Asia has always been a fertile ground for innovation, particularly in Travel and Mobility Tech.

This trend was clearly reflected in VC funding trends in the past.

You might remember our previous TNMT Asia Funding Report.

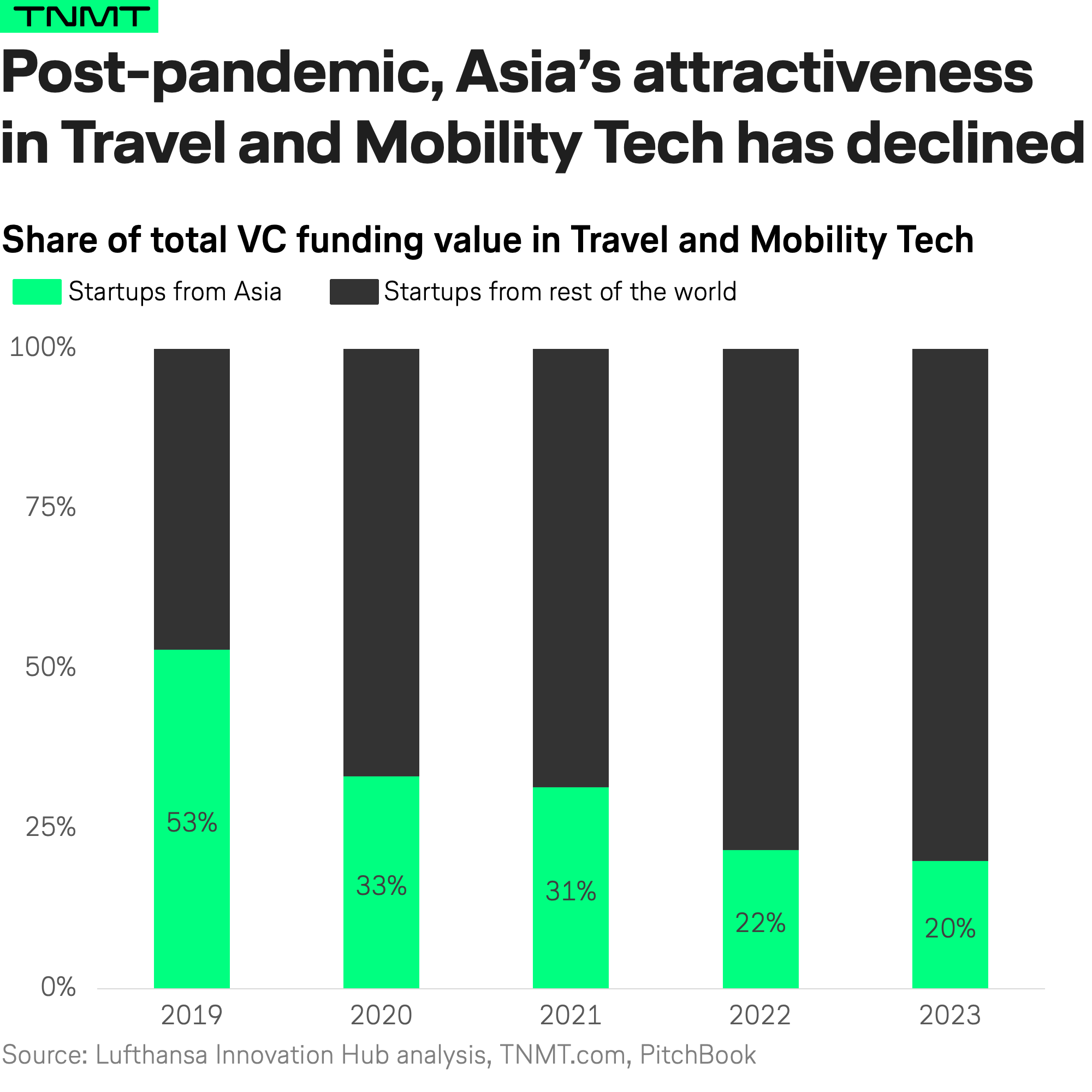

It revealed that Asian startups consistently raised more than half of all investment dollars going into Travel and Mobility Tech startups between 2015 and 2019.

However, post-pandemic, the funding landscape has undergone significant changes.

- The venture capital environment for startups has cooled off dramatically in the context of rising interest rates.

- Startups are now increasingly compelled to prioritize profitability over hyper-growth to ensure their financial longevity.

- This shift in the “VC mantra” has led to a wave of company shutdowns and staff layoffs, affecting sectors globally.

Interestingly, this cooldown in funding has impacted Asian Travel and Mobility Tech startups more severely compared to their Western counterparts. This trend is partly due to American investors becoming more cautious about their involvement with Chinese startups.

Our data reflects this change:

The previous dominance of Asian startups in funding across Travel and Mobility Tech has steadily diminished over the past four years.

- In 2023, only every fifth investment dollar went to travel and mobility disruptors from the Far East.

- As we look forward to 2024, this trend is expected to continue, especially as international outbound travel from China remains suppressed, limiting the market potential for many startups in Asia, particularly those emerging from China.

A Shift from Quantity to Quality

Despite the apparent slowdown in funding across Asia, particularly in China, it would be a mistake to underestimate the innovation still happening in this region.

The landscape is evolving, not diminishing.

Here’s why we believe the innovation dynamics in China’s Travel and Mobility Tech scene remain robust:

- Innovation hasn’t slowed; it’s just become less visible as funding figures are no longer the primary indicator of innovation. Startups have adapted, focusing on arguably more sustainable business models that require less capital investment upfront and less reliance on intense marketing battles with competitors.

- Evidence of this shift is seen in the average deal sizes within Asia’s Travel and Mobility Tech ecosystem. These have actually increased for those companies raising post-pandemic, indicating a move toward a more mature market phase.

This evolution signifies a condensing of the startup landscape.

There’s less total funding and fewer deals, but those startups that manage to survive are securing higher average deal values than during the previous high-growth phase of unicorn creation.

In other words, the focus has shifted from quantity to quality, marking the next stage of maturity in Asia’s Travel and Mobility Tech ecosystem.

Asia’s Travel Tech Front-Runners: Leading the Next Evolution

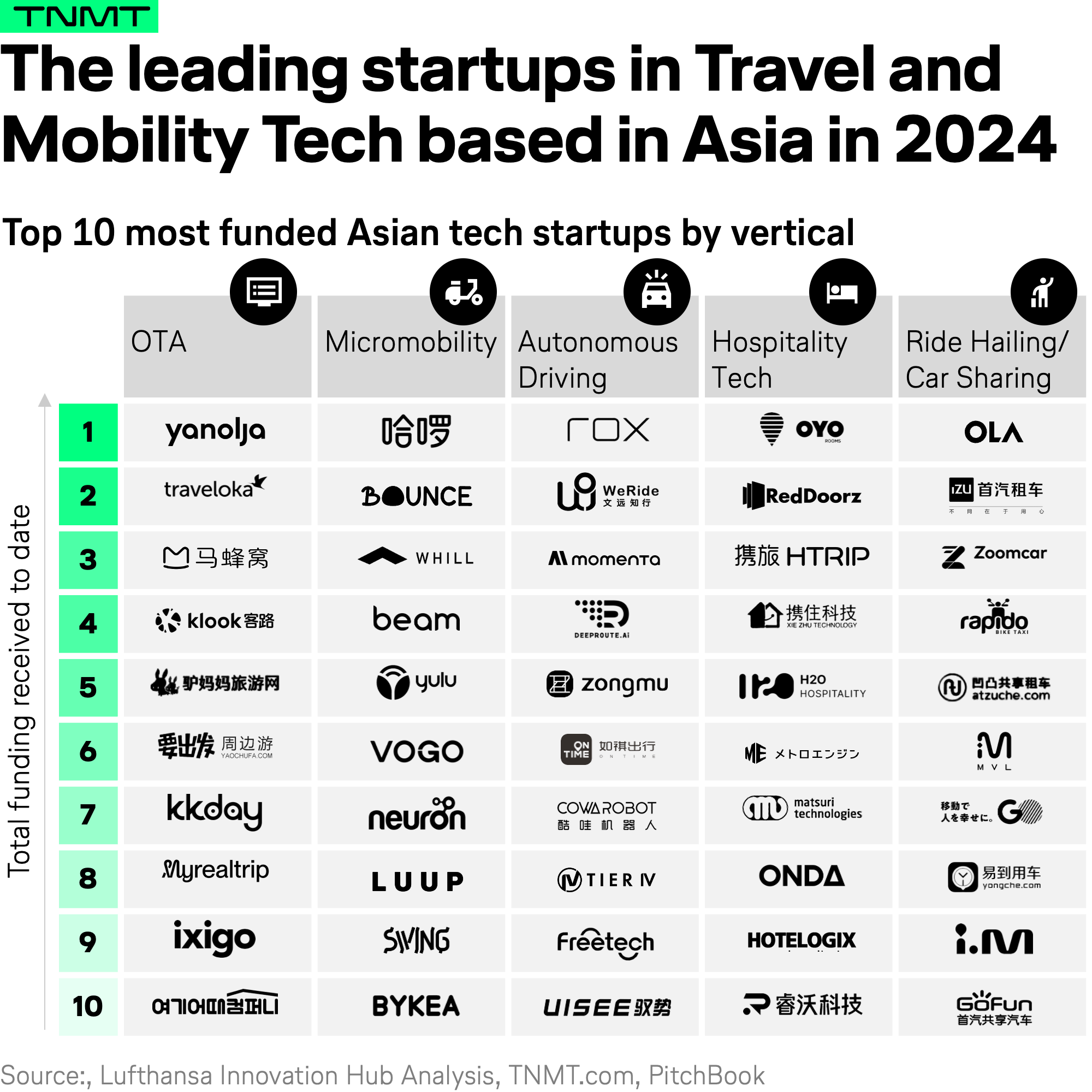

Speaking of quality over quantity, it’s vital to spotlight those startups that have weathered the funding challenges of recent years and are now poised to drive the sector’s next evolution.

To do so, we’ve meticulously compiled our 2024 Startup Leaderboard for Travel and Mobility Tech in Asia, highlighting the top contenders across five major categories.

But who are these trailblazers, and what makes their innovations stand out?

While we’re delving deep into a comprehensive analysis (coming soon!), let’s offer you a sneak peek.

Here’s a brief look at each category leader, shedding light on their current innovation focus.

Yanolja: A Trailblazer Among Startup OTAs

In the dynamic Online Travel Agency (OTA) segment, diverse strategies are being deployed by companies to capture market share from rivals.

- Take Traveloka, for instance. The company initially pursued a super-app model, encompassing services like e-grocery and food delivery. However, in 2022, it scaled back these ancillary services, refocusing on core travel offerings in preparation for an IPO.

- Klook, rebranding as a super-app for travel and leisure, has strategically partnered with digital wallets and e-commerce platforms to expand its reach.

Yet, it’s Yanolja, the most heavily funded startup OTA, that stands out with a unique approach.

- Initially known as South Korea’s top OTA, the company had already made its mark with over 20,000 partner accommodations by 2019, representing about half of the nation’s registered inns and guesthouses.

- But it’s Yanolja’s bold move into the B2B travel software sector, fueled by an aggressive acquisition strategy from 2020 to 2023, that has reshaped its identity.

- These acquisitions not only secured its global presence, extending into markets like Europe and the U.S. but also positioned Yanolja as a formidable player in the travel SaaS domain.

However, the success of this strategy is yet to be fully realized. Despite securing a substantial $1.7 billion USD investment from Softbank’s Vision Fund 2 in 2021, there’s still speculation about Yanolja’s profitability and valuation trajectory.

Bounce: Reinventing Micromobility

In the micromobility sector, covering e-scooters and bike-sharing, there’s been a significant evolution as well. Initially supercharged by immense hype, the segment is now grappling with practical realities, slipping into what can be described as a trough of disillusionment.

The root of the challenge lies in the sharing model itself.

- Turning shared micromobility into a profitable business model has proven to be an uphill battle, perhaps even an unattainable goal for many.

- But Bounce, the current funding leader in the micromobility category, appears to be charting a different course.

Key to Bounce’s approach is a combination of innovative technologies and operational strategies.

- The company’s proprietary OTP technology, coupled with a dockless operational model and a custom scooter design, has provided it with a competitive edge, allowing more efficient scaling than many of its rivals.

- Though the COVID-19 pandemic put a temporary brake on their expansion plans in 2020, Bounce has been making steady strides since.

However, the journey hasn’t been without its challenges.

The company has undergone several rounds of layoffs and made the tough decision to shut down its struggling ridesharing business earlier in 2023.

Now, the focus has shifted to its e-scooter manufacturing business, which seems poised for success.

- This pivot towards manufacturing has already garnered a significant vote of confidence – a $20 million USD investment from existing backers like Sequoia Capital India.

- With such strong backing, Bounce is optimistic about reaching EBITDA breakeven in the 2024 fiscal year, potentially setting a new benchmark in the micromobility space.

Rox: Leading the Charge in China’s Autonomous Driving Race

In the Autonomous Driving category, it’s clear that Chinese startups are leading the way.

This makes sense when you consider that China is ahead in both the technology and road infrastructure needed for autonomous cars in Asia.

One company standing out in this space is Rox Motor.

Though it joined the autonomous race later than others, it’s not lagging behind.

- Rox, co-founded by Chang Jing from Roborock and Feng Yan, a former big shot at Weima Automotive Technology Group, has quickly moved through its early funding stages. It recently bagged a huge $1 billion USD investment from Shandong Weiqiao Pioneering Group.

- Their partnership with Beijing Automobile Works has already shown results. Its main product, the Polestone 01 SUV, hit the roads just two months after its introduction. This speed gives Rox an edge over its competitors like Deeproute.ai, which Alibaba backs, and WeRide from Silicon Valley. Both are aiming to bring their autonomous driving tech to the market by 2024, but Rox appears to be zooming ahead.

Oyo: Dominating the Hospitality Tech Scene

Hospitality Tech, a sector that’s been hit harder than most in Travel Tech, has seen its own share of challenges.

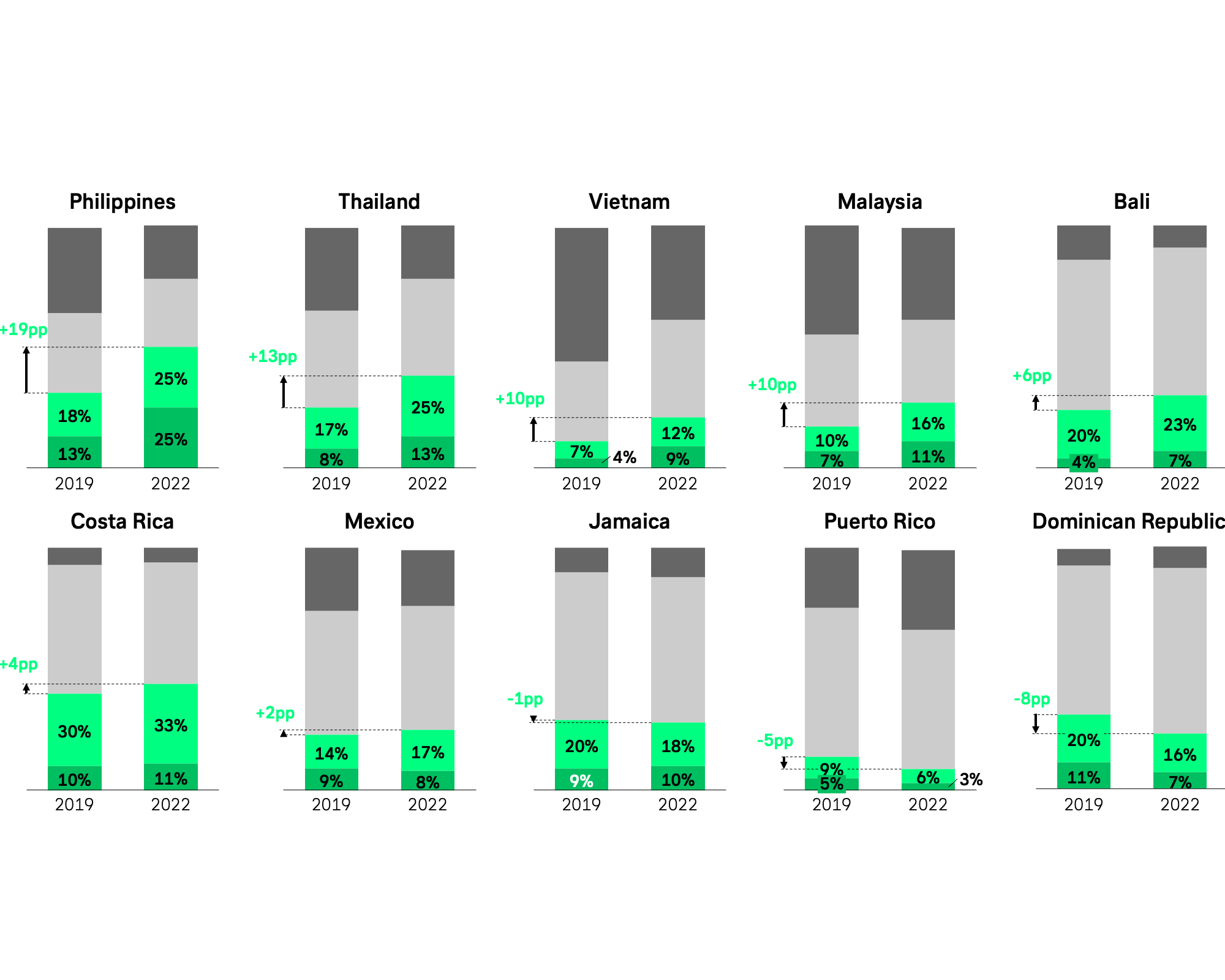

- In recent years, funding for Hospitality SaaS plummeted, from a significant 25% in Travel and Mobility in 2019 to a mere 1.4% in 2023, according to our TNMT deal database.

- Even with a spike in funding in 2022, the majority of new investments flowed into established players rather than newcomers.

Despite this downturn, one of Asia’s most prominent travel-tech names continues to lead the pack as we move into 2024.

Oyo Rooms, based in India, might be too big to be called a startup now, but it’s still at the forefront of the Hospitality Tech category. This leadership position is a testament to the company’s ability to adapt and thrive amid shifting travel trends and challenges.

- Oyo’s journey through the pandemic was marked by aggressive cost-cutting, helping it stay afloat even as revenues dropped to just 30% of pre-pandemic levels.

- The launch of OYO Vacation Homes in 2019 proved to be a smart strategic move, tapping into the growing demand for private accommodations.

- Moreover, Oyo’s focus on five core markets during these challenging times played a crucial role in stabilizing the business.

Today, Oyo stands as the world’s third-largest hotel chain by room count.

More importantly, the company has crossed a significant milestone, achieving profitability and turning cash flow positive in the last quarter of the 2023 financial year.

Ola: Navigating the Ride-Hailing Storm

Ride-hailing, once the darling of the era of abundant venture capital, has found itself in a precarious position since the funding landscape shifted in 2022.

Ola, the category leader, serves as a prime example of a company that ambitiously expanded not just in ride-hailing but also into adjacent markets like used car marketplaces.

Faced with the reality of a funding freeze, Ola has been compelled to explore new ventures with more promising returns.

- Similar to Bounce in the micromobility sector, Ola has ventured into the e-scooter manufacturing arena through its subsidiary, Ola Electric.

- Currently, Ola Electric dominates India’s e-scooter market, boasting a 32% market share. This dominance was further bolstered by a significant $140 million USD investment round from Temasek and the State Bank of India.

- The latter funding is earmarked for expanding Ola’s EV business and establishing India’s first lithium-ion cell manufacturing facility in Tamil Nadu.

However, this pivot to new ventures comes amidst increasing financial pressure.

Ola’s losses have escalated alarmingly, soaring from $1.3 billion USD in 2021 to $1.8 billion USD in 2022.

This increase in losses is attributed mainly to the high costs associated with its diverse portfolio, which includes overseas cab-hailing services, cloud kitchens, and stores.

Evolving Dynamics in Asia’s Travel and Mobility Tech

The landscape of venture capital category leaders in Asia reveals a range of intriguing dynamics and varying stages of maturity across different segments.

One clear example is the micromobility sector. This category, after riding a wave of hype and abundant funding, has now reached a point of critical reassessment.

The sector is actively searching for business models that promise long-term sustainability.

This trend mirrors developments in the West, where many micromobility companies face similar challenges.

- A notable instance is the recent fire-sale merger of Germany’s Tier Mobility with Dott, which drastically reduced the company’s valuation from its 2021 peak.

- German publication Manager Magazin reported that the merger will value the new company at just €150 million — a huge drop from Tier’s 2021 valuation of €2 billion.

Another interesting observation is the absence of highly promising niches such as Advanced Air Mobility and Travel AI on the current leaderboard of Asian innovators.

- These sectors have also seen a noticeable increase in funding and interest in Asia.

- However, the total investment and the number of players with publicly disclosed funding in these niches are relatively small, keeping them off our current leaderboard.

As we move into 2024, we’ll continue to monitor these trends and provide updates on any significant shifts or new developments in this ever-evolving landscape.