There’s a single question on everyone’s lips in the Travel and Mobility Tech industry today: how will we recover from the Covid-19 pandemic that has slammed travel in ways we’ve never seen before?

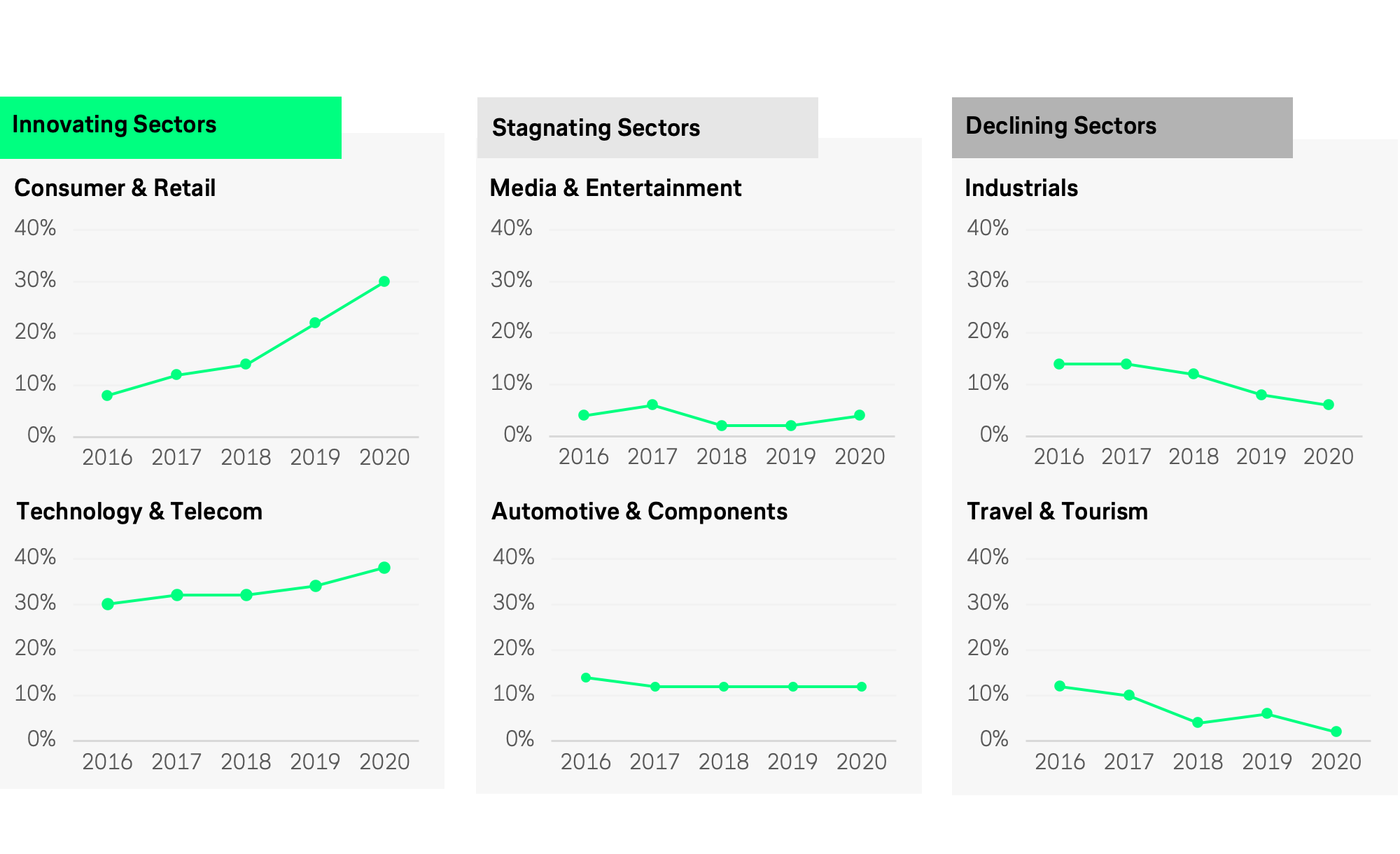

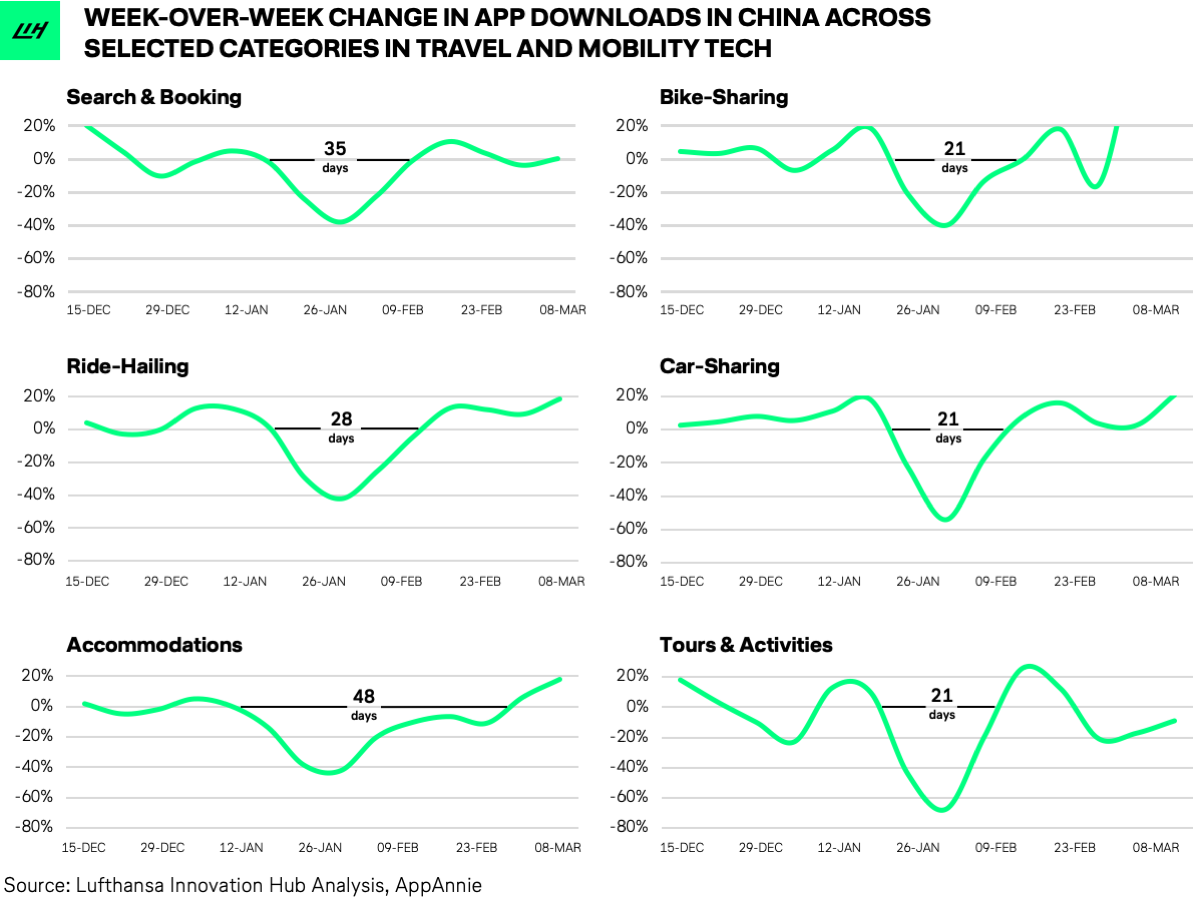

At the end of March, we took a first shot at this question by analyzing several indicators for travel demand, particularly week-over-week app download trends across various travel-related segments in China (see the full article here). We saw that China had quickly overcome the initial Covid-19 panic phase and was gradually entering recovery mode following a return of interest in travel. This was an encouraging sign. One that we hoped could apply to the global travel industry.

Our rationale at the time was that China could be an example of what the future might look like in two months for us here in the West, thereby providing a possible path forward.

Two months later, we are now able to draw a much more comprehensive picture with more data at hand to outline some major future scenarios on how the travel industry might recover over the next few years. Again, we look at China to observe how travel demand has developed over the previous weeks to speculate what this might mean for the global landscape.

We want to base our best-educated guess on real-world observations that we can measure rather than theoretical spreadsheet models, which all of the big management consultancies have been excessively mapping out to describe the scenarios for what the new, post-coronavirus world will look like (see latest scenario reports by BCG, McKinsey, Bain, Deloitte, and Roland Berger).

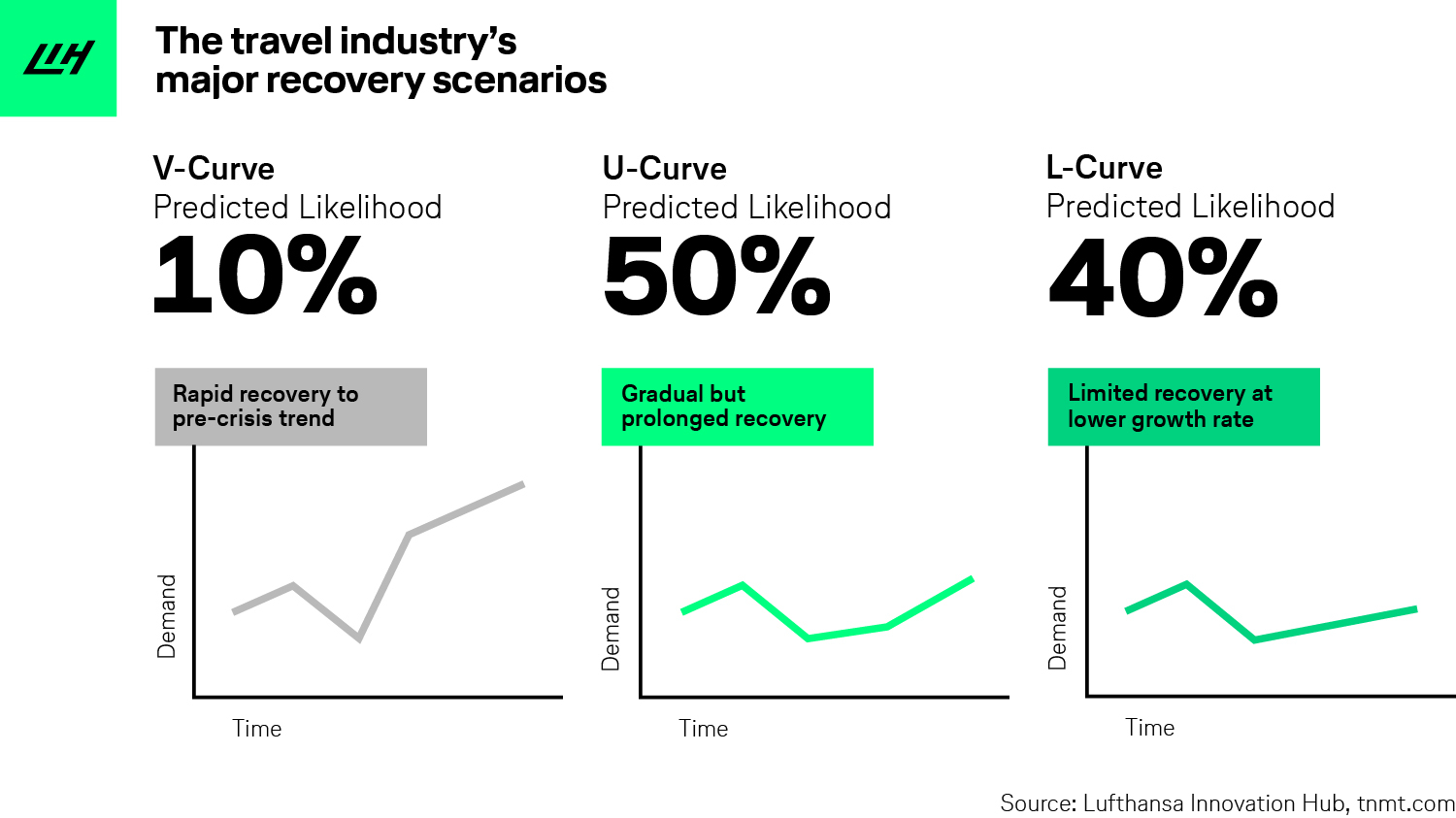

The concrete task we set ourselves was to come up with an educated guess on the likelihood of a V-curve vs. U-curve vs. L-curve progression in the future.

Some technicalities before we start

A couple of remarks to set the stage:

- As an airline-affiliated company, we are certainly biased in our opinion since we have “skin in the game.” We want the travel industry to recover as soon as possible. What follows in this article is simply our best attempt at finding a silver lining.

- We would also like to stress that we are not basing our analysis on the latest Covid-19 case numbers, or data suggesting how the pandemic is being contained through an increasingly effective medical and political response. Of course, the future progression of the travel industry is closely intertwined with how fast the overall economy can reboot, which is driven by how aggressively governments are able to react and come up with a comprehensive and effective plan to guide us into the post-lockdown world. We leave this debate up to the experts in their respective fields. Instead, our focus is on travel-related early indicators only – so we stay within our playing field, even if this means we’re not considering all relevant variables.

- Last but not least, generalizing future scenarios across all the different regions of the world is perhaps a futile task. The Chinese context is unique. Therefore, it is arguably a stretch to build analogous future scenarios for other countries based on data from a single region – especially one that is so unique on various dimensions such as the People’s Republic. We recognize that our findings for China may not be directly transferable to other markets. Still, we hope they offer some value in providing a real-world example of recovery.

Our best-educated guess

This being said, here is our overall assessment as of today. The likelihood of the travel industry progressing down each curve is as follows:

The V-Curve: A Travel-As-Usual Scenario

Likelihood: 10%

Covid-19 has put the entire travel industry in uncharted waters. But there’s always a lot we can learn from the past: according to the Boston Consulting Group, historical flu shocks have, in fact, mostly been V-shaped. In a V-path scenario, an economic shock leads to an intertemporal reduction of demand. But quickly, growth resumes on its original output path.

Looking at our analysis from late March, week-over-week app download trends for various Travel and Mobility Tech categories in China seem to suggest such a V-like return to normal.

However, week-over-week changes might indicate a slightly biased story if you confuse weekly changes with absolute download figures. Here’s the same chart with absolute app download trends (starting values are indexed to 100).

The takeaway: the week-over-week charts show that the initial dip in travel demand in China quickly stabilized after “only” about six weeks of continuous (and dramatic) freefall. However, compared to absolute pre-crisis levels, overall travel interest is far from full recovery. Hence, a V-curve path in its classic definition (based on absolute demand levels) is very unlikely, even in China where the virus outbreak was controlled quite effectively using the latest technology (which we looked at in more detail) and other rather authoritarian initiatives that would be questionable to adopt in the West.

What the charts also tell us is that the recovery mode will be different based on the segments we look at within Travel and Mobility Tech. Not all travel modes are affected equally. The bicycle, for instance, has proven to be crisis-resilient with travel interest and demand crashing down for “only” about 20 days before slowly recovering. This observation is supported by recent BCG survey data, outlining that the usage of both private and shared bikes has actually soared around the world in recent weeks. A similar trend can be witnessed for non-pooled ride-hailing, and car-sharing while classic travel and vacation bookings for hotels, flights, and activities will take significantly longer to bounce back.

What else supports the V-like recovery?

Again, let’s look to the past. It turns out that historic V-like recoveries in the overall economy are usually accompanied by significant monetary and fiscal responses from governments and central banks. It is probably safe to say that the amount of government-backed incentives and cheap credit in recent weeks has been unprecedented. In the Covid-19 version of her annual Internet Trends Report – a touchstone for many investors and entrepreneurs in gauging current and future tech trends – Mary Meeker concludes:

“Recent government-imposed containment actions have necessitated government-funded lending, liquidity, stimulus programs at unprecedented speed, scope, scale, and complexity. In its effort to stabilize and stimulate the weakening economy, the (U.S.) government (alone) has committed over $2 trillion in aid to consumers and the economy while the Federal Reserve has committed up to $2.3 trillion to expand an existing corporate lending program for small medium-sized businesses along with the purchase of municipal bonds. These numbers will likely continue to rise”.

Fiscal stimuli in other parts of the world have also reached never-seen-before dimensions – take a look at Europe.

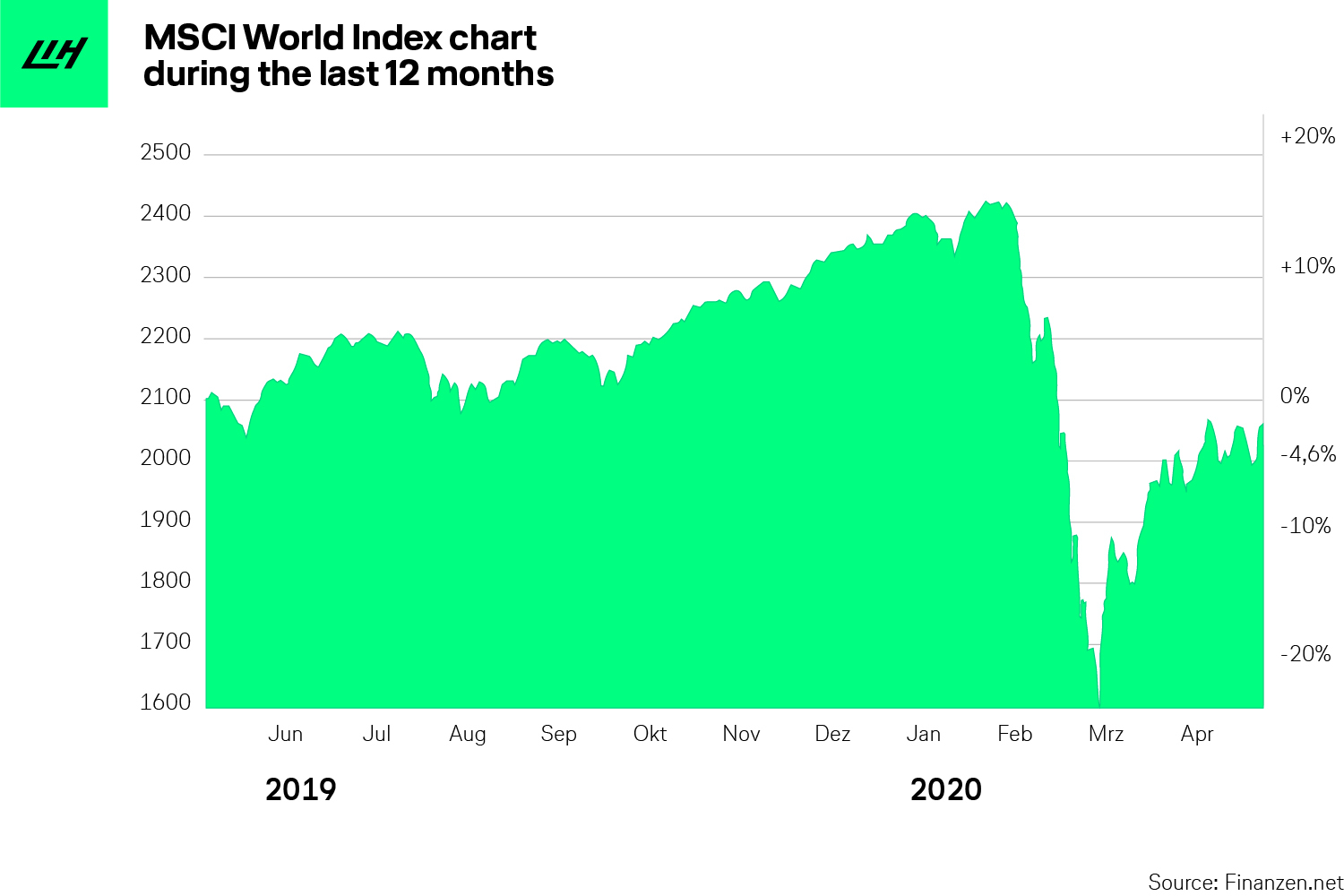

Stock markets recovered rapidly

With such historic level of fiscal support which trumps even that of the 2008 financial crisis, we can’t fully dismiss the possibility of a V-curve like bounce-back. Stock markets have been bolstered by the de-facto unlimited amounts of capital being pumped into the global economy so far. After major stock indices around the world entered the bull market at a record pace, stocks recovered surprisingly quickly, up more than 30% from their March lows – making April the best month for the stock market in over 30 years! So, we actually seem to see the V-shaped recovery priced into capital markets.

Many Wall Street analysts find this recovery path for capital markets quite disturbing, considering the spike in unemployment numbers and the dire economic outlooks we hear about every day. While this trend emphasizes the obvious divergence between equities and the broader economy, it does lift our best guess at a V-curve-like progression for travel from a mere 5% to a slightly better 10% likelihood.

However, our overall assessment is that the belief in a V-like recovery scenario is overly optimistic looking at the broader facts, such as the IMF projecting the worst economic recession since the Great Depression in the 1920s.

The L-curve: A Troublesome New Normal

Likelihood: 40%

It is easy to be trapped in the most pessimistic L-curve scenario these days with companies from all kinds of verticals slashing their revenue and income outlooks. It’s probably the case we should all prepare for. In an L-curve simulation, the Covid-19 shock sends travel and the global economy into a long-term depression with returning growth rates significantly lower than pre-Covid times (if positive at all). The structural impact and damage will likely slow growth rates not only during the upcoming months but for years to come.

A lot of travel analysts and economists predict this bear-case scenario. Some are giving the travel industry a minimum of five years to fully get back up again. Important sectors like corporate travel, events, and conferences might never even recover to pre-Covid levels. What’s the argument for this case? Travel was certainly the first industry to be hit economically by the virus and will most likely take the longest to return. According to the U.S. Travel Association and travel news platform Skift, more than half of the 15.8 million travel-related jobs in the U.S. have already disappeared since the outbreak of this pandemic – driving an unemployment number (51%) that is more than twice the 25% rate the country as a whole experienced at the worst of the Great Depression. What makes the outlook even more depressing: international travel restrictions are expected to exist for many more months, if not years, depending on how long it will take to find a vaccine available for the masses.

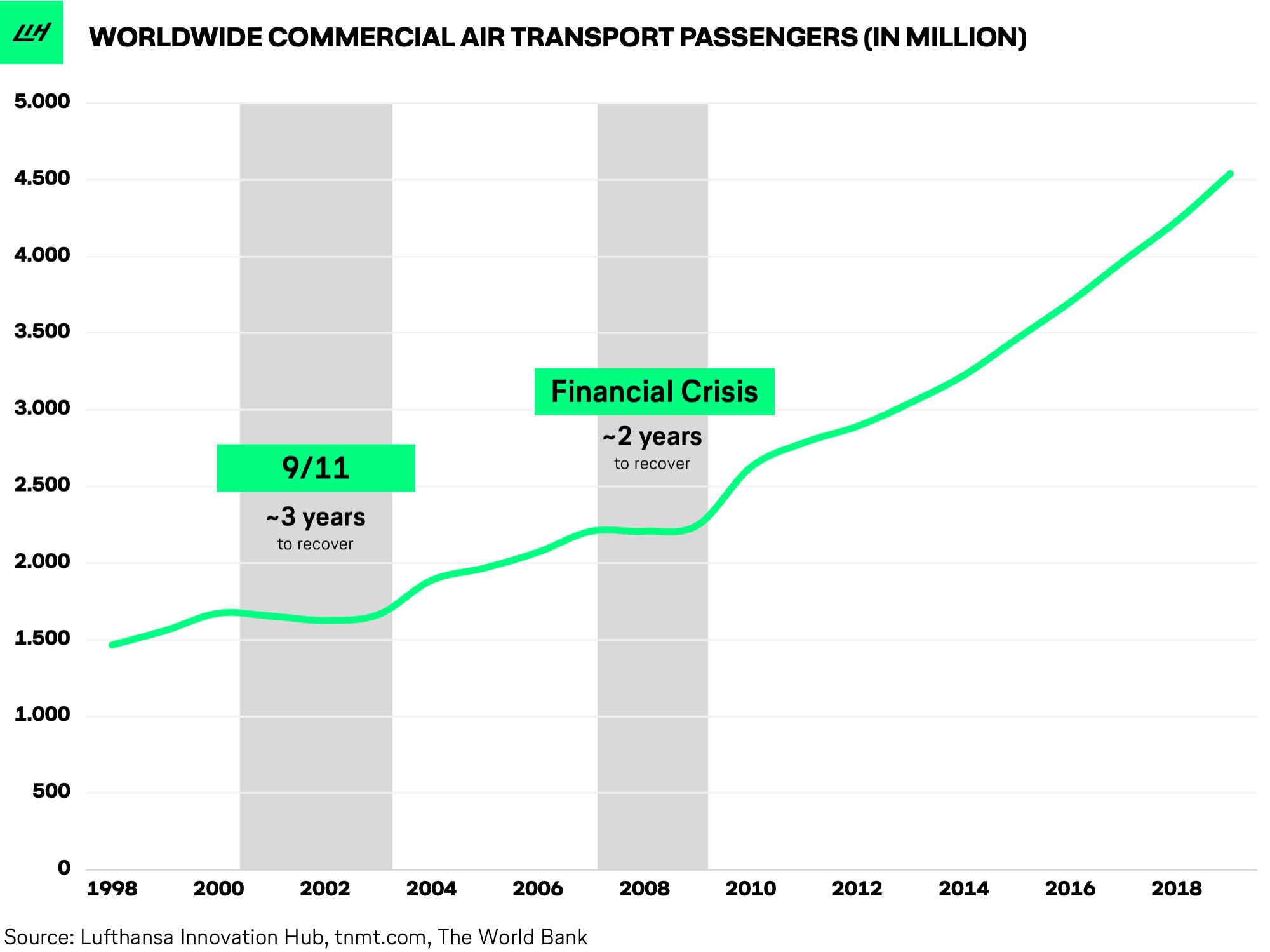

The multi-year recovery cycle is based on previous evidence

Furthermore, previous crises shook the travel industry significantly longer than other sectors. Airlines needed around 3 years to return to pre-crisis passenger levels after 9/11. For the 2008 financial crisis, it took about two years for the equivalent numbers. As such, many airlines, including our parent company, don’t expect flight demand and capacity to return to pre-crisis levels before 2023.

Still, let’s not get lost in this dark scenario. It is important to emphasize that even if we do get stuck in the L-curve temporarily, it will most likely be due to the wider economic damage and continued government travel bans rather than an issue of structural demand. It’s unlikely that people will lose interest in travel indefinitely or that travel companies will need to imagine a whole new reality where people no longer wish to explore the world.

People won’t stop traveling

The human desire for travel, discovery, and seeking experiences in the physical world will persevere. Yes, there’s talk of the death of business travel and the repulsion of flying in a metal tube at 10,000m with hundreds of other travelers. But these statements probably won’t age well. Similar things were said post-9/11 and post-SARS. Life returns. A new normal emerges. And travel will regain strength, even if it means we all fly with our masks on. Most of us want to travel as soon as the situation improves. And if there’s anything these two months of social distancing have taught us so far, it is that people are already getting cabin fever. They are bursting to get out, whether to go back to their favorite cafe or restaurant, annual family holidays, or overseas adventure trips. Consumer confidence will take less time to return than what most experts suggest.

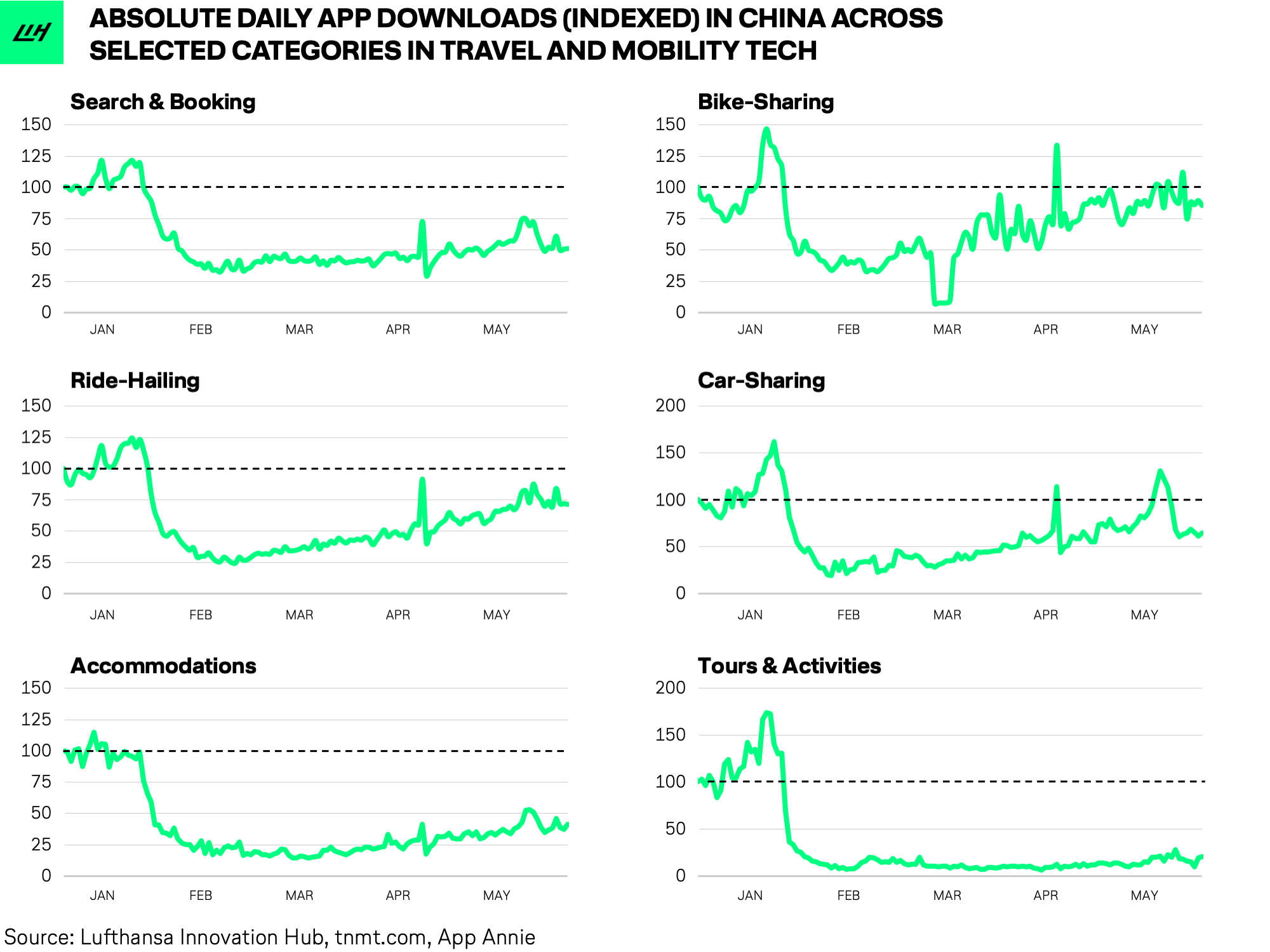

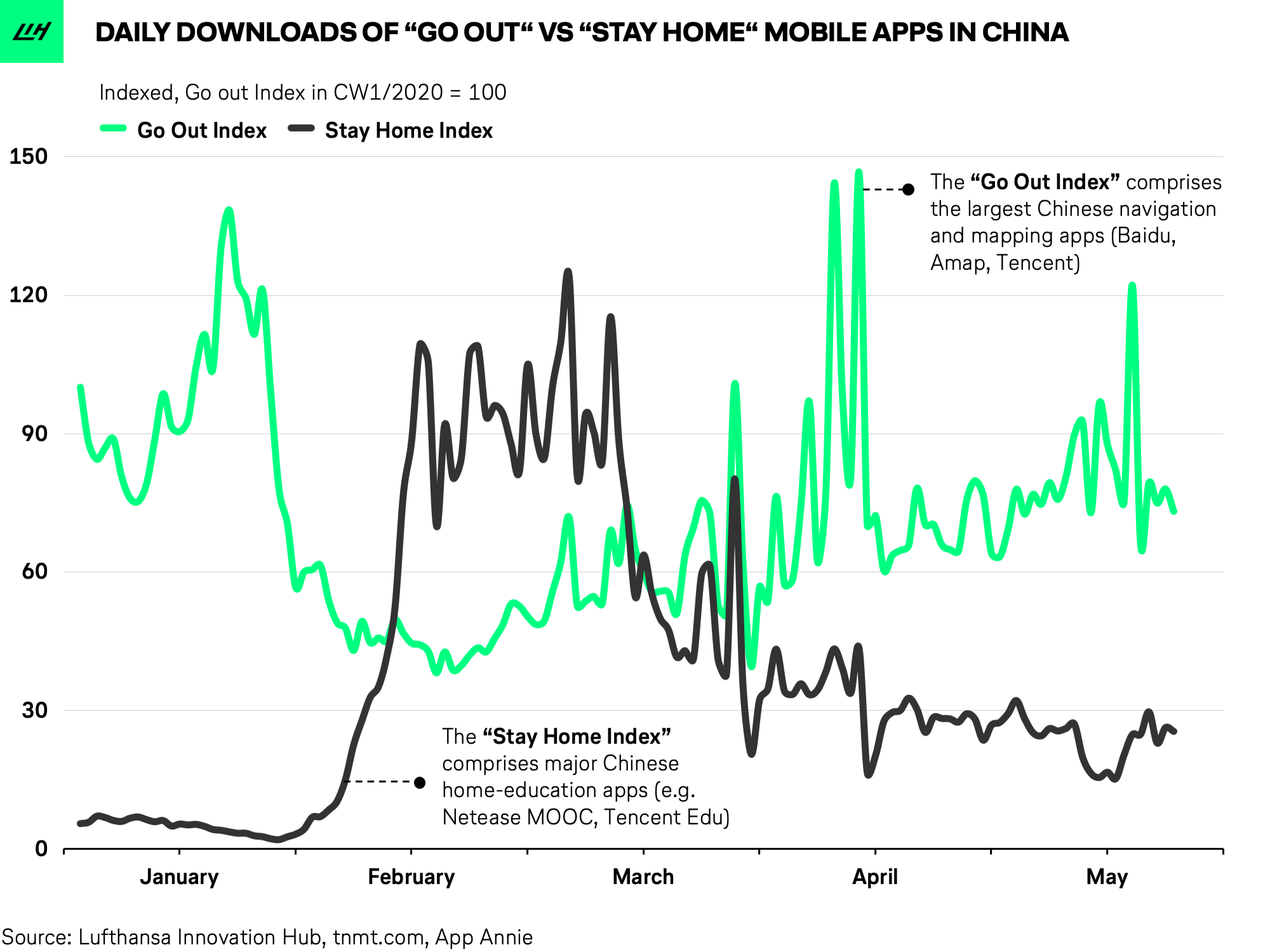

If you have any doubts, check out the Mobility Report released by Google on how inner-city travel behavior has picked up again after loosening lockdown rules in many countries. Our own analysis supports this. We compared how different app categories in China performed over the past three months and can confirm: we will move again. The moment lockdown restrictions were eased, many Chinese exchanged their homes for outside activities as you can see from the graph below.

The U-Curve: A Deferred And Adjusted Normal

Likelihood: 50%

We believe it is too early to accept the L-curve projection, despite the fact that the pandemic is continuing to slam not only the travel industry but many other sectors in an unparalleled manner. The IATA forecasts a whopping $314 billion revenue loss and 25 million jobs at stake for the aviation industry alone.

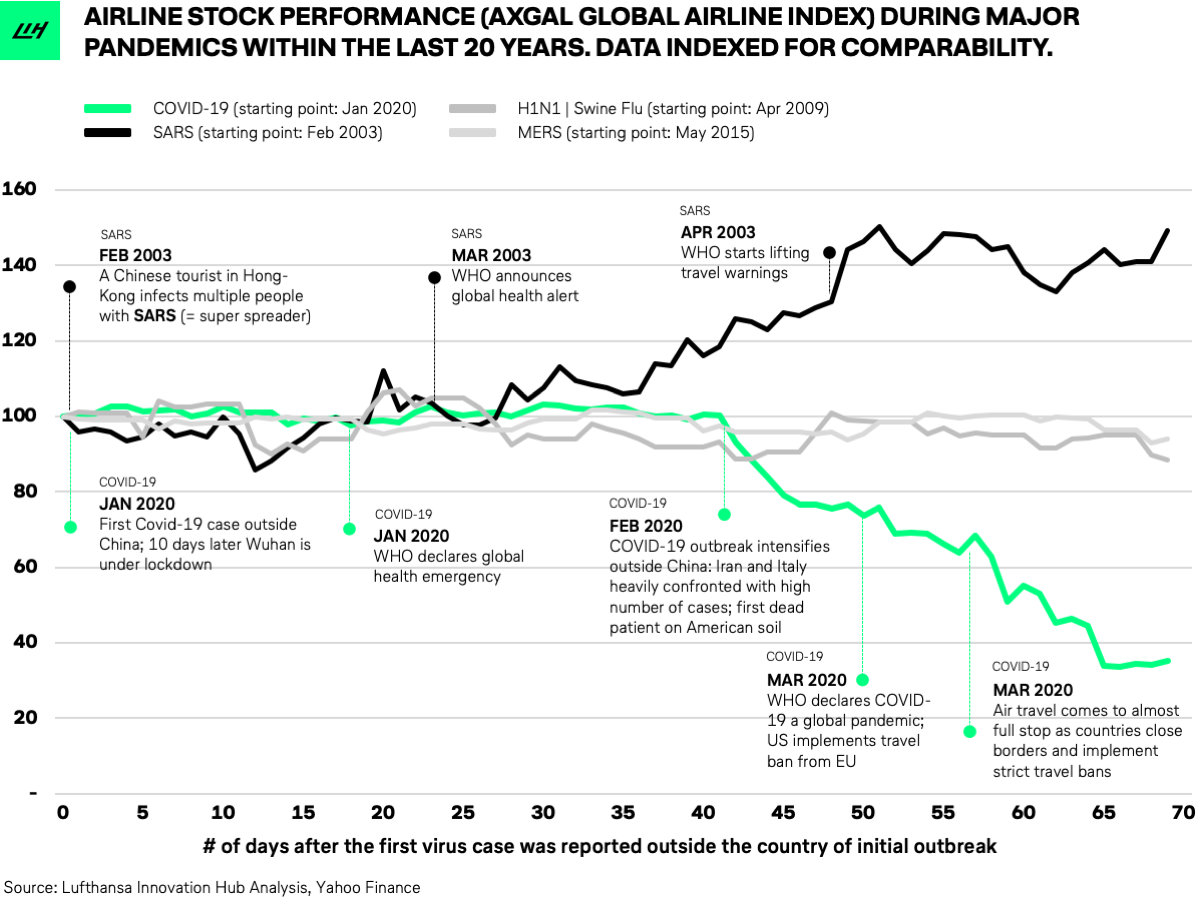

On the other hand, any realistic hope of a V-path like recovery feels almost delusional. And while previous virus outbreaks might have followed V-like recovery paths, the Covid-19 pandemic is a different beast. A simple look at the stock market confirms this: while airline stocks remained mostly stable or even gained in value during previous virus outbreaks such as SARS, MERS, and the swine flu, shares took a nosedive in recent weeks.

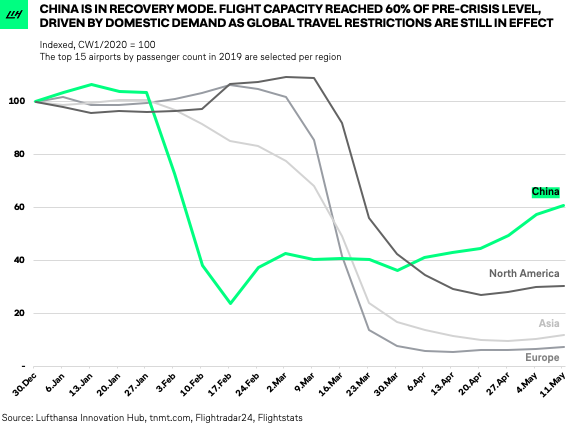

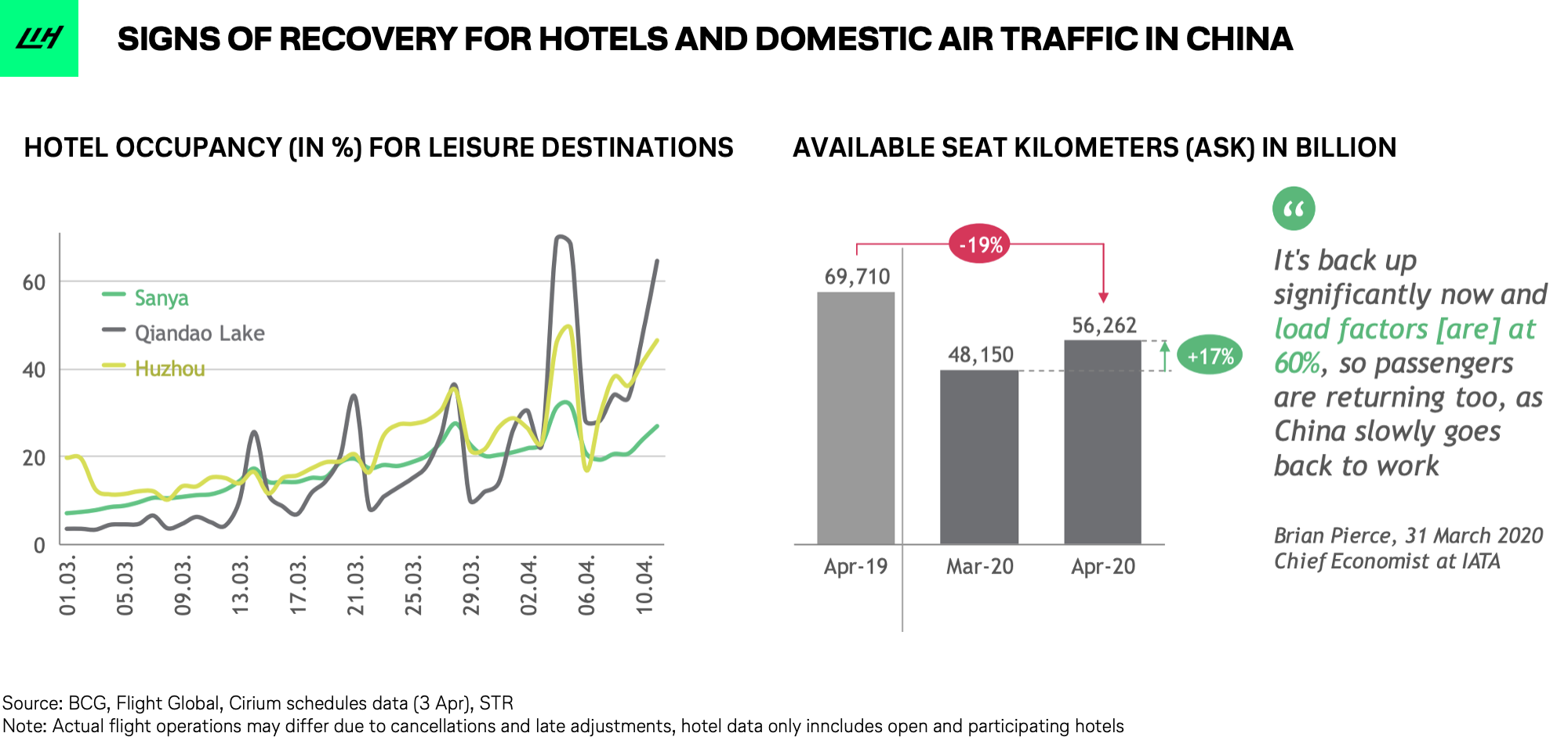

Hence, our bet is on the U-curve type return with a gradual recovery over the next two years. Data from China strengthens this view: our Flight Demand Tracker shows that flight capacity has returned to around 60% of pre-crisis levels with the overall trend line inching slowly upwards.

The positive trajectory is driven by domestic air travel that is back at already 80% of capacity (measured in available seat kilometers vs. last year). Also, hotel occupancy is recovering steadily but surely. Welcome to the U-curve.

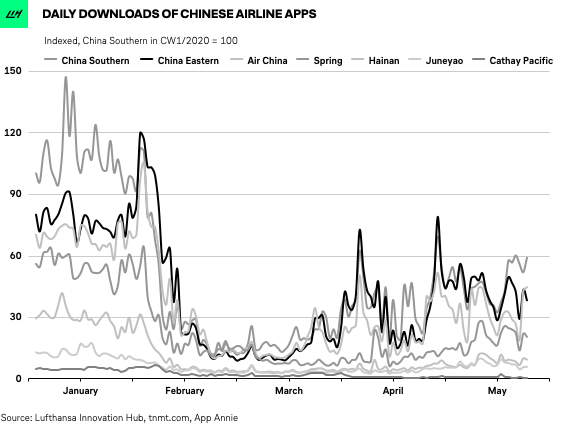

Similarily, also airline app downloads – a powerful early indicator of travel interest – are trending upwards in China, slowly breaking out of the L-shape into a right-tilted U.

Based on all these charts, we don’t believe in the scenario of a long-term structural change to traveler behavior, especially in leisure. We don’t buy into the idea that the world and the notion of travel have changed forever and that human behavior is fundamentally different post-Covid.

BCG’s mid-May consumer sentiment results appear to confirm this: when consumers identify the activities they miss most while waiting out the pandemic, they consistently rank leisure travel number one, across countries, age groups, and income levels, with over 60% agreeing that they “can’t wait to start traveling again.”

As a result, we give the U-scenario a 50% likelihood.

Of course, for the U-curve to become a reality, the underlying assumption is that borders slowly reopen and countries relax strict lockdown policies, allowing people to travel again.

Where do we go from here?

One could argue that it is best to ignore anyone who is predicting what things might look like months or even years from now. None of us have a crystal ball. However, looking at China these days feels like looking into the future. The Far East started battling the virus about 2-3 months earlier than most other countries, especially in Europe and the U.S. China was arguably also the first country to bring the virus outbreak under some control. Data from China suggests that a U-curve path forward seems to be possible. This is certainly the case we want to believe in.

Of course, the major assumption for this scenario is that the virus outbreak can be controlled domestically first and that we will ultimately find a vaccine to allow cross-border travel again without jeopardizing the health of millions of people. Individual countries’ responsiveness and ability to manage the crisis will influence their perception as potential travel destinations. It is a whole new world.

Therefore, our best-educated (and biased) guess is a right-tilted U characterized by a slow but steady recovery.

The reason is simple: people’s thirst for travel is universal.

However, travel restrictions will limit international air travel in the foreseeable future to avoid a second or third infectious wave. We see this in China and South Korea that both faced a second wave of Covid-19 cases before halting most international air travel. This is also visible in the data where we see a big shift from cross border to domestic air travel only.

It seems plausible to assume that domestic travel will rebound first followed by intra-regional travel, as countries reopen borders and consumer confidence grows. But it will take time. Lingering health concerns mean people could still be afraid to fly. Not all countries and cities are expected to re-open at the same time, and some international travel restrictions will likely remain in place long-term. Airlines, in particular, will face a long, slow climb.

Business travel will most likely suffer the most as the U-comeback is expected to take significantly longer than for leisure travel.

However, the underlying driver will also bring back business travel. Despite better video conferencing and Zoom webinars becoming the new normal, we think business travel will persist. Virtual conferences and business trips will complement each other. Physical meetings and events may become reserved for selective purposes. Yet our hypothesis is that not traveling to critical business events (e.g. board meetings) will be a disadvantage for those who don’t attend. It comes down to the fundamental nature of humans, which Ariel Cohen, CEO of TripActions – one of the most heavily-funded business-travel startups in the world – accurately explains:

“I think eventually, we are all social creatures, and we want to meet face-to-face. I think if you and I were sitting right now in the same room, the level of energy would be completely different, the abilities in terms of interacting would be completely different. So do I fear a world where people are not traveling for business? I cannot even imagine a world like that. I think that as long as people are social creatures, they will want to meet face-to-face.”

Being strong optimists, we believe there is hope on the other side of despair. The scenarios outlined above should give us an opportunity to prepare for the future.