In June of this year, we published our annual Travel and Mobility Sector Attractiveness Report, offering a comprehensive look into the investment priorities of major global players across aviation, ground transport, hospitality, and online travel.

The report revealed key areas of focus and highlighted the startups attracting the most attention, providing a clear picture of where the future of corporate travel innovation is headed.

However, while the report gave a global perspective, it didn’t address one crucial aspect: regional trends. Specifically, it lacked an in-depth look at the investment strategies of one of the world’s most important innovation hubs—Asia. Today’s analysis fills that gap, focusing on the corporate investment priorities of companies based exclusively in Asia.

Why Asia, you might ask?

The answer lies in Asia’s undeniable influence on the global Travel and Mobility Tech landscape.

- As we’ve repeatedly shown in previous reports, such as our widely read “State of Travel and Mobility Tech in Asia,” Asia has long been at the forefront of travel innovation.

- The continent has consistently driven forward-thinking developments, particularly in how travelers plan, book, and experience their trips, for instance, through WeChat’s mini programs, to name just one example.

- Asia’s mobile-first approach and rapid adoption of digital platforms have made it a testing ground for new technologies and consumer behaviors that are often 3-5 years ahead of the rest of the world.

With today’s analysis, we build on our global sector report by zooming in on five standout trends that set Asia apart from its global peers.

These trends reveal where corporations in Asia are placing their growth bets and how their investment priorities differ from those in other areas of the world.

Understanding these trends isn’t just relevant for professionals operating in Asia—it’s crucial for anyone wanting to glimpse into the future of travel and mobility. In other words, this article offers a window into where innovation is happening now and what’s coming next.

Without further ado, let’s start with Key Insight #1.

Key Insight #1: Asia’s Steady Hand–Corporate Funding into Travel and Mobility Tech Holds Firm Despite Global Instability

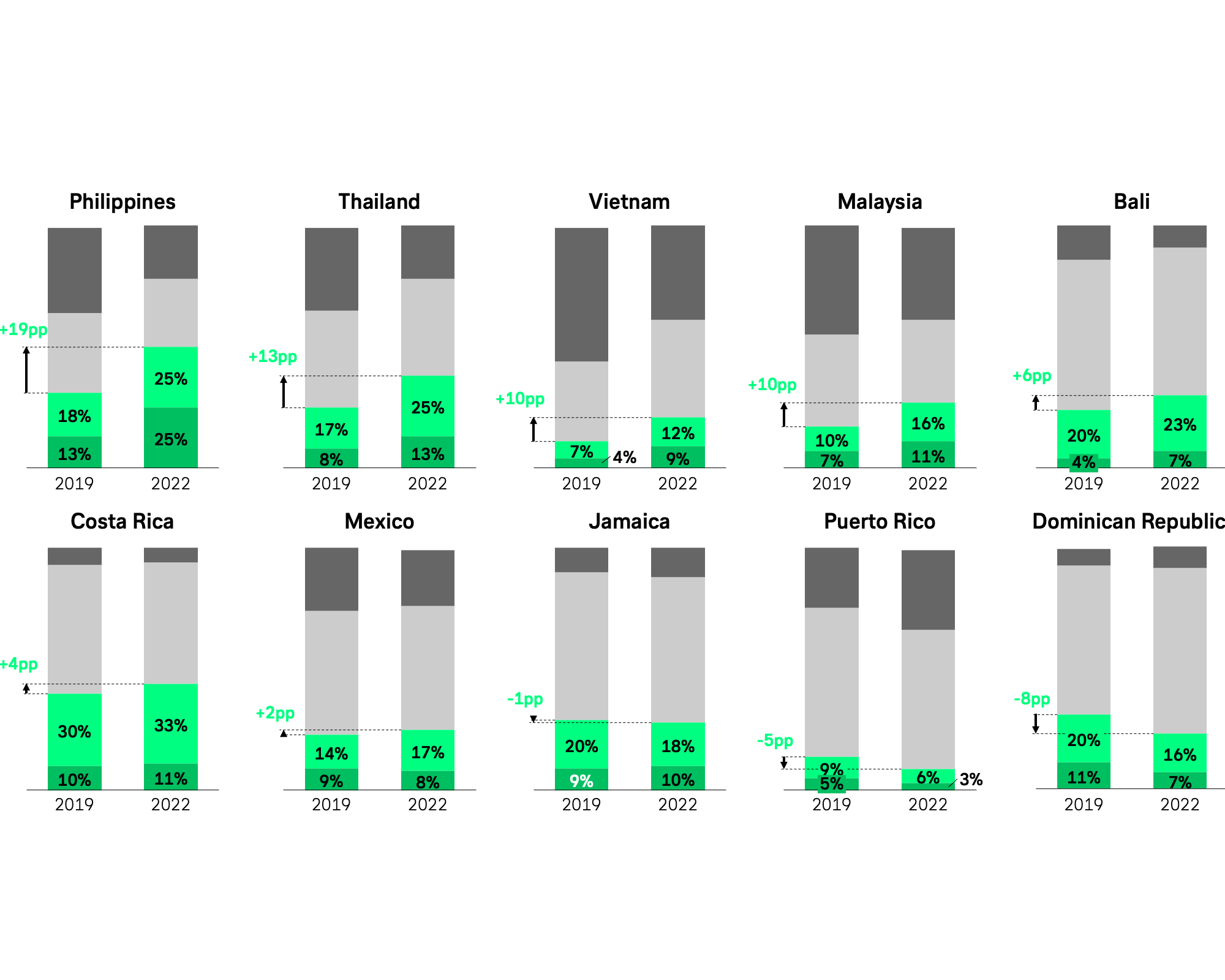

In recent years, corporate funding into Travel and Mobility Tech in Asia has shown remarkable resilience, especially when compared to global investment trends. While total corporate investment activity across the world has experienced significant fluctuations over the past seven years, Asia has remained a notable exception.

Even during the pandemic years between 2020 and 2023, when global markets faced unprecedented instability, corporate investments in Travel and Mobility Tech in Asia remained comparatively stable (even though they slightly declined).

This steady flow of corporate funding suggests something crucial: a more resilient and stable corporate innovation culture in Asia.

While much of the world was grappling with economic uncertainty, Asia’s major corporations continued to invest in technological advancements and breakthrough innovations. This insight becomes even more significant when we consider the challenging Venture Capital (VC) environment in Asia.

- According to Crunchbase, VC in Asia has faced a severe downturn in recent years.

- In 2023, total venture funding dropped to $78.1 billion USD, the lowest level since 2015—a stark contrast to the $125.2 billion USD raised in 2022 and an even more dramatic decline from the $187.4 billion USD raised in 2021.

Yet, despite this VC slowdown, corporate investment activity has held firm. This stability shows that while VC might be pulling back, corporate innovation dollars are stepping in to fill the gap.

- In many ways, this is an even stronger indicator of long-term innovation and growth potential in the region.

- Large industry players are signaling their commitment to pushing forward despite the broader economic headwinds to secure future competitiveness.

This key finding strengthens the need to take a closer look at where these corporate innovation dollars are being directed.

Which sectors and technologies are Asian corporations prioritizing?

Let’s dive into Key Insight #2 to learn more.

Key Insight #2: Ground Transport and Online Travel Lead the Corporate Investment Race in Asia

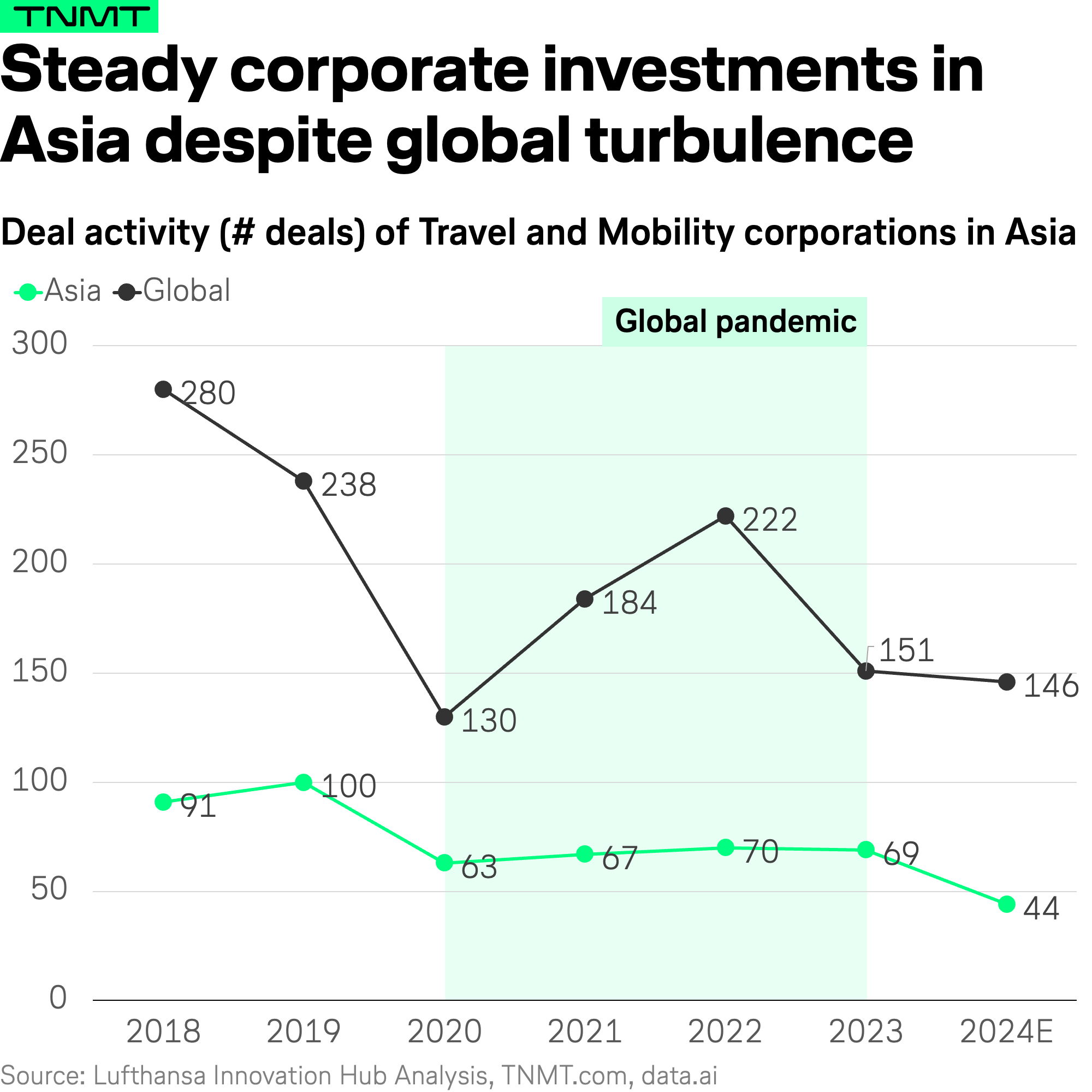

When analyzing the sectors driving corporate investment in Travel and Mobility Tech in Asia, two stand out: Ground Transport and, more notably, Online Travel.

This is a striking difference from the global landscape, where Aviation companies have dominated corporate investment activity. However, in Asia, especially OTAs have surged ahead, leading the innovation race with a significant portion of the sector’s investment dollars.

What’s driving this investment buzz in Online Travel in Asia?

There are several key factors at play:

1. Post-Pandemic Profitability of Asian OTAs

The surge in investment activity by Asian OTAs over the past two years can be attributed to their increased profitability, driven by the delayed but robust recovery in travel demand following the pandemic. As travel resumed, these OTAs saw their revenues (and profits) climb, putting them in a stronger financial position to reinvest in innovation and startups.

In contrast, many key players in Ground Transport, such as Grab in Southeast Asia, have faced financial challenges in recent years, operating at a loss and thus contributing to their decreased share of investment between 2020 and 2023.

However, this trend may shift in 2024, with Ground Transport expected to recover some of its share in the investment landscape.

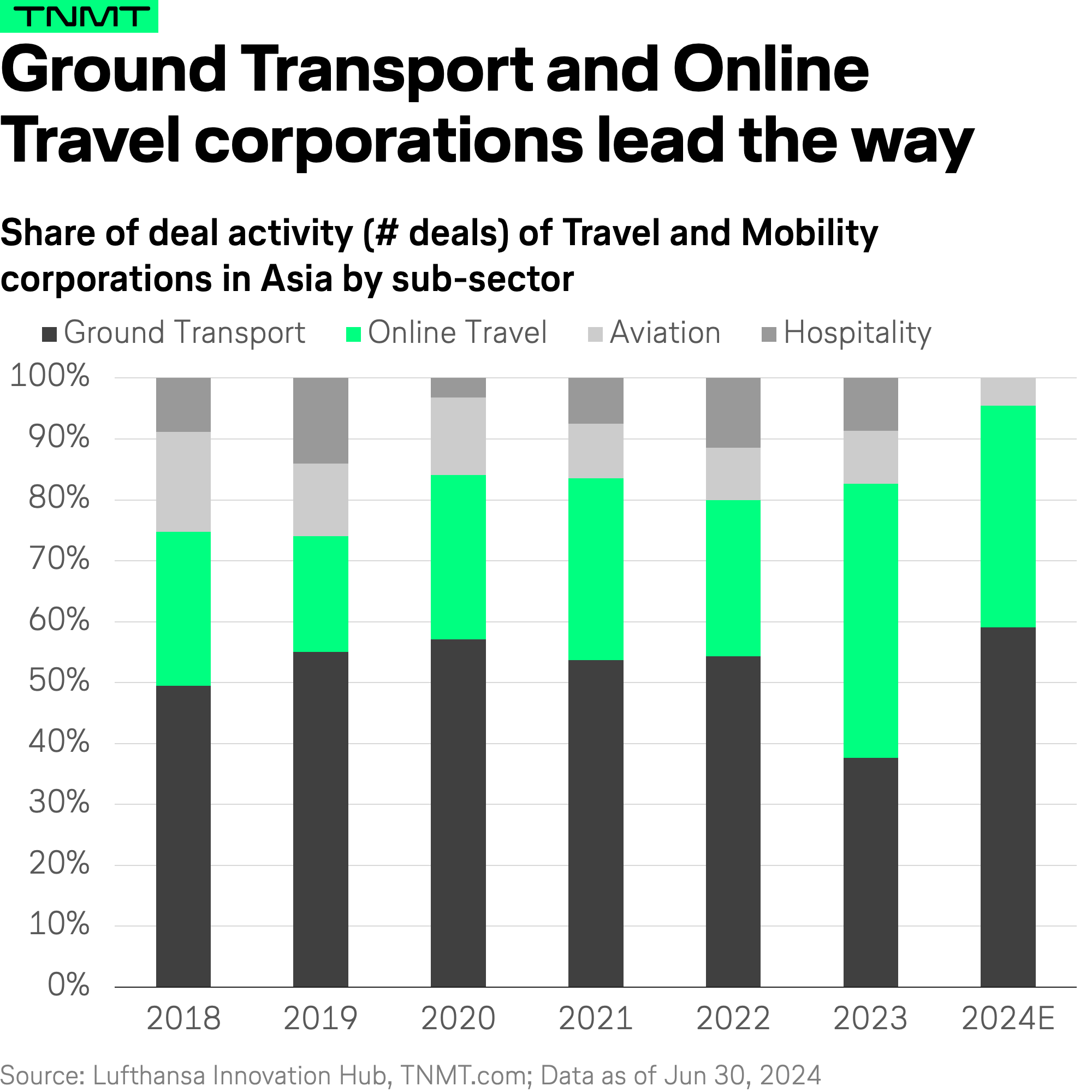

2. Dominance of Four Major OTAs

When we drill down into the specifics of Online Travel investments, four companies stand out as the top contributors: AirTrip (Japan), Yanolja (along with its travel-tech platform, Yanolja Cloud from Korea), EaseMyTrip (India), and Trip.com (China).

These four players accounted for over 90% of investment deals into Asian companies in the past five years.

Their dominance is clear, and they’ve led the charge in driving innovation across the sector.

How exactly? These OTAs are not just expanding their travel offerings—they’re leading the way in reshaping how consumers interact with travel services; see the next key highlight.

3. Focus on Operational Efficiency and Diversification

Additionally, OTAs are leveraging social big data analytics to refine their strategies and enhance decision-making.

A closer look at the types of companies attracting OTA investments reveals a clear trend: OTAs are primarily investing in startups that focus on improving operational efficiency. These investments are particularly targeted at areas like marketing automation, HR operations, and customer data tools designed to provide better insights into inbound tourism.

Beyond optimizing internal operations, many OTAs are also expanding into services outside of traditional travel, exploring new ways to diversify their offerings.

- Increasingly, they are investing in sectors like ticketing services for concerts, wellness services (e.g., medical checkups), goods delivery, and food commerce, aiming to provide a more comprehensive and enriched travel experience for their customers.

- This strategic diversification potentially helps OTAs create new revenue streams and enhances their appeal in a highly competitive market.

Key Insight #3: Asian Corporations Double Down on Enhancing the Digital Consumer Experience

When analyzing the investment strategies of Asia’s top players beyond Online Travel, so including Ground Transport, Aviation, and Hospitality, another clear innovation pattern emerges—one that diverges significantly from the global landscape.

As detailed in our global Sector Attractiveness report, we categorize all investment targets into four strategic buckets based on the priorities of the investing entities: Raising Operational Efficiency, Enabling Market Expansion, Increasing Sustainability Impact, and Enhancing the Digital Consumer Experience.

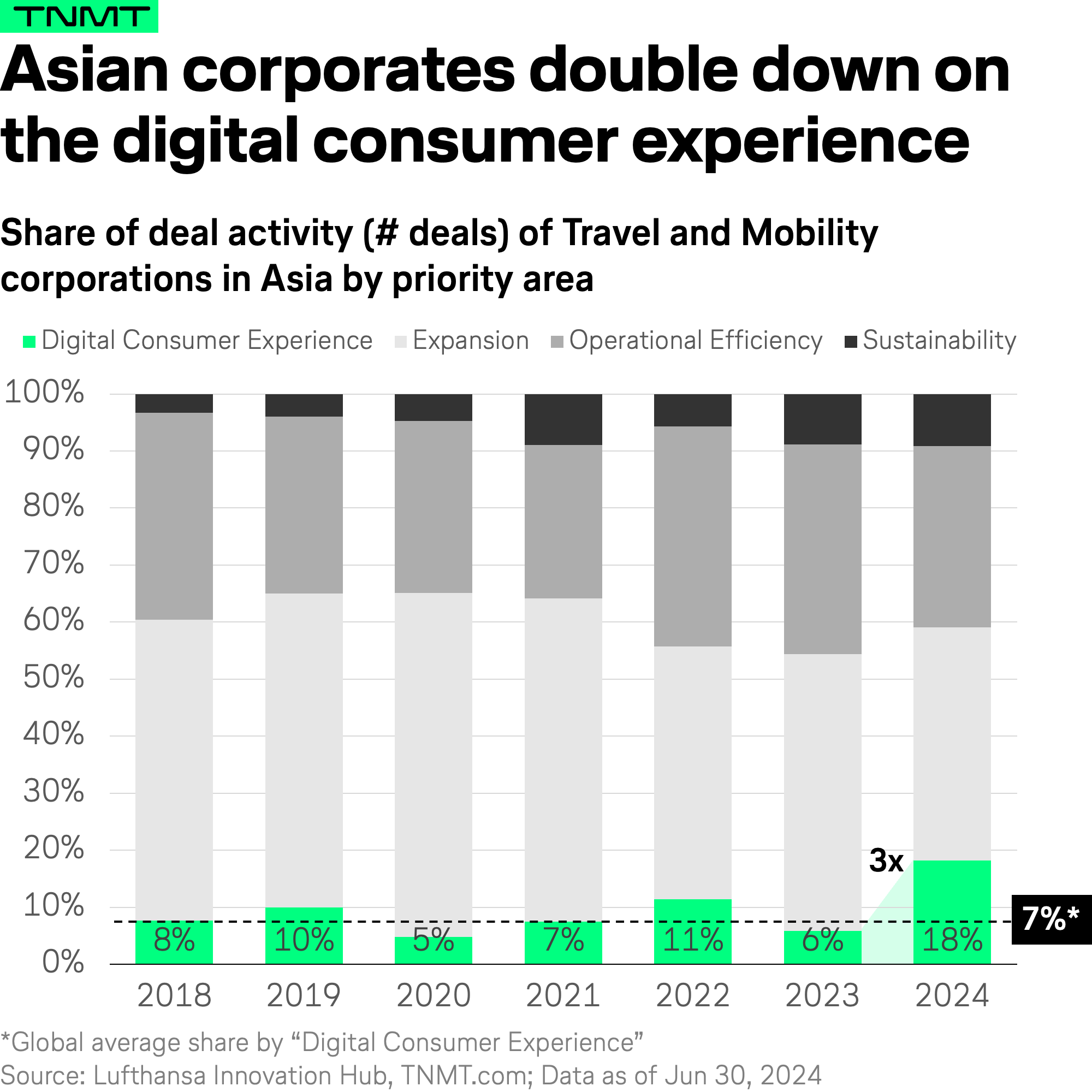

For Asian corporations, one area is gaining momentum rapidly: Investments in enhancing the digital consumer experience in travel.

- This year, the proportion of deals in this space is expected to surge from 6% in 2023 to an impressive 18% in 2024—even as the overall number of deals is forecasted to decline.

- This growth makes the focus on the digital consumer experience almost 2.5 times higher than the global average in 2024.

But why is this so significant, and what does it mean for the future of travel in Asia?

This growing emphasis on digital consumer experience is a massive shift that reflects a strategic recognition among Asian corporations that the future of travel will be increasingly digital, personalized, and seamless, especially among the continent’s mobile-first population.

The investments being made today are laying the groundwork for smarter, more intuitive travel experiences, where technology plays an integral role in simplifying and enhancing every step of the traveler journey—from booking and check-in to in-trip services and post-travel engagement.

What exactly does this focus on improving the customer experience entail for travelers?

Let’s dive deeper into this transformation in Key Insight #4.

Key Insight #4: Breaking Down “Enhancing the Customer Experience” in Asian Travel Tech Investments

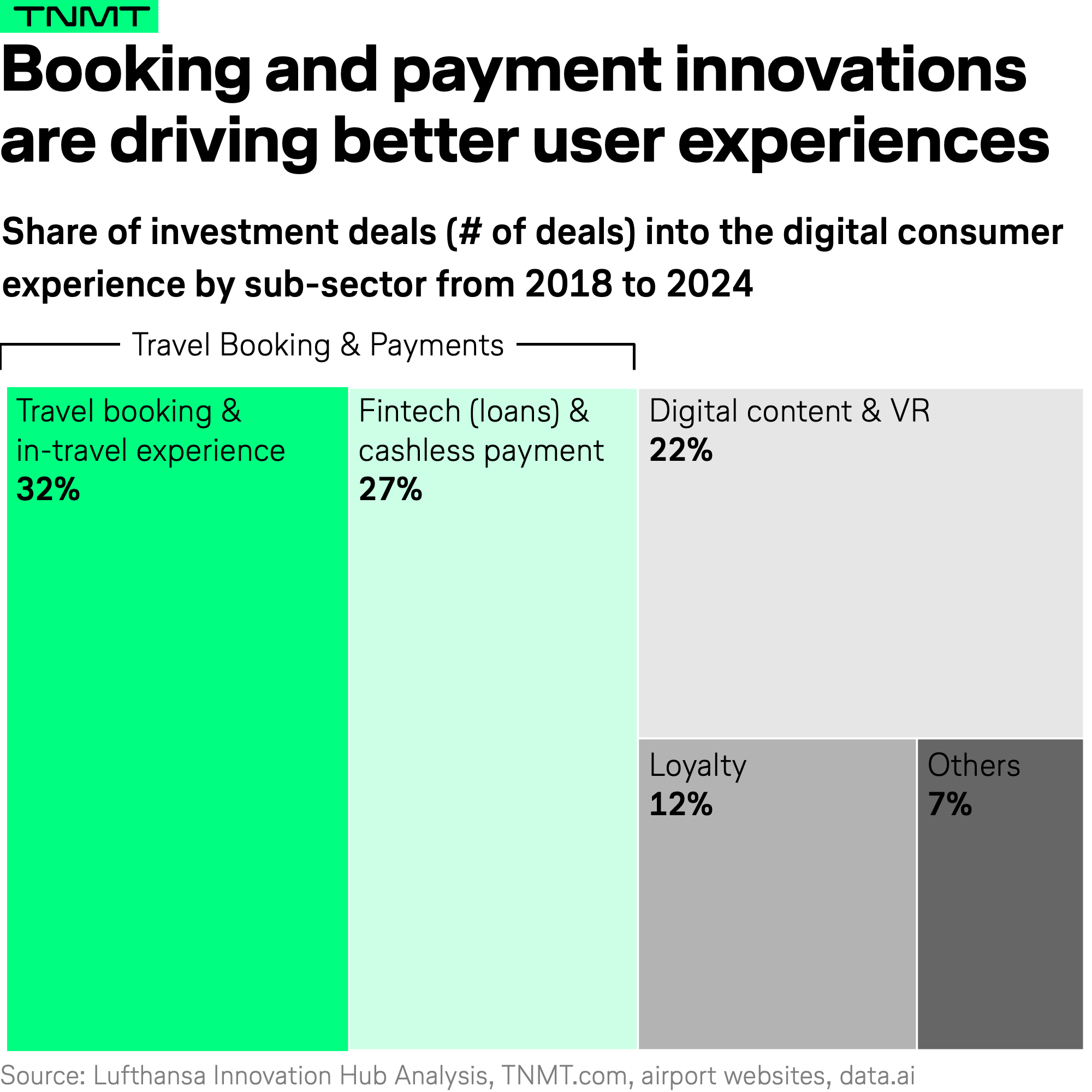

To better understand what “enhancing the customer experience” truly means, we conducted a deeper analysis of the sub-segments that have attracted the most corporate investment in Asia.

- As shown in the chart below, the majority of investments made by Asian corporations in the “Digital Customer Experience” category since 2018 have been focused on specific booking innovations, whether for hotels, flights, or experiences.

- Close behind are fintech solutions, particularly those related to cashless payment services.

Together, these two categories account for more than half of all corporate investment dollars directed toward improving the digital customer experience in the travel space.

What does this tell us?

It signals a clear commitment from Asian corporations to create a truly seamless travel journey, focusing on integrating services that make booking and payments smoother and more efficient for travelers.

This approach is particularly promising in the context of Asia’s thriving travel superapp ecosystem—where platforms offer a variety of travel-related services within one integrated app. As we’ve shown in previous analyses, this superapp model is already well-established across industries in Asia, and it’s increasingly gaining momentum in the travel sector.

But what are some concrete examples of how these investments are translating into real-world innovations that enhance the mobile travel experience?

Here are three standout examples:

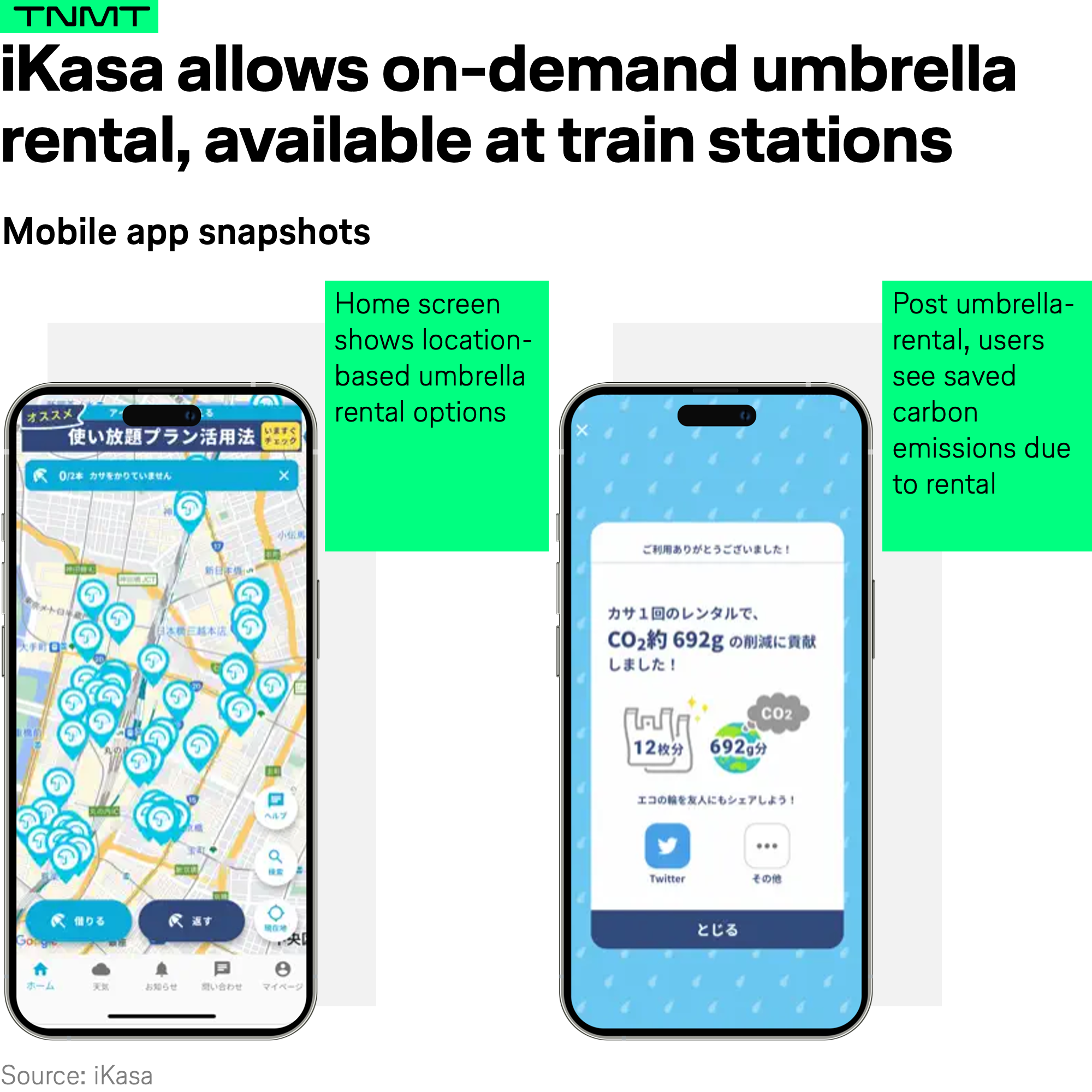

1. JR East’s Investment in iKasa

Japan’s railway giant JR East, through its corporate venture capital arm, has invested in the umbrella-sharing startup iKasa.

This app allows users to rent umbrellas from various locations, such as train stations and shopping centers, and return them at any designated spot.

By integrating this service with train travel, passengers can enjoy added convenience during unexpected rain showers without the need to purchase or carry umbrellas.

Not only does this enhance the traveler experience by offering a practical solution, but it also contributes to sustainability by reducing the environmental impact of disposable umbrellas, which are frequently discarded in Japan.

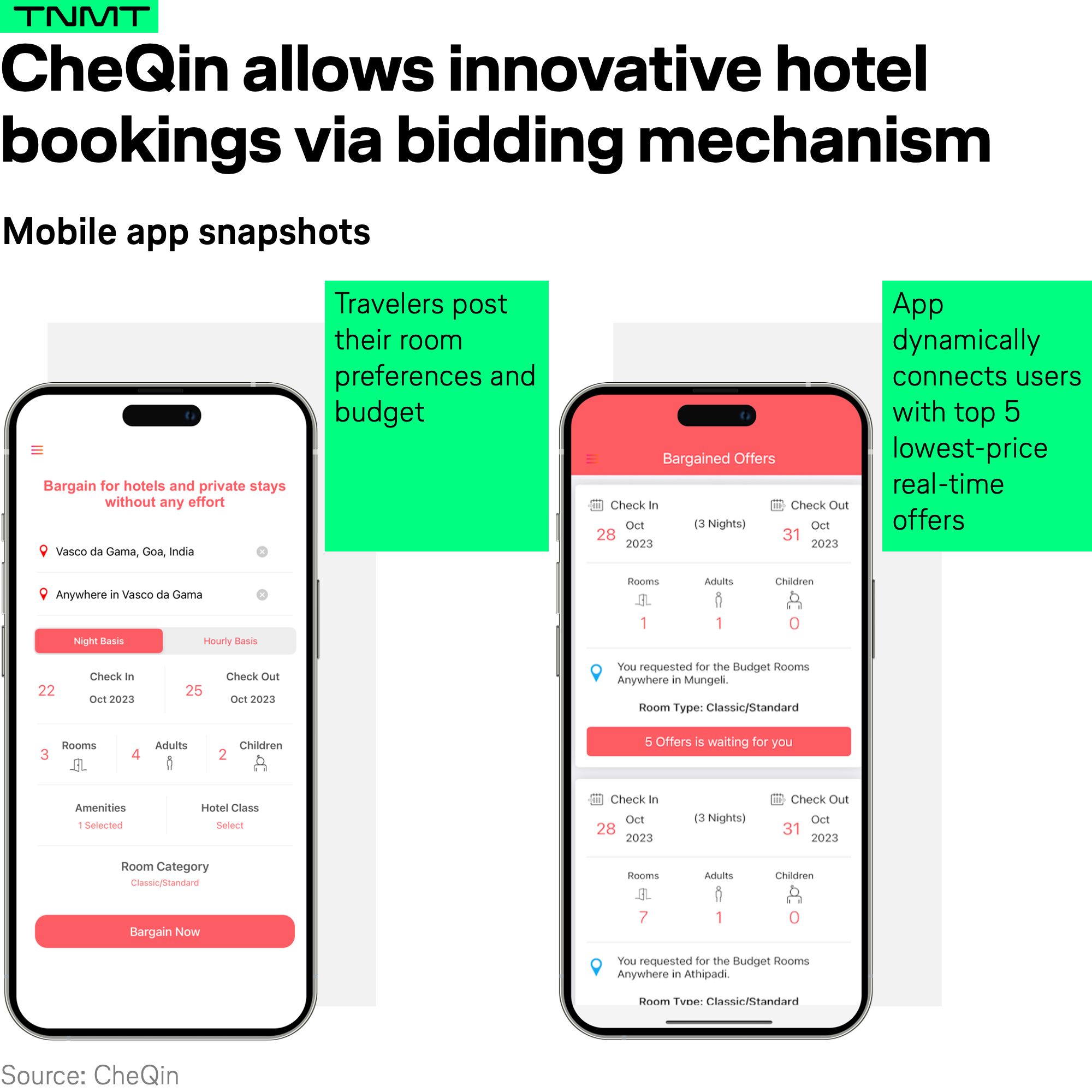

2. EaseMyTrip’s Acquisition of CheQin

India’s leading OTA, EaseMyTrip, has recently acquired a majority stake in CheQin, an innovative hotel booking app that allows users to negotiate real-time deals on accommodations through a dynamic bidding process. This acquisition is a strategic move to tap into a growing market for price-sensitive travelers seeking flexibility and value.

CheQin’s unique model connects travelers directly with hoteliers, enabling real-time bidding to ensure customers secure the best possible rates. By integrating CheQin’s competitive pricing structure into its existing platform, EaseMyTrip is expected to significantly enhance its hotel booking services, providing greater value for both travelers and hoteliers. This move aligns with a broader industry trend of leveraging real-time, tech-enabled solutions to deliver more personalized and seamless booking experiences.

Notably, the platform goes beyond pricing by offering additional features that cater to personalization. Users can specify preferences such as early check-in times or short stays, including stays that last only a few hours. This focus on flexibility and last-minute bookings positions EaseMyTrip to attract budget-conscious travelers who prioritize affordable and adaptable accommodation options.

3. Didi’s Acquisition of Brazilian Fintech Company BePay

China’s leading ride-hailing company, Didi, which has successfully expanded its operations across 14 countries in the Asia-Pacific, Africa, and Latin America, has made a strategic acquisition of BePay, a Brazilian fintech specializing in digital payment solutions. BePay’s core offerings include secure online services such as a digital wallet and token-based contactless payment technology.

This acquisition aligns with Didi’s broader strategy to expand its digital payment services in Brazil and beyond. By integrating BePay’s technology into its platform, Didi enhances its financial services portfolio, offering travelers more secure and seamless payment options, especially in emerging markets. Additionally, this acquisition supports Didi’s ongoing efforts to promote Chinese electric vehicle (EV) adoption in Brazil, creating synergies between its mobility services and the expanding fintech ecosystem.

Acquisitions of fintech companies by transportation corporations are not new in Asia, where such deals offer access to well-established local networks and regulatory infrastructure. Similar moves have been made by other Asian tech giants, such as Grab’s acquisition of iKaaz and Gojek’s investment in Kartuku, both aimed at strengthening their digital payment ecosystems and expanding their regional footprints.

All three examples highlight the clear trend of integrating innovative services into travel platforms to make the entire travel journey—especially the booking process—more convenient, intuitive, and cost-effective.

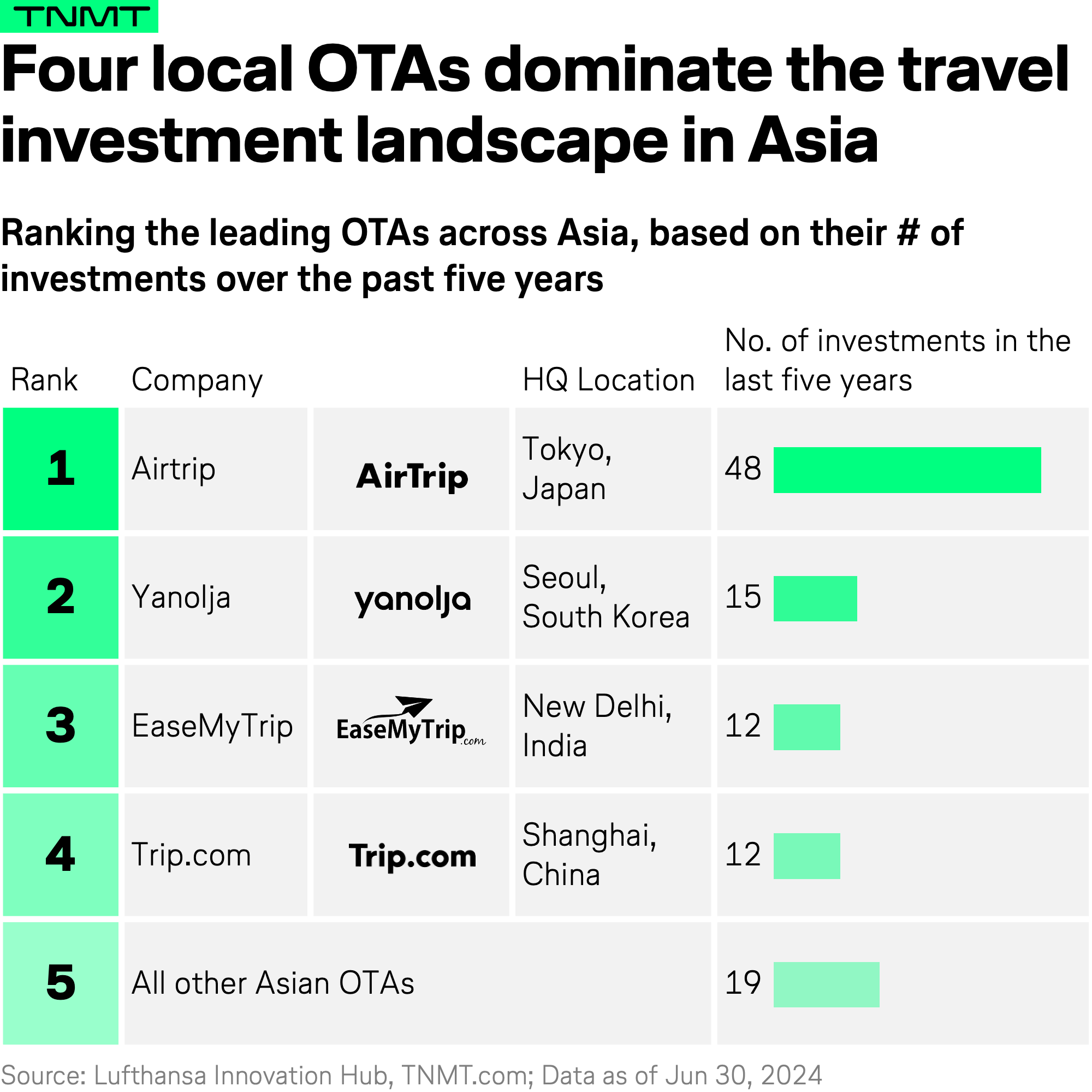

Key Insight #5: Non-Travel Corporations Increasingly Enter the Travel Space

The fifth and final key insight from our deep dive into the innovation priorities of Asian corporations in Travel and Mobility Tech looks beyond the traditional boundaries of the travel industry itself.

One of the most interesting trends we’ve uncovered is the growing number of non-travel companies investing in the travel sector.

Why is this happening?

As we explored in our Embedded Travel analysis, many companies from outside the travel industry have recognized the potential of engaging with travelers through their existing, non-travel-specific platforms. The goal is to enable travel bookings directly within their ecosystems without requiring users to navigate away to OTAs or airline and hotel websites.

A standout example is Douyin, the Chinese version of TikTok, which has made significant inroads into the travel sector over the past 12 months.

Douyin has strategically invested in travel-related offerings to allow its users to book trips directly within the social media app itself. The logic behind this move is clear: by keeping users within their own platform, Douyin can offer a more seamless booking experience while capitalizing on its massive user base to compete with established travel booking platforms.

But it’s not just social media platforms like Douyin that are making waves in the travel space.

- Financial institutions are also recognizing the potential to tap into the travel market. One prominent example is South Korea’s major credit card issuer, Lotte Card, which partnered with online travel platform Hopper to develop a travel loyalty portal.

- This portal, integrated into Lotte Card’s “Digi-LOCA” app, will offer services such as flights, accommodations, and car rentals to Lotte Card’s 9.35 million cardholders and 3.13 million affiliated merchants.

This growing trend of non-travel companies entering the travel industry is shaping a new era of the financialization of the travel industry, where travel services are offered as extensions of existing non-travel platforms.

This shift not only allows these corporations to capture a share of the lucrative travel market but also enhances their overall value proposition by providing their customers with a more comprehensive suite of services.

What’s Next?

As we continue to monitor the evolution of these trends, it becomes clear that the Asian travel landscape is expanding beyond traditional boundaries much faster than in the West, with new players from sectors such as social media, finance, and retail making their mark.

For travel providers, this means increased competition but also exciting opportunities for collaboration and partnership as the lines between industries continue to blur.

Interested in learning more?

Stay tuned for future updates as we track how these cross-industry investments are reshaping the future of Travel and Mobility Tech in Asia and beyond.