Innovation has long been a defining characteristic of the aviation industry but it’s also a paradox.

- On the one hand, aviation is one of humanity’s greatest technological achievements—a symbol of innovation that has fundamentally transformed the way we connect with the world.

- On the other hand, the pace of innovation in aviation appears to have slowed in recent decades. Many of the aircraft we fly today were developed years, often decades ago, and the customer experience—judging by persistently low satisfaction scores—often falls short of what passengers expect in a world driven by rapidly evolving technology.

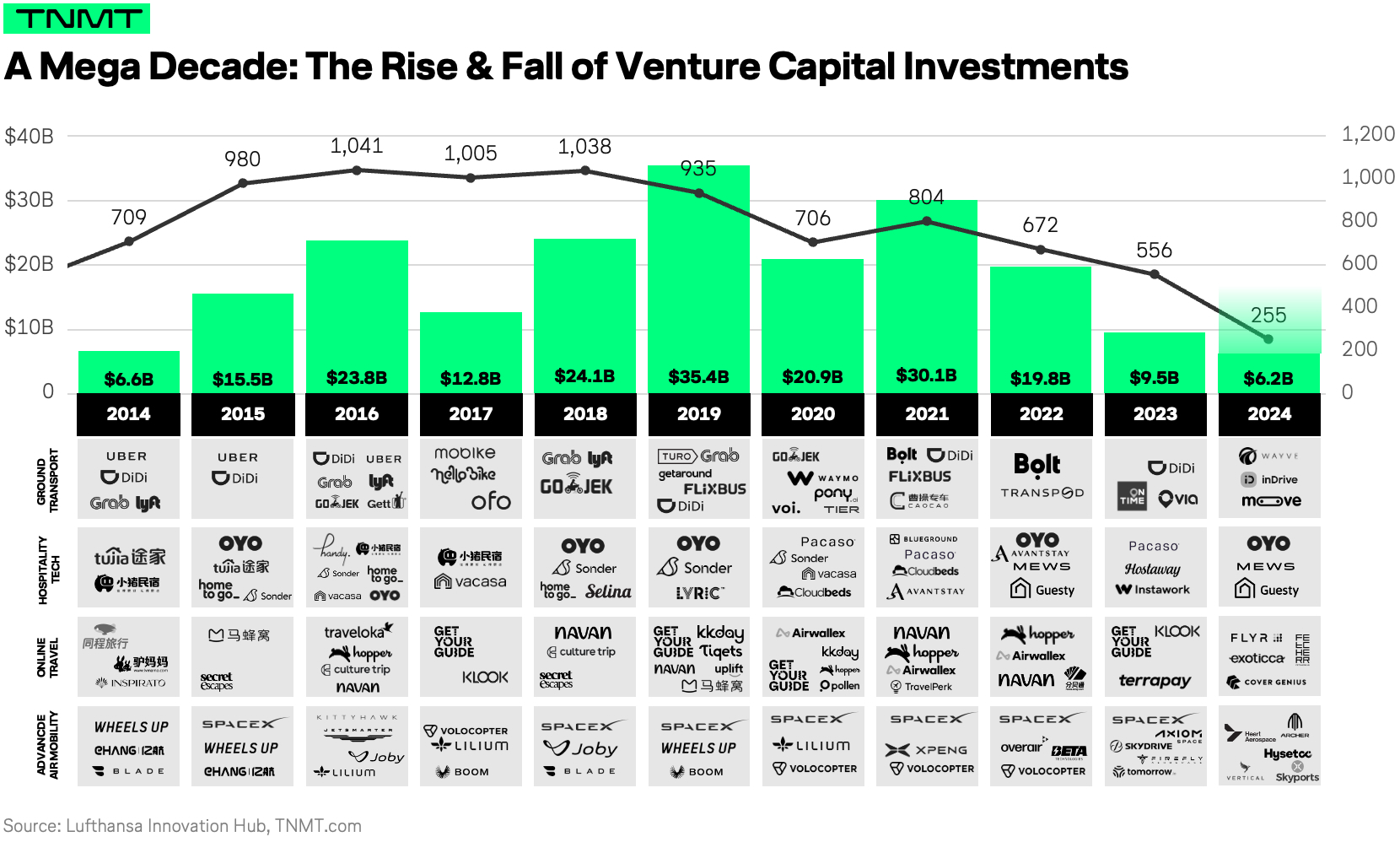

In an effort to address this innovation dilemma, standalone innovation units—dedicated teams positioned outside corporate headquarters—have proliferated across the aviation industry over the past decade.

Their mission?

To break free from traditional corporate constraints, drive forward-looking initiatives, and tackle the sector’s most pressing challenges.

Yet, the results of these efforts have been mixed.

- Critics argue that such units often fail to deliver measurable impact, dismissing them as costly experiments without tangible outcomes.

- On the flip side, advocates of such units—including ourselves at the Lufthansa Innovation Hub—firmly believe in their transformative potential—provided these units are strategically focused, well-positioned, and designed to deliver real impact, both financially and strategically.

Last year, as the Lufthansa Innovation Hub marked its 10-year anniversary, we took the opportunity to reflect on the evolution of standalone innovation units in aviation, including our own trajectory.

Today, we want to share what we found out.

In this analysis, we take a data-driven look at today’s aviation innovation landscape.

We’ll explore:

- The key capabilities these external innovation units have built to address the industry’s most significant pain points.

- The specific focus areas that dominate their efforts shed light on the challenges they aim to solve.

- What it truly takes for such units to succeed, drawing from our internal expertise and best practices observed across the entire aviation ecosystem.

For clarity: This is not a marketing pitch to justify our existence—nor will we showcase our own success stories. Instead, this is a forward-looking discussion on how to unlock real innovation in a sector that urgently needs it.

The Rise of External Innovation Units in Aviation

To get started, let’s take a bird’s-eye view of the sheer existence of such dedicated innovation units. It turns out these entities, designed to operate with a degree of autonomy, have gained massive popularity among aviation leaders over the past decade.

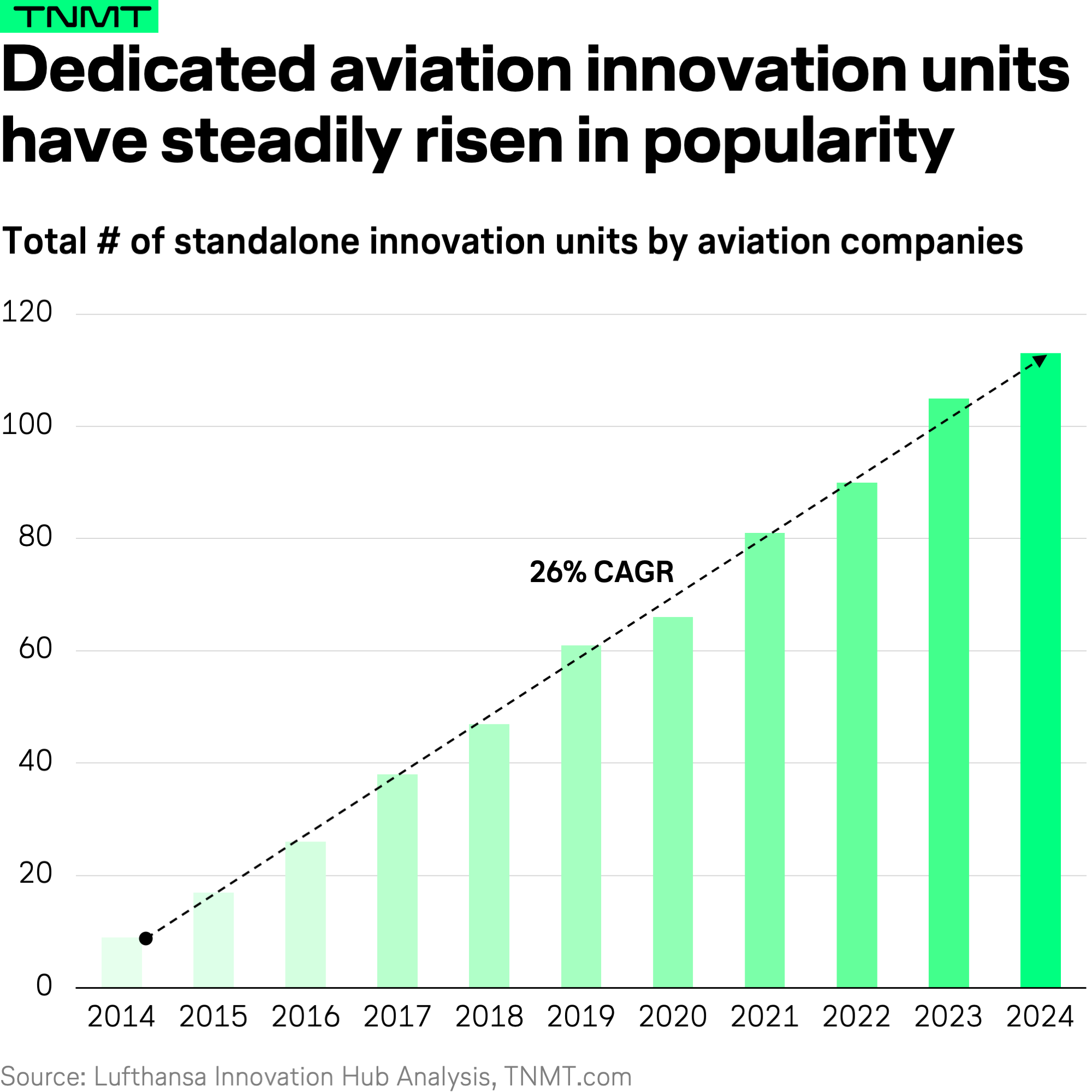

- Over the past ten years, we’ve tracked well over 100 such entities being founded.

- While it’s difficult to determine precisely how many of these units are still operational today—companies are far more eager to announce their openings than their closures—the vast majority, according to our research, remains active.

This growing trend reflects a clear vote of confidence from aviation executives in the potential of these units to drive change. It also signals an industry-wide acknowledgment that tackling long-standing challenges sometimes requires breaking free from the constraints of traditional corporate structures.

With this context in mind, it’s time to dig deeper:

- Where are these units focusing their efforts?

- What challenges are they solving?

- And, crucially, are they living up to their potential?

The Many Faces of Innovation Units in Aviation

Before diving into the specific focus areas of aviation innovation units, it’s crucial to clarify what we actually mean by “innovation units.” The term can encompass a wide range of structures, responsibilities, and objectives, and not all innovation units are created equal.

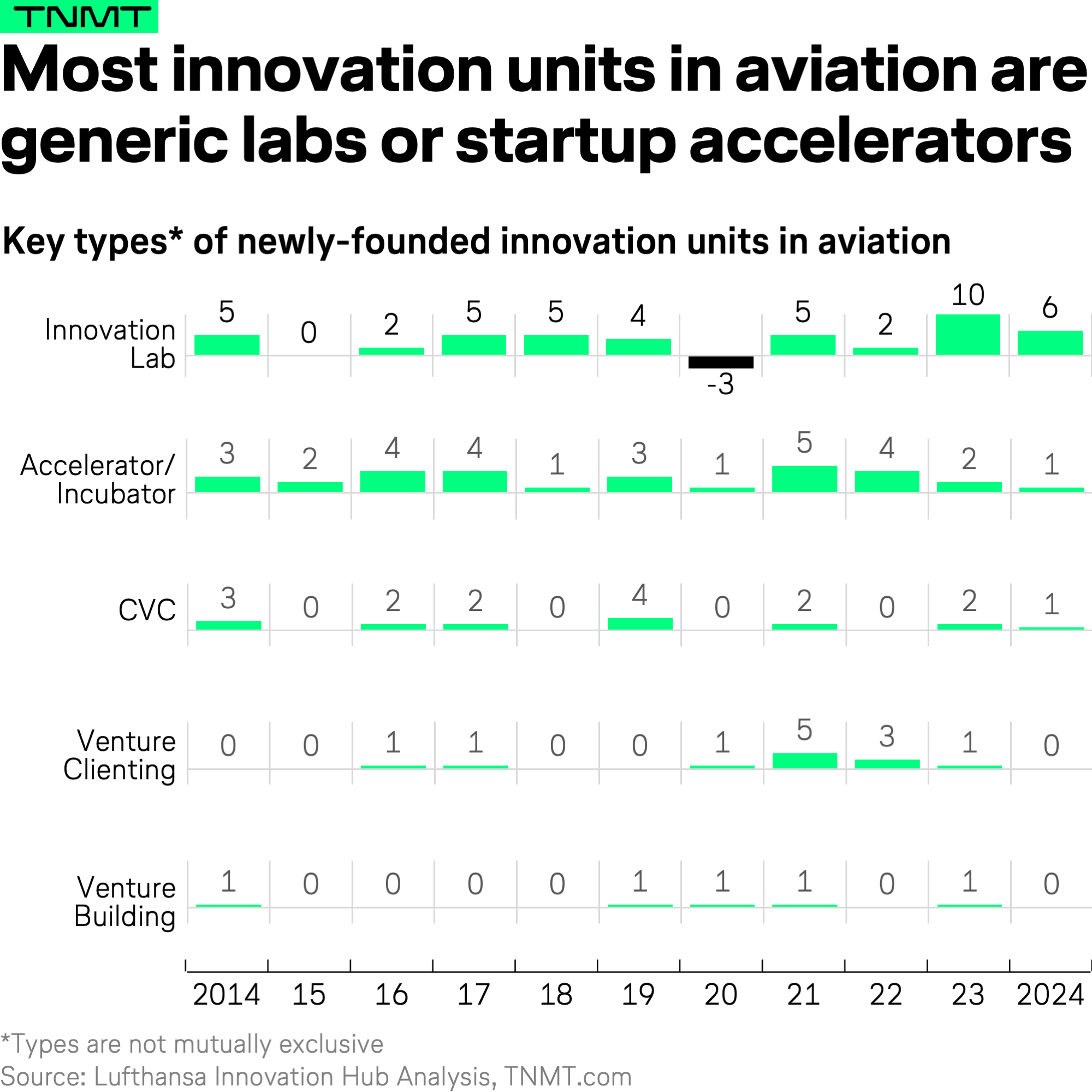

Based on our analysis of 100+ innovation units in aviation, we’ve identified five distinct types—or “innovation capabilities.” Many units combine more than one capability to maximize their impact (ours at the Lufthansa Innovation Hub is a good example of this).

Here’s a closer look at the different types:

Innovation Labs

The all-rounders of the innovation world. Innovation labs typically serve both the internal corporate parent and the external startup ecosystem, acting as hubs for research, intelligence, and cultural transformation. Take our own Lufthansa Innovation Hub, for instance. We operate across multiple fronts: running research and intelligence (hello, that’s us!), driving transformation to accelerate cultural and structural change, and venturing into new business models through our venture-building activities.

Accelerators and Incubators

These units are primarily focused on nurturing startups, often through mentorship, training, and access to corporate resources. Accelerators usually work with early-stage startups over a fixed program duration to help them scale quickly, while incubators support entrepreneurs from the very start, often co-creating ideas in-house.

Corporate Venture Capital Funds (CVCs)

With a more investment-focused approach, CVCs deploy capital into promising startups. Beyond funding, these units often provide strategic guidance and open doors to partnerships with the parent company. However, reaping financial rewards from startup investments typically requires a long-term commitment of at least 10 years, making this a resource-heavy strategy.

Venture Clienting Units

These units usually act as early adopters of startup solutions. Instead of investing capital, they become the first major customers, enabling startups to validate their ideas while solving real business challenges for the corporate parent. This approach can be particularly impactful for startups focused on niche challenges that align with aviation’s unique needs. At the Lufthansa Innovation Hub, we also leverage this capability through our Startup Gate program. This initiative allows ventures from the Travel and Mobility Tech ecosystem to submit their startup pitches, which we then evaluate for synergies within Lufthansa Group’s business units—scouting for the best startup solutions to address key company challenges.

Venture Building Specialists

Unlike accelerators or CVCs, these units focus on creating entirely new ventures, often from scratch. They take ownership of ideation, prototyping, and scaling new business models, either as standalone entities or integrated into the parent company. While this approach can unlock substantial value, it’s also one of the most resource-intensive strategies.

As the chart below shows, Innovation Labs, alongside Accelerators and Incubators, dominate the aviation innovation landscape.

The focus on Innovation Labs appears logical. Given the complexity of the aviation industry—marked by long development cycles, strict regulations, and unique technical challenges—these labs can usually bridge the gap between internal expertise and external innovation well. Similarly, Accelerators and Incubators align well with aviation’s ecosystem by supporting startups that naturally complement the parent company’s core business.

On the other hand, CVCs and Venture Building Units are less common in aviation. Their resource-intensive nature and long timeframes for generating returns make them a less desired fit for an industry where short-term operational improvements often take precedence over long-term growth bets.

That’s not to say these approaches don’t have a right to exist—they absolutely do. However, they require careful intention and alignment with the organization’s goals to justify their cost and complexity. This is especially true in times of economic uncertainty, where tighter budgets and a heightened focus on immediate returns make long-term, capital-intensive innovation bets even harder to justify.

Aviation’s Unique Innovation Landscape vs. Broader Industry Trends

What makes the distribution of innovation types in aviation so fascinating is how it contrasts with broader industry trends. This divergence sheds light on the unique challenges of the aviation sector—and possibly its slower adoption of emerging innovation best practices.

Take the aviation industry’s reliance on Accelerators and Incubators, for example. These innovation tools dominate the landscape in aviation but are losing favor in many other industries.

- According to Mind the Bridge’s Open Innovation Imperative Report, startup Accelerators and Incubators are now the second least popular innovation capabilities across industry segments.

- In fact, since 2021, the number of companies shutting down Accelerators has outpaced new launches each year.

- Today, fewer than 20% of Fortune 500 companies use Accelerators, reflecting a growing shift away from this model.

Why?

Many corporates are pivoting to newer, more agile methods like Venture Clienting Units—a capability that has become the most widely adopted innovation tool (>60%) among large companies.

- Venture Clienting Units are gaining traction for good reason: they are fast, flexible, and come with lower financial risks.

- Unlike Accelerators, which often involve lengthy programs and upfront investments, Venture Clienting Units allow companies to test and implement startup solutions immediately by becoming early customers.

So, what do these insights reveal about aviation’s innovation ecosystem?

On the one hand, the continued popularity of Accelerators and Incubators reflects the industry’s complexity. Aviation startups often require more time and specialized support to align with the operational and regulatory nuances of the sector. For such cases, Accelerators and Incubators can be valuable tools.

On the other hand, the relative scarcity of Venture Clienting Units in aviation likely signals a lag in adapting to the latest innovation methods. Compared to industries like consumer goods or automotive, where venture clienting units have become a dominant strategy, aviation seems slower in recognizing its potential benefits.

Aviation leaders would do well to reevaluate their approach, ensuring their current innovation tools are fit for purpose in a rapidly evolving world—especially as the need for immediate payoffs and a direct impact on core operations becomes increasingly urgent. After all, innovation isn’t about relying on what worked in the past—it’s about staying ahead of the curve.

Finding Focus: Why Clear Priorities Matter for Innovation Units

While the choice of innovation vehicle—be it an Innovation Lab, Accelerator, Venture Clienting Unit, Venture Building Specialist, or CVC (or a mix of these)—is essential, its effectiveness ultimately depends on the clarity of its focus areas.

Without a clear and strategic focus, innovation units risk disconnecting from their parent companies’ core challenges. Worse, they may end up being perceived as “innovation theater” rather than true growth engines. This happens more often than you might think. One of the most frequent criticisms of standalone innovation units is their perceived misalignment with corporate strategy, leading to solutions that appear innovative on paper but fail to address real-world problems.

At the heart of this disconnect lies a common issue: misalignment of innovation objectives.

- Imagine a spectrum of goals—on one end, those tightly aligned with the core business; on the other, exploratory ventures designed to push the boundaries of what’s possible.

- Striking the right balance between these two extremes is critical, and regular communication about this balance is often what separates long-lasting units from those that disappear as quickly as they are launched.

Focusing too heavily on tactical, short-term objectives tied to the core business can also be damaging.

- One of the greatest advantages of an external innovation unit is its ability to remain somewhat separate, creating space for novel thinking that corporate structures often suppress.

- When the relationship between an innovation unit and its parent company is healthy, this separation becomes an asset—enabling exploratory initiatives while staying grounded in the realities of the aviation industry.

So, what focus areas strike the right balance between incremental progress and visionary thinking?

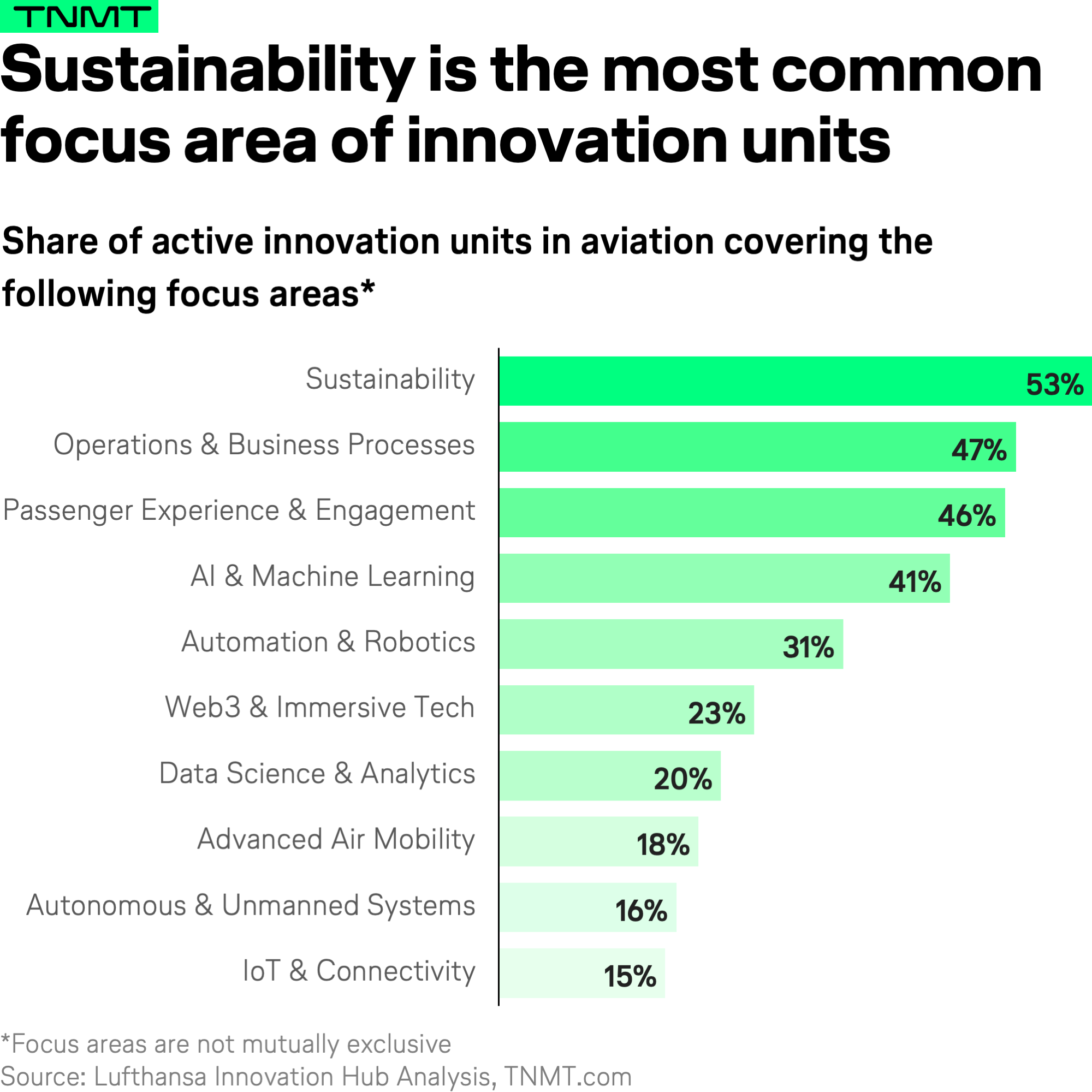

Analyzing our dataset of over 100+ aviation innovation units reveals a clear pattern: the leading focus areas align closely with industry priorities but also leave room for tackling emerging challenges.

At the top of the chart stands Sustainability, with over half of all aviation innovation units identifying it as a primary focus. This is a promising signal, as the aviation industry’s ability to secure its short- and long-term future depends on addressing its environmental imperatives.

Several innovation units are making meaningful strides in this area. For example:

- Delta’s Sustainable Skies Lab and Airbus’ UpNext innovation lab are partnering to develop hydrogen technology and test more efficient airframe and flying techniques.

- United Airlines Ventures’ Sustainable Flight Fund has raised over $200 million USD and invested in more than 10 Sustainable Aviation Fuel (SAF) companies to date.

These efforts underscore the potential of innovation units to lead the charge in sustainability, tackling what is arguably the industry’s most pressing challenge and safeguarding its social license to operate in the decades to come.

Following closely behind sustainability is Operations and Business Processes. Nearly half of all aviation innovation units prioritize operational efficiency—a logical alignment given the industry’s low-margin reality.

- Operational efficiency has always been a cornerstone of aviation, and innovation units are clearly stepping up to optimize processes for airlines and airports.

- This aligns with findings from our 2024 Sector Attractiveness Report, which revealed that nearly 50% of aviation investments in startups and acquisitions are dedicated to improving operational efficiency.

Ranking third is Passenger Experience, an area much discussed but historically underprioritized by the industry. It’s encouraging to see this as a top-three focus area for aviation innovation units, especially given the disconnect between its perceived importance and actual investment levels.

- For instance, Amadeus’ Travel Technology Investment Trends 2024 survey found that passenger experience ranks only fifth or sixth as an objective driving airline investments.

- Similarly, in our own TNMT traveler sentiment analyses, passenger satisfaction consistently emerged as an area in need of significant improvement.

By focusing on the passenger experience, aviation innovation units are addressing a critical gap and reinforcing their role in enhancing customer-centricity across the sector.

The key takeaway: From sustainability to operations and passenger experience, the focus areas of aviation innovation units appear well aligned with both the pressing challenges of their parent companies and the long-term needs of the industry.

Diving Deeper: Focus Fields by Stakeholder Group

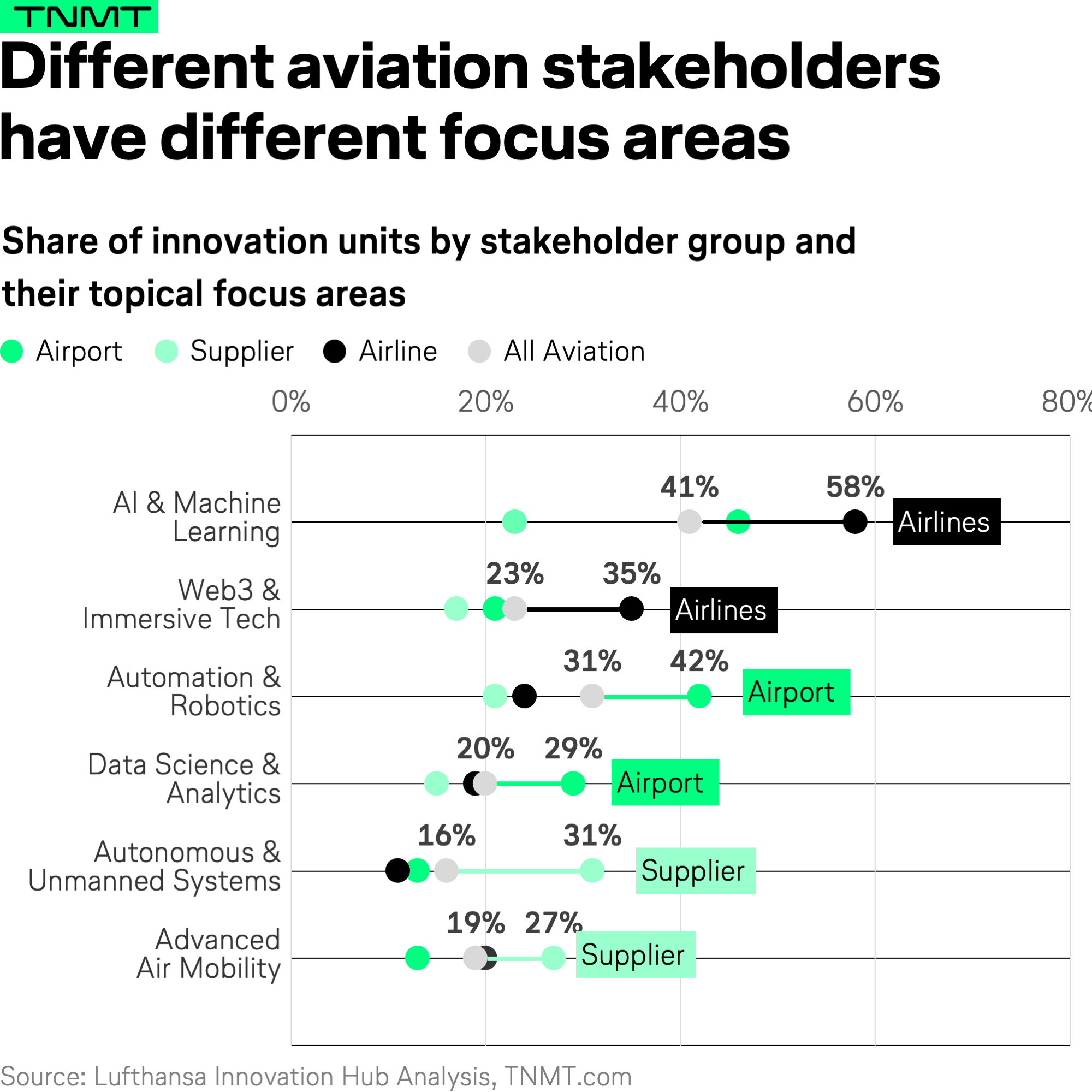

Given our finding that most aviation innovation units are successfully targeting the most pressing challenges in our industry, how does this focus vary across different stakeholder groups—airlines, airports, and aviation suppliers–especially when it comes to striking a balance between immediate and long-term innovation bets?

To better understand this dynamic, we analyzed the relative importance of innovation focus fields for each stakeholder group. Specifically, we measured the top focus areas by their positive delta from the average across all stakeholders.

What we found striking is that for two stakeholder groups, there is a clear split between one focus area that supports immediate, core-business objectives and another that reflects a more exploratory, future-oriented bet.

1. Airlines: The AI-Web3 Duopoly

Take airlines, for example. Nearly six out of 10 airline innovation units—regardless of their specific capabilities—prioritize AI and Machine Learning as a core innovation focus. This figure is 17 percentage points higher than the industry average, emphasizing AI’s critical role in improving efficiencies and enhancing processes like customer interactions and operational workflows.

On the other end of the spectrum, airline innovation units are also leading in their focus on Web3 and immersive technologies. While Web3’s potential impact on travel remains a topic of debate, we’ve seen intriguing use cases emerge, such as blockchain for loyalty programs or VR-enabled immersive travel booking.

This dual focus suggests that airline innovation units have struck a thoughtful balance, aligning innovation efforts across short-term operational needs and long-term transformational opportunities.

2. Airports: Data-Driven Today, Robotics for Tomorrow

Airports exhibit a similar pattern. Their strongest focus area is Data Science and Analytics, a field critical to optimizing operations in the short term. Whether it’s improving passenger flow management, predicting peak times, or enhancing operational efficiency, this data-centric focus ensures airports are meeting today’s immediate challenges of growing traveler demand.

On the exploratory side, airports are investing heavily in Robotics and Automation (something we explored in more detail recently). This includes developing robotic fleets to handle labor-intensive tasks, a forward-looking response to structural labor shortages that are becoming increasingly common across the sector.

This balanced approach will likely allow airports to tackle pressing operational challenges while positioning themselves for a more automated and efficient future.

3. Aviation Suppliers: Moonshot Innovations

For suppliers—such as aircraft manufacturers like Boeing and Airbus—the focus fields of their external innovation units tell a slightly different story.

Rather than prioritizing only near-term efficiency gains, these units explore a much broader spectrum of “explorative” emerging technologies, including Autonomous and Unmanned Systems, Advanced Air Mobility (AAM), AI-driven aerospace applications, and even Web3 innovations. While many of these fields represent ambitious, long-term bets, they complement more immediate technological advancements happening within their core business.

While this focus might seem unbalanced at first glance, it’s important to consider the broader context.

- Suppliers’ internal R&D departments are, by nature, heavily geared toward delivering incremental innovation, like refining aircraft designs and optimizing manufacturing processes.

- This potentially allows their external innovation units to focus exclusively on moonshot initiatives, such as developing air taxis or autonomous aircraft technologies.

This strategy could be a deliberate effort to keep their innovation portfolios diversified, ensuring both immediate business needs and far-reaching visions are addressed across different teams.

The broader takeaway is clear: innovation units in aviation are not one-size-fits-all. Their focus fields are shaped by their parent organizations’ specific needs and strategic priorities, and understanding this variation is key to evaluating their impact.

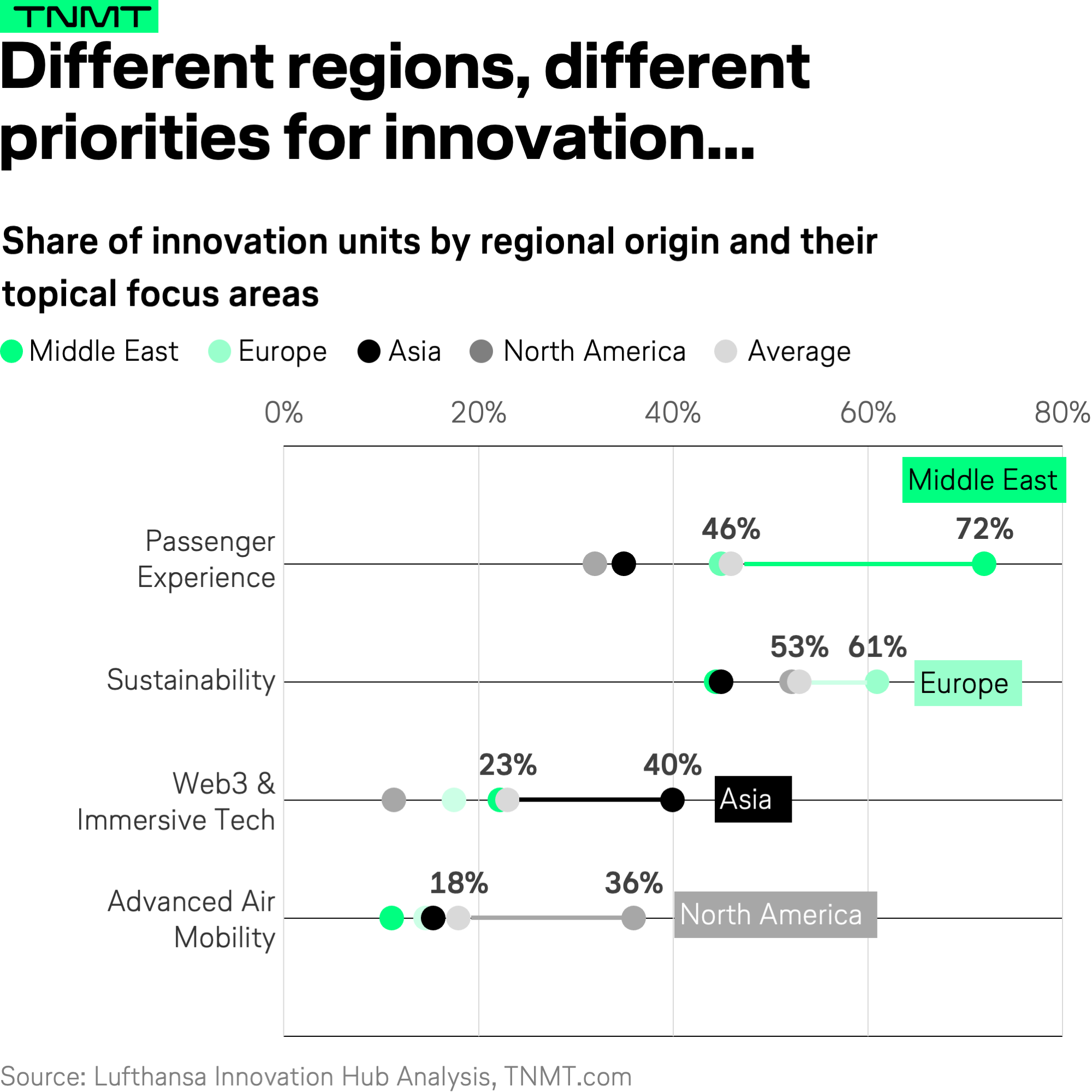

Regional Nuances in Innovation Focus Areas

An even more nuanced perspective on focus fields emerges when we analyze innovation units based on their regional origins.

It turns out that the regional background plays a critical role in shaping the priorities of these units, with clear trends aligning with cultural and market-specific dynamics.

Middle East: A Customer-Centric Approach

Innovation units in the Middle East stand out for their strong focus on enhancing the passenger experience, significantly more than their counterparts in other regions.

- This emphasis aligns with the region’s global reputation for luxury airlines and world-class passenger services.

- Airlines like Qatar Airways and Emirates consistently dominate Skytrax awards, with Qatar Airways clinching “Airline of the Year” in 2024.

One notable innovation from the region comes from Emirates’ Ebdaa Innovation Lab, which developed Sara, a robotic check-in assistant capable of performing tasks such as facial recognition for passport matching, passenger check-ins, and guiding travelers to luggage drop-off points. This example reflects the region’s drive to seamlessly blend luxury with technology in customer interactions.

Europe: Leading the Charge in Sustainability

In Europe, sustainability dominates the focus areas of innovation units. This prioritization makes perfect sense given the region’s regulatory pressures and societal demand for greener aviation solutions.

- Take, for example, IAG’s Hangar51, which has made significant investments in startups working on sustainable aviation fuel (SAF), hydrogen-electric aircraft, and advanced fuel management systems.

- Similarly, at the Lufthansa Innovation Hub, we have been heavily focused on sustainability-driven innovation. Over the years, we’ve successfully spun out ventures such as Squake, which facilitates seamless carbon offsetting for corporate travel and built and expanded Compensaid into Lufthansa Group’s company-wide booking platform for carbon offsetting and SAF-based emissions reductions. These are just two examples from our broader portfolio of initiatives to accelerate a more sustainable aviation future.

Asia: Pioneering Emerging Technologies

Innovation units based in Asia are ahead of the curve when it comes to adopting and experimenting with emerging technologies like Web3, augmented reality (AR), and virtual reality (VR).

- This trend arguably reflects the region’s broader narrative as a global leader in consumer technology innovation.

- From pioneering cashless payment systems to immersive virtual experiences, Asia continues to push boundaries.

United States: A Strong Focus on Advanced Air Mobility

In the U.S., innovation units are heavily focused on Advanced Air Mobility. This trend aligns with the country’s leadership in AAM-related developments, though this prioritization appears questionable given the ongoing doubts about AAM’s commercial readiness.

- For example, more than two-thirds of global eVTOL patent filings come from U.S.-based companies, according to previous TNMT research.

- Leading examples include United Airlines Ventures and JetBlue Ventures, both of which have invested in a wide range of AAM startups, from hydrogen-powered aircraft to electric and supersonic aviation solutions.

Standout Examples of Aviation Innovation Units

Building on the regional and stakeholder-specific insights from the previous section, let’s spotlight some standout innovation units that have carved out impressive niches in the aviation ecosystem.

Naturally, we at the Lufthansa Innovation Hub have a strong perspective on this topic. Over the past decade, we’ve built one of the most comprehensive external innovation strategies in the entire Travel and Mobility Tech ecosystem—without a blueprint to follow. Our work has spanned launching dozens of digital prototypes (several of which have scaled into rapidly growing standalone startups), making strategic VC investments in some of the most promising Travel and Mobility Tech pioneers, and building industry-wide tech platforms and research communities like TNMT (hello, everyone!).

Beyond that, we’ve played an active role in shaping Lufthansa Group’s innovation agenda, from new pricing models and industry-first booking features to cultural transformation initiatives.

However, this article is not about us—it’s about the broader innovation ecosystem. With that in mind, here are three other innovation units that stand out for their strategic vision and measurable impact:

1. JetBlue Ventures: Bold Moves in Airline Innovation

JetBlue Ventures (JBV) is widely regarded as a leader in airline-led innovation, exemplifying a proactive approach to investing in the future of aviation and travel tech.

Since its inception, JBV has invested in 40+ startups (see all of them in our Airline Investment List), covering a broad spectrum of topics, including loyalty and customer engagement; operational efficiency and passenger communication; sustainability through SAF and hydrogen; Advanced Air Mobility with eVTOL startups, as well as broader travel-tech solutions, such as property management software.

JBV’s comprehensive innovation agenda ensures it addresses both core airline challenges and opportunities within the wider travel ecosystem, making it a benchmark for other airlines.

2. Rome Airport: Innovating at the Ground Level

When it comes to airports, Rome Fiumicino Airport has emerged as a trailblazer in leveraging external innovation to improve operational efficiency and passenger experience.

Through just the first two phases of its accelerator program, the airport achieved:

- 600 startup submissions.

- 23 Proof of Concepts (PoCs) implemented.

- 40% rollout rate, directly integrating solutions into airport operations.

Notable solutions that are now in use include AI-driven airside operational safety systems, autonomous services for passengers with reduced mobility, biometric payment systems, and AI solutions for waste management.

Building on this success, Rome Fiumicino Airport is now expanding its innovation arsenal by establishing a Corporate Venture Capital fund and testing venture clienting models.

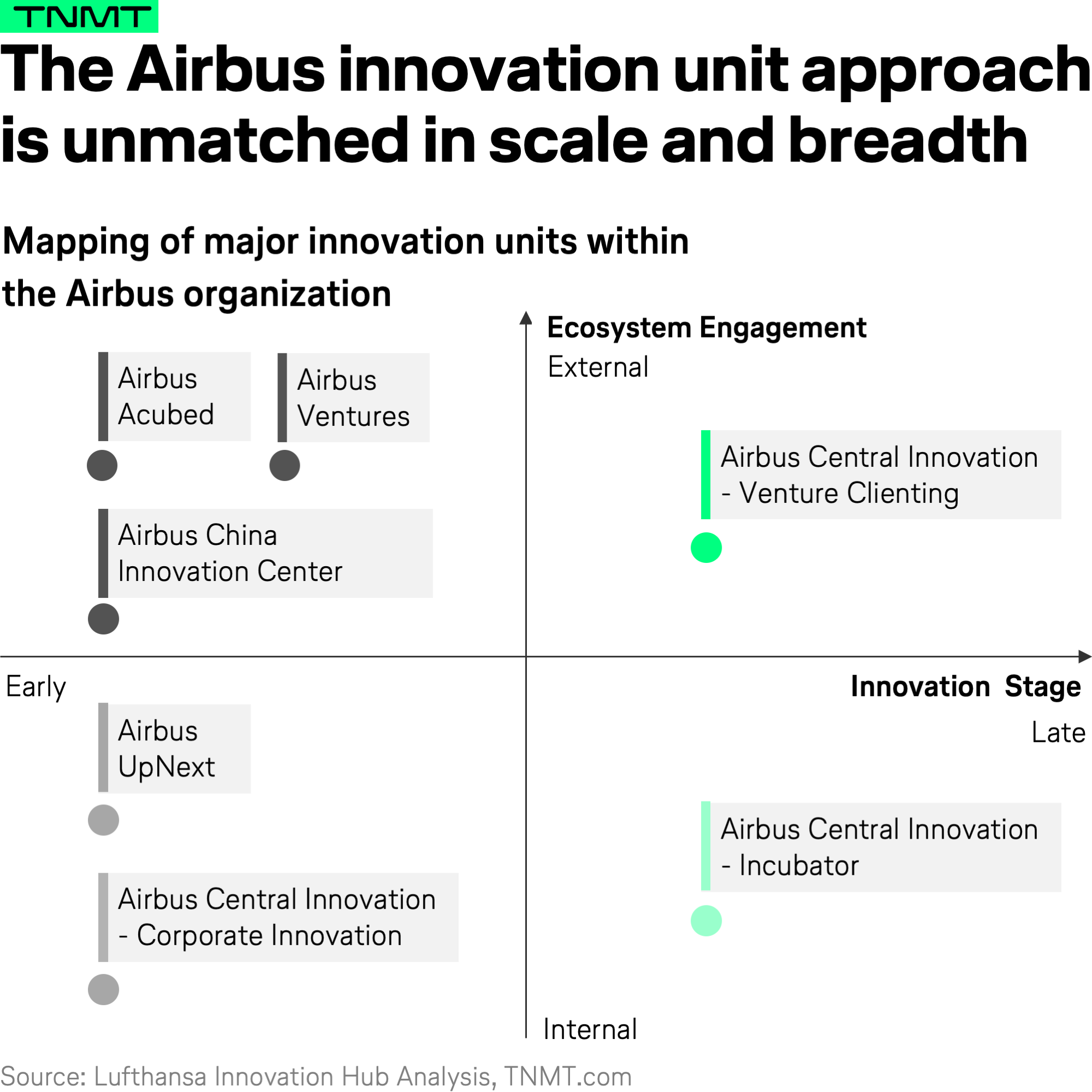

3. Airbus: The Gold Standard in Aviation Innovation?

Not only among aviation suppliers but also across the wider aviation and Travel and Mobility Tech landscape, Airbus sets the most comprehensive approach for external innovation approaches.

With its vast resources and global presence, Airbus has built one of the industry’s most holistic and wide-ranging innovation ecosystems. However, some critical voices—both internally and externally—argue that the competitive nature of these units leads to overlapping efforts, potentially diluting focus and efficiency.

What makes Airbus stand out is its ability to utilize all the innovation tools discussed in this analysis:

- Venture Building and Incubation: Through Airbus Central Innovation (formerly named Airbus Scale), the company has focused on projects like direct air capture and predictive supply chain capacity planning. Airbus Central Innovation has evolved from the company’s BizLab accelerator.

- CVC through Airbus Ventures: Operating with a $155 million USD fund and a portfolio of 47 companies tackling key challenges in aerospace and beyond.

- Since 2022, Airbus has implemented a Venture Clienting Unit model, which has accelerated the adoption of startup solutions. According to Greg Ombach, SVP at Airbus, this has improved speed, quality, and efficiency in delivering tangible outcomes.

- A range of specialized Innovation Labs: Airbus hosts a multitude of labs across diverse focus areas, sometimes even encouraging internal competition to drive progress faster. Some of these units include: Cybersecurity through the Cyber Innovation Hub and CISPA-Airbus Digital Innovation Hub; AI and Digitalization through Acubed; Novel Propulsion and Aircraft Design through Airbus UpNext; and focus on China’s innovation ecosystem through the Airbus China Innovation Center.

The scale and breadth of Airbus’ innovation efforts are certainly unmatched in aviation.

While not every company can replicate Airbus’ approach due to resource constraints, its strategy offers valuable lessons for creating a cohesive and impactful innovation ecosystem.

Conclusion: The Future of Aviation Innovation

If there’s one takeaway from our exploration of aviation’s standalone innovation units, it’s that no one-size-fits-all strategy exists. Truly impactful innovation relies on a diverse mix of vehicles, from Venture Clienting Units and CVCs to Accelerators and Innovation Labs.

At the same time, the holy grail of aviation innovation lies in a well-balanced approach, addressing both immediate business needs and long-term growth opportunities. This is no small undertaking, especially in an industry as conservative and resource-intensive as aviation.

From our deep dive into aviation’s innovation ecosystem, it’s evident that this landscape is diverse, robust, and growing. At a time when the industry faces macro-level headwinds—labor shortages, supply chain delays, and shifting consumer preferences—this is incredibly encouraging.

Why?

Innovation remains the key to tackling these challenges and future-proofing the sector.

Looking ahead, we believe that both existing and future innovation units can benefit from focusing on three critical priorities:

1. Modernizing Innovation Models

The aviation industry must continue to evolve its approach to innovation. While older models like Accelerators have played a role in kickstarting external innovation approaches, newer frameworks like Venture Clienting Units offer clear advantages in today’s context.

With their speed, flexibility, and lower financial risk, Venture Clienting Units are particularly well-suited to addressing aviation’s pressing challenges. Modernizing these models can help aviation leapfrog inefficiencies and bring impactful solutions to market faster.

2. Collaboration for Shared Problems

Some challenges—such as sustainability—are too vast for any single organization to tackle alone. Aviation needs industry-wide collaboration, where airlines, airports, and suppliers join forces to pool resources, knowledge, and talent.

It’s promising to see sustainability emerging as the top focus for innovation units, but achieving net-zero goals will require more than isolated efforts. Joint initiatives and cross-sector partnerships are essential to addressing this monumental task. We are not seeing enough of such collaborations materialize in practice—an area where the industry needs to step up significantly.

3. Passenger-Centric Innovation as a Differentiator

While sustainability demands collaboration, passenger experience innovation offers a key opportunity for differentiation. Airlines and airports alike have the chance to stand out by delivering unique, customer-focused solutions that drive satisfaction and loyalty.

Whether it’s through personalized travel experiences, enhanced accessibility, or next-gen technologies, passenger-centric innovation should remain a top priority for companies looking to compete in an increasingly demanding market.

This article was developed with significant research and insights support from Michael Meng, Research & Intelligence Analyst at Lufthansa Innovation Hub.