“The United States innovates while Europe regulates (and China replicates).”

That’s the kind of narrative we’ve been hearing a lot lately, especially from across the Atlantic.

- A narrative that paints Europe as a continent of red tape, not rocket ships.

- One that suggests we’re better at reinventing bottle caps than building breakout tech companies.

Case in point: here’s a recent slide from U.S.-based VC firm UP.Partners in its latest global mobility report:

But is that really the full story?

We’ve been asking ourselves the same question at TNMT.

And sure, we’re biased. We’re rooted in Europe.

But maybe that’s exactly why it’s time we use our TNMT platform to take a closer look.

- Yes, Europe may have fallen short on producing Google-, Amazon-, or Meta-sized tech giants.

- But that doesn’t mean there’s no tech magic happening here, especially in the Travel and Mobility Tech space.

In fact, we’re seeing more and more home-grown startups and scaleups quietly hitting serious commercial milestones, scaling aggressively, and solving real industry problems.

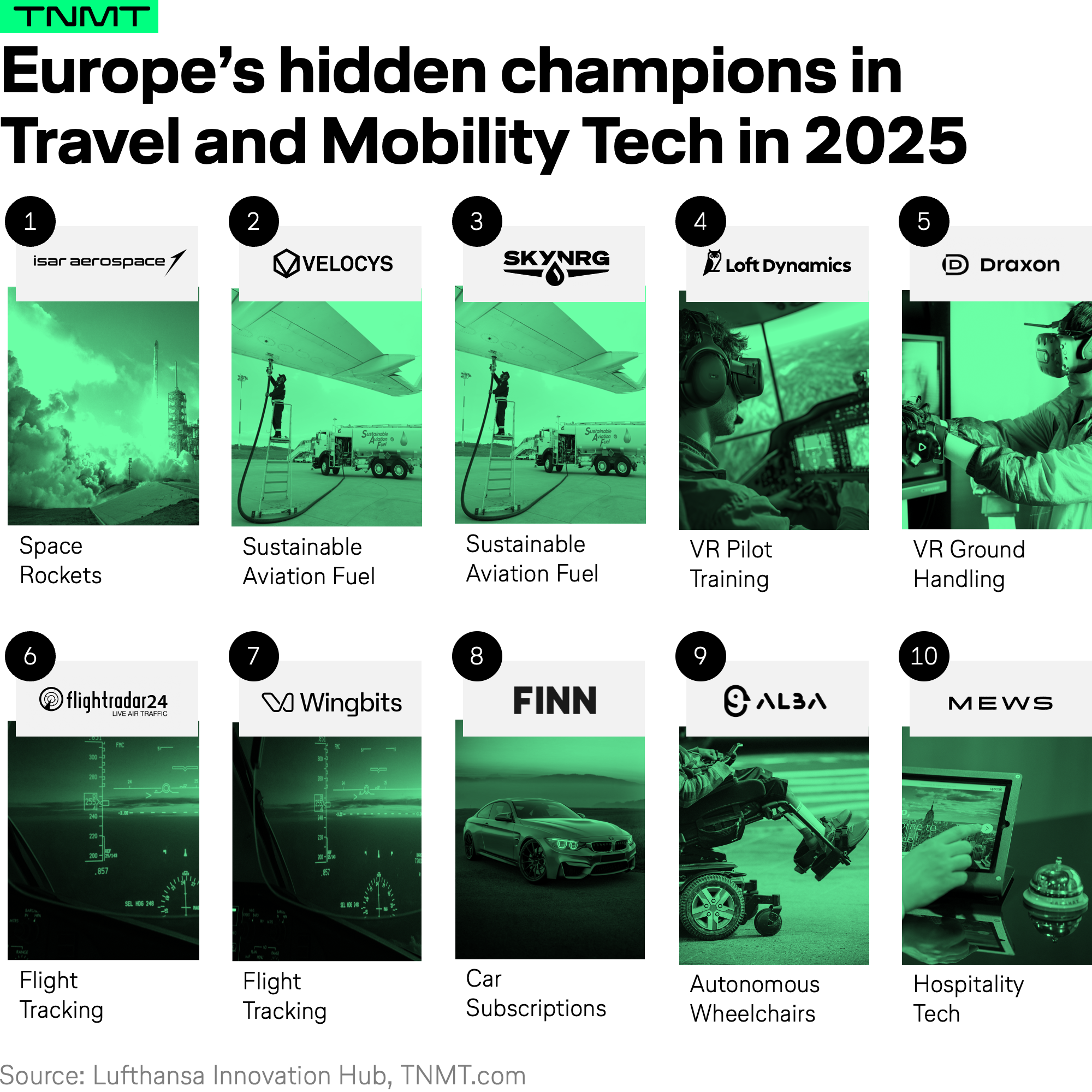

Over the past few months, we have tracked and analyzed ten European Travel and Mobility Tech companies that prove innovation here is not only alive, but quite literally flying!

All ten company stories await you below.

(And no, it’s not about bottle caps.)

Europe is on the rise

Before we jump to our first European breakout story, a few more (data-driven) signals that Europe deserves our attention.

Turns out investors are starting to agree.

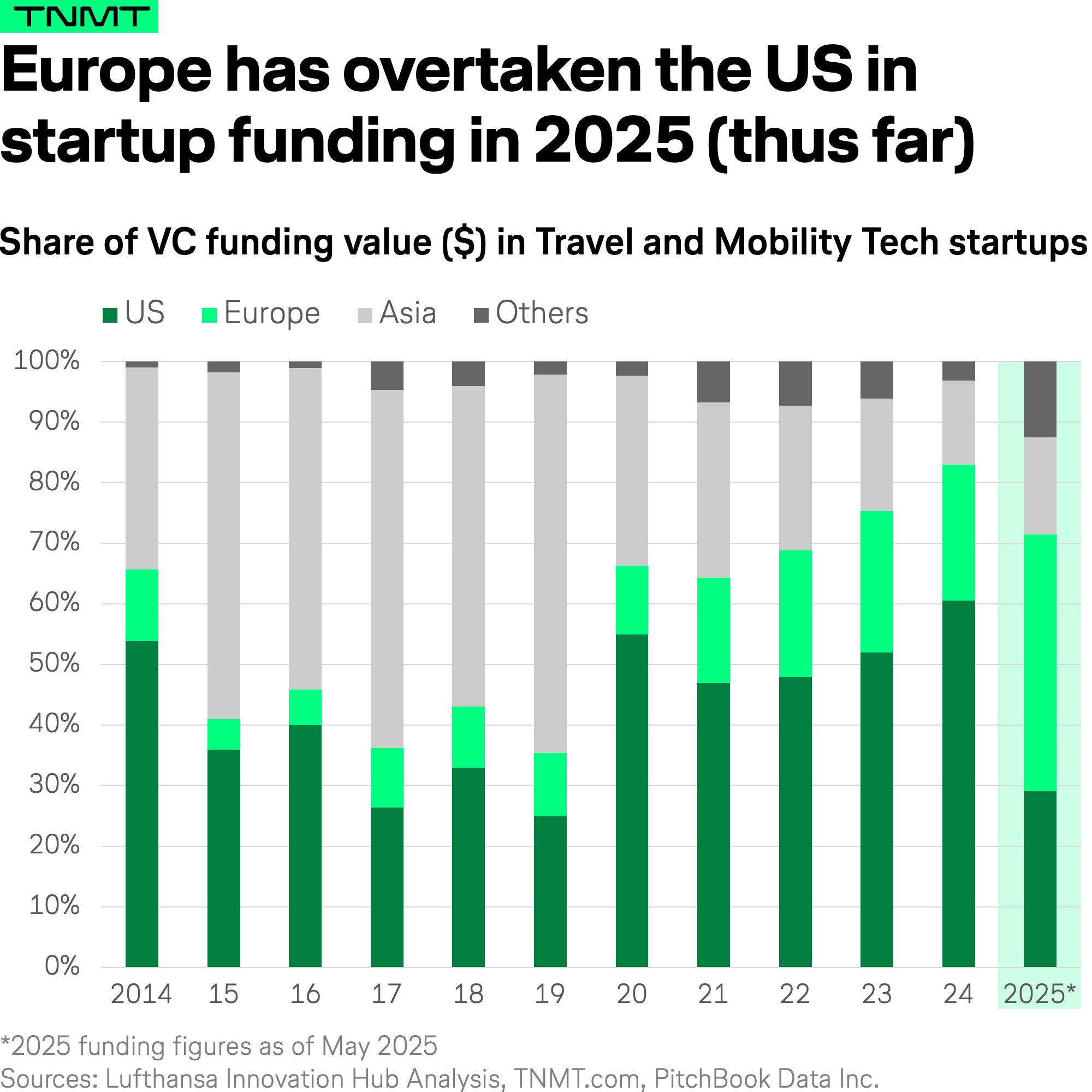

According to our in-house TNMT investment tracker, European Travel and Mobility Tech startups have (for the first time in over a decade) raised more VC funding than their U.S.-based peers in 2025 (at least up until the end of May).

This isn’t just a fluke.

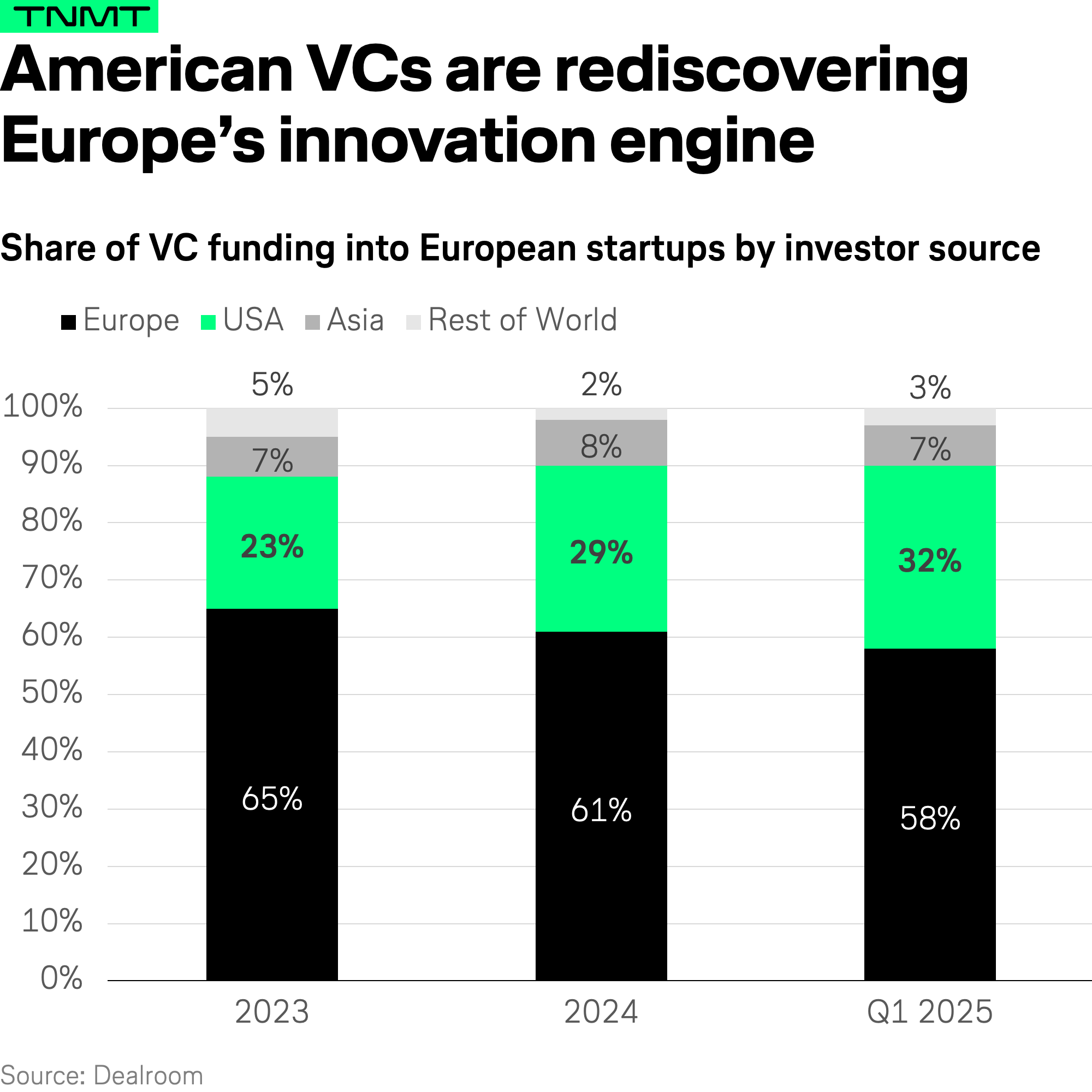

- Even U.S. investors are shifting focus toward European disruptors.

- As of Q1 2025, roughly one-third of all VC euros invested in European startups (across all sectors) have come from U.S.-based investors, up from just 23% three years ago.

And there’s more.

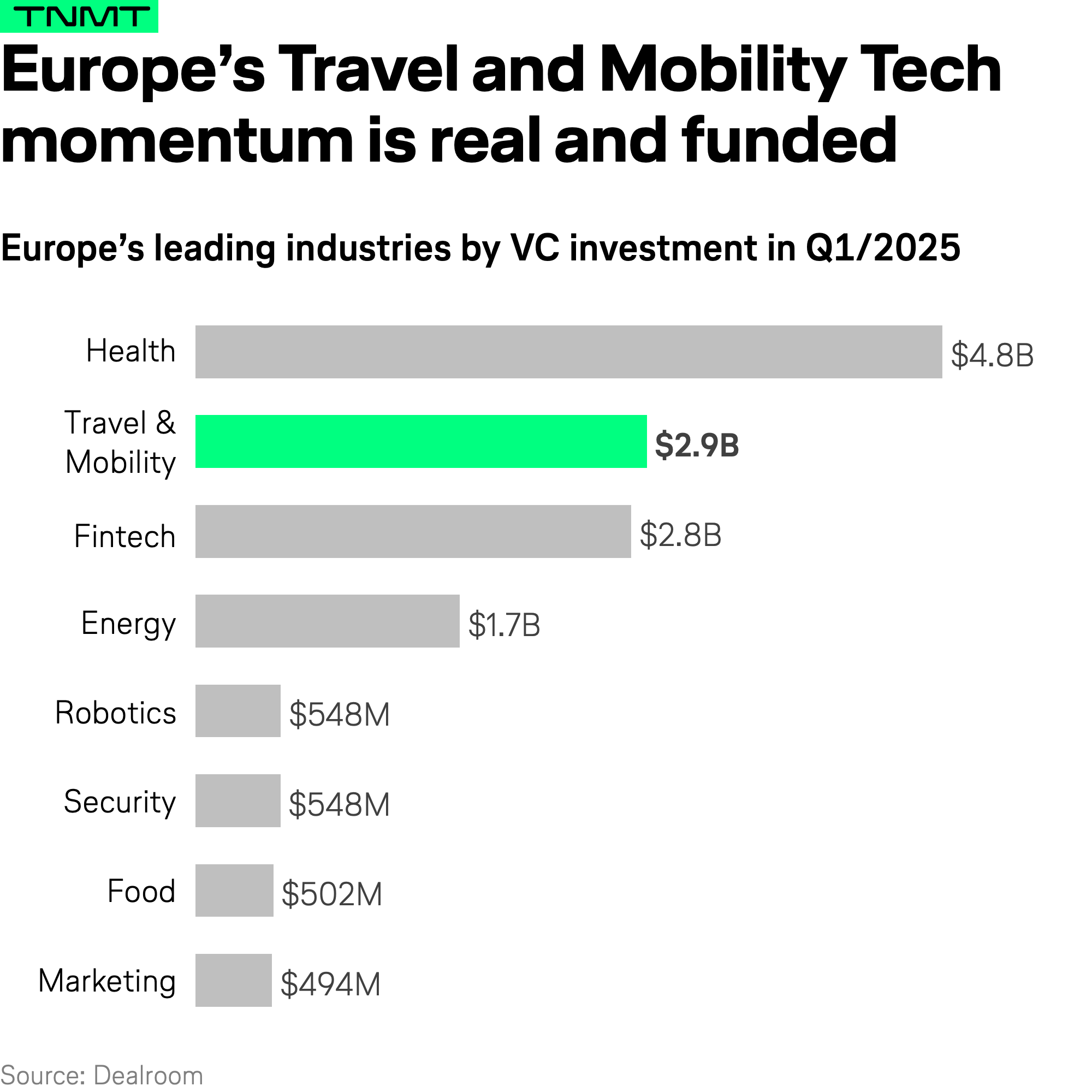

Dealroom data shows that, with this backing, Travel and Mobility Tech has emerged as Europe’s second-most funded sector in Q1, trailing only Health Tech.

So what’s fueling this momentum?

Surprisingly, it’s not just the AI wave.

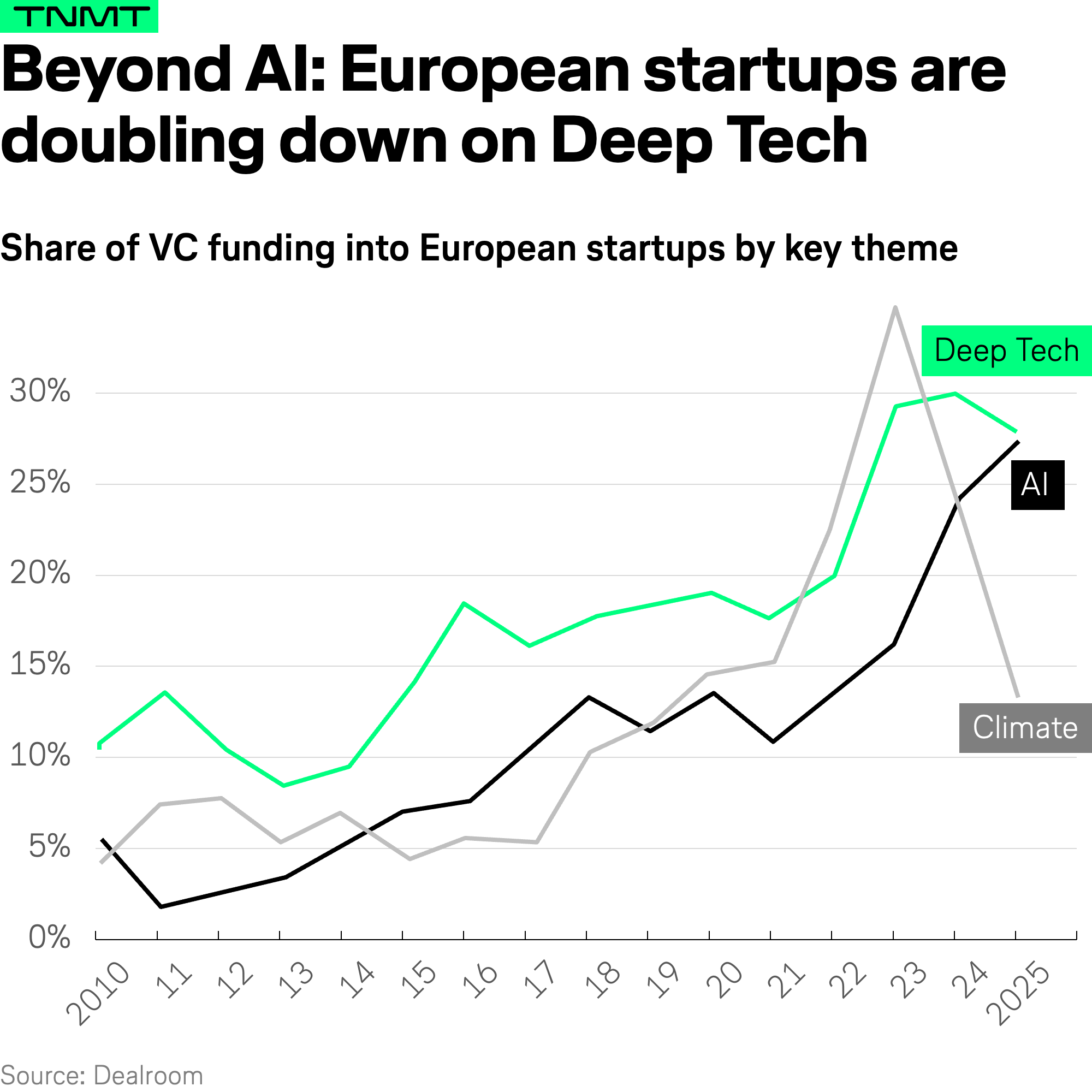

Dig deeper into the European VC landscape, and you’ll find a rising force: Deep Tech.

- In Q1 2025, nearly 30% of all VC investment in Europe has flowed into startups working on heavy-duty innovation, such as real-world hardware, complex engineering, advanced robotics, and breakthrough materials.

- So it’s less about apps, more about atoms.

This Deep-Tech movement reflects something Europe has long excelled at: industrial ingenuity and manufacturing depth.

And it’s this Deep-Tech focus that leads us to the first Travel and Mobility Tech startup we believe deserves the spotlight.

1. Europe’s SpaceX-in-the-making?

Our first standout company in this new series might not be entirely unknown to TNMT readers.

And to be clear: there’s no sponsorship involved–our selection is based purely on market signals.

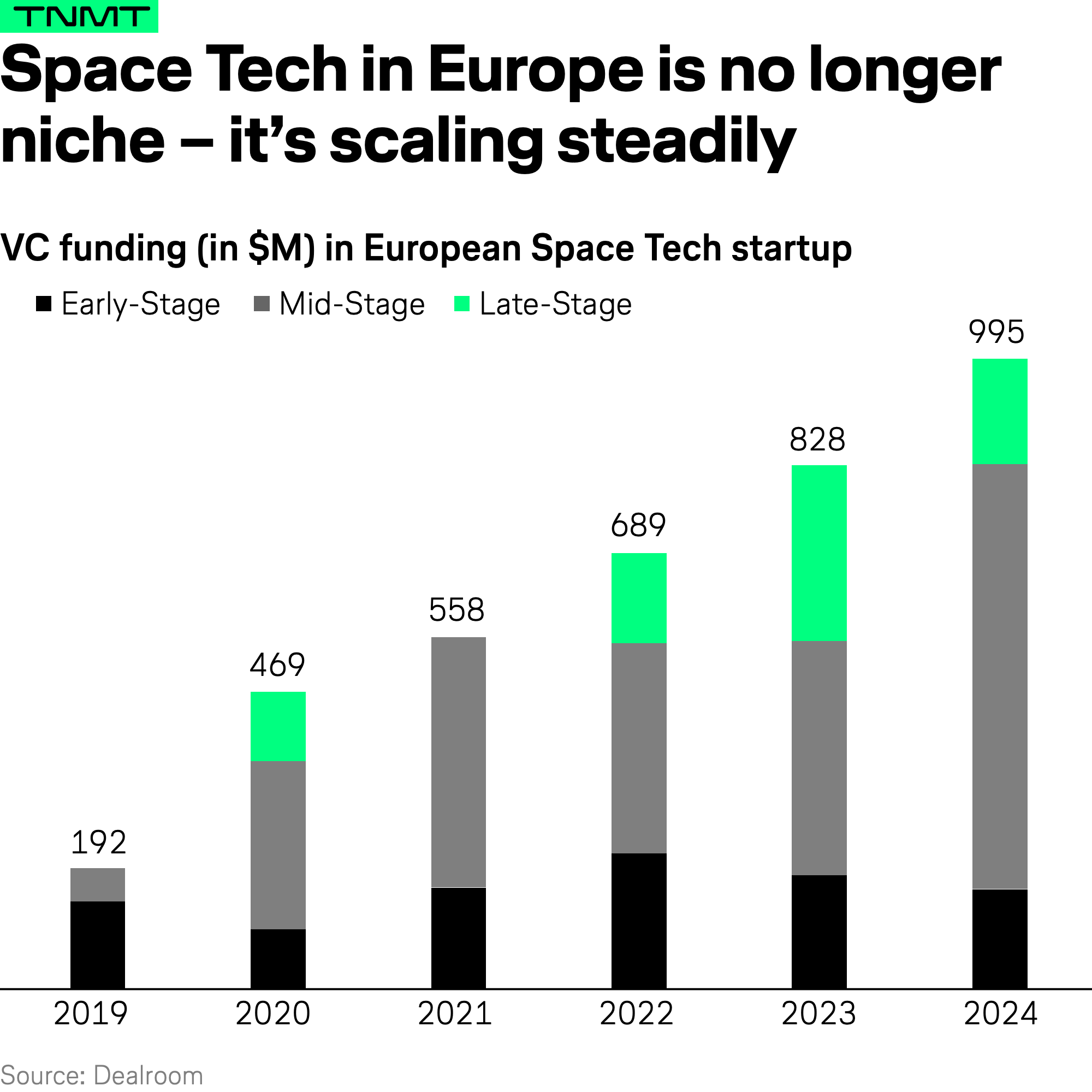

After all, Isar Aerospace has made quite a few headlines this year.

But despite the buzz, it still doesn’t get the credit it deserves.

So let’s fix that.

Isar Aerospace is Europe’s boldest Space Tech bet and a potential SpaceX rival in the making. (Even if that’s still many rocket launches away.)

But let’s take it one step at a time.

For those not familiar, Isar Aerospace builds rockets for satellite launches.

The Munich-based startup (yep, Isar is the river running through the city) designs and manufactures its own launch vehicles, most notably the Spectrum rocket, to offer independent, cost-effective access to space for small- and medium-sized satellite operators.

Its edge?

- Full vertical integration and a commercial mindset.

- Unlike legacy space agencies or fragmented European competitors, Isar builds its own engines, systems, and infrastructure.

- That means faster iteration cycles and more competitive pricing.

It’s a European answer to SpaceX, but tailored for the booming small satellite market, as industries increasingly rely on satellite connectivity, Earth observation, and in-orbit data infrastructure.

Isar’s clients range from satellite startups and commercial operators to government agencies seeking sovereign-independent launch capacity, a concern that has grown sharply in the wake of the Ukraine war and wider geopolitical tensions.

From 30 seconds to 1 billion

Two major milestones have catapulted Isar Aerospace from Deep-Tech underdog to a serious Space Tech contender in 2025.

First, the company’s inaugural rocket launch in March.

- Yes, the flight lasted only 30 seconds before crashing back to Earth.

- Yes, German media were quick to label it a “failure.”

- But that misses the point entirely.

Because this was more than the first official test flight.

- It was the first-ever launch of a commercial space rocket from European soil, taking off from the Andøya Spaceport in Norway.

- A landmark moment for Isar, and Europe’s long-overdue ambitions in commercial spaceflight!

And while the rocket didn’t reach orbit, it did help launch something else: investor confidence.

Just two weeks ago, Isar Aerospace announced a new €150 million funding round, including backing from U.S.-based Eldridge Industries (yes, yet another sign of American VCs waking up to Europe’s Deep-Tech potential).

New unicorn spotting

While the company hasn’t confirmed it publicly, this round is likely to have pushed Isar’s valuation past the $1 billion USD mark.

Yep, a European unicorn in Space Tech. That’s rare air.

To put it into perspective:

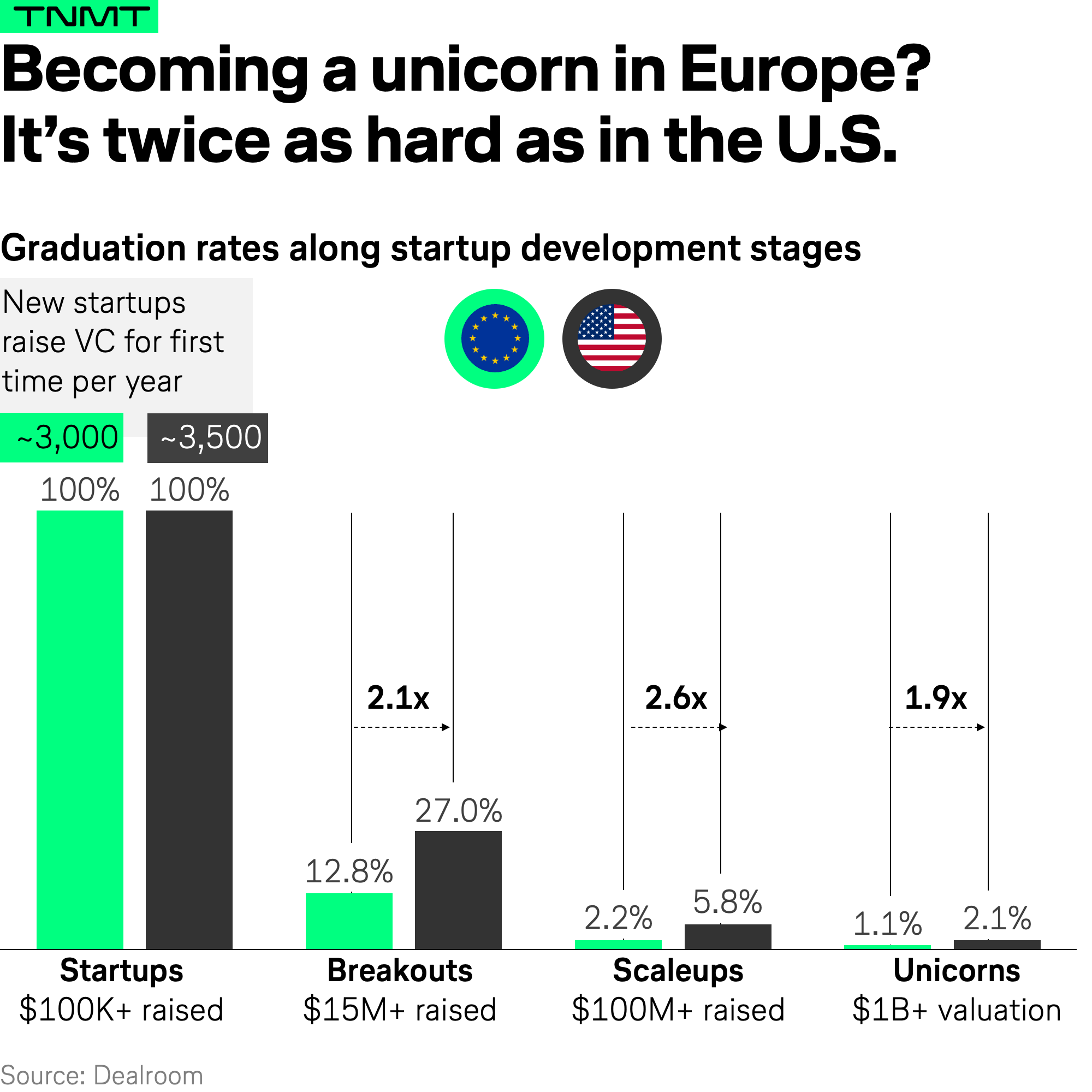

- Only about 1% of VC-backed startups in Europe ever reach unicorn status. That means Isar is literally a 1-in-100 exception.

- For comparison, the unicorn hit rate in the U.S. is closer to 2%, which is twice as high, making Europe an even tougher playing field to break through.

Bottom line?

Even in a post-ZIRP (zero interest rate policy) world of cautious capital, Isar Aerospace is attracting major belief and backing.

And that’s exactly the kind of signal we look for in a TNMT standout.

The bigger picture

Let’s be clear: a fresh round of VC cash and a unicorn badge don’t guarantee a smooth journey to orbit.

- SpaceX burned through hundreds of millions and three failed launches before its first successful takeoff in 2008.

- And Isar is essentially 17 years behind the market leader, which, let’s be honest, is a serious gap.

But here’s the upside: Isar benefits from a far more mature ecosystem of suppliers, talent, and downstream applications.

And momentum is clearly building.

As we’ve covered before, the space hype and the rise of commercial space infrastructure are closely tied to macroeconomic forces, including global connectivity and geopolitical self-reliance.

Europe can’t afford to sit this one out.

Isar’s emergence and the broader growth in European Space-Tech funding signal a shift:

- Europe isn’t just building rockets.

- It’s building resilience!

Now, Isar Aerospace may be reaching for the stars, but it’s far from the only European startup turning heads in Travel and Mobility Tech.

In fact, many of the most exciting breakthroughs are happening much closer to home, right on the runway, in control towers, hangars, and fuel tanks.

So in this next section, we’re shifting our focus from space to sky.

Because Europe’s not just launching rockets. It’s quietly building the future of flight.

2. Aviation Tech takes flight

So what’s driving the next wave of European Travel and Mobility Tech innovation beyond the headline-grabbing rockets?

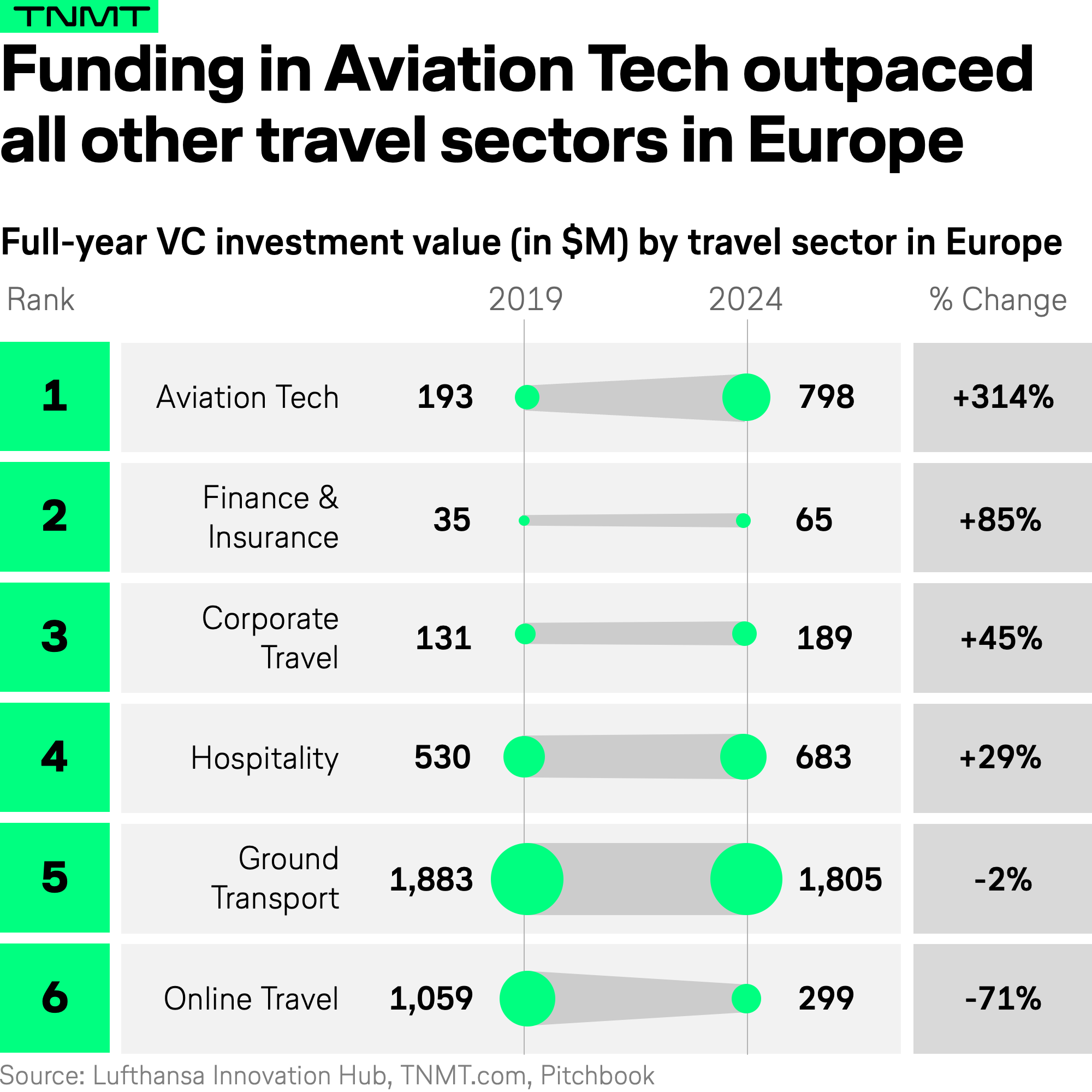

To find out, we (once again) turned to our in-house TNMT investment tracker and broke down VC activity by sub-sector, comparing full-year funding volumes from 2019 to 2024.

The result?

One category is clearly pulling ahead.

Aviation Tech, so the segment focused on innovation in and around the aircraft itself, has experienced the sharpest growth in funding volume over the past five years.

But what exactly falls under Aviation Tech?

In our definition, this category covers a broad spectrum of startups working on the operational, technical, and infrastructure layers of aviation. Think:

- Airport innovation (e.g., automation, turnaround tech, and robotics, as covered in our previous deep dive on airport operations)

- New airline operators (particularly in charter, private, or low-cost segments)

- Next-gen aircraft manufacturers (including suppliers for new aircraft designs and electric aircraft developers)

- Digital tools for aircraft operations, such as digital twins, drone-based inspections, and AI-powered MRO solutions

In short: The kind of real-world, often complex tech that transforms how aircraft are built, flown, and maintained.

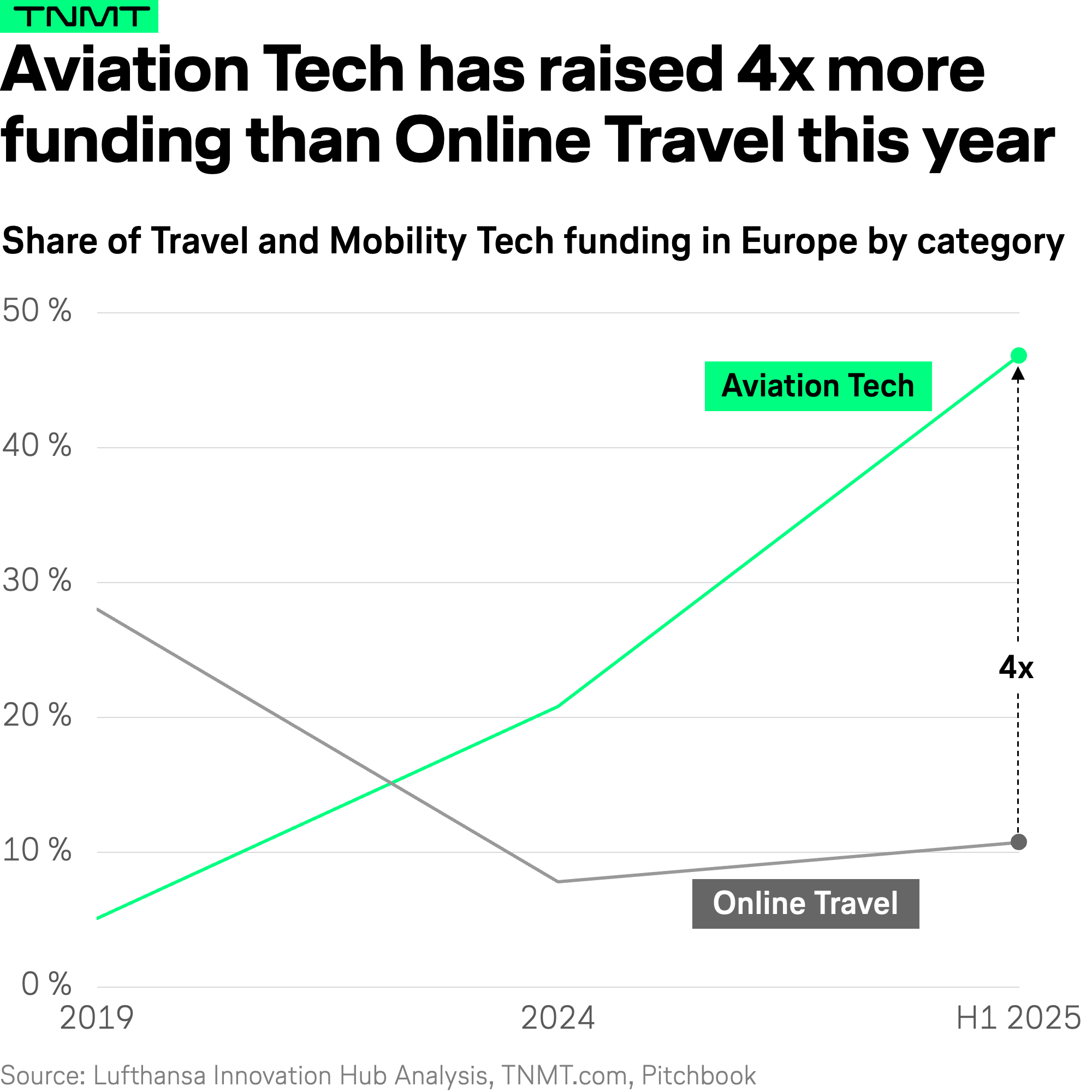

Aviation Tech vs. Online Travel

Aviation Tech’s momentum becomes even more striking when compared to another high-profile corner of the industry: Online Travel.

- Over the past year, Online Travel has been heavily in the spotlight, largely thanks to the GenAI boom and the promise of AI-powered disruption across the booking journey.

- From chatbot interfaces to personalized trip planning, the hype around reinventing how people search, plan, and book travel has been hard to miss.

And yet, all that buzz hasn’t translated into funding success.

In fact, few Online Travel startups have managed to raise meaningful capital in 2025.

The reason?

- Investors are still grappling with uncertainty around how, and when, AI will reshape the booking experience.

- Will traditional OTAs and airline.com websites get replaced by GenAI interfaces like ChatGPT?

- Will travelers really trust a chatbot to plan their entire trip?

Until those questions are clearer, capital is staying cautious.

Meanwhile, European Aviation Tech startups are cutting through the noise.

In just the first half of 2025, they’ve raised 4x more funding than their Online Travel counterparts.

It’s a signal that the market is shifting its focus: away from flashy AI concepts and toward grounded, operational innovation.

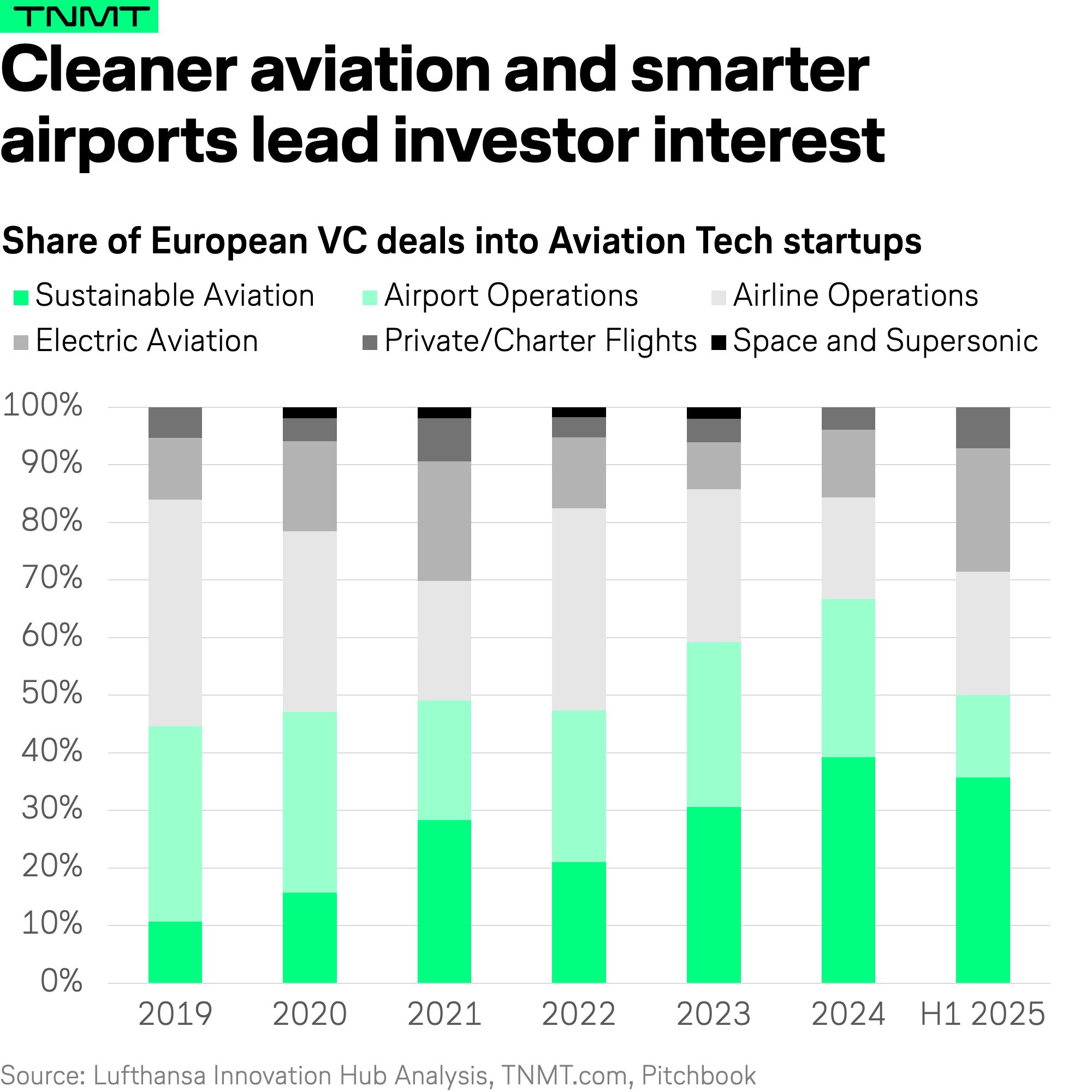

The green engine driving Aviation Tech

So, the obvious next question: What exactly is attracting all this capital within Aviation Tech?

To find out, we broke the category down (again) into its six main sub-segments.

And once again, one theme stands out, and it’s not new, but it’s gaining ongoing traction: sustainability.

- European startups focused on making aviation more sustainable have steadily grown their share of overall Aviation Tech funding.

- Back in 2019, they accounted for just around 10% of sector funding.

- In 2025, they’re now responsible for more than a third, even after a slight dip from last year’s peak of 40%.

Some have claimed the climate-tech hype is fading.

But in European Aviation Tech, that narrative doesn’t hold.

If anything, the opposite is true: sustainable aviation innovation is becoming a core pillar of the ecosystem.

And that brings us to these standout startup(s): companies putting sustainability at the center of aviation’s future.

Meet the startups fueling aviation’s green transition

Two names worth remembering in the push for cleaner skies: Velocys and SkyNRG.

Velocys is a UK-based technology licensor spun out of Oxford University back in 2001.

It has quietly become a key enabler in the SAF value chain.

- While not a fuel producer itself, Velocys licenses proprietary tech that transforms household and forestry waste into Sustainable Aviation Fuel.

- After more than two decades of development, the company is now scaling fast: it has raised over $100 million to date, including $40 million in 2024 alone, and just closed another (undisclosed) growth equity round in June 2025 to push its technology into large-scale commercial deployment.

Meanwhile, SkyNRG, headquartered in Amsterdam, is taking a more integrated approach.

- As both a SAF producer and strategic advisor, the company is building out physical production capacity while also partnering with airlines to accelerate adoption.

- Its biggest milestone yet: a $300 million funding round in 2025 to build SAF plants in the Netherlands, Sweden, and the United States.

- Already a long-time partner to KLM, SkyNRG is fast becoming a heavyweight in the global SAF supply race.

Together, Velocys and SkyNRG represent two complementary approaches: one focused on core tech, the other on infrastructure and distribution.

But both are united by a shared goal: making SAF commercially viable and widely available.

And that matters.

Despite all the experimentation in green aviation (think electric and hydrogen flying), SAF remains the only technically viable solution today to mitigate aviation’s CO₂ output at scale.

The problem?

- Supply is nowhere near where it needs to be.

- Today, SAF still makes up less than 1% of global jet fuel use.

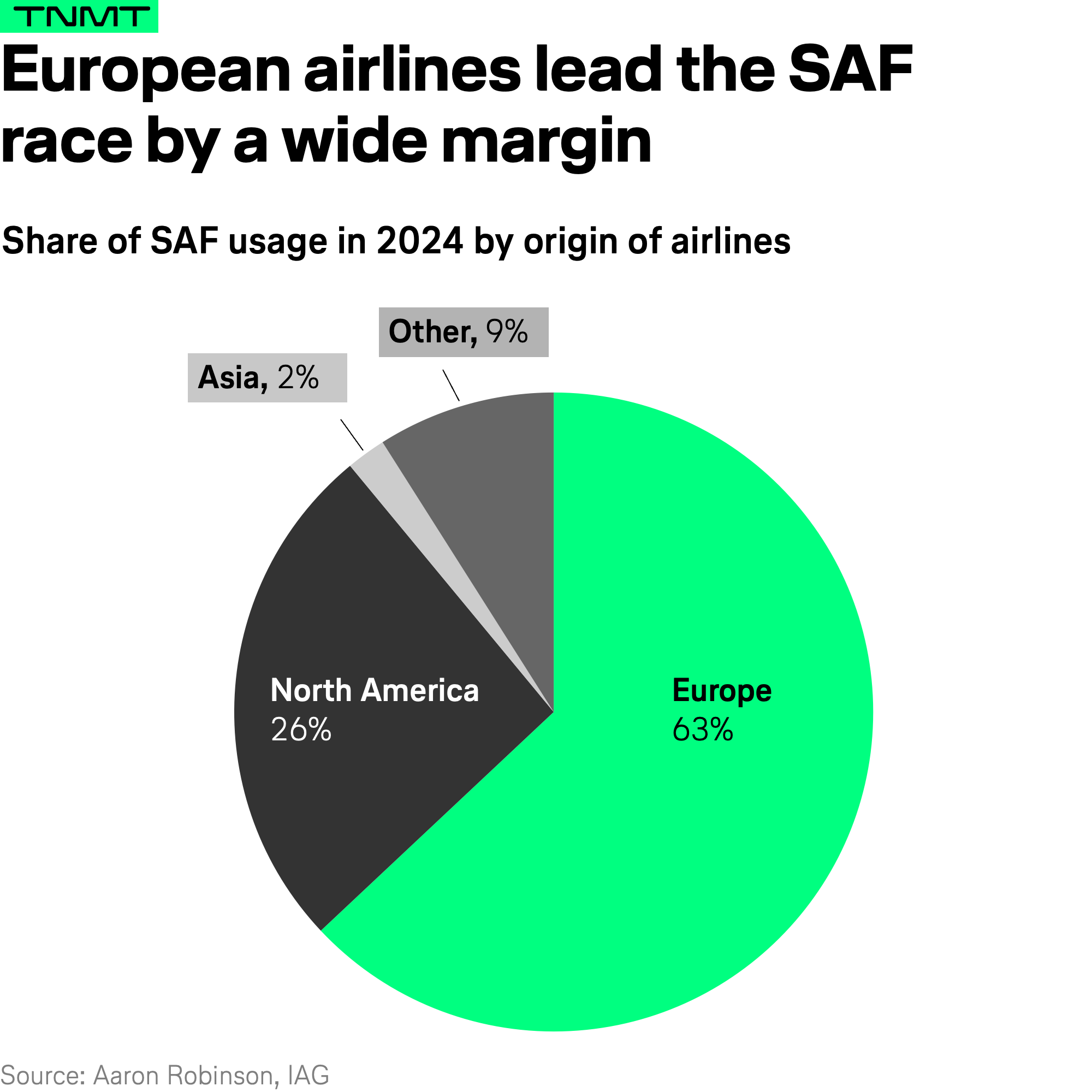

That’s where Europe steps in.

Unlike other regions, Europe’s push for sustainability isn’t just culturally driven (though public sentiment does skew greener than in markets like the U.S.)

It’s also policy-powered.

The EU’s SAF mandate requires a 2% SAF blend by the end of 2025, rising to 70% by 2050.

And it’s already showing up in the data:

- In 2024, 63% of global SAF volumes were used by European carriers.

- North American carriers followed with 26%, while Asian carriers trailed at just 2%.

In short: while others are debating (or ignoring) the long-term future of a more sustainable aviation, Europe is doubling down on the only scalable solution available today, and building the ecosystem to make it work.

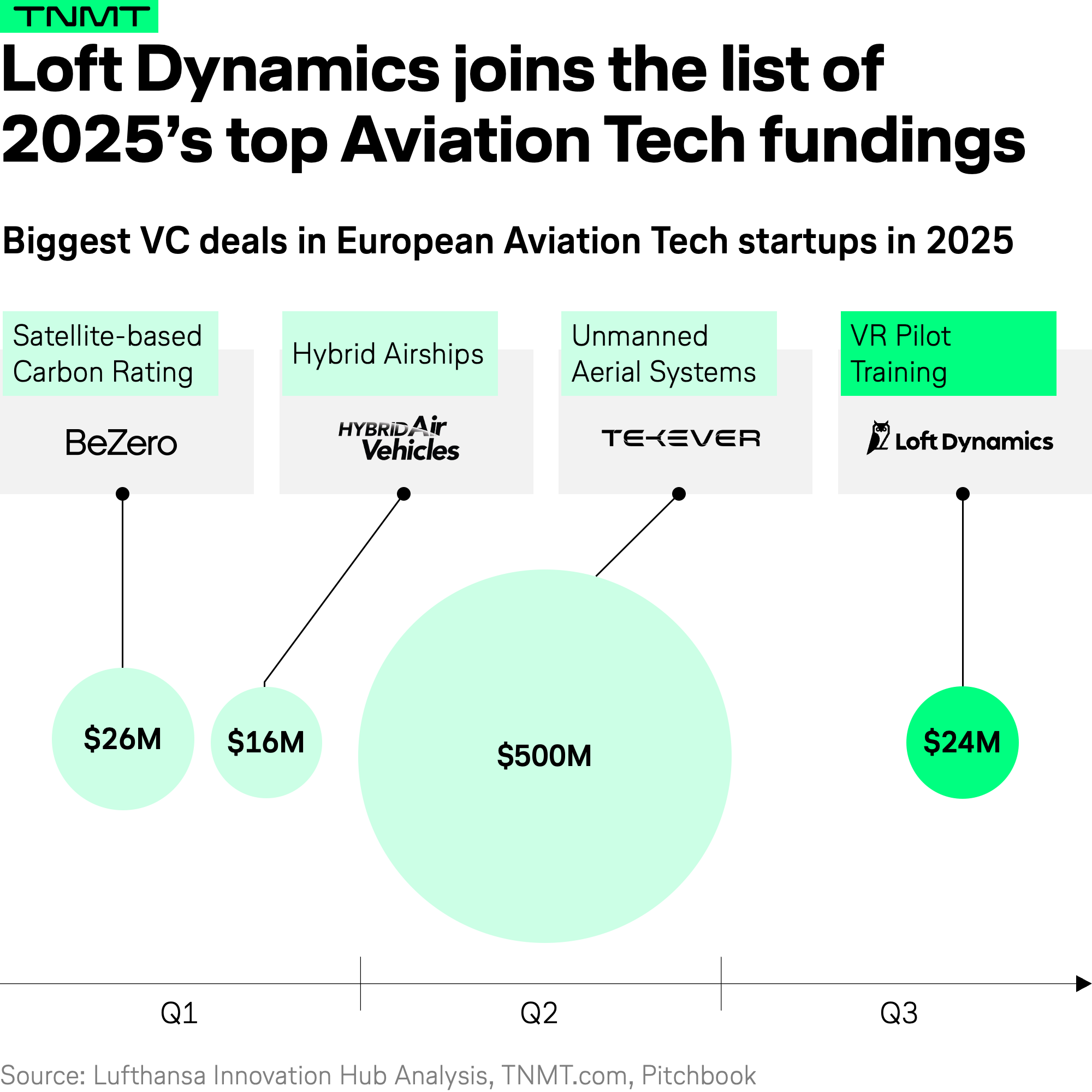

3. Virtual Reality Meets Aviation

This brings us to the next disruptor reshaping the skies. And just like Velocys and SkyNRG, this one sits right at the heart of aviation.

- 2025 is shaping up to be another big year for Aviation Tech, with several hundred million USD in fresh funding likely to flow into the sector.

- Case in point: the latest Aviation Tech deal was a $24 million USD round for Loft Dynamics – our next European startup standout as part of this series.

So, who is Loft Dynamics?

Founded in Switzerland in 2016, the company is disrupting the world of pilot training with revolutionary VR flight simulators.

And not just any simulators. Loft Dynamics is the first ever to receive both EASA and FAA qualifications.

Here’s what that looks like in action:

For now, Loft Dynamics is focused on helicopters.

But the potential goes much further.

One airline has already spotted the opportunity: Alaska Airlines.

Earlier this year, Alaska invested in Loft Dynamics to help develop the world’s first hyper-realistic, full-motion Boeing 737 VR simulator, opening the door to VR-based training in commercial aviation.

This next-gen simulator could provide a fully immersive experience that replicates real-world flight scenarios, all in a hardware device compact enough to fit inside a standard office.

And that’s the game-changer: simulators are no longer confined to a few centralized training facilities but deployable almost anywhere.

- Today, pilot training relies on classical full-flight simulators, housed in only limited locations worldwide.

- They’re costly, resource-intensive, and often overbooked.

- Trainees face long waitlists, slowing down recertification and new-pilot readiness.

That’s a structural problem, because the aviation industry is already facing a severe pilot shortage.

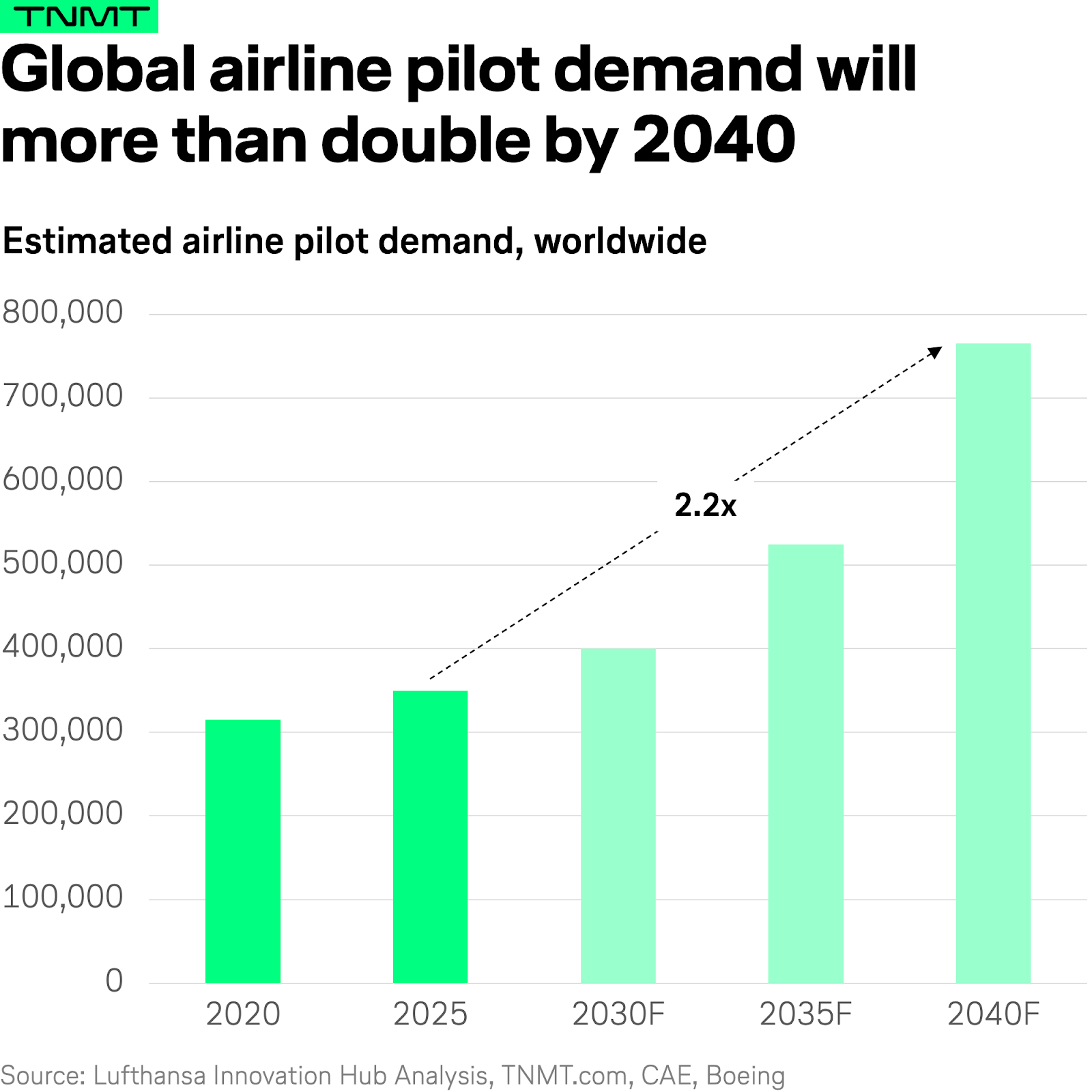

- Boeing estimates that the world will need over 600,000 new pilots over the next 20 years, while CAE projects demand for 250,000 new pilots within the next decade alone.

- For context: Today, there are only about 350,000 active airline pilots worldwide.

- This massive demand for more pilots stems from multiple factors, including pilot retirements and increasing travel demand.

Loft Dynamics’ decentralized VR training model could help close that gap.

- By making training more accessible and scalable, airlines could train more pilots more often and at a lower cost.

- So, Loft Dynamics isn’t just innovating simulation tech; it’s tackling one of aviation’s most urgent bottlenecks head-on.

All the more reason to celebrate a European startup taking on this challenge.

But it also raises a question: why was an American airline, rather than a European one, the first to back this vision?

In some cases, the answer is simple: incumbents prefer to build capabilities internally rather than invest externally.

Case in point:

- Brussels Airlines now uses Virtual Reality as an integral part of A320-type rating training.

- The program is the result of a two-year collaboration between Lufthansa Aviation Training and Airbus, which co-developed the VR software.

- After an intensive test phase, Brussels Airlines became the launch customer within the Lufthansa Group, marking the first time VR has been formally embedded into type rating training in Europe.

This illustrates the dual track we’re seeing: while startups like Loft push the frontier with disruptive solutions, large incumbents are also moving forward, sometimes by building their own pathways instead of betting on external ventures.

And the VR momentum doesn’t stop there.

Beyond pilot training, VR is spreading into other parts of aviation operations.

A fresh example from Europe:

- A VR-powered training program for ramp agents is now rolling out across Zurich, Vienna, and Berlin airports.

- The initiative is driven by a partnership between leading ground handling provider Airline Assistance Switzerland (AAS) and VR training startup Draxon.

What’s the use case?

- Traditionally, new ramp recruits learn the ropes on the job during countless aircraft turnarounds, which is a process that eats up time, drives costs, and puts pressure on staff availability.

- With Draxon’s VR training modules, multiple new hires can practice ground-handling fundamentals simultaneously, in a safe, controlled, and repeatable environment. The result: faster onboarding, lower training costs, and enhanced safety.

And here’s the kicker: Draxon was founded by two well-known Berlin entrepreneurs: Stefan Smalla (founder of Westwing) and Paul Schwarzenholz (co-founder of Flaconi).

Two seasoned e-commerce operators are now turning their attention to aviation.

Another strong signal that VR in aviation is heating up as a highly promising startup sector.

That brings us to one of the industry’s most valuable (and often overlooked) assets in Aviation Tech: data.

4. Flight Tracking on Steroids

The hidden champion we’re crowning in the data domain is Flightradar24.

Most of us are familiar with Flightradar24, especially through its iconic live flight maps that often go viral on social media.

- Whether it’s aircraft rerouting around no-fly zones like war zones

- Record-breaking days with the skies packed to capacity

- Or celebrity jets sparking public debate

Flightradar24 has become the go-to window into global air traffic.

But beyond the social media buzz, what makes Flightradar24 truly special is the technology behind it.

- Instead of relying on traditional, closed flight-tracking systems (like radar and onboard transponders visible only to air traffic controllers), the company pioneered large-scale use of ADS-B (Automatic Dependent Surveillance–Broadcast).

- This system enables aircraft to broadcast their positions using unencrypted signals via 1090 MHz, which Flightradar24 captures through a global network of more than 50,000 ground receivers, most of which are operated by volunteers, aka aviation enthusiasts.

In the US and Europe, all commercial aircraft are now required to install ADS-B technology, and Flightradar24 estimates that about 70% of global commercial traffic now carries an ADS-B transponder.

The result?

A real-time map of global air traffic that disrupted the traditional, often restricted world of flight tracking and, most importantly, made it available to everyone.

All you need is the Flightradar24 app or website.

Now, if you think real-time flight maps are just for aviation geeks and digital plane spotters, think again.

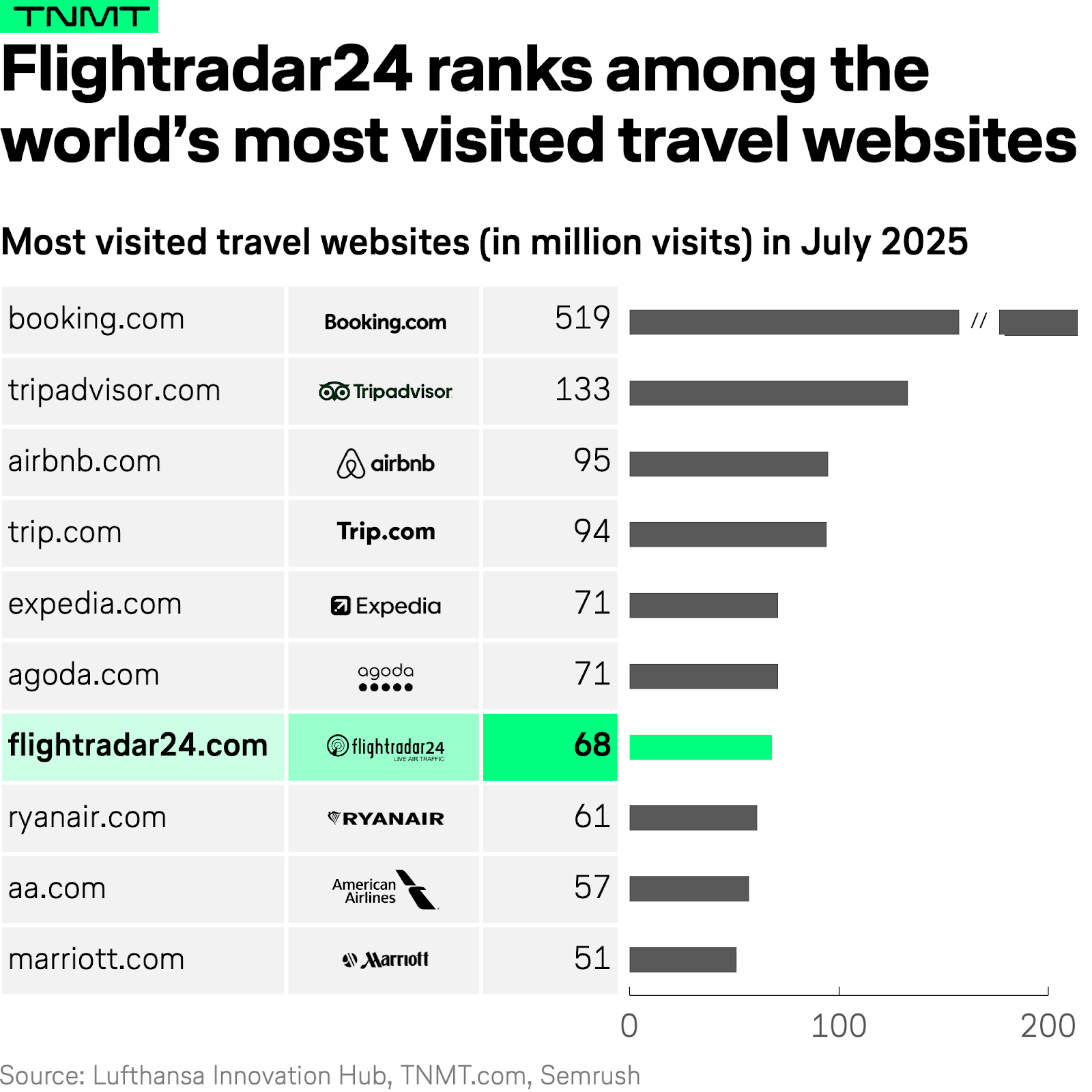

Flightradar24 consistently ranks among the most visited travel websites and apps in the world.

- In July alone, the site received nearly 70 million visits.

- That puts Flightradar24 firmly in the global top 10 travel websites and right up there with OTA heavyweights like Expedia.

- And here’s the kicker: it’s way ahead of any airline website.

So, where does Flightradar24’s massive traffic actually come from?

Sure, the platform is frequently cited in news stories and headline-catching articles – whether it’s tracking unusual travel patterns or reporting on Bill Gates arriving on time for Jeff Bezos’ wedding.

But media buzz alone doesn’t explain the scale of its user base.

Two groups are far more important:

1) Travelers: Millions of passengers use Flightradar24 to track the status of their flights, especially their incoming aircraft, long before the airline provides any transparency. It’s become the unofficial tool for frustrated travelers seeking real-time clarity that airlines rarely offer.

2) Industry users: Airlines and other aviation players (like Boeing, Airbus, and a range of TMCs) increasingly rely on Flightradar24 to monitor not only their own fleets but also those of their competitors.

To serve this growing B2B demand, Flightradar24 launched a dedicated API in October last year, opening up its real-time tracking data for professional use cases at scale.

From side project to profitable powerhouse

And it’s particularly this untapped B2B potential that makes Flightradar24 such a compelling hidden champion in travel.

Because while the company is already financially strong, its current growth trajectory still looks far from fully exploited.

Here’s a look at the high-level numbers:

- Flightradar24 has grown steadily over the past five years, reaching nearly $40 million USD in revenues in 2024, largely driven by its paid subscription model.

- The free version offers live flight tracking for casual users, but it’s the premium tiers (with added data layers, historical flight records, and advanced features) that have converted millions into paying customers worldwide.

What’s even more impressive:

- Flightradar24 operates with profit margins north of 50%.

- Few travel-tech companies can match that kind of financial profile.

- Even more remarkable, the entire business is bootstrapped, with no outside investors.

It all began as a side project in 2006, when the founders were running a flight price-comparison site and started experimenting with ADS-B tracking.

By 2009, Flightradar24 had grown into a standalone business stream and hasn’t looked back since.

But here’s the real kicker: all this success has come primarily from B2C subscriptions.

Once Flightradar24 fully unleashes its B2B potential (through data APIs, airline and airport integrations, and enterprise partnerships), the growth story could accelerate even further.

And we’re not the only ones who think so.

A new chapter under private equity

Four weeks ago, in a move that surprised many, Flightradar24’s founders sold a 35% stake to London-based private-equity firm Sprints Capital at a rumored valuation north of $500 million USD.

That’s serious money, implying an EBIT multiple of roughly 24x.

For a bootstrapped, steadily growing travel-tech company, that’s an unusually rich valuation. (Of course, with no official confirmation, the actual number could be lower.)

Either way, it marks a massive payday for Flightradar24’s founder team, who turned a hobby project into one of Europe’s most valuable aviation data businesses.

Now the big question: what does this mean for the future of Flightradar24?

In all likelihood, a more aggressive monetization path.

- Private equity investors aren’t exactly known for putting user interests first.

- The days of a feature-rich freemium model may well be numbered, as Sprints Capital will look to maximize returns on its half-billion-dollar bet.

On the B2B side, we can expect a significant build-out of Flightradar24’s commercial offering.

The API (already a key growth driver) may see steep price increases as the firm positions itself as the gold standard for professional flight-tracking data.

Whatever happens next, Flightradar24 remains one of Europe’s quiet success stories: a bootstrapped, steadily scaling, and highly profitable business in a tech ecosystem often obsessed with hypergrowth and venture backing.

And Flightradar24 isn’t flying solo.

The surge of attention (and investment) into flight-tracking highlights just how attractive this space has become.

Which brings us to our final section: a closer look at the emerging competitors reshaping the flight-tracking market.

The next wave of flight tracking challengers

Flightradar24 may be the undisputed leader, but it isn’t the only player in the sky.

Several other platforms have carved out niches in the flight-tracking space. A few examples:

- Radarbox.com: A direct consumer-facing competitor offering real-time flight data.

- FlightAware: More analytics-driven, with a strong focus on B2B and government use cases (we’d bet Sprints Capital took a close look at them as well).

- Flighty: Positioned as a high-end travel companion app with a sleek design and a clear B2C focus.

But there’s one emerging company we’re particularly excited about, and, like Flightradar24, it comes from Sweden: Wingbits.

Currently still in beta, Wingbits uses the same ADS-B technology as Flightradar24 and its peers.

But its business model is fundamentally different.

- Instead of relying on volunteers who provide flight-tracking data for free, Wingbits is building the first rewards-based flight-tracking network.

- What that means: contributors are directly compensated with $WINGS tokens for the data they provide.

So far, the strategy seems to be paying off:

- 2,100 active stations installed within the first year, tracking 120,000 flights daily across 85 countries.

- According to Wingbits, the network is growing faster than any other flight-tracking system in the past.

- Over 90% of receivers are exclusive to Wingbits, creating unique data sources rather than duplicating existing coverage.

- More than $9 million USD in VC funding raised across two rounds.

It will be fascinating to see how Wingbits scales from here.

Could it become the next big flight-tracking success story?

One where not just the founders, but an entire community of hardware contributors, share the upside?

Only time will tell.

We’ll keep you posted.

5. Europe’s Quiet Mobility Revolutionaries

In the meantime, let’s quite literally shift gears. From the skies to the streets, we’re turning our lens toward the companies redefining mobility on the ground.

Because in European mobility, there’s one company that has become not only the fastest-growing startup in transportation, but the fastest-growing startup in all of Europe!

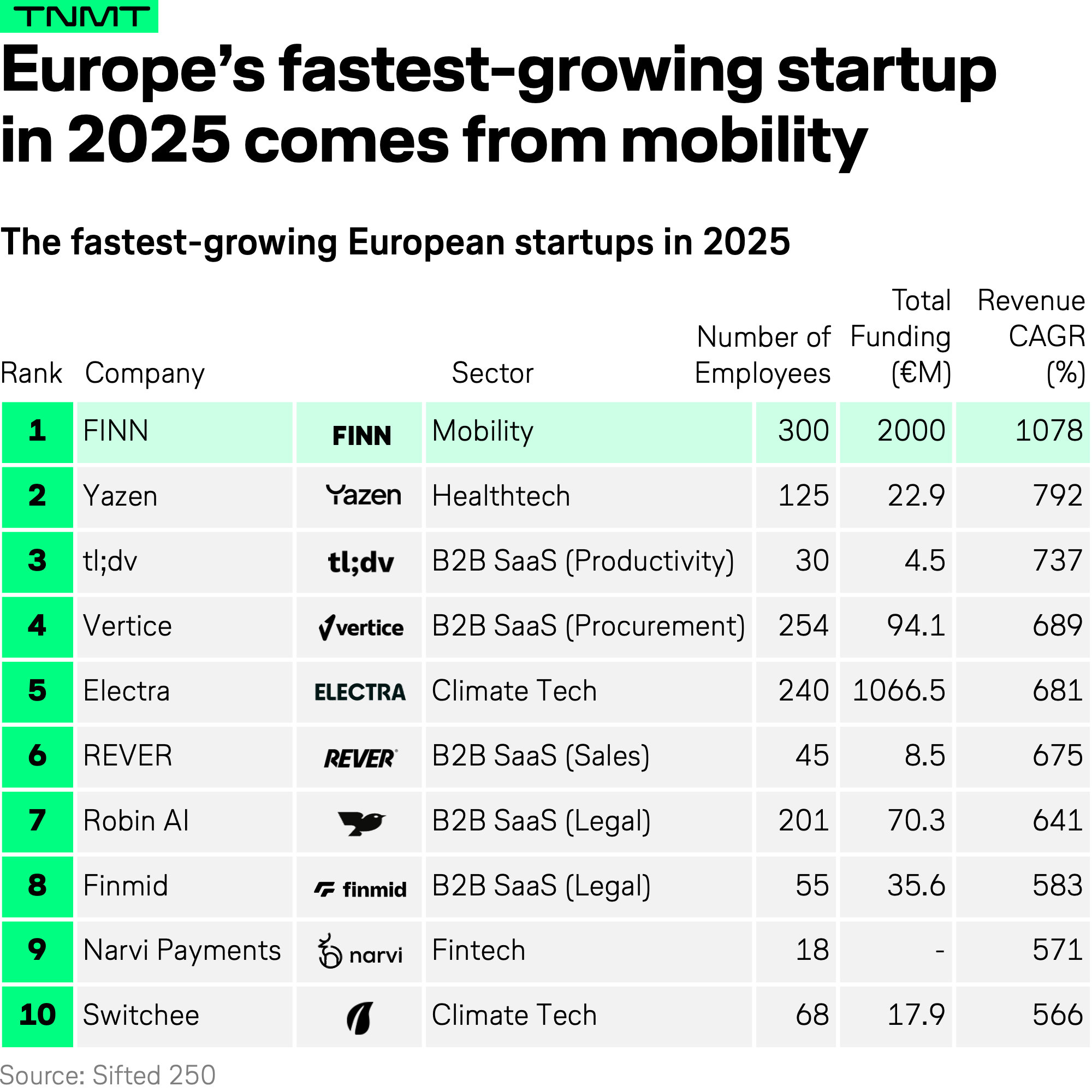

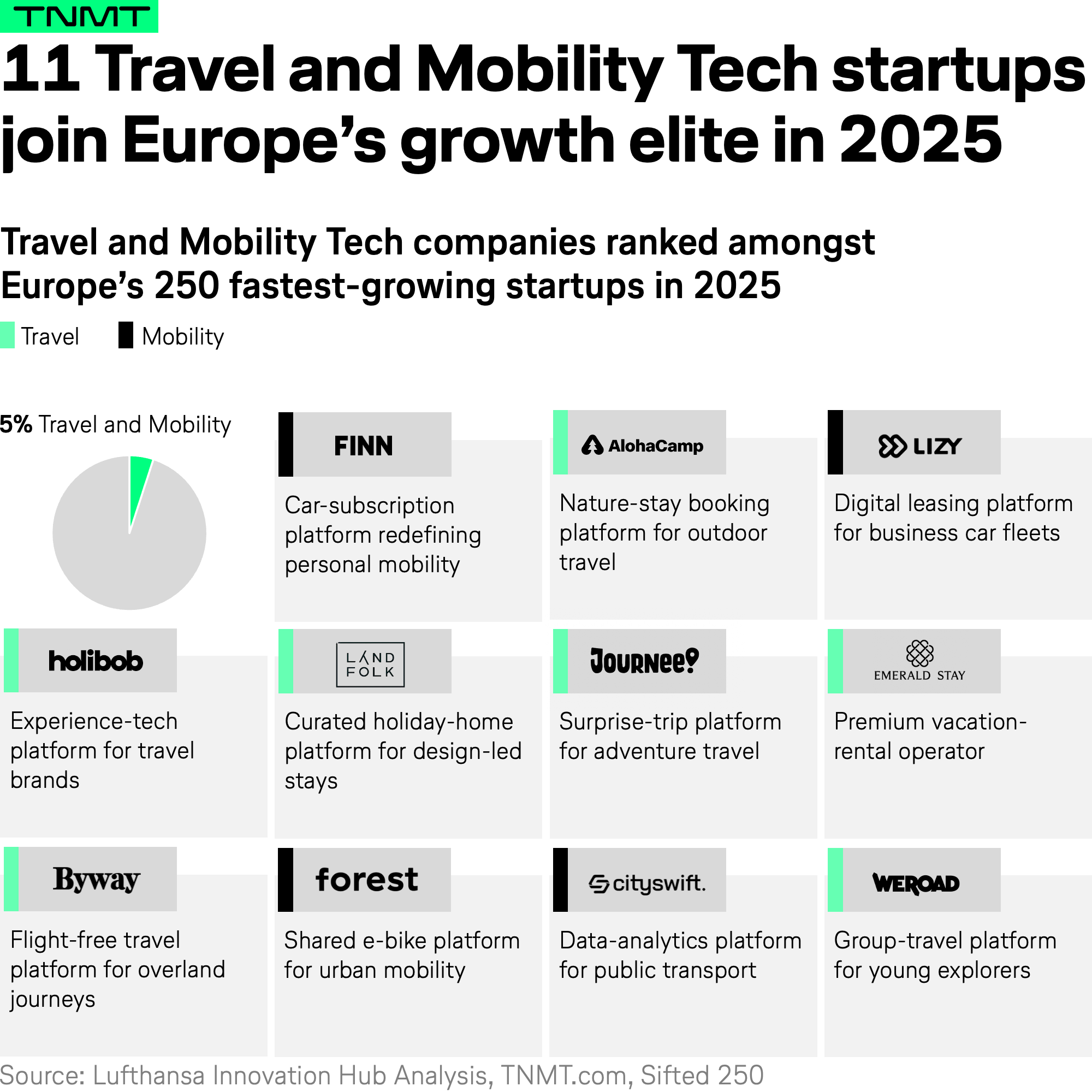

Recently, Sifted released its list of Europe’s 250 fastest-growing startups, and topping the ranking was a name we’ve been watching closely: FINN, the Munich-based car subscription company redefining how people access cars.

FINN has been on a rocket ride, posting a +1,000% annual growth rate over the past two years.

Its hypergrowth has been fueled by major capital injections, most recently a $1 billion USD debt financing round announced earlier this year, which has propelled its expansion across Europe and the United States.

At its core, FINN has disrupted the traditional car rental and leasing model.

How?

The company offers flexible, all-inclusive car subscriptions, where users can select a car online, pay a flat monthly rate, and get insurance, maintenance, and delivery all bundled in.

- No upselling at the counter.

- No endless insurance options.

- No paperwork.

Just a seamless, fully digital experience that feels more like shopping on an e-commerce platform than dealing with a rental desk. (Note to airlines: this is how intuitive booking should look.)

What also sets FINN apart is its almost limitless scaling potential.

It’s building a global category leader in one of the largest asset classes in the world: the car market.

And to put things into perspective:

- Achieving just a 5% market share in the U.S. and Europe would translate into a subscription ARR exceeding €30 billion.

- Opportunities of that magnitude are exceptionally rare in today’s startup landscape.

And here’s where it ties back to travel.

- Monthly car subscriptions aren’t just a convenient alternative for commuters.

- They’re also increasingly relevant for travelers and tourists seeking in-destination mobility options for longer stays, especially in today’s era of hybrid, long-term Blurred Travel.

Beyond FINN: Europe’s wider mobility momentum

In all fairness, FINN isn’t exactly a hidden champion.

Most of us in the startup and tech space have heard of the company; it’s hardly flying under the radar.

So let’s look beyond the top ten of Sifted’s 250 fastest-growing startups list.

- It turns out there’s plenty more happening across the Travel and Mobility Tech ecosystem.

- In fact, 11 companies on that list fall squarely into this category.

As you can see, these 11 companies span a wide range of corners within the travel and mobility spectrum, both in terms of transport modes (cars, e-bikes, public transport) and travel types (nature-focused, luxury, flight-free, or group travel).

Some are more B2C-oriented (AlohaCamp, Landfolk, Journee), while others lean B2B (Lizy, Holibob, CitySwift).

What unites them all is a shared focus on digital simplicity and flexibility; arguably, the key ingredients for any modern value proposition to stick.

Yet, interestingly, none of these fast-growing startups operates directly in the aviation space – a reminder that the skies remain one of the toughest frontiers for disruption.

The next hidden contender

So, let’s return to the aviation context, even though we’re staying firmly on the ground.

- One area we’ve repeatedly called out for promising innovation is the airport environment, particularly the application of robotics.

- And one company that has been on our radar for quite some time, even though it’s still early-stage, is ALBA Robot.

ALBA is a manufacturer of autonomous vehicles, including (and here’s the interesting part) autonomous wheelchairs for airports.

Founded in 2019, the Italian startup recently raised $6 million USD in venture capital and is already showing signs of strong commercial traction (more on that below).

What makes ALBA especially compelling is its dual impact:

- It enhances accessibility and inclusivity for travelers with reduced mobility.

- While simultaneously helping airports mitigate labor shortages, a persistent operational pain point across the sector.

Its B2B model focuses on selling directly to facilities such as airports, offering both its autonomous vehicles and the accompanying fleet management software, which coordinates all vehicles in real time to ensure smooth, efficient passenger journeys.

Like many of the companies mentioned above, ALBA is deeply technology-oriented, going far beyond its core autonomous-driving capability.

For instance, its wheelchairs now feature a ticket-scanning system that reads boarding passes, calculates the route to the gate, and estimates arrival times, acting almost like a robotic concierge for travelers with mobility challenges.

And it’s not just us who are impressed.

ALBA’s technology is already being piloted at Manchester Airport and, most recently, London Stansted.

In summary: a small company solving a big problem.

And a powerful reminder that some of Europe’s most meaningful mobility innovation is happening quietly, just a few meters above the tarmac.

6. And last but not least, Hospitality Tech

To introduce our 10th and final European standout, we need to make a quick detour into a very exclusive neighborhood: Unicorn Land – the elite club of hyper-growth startups valued at more than $1 billion USD.

When looking at the current unicorn club (across all sectors), Europe is far less irrelevant than some people like to suggest.

- In fact, according to Dealroom, the share of unicorns headquartered in Europe has climbed to its highest level in over a decade.

- This year, 23% of all unicorns globally are Europe-based, up from just 15% two years ago.

A quiet shift, but a powerful one, and another signal that Europe’s tech output is reaching levels even the skeptics didn’t see coming.

Which brings us to today’s featured company.

- It’s a unicorn.

- It’s part of the travel ecosystem.

- And unlike household names such as FlixBus, BlaBlaCar, or GetYourGuide, it’s still surprisingly under the radar.

Oh, and one more thing: it’s the only B2B hospitality tech company in the world with unicorn status.

Our final European standout is Mews.

Mews: Europe’s Hospitality Tech Unicorn

While Mews is still “new” to many in the wider tech scene, it’s anything but new in hospitality.

- The company was founded back in 2012 in Amsterdam by two former hoteliers who shared a frustration that hotel technology had barely evolved since the 1990s.

- Their goal was simple but radical: build a modern, cloud-based operating system for hotels from the ground up.

Fast-forward to today, and Mews has become one of the world’s most important hospitality technology companies, and the only pure-play B2B hospitality unicorn globally.

What Mews actually does

Mews provides an end-to-end hospitality cloud for hotel operators. Essentially, the digital backbone that runs a modern hotel.

Its platform covers:

- Property management (PMS).

- Payments.

- Guest experience tools

- Automation for front-office and back-office workflows.

- Integrations with hundreds of third-party hotel-tech providers.

In short: Mews is the OS for hotels, powering everything from check-in to housekeeping to data pipelines.

And the company has fully cracked the scaling challenge that many claim European startups can’t solve:

- Today, over 12,500 hotels worldwide run their operations on Mews.

- The company reported more than $200 million USD in revenue in 2024.

- And it employs 1,000+ people globally.

That’s not a startup anymore; that’s a category leader.

The founder effect

Another element that sets Mews apart?

Its founders.

Anyone who attended the FutureTravel Summit in Barcelona this November saw CEO Matthijs Welle on stage: charismatic, sharp, and genuinely inspiring when talking about the future of travel and hotel tech.

And founder Richard Valtr has earned a reputation across the industry as one of hospitality tech’s most provocative thinkers, challenging legacy models, legacy infrastructure, and legacy assumptions.

(If you haven’t yet, watch his Skift interview below.)

Aggressive, more aggressive, most aggressive

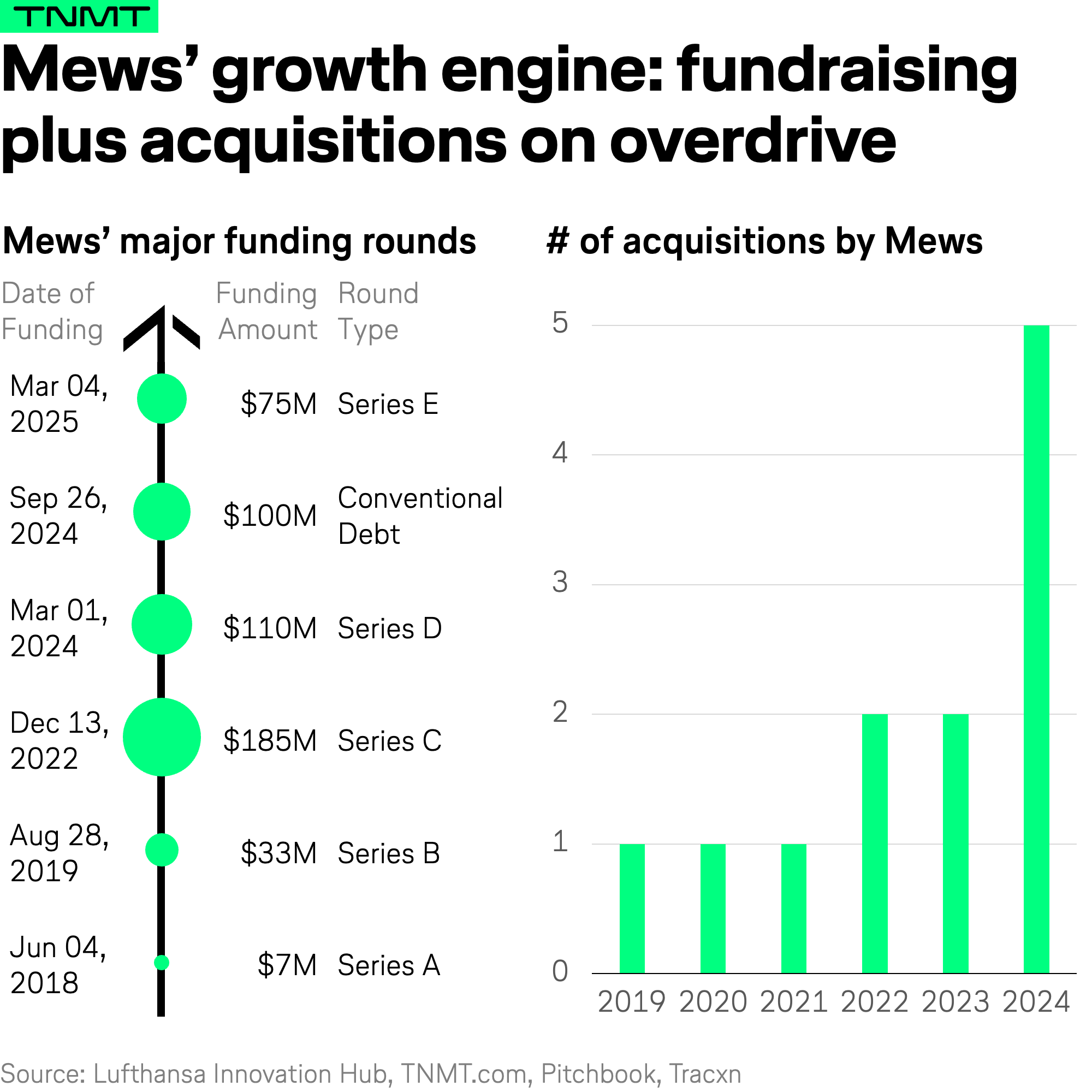

But there’s another way Mews distinguishes itself even more: its scaling strategy.

The company has raised nearly $500 million USD to date (that’s half a billion!), including a $75 million Series D this March.

But instead of spending it on marketing burn, Mews has taken a hyper-strategic acquisition approach:

- Our deal tracking shows 12 acquisitions through 2024.

- And that number has grown with two more deals announced just last month with DataChat and Flexkeeping.

Flexkeeping (a housekeeping automation platform) strengthens the operational stack, but DataChat is the real game-changer.

It marks a major step toward building fully agentic hospitality systems, where intelligent agents autonomously:

- Manage day-to-day hotel operations.

- Optimize performance.

- Adapt workflows in real time.

- Free staff to focus on guest experience, not admin.

This aggressive (and admittedly risky) acquisition approach currently places Mews well ahead of other hospitality-tech players, including both startups and incumbents like Oracle and Cloudbeds.

A hospitality tech unicorn… with its own VC arm

Another element that sets Mews apart is its governance structure.

To support its appetite for acquisitions, Mews built Mews Ventures: its own in-house venture vehicle.

Highly untypical for a VC-backed scale-up, but perfectly aligned with its strategy: own the ecosystem, shape the category, and consolidate the fragmented hotel-tech landscape.

Closing the 2025 European Standout Series

This wraps up our 2025 European Standout Research Storyline.

The ten standout companies we highlighted are proof that Europe’s Travel and Mobility Tech landscape is far more dynamic than the stereotypes allow.

Each one tackles a real problem, scales across borders, and pushes the boundaries of what’s possible in aviation, mobility, hospitality, and beyond.

This is Europe at its best: quietly building the foundations of the future.