Airline innovation is a broad and complex field.

From internal R&D and digital transformation initiatives to partnerships and corporate innovation labs (see our recent deep dive into airline innovation units), there are countless ways airlines attempt to drive change.

But among all these tools, one stands out as the clearest signal of long-term strategic commitment: startup investments.

Why?

Because investing in startups—as the terms says—requires skin in the game. Unlike many of the innovation narratives airlines like to promote—often more “innovation theatre” than real impact—startup investments involve real dollars being committed to novel ideas and emerging technologies. These investments are inherently high-risk and high-reward, making them one of the boldest approaches to driving meaningful change.

That’s why tracking airline startup investments is mission-critical to understanding the industry’s real long-term bets.

- For the past five years, we’ve been doing exactly that. TNMT is the only source that systematically tracks every airline-startup deal at this granular level through our Airline Investment Ranking.

- Today, we’re back with an updated snapshot—this time, looking specifically at 2024—to reveal where airlines are betting on the future of Travel and Mobility Tech.

- By analyzing these investments, we gain an unfiltered view of the industry’s top innovation priorities that could reshape air travel as we know it.

So, where did airlines put their money in 2024? Let’s dive into the latest data.

Startup Investments: A Rare Strategy Among Airlines

Before diving into the latest data, let’s take a quick step back and assess just how widely startup investments are adopted in the airline sector.

It turns out that investing in startups is an exceptionally rare approach to airline innovation.

How come? Because startup investments are inherently high-risk, long-term commitments—a stark contrast to the risk-averse and short-term strategic mindset that dominates most airline boardrooms.

Most startup investments require airlines to bet on unproven ideas and solutions, often with uncertain payoffs years down the line.

The numbers speak for themselves.

- Out of the 340 IATA-member airlines operating in 2025, only 25 airlines have ever made a single startup investment.

- That’s just 7% of all commercially relevant airlines worldwide.

This strikingly low adoption rate highlights just how conservative airline innovation strategies remain. The vast majority of airlines are sitting on the sidelines, hesitant to put capital behind emerging ventures.

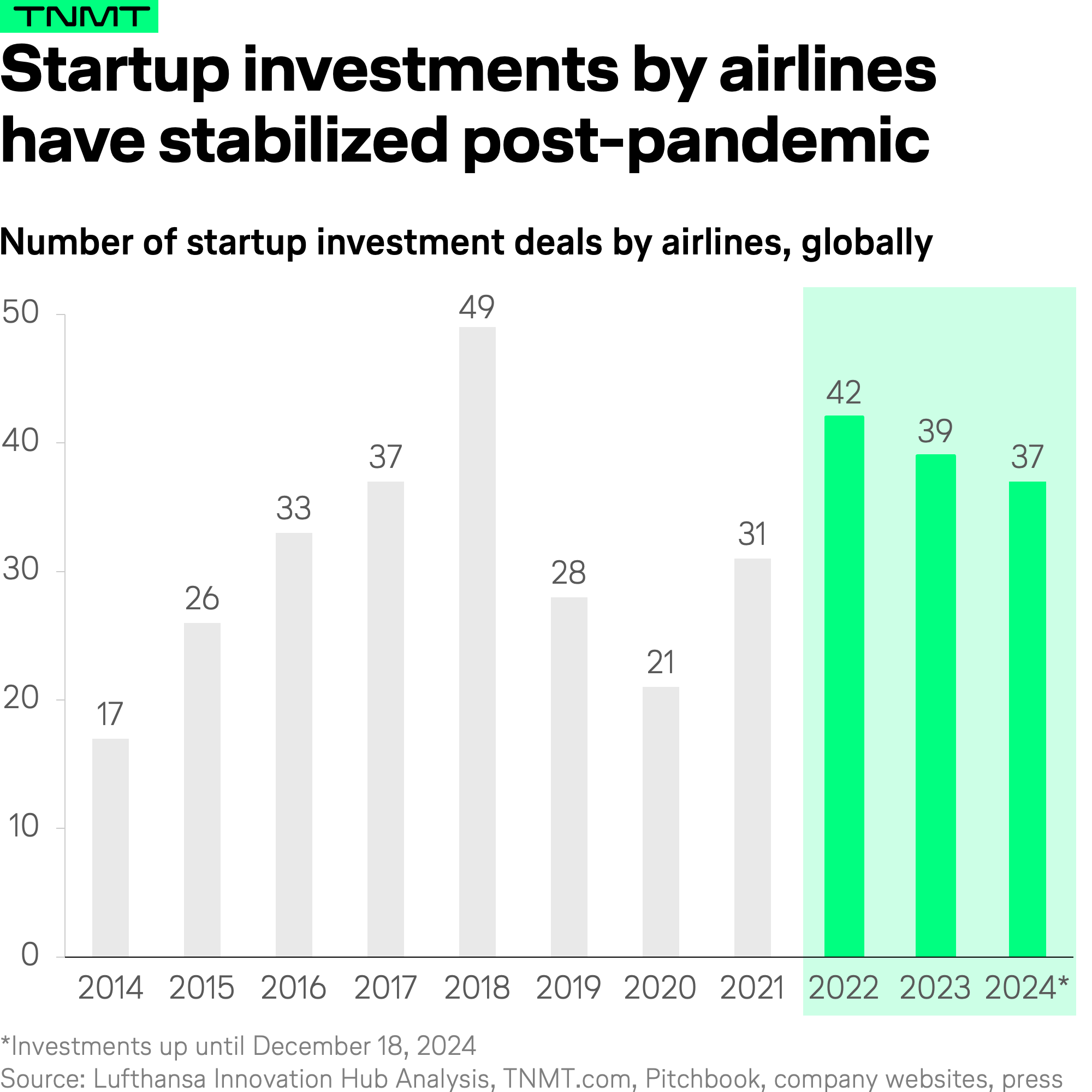

And this hesitation is clearly reflected in the investment trends of the past decade.

Despite ongoing technology disruption and growing innovation pressures, there has been no real upward trajectory in the number of airline startup investments per year.

Typically, we see 30 to 40 startup deals annually, with only minor fluctuations following economic cycles. For example, during the pandemic, when airline budgets were even tighter than usual, the number of investments dropped significantly.

On the bright side, the past three years have shown a degree of stability, with airline startup investments consistently trending around 40 deals per year.

While this number remains low in the grand scheme, it suggests a steady commitment by those airlines that have embraced startup investments as a core part of their innovation strategy—even if the broader industry remains cautious.

Where Are Airline Startup Dollars Flowing?

Now, let’s get to the core questions:

- Where are airlines placing their startup investment bets?

- Which Travel and Mobility Tech startups are attracting the most airline interest?

- And which carriers are currently leading the way in startup investments?

Let’s start with the key themes shaping airline startup investments.

One Clear Leader: Sustainability

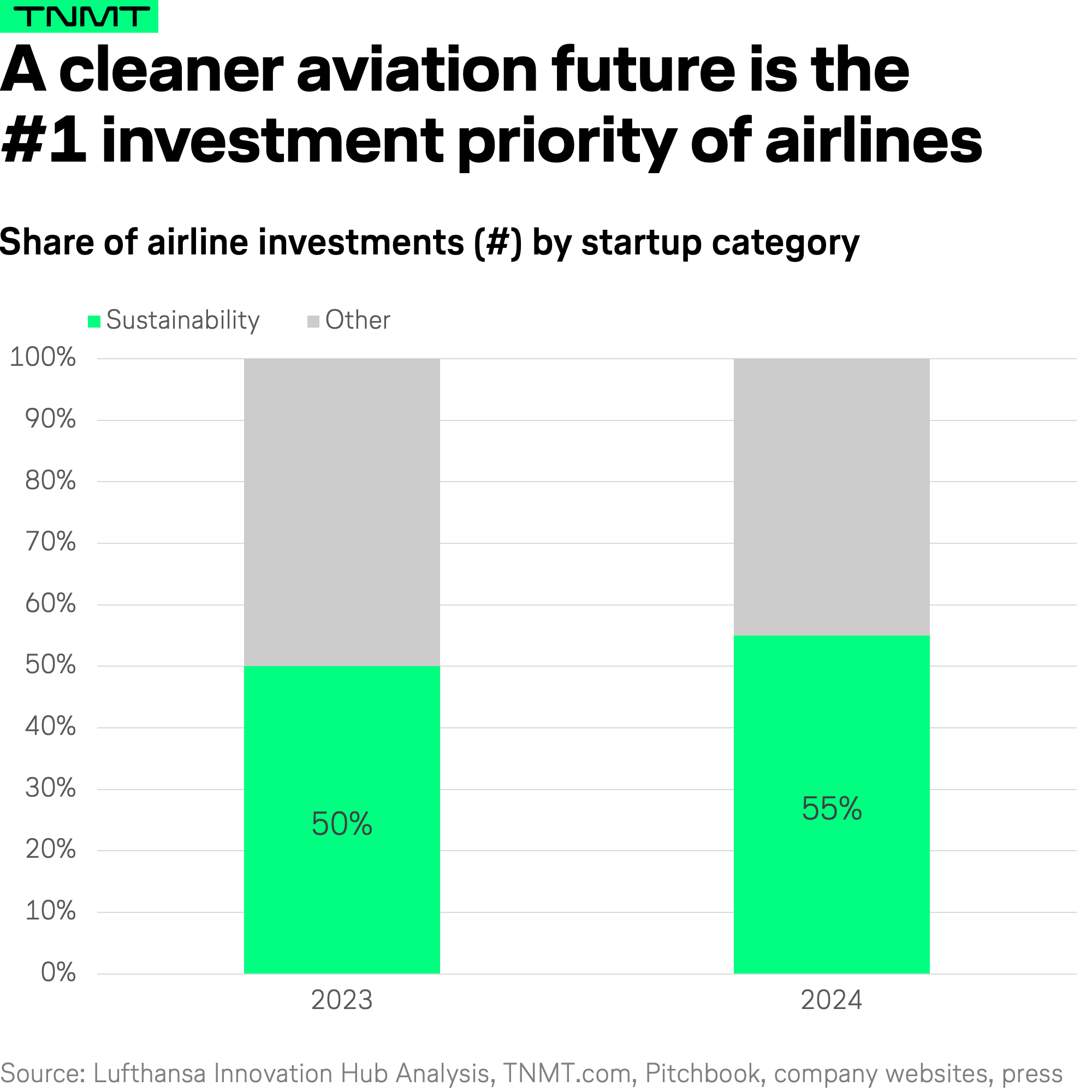

In 2024, more than half of all airline startup investments went to startups working on aviation’s sustainability challenge.

This is not a sudden shift—it’s a sustained trend.

Back in 2023, 50% of airline-backed startups were also in the climate-tech space, reinforcing sustainability as the dominant investment theme for two consecutive years.

This is a promising signal.

Aviation’s long-term survival depends on solving its sustainability challenge, yet the industry still lacks a realistic path to net zero.

That’s why turning to the startup ecosystem to fuel breakthrough technologies is the right move—and one that deserves recognition.

In simple terms: We can’t expect game-changing innovations if we don’t fund the bold ideas that could one day redefine aviation.

But will sustainability remain a top priority for airlines?

- Broader market signals suggest that executives across industries may be deprioritizing sustainability in favor of more immediate concerns.

- According to a recent Bain & Company study, CEOs are placing less emphasis on sustainability as AI advancements, inflation, and economic pressures dominate boardroom discussions.

This raises an important question: Will airlines follow suit?

It will be interesting to see whether the airline industry maintains its strong commitment to sustainable aviation—or if investment dollars begin shifting toward more immediate, AI-driven innovations, which brings us to the next key insight.

The Rise of AI & Machine Learning

Trailing sustainability as the second most popular investment theme in 2024 is, indeed, AI & Machine Learning, which attracted 22% of all airline startup investments, up from 18% the year before.

This trend is hardly surprising.

The Generative AI movement of the past two years has fueled unprecedented interest in AI-driven solutions across industries—including aviation.

For airlines, AI presents a high-impact, immediate-use case for optimizing operations, reducing costs, and enhancing efficiency at scale.

Moreover, while sustainability investments—especially in hardware-driven solutions—often require long-term commitments with uncertain payoffs, AI investments appear more commercially viable in the near term.

The ten largest startup investment deals in 2024 reinforce this pattern—every single one was in either sustainable aviation (Climate-Tech) or AI, with several startups sitting at the intersection of both fields.

The Most Active Airline Startup Investors in 2024

Let’s now examine the most active airline investors themselves.

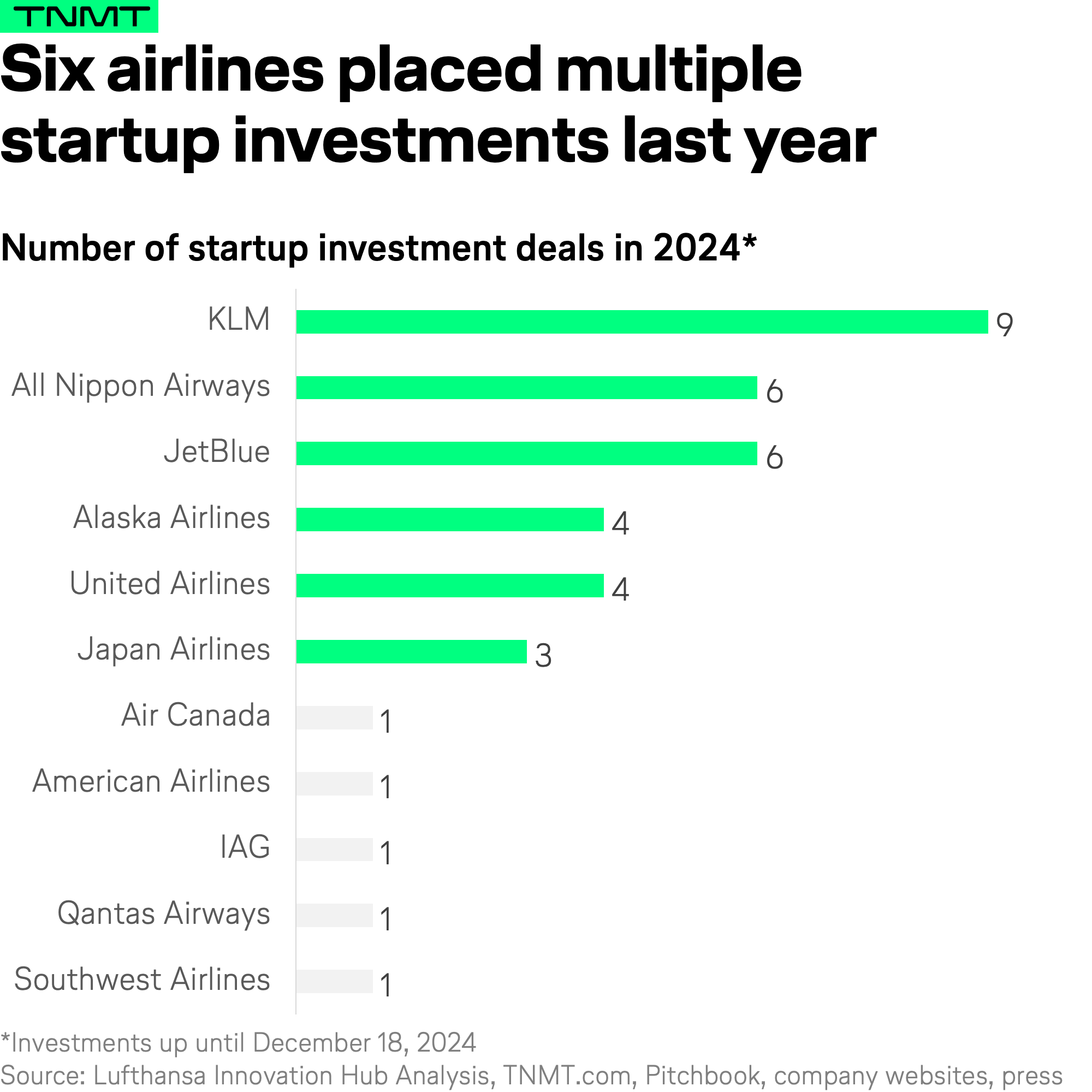

Unsurprisingly, six airline groups stood out in 2024 with multiple investments—most of them repeat players with established corporate venture capital (CVC) arms.

This is no coincidence.

- Having a dedicated CVC fund is typically the biggest internal milestone an airline must overcome to become a consistent startup investor.

- Without one, investments are often made off the balance sheet, requiring extensive internal approval processes for each deal.

Among the most notable new airline investors in 2024 was All Nippon Airways (ANA).

In 2024, ANA officially established a CVC arm with the launch of its ANA Future Frontier Fund—an 8 billion yen (~$55 million USD) corporate venture capital fund with a 10-year investment horizon. The new entity didn’t wait long, as they placed bets in six ventures within their first year of operations.

The fund’s mission?

To accelerate open innovation by investing in seed to mid-stage startups—particularly early-stage companies working on:

- Next-generation mobility (air mobility, MaaS platforms, drones, and space tech)

- Customer base utilization businesses (fintech, data analytics, and NFTs)

- Carbon-neutral fuels

- Innovations in aviation services and operations

Geographically, ANA’s fund is Japan-centric, planning to allocate 60% of its investments domestically and 40% internationally.

In 2024, ANA primarily focused its investments on AI & ML technologies, as well as Space Tech—aligning with its long-term vision for future mobility and aviation advancements.

Another key airline investor last year was KLM, which has been particularly active in sustainability-driven startup investments.

- KLM primarily invests through SHIFT Invest III, a venture fund dedicated to making mobility and logistics more sustainable.

- The fund’s core investment thesis is to combat climate change, biodiversity loss, and natural resource depletion, meaning that KLM’s startup investments in 2024 were heavily sustainability-focused.

JetBlue was also one of the most active airline investors in 2024. In fact, looking beyond just last year, JetBlue has consistently been the most active airline in startup investments across the industry, primarily through its corporate venture arm, JetBlue Ventures (JBV).

JBV’s 2024 investment portfolio continued its tradition of spanning a diverse range of sectors—including CleanTech, AI & ML, and Blockchain—demonstrating a broad, future-focused strategy that extends beyond aviation into wider Travel and Mobility Tech opportunities.

What This Means for Airline Innovators

For airline innovation leaders, our latest data on startup investments delivers a clear message:

- Airline innovation isn’t just about internal transformation—it’s about placing bold bets on the future.

- While only 7% of airlines worldwide have engaged in startup investing thus far, those that do are actively shaping the industry’s next frontier.

Beyond gaining access to cutting-edge technologies, startup investments offer the potential for exponential returns, the ability to build a credible growth story beyond an airline’s core business, and a strategic edge in an industry with limited expansion opportunities outside traditional M&A.

Additionally, Sustainability and AI are no longer “nice-to-have” innovation topics—they are mission-critical priorities that will define competitive advantage in the years ahead. Airlines that consistently place startup bets in these areas will gain a significant edge as these trends mature and pay off commercially.

For airlines not yet in the startup investment game, the question is no longer if your airline should engage with startups, but how:

- Will you commit capital through a CVC fund to secure long-term innovation access?

- Will you partner with startups via alternative models like Venture Clienting to bring immediate solutions into your operations?

- Will you build strategic alliances to stay ahead of disruptive trends?

For existing airline investors, the challenge isn’t whether to invest—but how to maximize impact:

- Are your investment priorities aligned with long-term strategic goals?

- How can you maintain internal commitment when startup bets take 7–10 years to pay off?

- Is your startup engagement model structured for both quick wins and transformational bets?

Now is the time for airline innovators, strategists, and M&A leaders to double down on the right bets—because in aviation, those who fund the future will likely define it.