For the past six years, we’ve been tracking airline startup investments in detail.

In fact, to our knowledge, TNMT remains the only source that systematically tracks every airline-startup deal at this level of granularity through our Airline Investment Ranking.

Our last annual snapshot revealed two important insights:

- First, sustainability had emerged as the dominant strategic theme behind airline startup investments.

- Second (and more importantly), airline startup investing remained a rare and underutilized innovation tool, despite all the talk about open innovation and the need for technology-driven transformation.

So where does that leave us now?

- What does airline startup investing actually look like as we head into 2026?

- And how serious are airlines, really, about leveraging startups as part of their long-term innovation strategy?

We took a close look, and what follows is a brutally honest assessment of the current state of airline startup investments.

Airline startup investing is quietly fading away

Let’s start with the uncomfortable part.

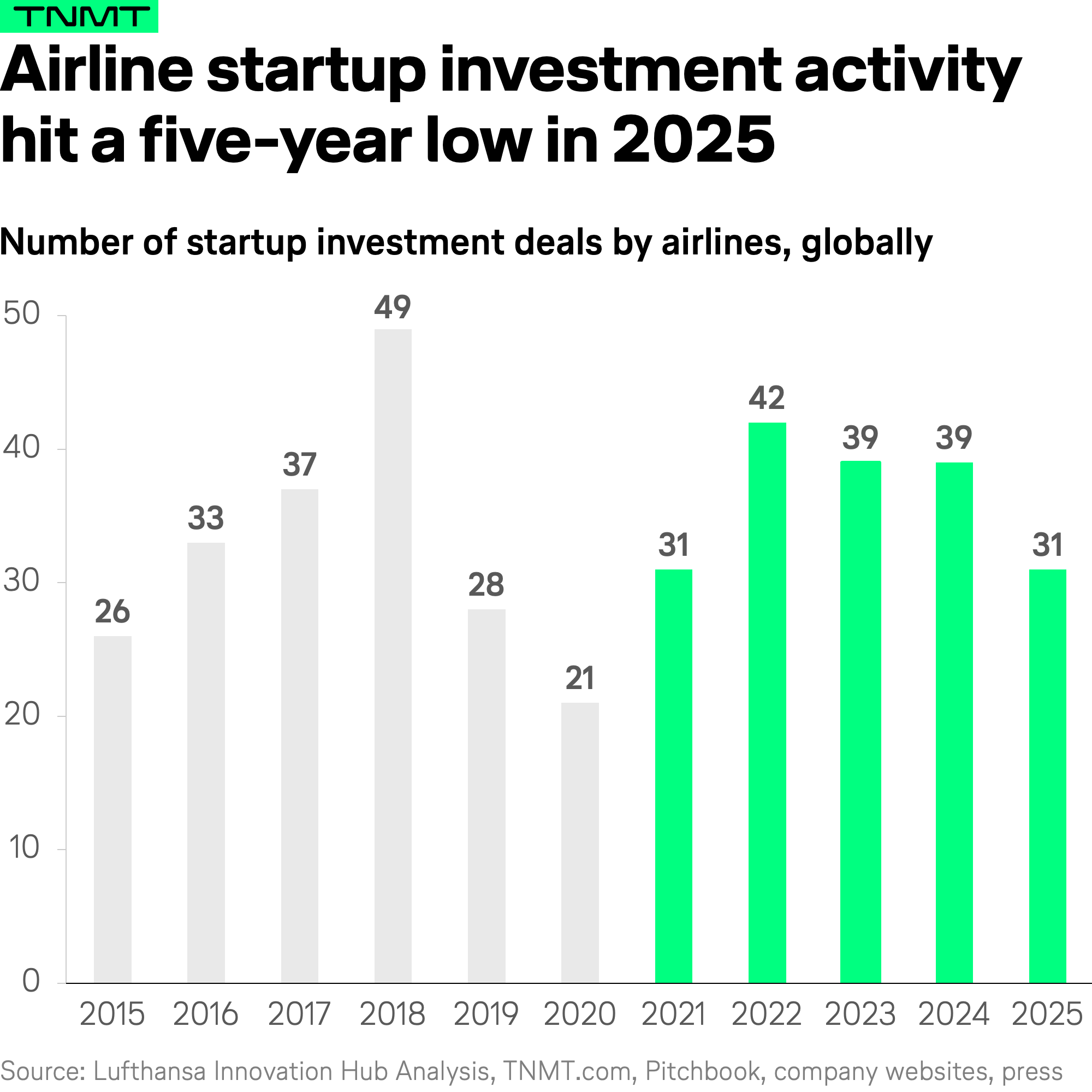

In 2025, airlines completed only 31 startup investment deals.

That’s down from 39 deals in 2024, marking the lowest annual deal count in five years, and roughly one-third below the airline investment peak in 2018.

On its own, that’s already a worrying signal.

But the picture gets even more concerning when we look at who actually placed those bets.

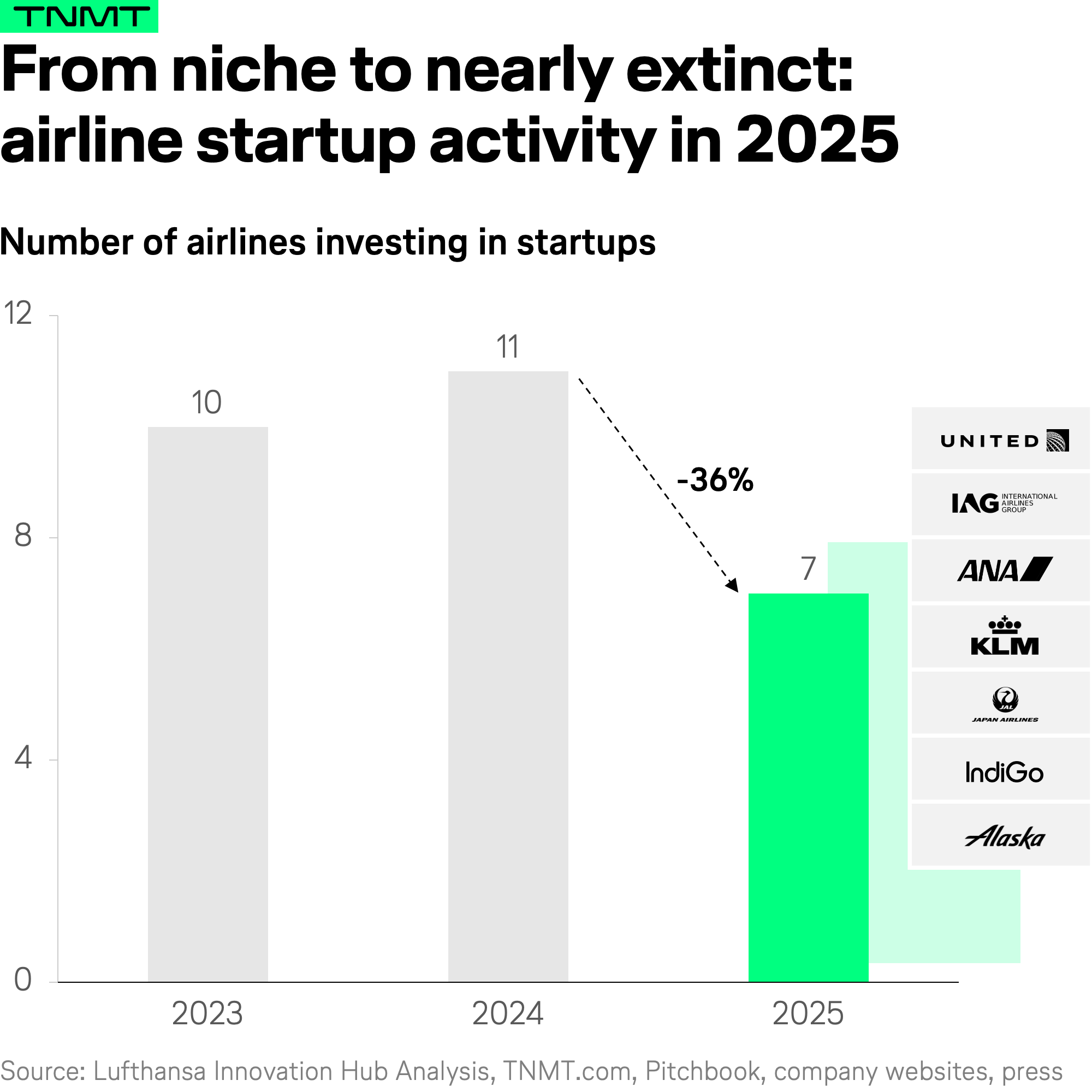

- In 2025, just seven airlines globally were responsible for all 31 startup investments.

- Compared to the past two years, that’s another sharp drop, and it means that airline startup investing has become even rarer than before.

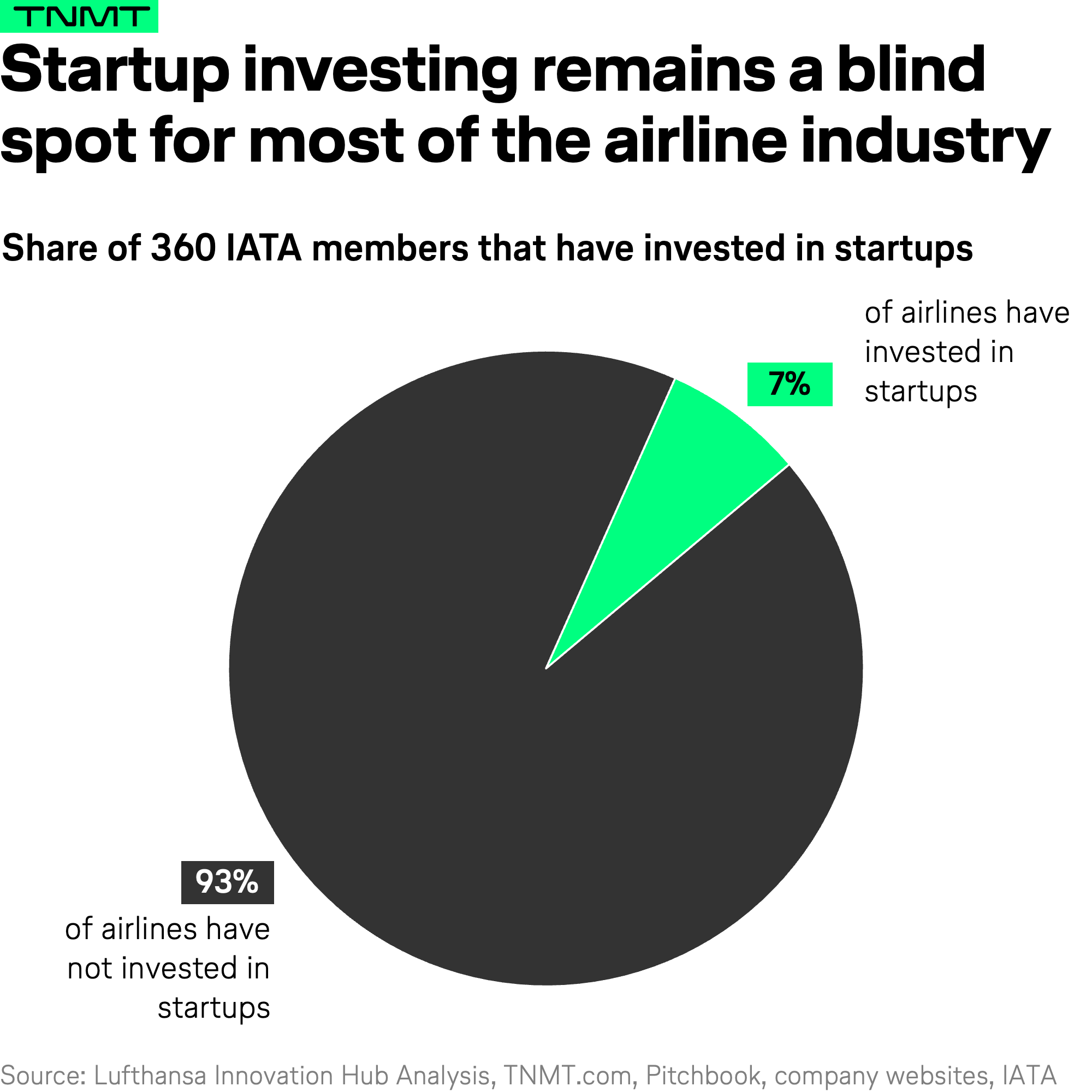

Zooming out further, the long-term picture remains extremely pale: Only 7% of IATA-registered airlines worldwide have ever made a startup investment.

In other words, for the vast majority of airlines, startup investing is not a strategic tool. It’s something other industries do.

You might argue that this is simply a reflection of a broader slowdown in startup investment. The global number of venture capital deals has been declining over the last few years.

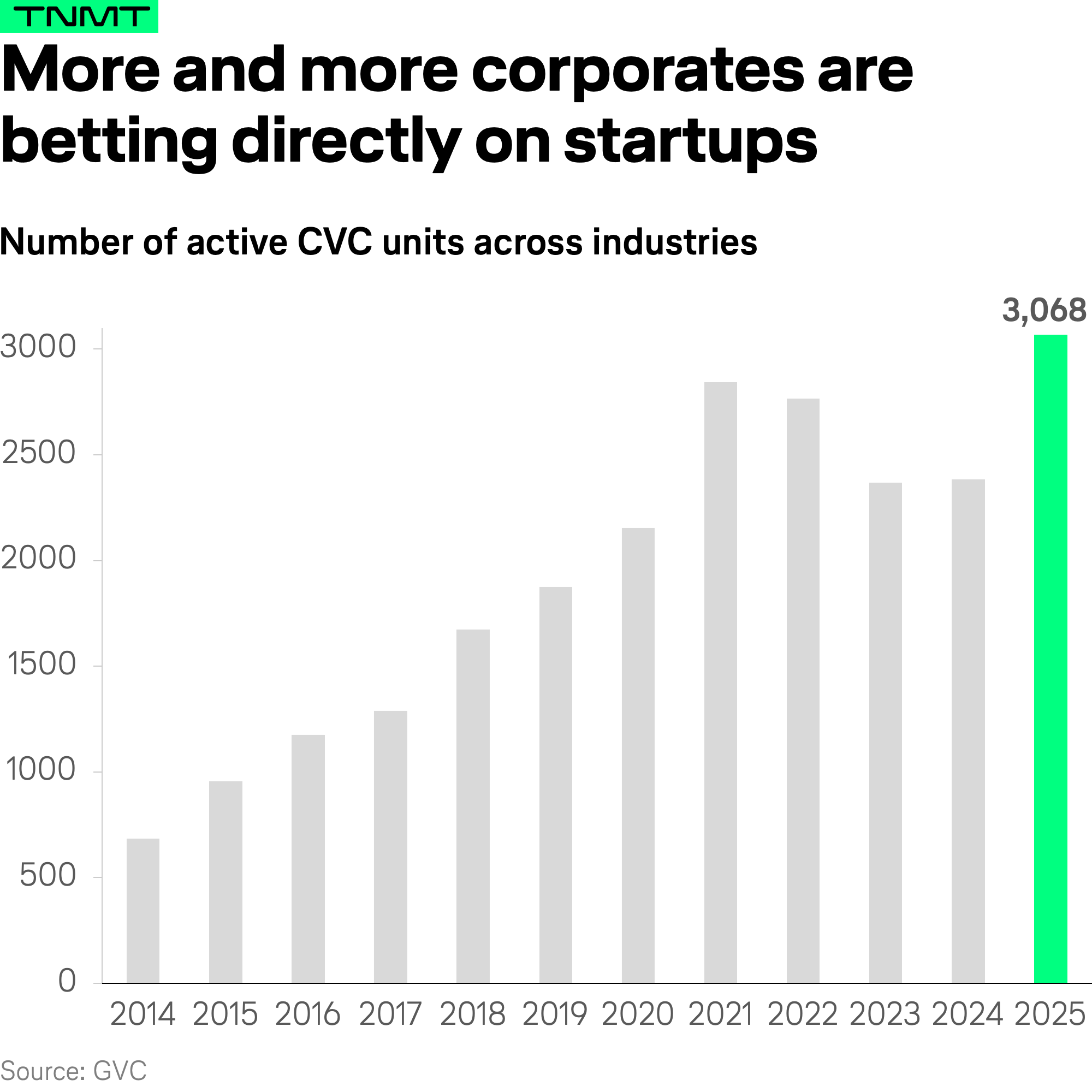

But that explanation doesn’t hold when we look at corporate venture capital (CVC).

- According to Global Corporate Venturing’s 2026 World of Corporate Venturing report, corporate venturing hit a record high in 2025.

- More than 3,000 companies were actively investing in startups.

- One in five startup funding rounds now includes a corporate backer, and capital deployed into those rounds surged 70% year-over-year to $233.8 billion USD.

Airlines, however, are largely absent from this picture.

They’re mostly watching from the sidelines.

And that’s the worrying part.

Because startup investments have repeatedly proven to be one of the most effective ways to access emerging technologies, stay close to disruption, and build both strategic and financial upside over time.

At a moment when other industries are doubling down on this instrument, airlines are quietly pulling back.

Let’s talk about the airlines that actually showed up

If you’ve been reading TNMT for a while, you know we’ve repeatedly called for more boldness in airline innovation. More commitment. More airlines putting their money where their mouth is…

But enough complaining.

Instead of dwelling on who didn’t invest, let’s flip the mindset.

Because in 2025, seven airlines continued to place startup bets, and that deserves attention.

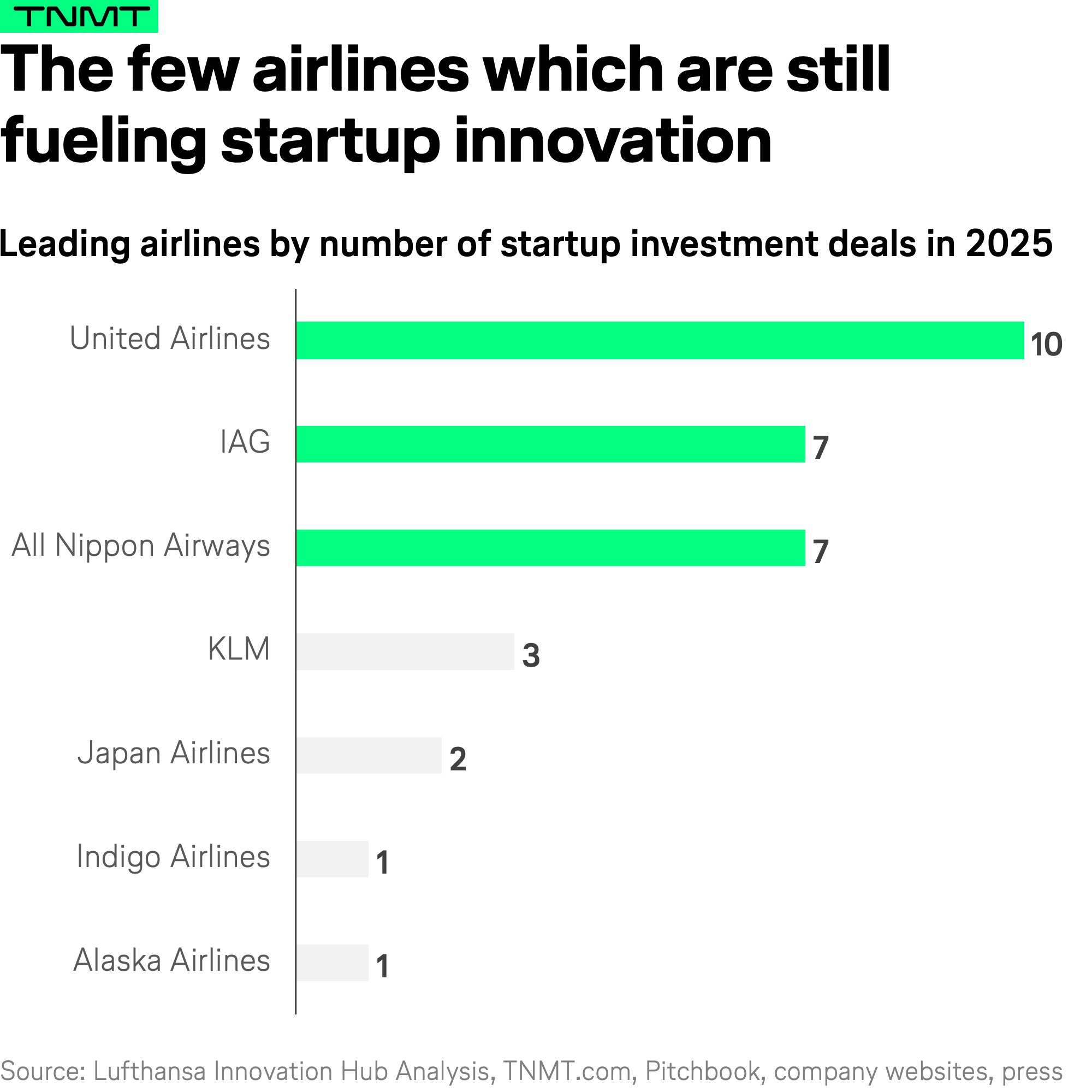

When we rank these seven airlines by the number of startup deals they closed last year, three carriers stand out:

- United Airlines led the field with 10 startup investments.

- IAG and All Nippon Airways followed closely, tied for second place with seven deals each.

United Airlines’ top position in the 2025 startup investment ranking is no coincidence.

Over the past year, United has repeatedly signaled that innovation for the airline isn’t confined to a single function (or a single vehicle like venture investing) but spans the entire organization.

Take marketing, for example.

- In September 2025, United made headlines for using AI to orchestrate real-time, culturally relevant brand campaigns.

- Instead of planning static marketing calendars weeks in advance, the airline applied AI to detect moments in the news cycle or broader public discourse and dynamically deploy messaging aligned with them.

- This was a strong signal that AI at United is moving beyond the usual airline domains of operations, pricing, or customer service and into brand and narrative control.

The same pattern shows up in the passenger experience.

- United was among the early adopters of Starlink for in-flight connectivity, betting on LEO satellite technology well before it became the industry standard.

- And on the ground, United has also been at the forefront of Apple Wallet boarding pass enhancements, enabling richer, real-time flight updates directly within passengers’ digital wallets.

But zooming back out to all seven airlines that placed startup bets in 2025, the obvious next question is:

What are these airlines actually investing in?

That’s where the story gets even more interesting.

Airline startup investing is shifting east

Before we look at what airlines are investing in, though, it’s worth asking where the airline investment activity is actually coming from.

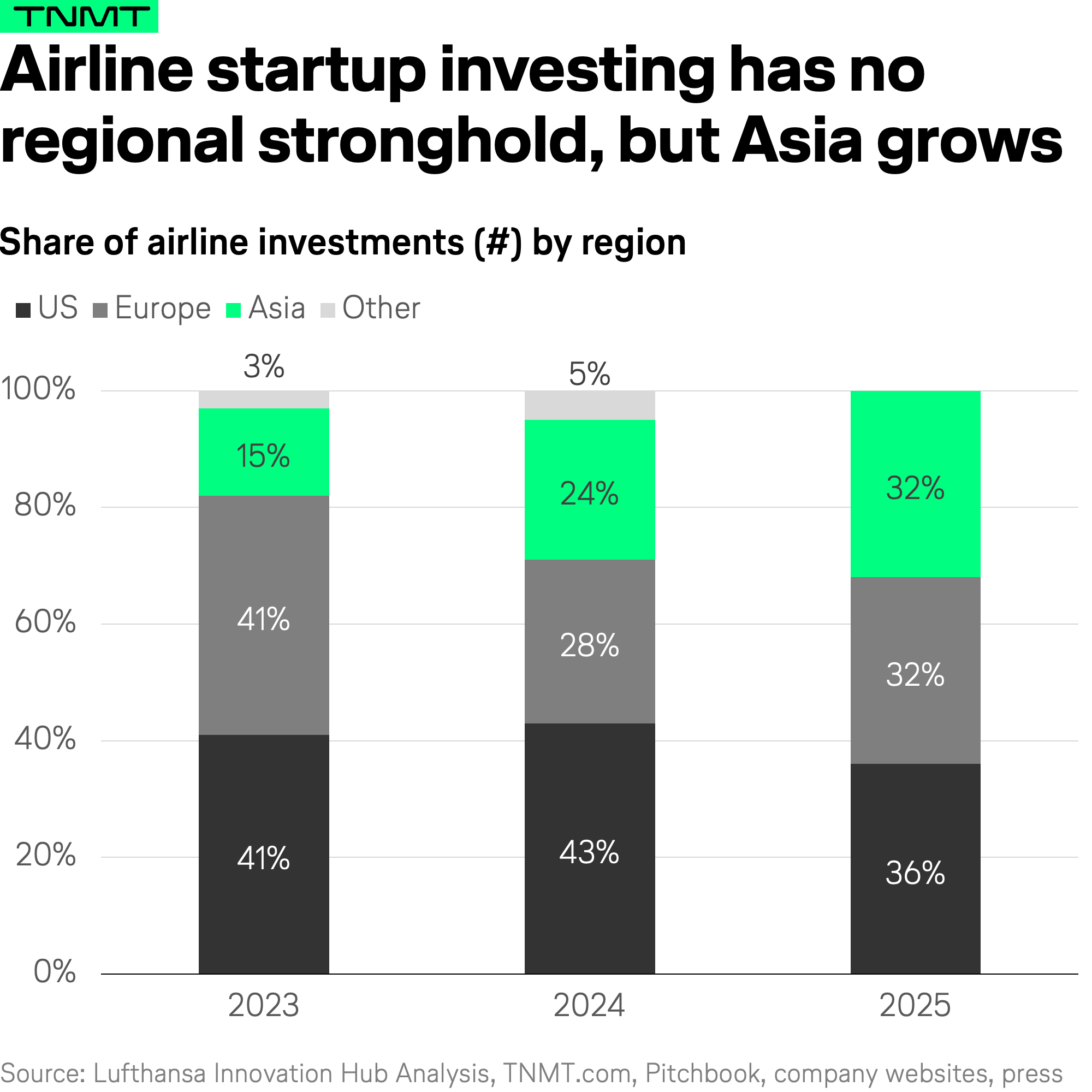

At first glance, the geographic split looks almost balanced. Over the past three years, airline startup investments have been spread relatively evenly across North America, Europe, and Asia.

But dig one level deeper, and a more interesting pattern emerges.

While U.S. and European airlines have largely plateaued (or pulled back), Asian airlines have been stepping up.

As shown in the chart below, Asian airlines’ share of startup investments (measured in the number of deals) has grown from roughly 15% to more than 30% by 2025. In other words, their share has doubled in just a few years.

This shift isn’t accidental.

It mirrors a broader trend in corporate venturing.

According to Global Corporate Venturing, many of the largest new CVC units launched in 2025 were created by Asian corporations, particularly in Japan, China, and Korea.

Airlines are clearly part of that movement.

Take All Nippon Airways.

- In 2024, ANA launched the ANA Future Frontier Fund in partnership with Global Brain Corporation, committing around $55 million USD (¥8 billion) to investments across mobility, sustainability, AI/ML, fintech, and travel.

- In its second year, the fund backed startups ranging from turbulence-prediction specialist BlueWX to ride-sharing platform NearMe.

Or IndiGo, which became India’s first airline to launch a formal CVC.

- IndiGo Ventures successfully closed its inaugural $52 million USD fund last year.

- Its first investment went into Jeh Aerospace, a domestic manufacturer of flight-critical components, signaling a long-term industrial and innovation play.

Outside Asia, new airline-backed venture initiatives have been far rarer, and even those announced have so far made relatively few concrete startup bets.

- IAG launched IAGi Ventures, committing €200 million over five years, one of the most substantial airline CVC programs in Europe.

- Qantas and Airbus jointly committed AUD 15 million to Climate Tech Partners to accelerate SAF and decarbonisation technologies.

- And the oneworld Alliance, together with Breakthrough Energy Ventures, launched a $150 million USD SAF-focused fund, backed by carriers including American Airlines, Alaska Airlines, IAG, Cathay Pacific, Japan Airlines, and Singapore Airlines.

At the same time, it’s worth noting that not all airline venture initiatives survived the recent financial pressure.

- One prominent example is JetBlue Ventures (long considered the prodigy of airline startup investing), which was acquired by SKY Leasing in May 2025 and rebranded as SKY VC later that year.

- The move reflected JetBlue’s decision to refocus on core airline operations and near-term profitability.

Long story short: while airline startup investing remains scarce globally, its center of gravity is slowly shifting toward Asia, where airlines appear more willing (and financially able) to institutionalize venture investing as a long-term capability rather than a one-off experiment.

Which brings us to the next, and most revealing, question:

What kinds of startups are these airlines actually investing in?

And what does that say about their innovation strategies?

Airlines are still betting on where it feels safest

So without further ado, let’s look at what airlines actually invested in last year.

As in 2024, we categorized all startups that raised funding in 2025 in deals involving at least one airline.

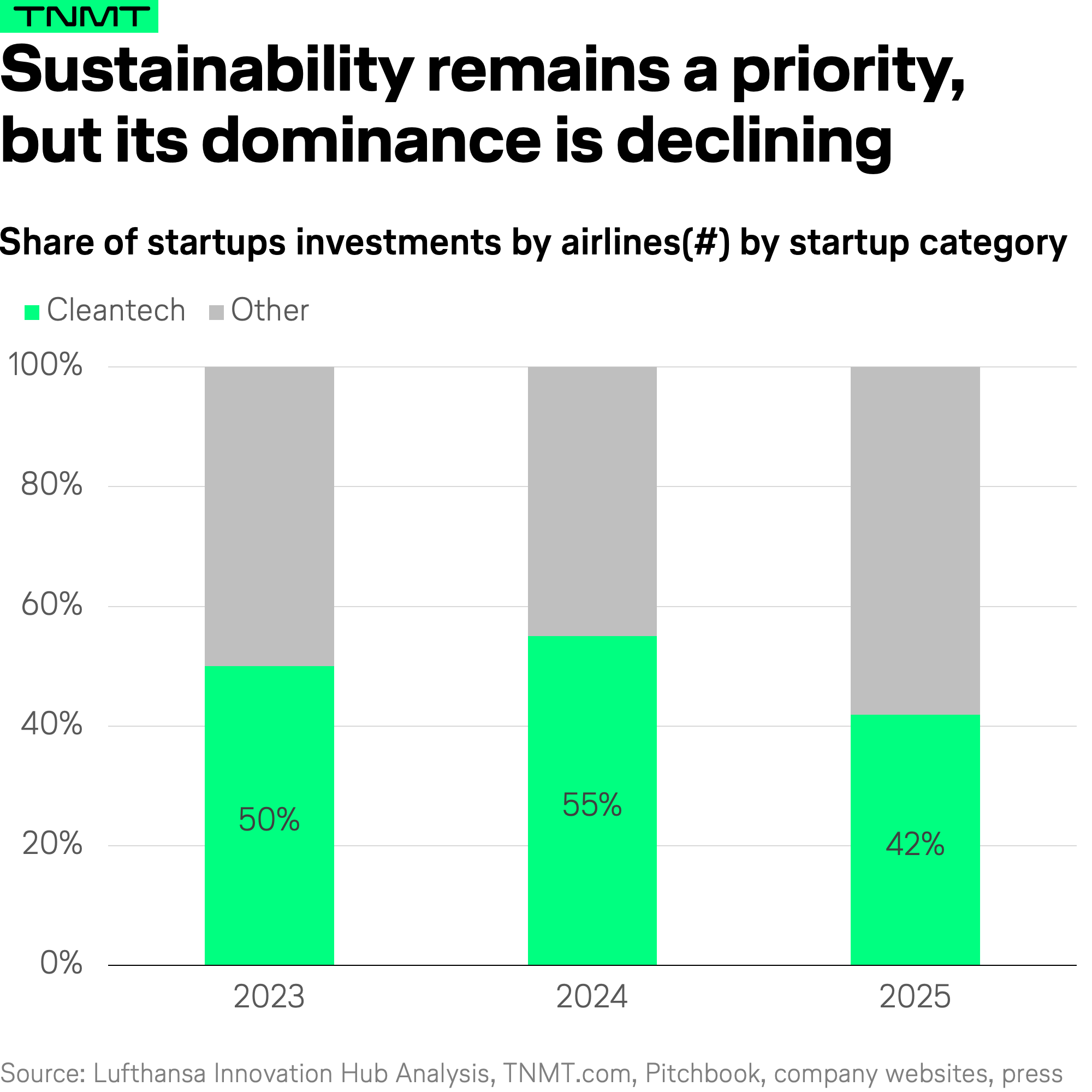

And once again, one category clearly dominated: cleantech/sustainability.

- In 2025, 42% of all airline-backed startups were sustainability-focused.

- That’s down from 55% in 2024, but still makes cleantech the single most important investment theme for airlines.

This isn’t surprising, and it’s not a bad thing.

Decarbonization remains aviation’s most existential challenge. Sustainable aviation fuel is still scarce. Aircraft efficiency gains are slow. Regulatory pressure is rising. Ongoing engagement with cleantech startups is essential.

But the decline in share raises an obvious follow-up question:

If sustainability is losing relative weight, what’s gaining traction?

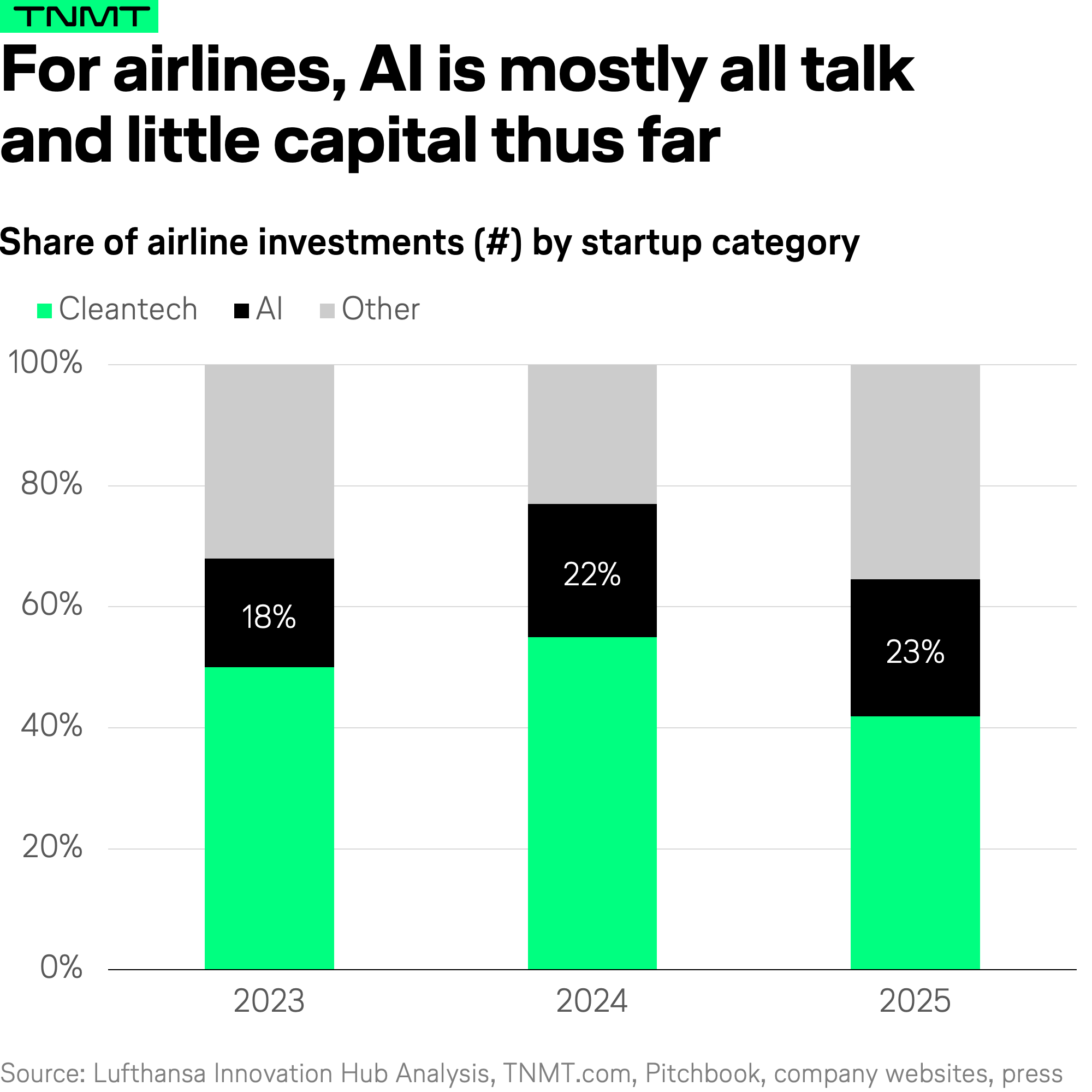

The intuitive answer would be AI.

- After all, AI is arguably the most transformative general-purpose technology of this generation, potentially even more impactful than the internet.

- It promises step-change improvements across airline operations, from crew scheduling and maintenance to disruption management and customer experience.

So we’d expect airlines to aggressively back AI startups.

The reality is more muted.

In 2025, roughly one quarter of startups backed by airlines were AI-focused.

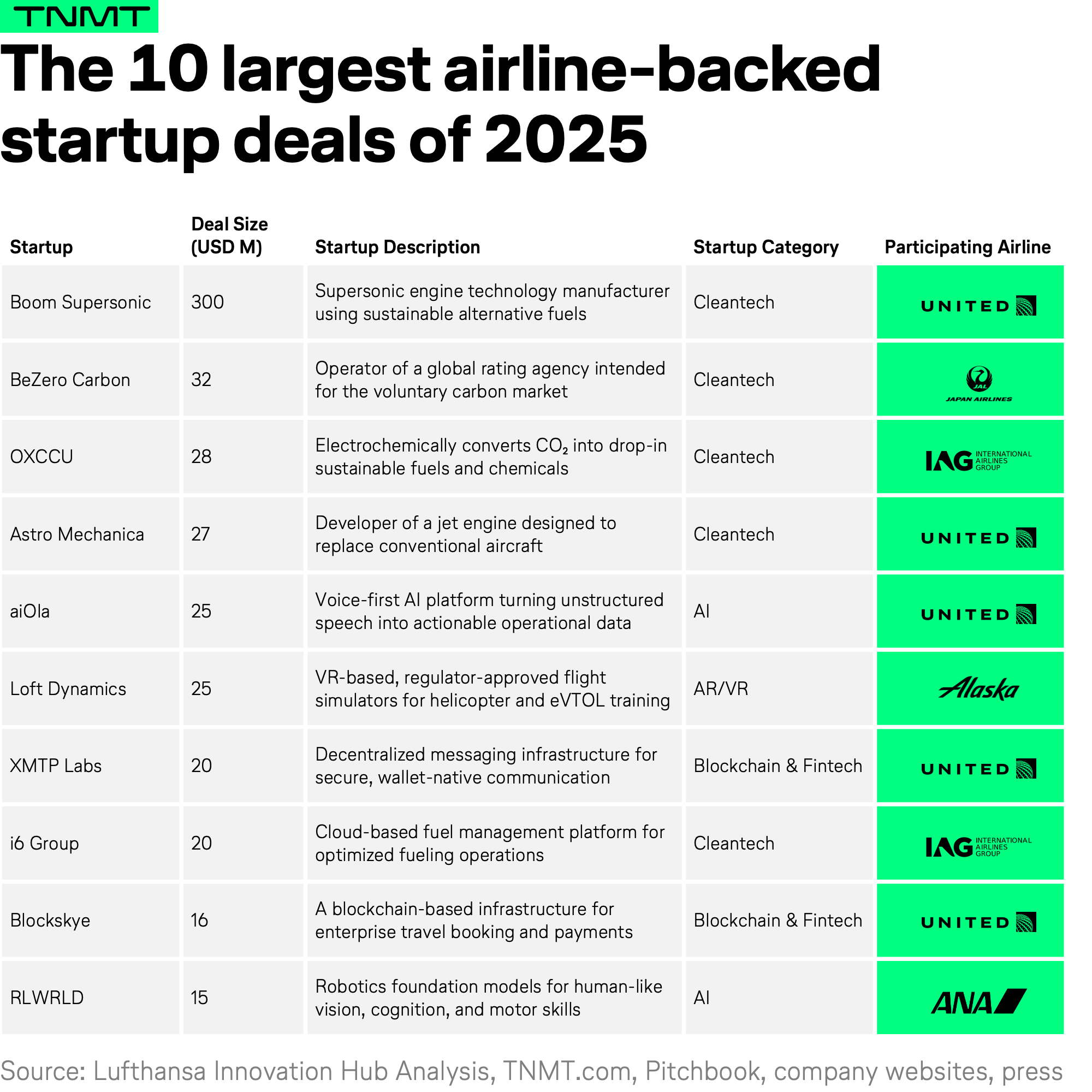

- Take aiOLA, a voice-first AI platform that turns unstructured speech into structured, actionable operational data. The company raised $25 million USD last year with United Airlines among the investors (an investment that makes sense in an airline context, where voice communication still dominates cockpit operations, ground handling, and maintenance workflows).

- Another example is RLWRLD, which raised a $15 million USD round in 2025 with All Nippon Airways participating. RLWRLD is building foundational AI models that enable robots to see, reason, and manipulate objects like humans, so a technology that could eventually play a role in automating airport operations, from baggage handling to ramp services and warehouse logistics.

Don’t get us wrong: these are meaningful bets.

But here’s the surprising part: AI’s share of airline-backed investments hasn’t been increasing over the past two years, despite the explosion of AI relevance and hype across every other industry.

It looks like airlines are playing it safe.

That impression is reinforced when we look at the company stage at which startups receive airline capital.

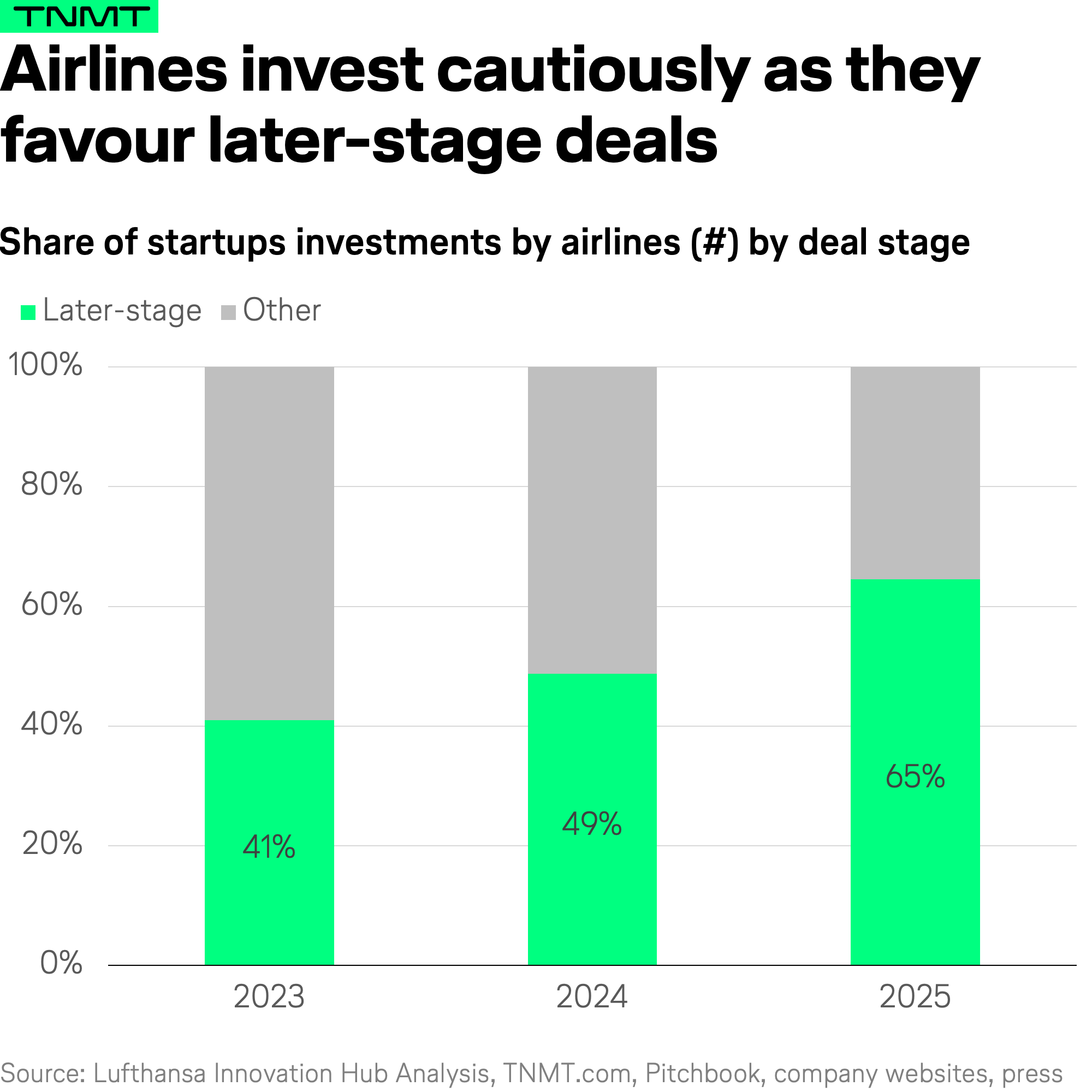

- In 2023, 41% of airline startup investments went into later-stage companies.

- By 2025, that figure had jumped to 65%.

What that means: airlines are increasingly investing in more mature, de-risked startups, often companies they already know, understand, or have worked with before.

This starts to look less like venture investing at the innovation frontier and more like continuation investing.

Or as Thayer Investment Partners recently put it in a PhocusWire analysis: airline CVCs often “have a good idea of where they want to end up,” but are “less familiar with what’s happening on the innovation frontline outside of aviation.”

That pattern also shows up when looking at the 10 largest airline-backed startup funding rounds of 2025.

The ranking is dominated by familiar names, most notably Boom Supersonic at the top, rather than truly new or unexpected players pushing radical new models.

At the same time, the majority of these investment deals remain cleantech-driven, with AI startups still the exception rather than the norm.

The takeaway from all of this?

A few selected airlines are still investing, but they’re doing so cautiously, selectively, and increasingly late.

That approach may reduce risk in the short term.

But it also raises an important question: are airlines still positioning themselves close enough to the next wave of disruption?

That’s where this analysis becomes uncomfortable. And that’s exactly why it’s necessary.

We’re curious how you see it. Are we being too critical of airline innovation strategies?

Let us know.