Today’s air travel landscape often tests travelers’ patience, particularly when they are faced with flight disruptions such as delays, cancellations, missed connections, and lost baggage.

Our previous analyses have repeatedly highlighted these issues as major pain points in the airline industry, both before and after the COVID era.

The uncomfortable truth is this: almost everyone has a travel horror story to share these days.

This widespread dissatisfaction has sparked a wave of discussions and publications on the miserable state of air travel, with mainstream media frequently exploring how to streamline and improve the flying experience.

The roots of passenger frustration are varied, covering everything from labor shortages that strain ground operations and airspace management, to overcrowded airports brimming with record passenger volumes, and increasingly severe weather conditions that easily disrupt flights.

Moreover, the travel industry as a whole suffers from a notable lack of innovation, particularly in digital self-service options that allow travelers to manage disruptions independently. This often results in lengthy waits at airport service counters and in customer service hotlines.

To further explore the root causes of customer dissatisfaction and the strategies to mitigate them, our analysis today delves into a comprehensive sentiment analysis across various stakeholder groups within the airline industry. This analysis reveals some previously undiscussed insights into the depth of traveler dissatisfaction and the urgent call for transformative solutions.

Methodology: Sentiment Analysis Across Stakeholders

To comprehensively understand the diverse perspectives on the state of the airline industry, we employed advanced Natural Language Processing (NLP) via Quid Discover. This analysis targeted the sentiments of three key stakeholder groups within the travel sector:

- Travelers: Continuing with our established method, we analyzed sentiments expressed in TripAdvisor reviews to gauge traveler experiences and opinions.

- Media: We also assessed the media’s perspective on the airline industry by analyzing content from major news outlets and articles published over the past five years, providing a broad view of the industry’s portrayal in the press.

- Airline Executives: To capture the insights of those at the helm of the industry, we examined sentiments from airline earnings calls and analyzed executive statements over the same period.

By comparing the sentiment scores across these groups, our goal was to clearly understand their distinct viewpoints on the industry, highlighting areas of consensus and divergence that may inform future strategies.

Analysis Results: Diverse Perspectives Across Stakeholders

Without further ado, let’s delve into our analysis’s findings. The data reveals a stark contrast in how these three stakeholder groups perceive the airline industry.

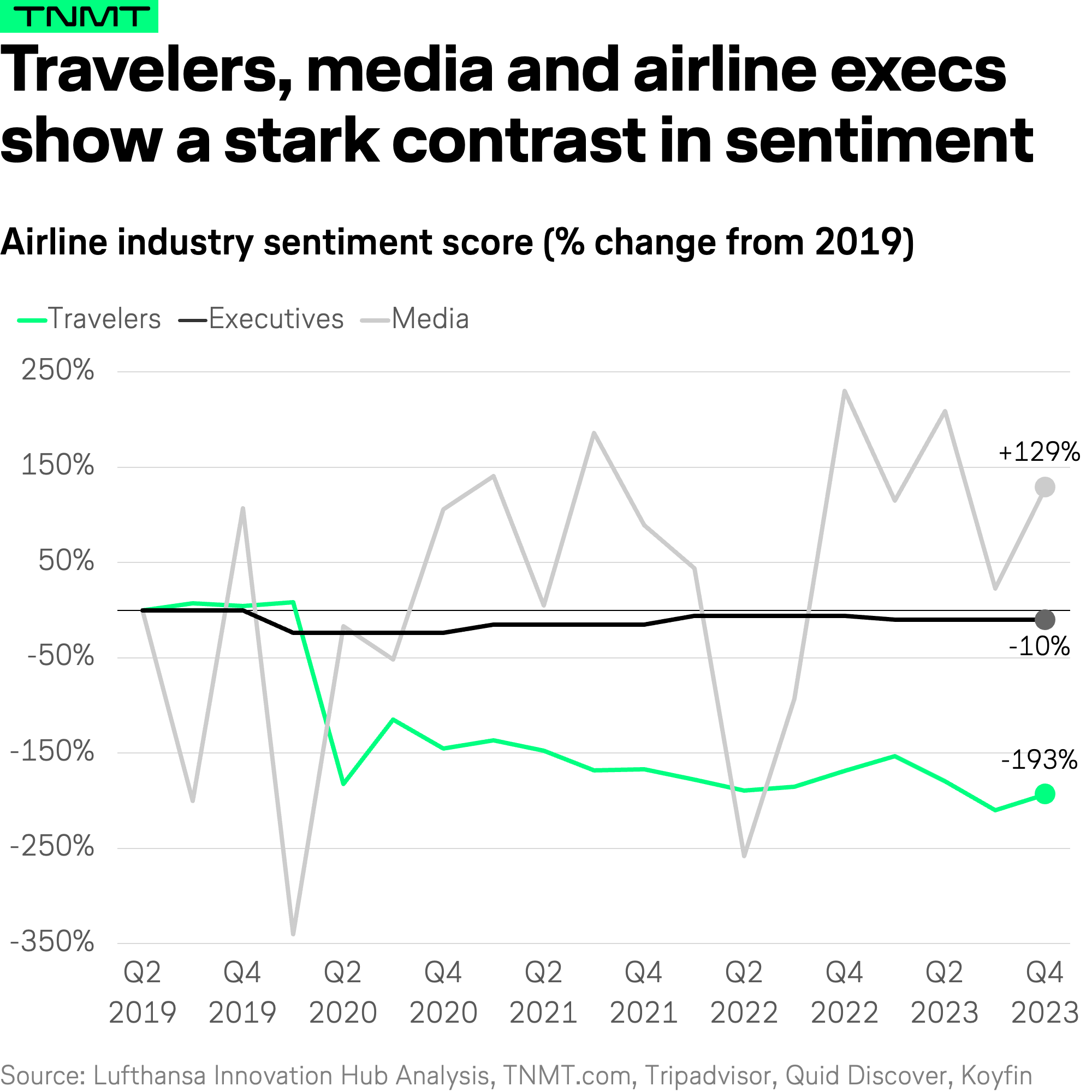

The chart below visualizes these differences clearly, providing a comparative view of sentiment trends over the past five years.

Sentiment among travelers remains significantly negative, hitting record lows that have not recovered since the initial pandemic-induced drop. Travelers continue to express substantial dissatisfaction with their travel experiences.

Media sentiment towards the airline industry resembles a rollercoaster ride characterized by frequent and sharp fluctuations. This reflects a mix of positive and negative coverage, depending on current events and developments within the industry.

In contrast, airline executives’ sentiment is remarkably stable, showing only a slight negative deviation from pre-COVID levels. This stability suggests a consistent internal perspective on the industry’s state despite external challenges and fluctuations.

Given these very unique and different views on the industry, what does this tell us going forward, especially when it comes to synthesizing the dramatic lows in traveler sentiment?

We see two key learnings from this comparison.

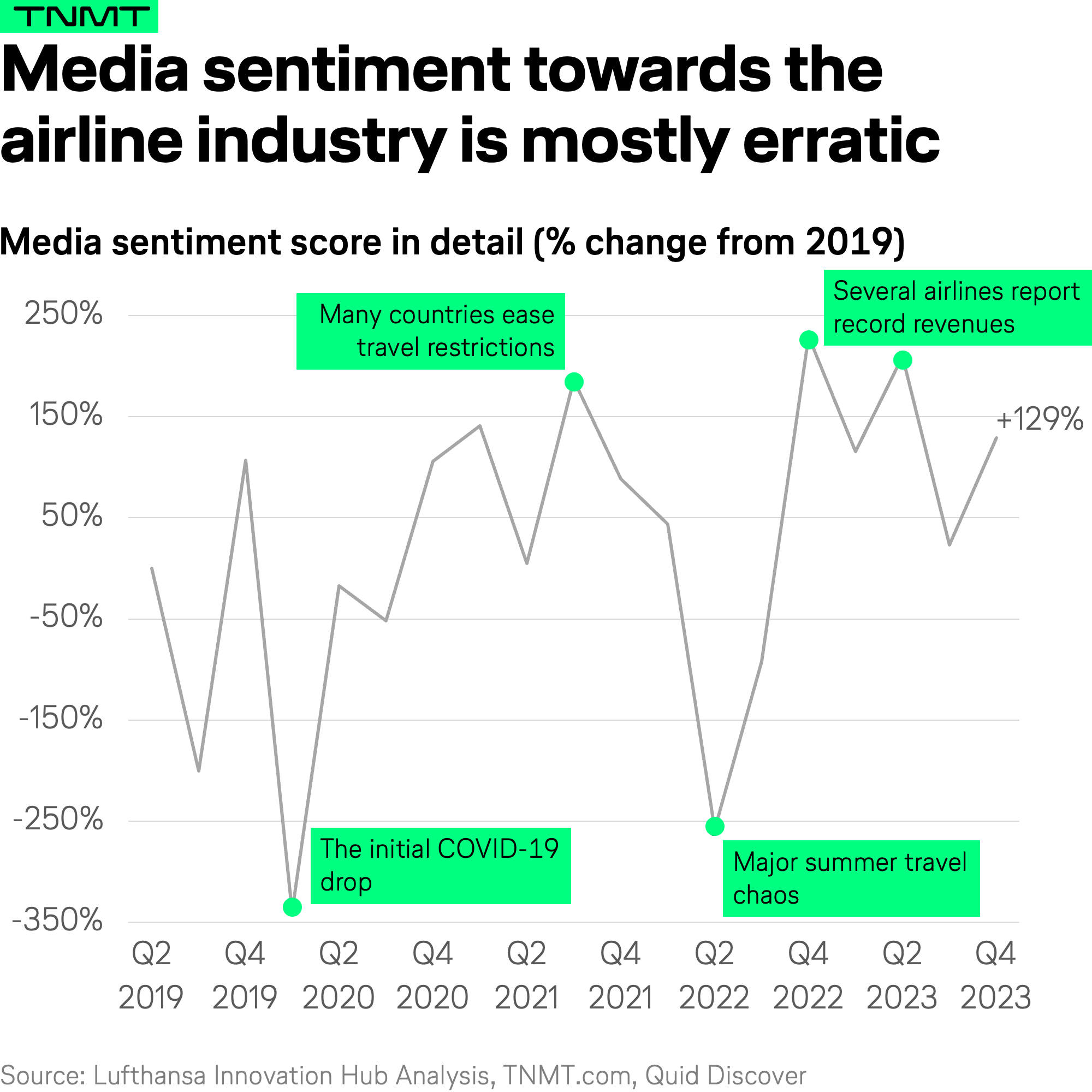

1. Media Trends Toward Sensationalism

The constant fluctuations in media sentiment clearly indicate a tendency towards sensationalism, focusing on extremes—either highly positive or negative, even though the latter seems to dominate.

While this approach captures attention and eyeballs, it doesn’t necessarily reflect the true sentiment toward air travel.

In fact, it can skew public perception, suggesting that extreme experiences are more common than they actually are.

- This would be a worrying insight because, according to J.D. Power’s 2024 North America Airline Satisfaction Study, media coverage significantly impacts traveler trust in airlines.

- For instance, travelers exposed to negative news coverage reported trust satisfaction scores 40% lower than those who did not encounter such content.

This suggests that some of the negative traveler sentiment could be amplified by media coverage, calling into question the objectivity of using traveler sentiment as a sole measure of satisfaction with airline services.

2. Stoic Airline Executives

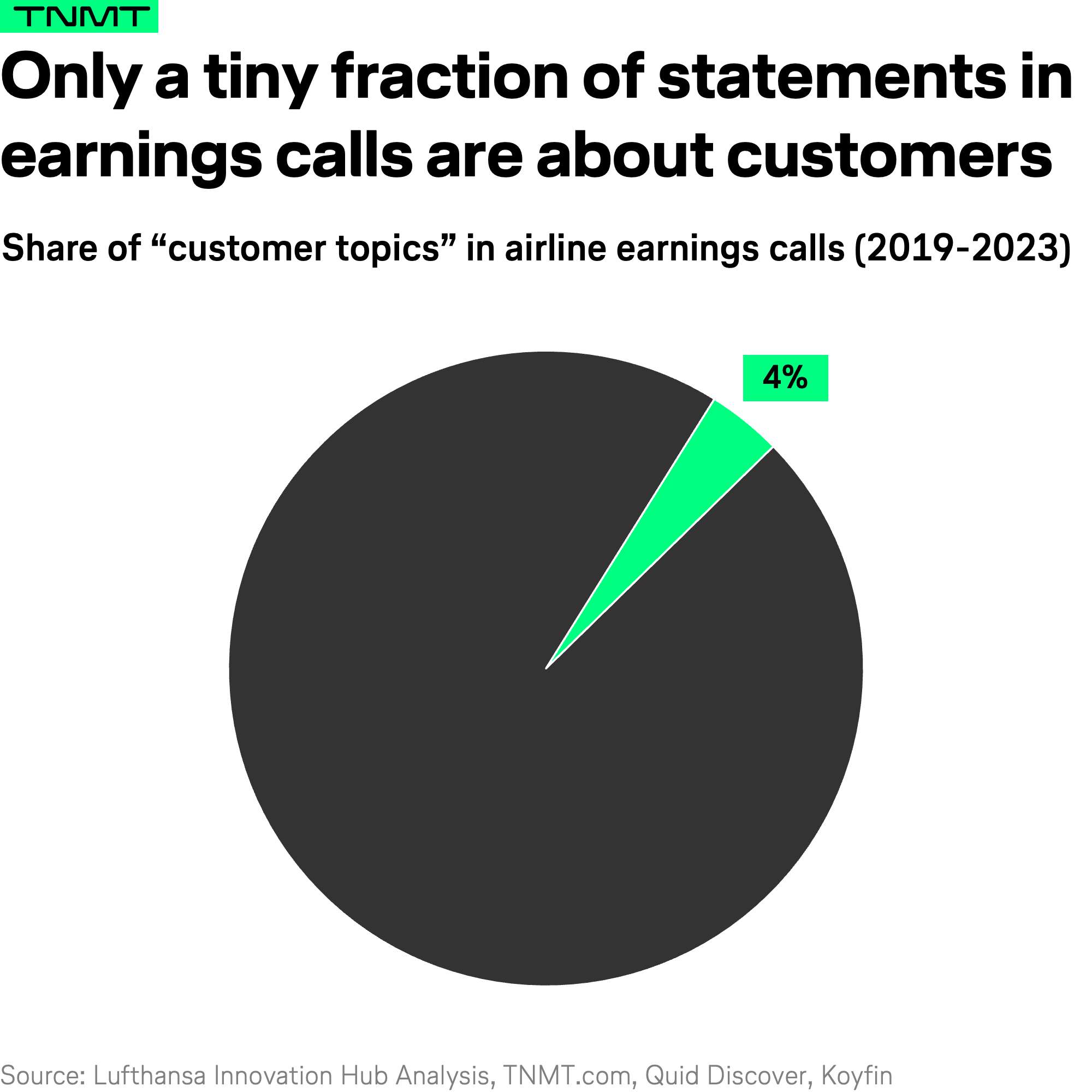

The remarkably stable sentiment among airline executives can be interpreted in several ways:

- On the one hand, it suggests diplomatic consistency. The stability in tonality likely reflects the executives’ polished and diplomatic tone during earnings calls, aimed at maintaining investor confidence despite external disruptions.

- On the other hand, it suggests financial focus over customer experience. Discussions in these earnings-call settings usually prioritize financial metrics like profitability and revenue growth over direct customer experience issues. This focus might explain why there is little to no discussion of deteriorating customer satisfaction, as executives (and Wall Street analysts) may not see a direct link between enhanced customer experience and immediate financial returns.

These insights suggest a need for a broader dialogue within the industry, considering both the sensationalist tendencies of media coverage and the potentially narrow focus of executive discussions on financials rather than customer-centric metrics.

The latter point is what concerns us the most.

The Urgent Need for a Customer-Centric Approach

The potential disconnect between airline executives’ focus and customer satisfaction has surfaced as the most critical point in our analysis. The lack of prominence given to customer experience in executive discussions, especially during earnings calls, raises concerns about the prioritization of passenger needs within airline strategies.

Recent findings from the 2024 Travel Technology Investment Trends by Amadeus further substantiate this concern.

According to the study, investment in enhancing customer experience is ranked significantly lower than other financial and operational priorities for the upcoming year.

This suggests a troubling oversight, as enhancing customer experience is not only about addressing immediate passenger grievances but also about securing long-term loyalty, trust, and, wait for it, financial return.

Happy Customers = Higher Prices

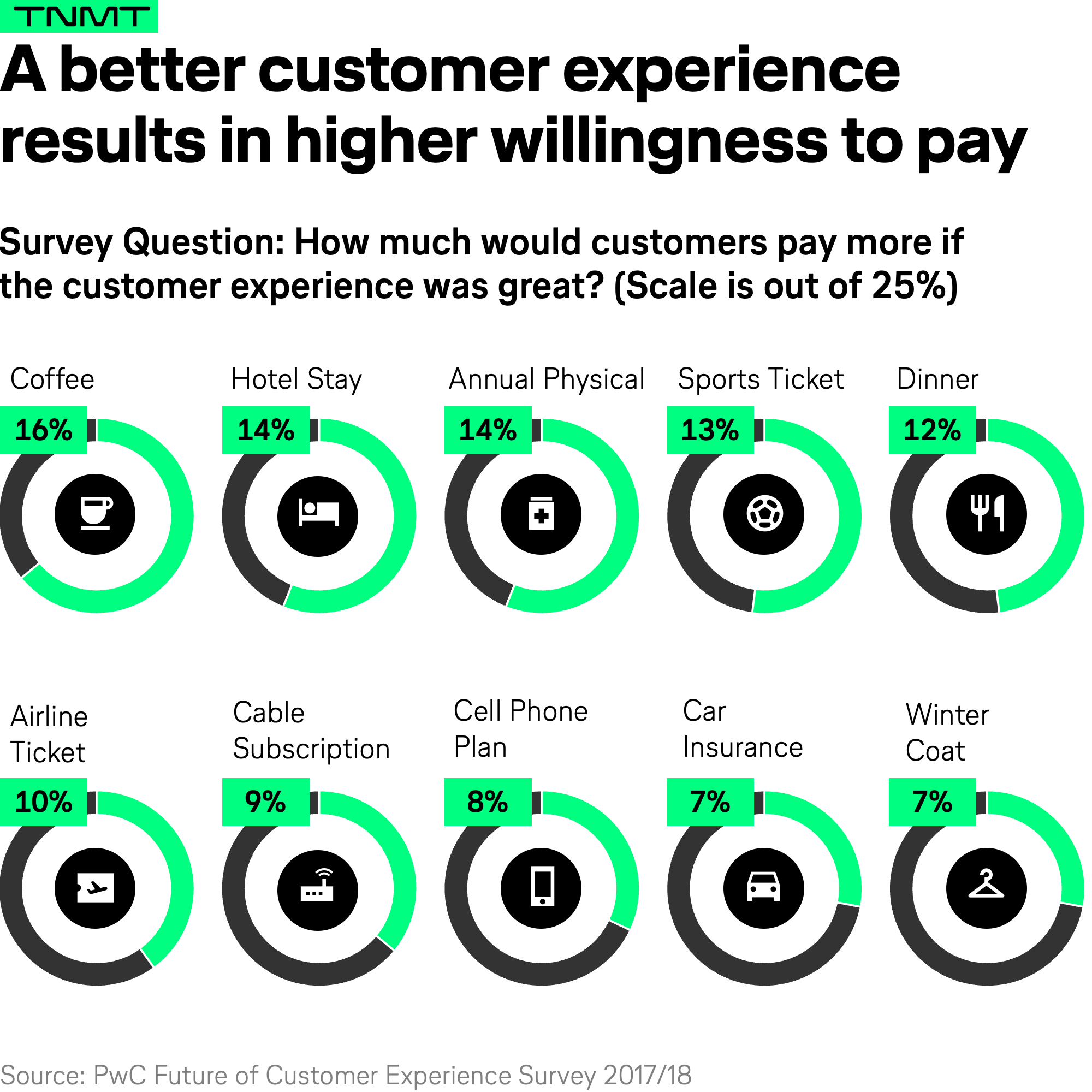

Management research shows that companies that prioritize customer satisfaction tend to see an increased willingness to pay from their customers.

According to PwC, providing superior customer experiences can increase the willingness to pay for an airline ticket by up to 10%. So, ignoring customer dissatisfaction is not just a service failure; it’s a missed financial opportunity, especially critical in the low-margin airline industry.

Happy Customers = Higher Stock Price

Moreover, an improved customer experience could result in not just higher revenues but also stronger stock performance aka shareholder value—essentially the core responsibility of executives.

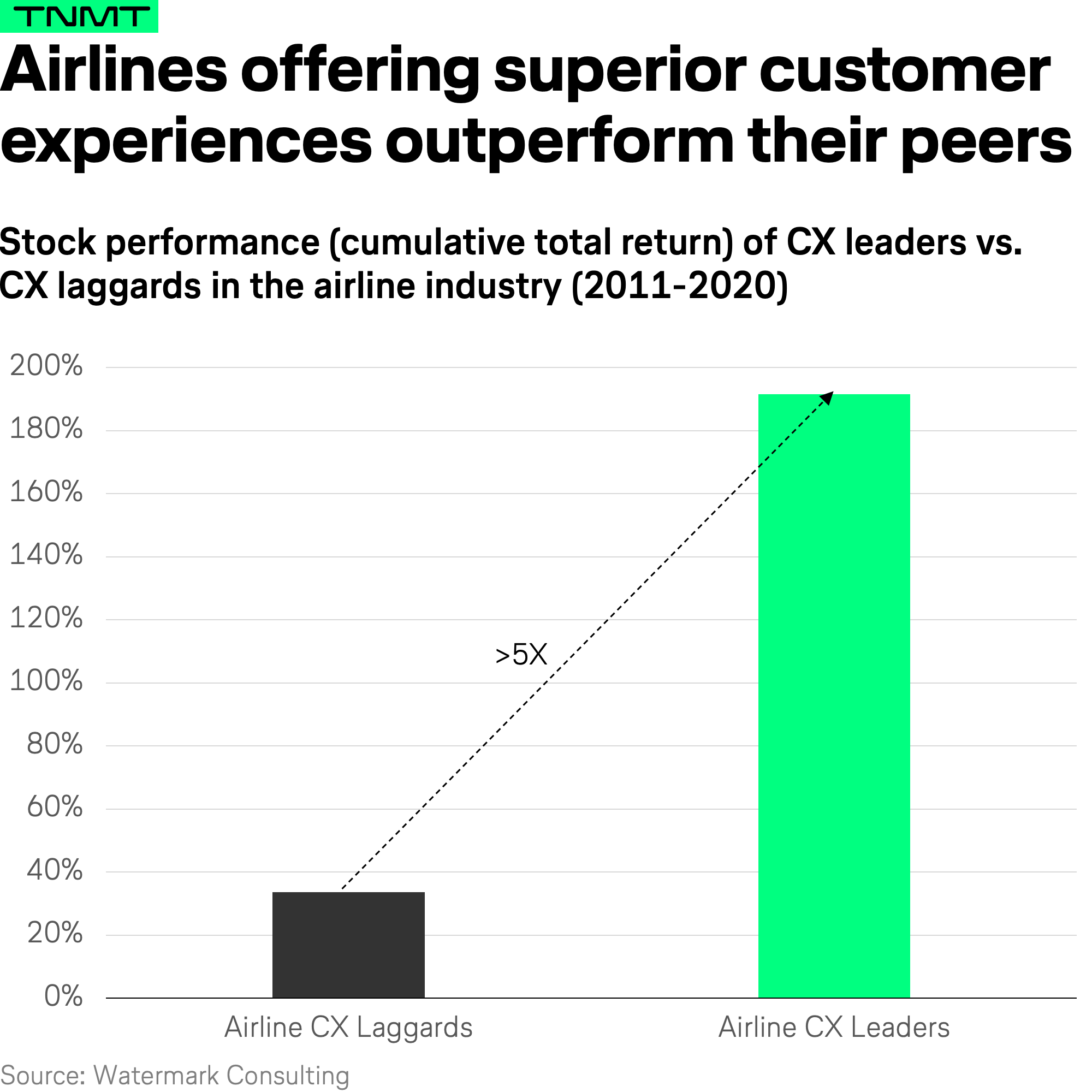

A study by Watermark Consulting highlights this financial implication: North American airlines that lead in customer experience demonstrate significantly better stock performance compared to those lagging in this area. Over the past decade, from 2011 to 2020, the cumulative total return of customer experience leaders in the airline industry was more than five times that of CX laggards.

These findings unequivocally support the argument that airlines must place a stronger emphasis on customer satisfaction, not just for service excellence but also for robust financial health and shareholder value.

The apparent lack of focus on customer satisfaction in strategic discussions suggests a potential misalignment between where airlines are focusing their resources and where they could generate the most significant long-term (financial) benefits.

Given these insights, it is imperative for airline executives to integrate customer satisfaction metrics more deeply into their strategic planning and discussions.