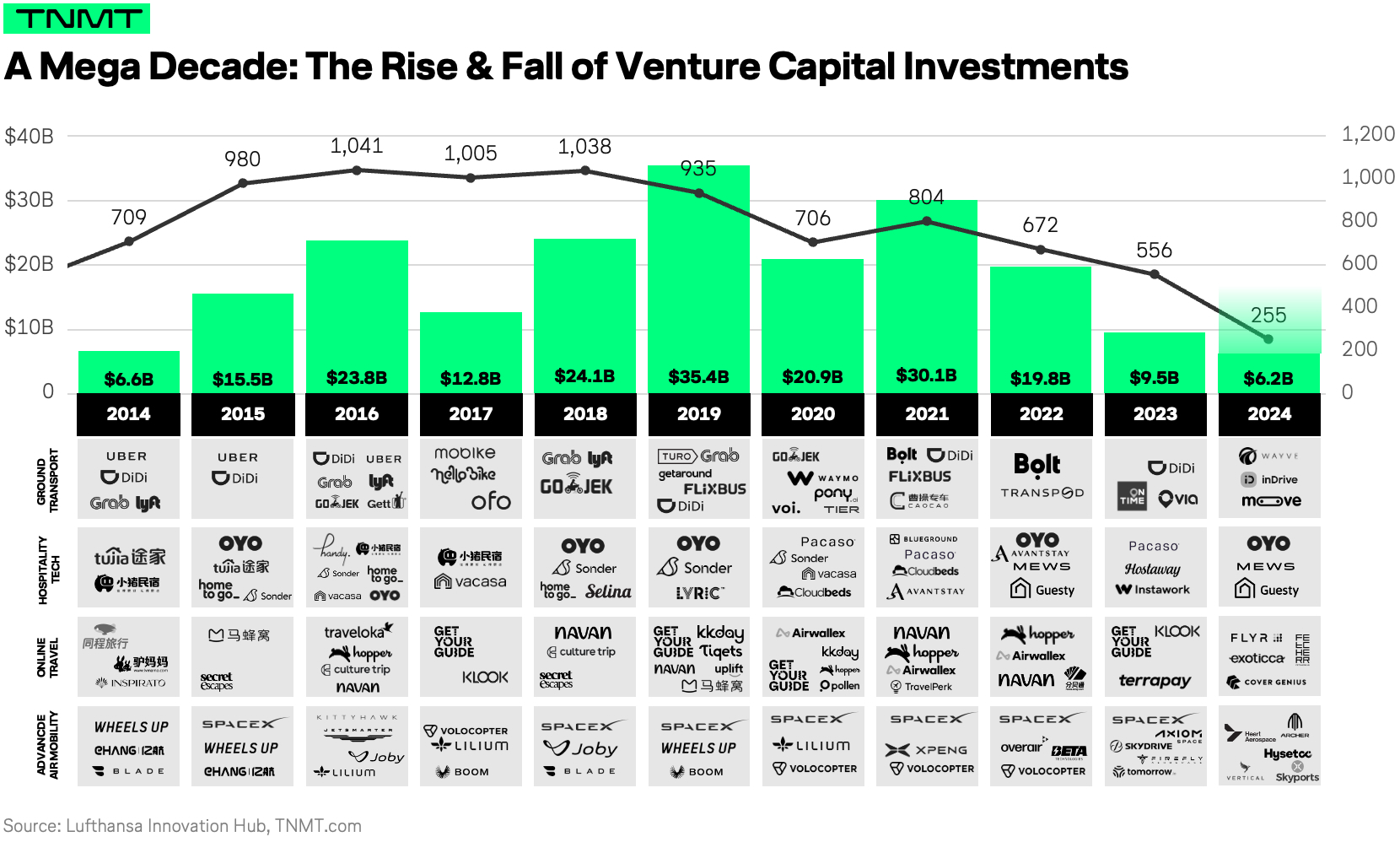

Here is a quick summary of global Venture Capital funding trends in our sector during the first six months of 2020.

Total dollar amounts invested remain strong

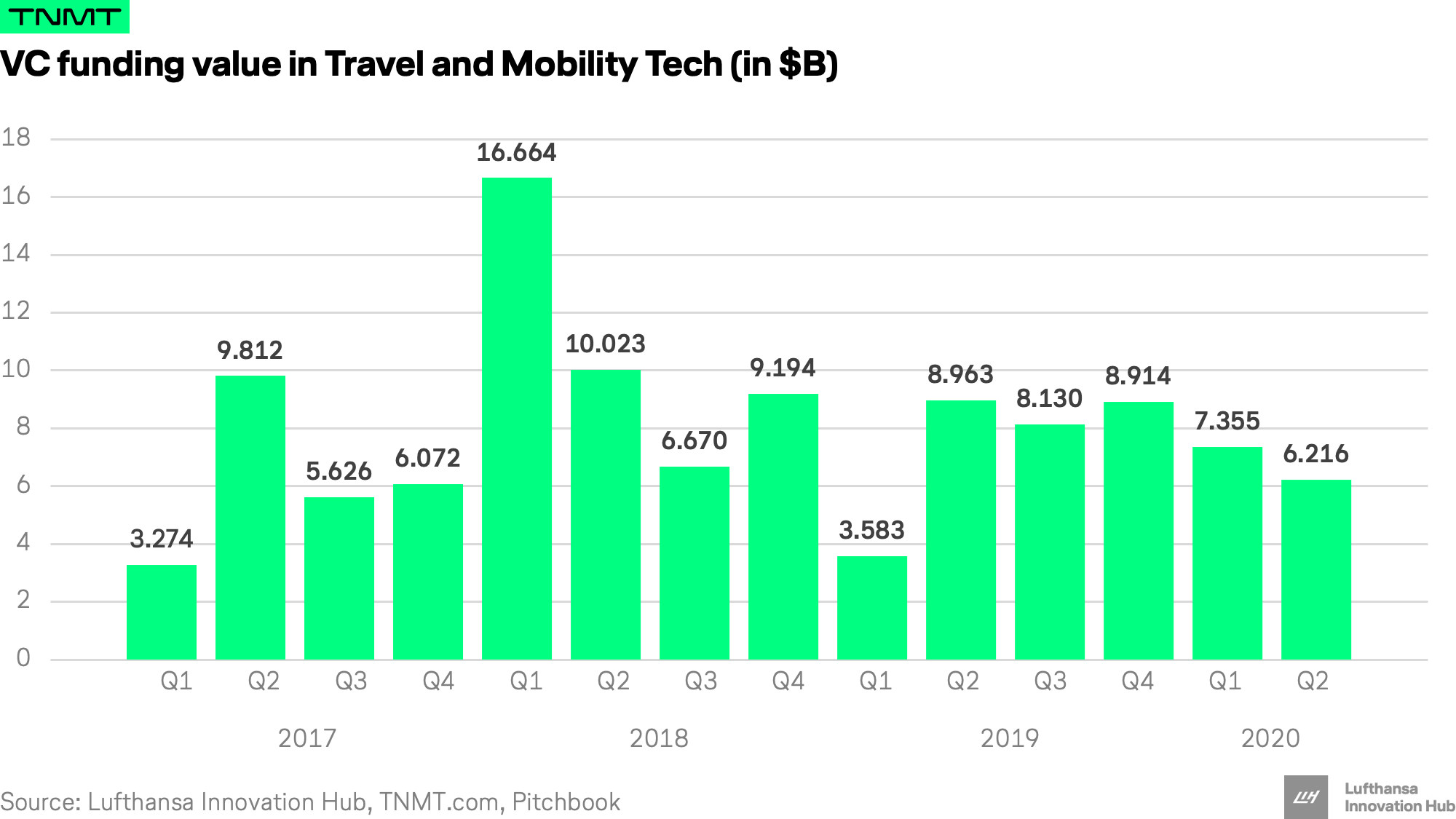

Over the past six months, about 13.5 billion USD were invested in startups across Travel and Mobility Tech – an 8% increase vs. the first six months in 2019.

It’s interesting to see funding amounts not only remain stable but slightly go up compared to last year considering the dramatic impact of the pandemic on our economy and the travel industry in particular.

However, it’s important to emphasize that dollar amounts invested in Q1 and Q2 have been lower than the preceding two quarters.

Also, last year’s Q1 came in dramatically below average mostly due to timing reasons as several mega-deals into the late-stage outliers (e.g. $1.25 billion into Uber) were completed just before Q1 started. So, the year-over-year comparison might be slightly blurred.

Deal activity slowed down

The negative Covid-19 impact becomes clearer when looking at VC activity measured by the number of deals that took place. VC deals saw a major bump in the first half of 2020 starting exactly in February when the virus found its way around the world.

In June, we tracked 39% fewer deals year-over-year and 27% fewer deals vs. pre-Covid levels in February.

The takeaway: the ongoing trend of “fewer but bigger deals” in startup land – something we extensively covered in our 2019 Startup Report – continues to amplify during the pandemic.

Young startups struggle the most

Standing out when looking at deal activity across different deal stages is a trend for investors specifically holding back on early-stage deals.

Angel and seed activity in our space has generally been lower than for the overall VC market for many years now (again see our 2019 Startup Report) but with early-stage activity now also cooling off, the next wave of highly disruptive startups in Travel and Mobility Tech might not come around anytime soon.

It seems to be the case that investors focus on stabilizing their existing portfolio companies with follow-on financing – indicated by the ongoing high level of late-stage activity – instead of betting money on the next generation of potential game-changers.

Growing risk aversion seems to also have reached the VC game.

Phocuswire wrote an interesting piece on how the crisis has changed fundraising dynamics for travel startups by providing several real-world startup cases, so take a read if you want to learn more.

2020’s lucky outliers

Despite the circumstances, several promising startups in our space were able to score significant investment rounds since the pandemic broke out.

Who are these players? Check out the 10 biggest VC deals since March 2020:

- Waymo – the California-based self-driving car startup raised $3B from Andreessen Horowitz, Mubadala Investment Company, and further investors.

- Go-JEK – the Indonesian ride-hailing startup raised $3B from AIA Group, Alphabet, and further investors.

- Li Auto – the Chinese electric vehicle startup raised $550M from Meituan-Dianping.

- Xpeng – the Chinese intelligent and electric vehicle startup raised $500M from Hillhouse Capital Group, Sequoia Capital China, and further investors.

- SpaceX – the US-based aerospace and space transport service designer raised $346.22M from Argonautic Ventures, Pegasus Tech Ventures, and further investors.

- Lilium – the German eVTOL startup raised $275M from Atomico, Freigeist, and further investors.

- Traveloka – the Indonesian online travel booking startup raised $250M from BRI Ventures, East Ventures, and Qatar Investment Authority.

- Via – the New York-based carpooling startup raised $200M from 83North, Broadscale Group, and further investors.

- Lime – the US-based bike-sharing startup raised $170M from Ajax Strategies, Alphabet, Bain Capital Ventures, further investors.

- Didi Bike – the bike-sharing arm of Chinese ride-hailing unicorn Didi Chuxing raised $150M from Legend Capital and SB China Venture Capital.

As you may have spotted, the top-10 list is very transportation heavy. Therefore, here a ranking of the 10 biggest VC deals for purely travel-related startups only:

- Traveloka – the Indonesian online travel booking startup raised $250M from BRI Ventures, East Ventures, and Qatar Investment Authority.

- TripActions – the US-based corporate travel management startup raised $125M from Greenoaks Capital Partners and Vista Equity Partners.

- Vacasa – the US-based vacation rental startup raised $108M from Riverwood Capital, Silver Lake Management, and Level Equity.

- Cloudbeds – the California-based hospitality management startup raised $82M from Counterpart Ventures, Cultivation Capital, and further investors.

- Hopper – the Canadian travel search and booking startup raised $75M from Business Development Bank of Canada, Caisse de dépôt et placement du Québec, and further investors.

- Selina – the US-based travel accommodation platform raised $60M from Revenio Capital.

- Fly Now Pay Later – the London-based travel payment startup raised $43.28M from Greenoaks Capital Partners and Vista Equity Partners.

- SevenRooms – the New York-based reservation tool for hospitality businesses raised $50M from Providence Equity Partners.

- Cloud Helios – the Chinese business travel and expense management startup raised $42.74M from Blue Lake Capital, China Renaissance, and further investors.

- Fenbeitong – the Chinese travel expense management startup raised $36M from BitRock Capital, China Growth Capital, and further investors.