Over the last few months, we’ve repeatedly made the case that software is eating business travel.

In particular, our landscape mapping of the 100 most-funded virtual work startups illustrated how virtual solutions are already disrupting the major (pre-pandemic) reasons to go on business trips, including travel to corporate events and client meetings, along with internal conferences and retreats.

Yet, while most industry experts agree that remote work is here to stay, key questions remain unanswered—specifically, to what extent will business travel return when the virus is no longer a threat? What will be the motives for business travel activity when people feel confident enough to go back to the office?

A framework for gauging long-term impact

To assess the long-term impact of the virtual-work revolution on office routines, and how this will affect business travel in the wake of COVID-19, we looked at the hard data.

First, to make sense of the vast software landscape, we categorized more than 250 virtual work startups from around the world based on their primary business focus and travel needs. These included:

- Virtual Events

- Virtual Meetings (i.e., presentation and interaction tools)

- Virtual Chats (i.e., text messaging and video chats)

- Virtual Collaboration (i.e., knowledge sharing, content creation, and workflow alignment)

- Virtual Office Spaces (i.e., digital alternatives to office buildings and department floors)

Next, we began researching total VC funding sums (with the goal of gauging investor interest), along with the cumulative growth in website traffic during the pandemic (to represent user interest). We completed these steps for all five virtual work startup categories.

Introducing the Virtual Tool Growth Matrix

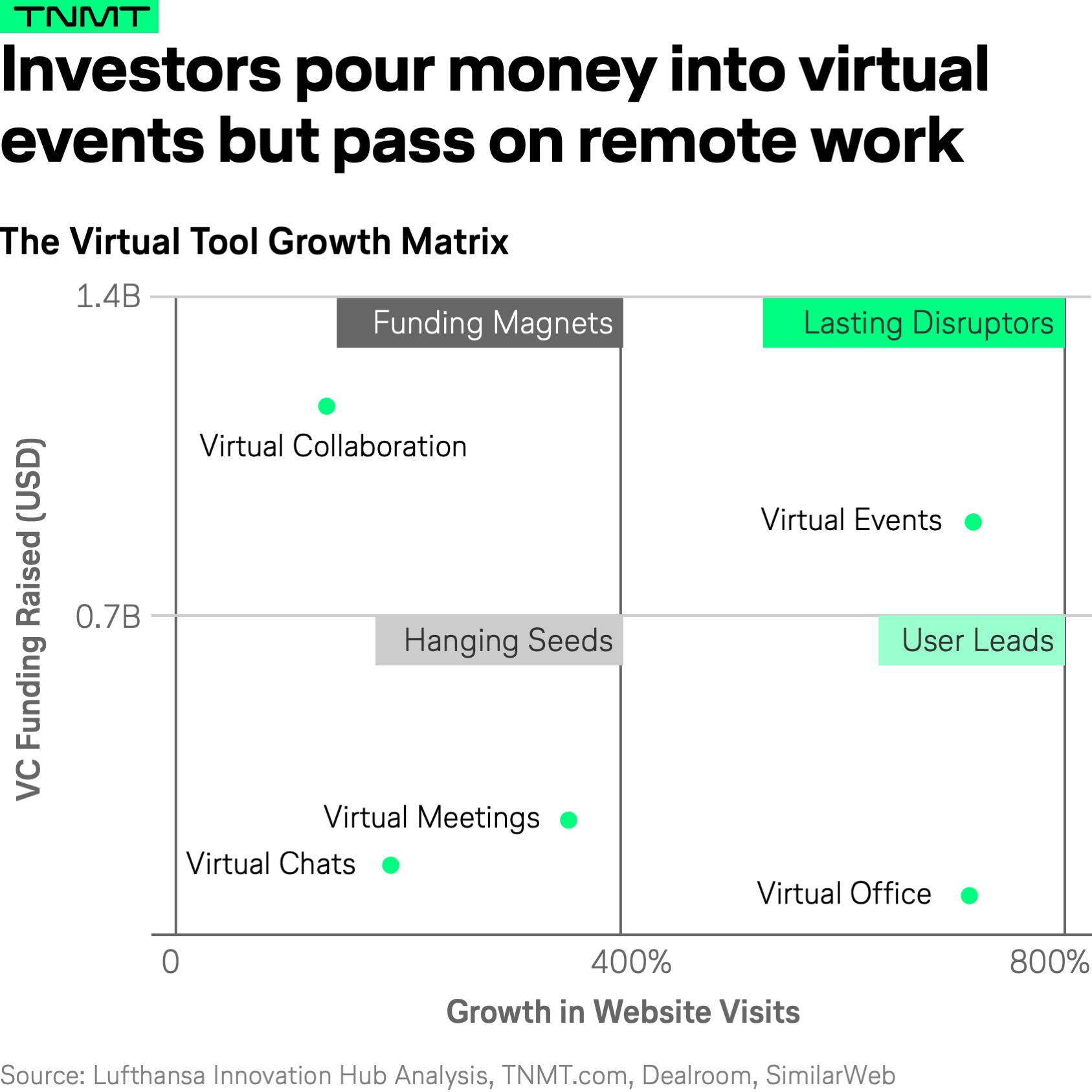

The result of this research is the Virtual Tool Growth Matrix. The framework delivers a quantitative evaluation of different virtual work activities’ post-pandemic longevity. Basically, it offers a clear take on which types of business travel are more likely to come back post-COVID-19.

How does the matrix work?

The four quadrants illustrate the widespread alternatives to business travel and their corresponding scope—offering founders and investors an evidence-based view of the most attractive virtual work segments going forward.

This understanding is also hyper-relevant for travel providers like airlines, giving them a chance to better prepare for a post-COVID-19 future by evaluating how software can be used to complement business travel instead of replacing it altogether.

In the following, we will outline our main takeaways from the Virtual Tool Growth Matrix.

Spotlight on lasting disruptors

According to our data collected through Dealroom, startups in the virtual events space have collectively raised over $1 billion in 2020 and 2021—making them the second most-funded category in the virtual work arena. Virtual events are also the category with the highest spike in pandemic website visits, which went up 718% between March 2020 and March 2021.

This proves that the virtual events category—whose physical counterpart accounted for about 20% of all pre-pandemic business travel—is an investor and consumer favorite.

It’s highly likely that virtual event offerings will continue post-COVID-19, even if in a hybrid form, and that they’ll eat away significantly at the traditional business trips previously taken to attend in-person conferences and trade shows.

The reasons for this bullish outlook are manifold, and largely in favor of virtual events software. Firstly, for obvious reasons, which include cost savings and convenience for event attendees (e.g., no travel involved).

Secondly, virtual events technology has quickly advanced, paving the way for meaningful digital interactions. Touchcast, for example, offers an immersive VR experience that essentially mimics human behavior. Meanwhile, Grip and Wonder are targeting networking events with their innovative spatial technology that replicates physical movements.

From here forward, as these tools’ tech stack continues to evolve, the experience gap between physical and virtual events will grow increasingly narrow. And so, when it comes to the post-pandemic future of the events industry, we can ultimately choose from top-quality in-person and virtual experiences. All things considered, we predict that up to 30% of traditional events will be postponed or canceled in favor of virtual alternatives.

Having said that, virtual events are still far from reaching the finishing line. As the industry matures, investors expect a return on their investment and if virtual event companies cannot prove a profitable business model, capital might dry out. Despite the current unprecedented growth, very few virtual event planning providers are making money so far.

However, investors seem to have high confidence in the virtual events industry, as indicated by the $1+ billion invested so far. This is because monetization opportunities appear rather obvious, for instance, by charging participants and/or event hosts, and the software is easily scalable. Hopin, the frontrunner with $565 million raised to date, for instance, reported $70 million ARR less than two years after the company was founded.

Let’s talk user leads

Virtual office tools recorded the 2nd highest growth in website visits (+714% since first lockdowns in March 2020). There’s no denying that there is strong consumer interest in virtual office software. That said, investor interest is next to nonexistent, with only $100 million raised so far to fund respective startups.

This discrepancy between investor funding and user interest suggests that investors don’t see the commercial model behind virtual office companies. Additionally, chances are high that many businesses expect their workers to return to the office in the near future (see Apple, for instance), and that the hybrid and remote work environments won’t necessarily require a new virtual tool infrastructure. After all, Salesforce—one of the first companies to announce a permanent remote work option—recently reported that compared to June 2020, when only 23% of employees wanted to return to the office, more than 72% of employees were eager to go back to in-person work as of April 2021.

Unlike virtual events where a handful of companies already generate tangible revenue, the majority of virtual office startups are still in beta. Product-market fit is anything but defined yet.

Another reason why virtual office startups haven’t captivated investors might be because of their gimmicky product interface. Companies like Gather—currently the most-funded virtual office startup, with $26.5 million secured—offer a virtual office environment that resembles some sort of Pokemon game world.

Sound fun? No doubt, but the gamified environment might be perceived as a barrier to productivity. Having said that, there are products that deliver a more discreet platform, including Teamflow (with $15 million in funding), or Spatial (with $22 million in funding) that deliver a seamless VR experience. However, also these startups have yet to prove their added value to tackling daily business activities.

Having said that the funding discrepancy might instead suggest that investors are currently misinterpreting consumers’ evolving needs. With an increase in website visits of more than 400%, the user interest for virtual office tools is undeniably present. And so, one might argue that virtual offices will host an engaged hybrid workforce post-pandemic.

The latest research confirms that this will be very important. An extensive study conducted by Stanford University, the University of Chicago Booth School of Business, and the Instituto Tecnológico Autónomo de México determined that after COVID-19, 22% of all work days will be remote, compared to just 5% before the pandemic.

The adoption of new technology like VR glasses, along with established remote work setups, will continue to fuel the shift to virtualization. And so, investor funding might just take off for virtual offices when the virus becomes a thing of the past—but knowledge workers will continue to work from home at least part-time.

Therefore, if not on your radar already, we suggest travel companies keep a close eye on the development of virtual office startups because ultimately these startups will further impact the need for business travel down the road. As remote work gains popularity, now is the time for travel providers to reevaluate how they can reach their customers. Airbnb, for example, is supporting its hosts to cater to the nomadic lifestyle trend with flexible booking conditions and long-term stay offerings after seeing that one-fifth of their guests used the platform to travel and work remotely in 2020.

A deep dive on funding magnets

Virtual collaboration startups, namely platforms that allow workers to create content online, collaborate via knowledge sharing, or align on workflow and objectives, have proven to be the most-funded category throughout the pandemic, with roughly $1.2 billion raised. This is a sign that digital collaboration tools have seemingly positioned themselves as the next big thing even in virtual work after COVID-19.

The lower growth rate in website visits, is likely due to the fact that many online collaboration tools were already popular pre-pandemic, and that newer options are largely unnecessary. Nonetheless, the 135% increase in website visits is far from negligible—which tells us that the shift to virtual collaboration tools is an evitable structural change that the pandemic simply accelerated.

With that, taking a closer look at the funding figures, we see two main investment areas: The virtual collaboration space has funded workflow coordination tools such as Calendly and Clickup along with whiteboard startups such as Mural and Lucid. Whiteboard startups offer a collaborative whiteboard format for teams to brainstorm, with appealing functionalities like sticky notes and drawing.

These are also some of the main drivers for website traffic—sending a clear message that many in-person brainstorming and workshop sessions will be replaced by software post-pandemic. Likewise, team alignment and work organization tools have proven just as effective in virtual format, making it more than likely that routine meetings will continue to be scheduled online.

To this end, similar to virtual office startups, virtual collaboration tools should be closely monitored by travel companies to prepare for the needs of a remote workforce. United Airlines takes the lead in this space, having teamed up with coworking startup Peerspace to offer tiered packages—including roundtrip flights and short-term collaborative workspace rentals—with the goal of helping teams work from anywhere.

The future of hanging seeds

Finally, let’s take a moment to discuss hanging seed categories, which have raised less than $0.5 billion in funding and experienced a slower (but still steady!) increase in website visits. Two categories fall into this quadrant: virtual meetings and virtual chats.

What are virtual meetings? These are startups that at core offer video conferencing solutions, or—in a pre-COVID-19 world—sales and client meetings. What makes them different from a typical Zoom call is that they bridge the gap between online and in-person interactions, with additional interactive functionalities (Around) that help captivate the audience (Klaxoon). Some of them even sense non-verbal cues (Headroom).

This category has raised $300 million in funding in the last year—a significant amount, but still quite low compared to virtual events. The lower funding inflow is most likely the result of investors expecting client and sales meetings to return to an in-person format post-pandemic. This shouldn’t come as much of a surprise, as we’ve been hearing that sales representatives find it easier to connect and interact with buyers face-to-face. A recent Bain & Company analysis also revealed that actual win rates and revenue-per-sales-representative were 21-35% lower than expected with virtual sales.

The same study, conversely, found that buyers and sellers preferred virtual sales interactions by 17% and 25%, respectively, this past year. This shift is made all the more powerful in that, contrary to popular belief, 50% of client interactions were already virtual before COVID-19. This is attributed to the time- and cost-efficiency of virtual sales, and the corresponding ability to interact with a broader audience.

So, unlike what many investors seem to believe, virtual client interactions are almost certainly here to stay. Having said that, we do not claim that virtual will completely take over the sales realm—but with the rising acceptance of virtual solutions, a fair balance of digital and field sales and client meetings will be established. The 350% increase in website visits notwithstanding, we expect this category to pique investors’ interest as online sales continue to rise post-lockdown.

Lastly, a quick overview of the virtual chats category, which has the least funding ($180M) of all the categories (in addition to the lowest growth in website visits with 194%. Startups in this category offer chat platforms that improve the asynchronous exchange and coordination between remote teams and clients with recordings, audio and video notes (e.g. Loom, Voodle), and advanced text-messaging capabilities (e.g. Front, Threads).

Why hasn’t this category caught on? When it comes to these low numbers, it appears that asynchronous audio and video communication represent a novel need that is still at its inception—meaning it has yet to draw public attention. After all, most asynchronous audio and video chat platforms are in their seed- or early-stage growth (e.g. Supernormal, Voodle).

However, it could be that users just don’t see the benefits these new virtual solutions bring and that they prefer to stick with more familiar products—even those that offer fewer functionalities and less personalization. Superhuman, for instance—which has raised $60 million to date—promotes itself as the “fast, delightful, and intelligent email client”. And while its AI-enhanced automation might improve the overall user experience, employers may hesitate to cover the costs of moving away from Outlook.

Additionally, the current dominant e-mail agents such as Gmail and Outlook come in a package with other well-integrated office-relevant tools (Calendar, Sheets, Drive, etc.) which adds to the value of the product. Therefore, it’s likely investors were not persuaded by the business model of some of these tools.

From where we’re standing, the latter is a more likely scenario and Virtual Chats did not prove their added benefit. Since lockdown began in late March 2020, we saw a few success stories—such as Loom raising about $30 million, at a valuation of $350 million—but they hardly compare to the mega-rounds raised by virtual collaboration and virtual event companies.

The abovementioned figures also indicate that virtual chats aren’t an urgent need, but simply a nice benefit for remote teams. As a result, they might have missed the growth momentum of their matrix counterparts. Widespread work-from-home delivered an invaluable opportunity for remote work startups, as many employers were forced to experiment with remote workforce productivity solutions. But ultimately, it seems as though companies felt they could do without asynchronous chats and advanced synchronous messaging platforms. Turns out, most found their existing systems were perfectly adequate.

It’s important to note here that we still expect startups in this category to increase in popularity this next year—but it’s unlikely that the masses will pick up on virtual chat platforms the same way they’ve turned to virtual collaboration tools and virtual events.

Which virtual work tools will survive the test of time?

Looking at the bigger picture, the long-term adoption of virtual tools—and their impact on business travel—will vary significantly based on the interaction.

Though we can’t see into the future, one thing is certain: The Virtual Tool Growth Matrix shows there are clear winners and some very likely trends ahead. Namely, virtual events and virtual collaboration startups have captured both user and investor attention, and in the coming months, we can expect these platforms to keep expanding, cementing their utility for knowledge workers and remote teams in the long term.

To this end, the Virtual Tool Growth Matrix also reveals a discrepancy between user interest and investor focus on different virtual tool categories. Specifically, it seems as though most investors are predicting a return to in-person meetings and physical events—while users are more open to long-term remote and hybrid work solutions, including virtual alternatives to traditional office solutions.

Ultimately, the matrix reveals that users will more than likely give up office huddling and watercooler chatter for the comfort of home, and the flexibility of permanent remote work.

Only time will tell, of course—and we plan on paying close attention to how things progress.