To the occasional traveler, frequent flyer programs usually feel like just another retail gimmick.

- Complicated point systems.

- Blackout dates.

- Endless fine print.

A marketing scheme that’s more of a hassle than help.

But for road warriors and business travelers, these programs have long been a kind of golden ticket: priority boarding, upgrades, lounge access, and the occasional “free” first-class flight–if you’ve played the game right.

Over the years, they’ve become symbols of savvy travel, even lifestyle flexes for frequent flyers.

And make no mistake. Airlines didn’t just invent this game; they perfected it.

In fact, the modern loyalty program was born in aviation.

- American Airlines’ AAdvantage, launched in 1981, is widely credited with pioneering the concept of tracking customer behavior to drive repeat purchases, long before the term “retention engine” became a startup cliché.

- What started in the skies eventually spilled into nearly every consumer-facing sector, from hotel chains and credit card companies to grocery stores and coffee apps.

But for airlines, loyalty programs have always been more than a marketing tool.

They’re serious business.

Especially in the U.S., loyalty has grown into a high-margin, high-stakes empire.

Fueled by lucrative co-branded credit card partnerships, where banks buy miles in bulk to reward customers, these programs can now account for more than 20% of an airline’s total revenue (see Southwest in the chart below). In some cases, the loyalty arm is worth more than the airline itself.

And it’s not just an American phenomenon.

Across Europe, major legacy carriers (including our parent company Lufthansa) have built billion-dollar loyalty machines of their own. These programs now represent powerful standalone business units with sizable P&Ls and strategic leverage.

But here’s the twist: despite their profitability, these once-beloved programs are coming under increasing scrutiny.

- Travelers are growing disillusioned.

- Perks are harder to earn.

- Rules keep changing.

- And the value exchange is starting to feel…off.

It was time for us to take a closer look.

The Growing Loyalty Backlash

In recent years, frustration with airline loyalty programs has been growing louder.

- Frequent travelers, once proudly flashing their elite status, are increasingly questioning the real-world value of these programs.

- Earning perks feels harder, redemption options are more limited, and the goalposts keep shifting.

But until recently, much of this discontent was mostly anecdotal: loud voices on social media, sporadic complaints, and the occasional think piece, for example, in the New York Times.

So, we went looking for harder data.

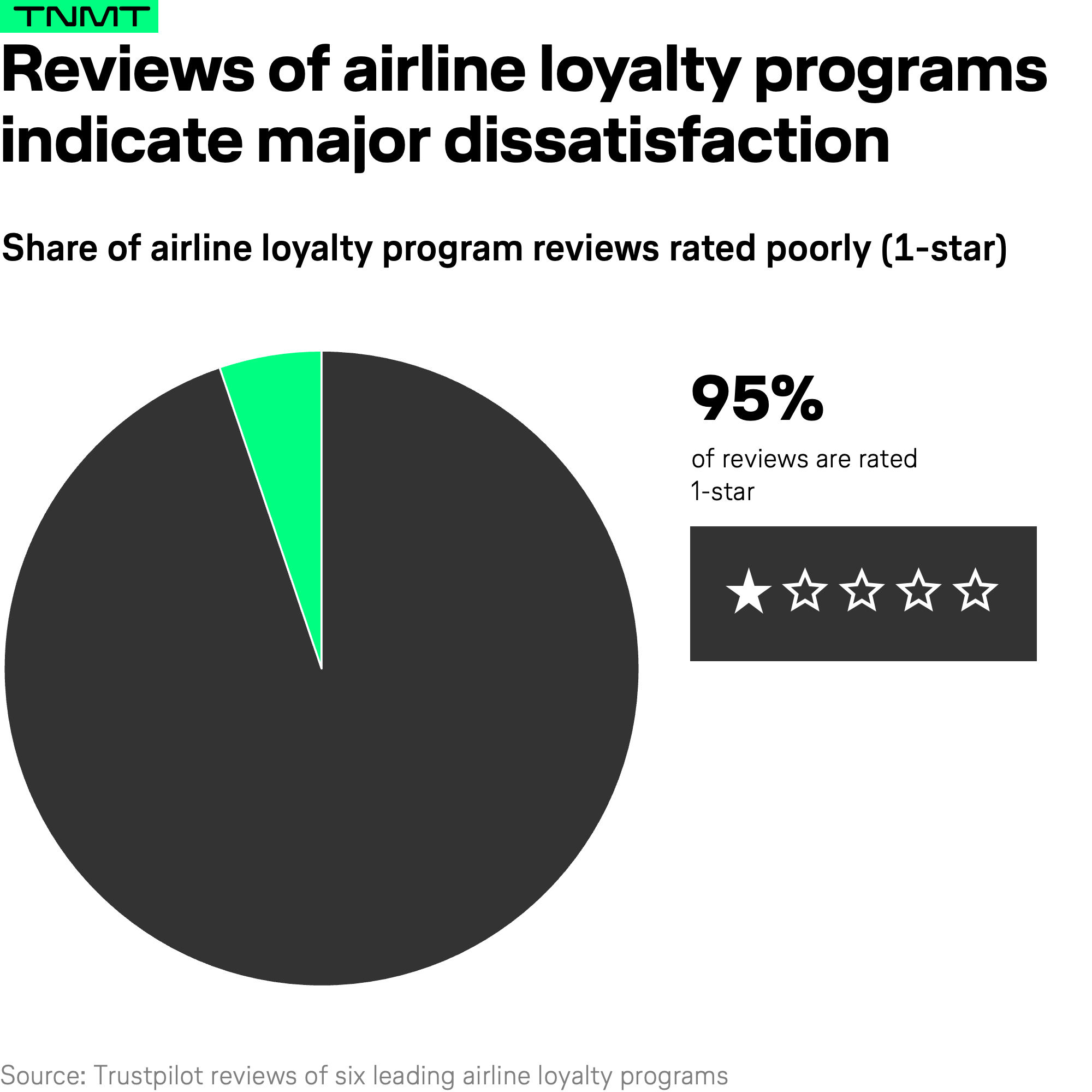

First stop: Trustpilot, a popular consumer review platform where customers share open-ended feedback about their experiences with brands and services.

Our finding: A staggering 95% of airline loyalty program reviews between 2019 and 2025 are rated just one star, the lowest possible score.

In all fairness, the sample may be somewhat skewed:

- Platforms like Trustpilot tend to attract more feedback from those with particularly strong (and often negative) experiences.

- In general, people are more likely to post reviews when they’re angry, not when they’ve scored an upgrade to business class.

- But even so, 95% is far from noise. It’s a warning sign.

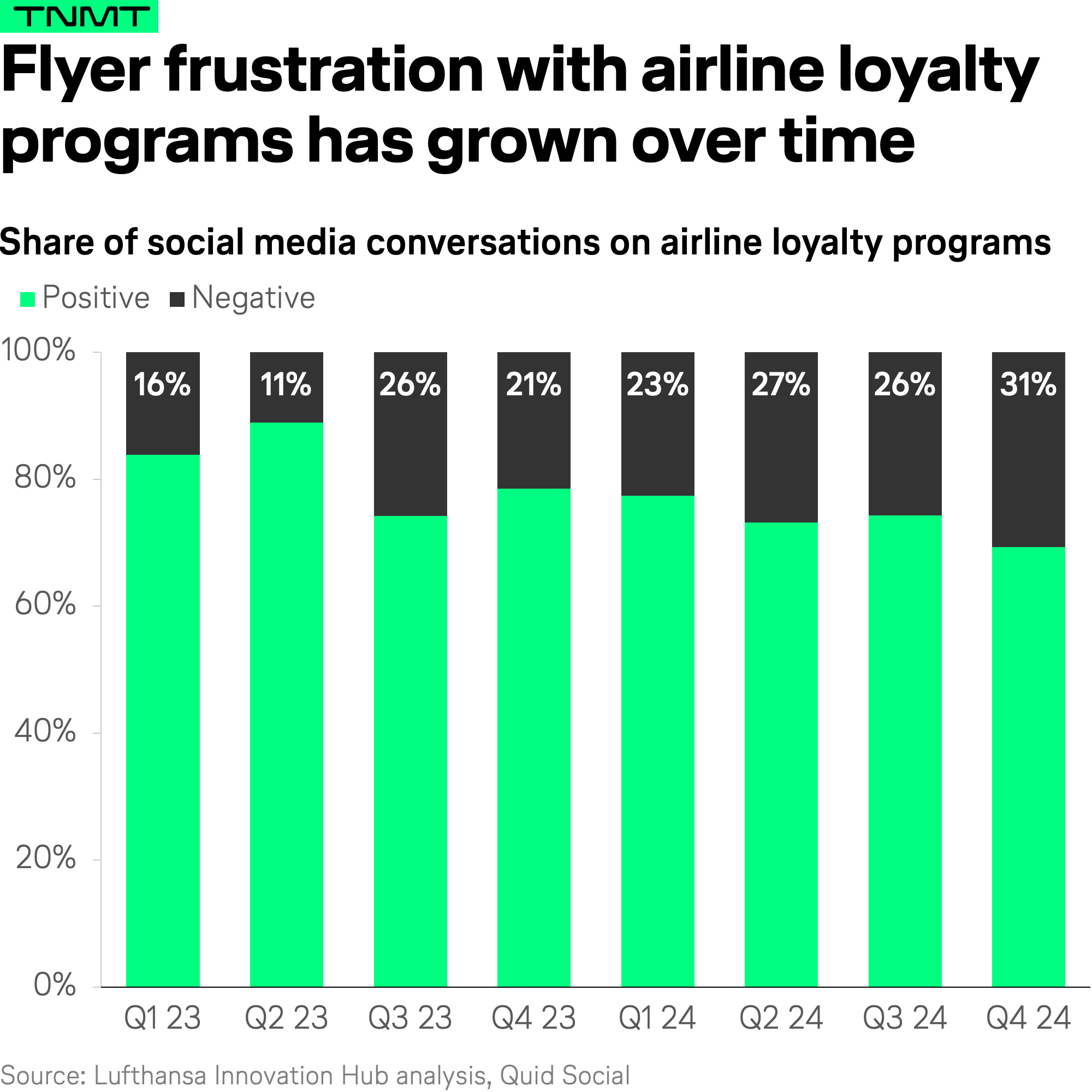

To cross-check the signal, we tapped a broader and more neutral source: social media.

- We scraped about 10,000 recent posts across major platforms like X (formerly Twitter), Facebook, Instagram, Reddit, and a few consumer forums, specifically targeting discussions around airline loyalty programs.

- Using natural language processing (via our data tool Quid), we analyzed the sentiment behind each post.

The result?

A more balanced picture than Trustpilot, yes, but still troubling.

- As of Q4 2024, one in three social media posts about airline loyalty programs carries a negative tone.

- Even more importantly, negative sentiment has been rising steadily over the past two years.

This is not just a few disgruntled voices yelling into the void. It’s a growing trend that airlines can’t afford to ignore.

But what exactly is behind this dissatisfaction?

To dig deeper, we turned to Point.me, a specialist platform known for its detailed assessments and rankings of global airline loyalty programs.

Its methodology breaks down program quality into multiple criteria, such as ease of redemption, value per mile, program transparency, and partner airline availability.

Here’s what we found:

- Most airline loyalty programs underperform across the board.

- Only one category, “availability of partner airlines”, meaning how easily you can redeem your points with non-home carriers in the same alliance, had more programs rated positively than negatively.

- For everything else, at least half of the programs fell short of expectations.

What’s causing this dissatisfaction in program quality and customer trust?

The Loyalty Betrayal?

The rising dissatisfaction with airline loyalty programs is not simply the result of shifting customer expectations. A major part of the story lies with the airlines themselves, who, over the past few years, have fundamentally altered the design and value proposition of their loyalty schemes.

Some might say this is eroding the very loyalty these programs were meant to foster.

- Starting in 2023, a wave of program overhauls swept across the industry.

- And unlike past updates aimed at expanding partner networks or adding perks, the recent changes have largely been unfavorable to customers.

Here’s the gist: Loyalty programs are not necessarily about loyalty anymore.

- Historically, frequent-flyer programs were designed to reward miles flown.

- The more you traveled, especially on longer routes, the more points you accumulated, making the system particularly attractive to frequent business travelers and aviation enthusiasts.

But that logic is rapidly disappearing.

- In 2023 and 2024, major carriers, including Delta, United, Emirates, and our own Lufthansa, transitioned to revenue-based models.

- That means elite status and point earnings now hinge primarily on how much money travelers spend, not how often or how far they fly.

One of the biggest gut-punches to longtime members? The elimination of fixed award charts.

- Many airlines, including American and United, have adopted dynamic pricing for award tickets.

- So instead of predictable mileage thresholds (e.g., 60,000 miles for a transatlantic business-class flight), redemption prices now fluctuate like cash fares.

- That same seat might now cost 150,000 miles, or more, depending on demand.

Travelers who spent years saving miles for aspirational redemptions are now finding themselves priced out, while the rules keep changing with little warning.

Even worse: airlines have consistently marketed these updates as enhancements, often burying the real trade-offs in fine print.

The result?

A growing sense of disillusionment. Airline reward programs, once seen as relationship builders, are now viewed as extractive and often misaligned with customer expectations.

Unsurprisingly, the backlash has been loud:

- Delta’s overhaul of SkyMiles triggered such intense public outcry that the airline had to walk back several changes.

- United and British Airways also faced mounting criticism after reducing elite perks and inflating redemption costs – both airlines were forced to reverse parts of their rollouts following customer uproar.

The irony is hard to miss: loyalty programs are undermining the very loyalty they were meant to build.

And while travelers once put up with small changes in exchange for aspirational rewards, the recent wave of devaluations has broken that contract.

For many, the magic is gone.

So, if loyalty is no longer earned through flying, and the rewards feel increasingly out of reach, what’s next?

Let’s look at where opportunity might still lie.

Startups Are Taking on Loyalty’s Broken Promise

There’s a bright side to all of this.

When legacy systems underdeliver, especially in high-margin categories where customers are both loyal and willing to spend, opportunities for disruption tend to emerge quickly.

And that’s exactly what we’re seeing in the travel loyalty space.

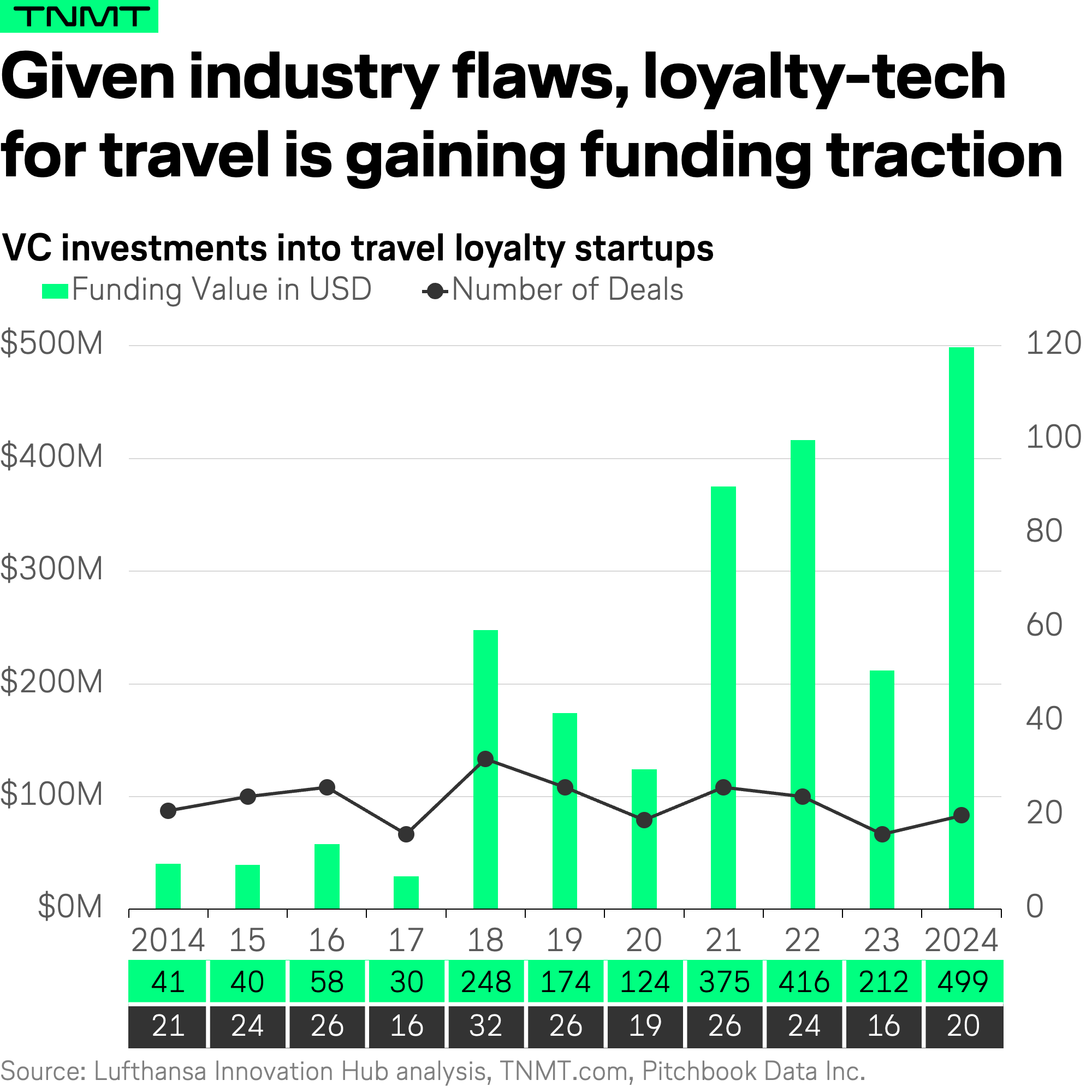

The frustration with today’s airline reward programs has triggered a wave of entrepreneurial response.

- Founders and investors are sensing a moment: a chance to reimagine loyalty from the ground up.

- Venture capital has followed suit.

- In 2024, investment in travel loyalty startups reached an all-time high, nearly half a billion dollars.

Recent VC investments into startup examples include:

- Arcube, a startup building modern airline loyalty infrastructure.

- Superlogic, which raised a Series A to offer experiential, non-monetary rewards.

- Point.me, a fast-growing search engine and booking tool that helps users find and book reward flights using points or miles from various airline and credit card loyalty programs.

At the Lufthansa Innovation Hub, we’re closely tracking a new generation of loyalty disruptors, and we’re seeing some exciting patterns.

- Many of these startups are no longer treating loyalty as a rigid points system.

- Instead, they view it as a layer of emotional experience, tailored to individual preferences and designed to spark a genuine connection between the brand and traveler.

In practice, this means shifting from transactional rewards (think: earn 5,000 miles, get €50 off) to more flexible, surprise-driven benefits like early access, exclusive events, and personalized perks based on actual behavior and values.

This evolution is particularly relevant for younger travelers, especially Gen Z, who have never experienced the “golden age” of traditional loyalty programs.

- They don’t miss award charts or predictable redemption tables.

- Instead, they expect brands to reward them with relevance, not just rebates.

- And as this generation’s share of travel spending grows, so too does the pressure on airlines to rethink what loyalty should actually mean in 2025 and beyond.

Curious which startups are leading the loyalty revolution?

Who’s Leading the Travel Loyalty Revolution?

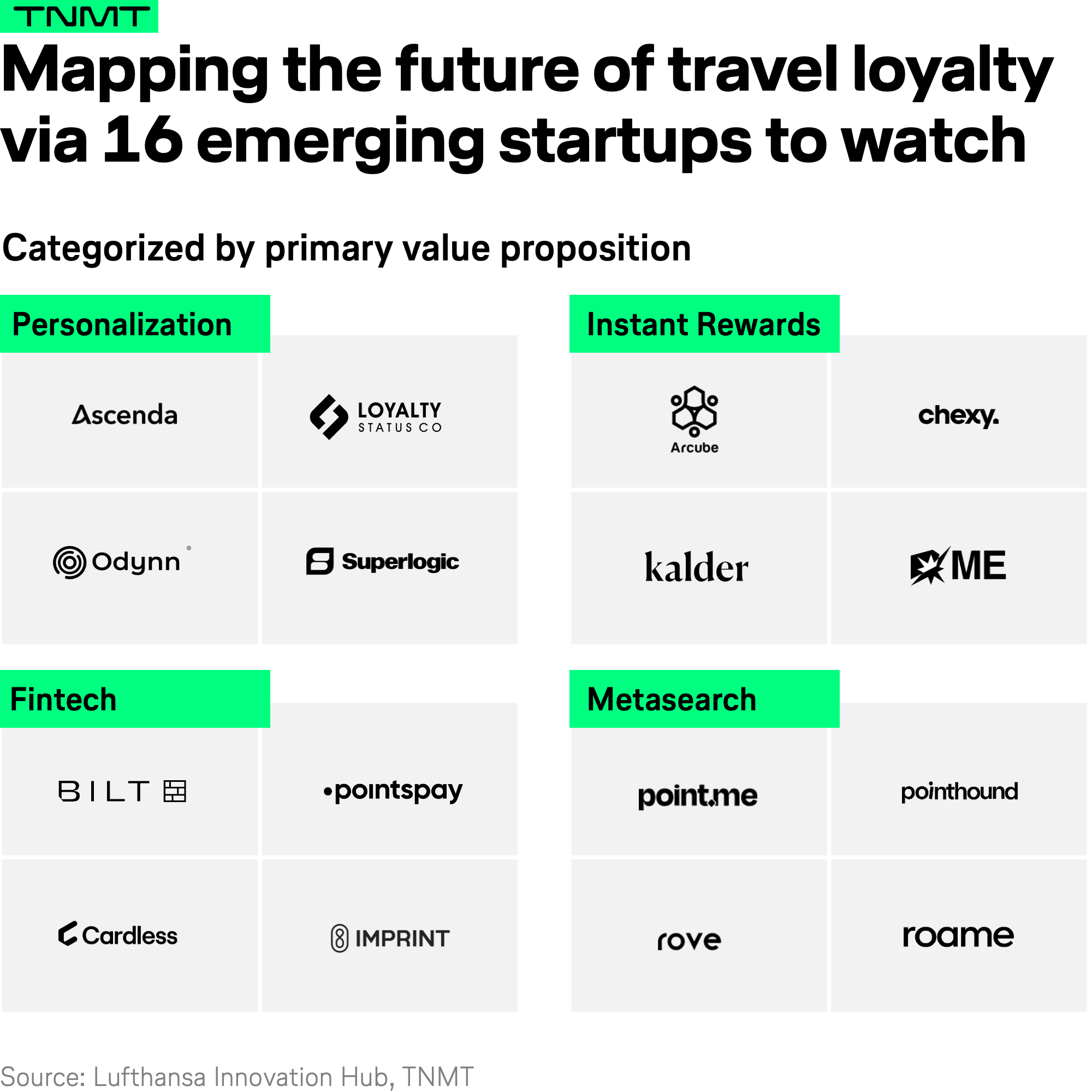

Our TNMT startup scouting efforts (part of the broader Lufthansa Group Venture Clienting ecosystem we operate through Startup Gate) have surfaced a growing wave of innovators rethinking what airline loyalty should look like in 2025 and beyond.

While loyalty innovation today spans a wide spectrum, from travel subscriptions to premium membership models, we’ve focused this mapping on startups that specifically reinvent the traditional points-based reward logic.

- In the chart below, you’ll find 16 standout travel loyalty startups that we believe are reshaping the landscape.

- They represent the sharpest signals of a broader shift in how loyalty is earned, redeemed, and experienced.

To make sense of this new terrain, we’ve grouped them into four distinct categories, each reflecting a different strategic angle, aka value proposition.

Let’s unpack what defines each cluster.

1. Personalization: From Pots to Personalized Perks

Most frequent flyer programs today still suffer from a rewards hangover: think generic catalogues full of uninspiring items (yes, including that infamous kitchen pot).

However, a new crop of loyalty startups is flipping the script by tailoring rewards to the individual, rather than the average.

At the heart of this category is personalization, the idea that loyalty rewards should reflect a traveler’s unique preferences, behaviors, and context.

Using AI and advanced analytics, these startups are ditching the one-size-fits-all approach in favor of dynamic offerings that feel relevant, timely, and experiential.

- Instead of redeeming points for random household items, travelers might now unlock a cooking class in Tuscany, a surprise room upgrade at their favorite boutique hotel, or VIP access to a local concert at their destination.

- In short, rewards become part of the journey, not an afterthought.

For airlines, this shift couldn’t be timelier.

Too often, the flight is viewed as merely the functional aspect between departure and destination.

But if rewards become part of the travel memory, blending seamlessly into the broader experience, they can help airlines reposition themselves as emotional brands, not just logistical ones.

One startup at the forefront of this movement is Superlogic, a loyalty tech company that turns rewards into real-world experiences:

- The platform lets brands (like airlines) integrate their white-label solution and offer their customers high-end, experiential redemptions, including courtside NBA seats to behind-the-scenes museum tours.

- Under the hood, the platform tokenizes loyalty points using blockchain, enabling more flexible, transparent redemption.

- The platform has an AI engine that personalizes rewards based on individual behavior and past redemptions, increasing emotional engagement and reducing churn.

Most notably, they co-created Bookit, a travel-centric rewards platform in partnership with Open Network Exchange (ONE), blending flights, hotels, and premium retail perks into a single loyalty experience.

With $13.7 million USD in Series A funding raised in early 2025, Superlogic is a strong signal of where loyalty is heading next:

Away from points-as-currency, and toward experiences-as-connection.

2. Instant Rewards: From Delayed Gratification to In-The-Moment Delight

One of the biggest frustrations with traditional airline loyalty programs?

You wait. And wait. And wait…

You spend months or even years accumulating miles, only to be met with uninspiring merchandise or blackout-date-limited redemptions that feel far removed from the magic of travel.

But the new wave of loyalty startups is flipping that model on its head.

- Instead of delayed gratification, they’re delivering instant rewards, so perks that activate in real time, right when travelers need them most.

- Consider extras such as extra baggage allowance, seat upgrades, or lounge access, but not at the time of booking (when most people are still weeks away from departure and not yet thinking about baggage), but rather at the airport or mid-trip.

And one startup is taking this logic a step further: Arcube.

- Arcube is turning the entire structure of loyalty programs upside down.

- Rather than focusing on redemptions before or during a journey, Arcube activates rewards after a trip is completed, when travelers are still mentally in “travel mode” and most receptive to relevant upgrades for their next journey.

Its key innovation?

Allowing travelers to convert unused frequent flyer miles–often left to expire under traditional programs–into personalized ancillary services for future flights.

For travelers, it’s a win. For airlines, it’s a revenue engine.

- Its dynamic pricing model ensures that each offer feels personalized and timely, boosting conversion rates and incremental spend.

- From a tech standpoint, Arcube also offers a B2B white-label solution, with flexible configurations (UI and CLI) that airlines can fully customize or plug into existing rules engines.

It’s already making waves:

- Etihad became Arcube’s first major airline partner and reported a 10%+ uplift in average order value during a pilot rollout.

- Recognition followed fast: Arcube was crowned “Best Loyalty Startup of the Year” at the Golden Loyalty Awards, won the Technology Category at the 2024 Venture Further Awards, and was a startup pitch winner at Phocuswright 2025.

3. Fintech Focus: Where Payments Meet Points

The next wave of travel loyalty is being driven by fintech.

Rather than focusing on airline perks alone, a new class of startups is blending loyalty with payment technology, unlocking ways to earn and redeem points in more flexible, everyday contexts.

At its core, this trend is about expanding the utility of loyalty rewards beyond the airline itself.

- Traditionally, frequent flyer points could only be redeemed within tightly controlled ecosystems, think flight upgrades or in-flight merchandise.

- But these fintech-driven models are rewriting that rulebook.

Today, loyalty currencies are being unbundled.

Instead of letting your miles sit idle or tying them to limited flight-based redemptions, you can now use them in more dynamic ways: from retail purchases to digital services.

Imagine booking a trip with airline points, then using leftover rewards to shop on Amazon.com.

One company championing this shift is Pointspay, a Swiss-based platform that allows users to earn and redeem loyalty points directly at e-commerce checkouts, bringing travel rewards into the world of everyday spending.

Another standout player is Cardless, a U.S.-based white-label provider building co-branded credit cards with built-in loyalty functionality.

- Its platform enables airlines to embed credit cards directly into their websites or mobile apps, streamlining both sign-up and usage.

- Cardless has already partnered with major carriers like Qatar Airways, LATAM Airlines, and TAP Air Portugal.

- The provider recently dropped its “one-card-per-lifetime” rule, allowing travelers to hold multiple airline cards and stack rewards more flexibly.

In late 2024, the company secured $30 million USD in later-stage funding to further expand its fintech loyalty infrastructure.

Both startup examples show that next-gen loyalty approaches are loosening the grip of legacy programs by turning loyalty points into a spendable, fluid currency. Anytime. Anywhere!

4. Metasearch for Loyalty: Navigating the Points Maze

If the loyalty landscape feels increasingly fragmented and opaque, you’re not alone.

For travelers juggling multiple airline or hotel programs, maximizing their points has become a complex game of guesswork and fine print.

Enter loyalty metasearch.

- Much like travel metasearch platforms such as Kayak or Skyscanner solved the flight pricing overload of the 2010s, a new wave of loyalty-focused search engines is tackling the reward system sprawl of the 2020s.

- These platforms enable travelers to search, compare, and redeem flights, hotels, or services, not based on cash prices, but based on their available points and miles.

By aggregating offers across providers, they bring much-needed transparency to a system that’s long been designed for insiders.

- More importantly, many of these tools offer “earn-and-burn” functionality across brands.

- That means users not only see where they can redeem rewards, but also where they can continue earning points, all from a single interface.

- The result: smarter choices, better value, and less friction.

A standout player in this category is Rove.

Founded in 2023, Rove is a universal airline mile platform that functions as a metasearch engine for loyalty rewards.

It enables travelers to both earn and redeem across multiple airline and hotel loyalty programs through a single, interoperable experience.

Some of its key features:

- A browser extension and travel portal that lets users earn points on everyday spending, from online shopping to travel bookings, and convert them into miles or hotel points.

- Full interoperability with 12 global loyalty programs, including Air France-KLM Flying Blue, Qatar Airways Privilege Club, Etihad Guest, and Air India’s Maharaja Club.

- Redemption options across 140+ airlines and 200,000+ hotels, all layered on top of users’ existing credit card rewards.

In other words, Rove turns fragmented loyalty currencies into a unified rewards wallet, making it especially appealing to occasional travelers who want simplicity without sacrificing value.

And that’s exactly where the broader shift is headed: away from complexity, toward clarity.

As travelers grow savvier (and startups get bolder), airlines can’t afford to ignore these emerging models.

To keep their golden loyalty goose alive, they’ll need to start testing new ideas before someone else wins over their most valuable travelers.