It’s been almost three weeks since the announcement, but we’re still wrapping our heads around it.

JetBlue has sold its much-admired corporate venture arm, JetBlue Ventures (JBV).

For those less familiar with the magnitude of this move:

- JBV wasn’t just another Corporate Venture Capital (CVC) unit.

- It was arguably the blueprint for forward-looking corporate innovation in Travel and Mobility Tech, especially within aviation.

Why?

Because JBV didn’t just talk about innovation.

The company put money behind it. Consistently. For years!

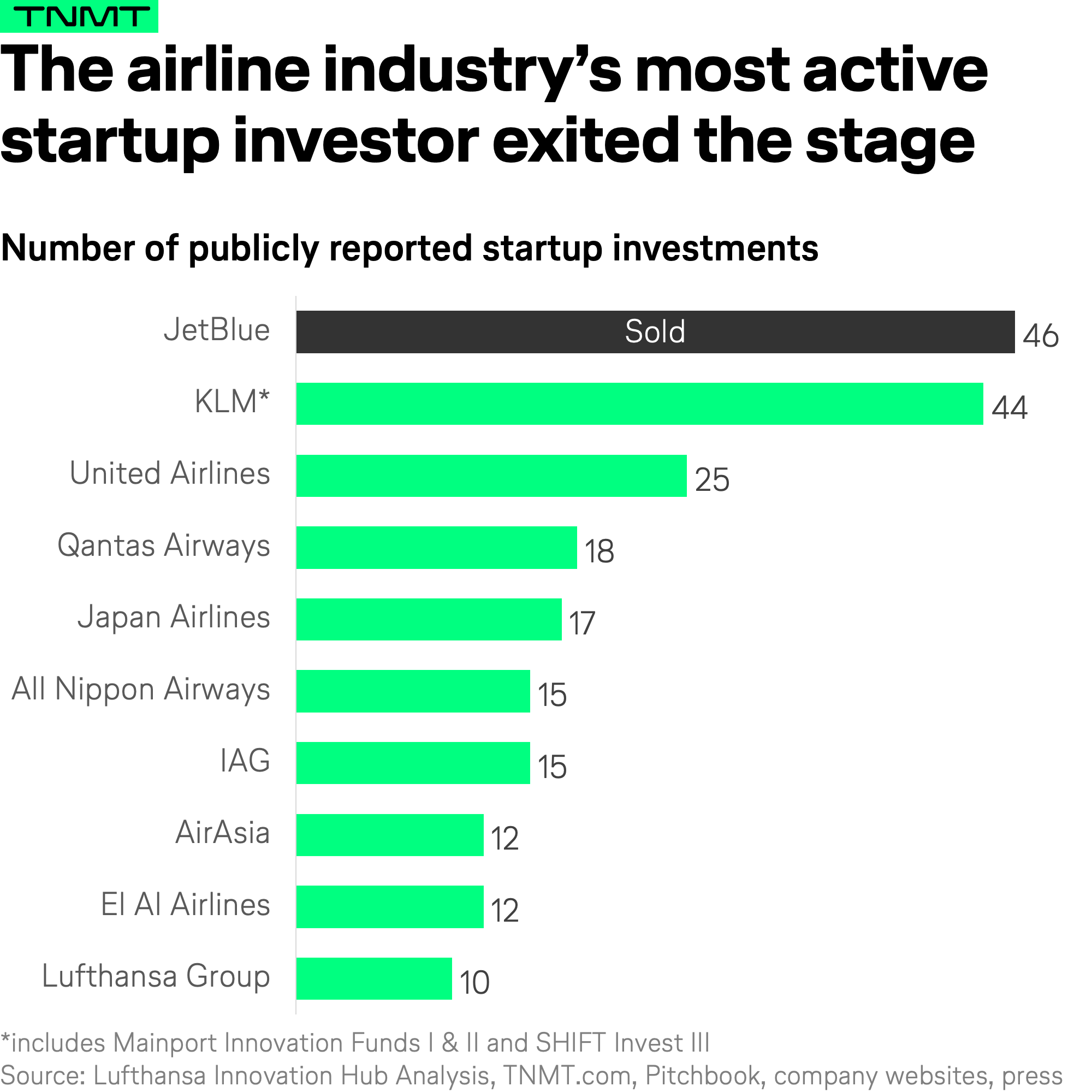

- According to our TNMT Airline Investment Dashboard, no other airline invested in more startups than JetBlue.

- Think of JBV as the Real Madrid of airline-related startup investing. Or the New York Yankees, for our U.S. readers.

In fact, its influence reached far beyond aviation. PhocusWire even placed JetBlue Ventures among the top five most active investors in all of travel last year.

So… why sell?

JetBlue’s official line?

The sale marks “the next era of growth for JetBlue Ventures,” unlocking new opportunities for the unit under its new ownership.

That’s textbook PR fluff. Let’s skip the brochure copy.

Now, the translation: two words – financial pressure.

- JetBlue’s Q1 2025 earnings report revealed losses of over $200 million USD.

- As part of the carrier’s “JetForward” cost transformation plan, the airline began trimming anything deemed “non-core.”

And with a startup portfolio recently valued at ~$90 million USD, JetBlue Ventures likely looked like low-hanging fruit.

Easy cash. Quick win.

But was it worth it?

Let’s assume SKY Leasing (the buyer) paid a slight premium. That might add ~$100 million USD to JetBlue’s balance sheet. Not bad.

But in the bigger picture?

This was a short-term gain at the cost of a long-term innovation strategy.

Just consider the timing: Anything but great.

- Startup valuations plummeted after the low-interest era ended.

- But now they’re slowly rebounding.

- In fact, JBV’s portfolio alone appreciated 5% between Q4 2024 and Q1 2025.

Selling now feels like giving away a winning lottery ticket before the draw.

The real loss? Strategic value.

Looking beyond the hard numbers, JBV didn’t just deliver financial upside potential.

- It gave JetBlue front-row access to emerging technologies.

- Real-world insight into startups shaping the future of travel.

Those collaborations were a strategic edge.

That edge is now gone.

Could it have been avoided?

Maybe.

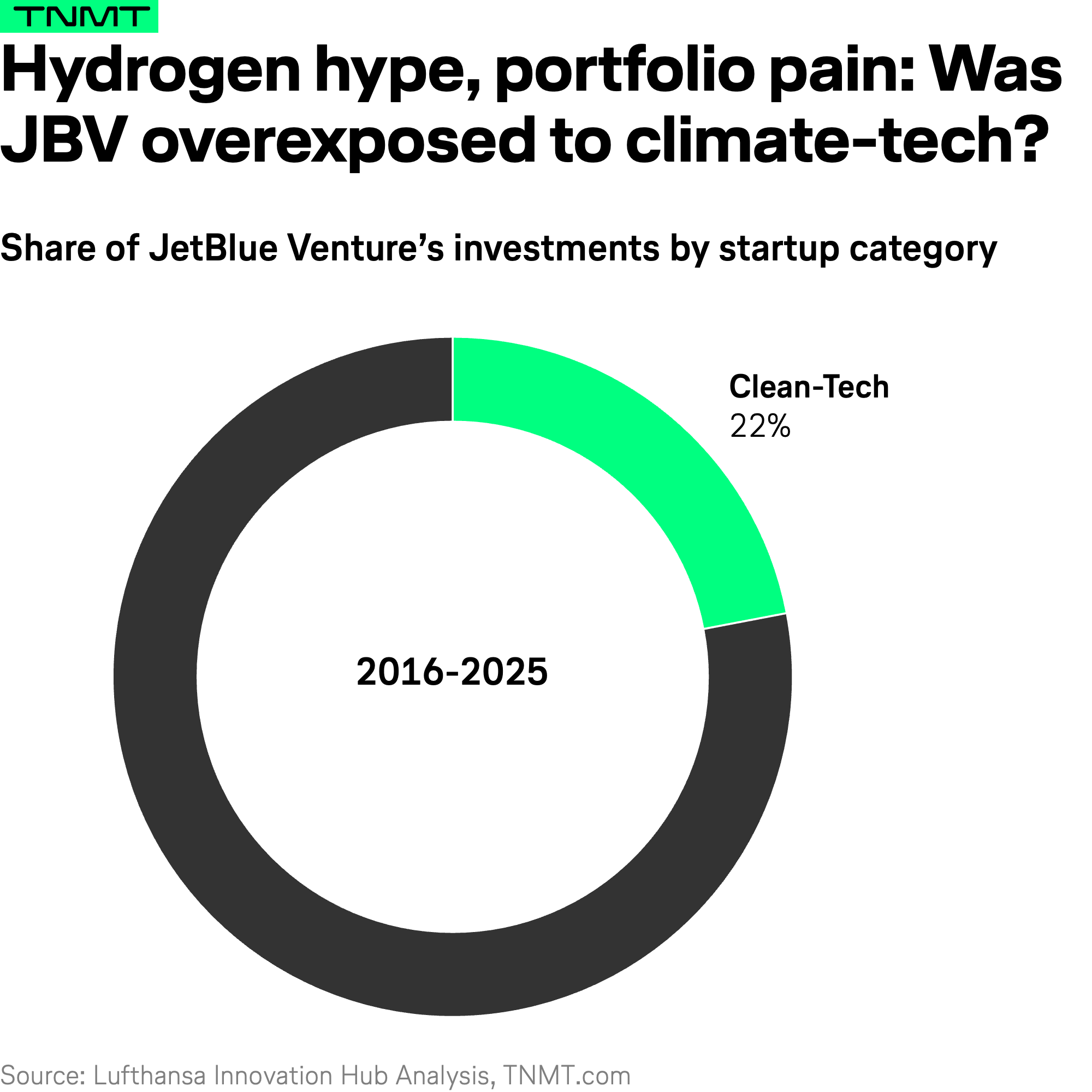

In hindsight, JBV’s focus on many high-risk deep tech bets, particularly in climate hardware, might have hurt its internal perception.

Case in point: Universal Hydrogen.

- The startup aimed to make hydrogen-powered flight a reality.

- But the venture collapsed in mid-2024, and JetBlue had to write off the investment.

- That single write-off probably accounted for a large chunk of JBV’s $22 million USD portfolio loss last year.

You can bet that didn’t sit well at corporate HQ.

Zooming out: What’s happening in corporate VC?

In all transparency, JetBlue Ventures isn’t the only CVC unit facing major change.

Over the past few weeks, several well-known corporate funds have either shut down, spun off, or hit pause, as reported by GVC:

- Uniqa Ventures (the VC arm of Austrian insurance group Uniqa) was spun off through a management buyout. It now operates independently under the name Shape Capital Partners. Translation: Uniqa wanted off the cap table, but the team kept going solo.

- AXA Venture Partners, backed by French insurer AXA, also separated from its parent company and rebranded as Atlantic Vantage Point. Another case of “we love the mission, but need some cash.”

- ING Ventures, the venture arm of Dutch bank ING, stopped making new investments entirely. While not officially shut down, this is a silent freeze. No new deals means effective hibernation.

Meanwhile, some firms are still betting big. Bosch, for example, just raised a sixth €250 million fund.

And in aviation, IAG announced the launch of IAGi Ventures – its CVC arm with an initial fund size of €200 million ($218 million USD).

So while some are pulling the plug, others are reloading.

What’s the takeaway?

Corporate innovation, especially in aviation, just took a serious hit.

And startup investing is under fresh scrutiny.

CVC isn’t dead, but it’s clearly evolving.

- Experts like GlassDollar are calling it a broader “adaptation in corporate innovation,” where investing is no longer the default move.

- Instead, Venture Clienting and Venture Building are stepping up as the new go-to tools in the corporate innovation stack.

What else is evolving in the aviation innovation playbook?

Earlier this year, we analyzed 100+ external innovation units across the industry and distilled the key lessons. Read here.