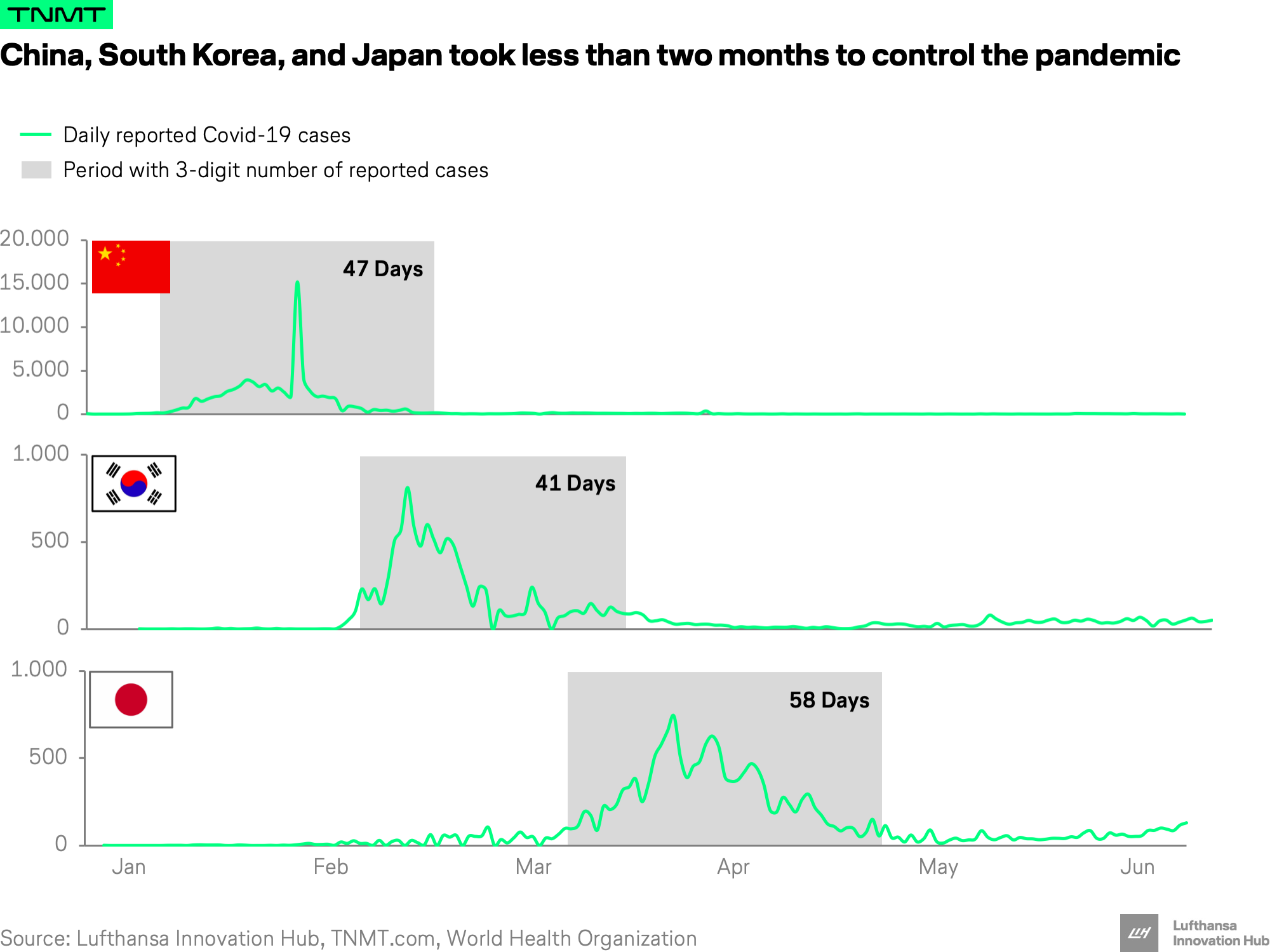

As COVID-19 keeps ravaging through many countries around the globe, the earliest harbingers in East Asia are finally navigating calmer waters. Through strict, collective efforts of governments, tech companies, and individuals, China, Japan, and South Korea have all managed to contain the spread of the virus within a relatively short, 40-to-60-day period. Following this brief pause on everyday activities, life has restarted in the three countries, including the return of travel.

As people in China, South Korea, and Japan begin to travel again, we wanted to find out how attitudes toward travel might have changed since the lockdown. So, we conducted a quantitative and qualitative study by reaching out to travelers in the three countries. Our goal was to understand their current sentiments and perceptions on traveling, specifically by air. The results may serve as inspirations for markets and travel providers that are currently trying to ramp up their businesses.

Methodology

We started the study by conducting a quantitative survey about East Asian travel sentiment and behavior. The ensuing data , sampled throughout June and July, comprises 530 responses from travelers in China, South Korea, and Japan. Following the survey, we identified four distinct groups of travelers: young singles, middle-class families, business travelers, and silver tourists. We then conducted in-depth qualitative interviews with each group in an effort to uncover their key drivers, concerns, and convictions about the future of (air) travel.

Based on the data-driven traveler survey and in-depth interviews, we saw five key patterns across the three markets.

Disclaimer: East Asian travelers in this article refer to surveyed travelers from China, South Korea, and Japan.

Here are our five key findings:

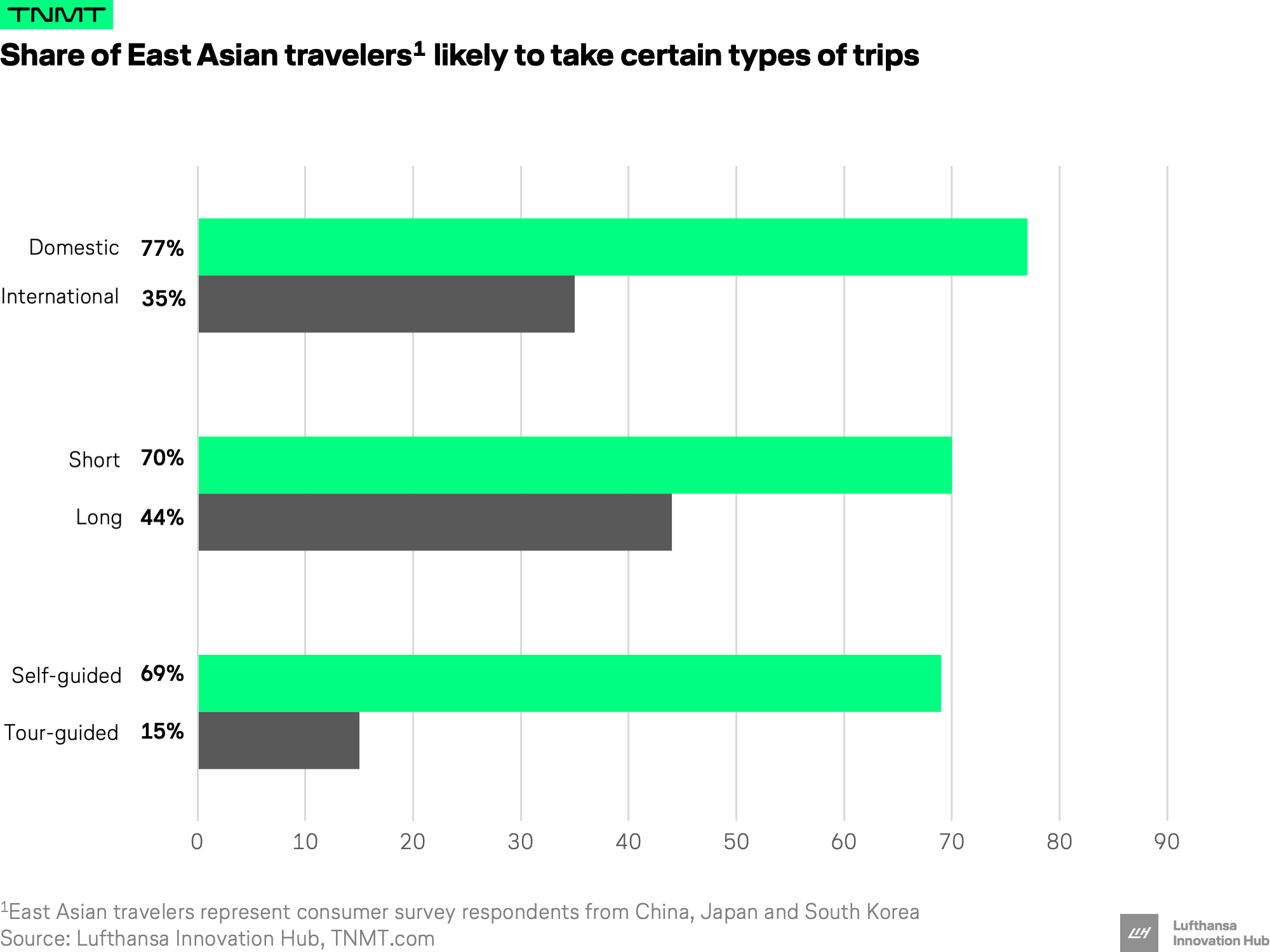

1) East Asian travelers are willing to travel again, but most current trips tend to be domestic, short, and self-guided

While the overall willingness to travel is high among East Asian travelers, this sentiment only applies to select trips.

Most people prefer domestic over international travel (77% vs 35%). Locals in the three regions perceive their home countries to be safer than other parts of Asia, and especially when compared to the Americas, where cases continue to rise at an alarming rate. Moreover, complex visa restrictions and the ever-changing travel bans act as hurdles for international travel. Based on our interviews, the single biggest deterrent for overseas travel is the 14-day quarantine required either on arrival, upon return, or even both — leaving travelers locked in for an entire month.

Short trips with a duration of 2-3 days or weekend getaways are favored over longer trips (70% vs. 44%) to reduce the likelihood of infection. Camping has become highly popular for these weekend trips. And the car is often chosen as the preferred mode of transport. In Korea, “glamping” and “camping car rental” have been the most searched terms in the leisure segment since mid-April on Naver, the most popular search engine in the country. And the car-based vacation trend seems to be universal. According to BCG, the share of US travelers who take trips within driving distance increased to 50% as of today from 33% in the days prior to COVID-19.

The vast majority of travelers prefer self-guided tours over guided ones (69% vs. 15%), revealing the largest disparity in our survey results. The popularity of guided tours and group travel has declined due to the fear of infection. As per Mckinsey, only 10% of Chinese travelers would consider a group tour for their next trip, down from 28% before COVID-19. The high preference for self-guided trips is also reflected in the usage of rental cars, one of the fastest travel segments on the rebound with a 10% year-over-year increase in bookings as of May (in Chinese).

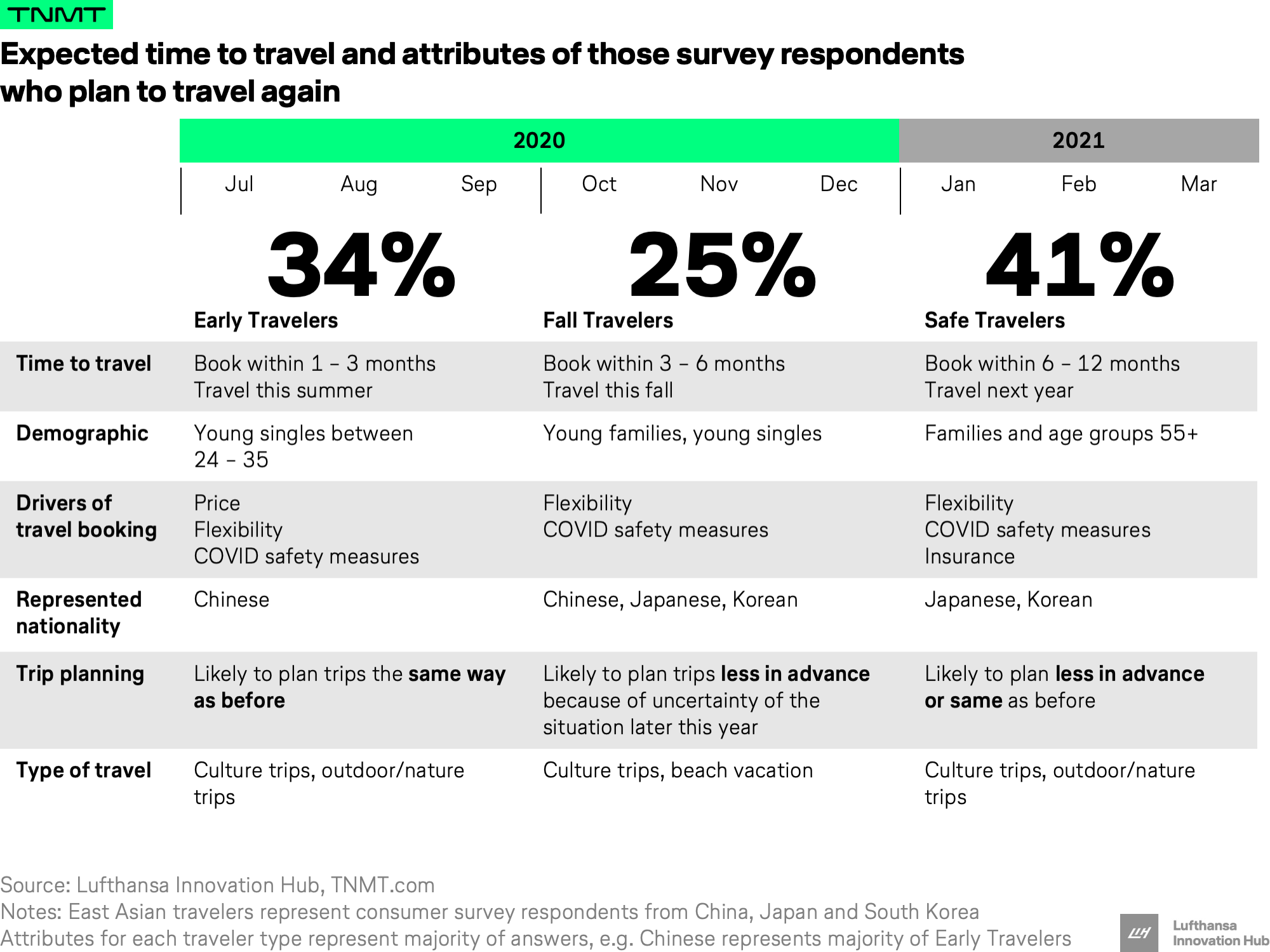

2) Three distinct groups of travelers stand out: Early, Fall, and Safe Travelers are expected to travel again in a phased timeline

Respondents in our survey didn’t completely abandon future travel plans. Rather, they’ve shifted their timeline for travel. We observed three groups of travelers with distinct levels of confidence about resuming their travel plans.

Close to 60% of the respondents still plan to travel in 2020, of which 34% are already planning to travel within the next 3 months. They are best represented by price-sensitive young singles aged 24 – 35 who value price over flexibility in booking and COVID safety measures. These Early Travelers mostly comprise Chinese tourists as China recovers earliest of the three surveyed countries in (domestic) tourism.

About 25% of respondents said they plan to travel within the next 3-6 months. Young families and singles from all three countries say they plan to travel again in October. Families will value flexibility in re-booking and cancellation so they can make potential last-minute changes in response to any unfolding situations. Due to the current uncertainty surrounding COVID-19, they’re also booking closer to the actual trip date than usual, with less advanced planning.

However, the biggest group of respondents (41%) were those that want to travel in 2021. These travelers want to play it safe, partly because they largely comprise families and those aged 55+. The majority of Japanese and South Korean respondents fall into the Safe Travelers category. They also show a higher willingness to travel internationally than the Chinese participants which explains why they would rather defer their travel plans to next year, since it’s difficult to travel overseas at the moment. Due to their safety concerns, respondents in this group reported a high interest in travel insurance.

Despite these varied travel timelines and booking behaviors among the three groups of travelers, one common denominator was the popularity of nature and culture trips. We expect these to remain popular in the mid to long term, as they’re the easiest to execute in the current climate.

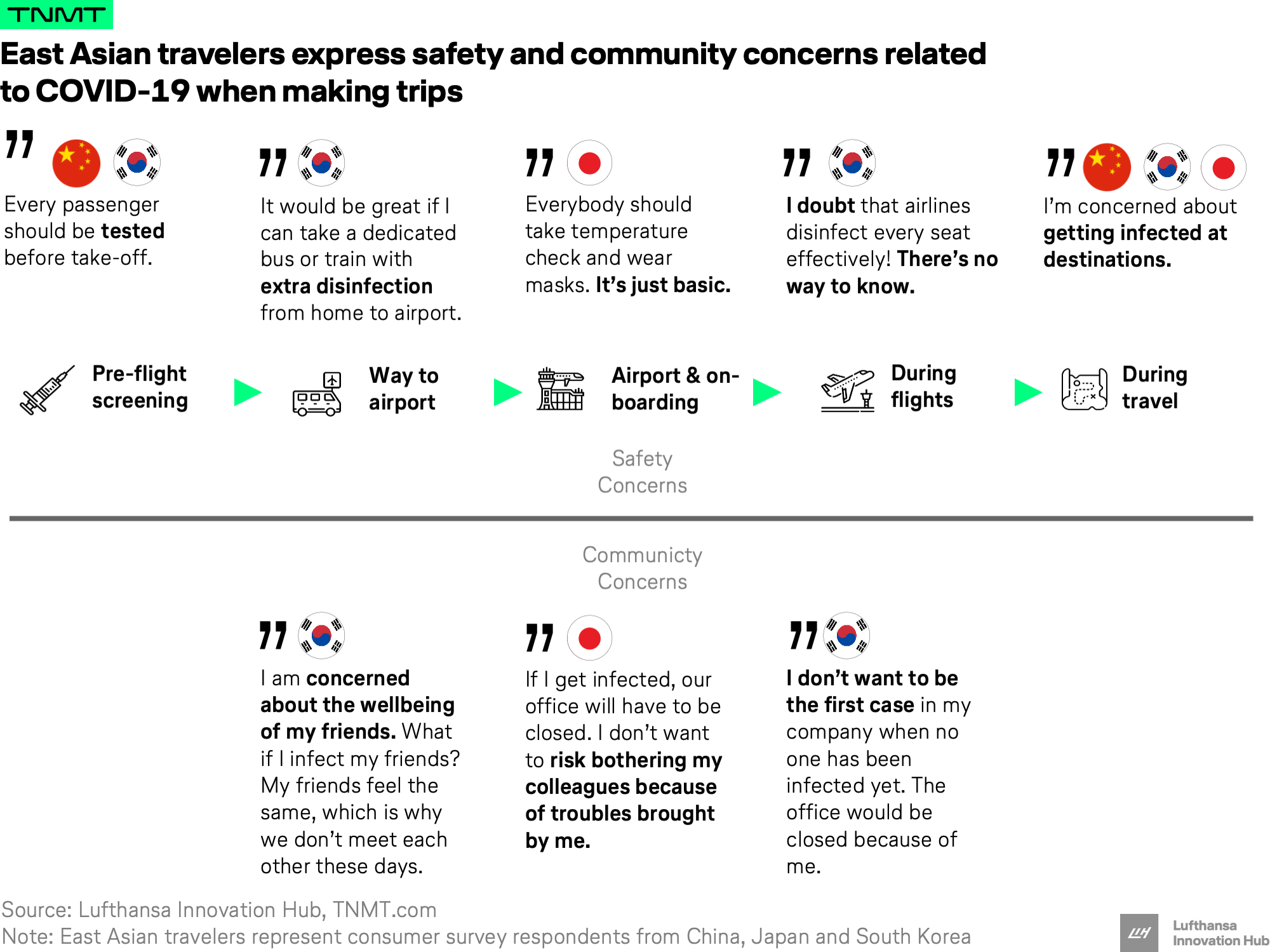

3) Perception of travel safety and personal motivation of saving societal and public face could deter more East Asian travelers from traveling

Travelers all around the globe put a hard brake on travel back in March 2020 due to concerns about containing COVID-19. East Asian travelers displayed a unique concern that stems from a collectivist culture that places an importance on maintaining a good public image.

In our in-depth interviews, the most cited reason for not traveling was the fear of passing on COVID-19 to other people, especially to their families and friends. “I am concerned about the well-being of my friends, and my friends feel the same,” said an interviewee, reflecting the thinking that minimizing personal exposure to COVID-19 serves the greater good of the community.

On a professional level, people also said they wanted to avoid being responsible for infecting colleagues, or even worse, being responsible for business closure due to an additional COVID-19 outbreak. As one of the interviewees said, “If I get infected, our office will have to be closed. I don’t want to risk causing problems for my colleagues.” This collectivist mindset triggered mass compliance in wearing masks and adhering to other safety measures, which explains the relatively fast containment of the pandemic in the three countries.

4) Last-minute booking could become the new norm — maximum flexibility does not convince travelers into booking in advance

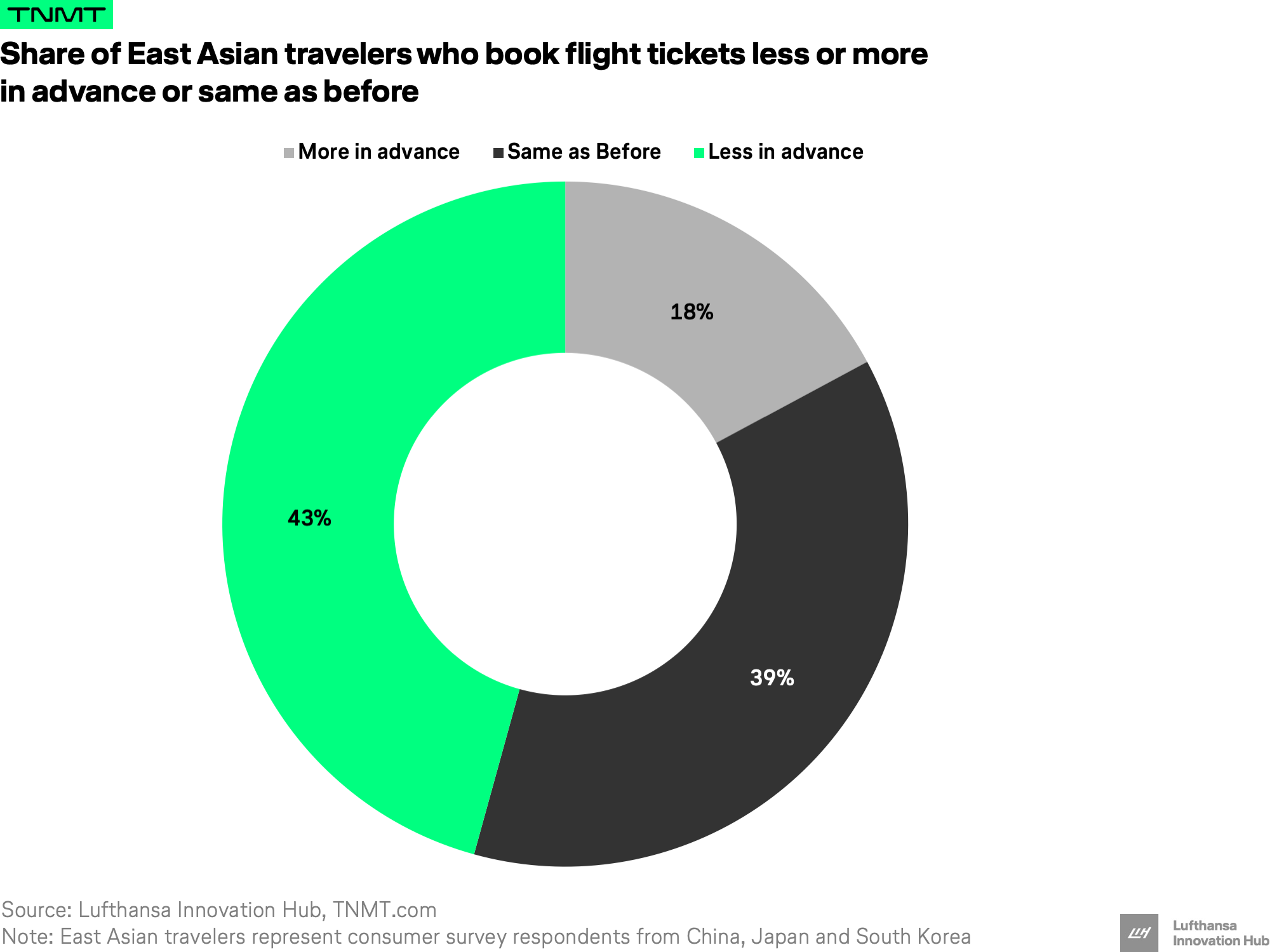

As shown in key insight #2, travelers emphasized flexibility as an important factor in booking travel, due to the high uncertainty of COVID-19’s impact on travel plans. We also observed that many airlines have compromised their re-booking and cancellation policies to maximize the flexibility in an effort to reap some bookings.

However, this gesture does not guarantee that travelers will book in advance, even if rebooking involves zero or minimal costs. According to our survey results, 43% of travelers from China, South Korea, and Japan say they will book less in advance than usual.

The unwillingness to book flights ahead of time could be attributed to the extremely affordable flight tickets that can be secured even 1 to 2 days before departure. It could also be that travelers simply want to avoid any hassle, even if changes are free of charge. “I know my flight fare will be reimbursed, but the process will be troublesome. I would rather buy tickets at the last minute,” said one interviewee.

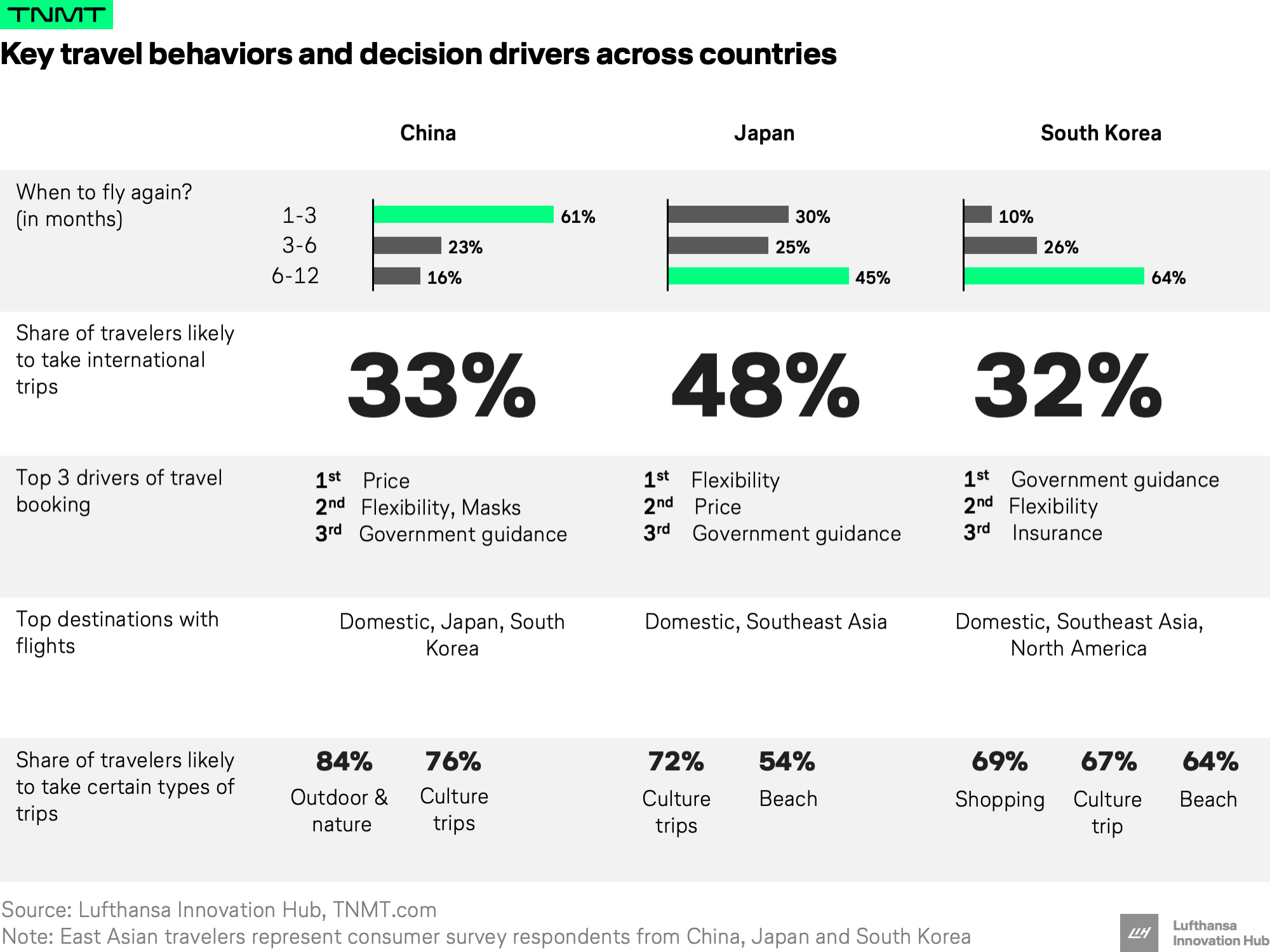

5) Key drivers of travel decision vary significantly across countries

We have now gotten a quick grasp of travel sentiment across the three countries as a whole. However, it is crucial for travel providers to digest such information at market-specific granularity, as key travel behaviors and decision drivers could vary greatly across countries.

As revealed in key insight #2, the majority of Chinese travelers will hop on a trip earlier than most Korean and Japanese travelers. However, travelers in different markets are prone to different incentives. For instance, Chinese and Japanese travelers value price, while Korean tourists prefer to buy travel insurance to increase their sense of security.

With regards to trip specifics, domestic and Asian destinations within quick reach remain the most popular for all markets. Notably, South Korea is the only country that places North America in the top 3 destinations, despite America’s rampant COVID-19 outbreak. Outdoor nature (84%) and culture trips (76%) are gaining popularity among the vast majority of Chinese tourists, while shopping (69%) is still top of mind among Korean travelers.

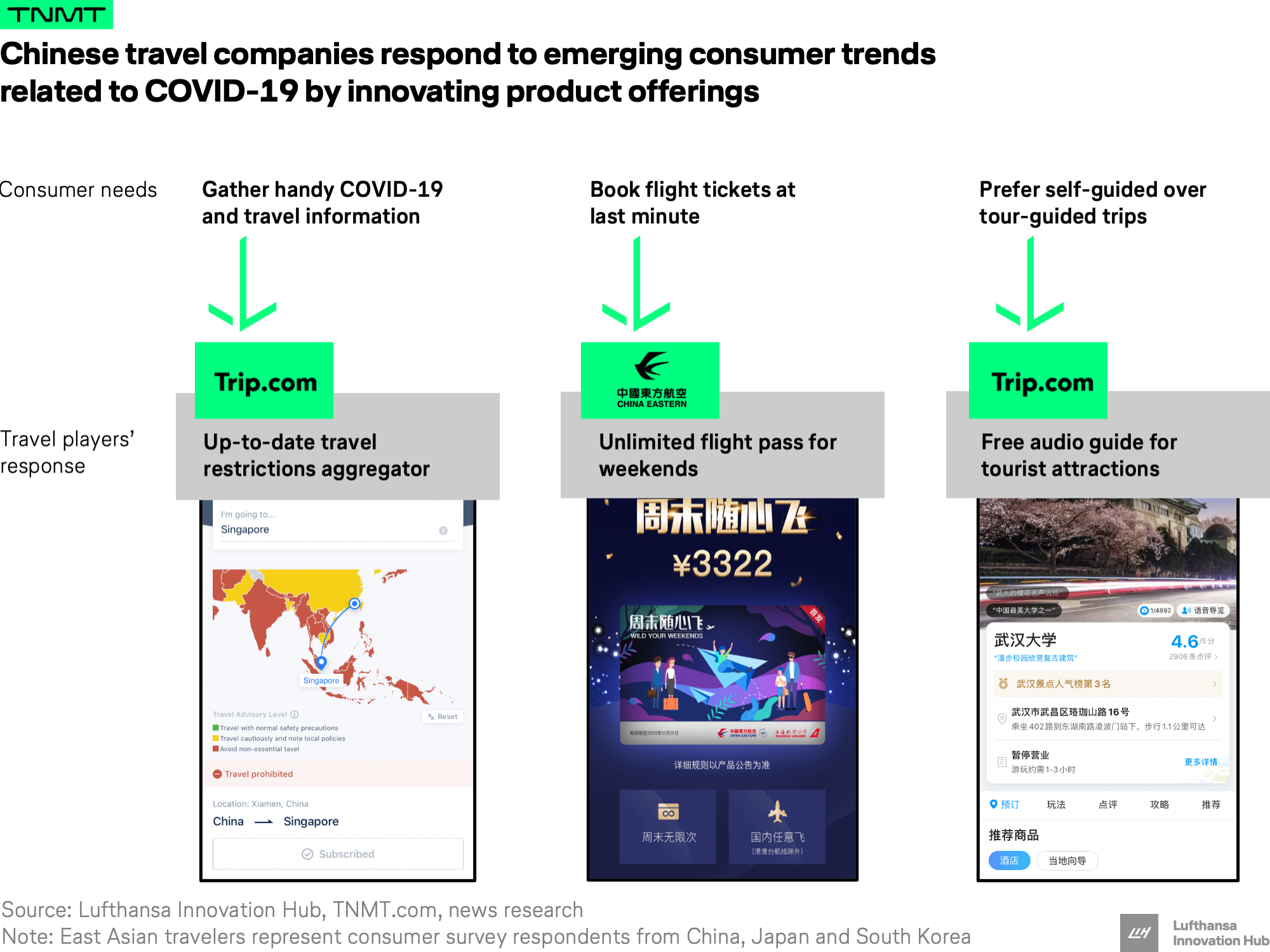

In light of new norms, Chinese travel companies rose up quickly to meet new challenges

With such shifting consumer sentiment in mind, global travel providers can take note of how Chinese companies are responding to new priorities and demands. Since the start of the COVID-19 outbreak, travel providers in China have acted swiftly to address the new challenges through digital innovation. Below, we’ll look at three notable examples from Trip.com and China Eastern.

China’s largest OTA, Trip.com, launched an information aggregator for COVID-19 case development and travel restrictions that cover almost all countries. On the platform’s international site, travelers can enter destinations and travel history to find out entry restrictions and prerequisites for open destinations. They also launched a website to introduce protective measures taken by different airlines to ensure a safe flight.

In response to the increasing reluctance to book tickets in advance and the rise of last-minute bookings, China Eastern innovated its flight sales strategy by launching the China Eastern weekend flight pass. This pass costs less than 400 EUR, remains valid through 2020, and allows unlimited booking of economy tickets at minor surcharges on Saturdays and Sundays to/from all China Eastern destinations in mainland China. This is economically feasible due to the low marginal cost of adding one pax to an empty flight. During the first week of launch, there were >65k tickets redeemed with the pass, generating immediate revenue and publicity. As of June 30, the airline announced that it will cease selling the pass, citing that the sales “exceeded their expectation.” Following their success, other Chinese airlines, including Spring Airlines and Hainan Airlines, also announced their own flight passes.

Finally, Trip.com’s Chinese app is promoting features like free audio guides of tourist attractions to meet the popularity of self-guided tours. Information also became readily available via live streams, which attracted large audiences during strict lockdowns. James Liang, the co-founder of Trip.com, became a top travel streamer, attracting over 1 million viewers and selling $3.84 million’s worth of travel packages within the first hour. The trend has now become part of the new norm as a popular source of information for travel, especially for people who plan their own trips.

Conclusion

COVID-19 still looms large in many countries, posing a threat to the global travel industry. As we all learn to live with its constant presence, many of our travel behaviors have changed. Some of the emerging trends we found in our East Asian Consumer Sentiment Study, e.g. caution to safety, flexibility in booking, etc. could even stay in the long run.

Smart travel companies should not wait for a return to pre-COVID norms. It is strongly advisable to leverage this downtime of low travel demand and pull resources together to adapt businesses to a new reality. Products and processes need to be modified to have more self-service, information transparency, and physical distancing to restore consumer confidence. The upside of the current situation is there is a golden opportunity to use this time to better understand differences in consumer needs across geographies and act as trustworthy travel partners. The post-COVID travel arena will be crowded, and those who act fast will leave a positive impression on travelers navigating the globe with fresh priorities.