If you’ve been a long-time reader of TNMT, you might recall the days when we extensively covered the unicorns in our sector—those startups boasting valuations of over $1 billion USD.

However, since mid-2021, we stepped back from analyzing and reporting on the Travel and Mobility Tech unicorn club.

Why?

During that period, paper valuations skyrocketed to unprecedented levels, quite clearly disconnected from actual business fundamentals like revenue, let alone profitability.

So many startups were reaching the much-cited $1 billion USD valuation mark without demonstrating real-world traction (meaning non-VC subsidized user growth) that we lost interest. The exclusivity of the unicorn club had vanished, and so had the insights you could once derive from looking at who made the list.

But after a three-year hiatus, we’re diving back into a current snapshot of the billion-dollar startups that are potentially reshaping the future of the travel and mobility industries.

Why now?

- We now find ourselves in a new financial environment where startup valuations are being recalibrated, aligning more closely with actual market traction. While overhype hasn’t disappeared completely (and likely never will), valuations are now more grounded in tangible performance outlooks.

- The past few years have brought significant changes to the sector’s unicorn landscape. Many former unicorns have exited (more on that below), while new players have emerged—especially ventures that have grown and thrived in the post-pandemic, post-cheap-money era. It’s important to recognize who these new players are to understand where travel innovation might be heading.

With these shifts in mind, it’s time to refresh our understanding of the most promising companies leading the sector in investor expectations.

Let’s take you through a detailed overview of the unicorn trajectory in Travel and Mobility Tech over the past three years.

The 2021 Unicorn Surge: Where It All Started To Go Wrong

Let’s begin by examining the high-level trajectory of the unicorn list as we saw it in 2021, the year we paused our reporting.

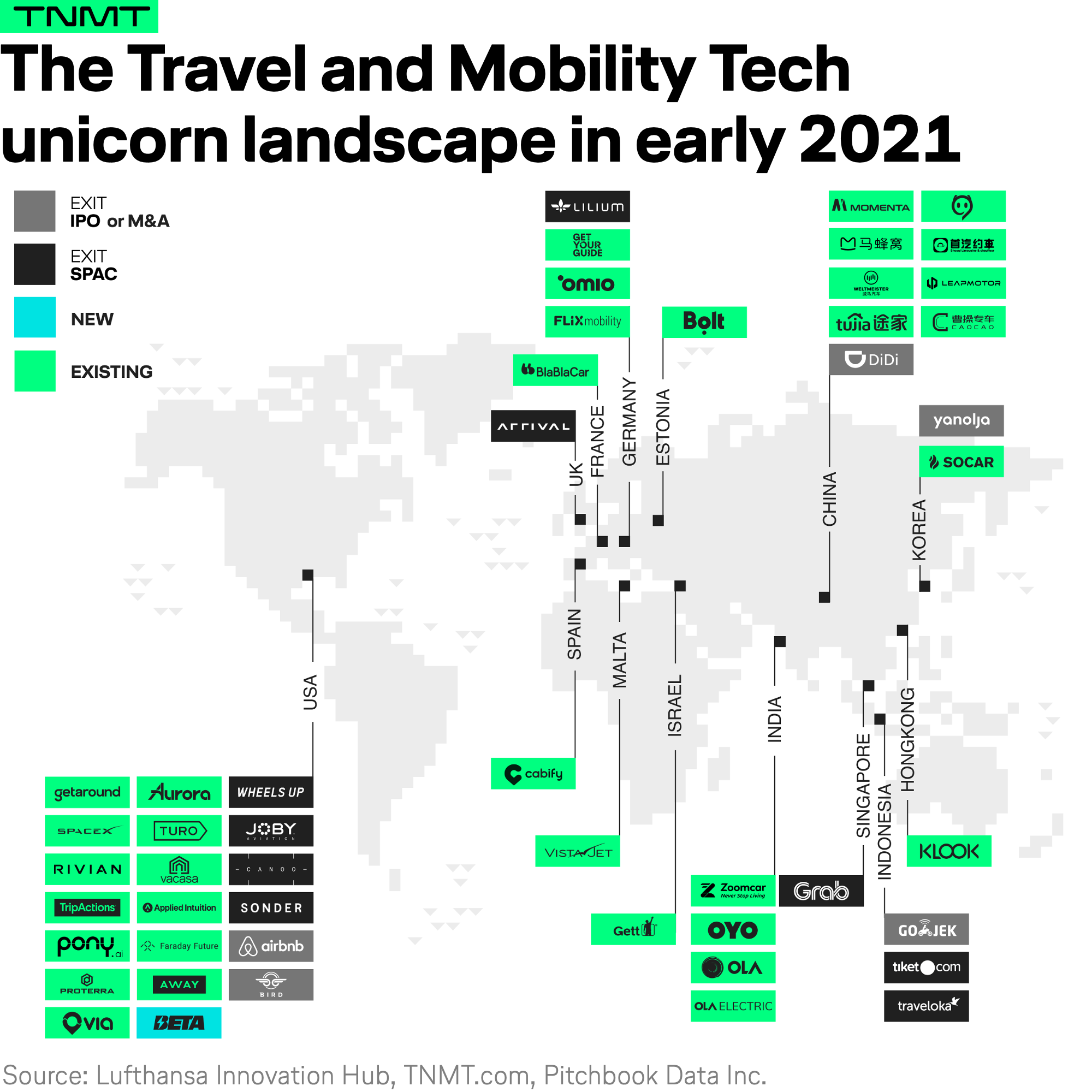

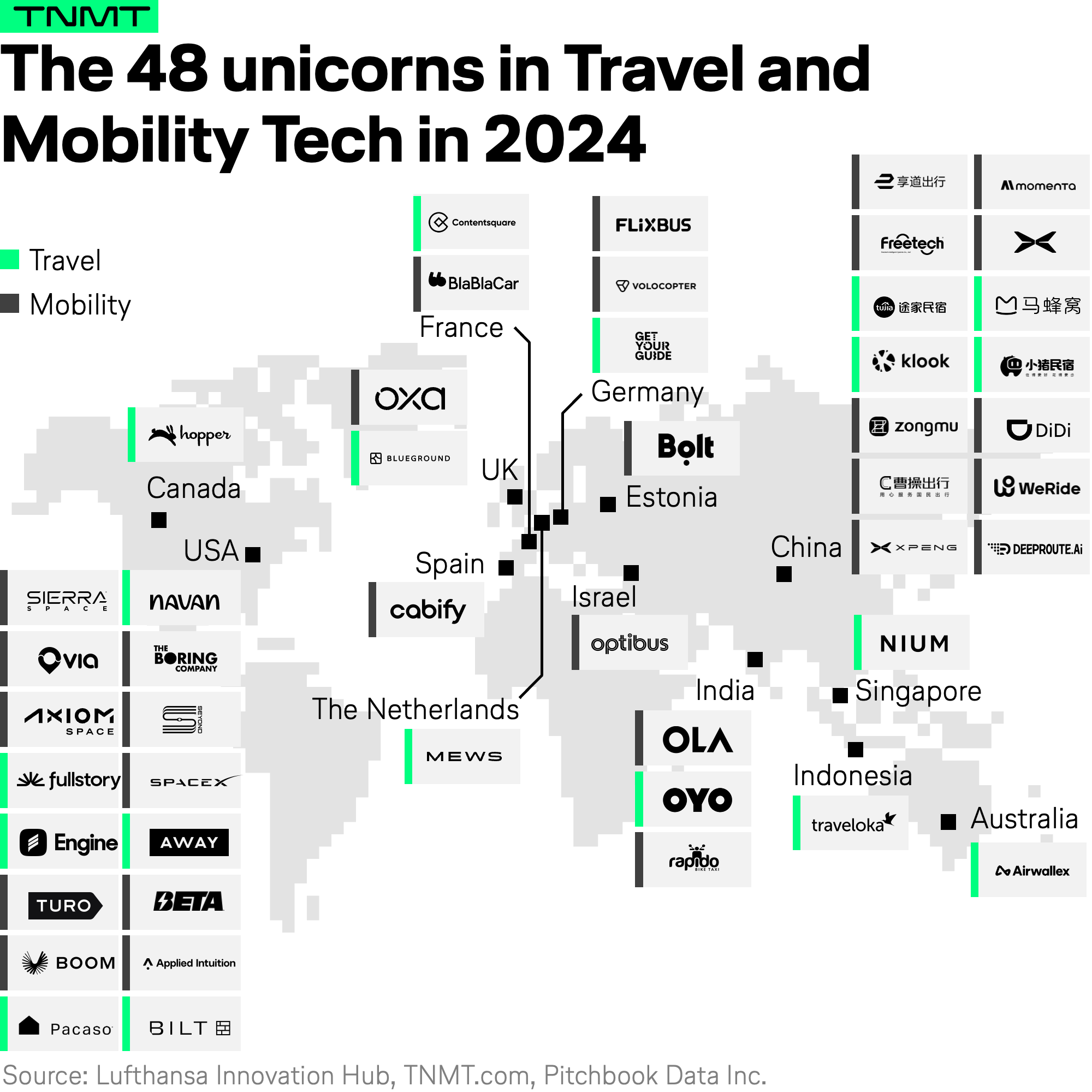

At the start of 2021, we had identified 36 companies in the Travel and Mobility Tech sector with valuations exceeding $1 billion USD. Below is the global landscape at the time, with several companies rumored to be exiting the list due to scenarios such as mergers and acquisitions (M&As) or initial public offerings (IPOs).

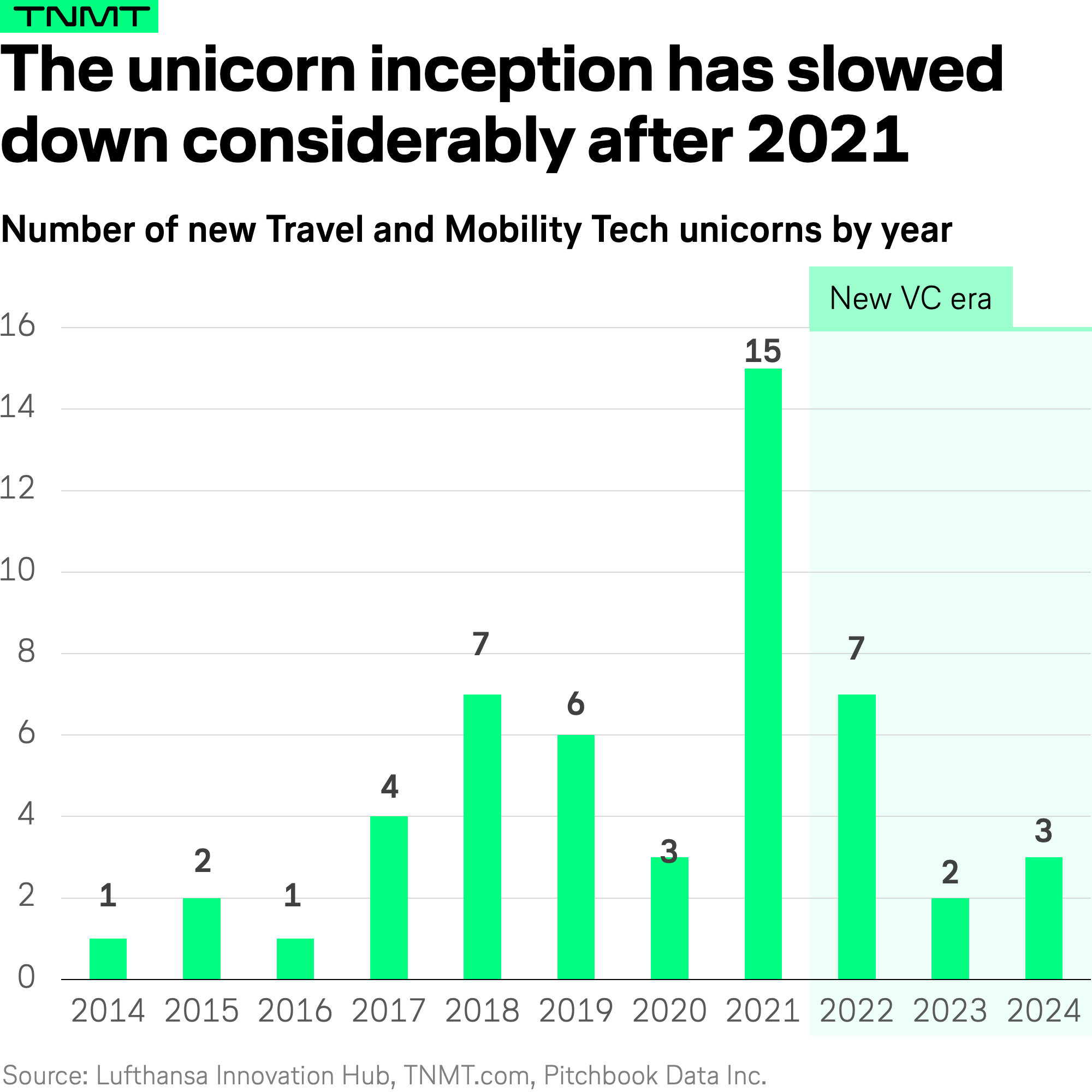

However, over the remainder of 2021, the list of unicorns expanded exponentially, reaching 49 firms by the end of the year.

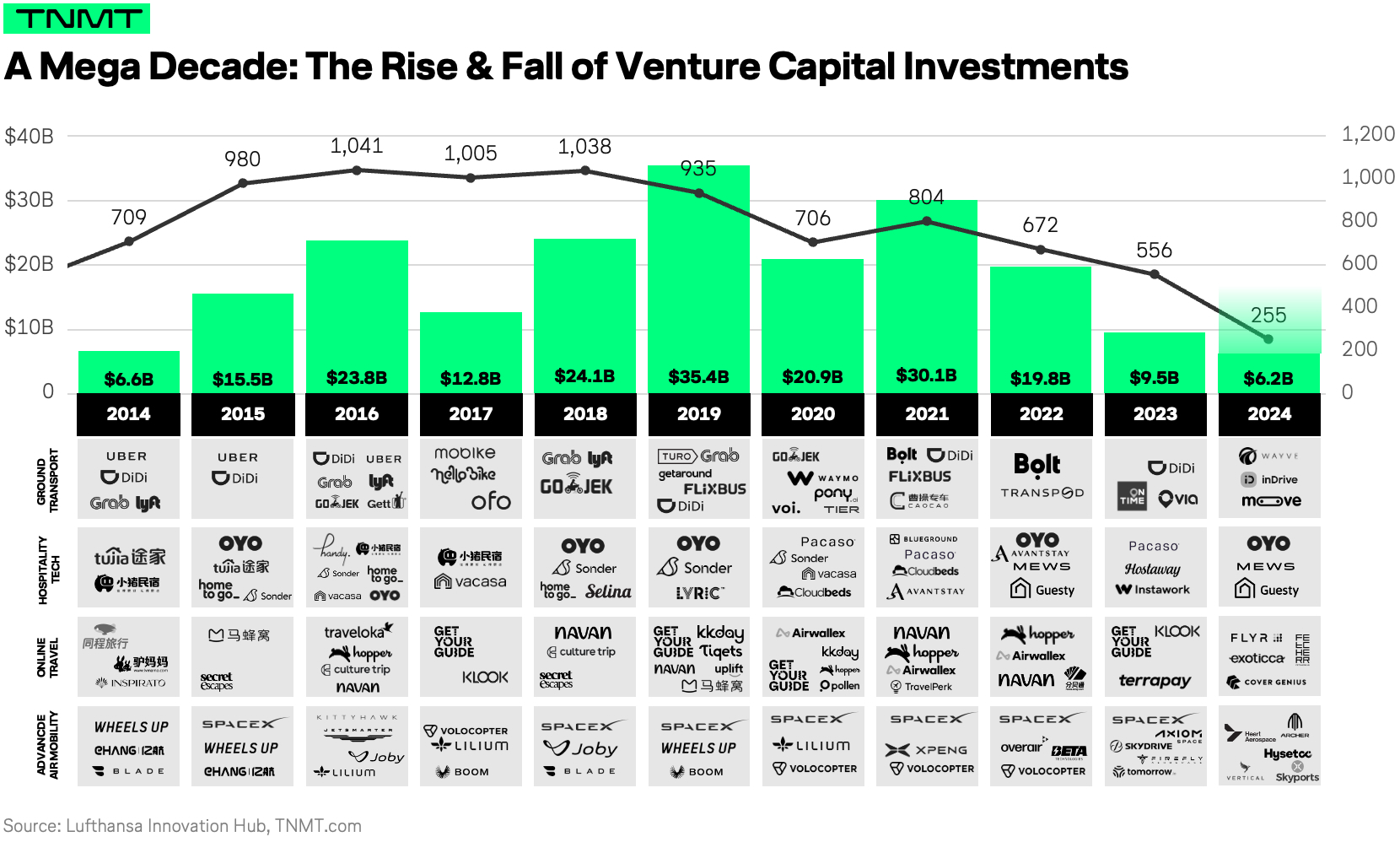

This surge coincided with an explosion in venture capital (VC) funding, which reached a record high of $44 billion USD for Travel and Mobility Tech in 2021; see our 2021 Funding Report.

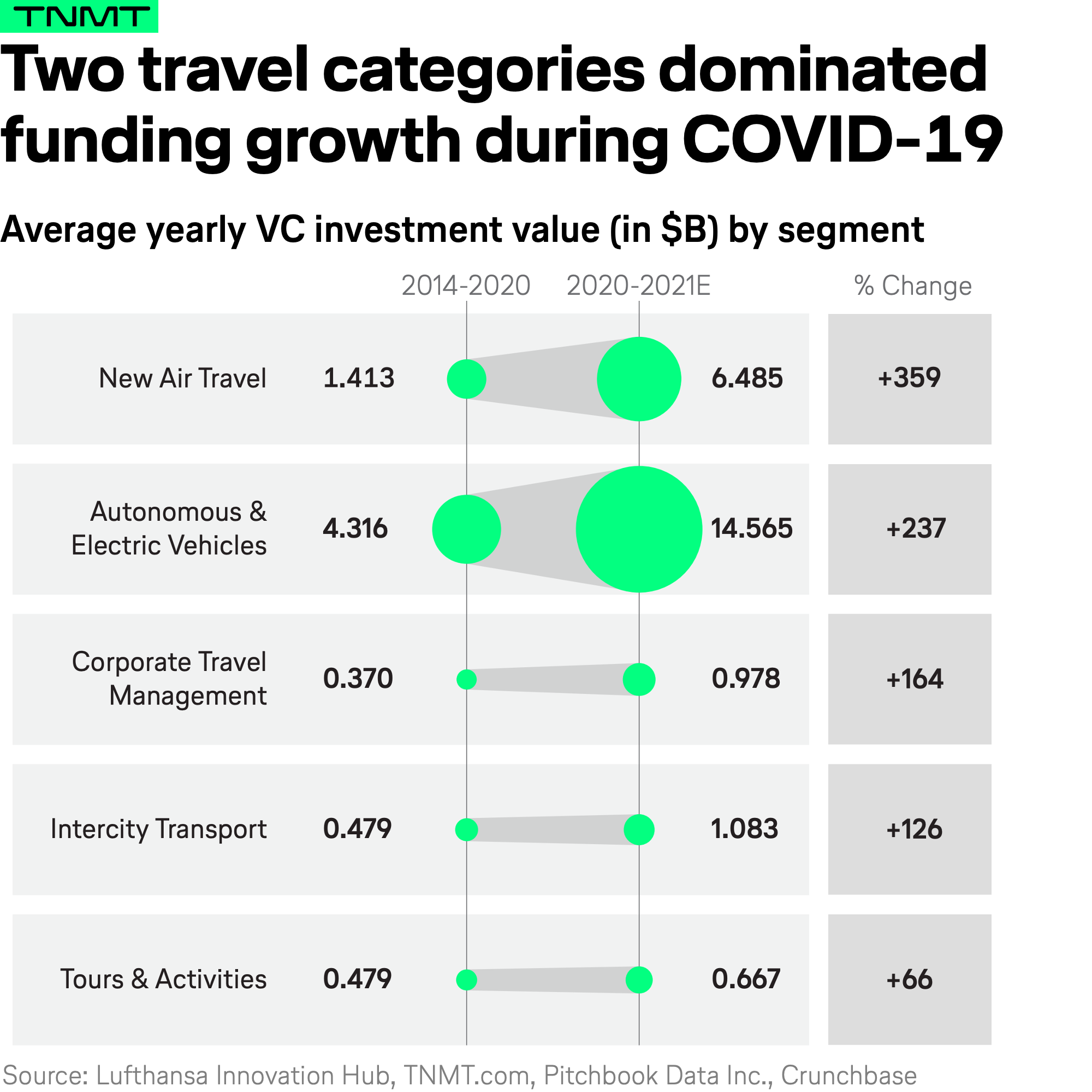

The spike in VC funding and unicorn valuations was largely fueled by VC dollars flowing predominantly into late-stage deals, particularly in sectors like Autonomous Driving and what we call New Air Travel—covering air-taxi services (eVTOL), space tourism, and Uber-like on-demand aviation startups.

Three notable unicorn formations from this period include:

- Volocopter: The German eVTOL company became the first in its category to achieve unicorn status in 2021, after securing $242.96 million USD in a Series D funding round.

- Didi Autonomous Driving and Deeproute AI: Both based in China and focused on autonomous driving, these companies each raised $300 million USD in their respective funding rounds in 2021, securing their place in the unicorn club.

From 2022 Onwards: A Major Turn for Unicorns

Then 2022 arrived, and with it came a massive shift. Rising interest rates across the globe in developed economies and an uncertain economic outlook caused a significant downturn in the broader VC landscape, which had a direct impact on fundraising and valuations within the Travel and Mobility Tech sector.

As we highlighted in our 2022 TNMT Sector Attractiveness Report, investor priorities shifted away from high-risk VC investments, and the rate of unicorn births slowed considerably.

This change led to a significant reshuffling of the unicorn list.

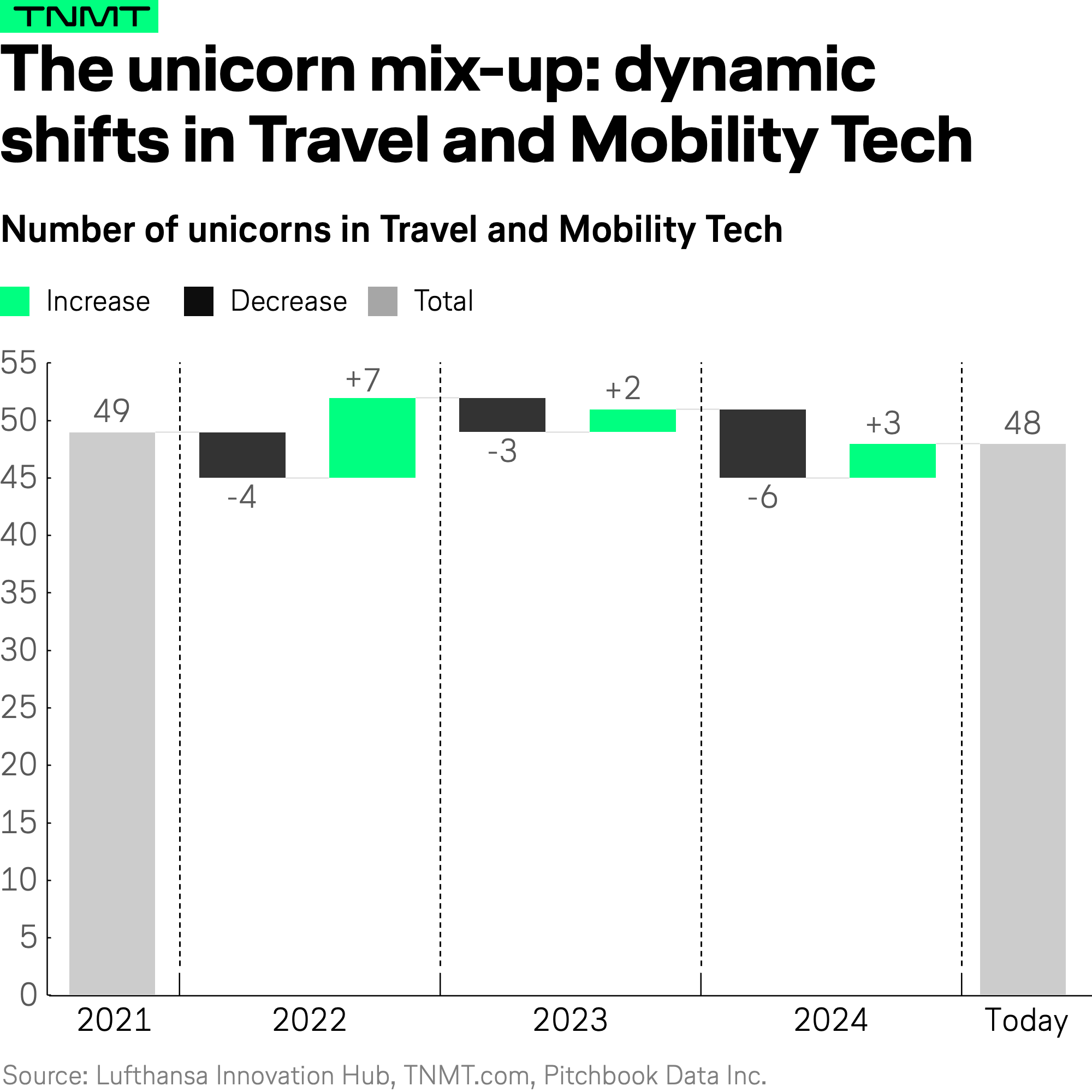

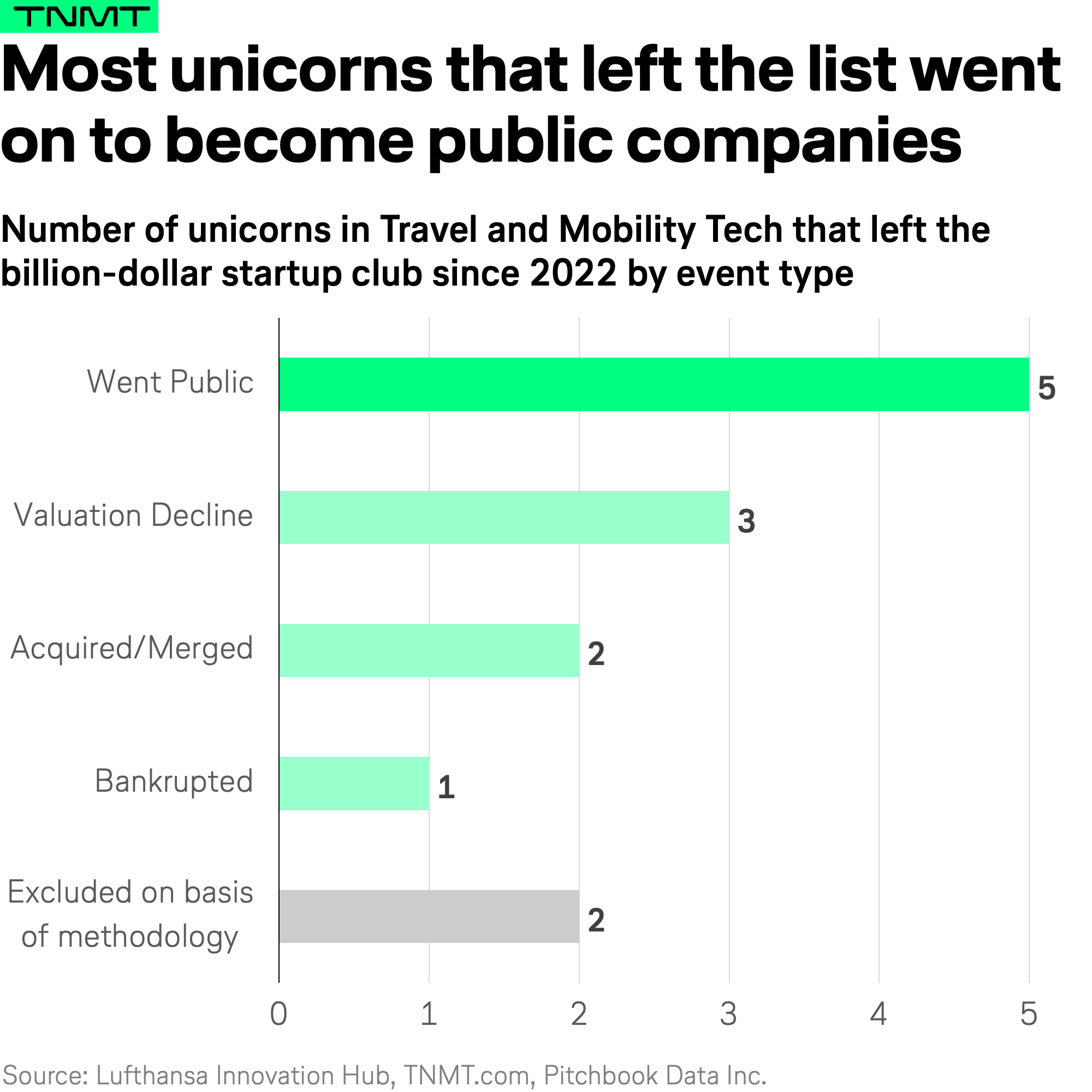

In less than three years, 13 former unicorn companies disappeared from the list—the largest reduction we’ve seen in such a short timeframe.

While this period also saw the formation of 12 new unicorns (which we’ll talk about below), the stagnant nature of the unicorn club over the past three years marks a new era in the startup world—one where radical visions and theoretical market outlooks are no longer enough to sustain billion-dollar price tags.

So, what happened to the 13 firms that left the list?

Let’s take a quick look at their fates and the forces behind their exits from the unicorn club.

The Unicorn Shakeout: Why Companies Dropped Off

At first glance, the reasons why 13 companies left the unicorn club over the past three years might seem encouraging. Most of these firms achieved what many startups dream of: entering the public markets—usually the ideal exit for any ambitious tech company.

However, a closer look reveals that much of this IPO activity was fueled by SPAC mergers, which, while seen as an innovative financial engineering move at the time, later proved to be a “cheap” workaround for the traditional IPO process. As we discussed in our SPAC deep dive, this method primarily benefited overhyped tech startups, for example, in mobility, where big visions and PR campaigns often overshadowed actual business fundamentals.

Take Getaround, for example:

- The UK-based car-sharing company exited via SPAC merger in December 2022 and went public on the New York Stock Exchange shortly after.

- However, the company’s stock price took a drastic hit—plummeting from $10 USD in late 2022 to under $1 USD by early 2023, a threshold it has been unable to break.

- As a result, the NYSE issued a delisting notice and suspended trading of Getaround’s stock in 2024.

Given these shaky outcomes, the IPO movement of the past few years must be taken with a grain of salt. The more common exit scenarios for unicorns in this period, when excluding the SPAC wave, have been acquisitions, downrounds, and, in the worst cases, bankruptcy.

Here are the most notable examples from recent months:

Acquisitions

- TIER: The Berlin-based shared micro-mobility company, once valued at over $1 billion USD, was acquired by Dott for €60 million on March 26, 2024.

- Gett: The UK-based black-cab ride-hailing company was acquired by Pango Israel for $175 million USD on May 9, 2024.

Downrounds Leading to Valuation Declines

- Omio: The Berlin-based travel booking platform saw its valuation drop from $1 billion USD in 2021 to $930 million USD by May 2022. The company has been managing debt financing since it first reached unicorn status in 2018.

- FLYR: This U.S.-based developer of a revenue management platform was valued at $1.15 billion USD in September 2021. However, by 2023, its valuation had dropped to $624 million USD, before rebounding sharply to $900 million USD in August 2024.

- Voi: The Stockholm-based micromobility rental service provider, long considered one of the globally leading e-scooter and bike-sharing contenders, reached unicorn status in December 2021 with a valuation of $1 billion USD. However, by March 2024, its valuation had dropped to $380 million USD, stripping it of unicorn status.

Worst Case Scenario: Bankruptcy

- Weltmeister: The Chinese EV company once valued at over $5 billion USD in 2020 saw a series of failed exit attempts. After unsuccessful attempts to go public on the Hong Kong Stock Exchange (Dec 2022) and through a SPAC (Sep 2023), as well as a failed acquisition attempt by Kaixin Auto Holdings in October 2023, the company finally filed for bankruptcy in the same month.

In summary, the Travel and Mobility Tech unicorn landscape over the past three years has largely been characterized by contraction and consolidation.

However, that’s not the full story—there are emerging newcomers that signal a fresh wave of innovation, which brings us to the most important section of this analysis.

The New Unicorns: A Fresh Era of Billion-Dollar Disrupters

Let’s shift our focus to what truly matters—examining the new unicorns that have joined the elite club since the beginning of 2022. This period marked the start of a new era in venture capital, as we discussed earlier, and unicorn formations have become much rarer, returning to the original meaning of exclusivity.

Since 2022, a total of 12 new companies have entered the unicorn list, with five of them joining in the last 24 months.

But what sets this new breed of billion-dollar travel and mobility disruptors apart?

Let’s dive into three key insights we’ve identified from studying the characteristics and backgrounds of these 12 emerging unicorns.

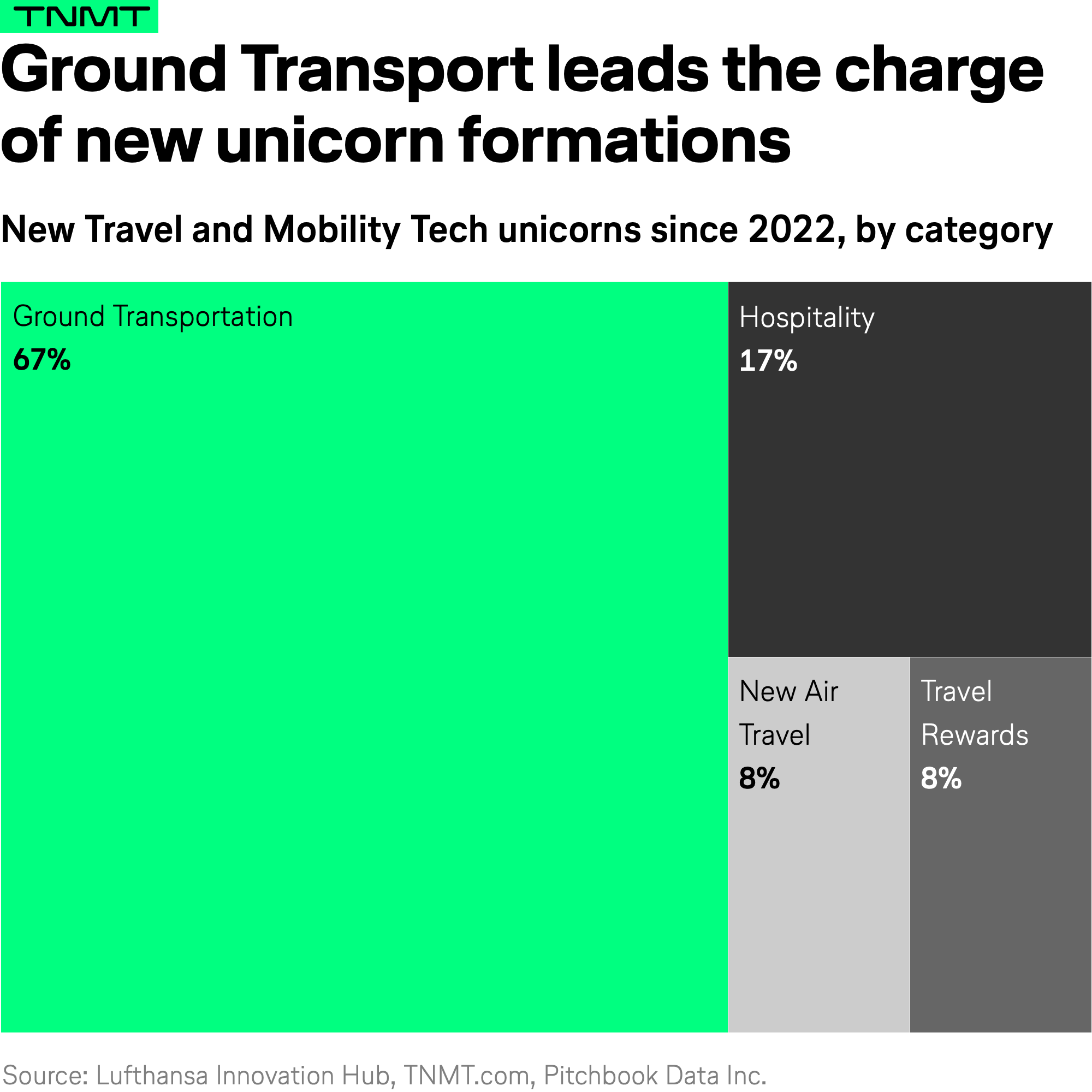

Key Insight #1: Ground Mobility Dominates the New Unicorns

A closer look at the 12 new unicorns that have emerged since 2022 reveals a clear trend: the majority of these companies are focused on ground mobility.

Despite the shift into a new era of startups, many of these unicorns continue to follow pre-pandemic and cheap-money era trends, with sectors like ride-hailing, car-sharing, micromobility, and—most notably—autonomous driving leading the charge.

So why is this the case?

Autonomous driving, in particular, remains one of the most sought-after innovations in the mobility space, and it is poised to transform how we travel from point A to point B. After years of overhyped expectations and ambitious timelines that turned out to be unrealistic, the momentum behind autonomous driving seems more real than ever, with several companies now launching real-world commercial operations.

Here are a few key examples driving this shift:

- U.S.-based company Waymo has launched fully autonomous taxi services in Phoenix, Arizona, and San Francisco, California.

- China is emerging as a global leader in the adoption of robotaxis, largely driven by Baidu. The company’s Apollo Go service has been rolled out across major urban centers, including Beijing, Shenzhen, and Wuhan. Wuhan, in particular, serves as Baidu’s flagship hub, with a fleet of reportedly more than 400 robotaxis contributing to the nearly 900,000 rides the company provided across China in Q2 2024 alone.

With robotaxis gaining real traction globally, it’s clear that autonomous vehicles will continue to be a major force in the ground transportation sector and, hence, also in our Travel and Mobility Tech unicorn list.

This trend also plays a critical role in the regional distribution of these new unicorns, leading us to Key Insight #2.

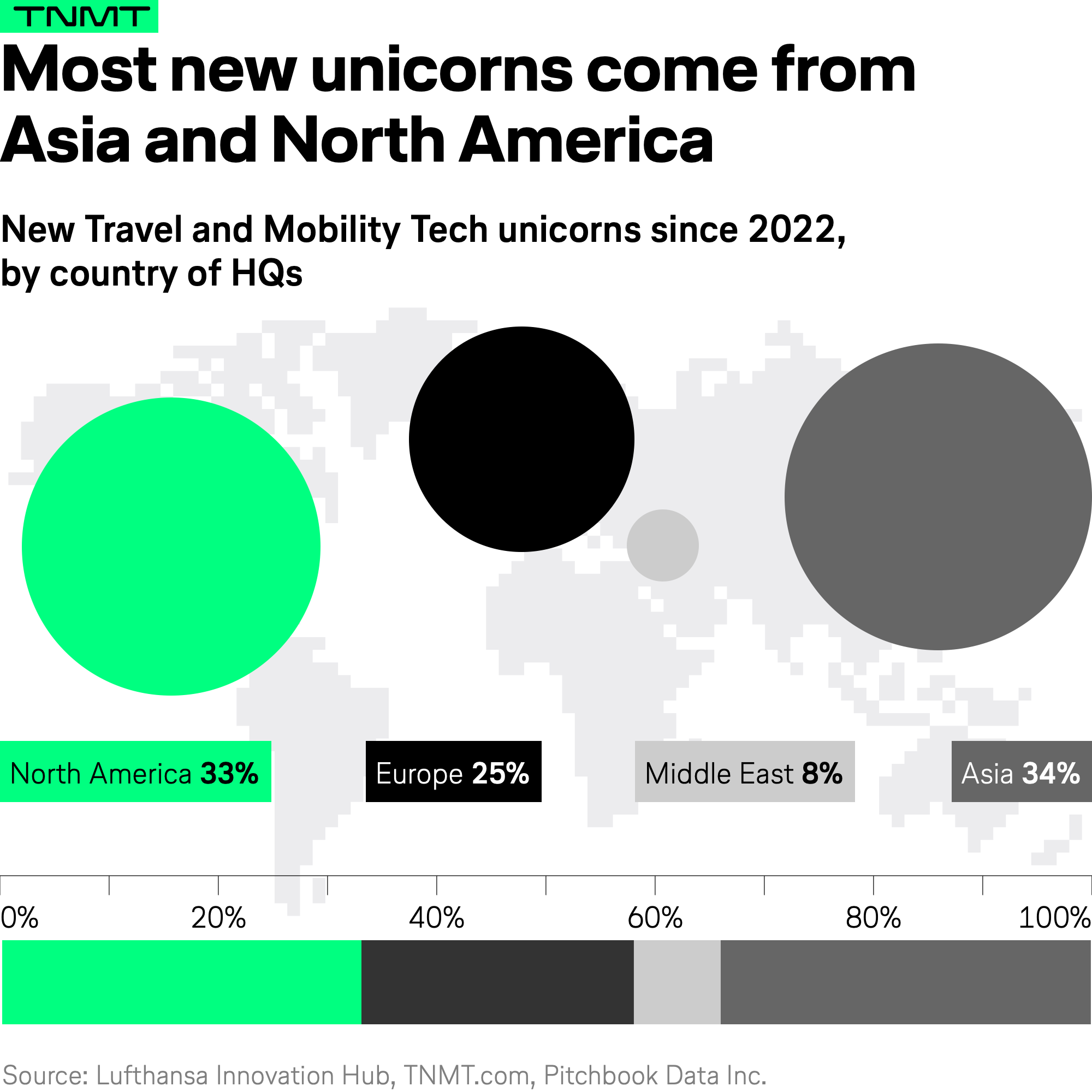

Key Insight #2: Asia and North America Lead, But Europe Is Gaining Ground

Unsurprisingly, given the duopoly in autonomous driving technology, Asia and the United States continue to dominate the Travel and Mobility Tech unicorn landscape.

- In fact, nearly 70% of current unicorns in the sector hail from these two regions.

- This trend is not entirely new—our 2021 unicorn mapping revealed a similar dynamic, with Asia and North America leading the way.

However, subtle shifts are beginning to take shape.

While Asia and North America remain the dominant regions for new unicorn formations, their dominance is slightly waning as Europe begins to take a bigger share of the pie. In fact, two of the three companies that joined the unicorn club in 2024 are, indeed, European. These companies stand out for their classical travel-tech focus, unlike their more mobility-centric peers.

- Mews: This Netherlands-based hospitality tech company leverages cloud-based property management software to streamline check-ins, guest management, and operations. Founded in 2012, Mews earned its unicorn status in March 2024 with a valuation of $1.19 billion USD, following a $109.43 million USD Series C funding round. Despite the challenging funding environment, Mews is leading the digitalization of hospitality providers in Europe. This digital shift has become increasingly necessary as the hospitality industry grapples with low levels of tech adoption and persistent staff shortages, amplifying the need for automated operations.

- Blueground: Founded in 2013, this UK-based company provides fully furnished and flexible rentals for extended stays, popular among business travelers and digital nomads. Blueground earned its unicorn title with a $1.02 billion USD valuation in March 2024, following a $45 million USD Series D funding round backed by investors like WestCap. Importantly, the company has grown rapidly across the U.S., Europe, and the Middle East, positioning itself as a significant rival to Airbnb. However, unlike Airbnb, Blueground focuses on stays ranging from a few months to a year, addressing the growing demand for long-term, adaptable accommodations—a trend driven by Blurred Travel, a phenomenon we’ve explored extensively in the past.

Key Insight #3: A Stagnation in Core Travel-Tech Innovations

One of the most striking observations over the past three years is the lack of movement in core travel-tech innovations—the kinds of disruptions that transform how we inspire, book, and experience travel.

While companies like Mews and Blueground belong to the travel-tech space, their focus on hospitality tech doesn’t address the core travel journey of going on holiday or business trips (or both).

This stagnation is disappointing, signaling that the visionary, transformative innovations many have anticipated as part of the travel recovery comeback post-pandemic—those that could truly reshape how we vacation—are not in sight. At least not on a level of mass adoption that would lead to unicorn status.

That said, the overall unicorn club still includes several classic travel-tech players that continue to shape the ecosystem; see here.

Notable examples include:

- Traveloka: Southeast Asia’s leading online travel company, offering flight and hotel bookings along with a wide range of travel services, including attractions and activities.

- Mafengwo: A Chinese travel platform providing user-generated travel guides and social media-like community features for trip planning.

- Navan (formerly TripActions): A U.S.-based platform offering corporate travel and expense management solutions.

- Klook: Asia’s top platform for booking experiences, attractions, and travel services.

- GetYourGuide: A Berlin-based platform specializing in booking tours, activities, and attractions worldwide.

- Hotel Engine: Simplifies corporate hotel bookings for businesses.

- ContentSquare: An experience analytics platform helping travel companies improve their digital user experiences.

- Hopper: A U.S.-based mobile app that uses AI to predict and recommend the best times to book flights and hotels.

- FullStory: A digital experience analytics company enabling travel businesses to optimize customer interactions.

While these companies are significant players in the travel-tech ecosystem, they are not new to the unicorn club. We’ve yet to witness the emergence of truly disruptive new entrants in the travel-tech space over the past three years.

However, one area showing interesting signals of innovation is the financialization of travel-tech—where fintech solutions intersect with travel.

- This trend is represented by unicorns like Bilt, a rewards program that allows users to earn points on rent payments, which can be redeemed for travel-related expenses.

- Similarly, Nium, a global payments platform, enables businesses, especially travel firms, to efficiently send, spend, and receive money across borders.

- Another notable player, Airwallex, simplifies cross-border transactions, making it easier for travel companies operating in multiple markets to manage their international payments.

Looking ahead, it remains to be seen whether travel-tech will reclaim its mark within the unicorn club—especially as Generative AI accelerates the rise of new startups in the travel-booking space.