If 2022 was the year of the metaverse and 2023 the era of Generative AI and ChatGPT, then 2024 is undeniably the year of robotics.

This shift signifies a broader trend in the tech industry, moving from a software-centric focus to a renewed interest in hardware.

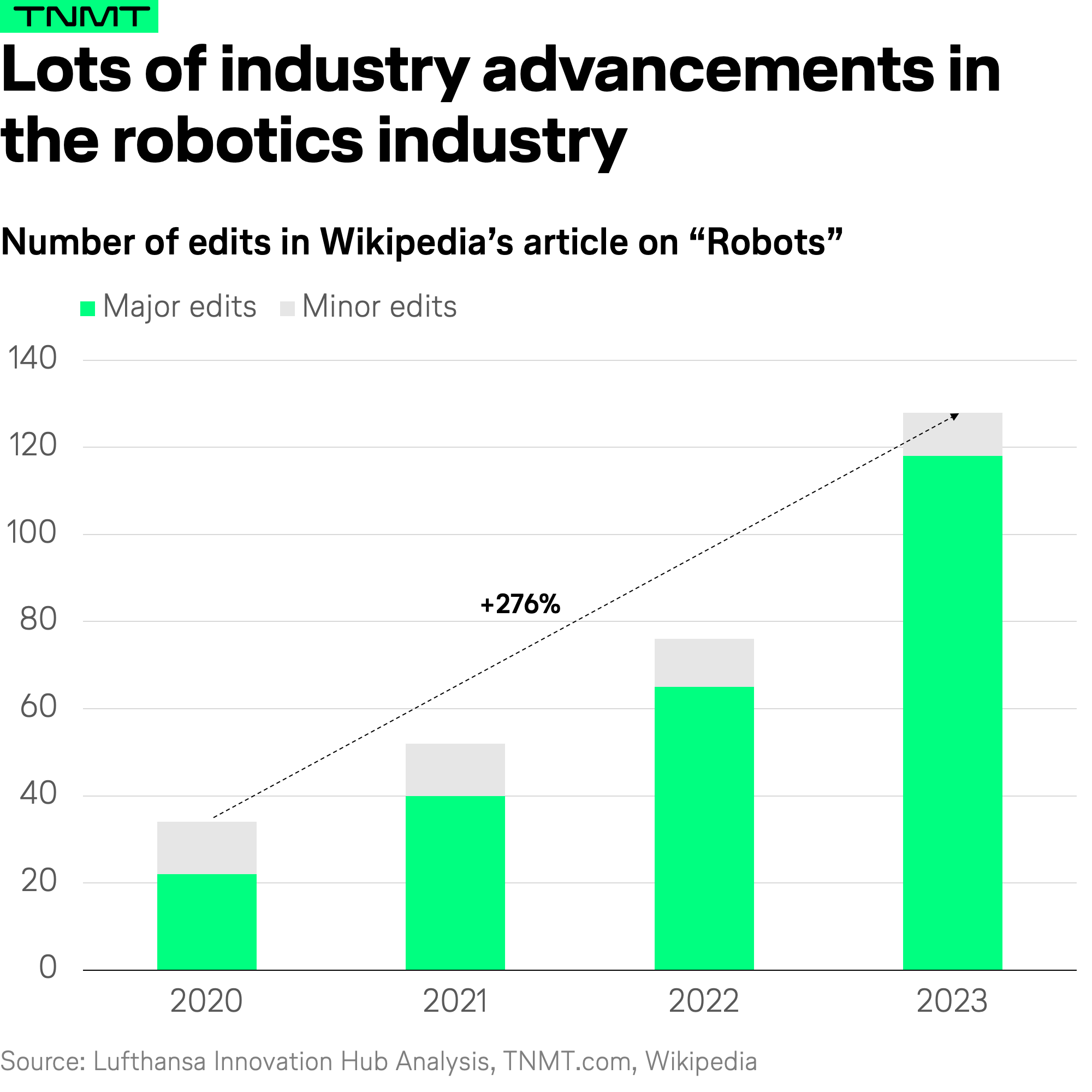

To quantify the growing excitement around robotics, we analyzed Wikipedia editing activity on the “Robot” page. Similar to our previous analysis on predicting hype cycles through Wikipedia edits, this approach reveals how industry developments spark updates and additions to relevant articles.

As illustrated above, the Wikipedia page on robots has seen a steady increase in major edits over the years, culminating in over 120 edits in 2023. While it’s too early to report 2024 figures, it’s expected that this trend will continue to climb.

Clearly, robots are capturing the public’s attention and becoming a significant focus in mainstream techland.

This rise in tech attention for robotics is not just reflected on Wikipedia.

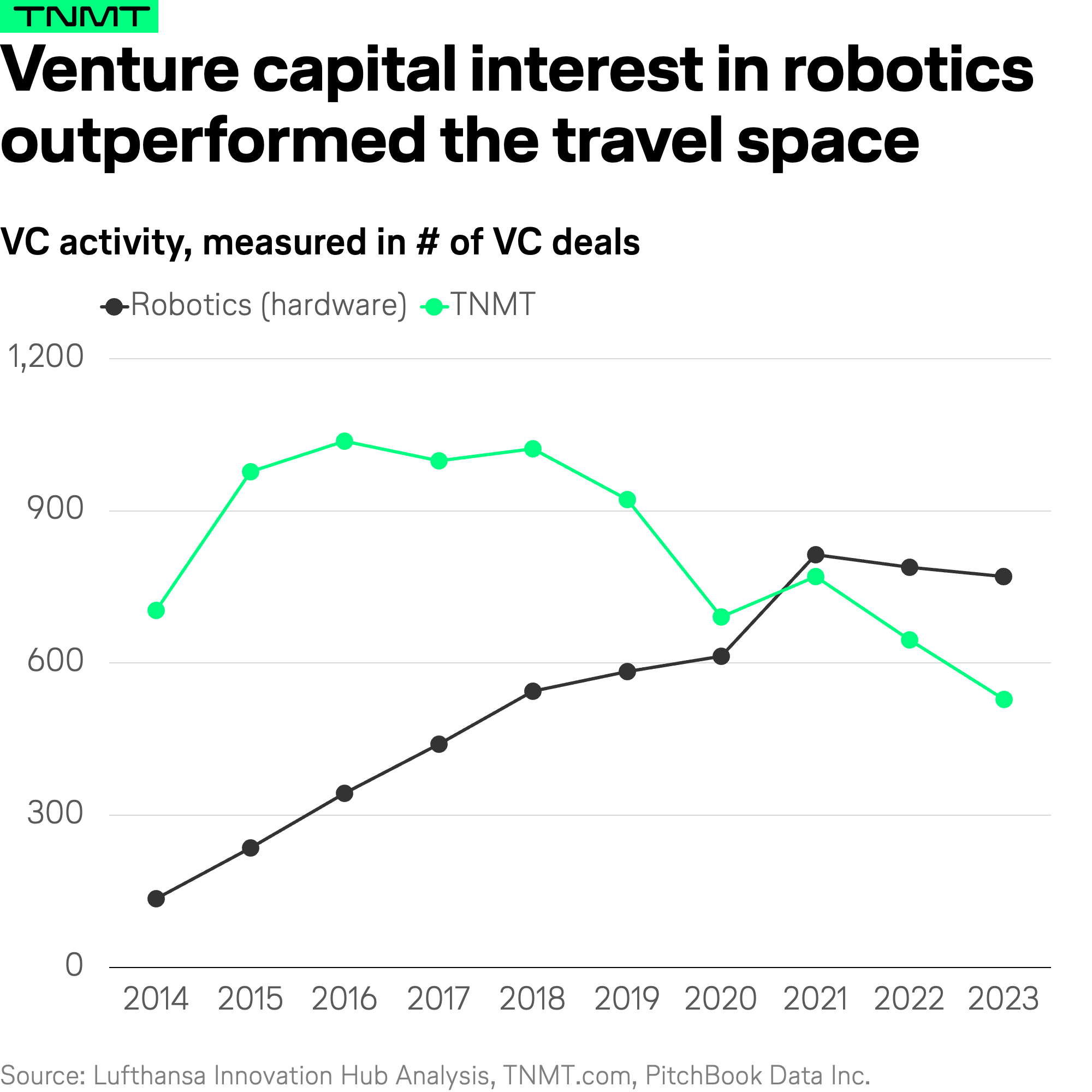

It is also evident in hard investment dollars.

- According to our analysis of Pitchbook data, there has been a notable increase in VC deals for robotics startups over the last decade.

- In 2023, despite a general slowdown in overall VC investment activity (including investments in the Travel and Mobility Tech sector, see the green line below), VC interest in robotics remained robust.

Why Aviation Should Leverage Robotics

Given the current robotics movement, we wanted to understand how aviation is leveraging this technology (if at all).

Is aviation participating in robotics innovation, or is our industry merely observing advancements from the sidelines?

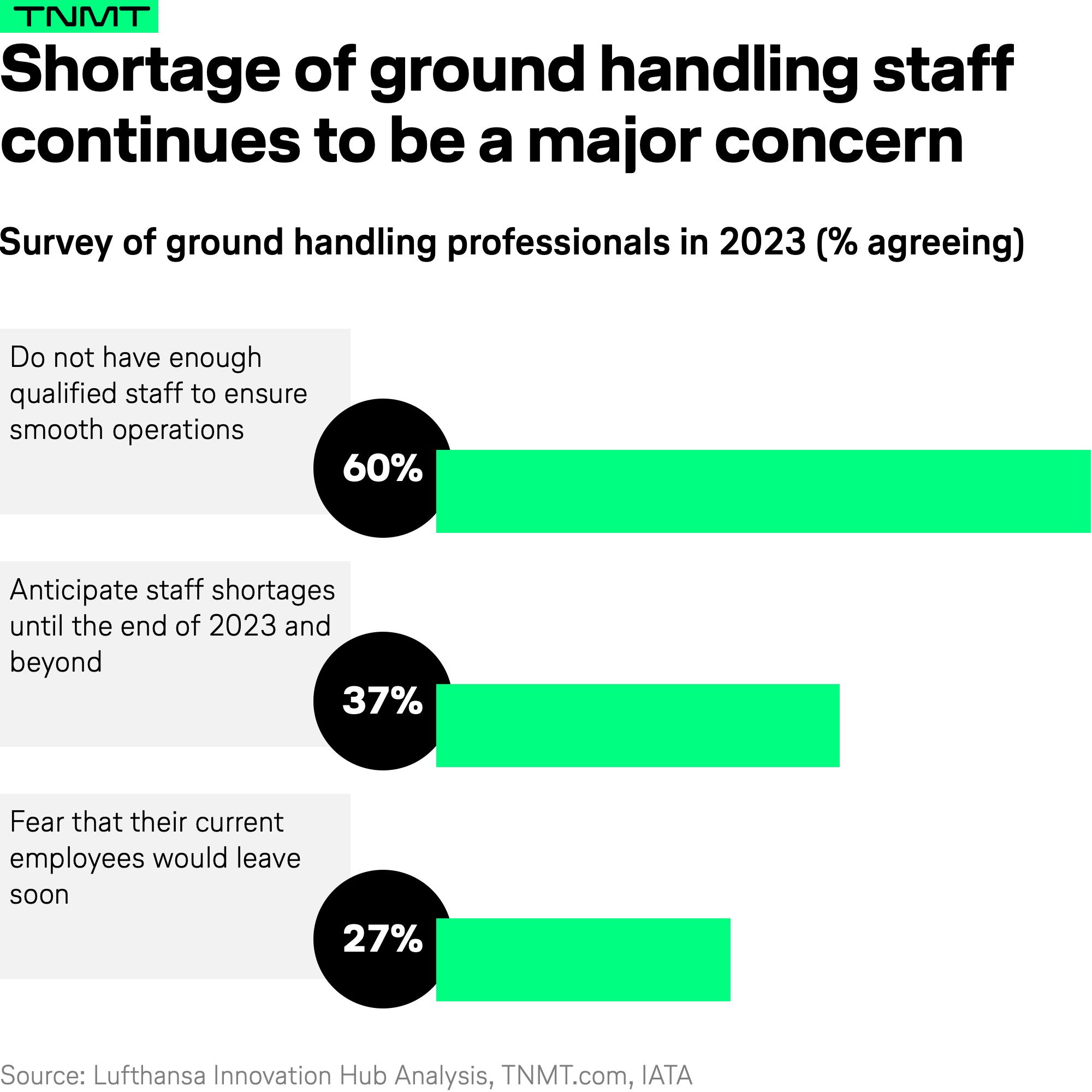

This is a critical question, particularly because the aviation sector, especially ground operations within airports, urgently needs to accelerate automation and improve efficiency in response to the ongoing severe labor shortage.

Staff shortages are arguably one of the key concerns, if not the top one, that the industry must address. These shortages have been a primary factor in the operational bottlenecks faced by the airline sector over the last few years.

- According to IATA, more than half of ground handling professionals at airports do not believe they have the staff available to ensure smooth airline operations.

- At major travel hubs like Schiphol Airport, up to 90% of employees are concerned about handling summer crowds due to severe staff shortages.

What makes the staff shortage in the airline and airport context so severe, and arguably even tougher than in other industries, is the lengthy process to hire employees. This is due to the need for stringent background checks and security clearances.

- For example, hiring aviation staff in Berlin-Brandenburg typically takes at least one month just to obtain security clearance from the Aviation Authority for a new worker.

- Adding the time required to interview and onboard new workers, the entire hiring process can easily take several months—far too long to quickly react to current operational bottlenecks.

The Role of Robotics in Enhancing Aviation Operations

Given the severe labor shortages, many aviation experts view robotics and automation as key solutions for ensuring stable operations, particularly within airport premises.

But what are the major areas in airline operations where robotics can truly play an effective role, and are they already being leveraged by airlines and airports?

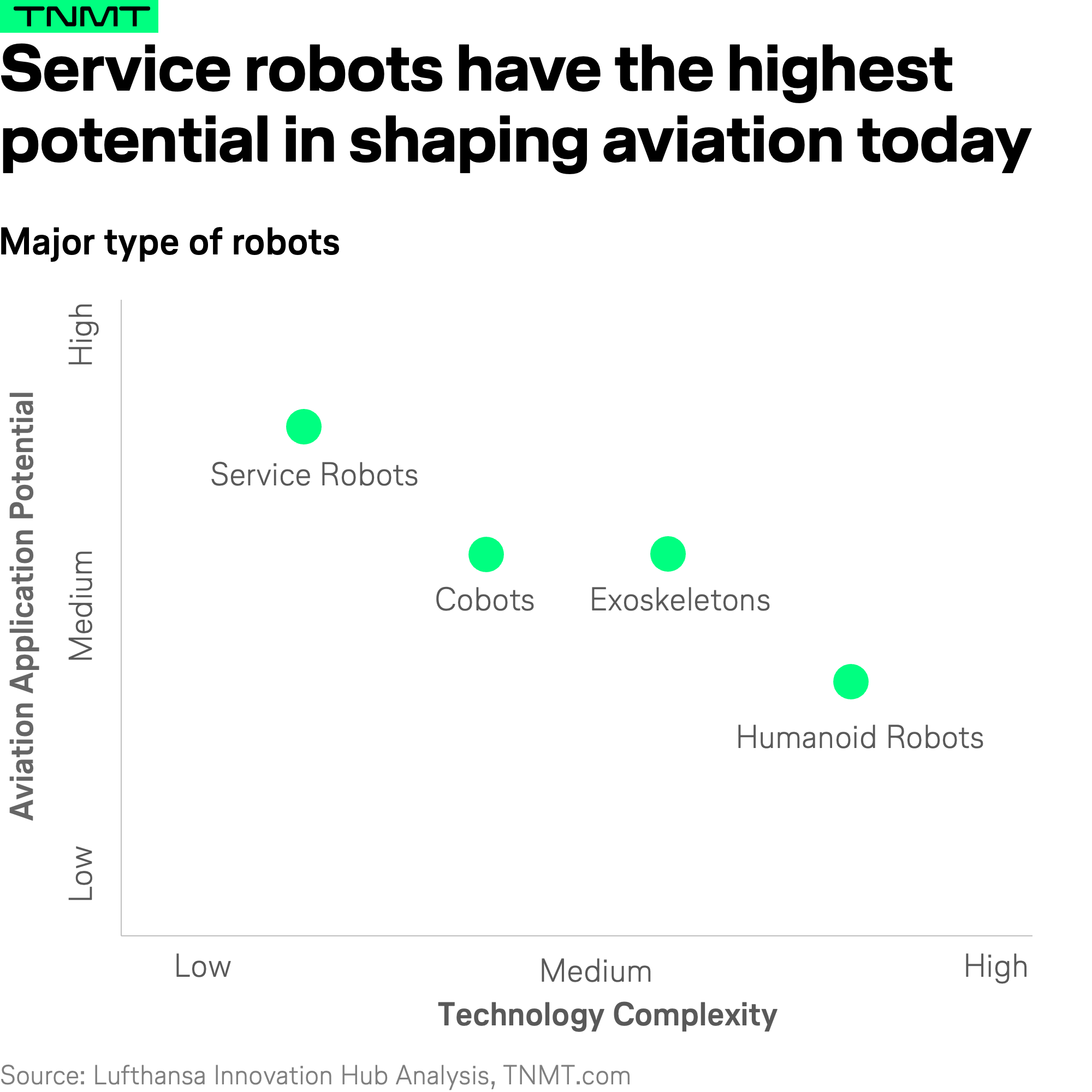

To answer this, we first need to define the major categories of robots. Pragmatically, there are four types of robots, each with varying technological complexity:

Service Robots: These mostly customer-facing robots are designed to enhance passenger convenience and operational efficiency. They can be utilized in various scenarios, including customer service (as seen at Munich Airport), assistance, security, and even maintenance.

Cobots (Collaborative Robots): These are largely non-customer-facing robots designed to work alongside humans in shared workspaces within airline and airport operations. Cobots enhance productivity and safety by taking over repetitive, physically demanding, or time-consuming tasks. Examples include baggage handling, cleaning and disinfection, and security screening.

Exoskeletons: These wearable robotic suits or equipment are designed to augment the physical capabilities of airline and airport employees. They provide mechanical support, enhancing strength, endurance, and efficiency in performing physically demanding tasks, such as baggage handling. Exoskeletons are particularly valuable in reducing fatigue and the risk of injury, thereby improving overall operational efficiency and safety.

Humanoid Robots: These are the ultimate type of robots, designed to resemble and mimic human movements and actions. With a human-like appearance, they are meant to perform tasks and interact with passengers and staff in intuitive and familiar ways. Humanoid robots will likely be employed to enhance customer service and passenger assistance, providing a more personal touch.

Based on our view of the robotics space, the more technologically advanced robots are, with humanoid robots at the extreme end, the less they may actually be relevant and applicable to concrete operations in the airline industry today.

Why is that?

Most of the current operational bottlenecks in aviation don’t require extremely sophisticated robotics technology that fully mimics human behavior.

Instead, it requires technological support to handle basic tasks, such as moving luggage from point A to point B and navigating the growing number of travelers through critical airport gateways like security. Therefore, the short-term strategy for the airline operations sector should focus on implementing available robotics solutions to enhance efficiency in the current system.

Current State of Robotics in Aviation

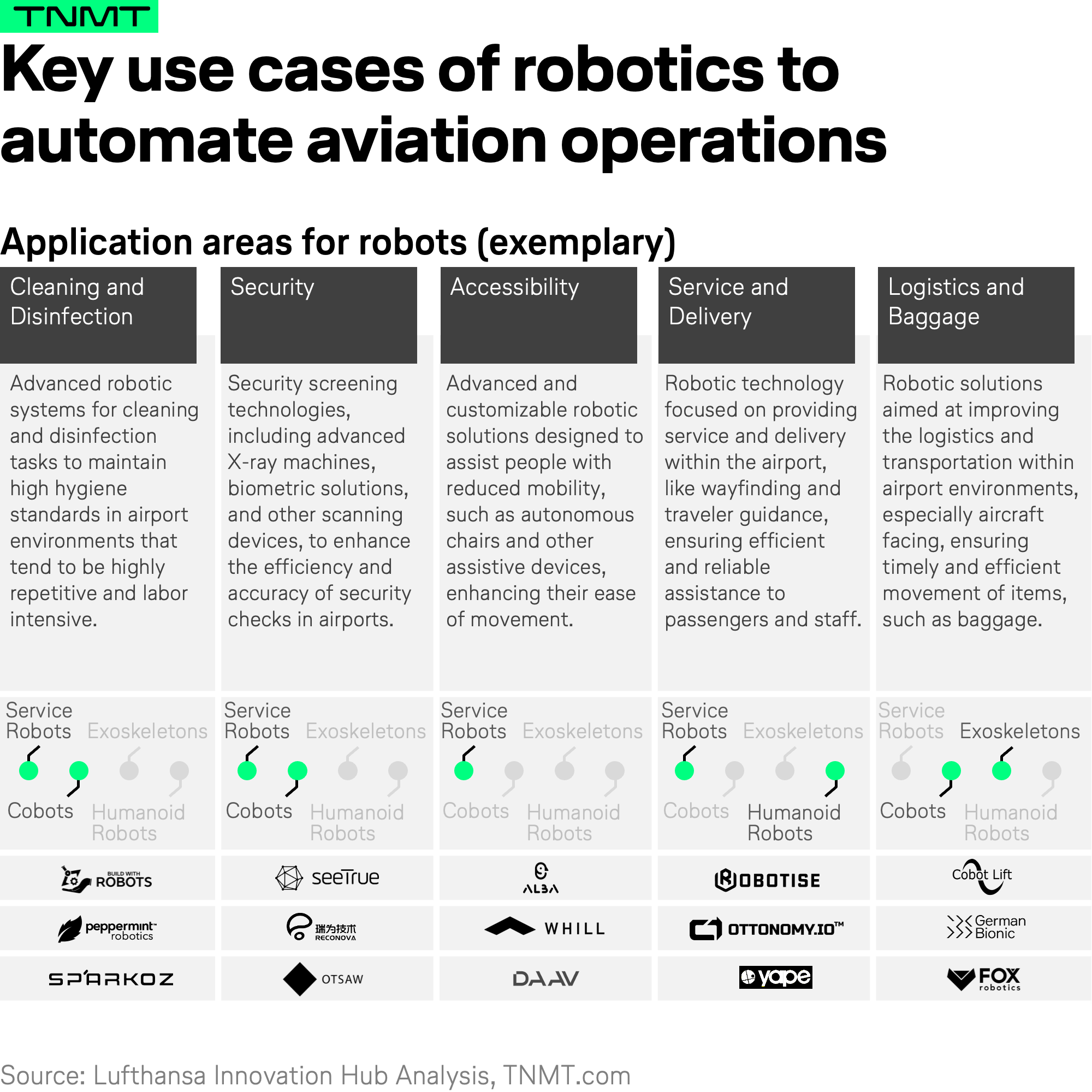

The major impact of relatively basic service robots on the aviation industry becomes evident when examining the current robotics solutions used at major airports worldwide. Service robots are poised to make the most significant impact due to their wide array of applications and relatively straightforward technological requirements.

These robots are already being integrated into various facets of ground operations, as illustrated in the robotics landscape below. The relatively lower technological complexity of service robots compared to other advanced robotics makes them practical and cost-effective solutions across the operational landscape.

- For instance, Munich Airport deployed JEEVES, a self-driving snackbot developed by Robotise. This robot, originally designed for the hotel and healthcare sectors, is being tested for one year to improve logistics and enhance the passenger experience.

- American Airlines announced the deployment of Whill’s autonomous electric wheelchairs in the terminals at Los Angeles and Miami International Airports for passengers with reduced mobility.

And it’s not just collaborations with startups.

Some airports even made investments. In June 2023, ADR Ventures, the corporate venture capital arm of Aeroporti di Roma, invested in Ottonomy, a startup specializing in autonomous delivery robots. This followed a successful pilot of Ottonomy’s robots at Rome Fiumicino Airport, enhancing passenger service through contactless deliveries.

Cobots and exoskeletons also show promising potential in the near term with a handful of real-world integrations already under way.

- In June 2023, Schiphol Airport announced a collaboration with Cobot Lift. The partnership includes testing various robotic and lifting aids, including a specially developed robot that can lift up to 90% of baggage, reducing the need for manual labor.

- Japan Airlines co-invested in Fox Robotics, a developer of autonomous robotic forklifts, in a $20 million USD round led by BMW i Ventures.

- In 2021, Stuttgart Airport started using Exoskeletons, developed by German Bionic, to reduce physical strain on the baggage handling workforce.

Conversely, humanoid robots may not find a strong foothold in the aviation industry in the near to mid-term future, even if the technology further advances. Customer service, especially in the physical airport context, will remain a deeply personal experience. Travelers are unlikely to favor humanoid robots for assistance, at least in the foreseeable future. A study by OAG revealed limited interest from travelers in humanoid robots for providing information and assistance, with only 19% of passengers expressing interest in interactive robots for concierge services and travel information.

Furthermore, the practical application of humanoid robots in aviation seems more like a sci-fi fantasy than a feasible solution. When you break it down, the use of humanoid robots for tasks such as moving items around an airport doesn’t add up in terms of efficiency. Why opt for the complexities and additional costs of humanoid features, such as bipedal locomotion, when simpler solutions like wheeled robots can perform the same tasks more economically? This consideration calls into question the practicality of humanoid robots beyond their novelty.

This being said, there have been examples of airports deploying first iterations of humanoid robots. However, the high costs associated with developing and maintaining humanoid robots, coupled with their limited ability to address real pain points, have hindered their adoption.

- For example, the Pepper robot developed by SoftBank Robotics ceased production in 2020 due to high costs and limited demand. Pepper was deployed at Munich and Prague’s Vaclav Havel Airport, exemplifying the challenges faced by humanoid robots in gaining traction within the aviation sector.

- Another instance is from the hospitality industry. In 2019, Japan’s Henn na Hotel, the world’s first robot-staffed hotel, reduced its robotic workforce by more than half due to operational issues. Many robots failed to reduce the workload and often created more problems, such as room assistant robots interpreting snoring as commands and luggage-carrying robots frequently malfunctioning.

Despite these challenges, there are relevant use cases for humanoid robots, particularly in unique operational scenarios.

- For example, Alaska Airport employs a headless four-legged robot, Aurora, to keep wildlife away from runways. Developed by Boston Dynamics, this robot costs about $70,000 USD.

- Korea Advanced Institute of Science & Technology (KAIST) is developing a humanoid robot, Pibot, that will be capable of flying an aircraft without the need to modify the cockpit.

Both of these examples illustrate that while humanoid robots face challenges in mainstream applications, they can be valuable in specific, niche operational contexts.

Barriers to Robotics Adoption in Aviation

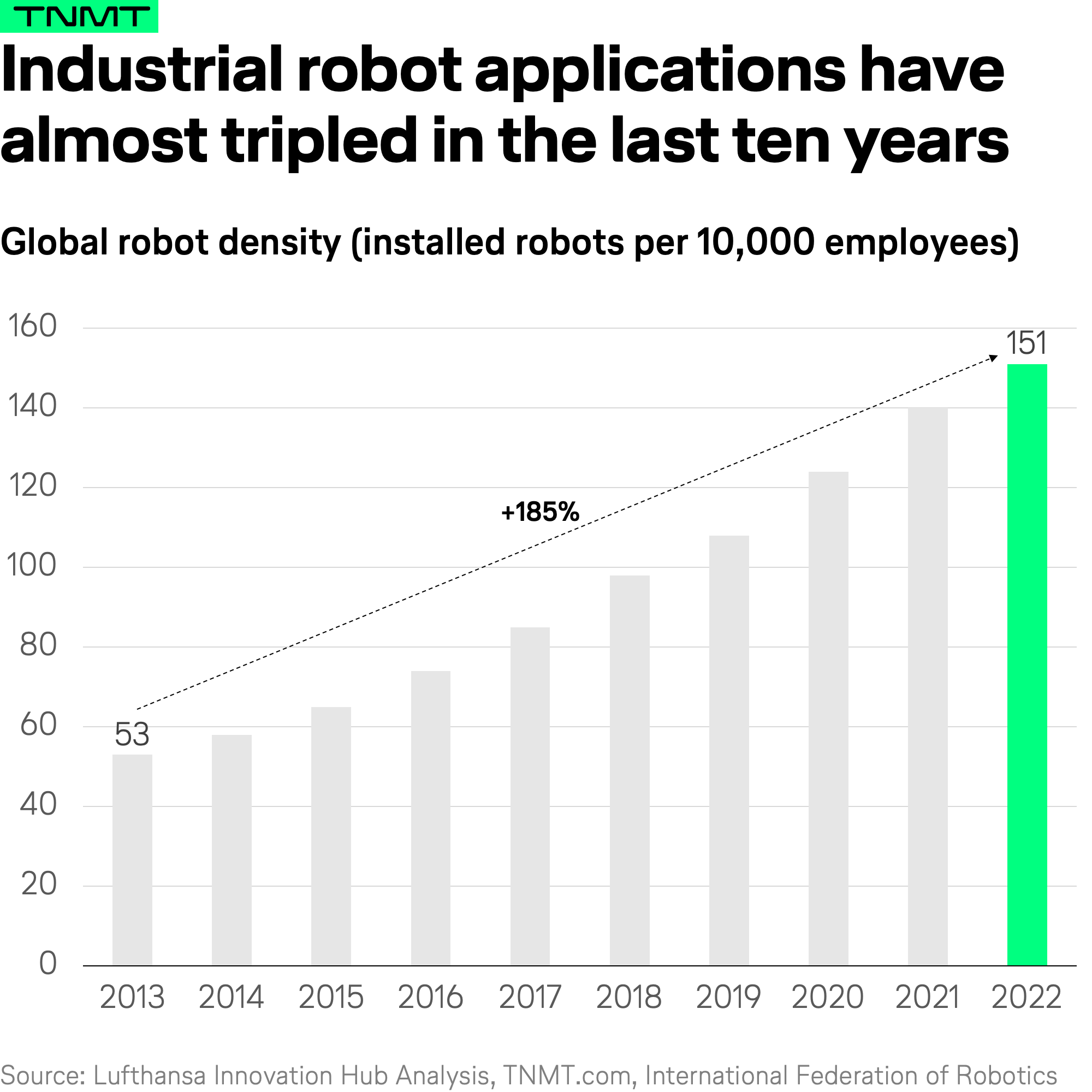

It may be premature to judge which types of robots will significantly impact the aviation industry because we are simply not seeing enough experimentation yet. The aviation sector is notably late in deploying robotics solutions compared to other industries, reflecting the overall slower innovation pace of the broader travel industry.

The industrial and manufacturing sectors, for example, are much more advanced in applying robotics. Over the last decade, the density of industrial robots in manufacturing increased by 185%. In 2022, robots installed per 10,000 employees stood at 151, compared to just 53 in 2013.

Why is aviation slower in testing and adopting robots?

Two primary reasons contribute to this lag:

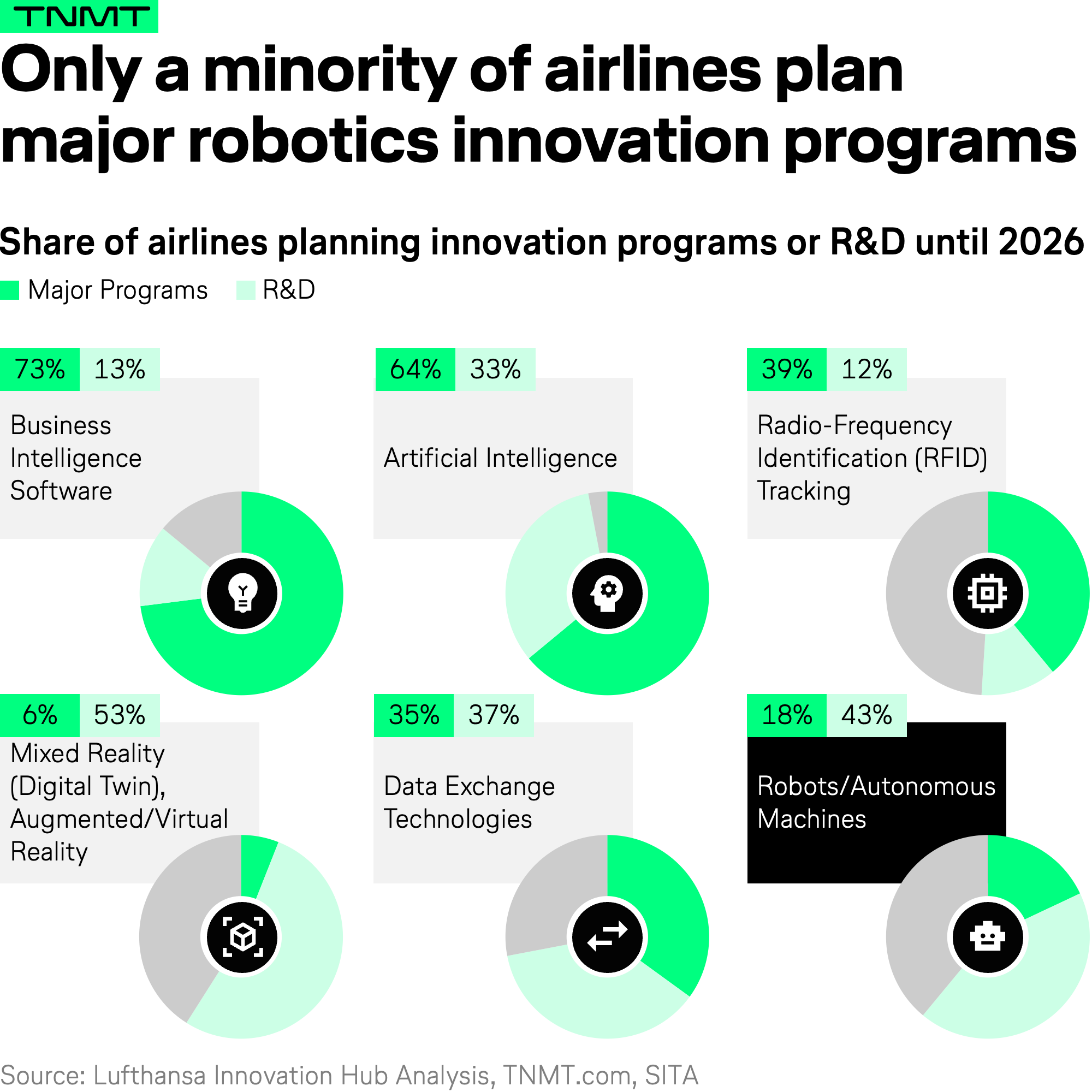

1. Robotics Not Considered a Tech Priority Among Executives

The first reason seems cultural. Major airlines simply prioritize other technology themes. According to SITA’s Air Transport IT Insights 2023 report, only 18% of airlines have planned major programs in the field of robotics and autonomous machines over the next few years until 2026.

This is the second lowest value among six technology fields, with robotics clearly lagging behind Business Intelligence Software, AI, and RFID.

2. Lack of Investment in Aviation Robotics

The second reason is the insufficient investment in specific robotics solutions focused on the aviation context. Investment in robotics by travel and mobility incumbents remains extremely low.

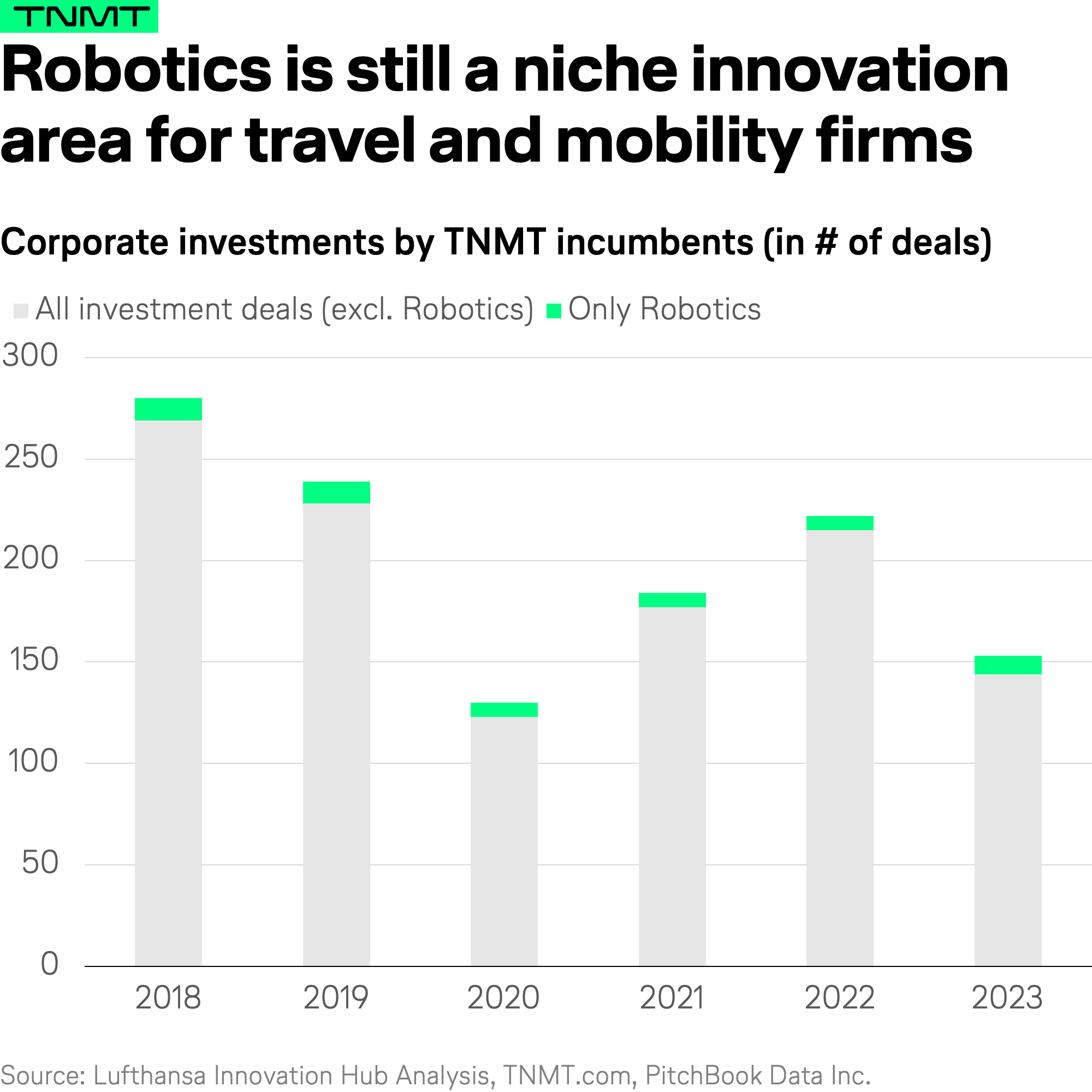

In our 2024 Sector Attractiveness study, we analyzed the investment activities of 60 major travel and mobility corporations, including aviation incumbents. We found that between 2018 and 2023, only 4% of the total number of investments by incumbents in our field were in the robotics sector.

These factors indicate a significant gap in both prioritization and financial commitment towards robotics in aviation, hindering the industry’s potential to harness automation and efficiency gains seen in other sectors.

Embracing Robotics: A Call to Action for Aviation

Given these facts, we strongly encourage airlines and airports to ramp up their experimentation with robotics. The labor shortage is a structural problem that is unlikely to disappear soon. Automation through robotics is not just a nice-to-have; it is a must-have area for aviation stakeholders to ensure smooth and efficient operations.

Despite the upside potential, the current pace of technology adoption in the aviation sector is too slow. As we have seen, other industries like manufacturing have surged ahead, leveraging robotics to achieve significant operational gains. The aviation industry must follow suit, prioritizing robotics and committing the necessary investments to explore and implement these technologies.