Consumer confidence in air travel has been shattered dramatically in recent months. The ongoing pandemic has produced far-reaching consequences, including travel bans, flight restrictions, and the perceived danger of infection in airports and planes (despite a lack of evidence). Unsurprisingly, travelers are hesitant to book their next plane ticket as they continue to feel anxiety and confusion about what keeps them safe.

Additionally, millions of travelers have had trouble getting a refund for their canceled flights. In April alone, the US Department of Transportation saw a +1546% y-o-y increase in complaints related to US airlines’ customer service—88% of these complaints concerned refunds.

It’s probably fair to say that consumer confidence in the travel industry might be at an all-time low right now.

That begs the question: how can we restore consumer confidence?

The focus of airlines and travel providers should obviously be on fixing refund and cancellation processes. But most importantly, they need to adopt COVID-specific safety procedures. Health and hygiene protocols must be implemented quickly, as creating a safer travel experience is of paramount importance to rebuild trust for the entire industry.

But there is A LOT more!

Making air travel great again

The future of the (air) travel industry will depend on more than just addressing travelers’ safety concerns. As McKinsey recently concluded: “the romance that travel used to inspire was already wearing thin even before the crisis.” And we agree—customer satisfaction appears to have suffered over the past decade.

The Atlantic proposes an interesting theory regarding the source of this growing frustration with airlines. They argue that flying has devolved from a relatively pleasant experience to a barely tolerable hassle in recent years due to the entrance of low-cost carriers. With them, the industry became heavily focused on cutting costs and stripping away goodies that flyers long associated with a comfortable travel experience, such as legroom, food quality, and complimentary baggage drop-off. Once taken for granted, these perks must now be paid for or done without, especially when traveling with a low-cost carrier.

Survey data confirm that many travelers felt stressed during their trip, even before the COVID crisis. And it’s not just the plane ride itself, but the unpleasant process before and after boarding, starting with navigating the airport. It’s no wonder that travelers would appreciate improvement on an already frustrating experience that the pandemic worsened and exposed.

Airlines and other travel companies shouldn’t only meet the bare minimum by reassuring customers. They need to excite and attract them. Leaders should focus on making travel better, not just safer. We need to listen to travelers’ complaints as well as build on the aspects travelers most appreciate.

The big question is how?

An unconventional approach to sourcing and analyzing customer feedback

To identify the most relevant and impactful measures for fixing today’s air travel experience, we wanted to find an objective, data-driven way to identify the major pain and gain points for travelers. Then, we wanted to find out how to strategically approach them. So, we developed a quantitative view on the aspects of the customer journey that need to be fixed most urgently, as well as the ways airlines should prioritize these topics through a strategic roadmap for improving the post-Covid air-travel experience.

In order to find travelers’ biggest frustrations with today’s state of air travel, we applied an unconventional approach that goes beyond typical consumer surveys. We turned to TripAdvisor—the world’s leading travel-review site.

On TripAdvisor, we scraped more than 15,000 reviews of 12 major airlines to get an industry-wide perspective on how travelers review their travel experiences. The selected airlines are mostly Western airlines (with the exception of Singapore Airlines) to adjust for language bias as we only looked at English reviews. The data was sampled for 2019 to phase out the COVID-19 impact, which would skew the data to customer service and refund issues.

We then analyzed the data with the help of a Natural Language Processing (NPL) tool called Quid Netbase that uses an AI-based algorithm to inspect the reviews for their content and themes to place each review into relevant categories, e.g. Food & Beverages, Onboard Services, Flight Irregularities.

How to measure pain and gain points

To objectively determine the most relevant pain and gain points, we defined two dimensions to help us gauge consumer reviews: relevance and sentiment.

Relevance counts how many mentions a specific topic has in order to measure its importance. The underlying assumption for this metric is that the more people talk about a given topic, the more relevant the matter.

Sentiment is the underlying tone of the review, which can be positive, neutral, or negative. The sentiment is used to define whether a given TripAdvisor review was mentioned with a negative tonality, which would categorize it as a potential pain point (“The flight was delayed for hours”) or in a positive light, characterizing the respective review as a gain point (“I really like the food on my flight”).

So, let’s take a look at what we discovered.

Results 1/2: What do customers bring up the most?

First, we looked at the topics travelers mentioned the most in their TripAdvisor reviews. Based on the number of reviews (relevance), it becomes immediately apparent that customers feel strongly about flight irregularities and want these to be addressed. The reviews were written pre-Covid so this theme was already highly relevant before the onslaught of flight cancellations following the outbreak.

Flight Irregularities surpass other topic clusters by a mile—20% of the 15,000 reviews bring up the issue and express the need for travelers to be taken care of when something goes wrong, e.g. after missing a connecting flight due to a delay in the preceding flight.

Here is the complete overview of the 16 most talked-about topic clusters by air travelers:

Food & Beverages (F&B) and Onboard Services were the second and third most relevant topics—with 15% and 13% of all reviews, respectively. This confirms that travelers don’t just expect airlines to transport them from A to B but also to deliver hospitable and friendly services during the flight (“crew performance” also featured strongly as an important factor in both clusters).

Surprisingly, monetary value was one of the least discussed topics in our review sample, going against the conventional wisdom that price is usually a major influencer when booking a flight. However, this seems to take a backseat when travelers evaluate an experience in hindsight.

Beyond these four categories, we also see standard topics for the airline industry, such as Seat Comfort, Carry-on Luggage, and Boarding. It’s worth mentioning that Punctuality (arrival and departure times) is discussed less often than hospitality topics F&B and Onboard Services, suggesting that travelers are willing to accept delays if they have a pleasant and friendly experience on board.

From a digital innovation perspective, Digital Accessories and Onboard Entertainment were also relatively dominant topics (together comprising ~9% of all reviews) while Boarding and Check-in – usually considered major moments of frustration – were less prominent (5% combined).

Last but not least, “seamless travel experience” seems to be gaining traction as travelers adopt the phrase, which was originally coined by industry professionals to describe the fluent, connected traveler journey. This concept was one of the most frequently mentioned topics, emerging as a separate cluster identified by our NLP tool.

Results 2/2: Identifying the biggest pain & gain points

Now that we know the most relevant topics, we need to identify the underlying sentiment of each review to understand which topics travelers consider pain points and gain points.

In the graph below, we ranked the major topic clusters according to whether they contain more positive reviews (labeled as a gain point) or more negative reviews (representing a pain point).

Flight Irregularities clearly dominate the pain-points ranking. The number of negative mentions highly exceeds the number of positive topics among the major gain points. Not only does this suggest that Flight Irregularities provide the biggest bottleneck in the overall customer experience, but also that they outweigh any positive experiences. Airlines should therefore prioritize preventing Flight Irregularities to avoid a devastating impact on customer satisfaction and gain a competitive advantage in the industry.

By contrast, no single positive point stands out from the crowd. Instead, the best experience seems to be delivered as a combination on several fronts. However, hospitality factors like Onboard Services, Food & Beverages, and Seat Comfort reinforce what we found earlier—namely that a great hospitality offering really makes a difference in customer satisfaction.

The strategic roadmap for a better customer experience

Although the above pain and gain points clarify which areas need attention, airlines and travel providers must ask: Where do we start in improving the travel experience?

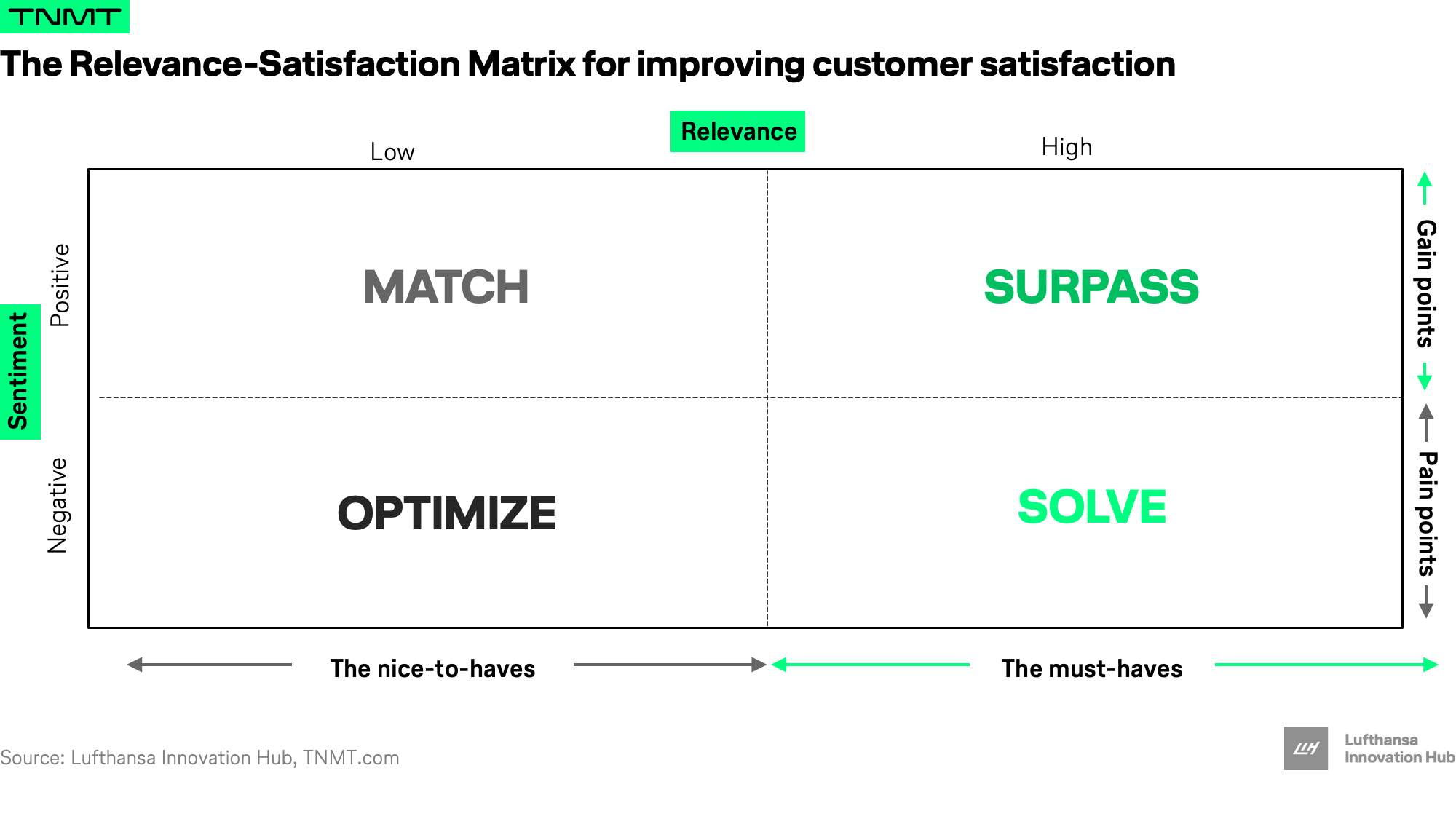

As a guiding framework, we propose a customer-satisfaction framework that we coined the “Relevance-Satisfaction Matrix.” The matrix pinpoints the urgency of the different parts of the flight experience and thereby helps airlines to prioritize topics.

The Relevance-Satisfaction Matrix

The Relevance-Satisfaction Matrix is split into four quadrants each suggesting a needed action step: Match, Surpass, Optimize, and Solve. By assigning each aspect of the flight experience to one of these categories, airlines can decide their customers’ most pressing needs and must-haves, as well as nice-to-haves that can be turned into competitive advantages.

The upper two quadrants represent gain points; the lower two contain pain points. The right half of the matrix indicates “must-haves”—topics that are highly relevant to customers. The left side of the matrix characterizes “nice-to-haves”—subjects that are less relevant to customers.

The matrix suggests that airlines should consider two factors to decide which part of the flight experience to tackle first—customer priority and current satisfaction level. We measure the current satisfaction level by subtracting the number of negative reviews from the number of positive reviews.

Each of the four quadrants offers different implications for travel providers.

“Match” represents categories with positive satisfaction scores. However, they are less critical for the flying experience – as they are mentioned less frequently by travelers – making them nice-to-haves. Companies may refer to these as a point of differentiation rather than a necessity.

“Surpass” comprises “gain point” categories that are important to the customer. Overall satisfaction is positive for these topics, which sets a certain standard that airlines need to surpass or be regarded as subpar.

“Solve” constitutes important services for customer satisfaction that airlines have failed to deliver. They should be the top priority for airlines that want to set themselves apart from the competition.

Lastly, “Optimize” describes “pain point” categories that are less critical to customers (they are brought up less frequently). Customers want to see improvements in these areas but are likely to be more lenient. If delivered, they carry the potential to become standout services as they provoke the highest negative sentiment among current consumers.

The action plan: How to translate customer reviews into action

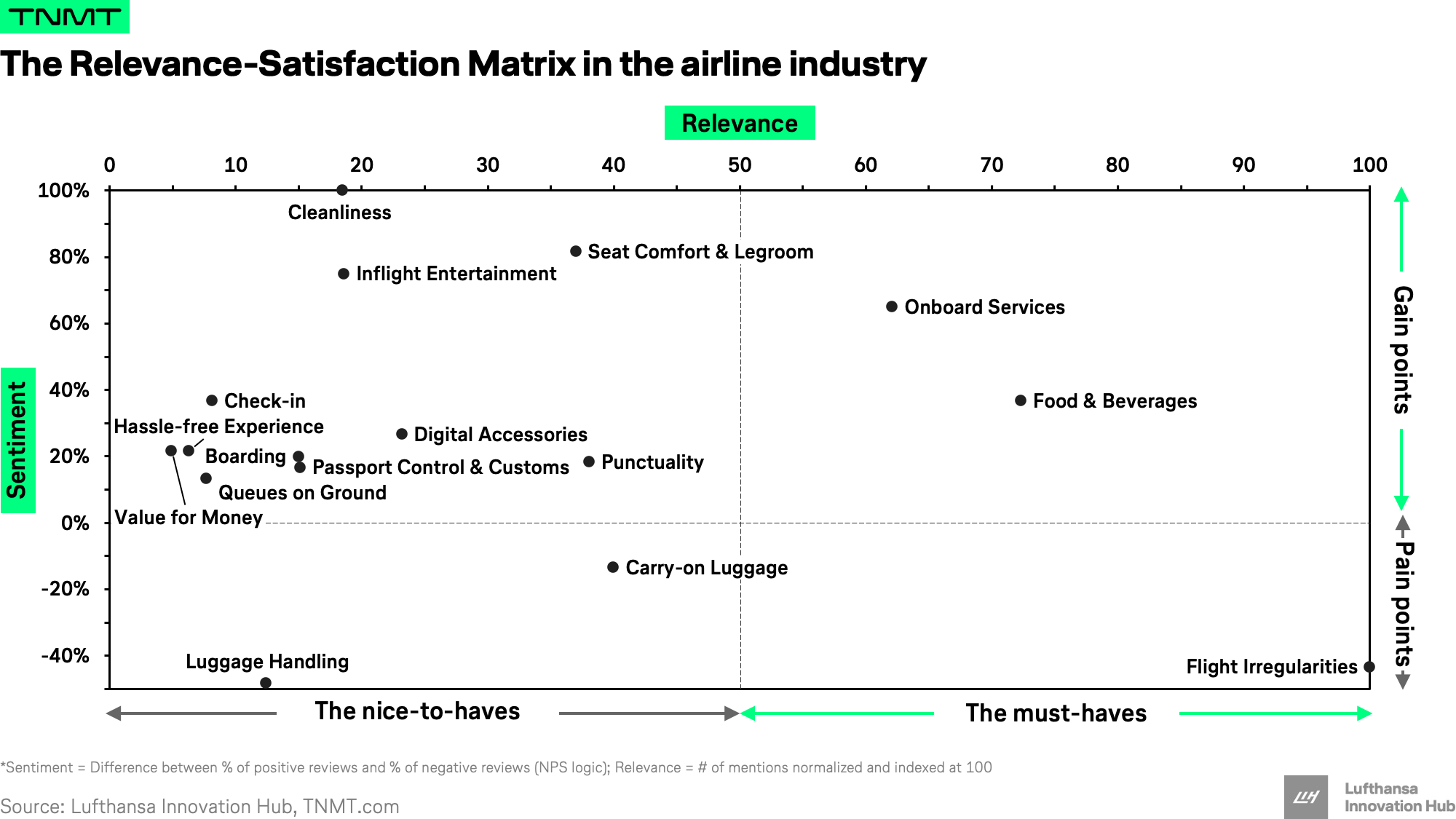

Now, let’s plot the pain and gain points for the airline industry based on the Relevance-Satisfaction Matrix and our TripAdvisor analysis of airline reviews.

This will help us define concrete actions and development plans for airlines to ultimately offer a better customer experience.

As a reminder, we analyzed 12 airlines, so the map reflects traveler satisfaction with the whole air travel industry, not an individual airline. This also means it reflects the perceived ‘standard’ in the industry for each flight experience cluster. Based on the insights from the matrix, we dug deeper into the individual reviews to try and find emerging themes and trends.

Here is the mapping for airline reviews in one chart:

While the matrix offers many insights, we summarized the most notable takeaways:

#1 Airlines need to (finally) fix the basics: Flight Irregularities

Flight irregularities are the number one most critical pain point for customers. The message is clear—travelers want them to disappear. Of course, airlines are not always in control of these delays. Nonetheless, the reviews confirm that airlines can drastically improve customer satisfaction in this area through simple and small changes. More on exact solutions below.

The far-right position in the matrix also indicates a disproportionate significance to customers compared to other clusters. As such, the way airlines treat their customers and handle situations in the event of delays or cancellations will overshadow impressions from other clusters.

So, what specific steps can airlines take to address this pain point? By carefully analyzing each specific review with the help of Quid’s AI, we found that most complaints concern the lack of timely communication surrounding delays and cancellations, as well as the lengthy rebooking and replanning process—some of the specific issues mentioned include long waiting times, unhelpful staff, lack of information, and transparency. Therefore, transparent communication and a user-friendly Flight Irregularities Management System may help to address this pain point and potentially even convert customers from competitors.

Many reviews also showed a preference for travelers to ‘handle it directly’ and ‘by themselves’. With automated processes and digital self-service solutions such as chatbots, airlines can offer more control and flexibility to their customers.

We do realize the proposed solution is only feasible for digitally native travelers. However, moving a proportion of distressed customers online will relieve the pressure for ground staff and enable them to focus on helping the non-digitally native customers with more efficiency.

#2 Taste is the epicenter of pain for airline meals but variety offers a solution

In the “Surpass” category (high relevance and positive sentiment), Food and Beverages makes an interesting case. The matrix tells us that travelers don’t think airplane food is as bad as we might expect, given experimental studies that show how low air pressure and white noise repress our taste buds (here and here). But as it turns out, taste is not the only important factor for satisfaction with F&B. The variety of choices can be a game-changer.

We found that while taste was a major pain point and the main driver of negative reviews, variety of choice seemed to act as a compensator. Many reviews praised the consideration for dietary preferences such as vegetarian, vegan, and gluten-free dining.

So what to take away? Since taste is particularly difficult to implement due to factors like low margins and limited storage, airlines should instead focus on diversifying their menu with more dietary options. Digital means could streamline the process, enabling customers to choose their meals online or in-app, helping airlines optimize supply.

#3 Bring-your-own-device coupled with in-flight entertainment

Entertainment & Digital Accessories belong to the “Match” quadrant with the majority of discussed topics. Reviews are mainly positive, though most travelers think of these as ‘nice-to-have’ features.

What stands out here is that travelers increasingly want to go “digital”—keywords such as IFE, Wi-Fi, USB ports, streaming music, etc. were clearly highlighted. In fact, Digital Accessories are only superseded by core topics such as Seat Comfort, Carry-on Luggage, and Punctuality (based on relevance). Even Boarding and Check-in aren’t mentioned as much. Therefore, airlines should acknowledge the significance of this topic for customers and prioritize it on the same level as Seat Comfort.

This category also provides answers to one of the biggest questions in commercial aviation: Do travelers expect to be entertained onboard?

The short answer is yes. However, airlines don’t have to carry the burden. Travelers want to be entertained but they also don’t mind bringing their own entertainment on their phones, tablets, or laptops. Airlines simply need to provide the infrastructure, such as charging points and internet connection.

Iberia is a frontrunner in this trend, as it already offers a wireless inflight entertainment platform that can be loaded through a device (phone, tablet, computer). The platform offers the same standard options as other IFE systems, e.g. movies, games, music, but on a personal device, not a built-in screen. According to Iberia’s report, customer satisfaction increased by 35% after implementing the digital system.

The bottom line is that travelers do expect entertainment onboard. However, mobile proliferation is changing the way customers consume content onboard. For short-haul flights, airlines could satisfy customers by providing charging ports or Wi-Fi. For long-haul flights, travelers appreciate a full in-flight entertainment system with native screens, which also accommodates non-digital natives.

#4 A long way to go for luggage but it should be digital

It should come as no surprise that the topic of luggage, be it carry-on or check-in, is a pain for travelers. Given the all-too-common complaints about excess weight and limitations on the number of allowed pieces, it’s interesting to see that Carry-on Luggage is not a bigger pain. For decades, airplane manufacturers have worked on optimizing luggage space onboard. Many airlines use favorable carry-on luggage rules as a differentiating factor. Nonetheless, it seems that travelers have learned to accept this hassle.

The topic of Luggage Handling (bottom left position in the matrix) presents a slightly different picture. This category mainly talks about checked-in and lost luggage, and while it shows the most negative sentiment, it is barely represented by volume. This may be because airlines and airports have collaborated with IATA to develop an efficient process that enables-baggage tracking across the whole industry, reportedly improving baggage handling by 66%.

Still, its lowest sentiment in the matrix reveals there is a lot of space for improvement. Again, digital solutions can help. For instance, American Airlines introduced a Baggage Notification System that allows its customers to track the status and location of their checked luggage. And it seems to be exactly what travelers want. SITA found in their 2019 report that passengers who received mobile notifications about their baggage status reported an 8.6% increase in satisfaction compared to travelers who relied on flight information displays and public announcements at the airport.

And there’s more to it …

Reviews have proven to be a powerful source of insight into consumer preferences and needs. These discoveries can form the basis of a strategic roadmap to help companies prioritize what issues to tackle first.

We encourage travel providers to not only establish an industry overview for their field but also to create a matrix of their own reviews and compare them with the industry benchmark. This way, the matrix can measure performance over time and track the progress of various innovation efforts.