Two weeks ago, Airbnb dropped a product update that made headlines across the Travel-Tech world.

In case you missed it:

- The company launched a new feature that lets travelers book on-demand services and activities directly through the Airbnb app.

- This includes massages, haircuts, private chefs, guided tours, and events.

What’s interesting?

These add-ons aren’t just tied to Airbnb stays.

They can also be booked independently, without reserving an Airbnb at all.

In other words: Airbnb is (once again) going beyond accommodation.

Important sidenote: This isn’t the company’s first rodeo in the experience space.

- Airbnb initially launched “trips” back in 2016, with another big expansion push in 2023.

- Both times, the offerings were quickly pulled from the platform not long after.

Now, with this third attempt, Airbnb seems more serious (and more strategic) about making it stick.

This move expands Airbnb in two directions at once:

- Into tours and experiences, competing with the likes of GetYourGuide, Viator, and Klook.

- Into stay-related services, offering hotel-style amenities that deepen the guest experience, essentially Airbnb’s own take on ancillary upselling.

So what’s behind this strategic detour?

On the surface, it’s a logical (and ambitious) platform move.

With a revamped app, including group chat and trip calendar features, Airbnb wants to become the travel hub for everything that happens before, during, and after your trip.

It’s also a defensive play, aimed at fending off growing traveler demand for more serviced accommodation options, including hotels.

- A recent Booking survey on Gen Z travel preferences found that travelers aged 18–27 are more likely to stay in hotels than in any other type of accommodation.

- This group also places high value on amenities like room service and breakfast options, and is even willing to pay extra for them.

But here’s what’s really driving the shift

Airbnb has grown massively over the past decade.

Its market share in short-term rentals (STR) hit 44% in 2024, up from 28% in 2019, according to Skift.

But the future supply side looks less rosy.

- Regulatory crackdowns in major cities and broader economic uncertainty are making it harder to onboard new hosts.

- Higher interest rates have made it more expensive to finance new vacation rental properties, many of which were previously bought on credit. As a result, fewer people are entering the host market.

As a result, STR market forecasts now project short-term rental supply growth at under 5% annually in the years to come – still decent, but a far cry from the hypergrowth of the past decade.

So, what do you do when your core market starts to plateau?

You branch out.

And local experiences, stay add-ons, and event partnerships offer a far less saturated arena.

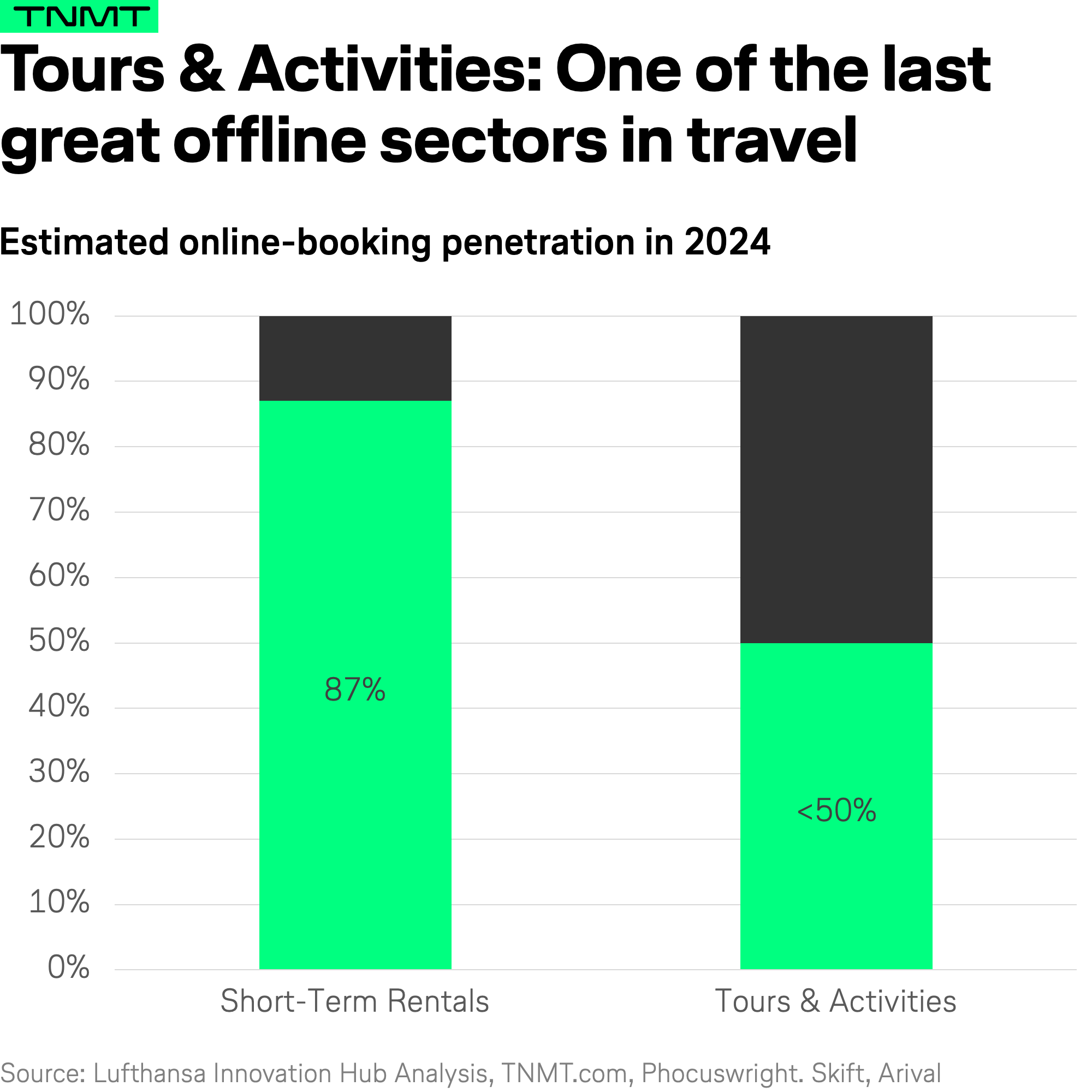

In fact, the global experience economy is worth over $1 trillion USD, and unlike hotel or rental bookings, most of it still happens offline.

What does this mean for airlines?

The idea of closer ties between Airbnb and airlines has been circling for years.

- So far, it’s mostly been empty rumors, speculation, and the occasional half-hearted partnership.

- But if Airbnb is serious about becoming a full-service travel platform, flights could be next.

Skift even called air travel “the ultimate test” of Airbnb’s ambition.

Maybe that airline + Airbnb bundle is finally more than just a myth.