This article was developed with significant research contributions by Nour-Elhoda Hassan, a Research and intelligence Intern at Lufthansa Innovation Hub.

In the world of startups, we love a good success story. The unicorns, the disruptors, the companies that go from garage to global dominance in record time.

These stories fuel the innovation hype cycle, reinforcing the idea that with the right vision, the right funding, and a little bit of luck, anything is possible.

But what if we flipped the script?

What if, instead of looking at the winners, we turned our attention to the companies that didn’t make it? The startups that burned through millions in venture capital, scaled too fast (or not fast enough), misread their market, or simply ran out of time.

Today, we’re taking a hard look at the startup graveyard of Travel and Mobility Tech—not to dwell on failure, but to understand what it reveals about the state of innovation in our industry.

Because failure isn’t random. Startups don’t collapse in a vacuum. Patterns emerge. And by analyzing which companies went under, why they failed, and where they came from, we can potentially uncover valuable insights into what’s working in our industry—and what isn’t.

So we asked ourselves:

- How many Travel and Mobility Tech startups have shut down, filed for bankruptcy, or been forced into firesales in recent years?

- Which sub-sectors have seen the highest failure rates—and why?

- And most importantly: What do these failures tell us about the future of innovation in our industry?

Let’s dive into the lessons hidden in the ashes of Travel and Mobility Tech’s graveyard.

The Reality Check: How Many Startups Don’t Make It?

Let’s start with a foundational question: How often do Travel and Mobility Tech startups actually fail?

Failure is an unavoidable part of the startup world, but understanding the scale of it is crucial to making sense of what’s happening in the industry today.

So, we turned to our proprietary Lufthansa Innovation Hub startup database to find the hard numbers.

Here’s what we found:

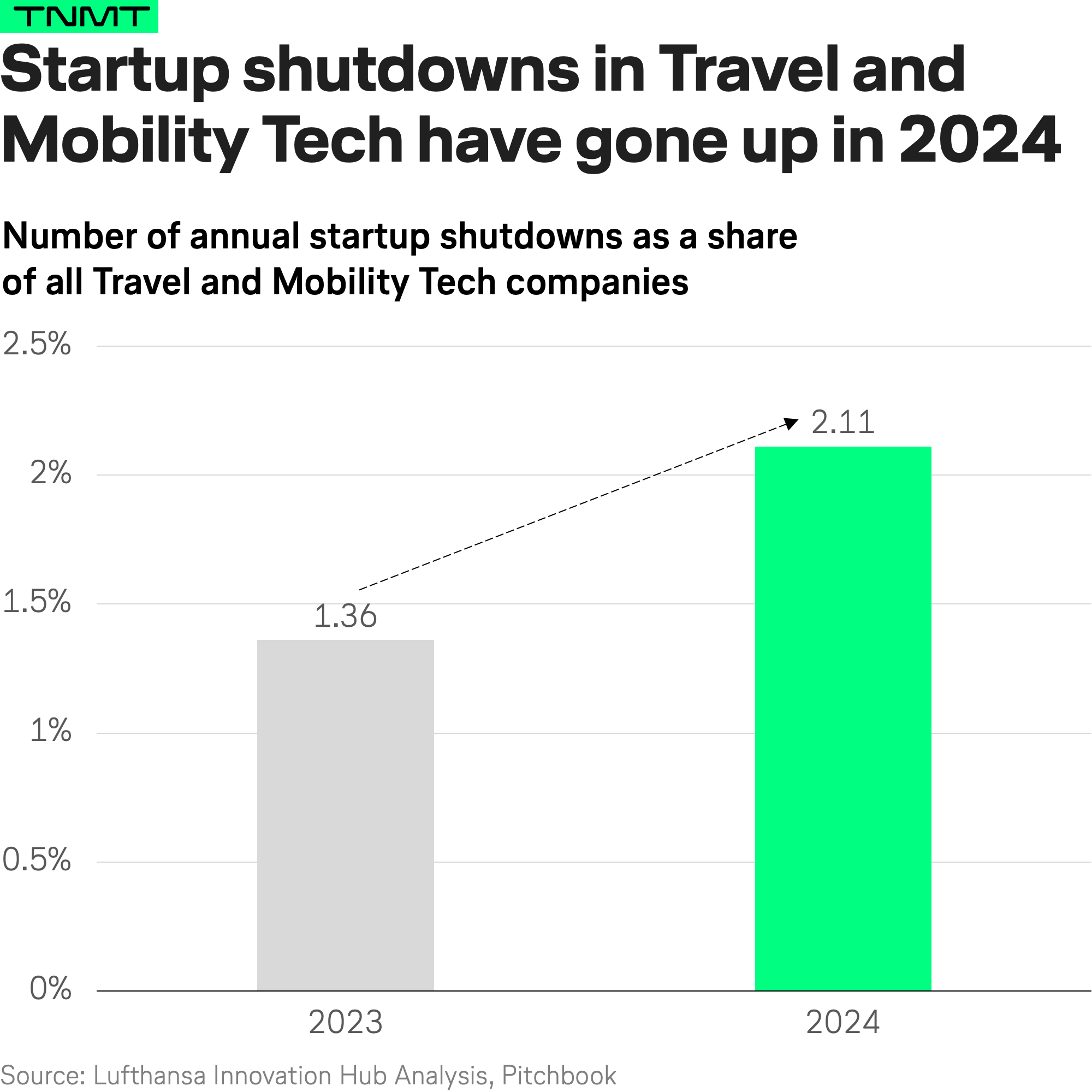

Over the past three years, between 1.3% and 2.2% of all existing Travel and Mobility Tech startups have failed each year—meaning they’ve shut down, gone into liquidation, been acquired in fire sales, or had their assets sold off.

What really stands out is 2024’s spike in startup failures.

From 2023 to 2024, there was a noticeable jump–startups collapsed at a significantly higher rate than before—but why?

When stepping back and looking at the macroeconomic picture, the trend makes perfect sense. 2024 was an incredibly difficult year for startups, especially in our sector.

- The economic climate shifted. Rising interest rates, inflationary pressures, and recession fears made capital more expensive and the cost of doing business significantly higher.

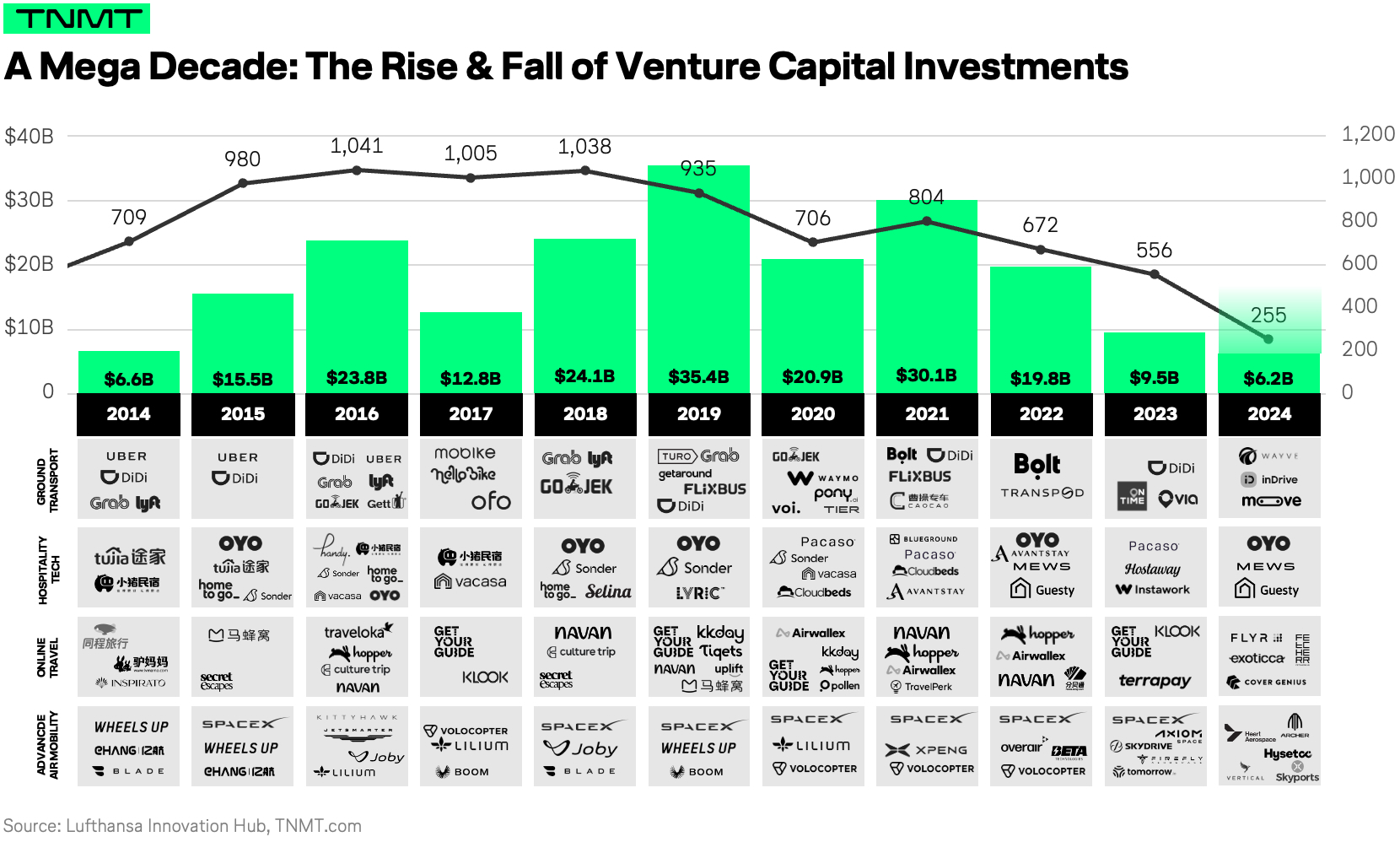

- As a natural byproduct, venture capital dried up. As seen in our Sector Attractiveness Report, VC firms shifted focus primarily to later-stage companies with proven business models, leaving early-stage startups in an increasingly fragile position.

- Thirdly, the post-pandemic recovery is still in progress, especially in the travel context. While leisure travel has rebounded, business travel remains below pre-pandemic levels, making it harder for startups relying on corporate demand to gain traction.

Put simply: 2024 was a survival test. The companies that had strong balance sheets, clear revenue models, and patient investors held on. The ones that didn’t? They faced an uphill battle that many couldn’t overcome.

And this is just the high-level picture.

The Hardest-Hit Sector: Why Online Travel Startups Are Struggling the Most

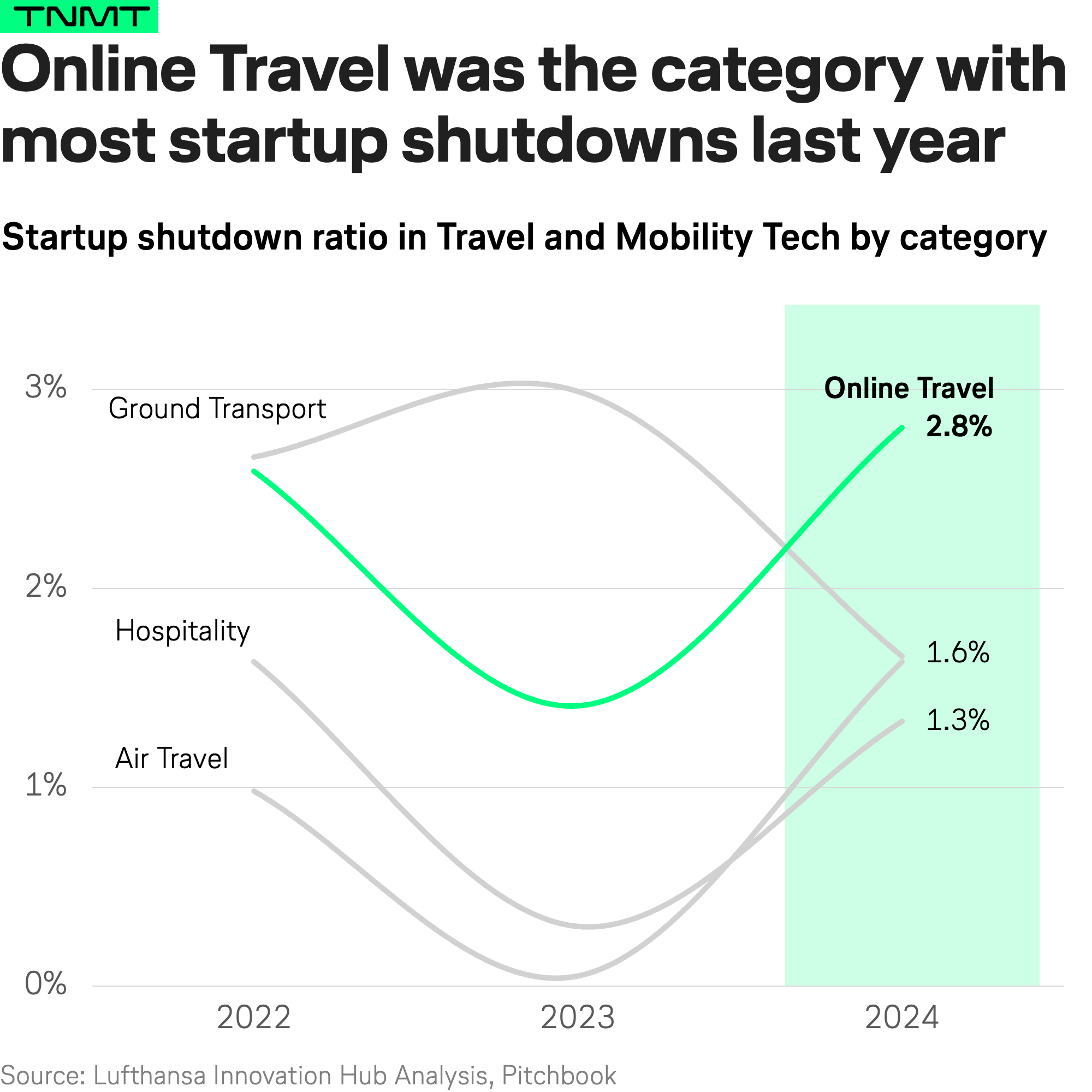

If 2024 was a survival test for Travel and Mobility Tech startups, some sectors would be hit harder than others.

We set out to uncover where failure rates were the highest—and the results were quite striking.

- Among the many sub-sectors in Travel and Mobility Tech, one category stands out: Online Travel startups.

- Companies focused on inspiration, planning, and booking platforms saw the highest failure rates in 2024, with nearly 3% shutting down.

- This is almost double the rate of other major segments like Hospitality, Air Travel, and Ground Transport.

This raises a key question: Why are Online Travel startups struggling more than the rest?

For one, Online Travel has always been an attractive playground for entrepreneurs.

- Travel is something we all experience firsthand, and we’ve all encountered frustrating pain points when booking trips—opaque pricing, hidden fees, inflexible cancellation policies, and clunky user experiences.

- This naturally leads to a common assumption: Online Travel can be easily “fixed” with better digital tools.

But reality tells a different story.

The Online Travel sector is, in fact, notoriously difficult to disrupt, and as our analysis shows, many startups ultimately fail to gain traction.

Here’s why:

1. It’s a Deceptively Complex Industry

At first glance, Online Travel seems like a low-barrier, software-driven sector. But behind the scenes, it’s powered by deeply entrenched legacy systems, complex partnerships, and highly fragmented supply chains.

Booking platforms don’t just require a great UX—they need to integrate with Global Distribution Systems (GDS), airline reservation networks, hotel inventory databases, and payment infrastructure, making execution far more difficult than many founders anticipate.

2. Too Many Startups, Too Little Differentiation

Because Online Travel is largely a pure software play, barriers to entry are lower than in asset-heavy segments like aviation or mobility hardware. This naturally leads to a high volume of new startups, but few manage to stand out. Travel content and data access have become quite commoditized, meaning many startups struggle to offer a unique value proposition. Those that don’t differentiate fail to attract enough users—or investor confidence.

Take Skyhour, for example.

- Launched in 2016, Skyhour aimed to reinvent flight gifting.

- The app lets users send and receive “Skyhours,” with each hour of flight time available at a fixed price—an alternative to traditional airline gift cards.

- JetBlue Ventures backed the company, and it partnered with 350+ airlines, building early momentum.

But industry analysts pointed out a core problem: if Skyhour wasn’t offering discounts, what truly set it apart?

Ultimately, it lacked a compelling enough reason for travelers to switch, and in 2024, it shut down.

The recent AI boom in Online Travel highlights this differentiation problem even further.

Following the rapid rise of Generative AI (GenAI), the market saw an explosion of AI-powered trip-planning startups, all claiming to revolutionize how travelers discover, plan, and book their trips. However, most of these startups vanished almost as quickly as they appeared.

Why? Because AI alone isn’t a viable differentiator.

At its core, trip planning remains a commoditized service. AI-powered itinerary builders and recommendation engines don’t fundamentally change the value proposition (at least thus far)—especially when major OTAs and metasearch platforms have all integrated AI into their existing offerings. In this sense, AI in travel has quickly shifted from a disruptive innovation to a basic feature—something big players can replicate at scale.

The result? A wave of AI travel startups launching with hype, only to shut down or be quietly acquired soon after.

Here are some examples of AI-powered Online Travel startups that gained attention but failed to gain traction:

- Tripnotes: A ChatGPT-powered trip planner that went viral but shut down in 2023 after struggling to raise funds and was later acquired by Dorsia, a members-only restaurant reservation startup.

- AMBLR: An AI-powered vacation planning tool with destination recommendations.

- Planit Earth: A ChatGPT-powered itinerary generator tailored to user preferences.

- Letsroam: An AI-driven city exploration assistant, gamifying travel with challenges and riddles.

- PlanMyTripASAP: An AI-powered travel planning assistant for weekend escapes and extended vacations.

- Wayfind: An AI-based itinerary builder designed for personalization.

- GetMeFlights: An AI-driven cheap flight finder attempting to compete with metasearch giants but failing to gain market share.

The pattern is clear: AI-powered travel startups face the same fundamental challenge as their predecessors—differentiation.

Simply integrating AI isn’t enough—startups need a truly unique value proposition, something that big OTAs and metasearch platforms can’t easily replicate. Without that, failure is inevitable.

And it’s not just new startups struggling with this. Even existing Online Travel companies that add a GenAI layer to their product face similar challenges.

- Many assume that integrating AI into an existing platform will automatically drive investor interest, new funding, or market differentiation.

- But as we’ve seen, that’s rarely the case—especially if the company is already struggling with market positioning or technology stack complexity.

Take Weeva, the sustainability reporting tool for the travel sector, which announced a major AI integration in 2023. The update was designed to streamline sustainability reporting, automatically pulling data from multiple sources, generating digestible reports, setting reminders for target-setting, and analyzing large datasets to compare performance across properties.

Despite these advancements, AI alone wasn’t enough to drive significant growth or shift the company’s trajectory. In the end, the business failed to scale and was ultimately acquired.

3. User Acquisition is Brutally Competitive

Building a great booking platform is one thing. Getting people to use it is another. Online Travel is a pay-to-play game, and legacy players dominate marketing channels. Take Expedia, for example—about 50% of its operating expenses go to marketing. Competing with that as an early-stage startup is nearly impossible.

As a result, most new ventures target niche audiences, a trend we explored in our Communities Define Demand deep dive. But while niche offerings can generate loyal users, many fail to reach the scale needed to build a profitable, growing business.

The bottom line? Many Online Travel startups don’t necessarily fail because they lack great ideas—they fail because the industry itself is uniquely difficult to break into.

Journera—a well-known B2B travel management platform—is another good example of this.

- Backed by Amadeus Ventures, Journera partnered with major players like Hilton, Hyatt, Marriott, IHG, and American Airlines to deliver a data-driven “Journey Matching” platform aimed at personalizing the traveler experience.

- But the company struggled with market readiness. Its technology and business model were ahead of industry understanding, making adoption slow.

- Then came GDPR regulations and high-profile data breaches across the travel industry, leading companies to delay or cancel critical implementations.

- When the pandemic hit, travel brands faced survival pressures for over two years—making investment in long-term data infrastructure a low priority.

Journera managed to survive all these challenges but never reached profitability, ultimately proving that even well-funded, well-connected startups aren’t immune to the structural challenges of Online Travel.

The Bottom Line

The barriers to success in Online Travel are higher than most founders initially realize.

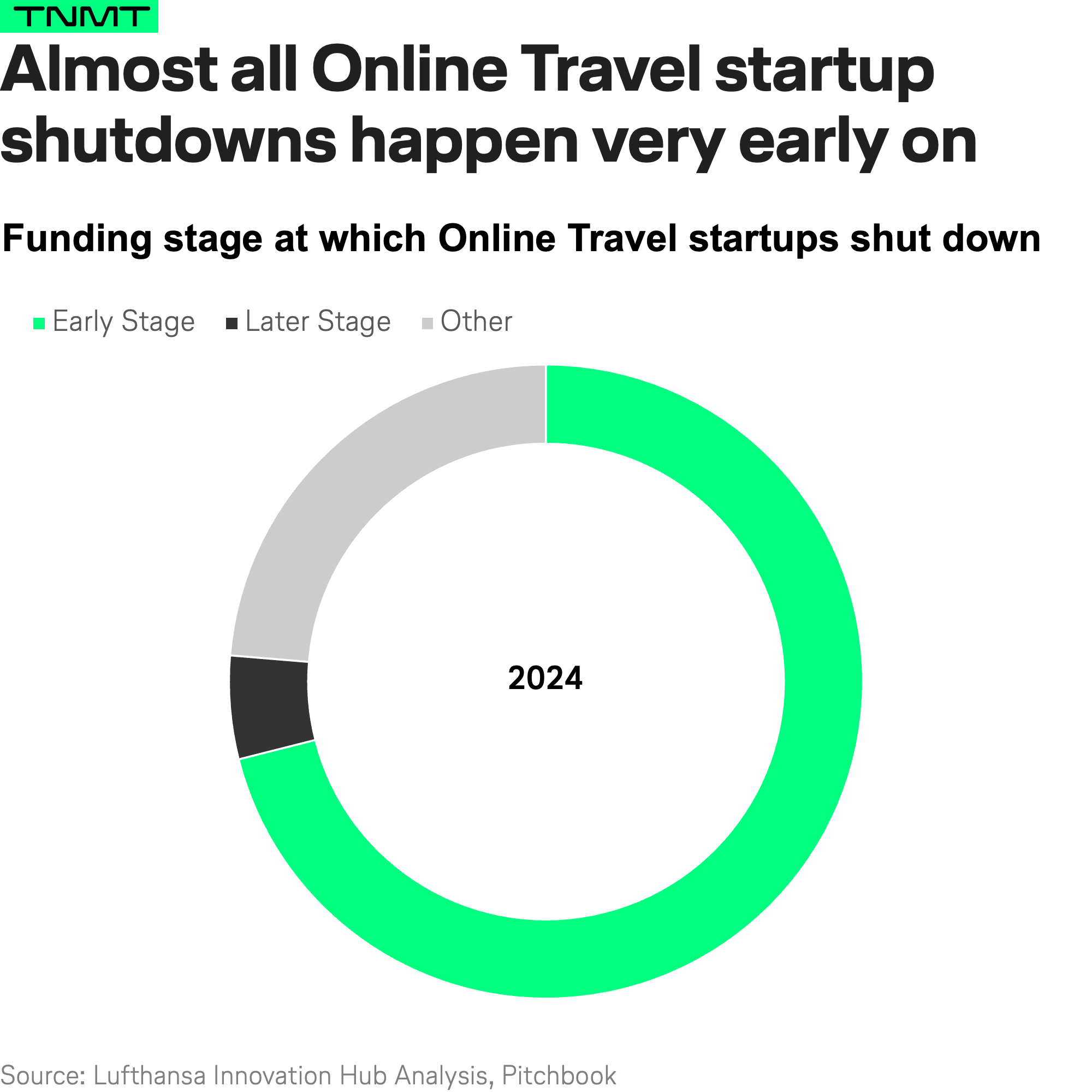

And as our data shows, these challenges are particularly severe for early-stage startups. Out of the 38 Online Travel companies that shut down in 2024, a staggering 27 had only raised early-stage funding—through accelerators, angel investors, crowdfunding, or seed rounds.

Another key reason? The heavy B2C focus of most Online Travel startups.

- Roughly 80% of newly founded Online Travel ventures are consumer-facing businesses, yet investor interest has increasingly shifted toward B2B models—a trend we explored years ago in our inaugural State of Travel and Mobility Tech Report.

- For early-stage startups trying to build consumer-facing travel platforms in today’s funding environment, the odds are simply stacked against them.

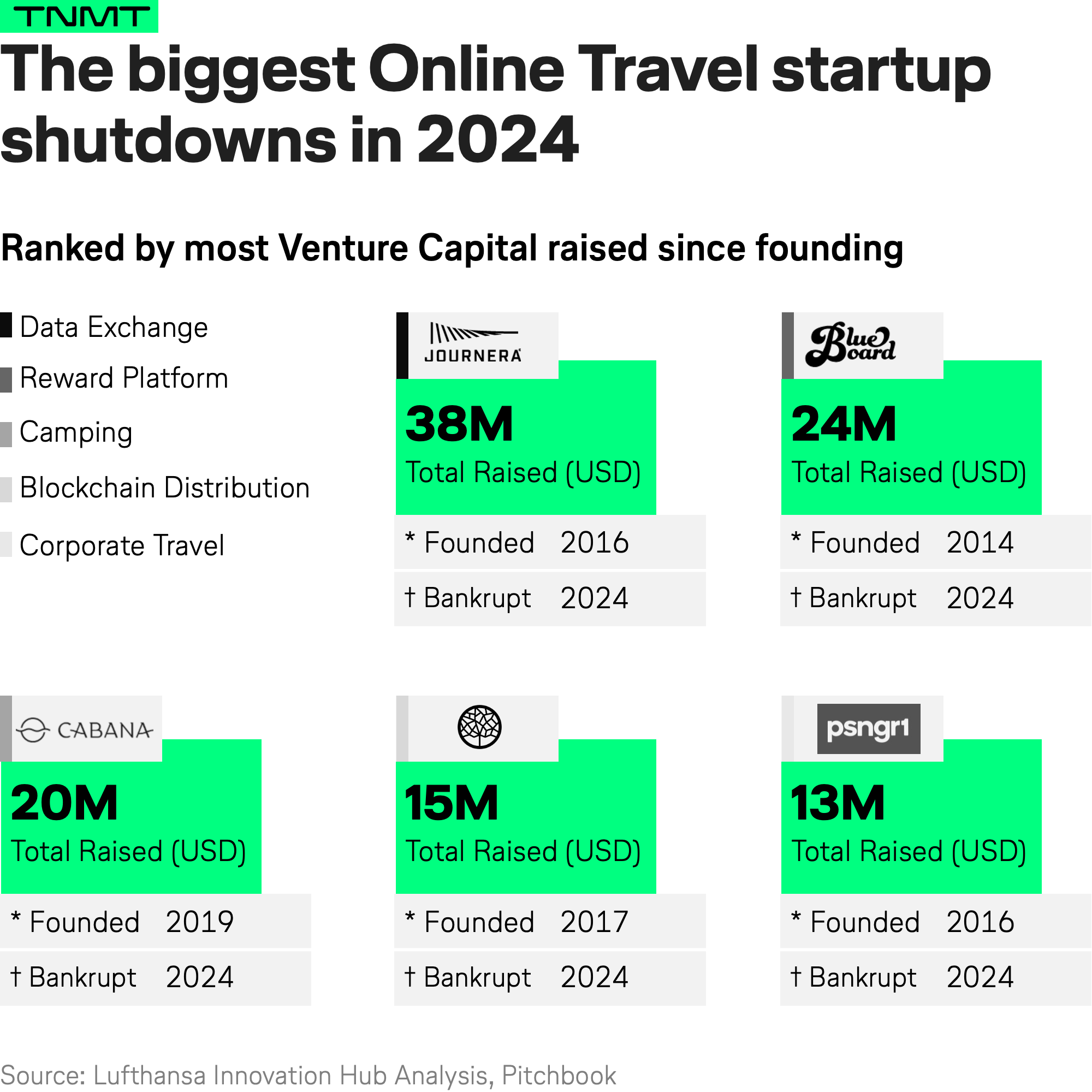

To dive deeper, here’s a list of the five largest Online Travel failures in 2024.

There are many more company-specific lessons to unpack, so we encourage you to explore these cases further and extract additional insights.

What Airlines Can Learn from Startup Failures

At first glance, this deep dive into Travel and Mobility Tech startup failures may seem most relevant to founders, venture capitalists, or those working in startup innovation.

But in reality, there are critical takeaways for airline industry professionals, particularly those involved in distribution, digital transformation, and revenue management.

Why?

Because many of the challenges that Online Travel startups struggle with—complex distribution systems, lack of differentiation, and brutally competitive user acquisition—mirror the same challenges airlines face with their direct online channels.

Consider this: Online Travel startups don’t just compete with OTAs and metasearch engines; they also compete with airline.com websites. Understanding why so many failed to scale offers a unique opportunity for airlines to reflect on their own digital and retail strategies.

Here’s what we believe airlines can learn from these failures—and what they can do to stay ahead.

1. Airline Distribution Is More Complex Than It Seems

For years, airlines have been trying to own their direct distribution channels instead of relying on third-party platforms like OTAs, metasearch engines, or GDS-powered booking agents.

But just like Online Travel startups, airlines face a highly complex and deeply entrenched digital infrastructure that makes this transition difficult.

While it may seem like selling a flight ticket is as simple as listing fares and enabling direct booking, the reality is far more intricate:

- Prices fluctuate in real time based on demand, seasonality, competition, and seat availability, all managed through aging reservation systems like GDS and Passenger Service Systems (PSS).

- Airlines increasingly rely on upselling ancillaries like seat selection, baggage, and lounge access, but delivering these options at the right time, in the right format, and with the right pricing remains a challenge. Many carriers are still struggling to fully implement New Distribution Capability (NDC), which is meant to modernize ancillary sales by enabling personalized offers and flexible bundling.

- Most airline retail systems were built decades ago, making it difficult to integrate modern e-commerce and personalization capabilities—a problem Online Travel startups faced firsthand when trying to build seamless user experiences on top of fragmented supplier APIs.

The lesson for airlines: The failures of Online Travel startups prove that a better user interface alone isn’t enough. Real innovation in airline retail requires rethinking the back-end systems that power pricing, distribution, and ancillary packaging.

2. Airline Websites Look—and Feel—the Same

A major issue for Online Travel startups was a lack of differentiation—and airlines face the same problem.

Most airline websites follow (mostly) identical structures:

- A basic search bar, static flight results, and standard ancillary upsells.

- Airlines operating within legacy GDS environments have limited flexibility in pricing models, bundling, and promotions, resulting in a homogeneous user experience across airline brands.

- If every airline sells extra legroom or priority boarding, customers will ultimately choose based on price alone, leading to a race to the bottom rather than brand differentiation.

The lesson for airlines: If Online Travel startups tend to fail because they can’t carve out a unique offering, airlines must take a serious look at their direct channels and ask: How can we make the experience of booking with us more engaging, more personalized, and more valuable than just going to an OTA?

3. Competition is fierce

For Online Travel startups, acquiring customers is arguably the biggest challenge—and airlines face a similar battle.

- OTAs, metasearch engines, and alternative travel platforms dominate how travelers discover and book flights. In 2023, more than 50% of travelers booked with OTAs, compared to just 37% who booked directly with airlines.

- Expedia, for example, allocated more than half of its operating expenses to marketing in 2023. Competing with that as an airline—especially outside of the top 10 global brands—is incredibly difficult.

Simply put, airlines are not just competing against each other for direct bookings; they’re competing against an entire ecosystem of digital-first travel platforms.

The lesson for airlines: Relying on the same traditional direct booking strategies won’t cut it. Airlines need to invest in smarter customer acquisition tactics, stronger loyalty incentives, and innovative ways to capture direct bookings.

How Airlines Can Stay Ahead: Three Key Action Points

Given these insights, airlines must take a proactive approach to avoid falling into the same traps as failed Online Travel startups. To compete effectively in the digital travel ecosystem, three major areas require immediate attention:

1. Modernizing Distribution and Retail

For years, airlines have relied on rigid, outdated booking systems that limit their ability to control pricing, upselling, and bundling. Many airline websites still operate within GDS constraints, preventing them from offering more dynamic and personalized content.

Transitioning to NDC is a crucial step in changing this. Airlines that fully embrace NDC can move beyond static pricing, create flexible ancillary bundles, and regain control over how their products are displayed and sold. The goal? More direct bookings, less reliance on intermediaries, and a stronger brand presence in the traveler’s booking journey.

2. Enhancing the Booking and Digital Experience

Most airline websites still offer a rather generic, transaction-based booking process—a missed opportunity in an era where personalization and engagement drive conversions.

One way to do this is by moving beyond static booking pages and embracing interactive content.

- Instead of simple text descriptions, airlines could use videos, 3D previews, and animated visuals to showcase different seat classes, premium lounges, or in-flight meal options.

- Short video tours could highlight the benefits of extra legroom seating, while an interactive meal selection experience could allow passengers to view and customize their in-flight dining choices before checkout.

Looking even further ahead, next-generation digital experiences could redefine how travelers interact with airline brands. As we explored in our Metaverse Scenarios series, immersive virtual airline showrooms could provide a highly engaging way for passengers to explore cabin layouts, compare services, and even book flights in an entirely new format.

3. Addressing Travelers’ Real Pain Points

Beyond optimizing the booking process, airlines must focus on solving actual traveler frustrations—not just selling flights. Travelers don’t just want better booking experiences; they want solutions to real-world travel challenges.

One pressing issue is visa accessibility.

- Visa restrictions remain a major barrier, particularly in high-growth markets like India and Southeast Asia.

- Instead of leaving travelers to navigate this process alone, airlines could integrate visa assistance services directly into their booking platforms, either through strategic partnerships or as part of bundled travel protection plans.

- This would offer travelers peace of mind and eliminate one of the biggest obstacles in the planning process.

Another example comes from IndiGo, which introduced gender-specific seat selection in 2024.

- This feature allows female passengers to choose seating next to other women, catering to specific traveler concerns and improving comfort for solo female travelers.

- Airlines that introduce thoughtful, experience-driven innovations like this can enhance passenger confidence and loyalty.

Airlines should also explore more flexible booking models beyond traditional ticketing structures. Subscription-based pricing, flight passes, and loyalty-driven dynamic fares could help improve retention by offering travelers more adaptable ways to book and pay for their journeys.

Our Final TNMT Thoughts

The biggest lesson from Online Travel startup failures is simple: Having a great product or website isn’t enough.

For airlines, success in the digital travel space requires more than just selling tickets—it’s about differentiation, smarter distribution, and solving real customer pain points.

Airlines that fail to modernize their booking experience, enhance their direct channels, and adapt to evolving traveler needs will continue losing ground to OTAs and alternative travel providers.

However, those who embrace innovation, focus on traveler-centric offerings, and invest in more engaging digital strategies will thrive in an increasingly competitive travel market.

The choice is clear. Which path will your airline take?