In the airline industry, the past 15 months have been characterized by an unprecedented volume of flight changes and cancellations. These have largely been the product of constantly changing lockdown measures, travel bans, and border control regulations.

The result: Air travelers have been confused about the major information asymmetries they’ve faced, while airlines have had to process an overwhelming amount of refund requests.

While frustrating for both parties, this mess could have been avoided—at least to some extent—if only the airlines had realized, in the years leading up to the pandemic, that being more digitally-prepared translates to being more crisis-resilient.

It’s important to note that airlines could have handled this unprecedented storm of customer requests by having well-functioning digital interfaces in place—like a user-friendly, feature-rich mobile app—during the pandemic. This would have enabled automated digital self-service and provided a direct communication channel for carriers to seamlessly inform travelers of the latest flight updates and travel restrictions.

The airline app disaster is nothing new

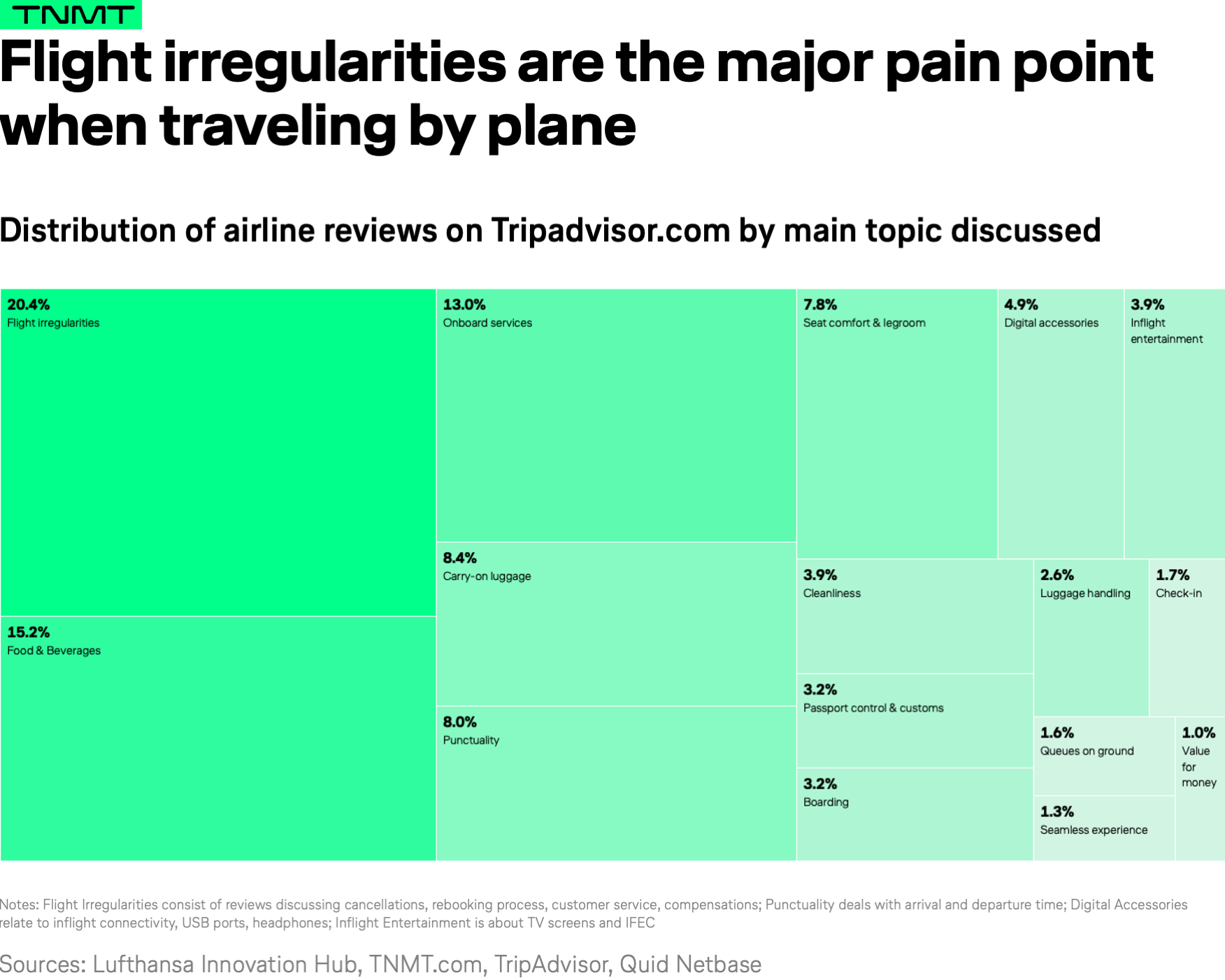

Travel industry experts and air travelers have long begged airlines for better digital service. Even before the public health crisis, half of travel industry experts considered “self-service” one of two major innovation areas in the airline industry, according to BCG. Similarly, according to our very own pre-COVID-19 Tripadvisor analysis, flight irregularities dominated air travelers’ pain-point ranking, having been mentioned in over 20% of airline reviews. Most complaints focused on the lack of timely communication surrounding delays and cancellations, and on the limited rebooking features available.

Undoubtedly, a well-functioning, comprehensive mobile app would have given travelers much-needed digital (self)-assistance—ultimately becoming a lifesaver for air travelers (with the exception of those who enjoy spending hours in line at the airport’s service center).

But unfortunately, most airline apps exhibited poor performance as travelers’ go-to source at the height of the pandemic. This was when customers needed to hear from their airlines the most, even for very basic service requests. In fact, out of all customer service requests reaching airlines during COVID-19, about 25% of queries were requesting their refund status—the answers to which could have 100% been provided via self-service.

No wonder, that the 2021 Customer Service Benchmark Report concludes that travel companies are failing to meet the demands of the modern traveler and are at risk of losing revenue and loyalty as a result.

Especially, since many airline apps remain quite unintuitive, lacking useful re-booking functionalities while offering little value in solving general information requests. Additionally, our Airline Digital Index shows that many airline mobile apps remain bug-heavy, requiring way too many clicks for straightforward requests such as checking in for a flight.

Travelers don’t value airline apps

With all of the above-mentioned shortcomings, it’s no wonder that airline apps are less-than-popular among travelers.

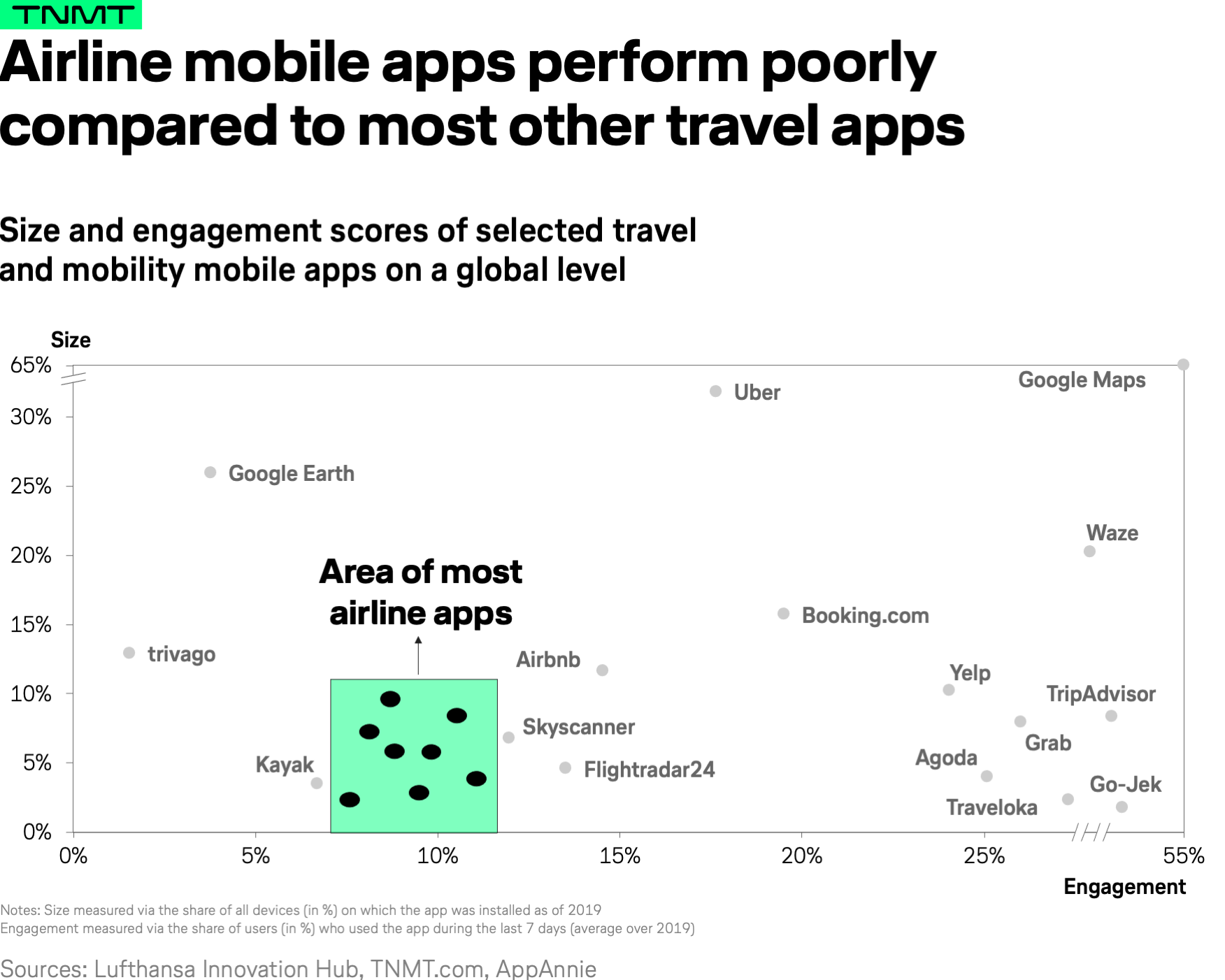

Most travelers avoid downloading airline apps in the first place—and those who do rarely engage with them compared to how often they interact with other transportation apps (i.e., OTAs, as well as public transport and ride-hailing apps).

The main reasons for this are simple: In contrast to ride-hailing and public transportation apps, airline applications don’t solve users’ daily core needs, allowing them to get to and from work, or helping them keep track of recurring schedules and transfers.

Consequently, airline app engagement is naturally lower than its public transport and ride-hailing app counterparts, as most people only use the app when taking a flight a couple of times each year. The graph below provides further insight into airline mobile app engagement.

Airline apps are competitive—and not only with one another

What many airline managers don’t seem to grasp is that travelers don’t set their mobile app expectations based on what other airlines are doing. Rather, they evaluate them based on the convenience, efficiency, and level of quality offered by the likes of Amazon and Uber. And compared to these tech giants, most airline apps don’t even come close in their ease of use, convenience, and overall utility.

As a result, and as more and more mobile apps compete for limited screen space, it has become exceedingly difficult for airlines to make it onto people’s smartphones in the first place.

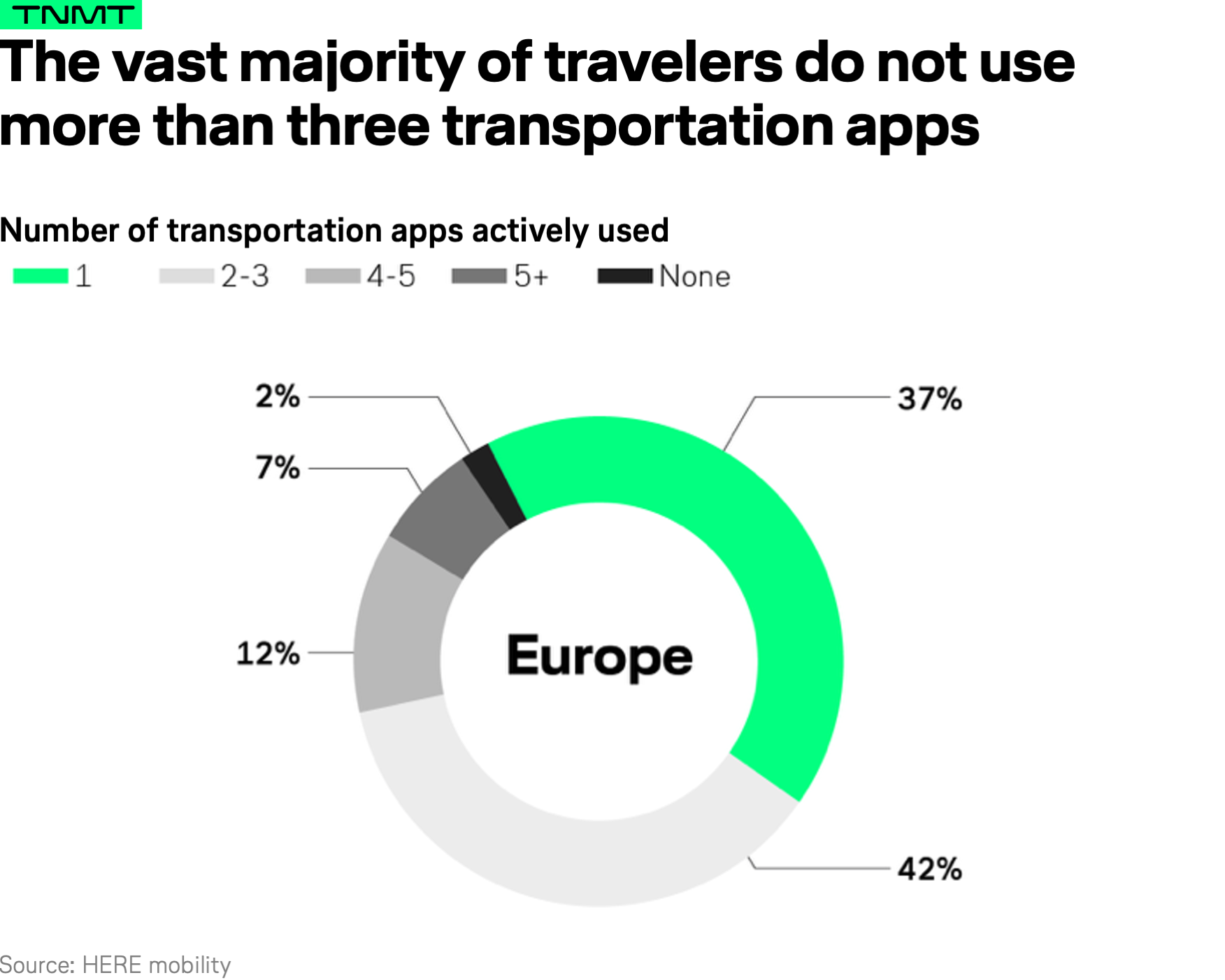

HERE Mobility found out that the vast majority of people (around 80% of those surveyed) do not consistently use more than three transportation apps (across all modes of transportation, including public transit and urban mobility), and that around 40% only use one transportation app.

To this end, becoming one of the few transportation apps that are actually used in the first place is an extremely challenging feat, especially when there is limited (if any) perceived value-add, as in the case of most airline apps.

Reasons to rebuild the airline mobile app experience

With all that being said, some airlines have (finally) decided to lead the charge and revamp their mobile apps—taking this proverbial leap of faith for two main reasons:

- First, to promote more frequent, proactive communication with their customers. This is something worth pursuing, as about 60% of travelers say communication that meets or exceeds their expectations in times of crisis distinguishes trustworthy travel brands from their competition.

- Second, to strengthen relationships with travelers by increasing touch-points through functionalities. These touch-points should offer more than just an expedited check-in before boarding.

The role models here are the Super Apps, mostly found in Asia, which address people’s daily needs—including navigation, urban mobility, mobile payments, and chat messaging. However, several transport apps from outside the direct airline context—for instance, rideshare apps—have also done a good job of triggering more consistent user engagement.

These airlines are spearheading the change

Without further ado, we ask a critical question: Who are the leading airlines that are not only willing to bet big on their mobile future, but that are also investing in a wider functionality portfolio to build the relevance of their mobile apps?

In the western hemisphere, Delta Airlines appears to have developed the most ambitious plan. In 2019, the U.S. carrier announced its intent to integrate weather, traffic, security, wait-time information, and ride-hailing features directly in its app to become a one-stop shop for travelers. While most of these features haven’t yet been introduced, a public announcement like this at the very least raises pressure to deliver in the near future.

American Airlines, meanwhile, has experimented to create a more accessible app experience for those who might not be inclined to download apps. The carrier did this by introducing App Clips, a disposable mini-app that launches with a single scan of a QR code. The app clip replicates the experience of American Airlines’ native app—which means that passengers can use it to check-in and retrieve a digital boarding pass, but it does not require a download. This is further indicative of airlines’ continued mobile investment, with an emphasis on solving accessibility issues.

AirAsia delivers the boldest move so far

One could argue that the airline most insistent on maintaining a sense of relevance in an increasingly competitive mobile app landscape is AirAsia, which stands as the world’s most digitally aggressive airline app.

And, it’s worth noting, AirAsia’s efforts to build aviation’s Super App started way before the pandemic. As the largest budget airline in Southeast Asia, with a customer base of about 75 million people, AirAsia aims to offer an integrated travel experience by capitalizing on the huge user base of Asian tourists.

The airline has become an OTA contender by filling its inventory of hotels, travel packages, transfers, and activities through a joint venture with Expedia, which began in 2011. In November 2019, AirAsia expanded its flight product coverage by going so far as to selling tickets from other airlines, either through direct cross-promotions or through virtual interlining partners.

AirAsia has also been proactive in experimenting with flexible payment options (i.e., unlimited flight passes and buy-now-pay-later options that fuel airline ticket sales).

“ASEAN Super App ambition” announced amidst COVID-19 pandemic

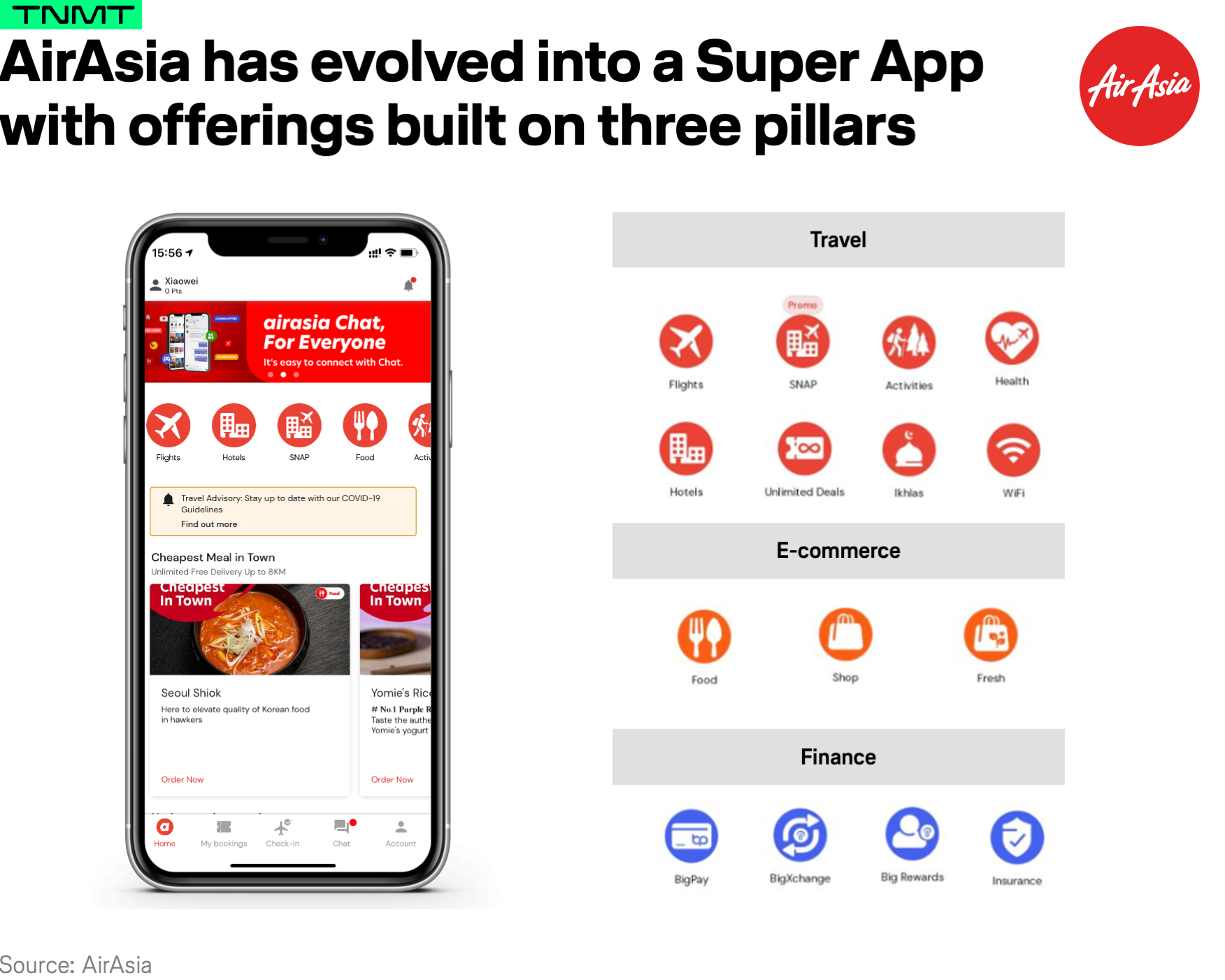

In October 2020, AirAsia announced its grand vision of becoming ASEAN’s premier Super App—a rebranded version of its existing online presence, or the consolidation of a wide variety of existing service portfolios, by launching businesses in new verticals. One example includes AirAsia Food, a delivery services platform that launched in Malaysia and Singapore at the height of the pandemic.

The AirAsia app now features 15 different products and services, ranging from travel and e-commerce, to finance.

It stands to be said that in times of underwhelming flying demand, AirAsia went above and beyond in pivoting—by venturing into the lifestyle services sector in order to maintain a relationship with grounded travelers, especially as the likes of food delivery services experienced a great surge in demand as part of the rising home-bound economy (due to lockdown restrictions).

Integrating chats for higher engagement

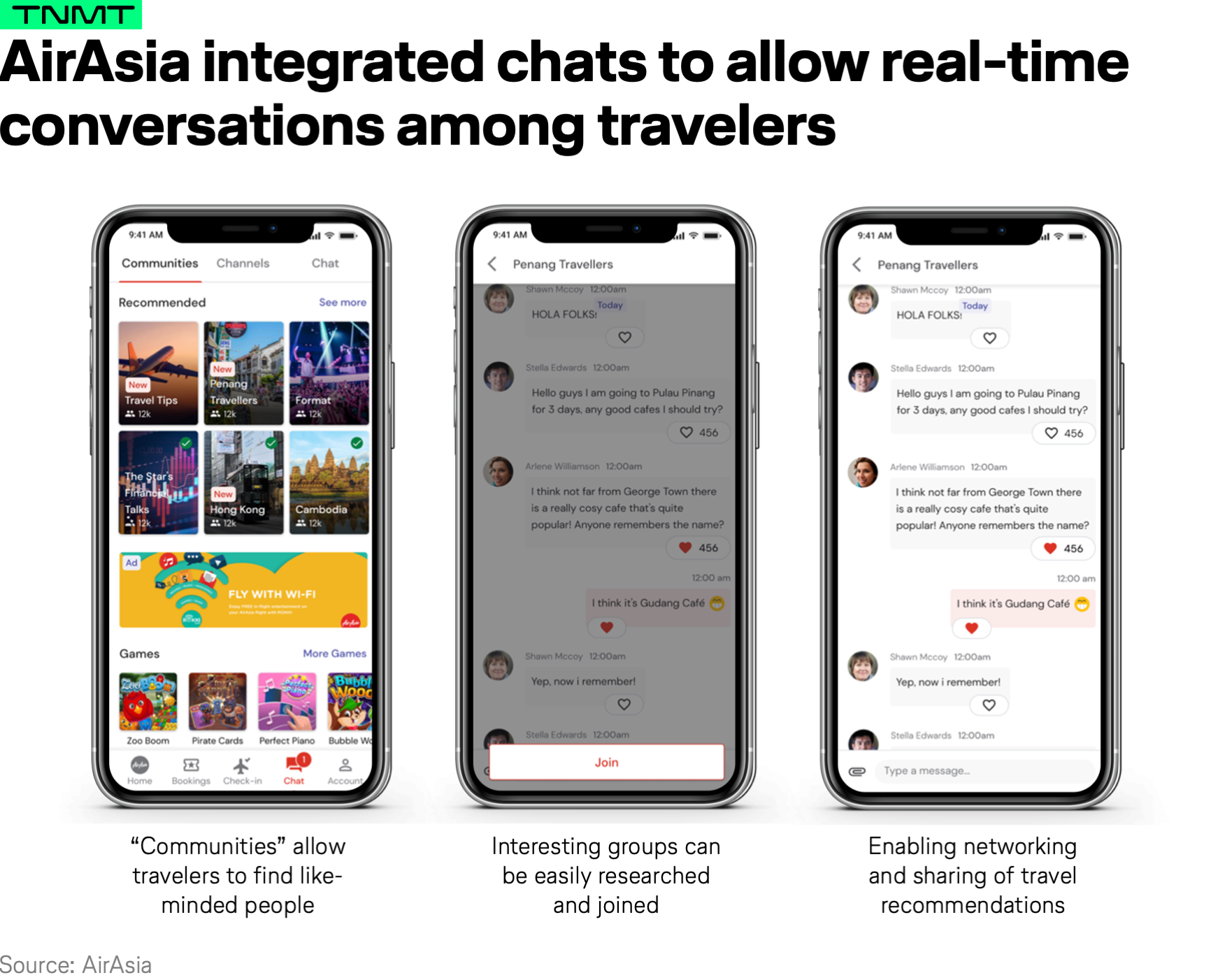

Beyond its diverse service offerings, integrating chats is AirAsia’s latest push in boosting engagement with travelers.

In March 2021, AirAsia introduced a built-in chat feature that allows travelers to chat with one another—sharing insights to discover places to stay, play, and eat in a variety of chat rooms. Users can glean valuable advice from others in the chat rooms while making travel plans. In the future, networking with other passengers on the same flights—either before take-off or during WiFi-enabled AirAsia flights—in the chatrooms could also be possible.

With this new and innovative chat feature, AirAsia is targeting higher engagement with cutting-edge user touch-points. The chatrooms encourage travelers to explore the AirAsia app as early on as possible in the travel planning stages, long before they purchase tickets.

Additionally, instant messaging in groups also seems quite useful, as travelers tend to share the most up-to-date information in this format (information that might not be available on official sites). These exchanges among travelers could bring relief in the volume of customer queries to AirAsia, as consumer communications become outsourced to the chat groups.

Looking at the long-term future, chat features offer a great deal of monetization potential. In this way, AirAsia could foster social-based commerce by cross-selling or up-selling travel products to travelers in real-time, as the carrier learns more about what users discuss in the chat rooms before or during flights.

Super App efforts seem to pay off

Today, the major question is whether this Super App strategy will pay off on a commercial level.

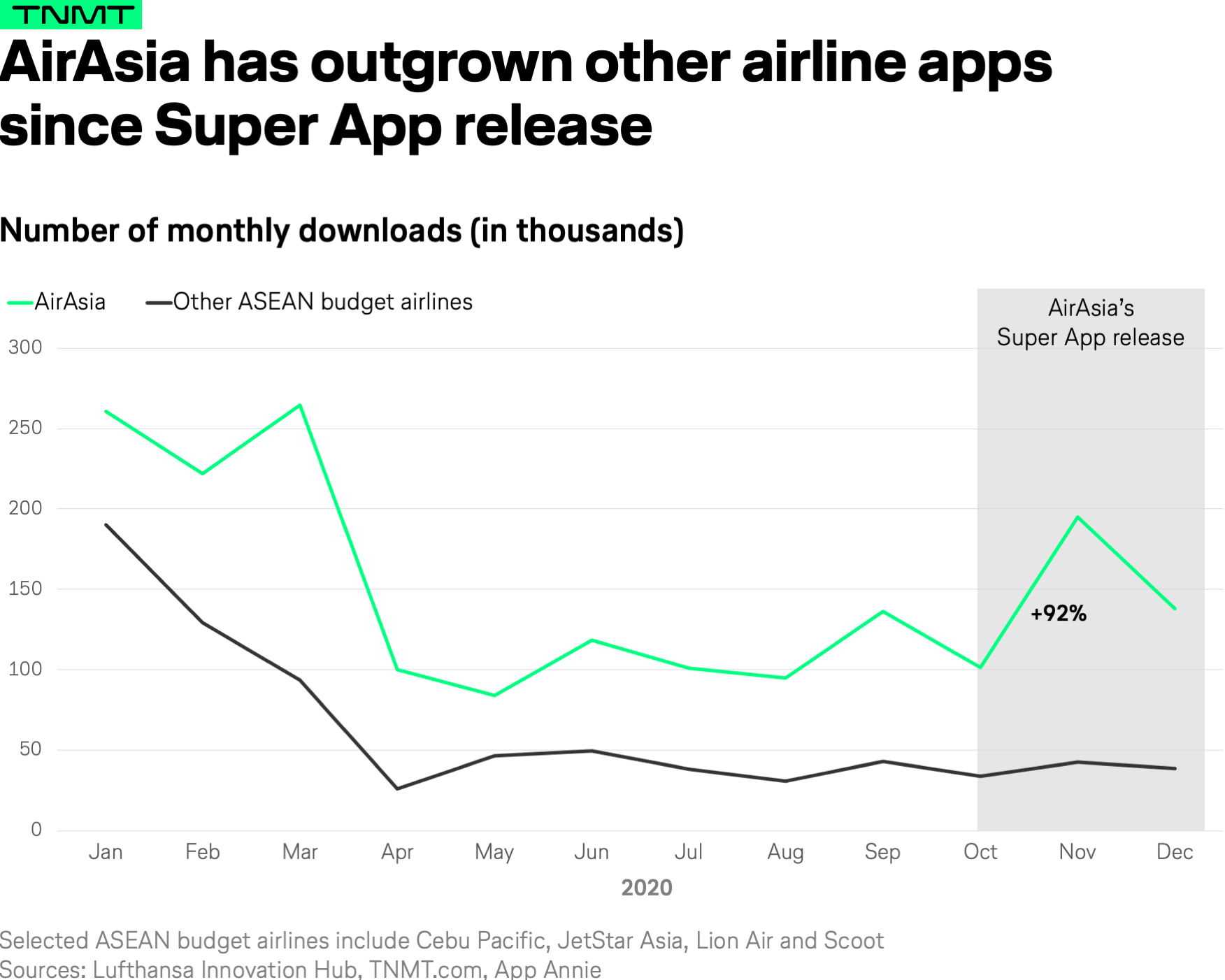

It is hard to predict the future at this point, but initial app traffic data seems to indicate that travelers have welcomed AirAsia’s new approach.

Throughout the pandemic so far, AirAsia has outgrown other ASEAN budget airlines in terms of app downloads for every month since March 2020. During the Super App relaunch in Oct 2020, AirAsia saw a clear surge in app downloads, in contrast to the stable downloads of its competitors.

If there’s anything airlines can learn here, it’s that lifestyle service integration gives travelers a crucial reason to download an airline app—even during a global pandemic that discourages flying.

Aggressive horizontal expansion is challenging

Despite the appeal of this integration, there are many challenges ahead for AirAsia’s horizontal expansion (particularly during this time of uncertainty for airlines).

For example, the new territories AirAsia recently entered to boost engagement are largely crowded with local Super Apps like Grab and Gojek. AirAsia entered the “high-frequency, high-engagement game” with no clear unfair advantages.

Take food delivery as an example: AirAsia is currently offering a lower commission of 15% to restaurant merchants than its competitors. Existing AirAsia consumers can also enjoy reduced order fees by burning loyalty points. Although both tactics bring exclusive advantages to AirAsia, whether or not these tactics are sustainable remains to be seen, as AirAsia is still struggling to issue refunds to 450,000 passengers.

However, compared to existing unicorns in the game, AirAsia’s rather limited number of restaurants—paired with the less-than-smooth user experience of its app—could be a big let-down. In consequence, broader offerings will likely be enticing for travelers who already have the AirAsia app installed. It seems, however, that the app does little to acquire new users, particularly other Super App users, who expect a more mature service level.

Should travelers expect more from airline Super Apps?

While the “connect daily” ambition might be too far-fetched for all airlines, it’s certainly an ideal scenario for airlines to eventually offer as much of the connected travel and mobility experience as possible. As such, it is worth investigating whether travelers actually expect airlines to be a one-stop shop for their daily needs.

It is worth stating, however, that carriers do need to trigger more frequent interactions through their mobile apps—at minimum during the actual travel journey, as customers (and not only members of Gen Z) expect their carrier to be digitally-available at all times, and equipped to provide end-to-end support throughout the entire journey.

One example might include the trip planning process. According to Oliver Wyman, the typical traveler completes 50 online searches, undergoes 38 website visits, and reads 12 reviews before making a travel decision.

With that, why not channel this travel search process into an airline app by building out inspirational content? This could include app-only deals, for instance, in the form of live streaming auctions, to name just one example.

And the options don’t end there. Again, why not offer travelers real-time currency information, along with voice-based translation services through the airline app, so that their arrival in a foreign country feels less frightening, overwhelming, or all-around chaotic?

But ultimately, at this point, perhaps we should take a step back. The global pandemic has sent us an unfriendly reminder that there are a number of basic digital focus areas that need improvement in the airline industry. If rescheduling flights or navigating information like fluid travel restrictions were a breeze, an airline taking on the role of a one-stop-shop for consumers’ daily needs could be a true market differentiator.