The airline industry is facing a silent crisis.

While much attention has been given to soaring post-pandemic travel demand and record-breaking passenger volumes, a critical issue has gone largely unnoticed: IT spending in the airline sector has plummeted.

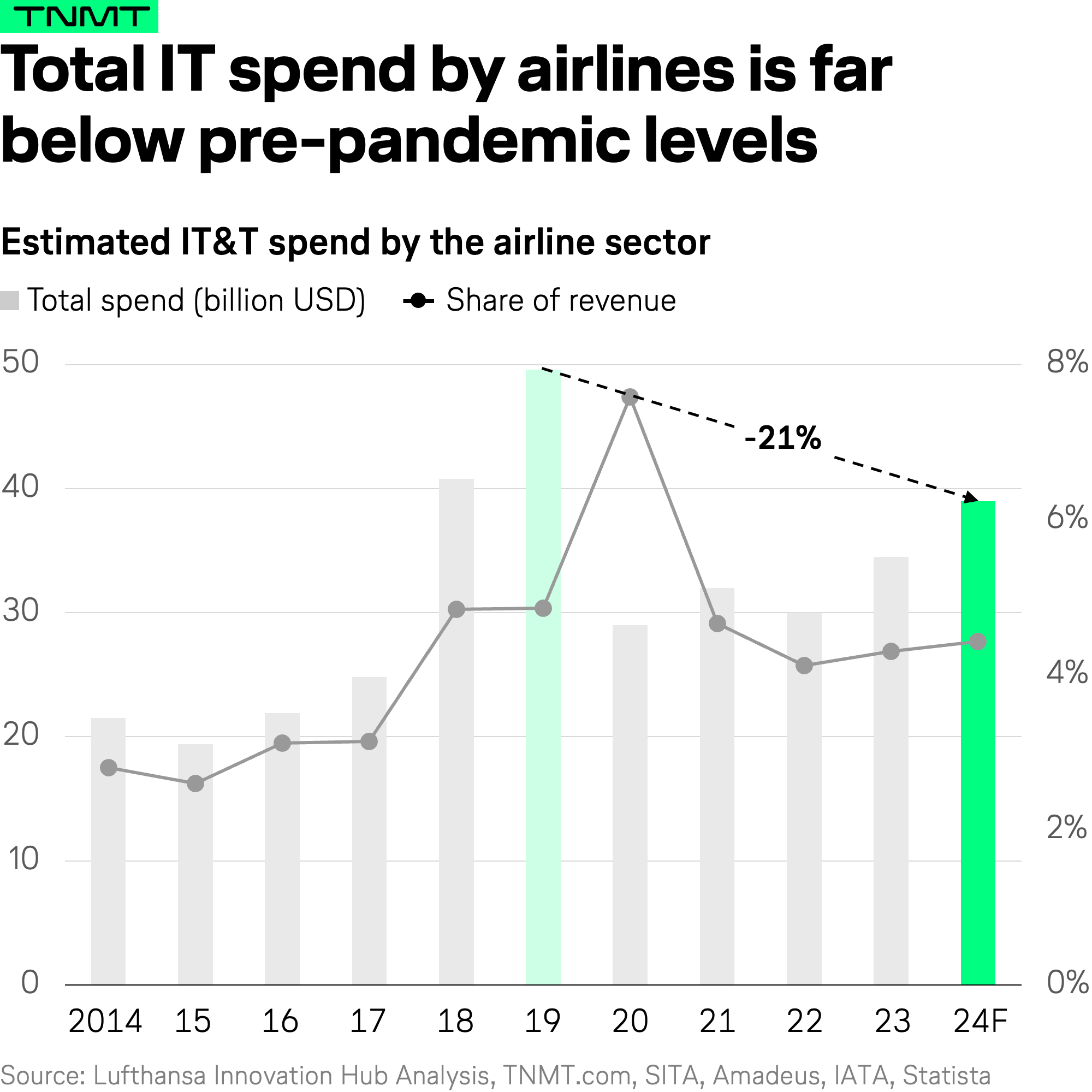

- In 2024, total IT spending by airlines is expected to reach approximately $39 billion USD—a staggering 21% decline from the $50 billion USD spent in 2019.

- Even more concerning, IT investment as a share of total revenue has fallen from an already low 5% pre-pandemic to about 4% today.

This trend raises an urgent question: Can airlines meet the challenges of modern technology demands when their technology budgets are shrinking?

We believe the answer is no—and the consequences are already showing.

Record-high customer dissatisfaction (see our traveler-frustrations analysis), driven by unstable flight operations and poor booking experiences, as well as recurring IT failures during peak travel periods, point to an industry struggling to handle today’s customer demands and operational complexities.

The lack of adequate IT investment is leaving airlines at a severe disadvantage, particularly as the travel sector becomes increasingly dependent on advanced digital solutions.

In this article, we argue for a complete reframing of how airlines approach IT spending.

We’ll explore:

- Why IT spending is essential for operational stability and long-term growth.

- How airports are outpacing airlines in digital innovation.

- Why reversing this trend is crucial for success in today’s travel landscape.

IT Spending: From Cost Center to Ops Stabilizer

For too long, most airlines have deprioritized the strategic need to modernize their legacy IT systems. This oversight has led to dramatic disruptions in recent years, exposing the critical weaknesses in outdated technology infrastructures.

- The consequences of this neglect were painfully evident in December 2022, when Southwest Airlines faced a severe crew scheduling outage. Coinciding with a winter storm, the crisis overwhelmed the airline’s outdated crew management systems, which lacked automation and relied heavily on manual processes. The result? Nearly 17,000 flights were canceled during the peak holiday season, throwing millions of travelers’ plans into chaos. Southwest’s failure to modernize its scheduling software turned a manageable weather disruption into a catastrophic operational meltdown.

- Delta Air Lines offers another cautionary tale. A faulty software update from CrowdStrike in 2023 disrupted Delta’s systems, leading to over 7,000 flight cancellations and stranding 1.3 million passengers over five days. While the airline attributed the failure to CrowdStrike, the cybersecurity firm highlighted Delta’s outdated IT infrastructure as the root cause that amplified the incident’s impact. The resulting chaos cost Delta an estimated $500 million USD—an expensive reminder of the risks tied to aging IT systems.

These incidents underscore a critical truth: outdated IT systems aren’t just a technological liability; they’re an operational risk. Airlines that fail to prioritize IT modernization risk not only financial loss but also severe reputational damage.

IT Spending: From Cost Center to Growth Driver

IT spending extends far beyond maintaining the operational backbone of airlines. To prove this, we need to confront the long-standing misconception that IT investments are merely costs to be trimmed, a mindset frequently reflected in airline boardrooms.

This narrow view misses the bigger picture.

Research consistently demonstrates that prioritizing digital transformation is not merely an operational necessity but a powerful driver of financial growth and competitive advantage.

Take banking, for example.

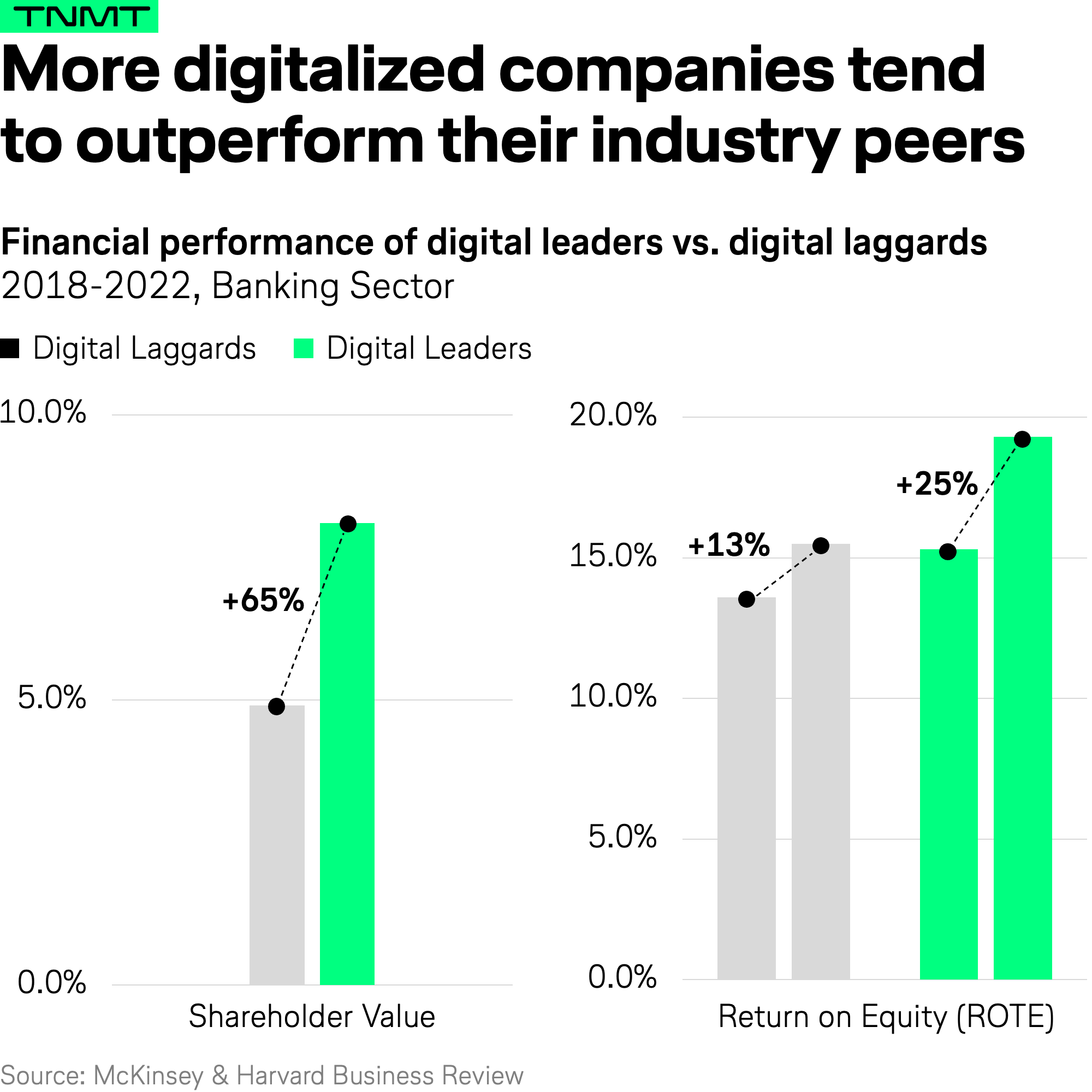

- Research from Harvard and McKinsey revealed that between 2018 and 2022, digital leaders in banking achieved an average annual total shareholder return of 8.1%, compared to just 4.9% for their less digitally mature counterparts.

- Moreover, these digital leaders saw significantly higher returns on pre-tax tangible equity (ROTE), increasing from 15.5% to 19.3%, while laggards managed only a modest rise from 13.6% to 15.3%.

What’s behind this outperformance?

These companies excel in two critical dimensions: driving revenue growth and controlling costs.

So digital IT transformation can directly impact both the top and bottom line by making customers happier (leading to a higher willingness to pay) and streamlining operations (resulting in cost savings).

And this dynamic isn’t limited to banking.

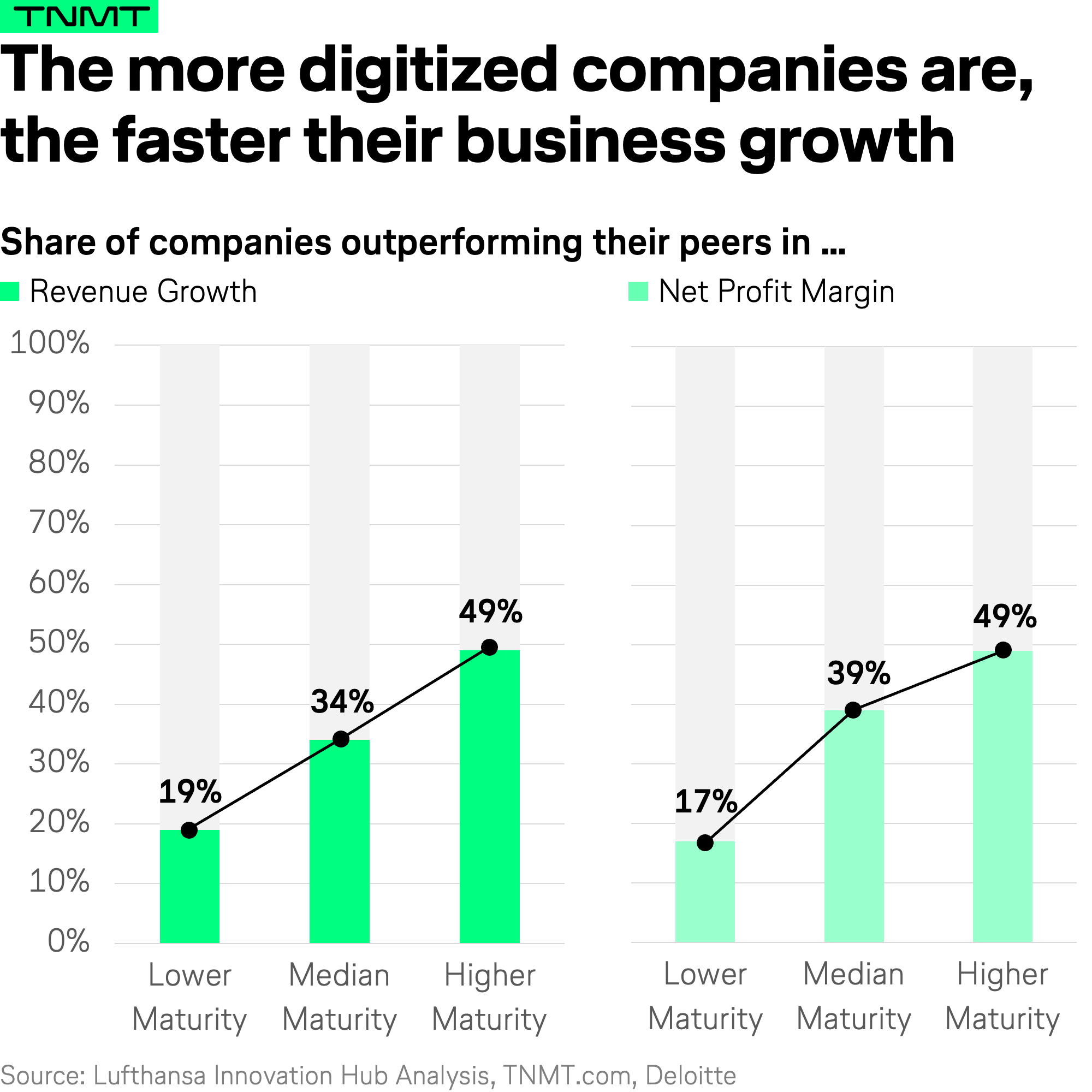

Across industries, digital maturity correlates directly with superior performance:

- A BCG study found that digital leaders achieve earnings growth 1.8 times higher than digital laggards.

- Deloitte confirms that the more digitally mature organizations are, the higher their revenue and profit margin growth.

The connection between IT investment and performance holds true for airlines as well.

- Research by Remarkable Group found a strong link between digital maturity and customer satisfaction. In fact, 80% of the top five most digitally advanced airlines also ranked highest in customer satisfaction metrics.

- For an industry plagued by customer frustration and razor-thin margins, this is a critical insight.

The takeaway is clear: IT spending is not a mere cost—it’s an investment in operational stability, but also customer loyalty, competitive differentiation, and financial growth.

What this means: For airlines, meaningful growth in IT investment is no longer optional—it’s a strategic necessity for survival and profitability.

With this in mind, it’s time for a mindset shift: stop calling it IT spending and recognize it as IT investment—the cornerstone of success in an increasingly digital-first world.

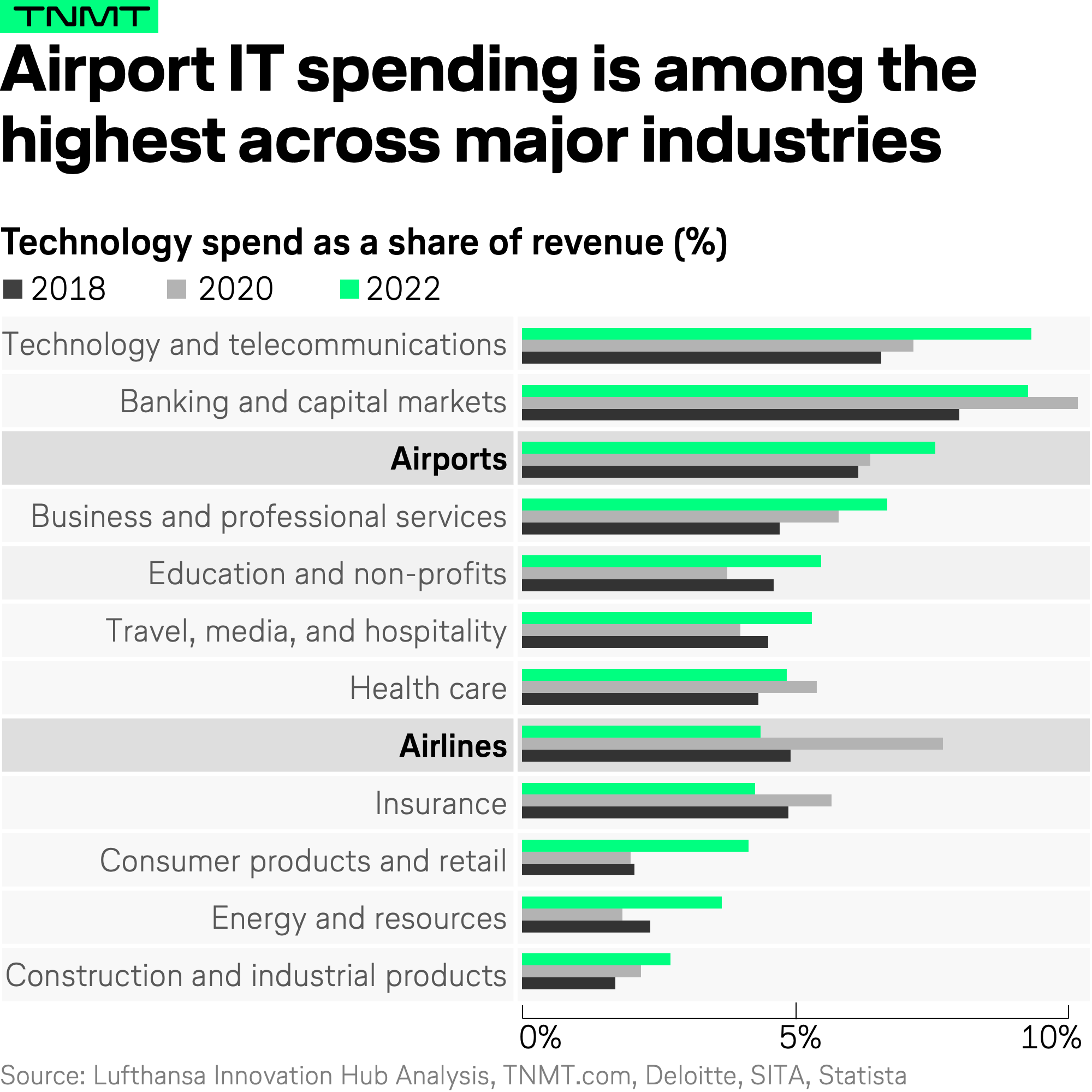

Airports: Leading the Way in IT Investments

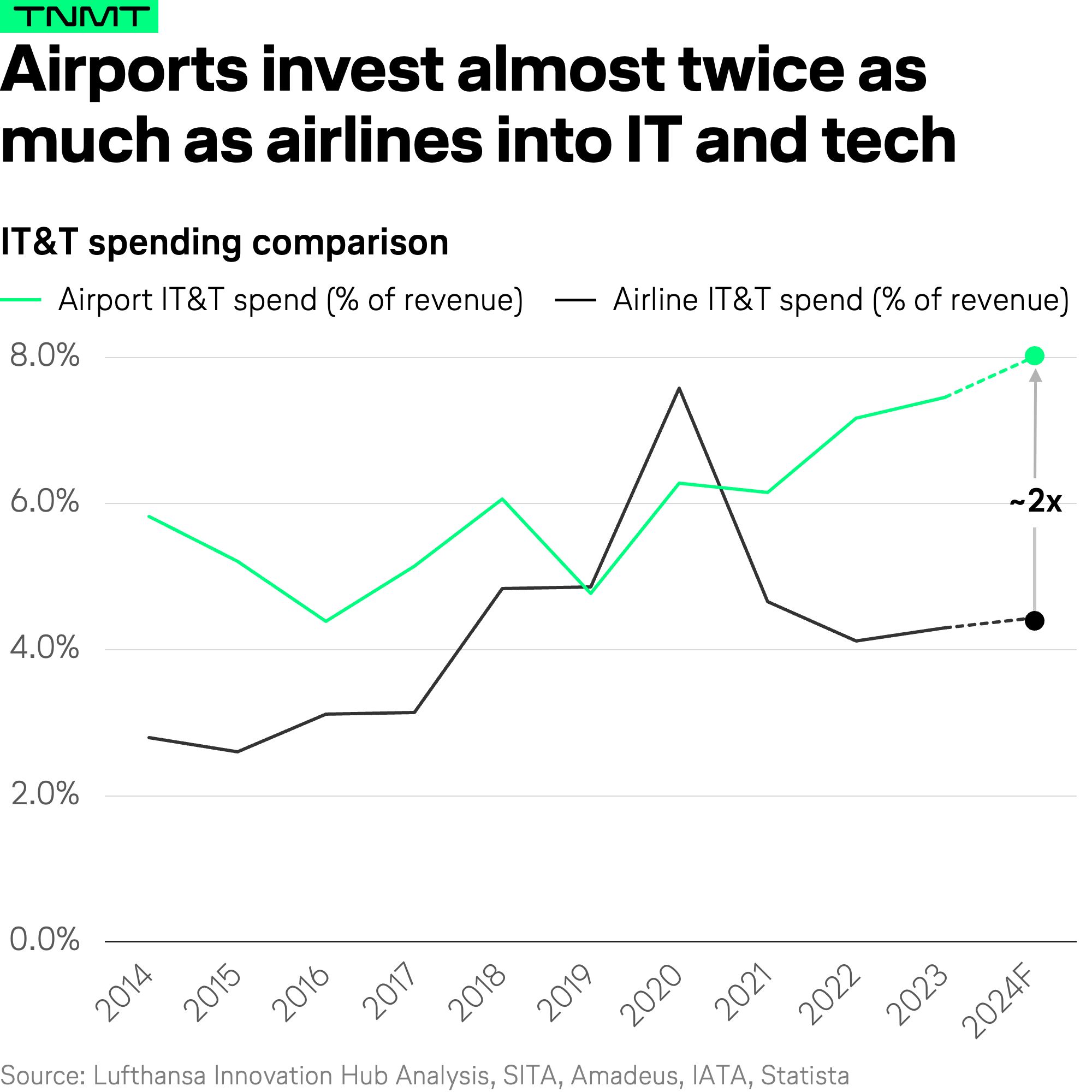

When looking for aviation stakeholders who have embraced IT investments more decisively, airports stand out. Unlike the airline industry, which has scaled back its IT spending, airports have significantly increased their technology budgets over the past five years.

- In 2018, global airport IT investment stood at just under $9 billion USD.

- By 2023, it reached a record high of $10.8 billion USD, and projections for 2024 indicate further growth.

- This level of commitment will represent more than 8% of total airport revenue—so almost double the relative share allocated by the airline sector.

Critics might argue that these investments haven’t yet transformed the airport experience into a more operationally robust and seamless journey, but the progress is undeniable.

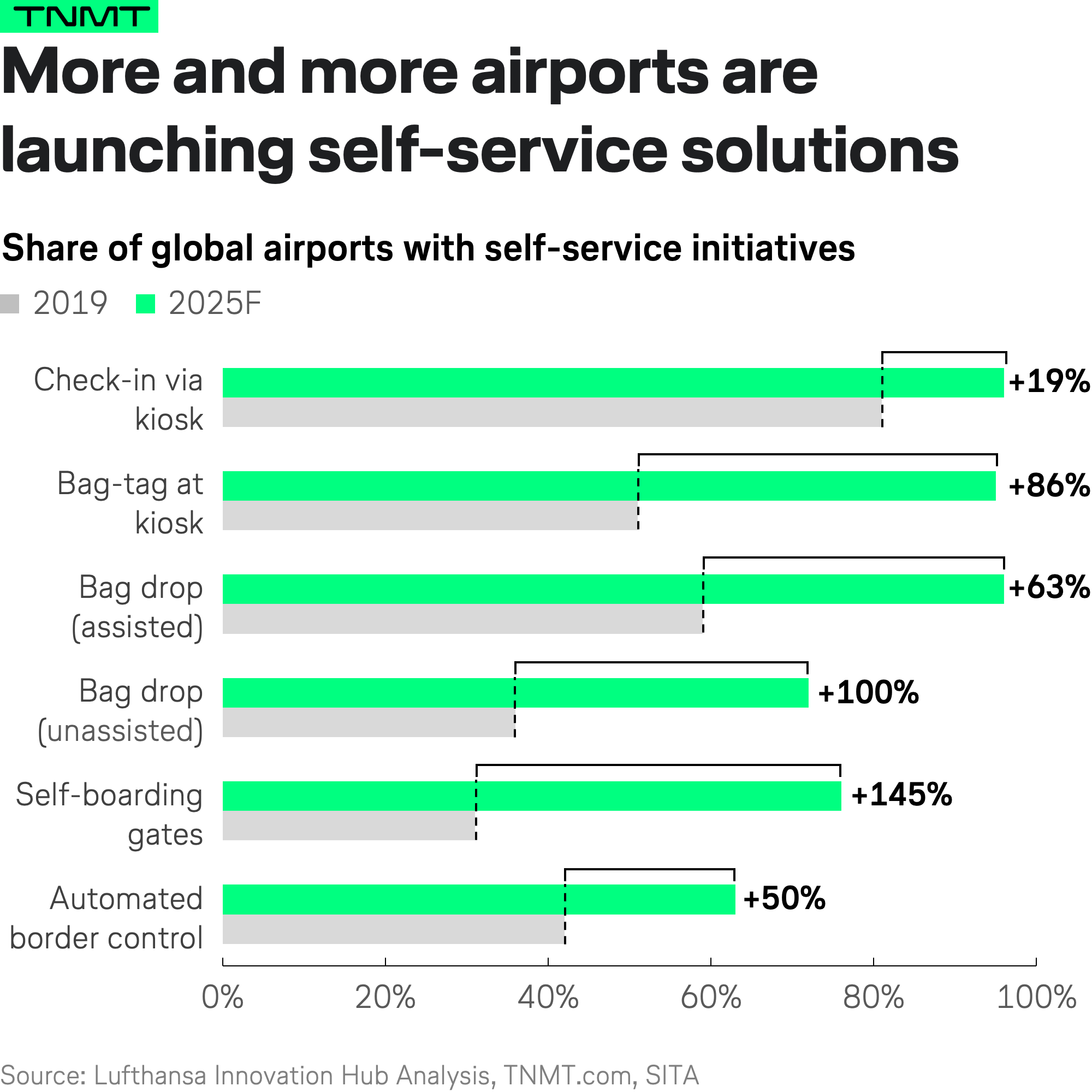

One area where this increased investment has paid off is in the proliferation of digital self-service tools.

- According to SITA, major traveler touchpoints like self-service kiosks, automated bag drops, and biometric identity verification systems are now much more widely available at airports than before the pandemic.

- These tools and solutions are reducing wait times, empowering passengers to navigate their journey with less staff intervention, and improving overall operational efficiency.

Here are three airports that exemplify this impact of growing IT investments:

1. Schiphol Airport, Amsterdam

Schiphol is widely known as an early adopter of self-service solutions, introducing comprehensive self-service units back in 2017. One of its standout innovations is the “move to mobile” feature, allowing passengers to transfer kiosk activity to their mobile devices seamlessly.

The results speak for themselves:

- The airport replaced 50% of staffed information desks with digital kiosks, reducing staffing costs by 33%.

- At the same time, the airport was able to manage three times more passenger queries as before.

So these strategic initiatives improved customer satisfaction while handling increased demand during peak times more efficiently.

2. Munich Airport, Germany

Munich Airport has been redefining security efficiency through a range of advanced technology. For example, the airport introduced CT scanners in Terminals 1 and 2, enabling passengers to keep electronic devices and liquids in their hand luggage.

Results are clearly measurable, even though recent incidents prove that more improvements are needed:

- The airport increased passenger processing capacity by 160%, with up to 520 passengers handled through security per hour.

- Given this, plans are now underway to implement this system across all security lanes by 2026.

3. Changi Airport, Singapore

Changi Airport, generally known for its innovation focus, has implemented many self-servicing applications, including passport-less immigration clearance using facial and iris biometrics across all terminals. This system allows passengers to pass through immigration without actually presenting a physical passport.

Again, the results prove the impact:

- Changi Airport reduced average clearance time by 60%, from 25 seconds to just 10 seconds.

- And by October 2024, more than 1.5 million travelers had benefited from this process.

What makes all these airports’ IT investment commitment particularly remarkable is its steadfast focus during one of the most challenging aviation decades ever.

Over the past ten years, airports have operated with an average profit margin of -6%, only slightly better than airlines’ average of -6.6% (see McKinsey). Yet, while both segments of the industry struggled financially, airports have managed to double down on IT investments, illustrating their understanding of technology’s critical role in future resilience and growth.

Even at the height of the pandemic in 2020, when essentially all of international travel came to a halt, airports doubled down on IT innovation. In fairness, it needs to be stated that the pandemic accelerated the demand for many touchless technologies, including self-service kiosks and biometric boarding solutions, to minimize human touchpoints and enhance passenger safety.

Luckily, passengers also quickly adapted to these innovations, given social-distancing habits, reinforcing airports’ belief in the value of tech-enabled self-service solutions. In many ways, the pandemic leapfrogged the industry’s adoption of these advancements, setting a new benchmark for passenger expectations.

The key takeaway, especially for airlines:

- Airports’ willingness to increase IT investments—despite similar financial pressures and operational uncertainties—offers a powerful lesson for airlines.

- These efforts show how prioritizing technology can improve the customer experience, enhance operational efficiency, and build resilience, even in times of crisis.

Applying the IT Investment Mindset to Airlines

By adopting a forward-thinking approach to IT investments—similar to the proactive strategies seen at leading airports—airlines can address one of their most pressing challenges: customer dissatisfaction, which is often rooted in unreliable operations and poor customer experiences.

- IT modernization is no longer optional; it is a strategic necessity.

- It not only enhances operational stability but also significantly improves the customer experience, creating a win-win scenario for passengers and airlines alike.

The need for airlines to modernize their outdated systems is urgent.

Many of these systems have been in operation for decades—some for nearly half a century.

These legacy systems are highly sensitive, and their failures have repeatedly disrupted operations on a massive scale. It’s time to eliminate security breaches and system crashes that ground flights across entire regions, reinforcing the case for IT transformation.

These IT transformations are expensive. No doubt about it.

But, for too long, airline IT has been perceived as a cost center rather than a driver of operational and commercial performance.

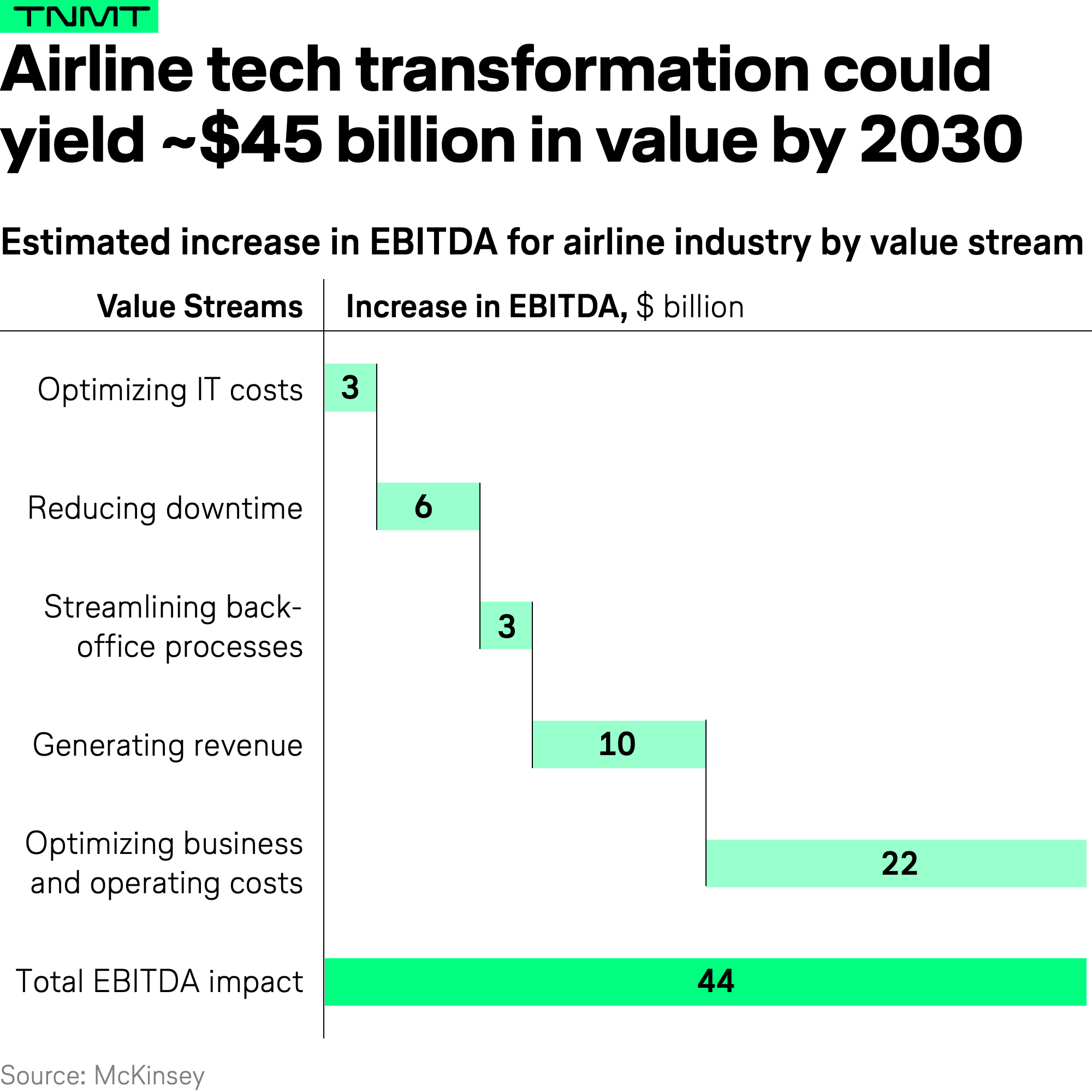

On an industry level, the potential upside of IT transformation is staggering. According to McKinsey, IT modernization could generate up to $45 billion USD in industry EBITDA by 2030, representing a 36% increase compared to 2019 figures.

Raising operational efficiency will be the biggest opportunity to be unlocked, for example, by leveraging predictive analytics, automation, and real-time data to streamline operations and reduce costs. Realizing this potential requires not only a clear roadmap of high-impact use cases but also dedicated funding for IT innovation.

Enhancing ancillary revenue through dynamic pricing and newly introduced relevant ancillary categories travelers actually benefit from and want is the second key area.

One airline demonstrating the benefits of this ancillary focus through IT innovation is United Airlines, which has launched a range of industry-first capabilities for customers.

For example:

- ConnectionSaver: Introduced in 2019, this tool identifies departing flights that can be held briefly to accommodate connecting passengers—without significantly delaying the flight’s on-time performance.

- Dynamic Seat Mapping: Integrated into the United mobile app, this feature ensures families can sit together for free, directly addressing a common customer pain point.

- Leading Mobile App: United’s app, the most downloaded airline app in 2023, addresses common traveler frustrations, exemplifying its commitment to customer convenience.

In its latest quarterly earnings call, United reported investing over $14 billion USD in technology over the past decade, emphasizing improvements in customer service. One of these initiatives includes implementing Starlink WiFi across its fleet by 2025.

Notably, United linked these IT investments to an impressive +24-point increase in its Net Promoter Score (NPS) from Q3 2019 to Q3 2024, proving the tangible benefits of prioritizing customer-facing technology.

A Target Benchmark for IT Investment

While there is no universally “optimal” level of technology investment, allocating 6–8% of revenue should serve as a near-term objective for innovation-driven airlines.

- Southwest Airlines, for example, learned the hard way how costly underinvestment in technology can be after its high-profile IT failure.

- Since then, Southwest has committed to significant tech investments, planning to allocate $1.7 billion USD (6.2% of revenue) to IT in 2024.

This growing commitment demonstrates that airlines are starting to recognize the critical role of technology in future-proofing their operations and enhancing the customer experience.

Other airlines would do well to follow suit.