The airline industry has faced significant scrutiny over passenger satisfaction, with our previous research on air traveler frustrations uncovering some concerning trends.

A quick reminder for those of you who may have missed our earlier analysis:

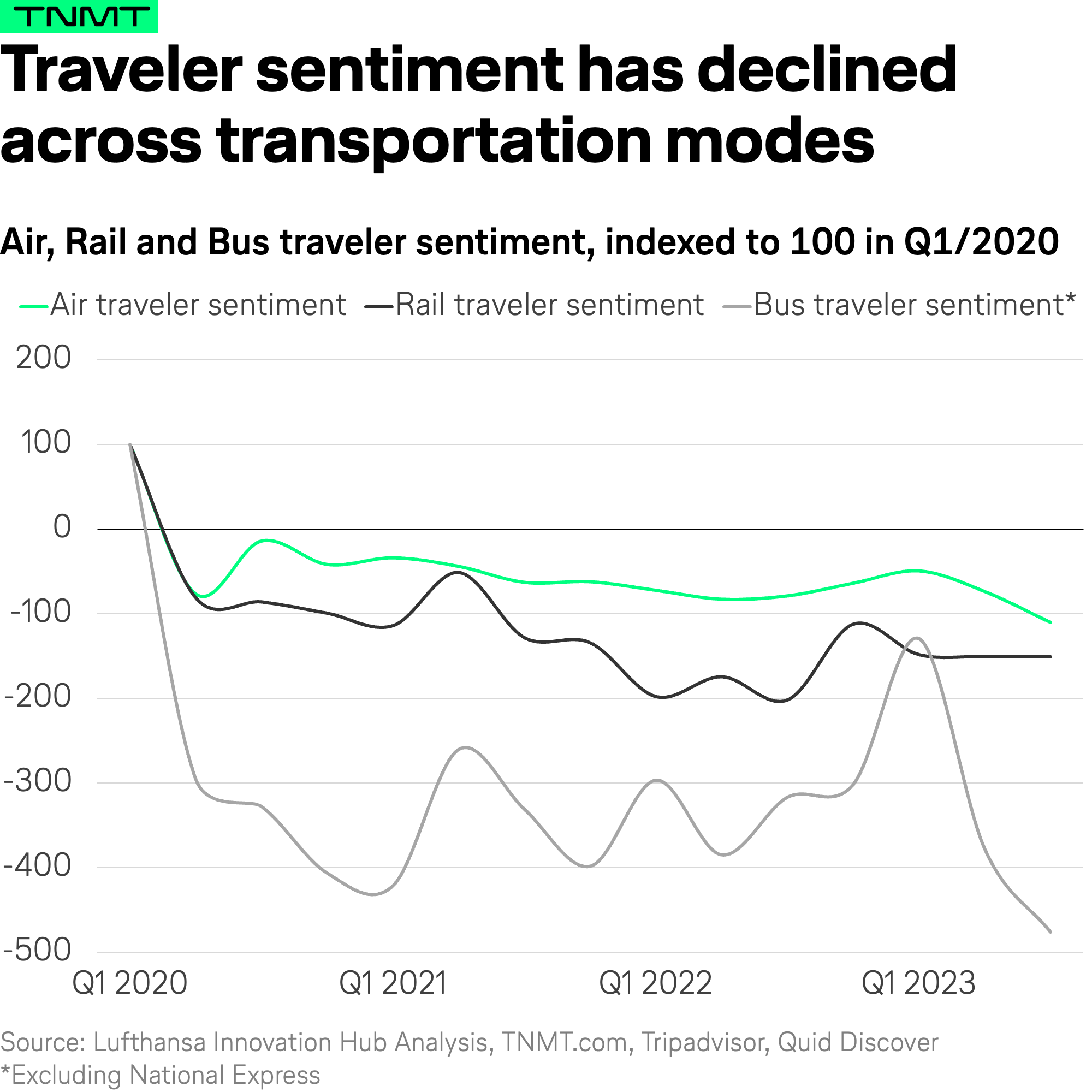

- Travel sentiment within the airline sector reached a new low by the end of 2023, plummeting even below the levels observed during the peak of the pandemic.

- A glaring discrepancy exists between the promised “passenger experience” marketed by airlines and the reality faced by travelers. This gap is notably wider than in other industries, such as retail or media, where product promises and experiences are more closely aligned.

Given the unique position of the airline industry in terms of customer satisfaction—or the lack thereof—we were intrigued to see how it compares to other modes of transportation.

Surprisingly, comprehensive analyses that benchmark customer satisfaction across different transportation modes are scarce. To bridge this gap, we embarked on an analysis comparing traveler sentiment across air travel, rail, and bus services.

Our objectives with this research were twofold:

- Gauge how air travel satisfaction stacks up against other transportation methods to better understand whether traveler frustrations are airline-specific or a wider industry trend.

- Seek potential lessons for the airline industry from other transportation sectors, providing a broader perspective on where airlines might stand to improve or adapt.

Before we delve into the insights, let’s outline our research approach.

Methodology: Unpacking Sentiment Through Tripadvisor Reviews

To conduct this analysis, we once again turned to Tripadvisor, a repository rich with customer reviews across a variety of sectors, including transportation.

- Specifically, we analyzed customer reviews for the 20 rail and bus companies that have accumulated the most reviews on Tripadvisor.

- In total, we examined approximately 12,000 Tripadvisor reviews for these companies, spanning from 2019 to 2023.

- Utilizing the Natural Language Processing (NLP) capabilities of Quid Discover, we assigned a sentiment score to each transport mode on a quarterly basis, allowing us to trace sentiment trends over time accurately.

- Quid calculates a sentiment combined score based on the number of positive/negative keywords as well as their semantic nuance and strength. The score quantifies the text on a scale from -2 (most negative) to +2 (most positive). To compare the sentiment across transportation modes, we indexed the aggregated scores to 100, with Q1 2020 as the base.

Let’s now turn to the key insights from our analysis.

The Main Insight: Air Traveler Sentiment is Better Than Perceived

Our analysis has led to some intriguing insights, particularly concerning the levels of customer satisfaction or dissatisfaction within these sectors.

Here’s what our research uncovered:

- Interestingly, when benchmarked against rail and bus travel experiences, air travelers exhibit a comparatively lower magnitude of dissatisfaction. This is not to say air travelers are broadly satisfied; they are not, but their levels of dissatisfaction are less severe than those of rail and bus travelers.

- The analysis paints a clear picture of the hierarchy of customer satisfaction across transportation modes. Air travel, despite its challenges and negative sentiment, fares relatively better when compared to rail and bus travel. Bus travel, in particular, scores the lowest in customer satisfaction, also marked by the sharpest decline post-pandemic.

- Although the sentiment among air travelers has been generally negative, it has remained relatively less volatile when compared to rail and bus travel. This relative stability suggests that while air travel dissatisfaction clearly exists, the issues might be more structural, pointing toward systemic problems rather than acute or sporadic service failures.

Now, what do these findings suggest?

It’s not our intention to downplay the dissatisfaction found in air travel. However, the analysis suggests a broader, transport-wide issue of unhappy travelers rather than a problem unique to air travel.

Notably, common pain points highlighted in Tripadvisor reviews across all three transport modes include similar issues like unpunctuality and unmet service quality expectations (e.g., poor Wi-Fi), among other reliability concerns. Identifying and addressing these shared issues could provide valuable lessons for improving customer satisfaction across the transport board.

Speaking about valuable lessons: there was one hidden customer champion in the bus segment, despite the category’s disastrous aggregate sentiment score, worth taking a closer look at.

Learning From the Best in Bus Travel

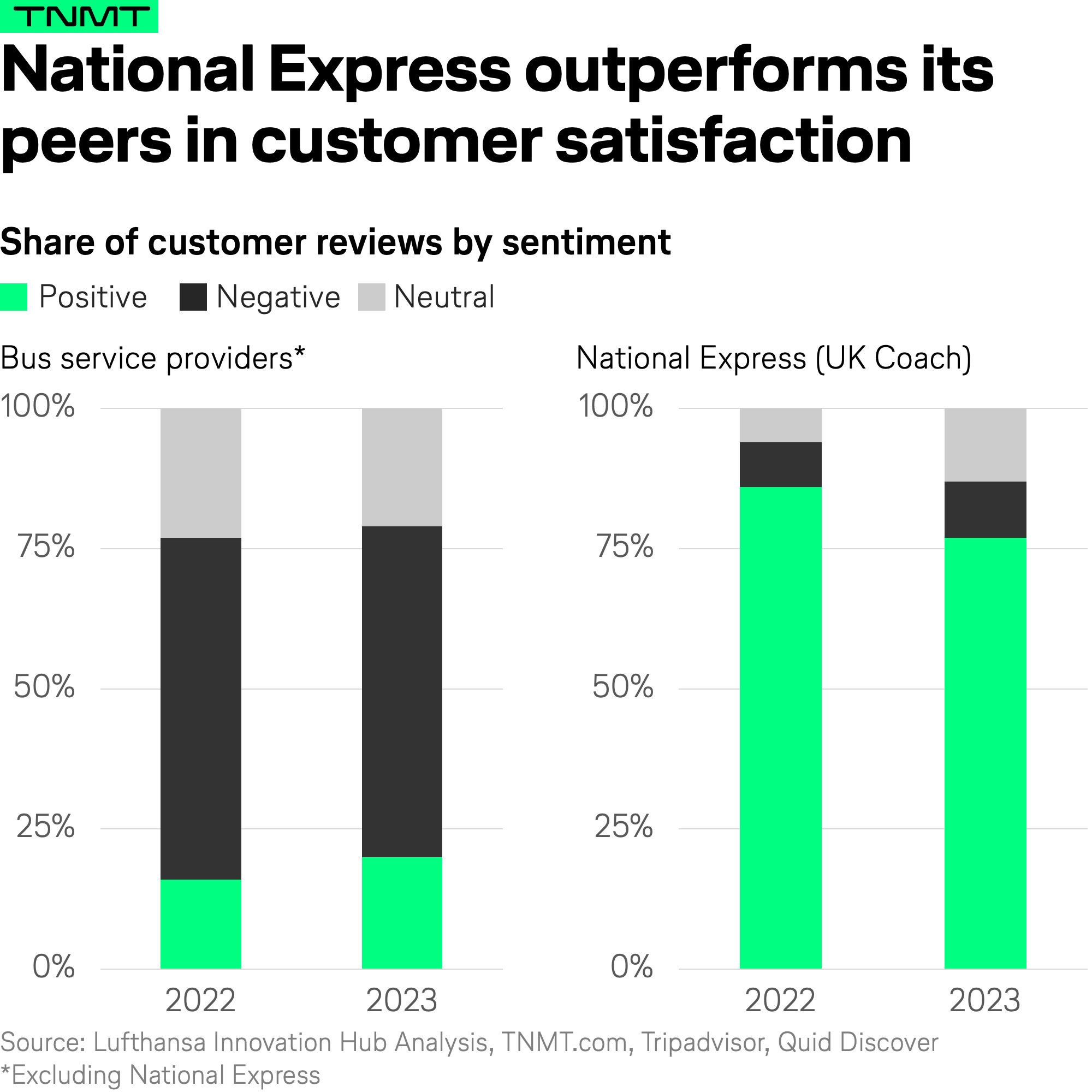

In seeking lessons across the transportation spectrum, we’ve uncovered a standout performer in the bus sector: National Express.

This UK-based bus provider not only outperforms its peers in customer sentiment but also presents key learnings for the broader travel industry.

National Express distinguishes itself with an overwhelmingly positive reception from travelers.

- A striking 78% of reviews for National Express were positive in 2023

- This is a stark contrast to the mere 21% positivity rate seen across other bus services.

Eager to understand the drivers behind National Express’s success, we delved into the data, uncovering three primary themes central to its high customer satisfaction rates.

Remarkably, 82% of all positive feedback for National Express clustered around these areas:

1. Reliability and Service Quality

Customers highly value reliability, particularly highlighting on-time departures and arrivals as key factors for their satisfaction. In addition, positive comments with respect to service quality include staff friendliness, responsiveness, and professionalism.

2. Comfort and Cleanliness

Customer feedback positively focused on the comfort of seats, cleanliness of coaches, plenty of legroom, and enough space for their luggage, all of which indicated that these elements are crucial for a pleasant travel experience.

The emphasis on space and cleanliness shows that these aspects are highly valued by travelers and contribute significantly to the overall journey experience.

3. Value for Money

Customers appreciate the affordability of the services, considering them good value for their travel needs. Reviews particularly compared it to trains and mentioned this as a cheaper option but with the guarantee of having a seat (for no additional fee). Additional amenities, such as free onboard Wi-fi, were also mentioned as offering great value for the cost.

These findings underscore a simple yet profound insight: satisfying the fundamental needs of travelers is essential for positive customer experiences.

National Express’s ability to excel in reliability, comfort, and value sets an example for the entire travel industry, illustrating that even in the face of overall sector dissatisfaction, excellence in these basic service areas can significantly elevate customer sentiment.

The Essential Lessons for Airlines

With these lessons in mind, what can airline professionals specifically take away?

Our analysis underscores a fundamental truth that has perhaps been overshadowed by the allure of innovation: the importance of getting the basics right – something we have repeatedly highlighted in the past.

- National Express’s positive reviews highlight the power of fundamental service elements in boosting customer satisfaction.

- This observation serves as a stark reminder to airlines (and ourselves): while hype-driven innovations like outfitting business class with Apple Vision Pros (see this airline) might generate buzz, they don’t necessarily address the core needs of the majority of travelers.

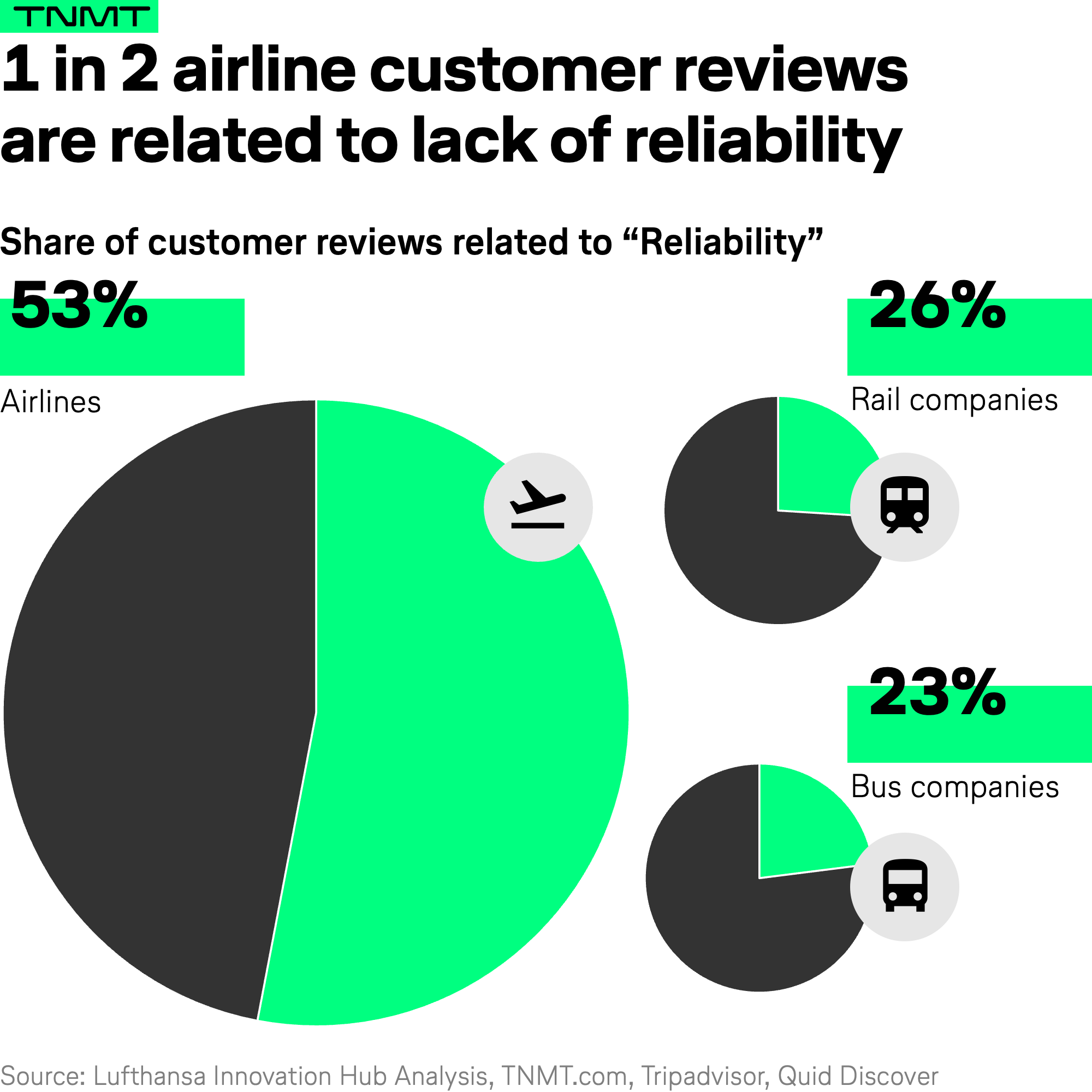

For airlines, the most crucial fundamental to address is “Reliability,” especially as we edge closer to the summer travel rush. This season traditionally tests the operational limits of the aviation industry, making reliability not just a priority, but a necessity.

Our data reveals that airline customers place a significantly higher emphasis on reliability than those traveling by bus or rail.

A staggering 53% of airline reviews focused on aspects of reliability, which is double the rate for reviews in the bus and rail sectors.

This focus on reliability gains even more importance given the current state of flight disruptions, which, according to Infare’s data analyzed by Amadeus, remained threefold higher in 2023 compared to pre-pandemic levels in 2019.

The lesson from National Express is clear: the aviation industry stands to benefit from redirecting its focus toward fundamental aspects of the travel experience, chief among them being reliability.

In essence, while a broad range of innovations are welcome, ensuring the reliability of flights remains the bedrock of a positive customer experience in our industry.