Given the ongoing AI boom, we aimed to delve deeper into how artificial intelligence is influencing Travel and Mobility Tech.

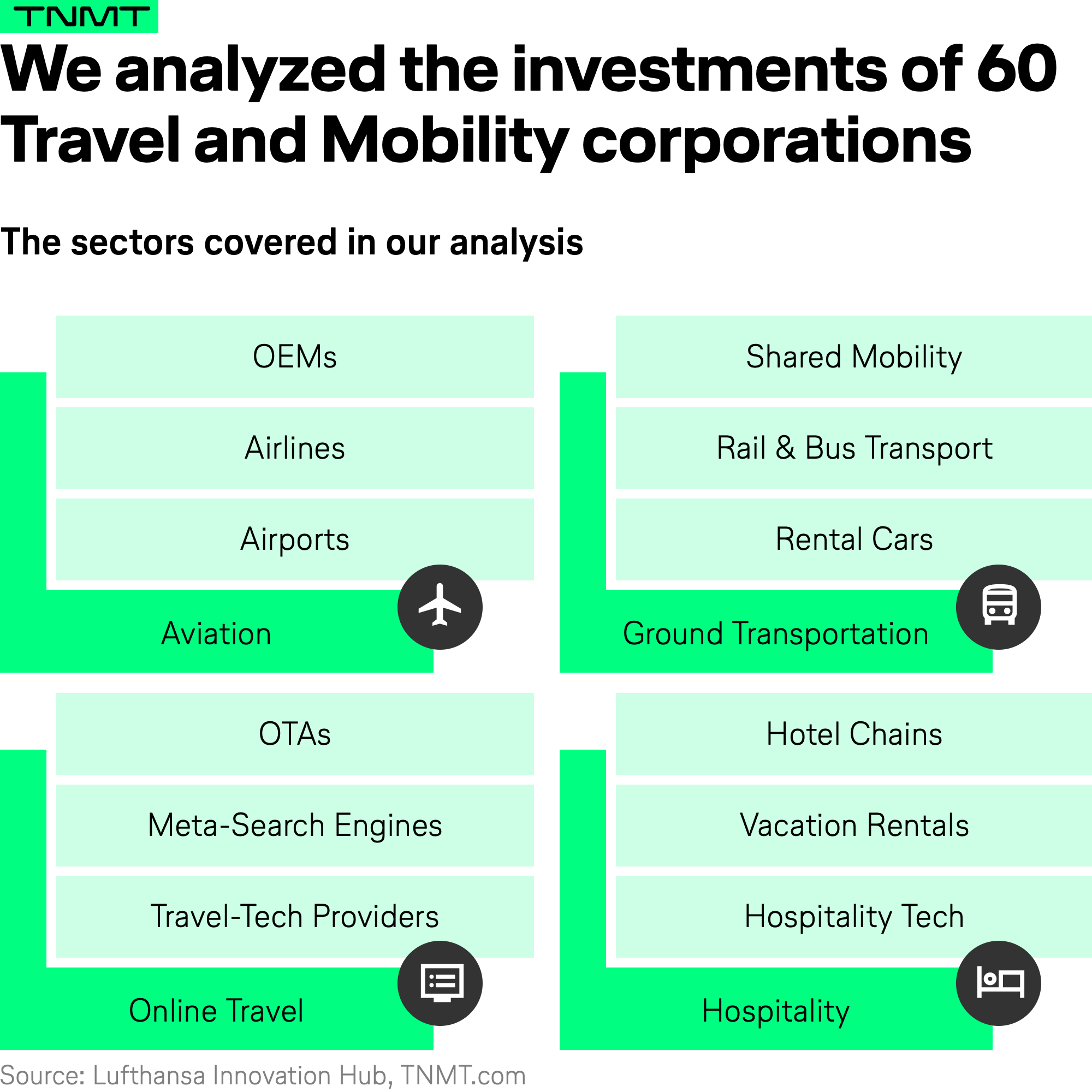

To accomplish this, we examined the investment strategies of 60 leading corporations (including their VC arms and investing subsidiaries) within our sector, spanning aviation (including airlines and airports), online travel agencies, hospitality providers, and mobility services. We analyzed their company investments from 2018 onwards, which included startup investments, mergers and acquisitions, and other forms of engagement like joint ventures.

Our goal?

To decode the investment landscape within Travel and Mobility Tech, which offers valuable insights into the priorities of leading industry stakeholders and their respective focus fields in preparation for the future.

In particular, we focused on companies’ technology investment strategies to answer a critical question:

Are the AI investments by Travel and Mobility Tech corporations aligning with the broader tech industry’s enthusiasm for this technology?

Travel and Mobility Tech’s AI Investment Landscape

To begin our analysis, we gathered all investment data related to the 60 most relevant corporations in Travel and Mobility Tech. We then filtered out all invested companies that were not based on any specific key technology. For those that were, we categorized each investment by the respective key underlying tech capability.

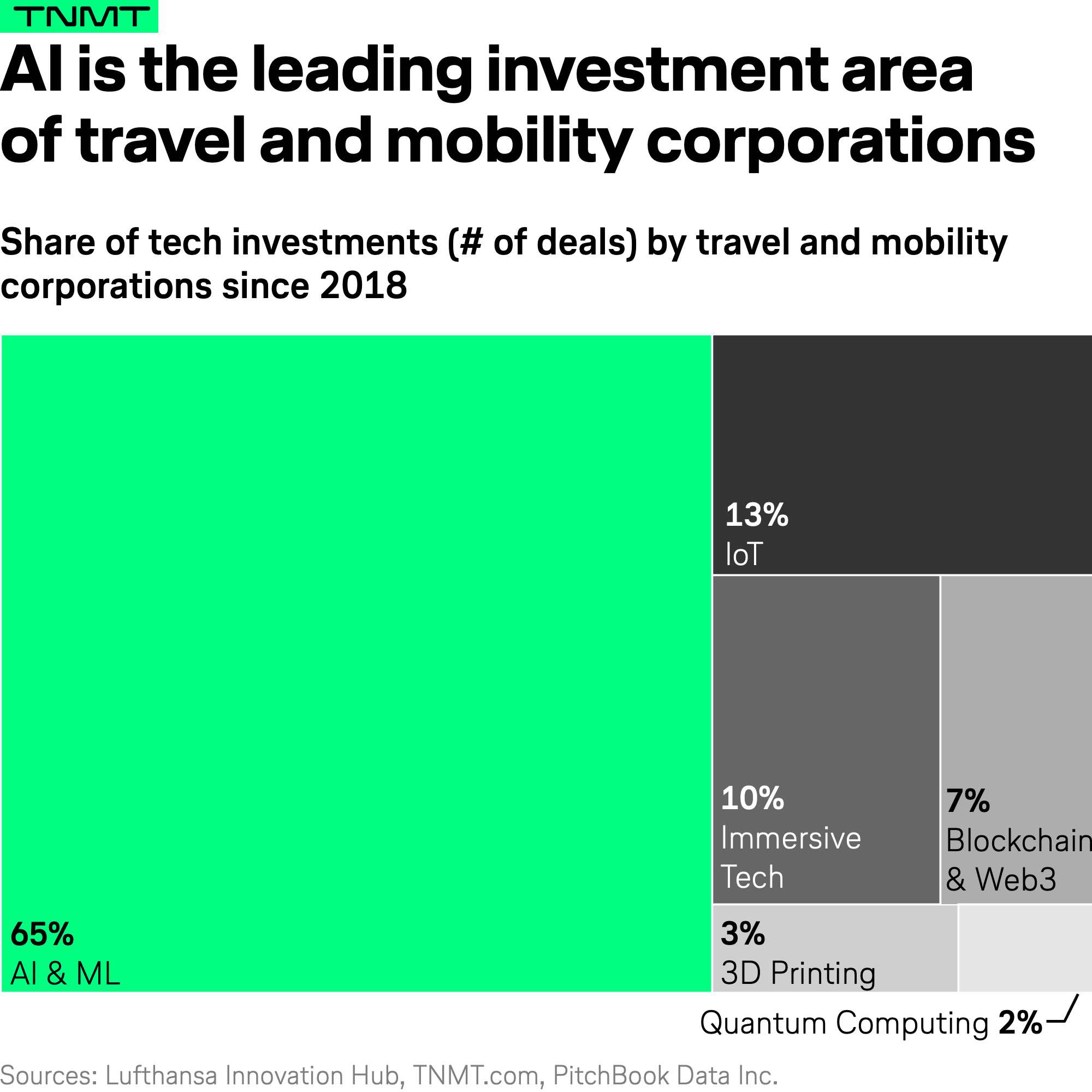

As the chart illustrates, AI and Machine Learning are indeed the most represented tech areas, attracting two-thirds of all investments by travel and mobility corporations.

This significant focus on AI-powered companies spans several key applications:

- Autonomous Driving: Investments are frequently directed towards companies specializing in computer vision and LIDAR systems, which are crucial for developing self-driving vehicles.

- Robotics and Drones: This includes firms focused on autonomous manufacturing processes and delivery systems.

- Predictive Analytics: These investments are targeted at companies enhancing process optimization using AI and ML algorithms.

- Customer Support: Enhanced by natural language processing capabilities, including large language models (LLMs), these investments aim to revolutionize customer interaction platforms.

This broad distribution of investments across various AI applications underscores our sector’s commitment to integrating AI technologies into today’s product and service offerings.

The Longevity of AI Investments in Travel and Mobility Tech

In light of the evident prioritization of AI within our industry, a second crucial question emerged:

Is this focus on AI a fleeting result of the recent surge in Generative AI popularity, or does it represent a deeper, more enduring trend?

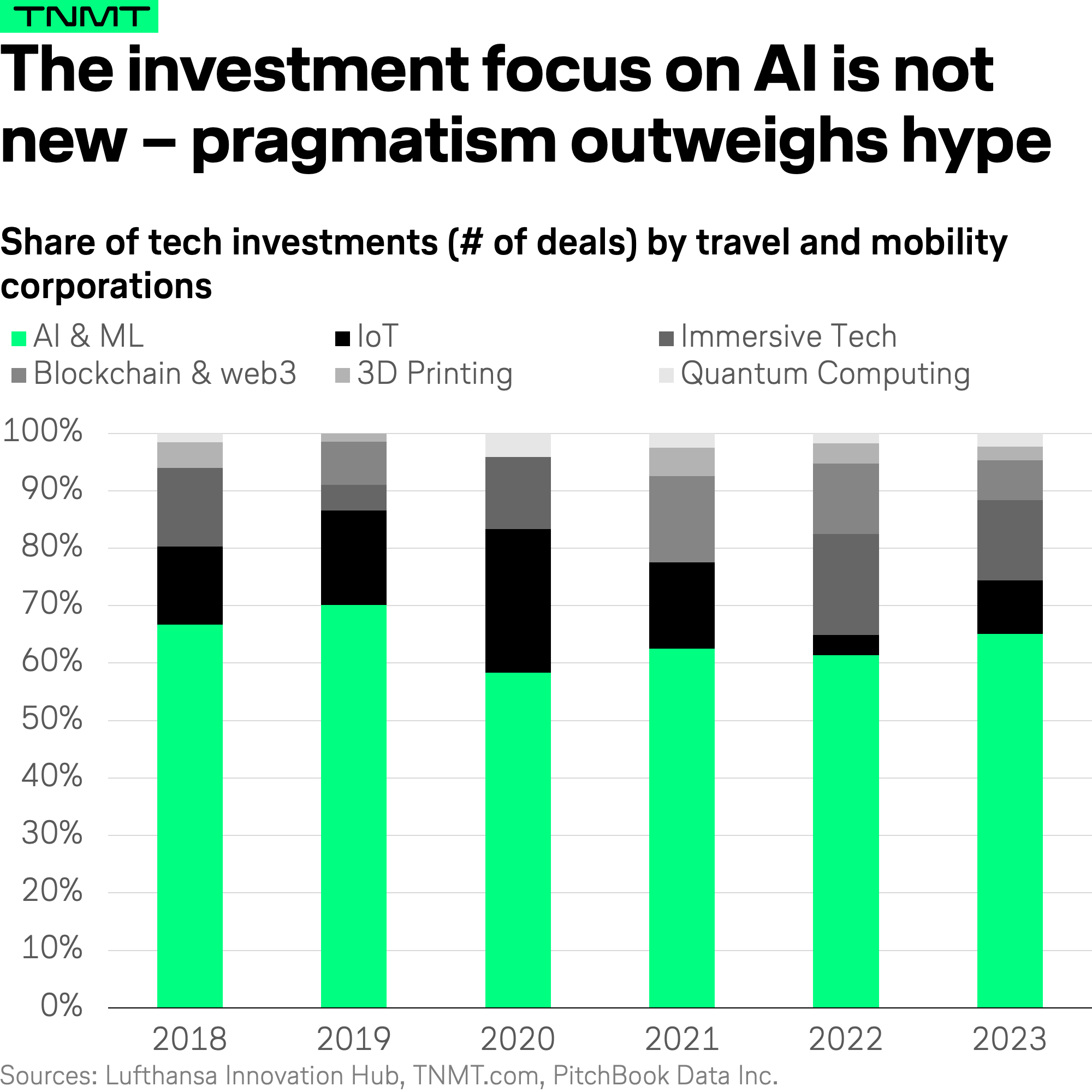

To determine this, we analyzed the distribution of technology investments over the years.

Our findings reveal that the focus on AI seems far from being a recent phenomenon.

- AI investments have consistently represented the majority of technology investments, accounting for 60 to 70% annually over the last six years.

- This finding underscores the sector’s long-standing commitment to AI as a pivotal technological pillar across various subsectors of Travel and Mobility Tech.

In fact, such sustained investment levels suggest that our industry recognizes AI’s transformative potential not just as a tool for incremental improvements but as a fundamental driver of future growth and innovation.

It looks like our sector is not merely riding a wave of tech trends but is deeply invested in leveraging AI to reshape the landscape of travel and mobility.

Leveraging Gen AI: From Observers to Participants

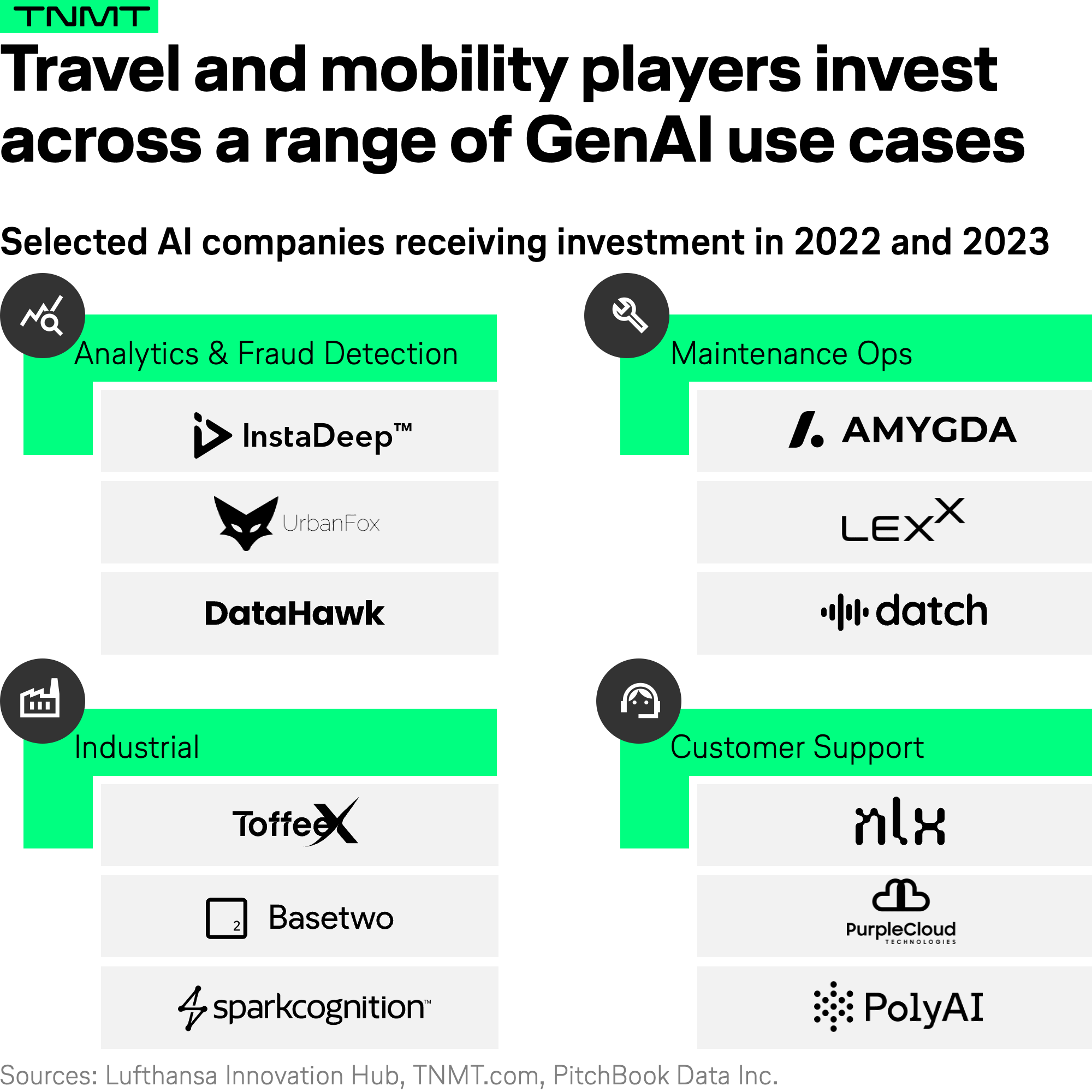

With the rise of Generative AI (GenAI) causing a recent surge in AI interest, we explored whether travel and mobility corporations have merely observed this trend from the sidelines or actively engaged with it.

Our analysis indicates that a minority of corporations in our sector have begun to explore the potential of Generative AI, with a modest but notable flow of investments into GenAI-powered businesses.

- To date, roughly a dozen notable investments have been made in this area, spread across four primary application fields. Customer support through Generative AI-powered chatbot interfaces is just one of these fields.

- Other areas, while less customer-facing, are heavily oriented towards enhancing operational efficiency within companies.

Operational Excellence in Aviation

In the last part of our mini-analysis, we looked beyond AI to understand the specific investment activities of some of the subsectors in Travel and Mobility Tech.

We were particularly interested in what airlines invested in.

So, we turned our attention to the aviation sector’s investment strategy.

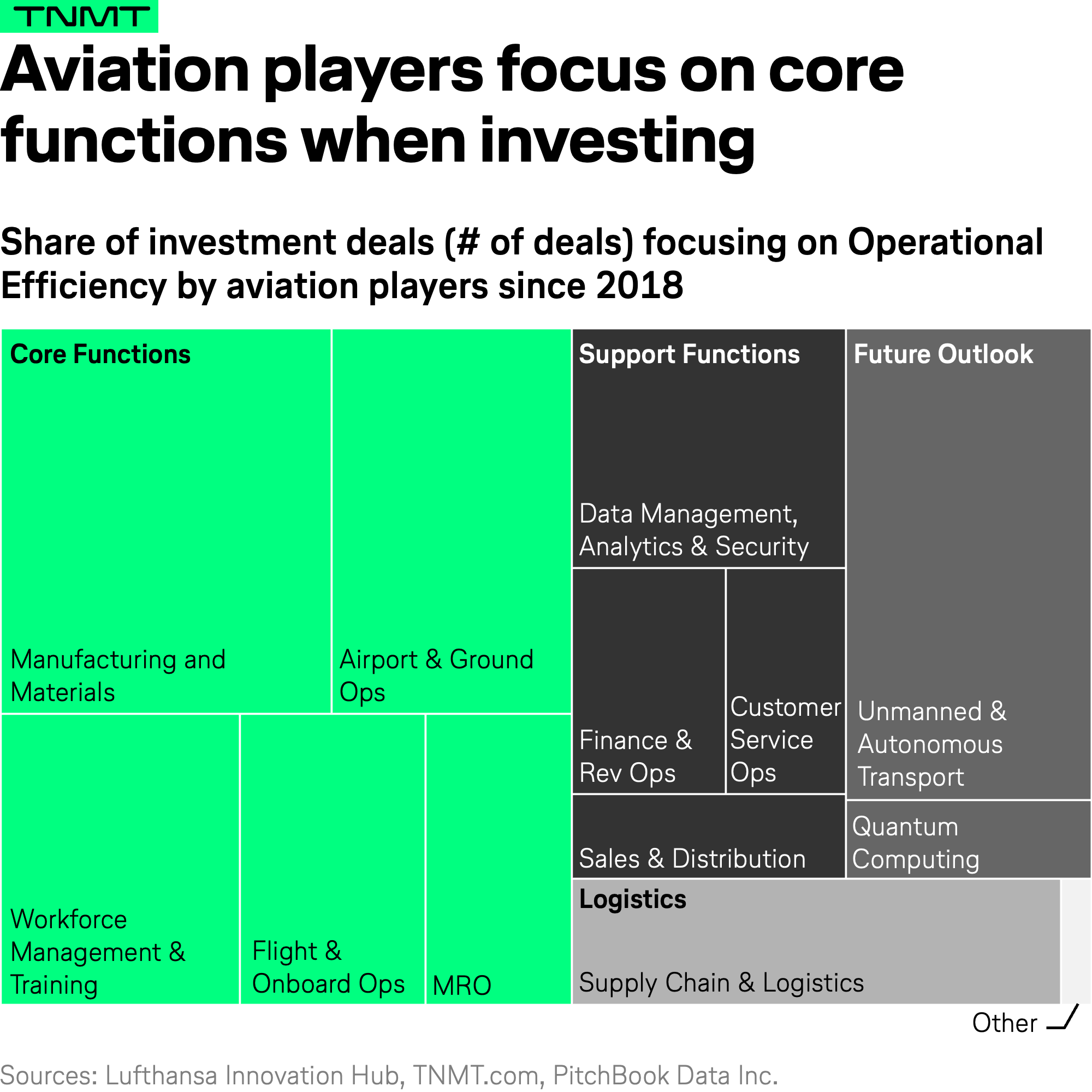

It’s evident that companies in this space—ranging from airlines and airports to aircraft manufacturers—have been particularly keen on enhancing their operational efficiency, whether through the help of AI or other means.

Our analysis of investments made by the aviation industry within Travel and Mobility Tech reveals a compelling trend: over half of all investments have targeted companies that bolster core business functions.

- These investments have focused on improving ground operations, workforce management, flight operations, and maintenance, repair, and overhaul (MRO) activities.

- This strategic allocation of capital indicates a clear commitment from aviation players to not only recognize the critical need for robust operational capabilities but to invest in solutions that can optimize these areas actively.

By partnering with innovative startups, aviation stakeholders are leveraging external expertise to address some of their most pressing operational challenges. This not only helps in refining their day-to-day operations but also positions them to meet the evolving demands of the industry going forward.

There Is More To Come

These findings are just the beginning of our deep dive into the comprehensive investment landscape of Travel and Mobility Tech.

Stay tuned for more detailed insights in the upcoming weeks as we continue to unravel the implications of these strategic investments across the sector.