There’s an uncommon dynamic currently unfolding in the airline industry – one that’s potentially reshaping its competitive landscape but receiving surprisingly little attention.

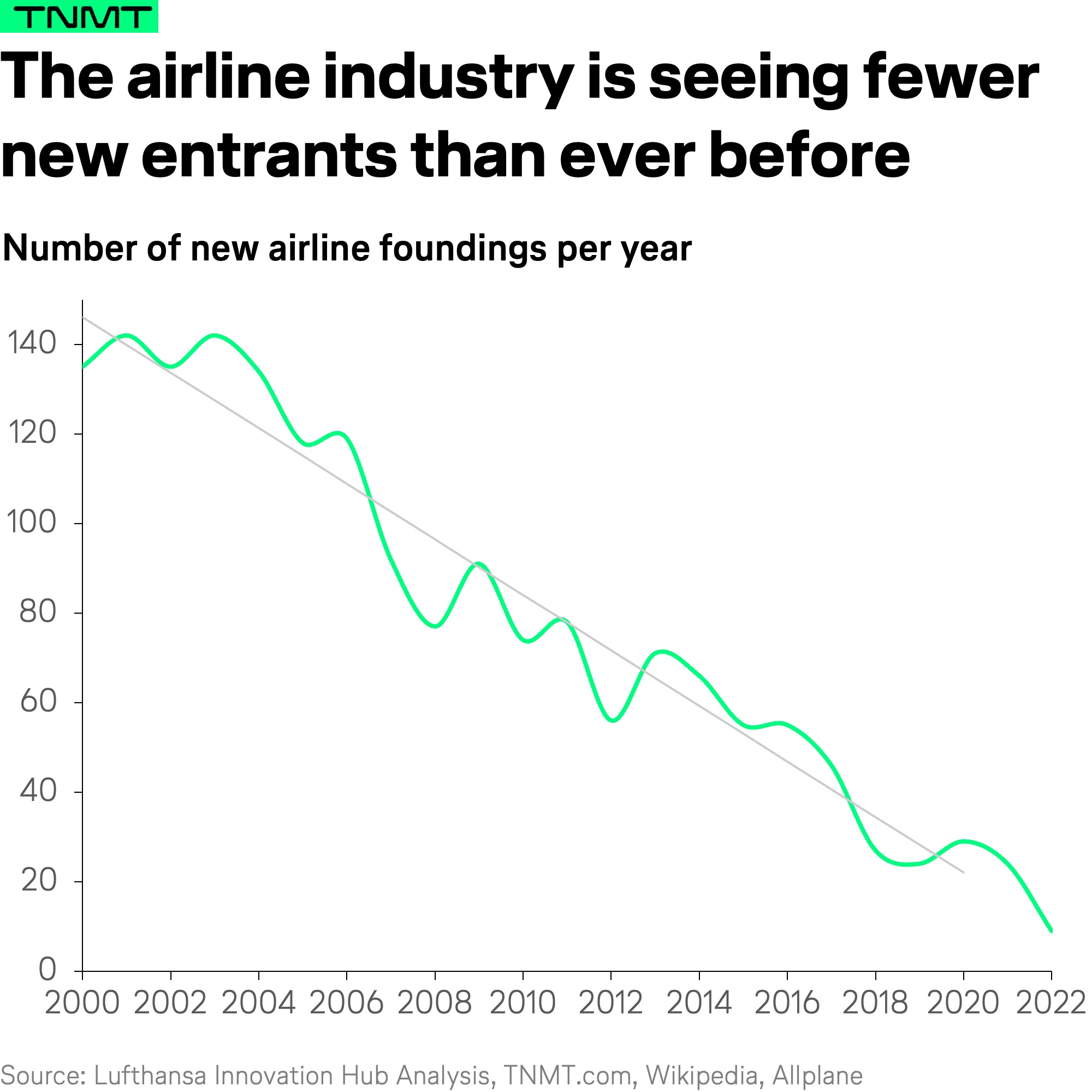

Two years ago, our research highlighted a sharp decline in the number of new airline startups. To recap: the annual number of new airlines entering the market dropped from nearly 60 in 2016 to fewer than 10 by 2022.

We took a deep dive into understanding the factors driving this decline and its implications (see our previous analysis).

However, it turns out that this reduced attractiveness for newcomers is only half the story.

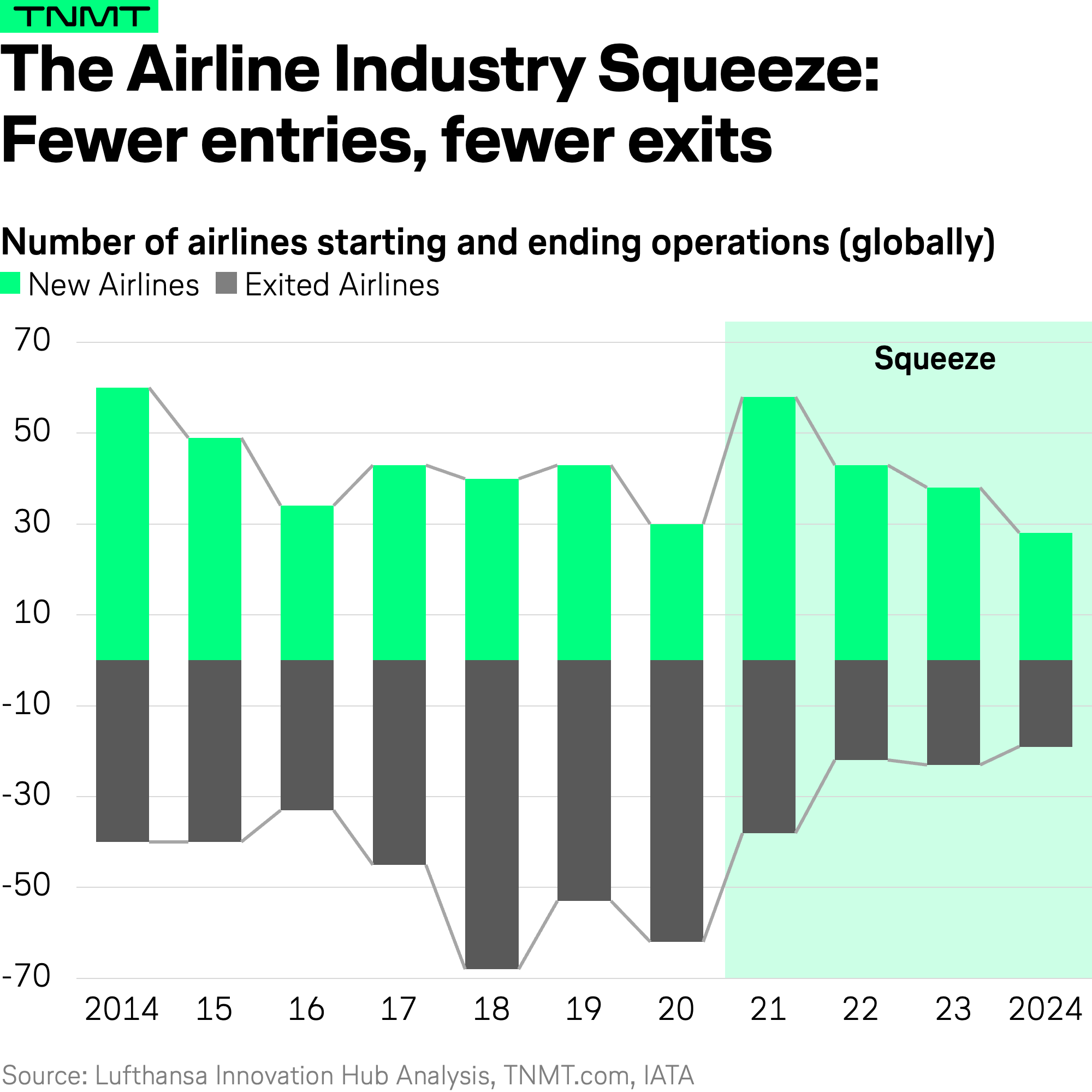

A recent IATA analysis reveals another striking trend:

- Not only are fewer airlines being founded, but fewer are exiting the market, too.

- What this means: Bankruptcies, mergers, and acquisitions have all slowed considerably.

This is particularly interesting because, on the surface, fewer exits are usually a positive sign – a signal of a stable, profitable, and attractive market.

But when we combine both trends, low entry and low exit, it paints a more complex picture.

Disclaimer: The IATA numbers on airline foundings don’t exactly match our own figures due to differing definitions of what constitutes a “founding.” However, the directional insight remains the same.

So, what’s really going on here?

How can we reconcile these two opposing forces occurring simultaneously, creating what we might call an airline industry “SQUEEZE”?

We took a closer look, exploring the underlying dynamics and asking ourselves what it all means for the future of innovation in aviation.

Fewer Airline Exits: Stability or Stagnation?

Let’s unpack the squeeze with some additional data. According to IATA, 2024 saw just 28 new airline formations (a record low), while only 19 carriers ceased operations. Most of the newcomers were low-cost carriers.

So what does this tell us? Especially about the drop in airline exits?

Unsurprisingly, the airline industry itself (represented by IATA) frames the trend as a positive sign of “market stabilization.”

And from an internal industry perspective, that interpretation holds true.

- Fewer exits mean fewer bankruptcies, liquidations, or distressed acquisitions.

- In an industry known for razor-thin margins, this kind of financial calm is understandably welcome news for incumbents.

But from an outside-in, innovation-focused view, the message is less reassuring.

Yes, fewer failures can indicate greater stability. But when paired with a record-low number of new entrants, it also signals a market that’s becoming increasingly protected from competition, or even resistant to it.

- Fewer new airlines mean less experimentation.

- Less pressure to differentiate.

- Fewer chances for bold new business models to shake things up.

So while the current environment might be comfortable for existing players, it may also be a warning sign of stagnation.

The innovation flywheel, which is so critical for improving passenger experience, rethinking operational resilience, and reducing the industry’s environmental footprint, risks slowing down.

Part of this slowdown stems from broader structural challenges:

- The current economic environment makes it significantly harder to raise the upfront capital needed to launch a new airline.

- Workforce limitations and ongoing labor shortages strain operational readiness.

- Airport slot availability continues to be a bottleneck for newcomers.

All of this contributes to the shrinking pool of viable airline contenders.

Is It Really an Airline Squeeze, or rather an Aircraft Squeeze?

But not so fast.

Before pointing the finger at the airline industry too quickly, it’s worth taking a closer look.

Because what seems like an airline squeeze might actually be something more specific: an aircraft squeeze.

The sharp drop in new airline launches might have less to do with waning interest or competitive exposure and more to do with a very practical problem: There simply aren’t enough aircraft available.

Take Thailand’s Really Cool Airlines (already a strong contender for best airline name of the decade).

- Originally slated to launch in 2023 as a next-gen, passenger-focused point-to-point carrier, the airline has now postponed operations to 2025.

- The reason? Delays in widebody deliveries from Airbus.

And they’re not alone.

India’s proposed ultra-low-cost carrier Air Kerala and UK-based Global Airlines have faced similar headwinds, as Simple Flying reports. With new and even second-hand aircraft in short supply, launch timelines are slipping across the board.

This isn’t just a technical issue.

It’s literally delaying innovation, arguably the one thing the airline industry needs most.

Here’s how:

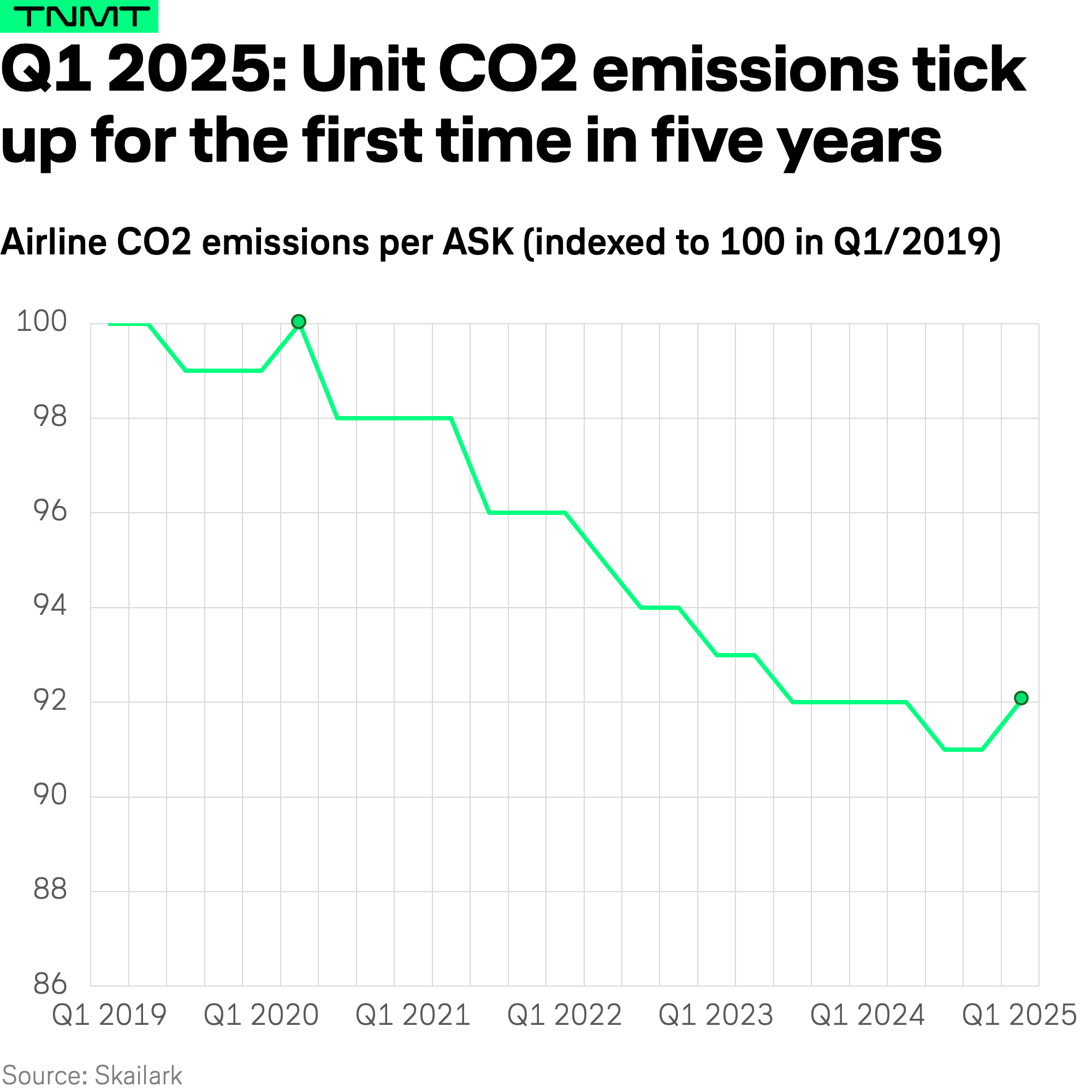

Aircraft delivery delays are already hurting the industry’s sustainability performance.

- According to Skailark, Q1 of this year marked the first per-unit increase in CO₂ emissions per available seat kilometer (ASK) in about five years.

- The reason? Airlines are being forced to keep older, less efficient aircraft in service longer than intended, because the newer, more fuel-efficient models just aren’t arriving fast enough.

So while the “airline squeeze” may look like a shift in competitive dynamics, it’s increasingly a supply chain story, and one with long-term implications, if not solved rapidly.