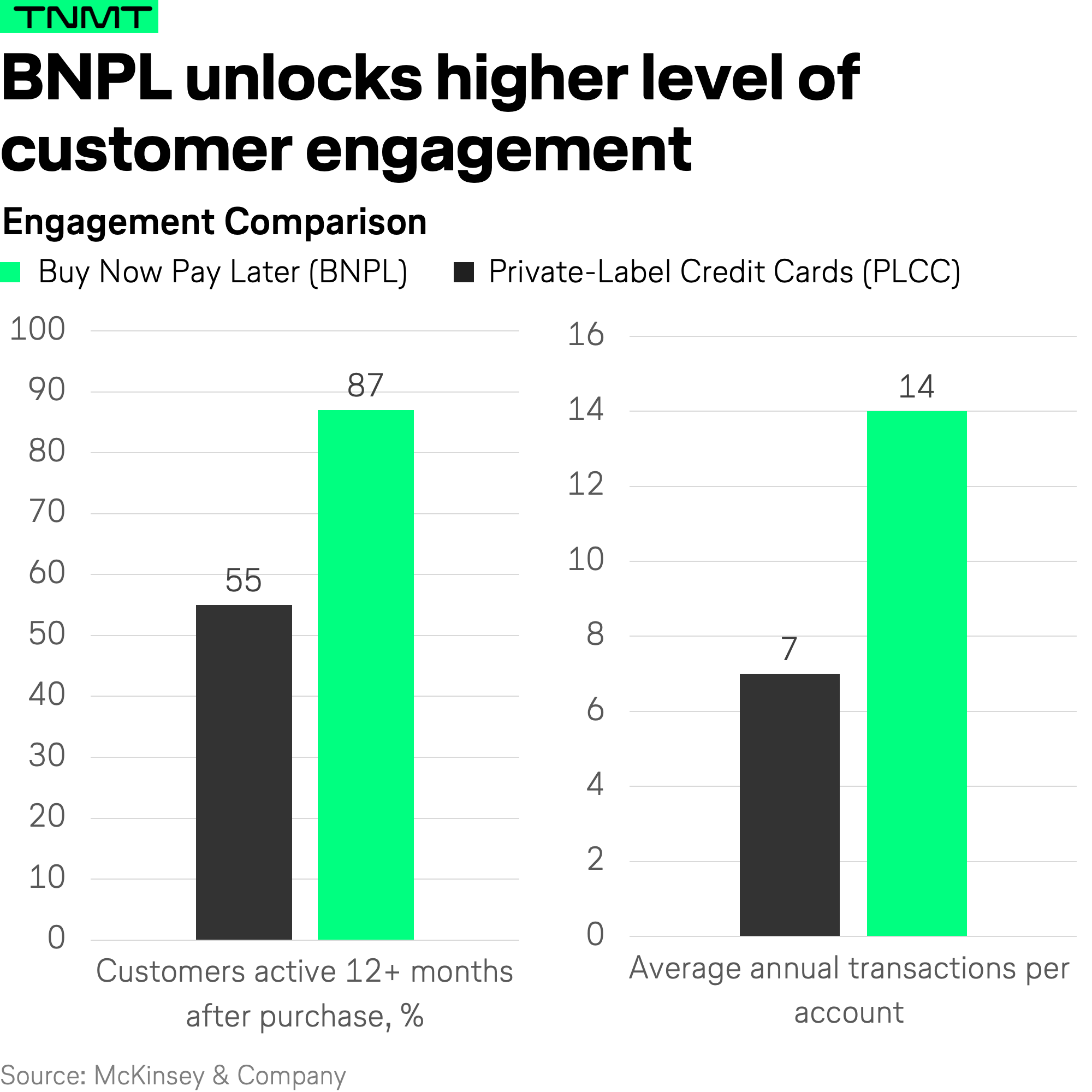

Interestingly, BNPL users tend to not only buy more but are also likely to do so on the same platform, outpacing the use of merchant-branded or private-label credit cards, according to McKinsey.

- Each installment completion or payment cycle generates a notification, whether via email or mobile messaging.

- These notifications offer an innovative channel for merchants on BNPL platforms to stay in touch with customers.

Singapore-based BNPL platform Atome has taken customer engagement a step further by introducing a loyalty program, Atome+, which awards points for every purchase made on the platform.

These points can be redeemed for exclusive experiences and gifts, enhancing customer retention and promoting repeat purchases. Other BNPL providers, such as Klarna, have launched similar loyalty programs, while Affirm is currently piloting one for the first time.

Moreover, BNPL allows travel companies to leverage merchant networks to offer complementary products and services. While travel-specific BNPL platforms like Fly Now Pay Later offer a ready community of industry-specific firms, general BNPL providers, such as Klarna and Atome, also boast ecosystems that include airlines, hotels, and online travel agencies.

This network effect can further enhance customer engagement and increase brand loyalty.

#5: A gateway to rapid market expansion, especially in Southeast Asia

As worldwide travel demand rebounds, the potential for revenue growth is especially pronounced in Southeast Asia (SEA). Estimated to surge ahead with an 11.73% compound annual growth rate in revenue between 2022 to 2027, SEA’s tourism income is projected to grow significantly faster than in Europe and the US.

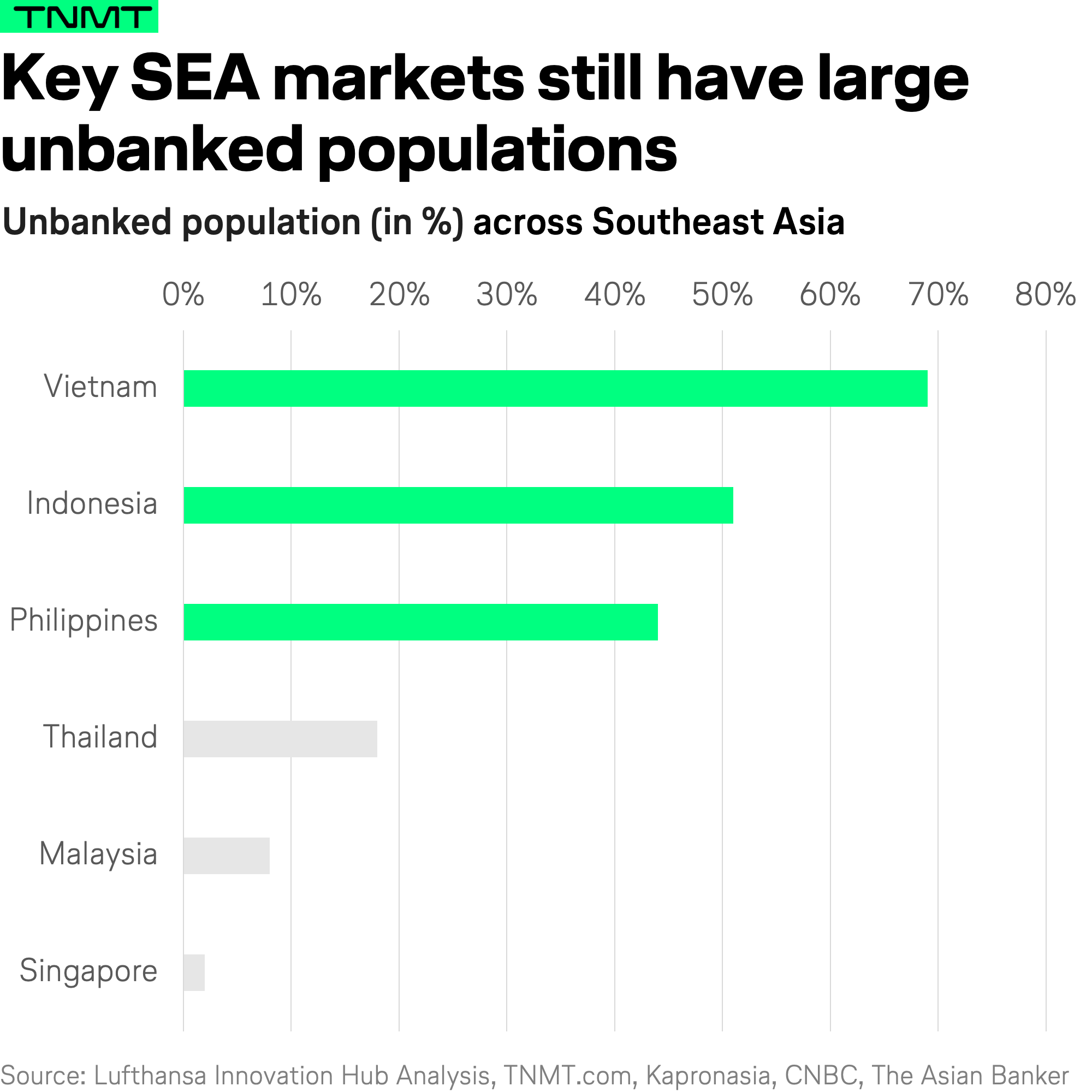

In this region, BNPL is not only surviving but thriving. This can be attributed to the large unbanked populations in major SEA markets, such as Indonesia, the Philippines, and Vietnam, which have limited access to credit. Beyond Singapore and Malaysia, the current collateral requirements make traditional loans inaccessible to most retail customers. Coupled with low credit card penetration rates, there’s a substantial market ripe for BNPL offerings.

Beyond the BNPL service itself, many providers also offer a broader suite of financial services that make them more resilient and appealing to consumers. This enables SEA users to find multiple financing solutions for their larger purchases within the same ecosystem.

Take for instance, Indonesia-based Kredivo‘s impending launch of its neobank, Krom Bank. This expansion not only widens the company’s loan offerings but also allows it to provide personal banking services to nearly seven or eight million users via a single mobile interface.

In countries where traditional credit scores are hard to obtain, BNPL providers are creating credit scores based on alternative data sources, such as mobile subscriptions. This wider array of collected data allows them to better manage consumer credit risk.

In the case of Kredivo, the company uses a proprietary underwriting engine that creates a credit score based on proxy data, like a user’s mobile phone and ecommerce data, to assess consumer risk. This innovative approach showcases how BNPL can bridge traditional financial gaps and unlock untapped markets.

BNPL’s potential in travel: balancing benefits with risks

As all of the above arguments demonstrate, BNPL offers vast potential within the travel industry.

Still, it’s essential to acknowledge and address the proverbial elephant in the room: the rising consumer debt and default rates.

In response to this, leading BNPL providers have taken proactive steps to deter bad loans.

- They’re introducing new charges and penalties, including interest on loans and late fees.

- For instance, Klarna’s global credit losses, including consumer defaults, declined by 12% quarter-on-quarter to 0.8% after they introduced late fees in 2022.

However, not all players are on the same path. Affirm experienced a significant drop in its stock price due to escalating consumer delinquencies.

Recent data from the US Consumer Financial Protection Bureau further highlights the need for caution, indicating that BNPL borrowers were 11% more likely to record a delinquency of at least 30 days compared to non-BNPL borrowers.

This does not suggest that BNPL is an unsalvageable dilemma that the travel industry should shun. Rather, it underscores the importance of careful selection of BNPL providers—those with effective measures in place to deter loan defaults. These measures may include interest on loans, late fees, credit score penalties, and strict limits on total loan amounts.

Providers like Klarna and Atome have already set the pace.

- Klarna linked consumer usage to credit scores.

- Atome instantly freezes user accounts missing a scheduled payment in the Philippines.

In markets where credit scores are scarce, travel providers should collaborate with those firms possessing a reliable proprietary system for determining user credit worthiness.

Despite these challenges, the opportunities with BNPL are compelling: heightened customer engagement and larger transaction values.

As a result, several travel companies have already begun their BNPL journey, with firms like Cathay Pacific and Firefly Airlines forging partnerships with Atome. These associations have shown promising results—a fact confirmed in our interview with an Atome manager.

For travel companies, a BNPL partnership today can take many forms, each offering unique strengths to leverage. With financial institutions, tech giants, and original BNPL firms all vying for a leading position, BNPL services are continually evolving to encompass a broader range of touch points in the customer journey, providing users with a more integrated shopping experience.

In summary, travel-related BNPL is not a sinking ship.

On the contrary, it is a potential buoy for travel brands to navigate the current financial climate, one they would be wise not to disregard.