We are progressing in our exploration of the metaverse’s potential impact on the aviation industry, focusing on how metaverse technologies could be applied within the aviation and wider travel context.

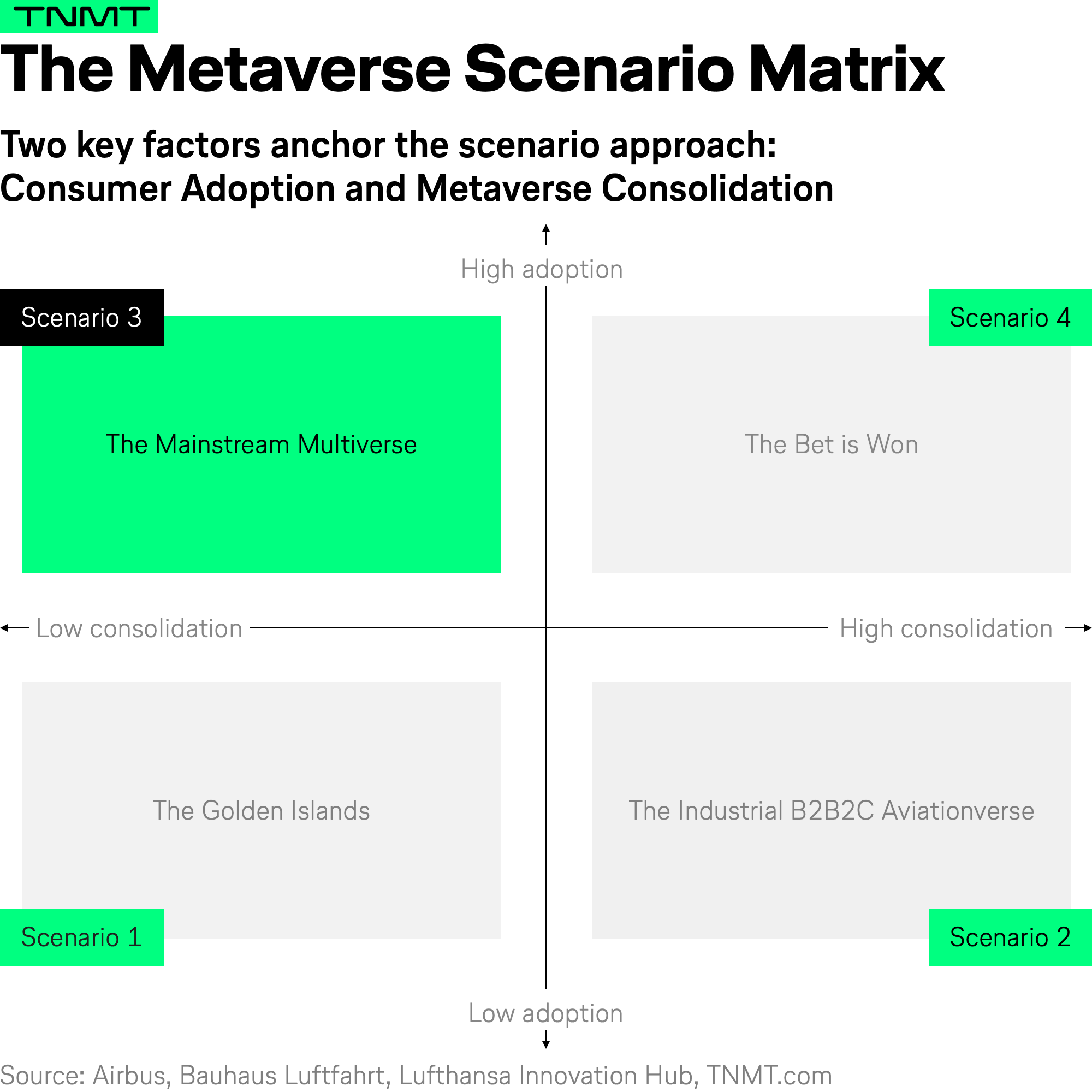

To answer this question, we applied a scenario-based approach.

Our collaborative effort, pooling insights from industry leaders at Airbus, Bauhaus Luftfahrt, and our team at the Lufthansa Innovation Hub, has led us to formulate four distinct scenarios depicting the possible evolution of the metaverse in aviation over the next decade until 2035.

Each scenario is crafted to reflect varying degrees of consumer adoption and metaverse consolidation, setting the stage for a range of potential futures.

Here are the scenarios we analyzed thus far:

- The Golden Islands: Scenario #1 imagines a future where consumer adoption of metaverse technologies remains relatively low due to high costs, and access to metaverse platforms is highly fragmented with niche use cases. This trajectory suggests a focus on luxury applications like high-end immersive pre-flight planning or concierge services.

- The B2B2C Aviationverse: In this second scenario, consumer adoption of metaverse technologies remains relatively low due to headset costs, inconvenience, and discomfort. However, a singular, integrated metaverse infrastructure in aviation has successfully emerged, particularly for industrial applications where comfort isn’t a primary concern. This could lead to next-gen digital simulations for training aviation professionals or digital twins and AR for aviation operations.

Today’s analysis focuses on scenario #3, which we call the “Mainstream Multiverse.”

Scenario #3: “The Mainstream Multiverse”

This scenario imagines a future in which consumer adoption of metaverse technologies takes off, making metaverse access a mass commodity.

However, various metaverse applications and platforms remain separate and fragmented across regions, consumer groups, and use cases, as we will further elaborate below.

Let’s review those two variables in more detail.

1. The Metaverse as a Mass Commodity

In the Mainstream Multiverse scenario, consumer adoption of the metaverse rapidly increases over the next decade, transforming metaverse access into a mass commodity.

Why will this happen?

In this future, the metaverse becomes convenient and affordable, with providers across various industries developing useful and engaging platforms and applications that successfully attract users.

Unlike the expensive and inconvenient headsets we discussed in scenario #2, this scenario envisions mobile and desktop screens remaining the primary means of accessing the metaverse. This shift eliminates the need for consumers to adopt new devices like headsets, leveraging existing interfaces like smartphones, which already have a global penetration rate close to 70%. Using these interfaces, consumers can access browser-based immersive experiences and spaces and interact with other users.

This outlook mirrors the current situation, where most virtual worlds are accessed through mobile and desktop browsers. To be exact, of the over 600 million metaverse users globally each quarter, less than 5% use dedicated VR headsets.

Thus, the assumption that the metaverse movement requires a new device interface, specifically headsets, proves to be questionable. By relying on familiar devices, the metaverse can achieve widespread adoption more seamlessly and effectively.

2. The Fragmented Evolution of the Metaverse

The second key assumption of the Mainstream Multiverse is that the metaverse will continue evolving in a fragmented fashion. Why is that? Historically, the metaverse has developed in exactly this way.

For context: The term “metaverse” became a huge buzzword back in 2021/2022, alongside excitement for tradeable digital assets like NFTs. However, even before the metaverse craze, platforms like Fortnite and Roblox—often labeled the first commercial metaverses—existed and attracted millions of users to immersive gaming environments.

These immersive platforms and web applications have been evolving for years, and the landscape has always been extremely fragmented across use cases, age groups, and regions. Case in point: According to consulting group Metaversed, by Q4 2023, the metaverse encompassed a total of 170 distinct virtual worlds.

Why the diversification? These platforms cater to very different demographics and purposes.

Here are just a few of the most well-known examples:

- Roblox: An immensely popular online gaming platform with more than 66 million users, nearly 60% of whom are under the age of 16, according to its most recent annual report.

- Zepeto: One of Asia’s largest metaverse platforms, launched by internet giant Naver in 2018. More than 50% of its users are based in Asia, and it is a major destination for fashion brands like Gucci, Dior, and Nike. A significant portion of its users are females aged 13-24.

- Edverse: An educational platform that partners with educational organizations and universities to offer virtual classes. Launched in 2022, the platform reportedly surpassed 4,000 users earlier this year.

While many current platforms focus on gaming and social features, new use cases and platforms emerge regularly. This indicates that the fragmentation of platforms and use cases will likely continue as new platforms cater to more niche demands, consumer preferences, and specific user groups.

As our world becomes more diverse and personalized, especially in the travel context (see the longtail of travel), the metaverse landscape will likely evolve to meet these varied needs, leading to thousands of specialized metaverse applications.

The Multiverse Impact on the Travel Industry

Roblox, Zepeto, and Edverse primarily focus on gaming, entertainment, and education. This leads us to the question: How would the trajectory towards the Mainstream Multiverse impact the travel industry?

Here’s what we think:

A key element of immersive platforms is their ability to visualize information in 3D, allowing users to see and, to some extent, experience a space similar to a physical visit. The travel industry, by nature, relies heavily on visual marketing. During the search and inspiration phase, images of destinations, hotels, and even cabin and seat classes are crucial drivers of decision-making. Accordingly, immersive experiences that can visualize destinations in 3D can significantly influence travel decisions, particularly given that online travel booking is still seen as a nerve-wracking process, even according to the CEO of global OTA Kayak.

This is why travel providers, including OTAs, have started experimenting with the metaverse and related technologies. Importantly, consumers also recognize these potential advantages. In a 2022 survey, nearly half of the travelers believed that the metaverse, utilizing extended reality, could enable virtual travel and tourism in the next decade, allowing users to experience virtual worlds and engage in tourism-related activities.

Admittedly, this survey was conducted during the peak of the metaverse buzz, which likely influenced consumer sentiment toward virtual travel.

However, virtual travel is not the only potential adoption area with impact on the travel industry and many of the use cases that scored highly in this survey relate to the travel experience, too.

Here are a couple of examples:

- Virtual Learning is already a crucial component of aviation training. For example, VR is used for training pilots, cabin crew, and engineers. Our last chapter on the “B2B2C Aviationverse” detailed this.

- VR-based entertainment is another metaverse facet gaining rapid traction in the airline industry. Several airlines are experimenting with offering XR headsets to business-class passengers. Most recently, Lufthansa announced that the Lufthansa Allegris Business Class Suite will be equipped with Meta Quest 3 devices on select routes.

- Virtual work settings have also significantly impacted the business travel industry, which has been slow to recover due to the abundance of digital communication tools available. Our 2023 article on the topic provides more details.

- Trading digital assets like NFTs is another metaverse-related field travel providers are exploring, especially in the context of loyalty programs–see more context in the next section.

In summary, this scenario predicts a growing number of “multiverse” applications in travel and tourism which have the potential to supercharge customer experiences and operational efficiencies across various touchpoints.

Fragmented but Thriving: The Diverse Landscape of Metaverse Applications in Travel

Looking at the most recent metaverse activity across the travel industry, the outlook for a growing landscape of diverse and highly fragmented metaverse applications seems likely.

Why is that?

It turns out that the travel sector is very actively experimenting with metaverse applications, already leading to a fragmented but rich landscape of consumer-facing innovations. Some prominent examples include Qatar Airways’ Qverse, a platform they’ve expanded with an AI-powered virtual assistant developed in collaboration with UneeeQ, a US-based startup focused on creating virtual assistants. And Qatar Airways is not alone in its enthusiasm for the metaverse.

So far, we primarily see three categories of metaverse projects in action. In all three cases, travel brands aim to engage younger audiences, indicating that they view metaverse experiences as powerful tools to attract the next generation of travelers.

1. Travel Providers Experimenting with Web3-Based Loyalty

In July this year, the Tourism Authority of Thailand announced a strategic partnership with the web3 loyalty app Freedom World. This app provides domestic and international travelers with information on local events and promotions, interactive maps, gamified activities, and rewards for their completion, alongside community-building functionalities. The initial focus area is Koh Samui, one of Thailand’s top destinations, with potential expansion to other key locations in the country.

This is not Thailand’s first foray into web3. In 2023, they launched multiple series of NFT-based digital art that travelers could collect by visiting attractions and landmarks throughout Thailand.

Other travel providers are also bullish on NFT-based collectibles. Similar initiatives have been launched by Ethiopian Airlines and Loyyal, Philippine Airlines, Sentosa Island in Singapore, Trip.com, Air Baltic, and Lufthansa Group (aka Uptrip).

2. Travel Providers’ Positioning Inside Virtual Worlds

Travel providers are increasingly positioning themselves within virtual worlds by partnering with popular metaverse platforms like Roblox, The Sandbox, and Decentraland to gain access to their consumer base.

- For instance, in July this year, AirAsia partnered with Mil.k, a blockchain-based loyalty platform, and The Sandbox, a metaverse gaming platform, to start offering events in the metaverse. MiL.k already hosts events in The Sandbox that allow users to collect its token, Milk Coin, which can be exchanged for AirAsia rewards.

- In April this year, the Tokyo Metropolitan Government launched a digital version of Tokyo on Roblox to promote the city as a tourist destination. This interactive space allows users to sightsee and experience major Tokyo landmarks, alongside “Treasure Hunt”-type games that help users learn more about Tokyo’s history.

Tokyo is not the only travel player on Roblox.

- In January 2023, the Singaporean island of Sentosa opened SentosaLand on Roblox – an immersive space where players can explore the island virtually and collect coins to win prizes such as an actual “staycation” on the island.

- In May, the Singapore Tourism Board followed suit and launched “Singapore Wanderland” on Roblox, reportedly drawing over two million visits in just a few weeks.

3. Immersive Travel Previews Becoming Dominant for Travel Inspiration

The last category of metaverse-like applications includes a growing number of travel providers, especially airlines, experimenting with 3D-based previews of cabin arrangements. This innovation gives travelers a clearer picture of what to expect from their travel experience.

This offering is not just a niche service but is appreciated by a significant share of travelers, as evidenced by recent survey data. According to a recent survey by Phocuswright, between 35% and 45% of surveyed European travelers have used VR to preview destinations, hotels, or attractions, and close to 30% have used VR to preview airplane seats.

These numbers are remarkable, indicating how quickly travel providers have adopted the “Try Before You Buy” strategy to enhance the search and inspiration phase of travel. We discussed this strategy and related examples in detail in our article on “Trip 3: Travel’s Journey into the Metaverse.” These immersive previews not only inform travelers but can also positively impact conversion rates for travel bookings.

Implications for Future Aviation – Use Cases

In the Mainstream Multiverse scenario, consumer adoption of the metaverse increases rapidly over the next decade. Consequently, related use cases could expand along the entire travel journey, starting with the search and inspiration phase (as we already see today with examples mentioned above), extending through the on-trip experience (e.g., virtual guides enhancing travelers’ exploration of cities and sights through VR elements), and even impacting the post-trip experience (see loyalty examples above).

Consequently, as personal adoption of metaverse technology takes flight, we will likely see a range of use cases on the professional B2B side develop rapidly as well. Today, we are seeing the first explorations in this area, but these will intensify in the decade to come.

Here’s a breakdown of the four key use case areas we can expect in this scenario across B2C and B2B:

- Search and Inspiration: Destination, hotel, and airplane seat previews using XR could become the new status quo for travel planning, with the virtual “Try Before You Buy” strategy driving companies’ development of metaverse products. This could take on new levels of interactivity, such as in airport retail, where users could try on clothes virtually or test makeup products to see how they match their avatar’s complexion before purchasing the physical product at the airport.

- Real-time Assistance: In our scenario on “The Golden Islands,” we proposed immersive “concierge” services as a potential use case. In this Multiverse scenario, we propose something similar but more “mass market” than “concierge.” We are likely to see highly automated (i.e., highly scalable) support use cases in the virtual realm, such as wayfinding apps, real-time translation, or virtual customer support and information services throughout the travel journey.

- Post-trip and Loyalty: In the context of loyalty, we would likely see a rapid expansion of web3-related loyalty programs that enable travelers across companies and regions to collect loyalty tokens and exchange them for rewards. We could also see new types of social networks emerge that are enabled by immersive maps. These maps could be used by travelers to share images and videos of their physical trips related to specific locations. Lastly, these types of “virtual memories” could even help enable loyalty and engagement. For instance, travel providers could incentivize users to share images and related reviews by allowing them to collect tokens for each transaction.

- Operations and Enterprise: With personal use of the metaverse taking flight, professional use cases will likely continue to evolve on par. For instance, we could see virtual meetings using avatars become the new norm for business meetings. On the operational side, existing use cases like training will continue to evolve and become more sophisticated. Additionally, new use cases will emerge and develop rapidly, such as virtual support for maintenance, ground operations, and even flight operations.

Would this multiverse scenario present the most bullish view on the future of the metaverse in travel?

Almost.

But there is one scenario that could even surpass the Multiverse outlook.

Intrigued to learn more? Then check back on TNMT in a few weeks to read our grand finale of this year’s metaverse in travel series from your favorite airline innovation hub.